Investing Update: The Chase Is On

What I'm buying, selling & watching

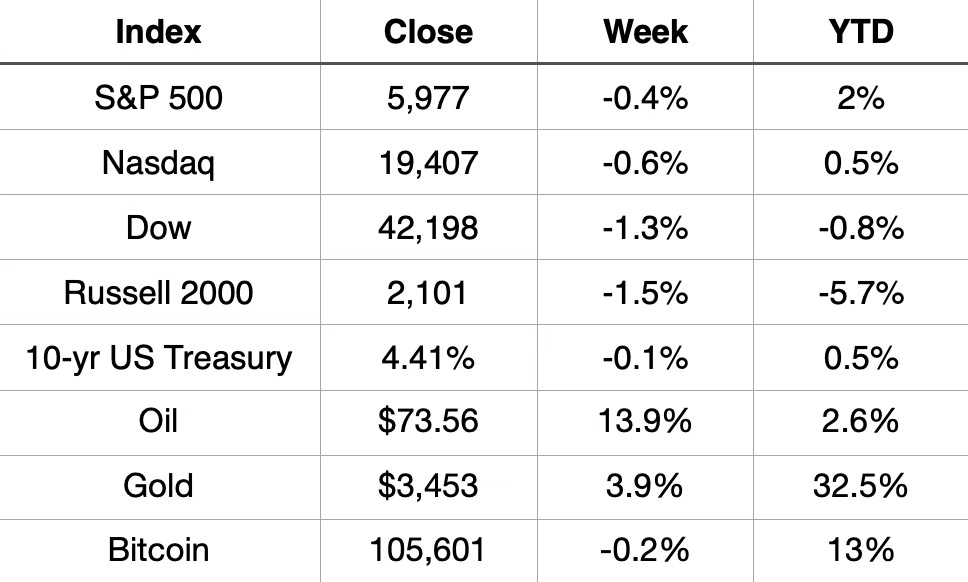

The S&P 500 fell back below 6,000 as the escalation between Israel and Iran weighed on the stock market to end the week.

All the major indices finished down on the week.

The winners this week were oil up 13.9% and gold up 3.9%.

Market Recap

Weekly Heat Map Of Stocks

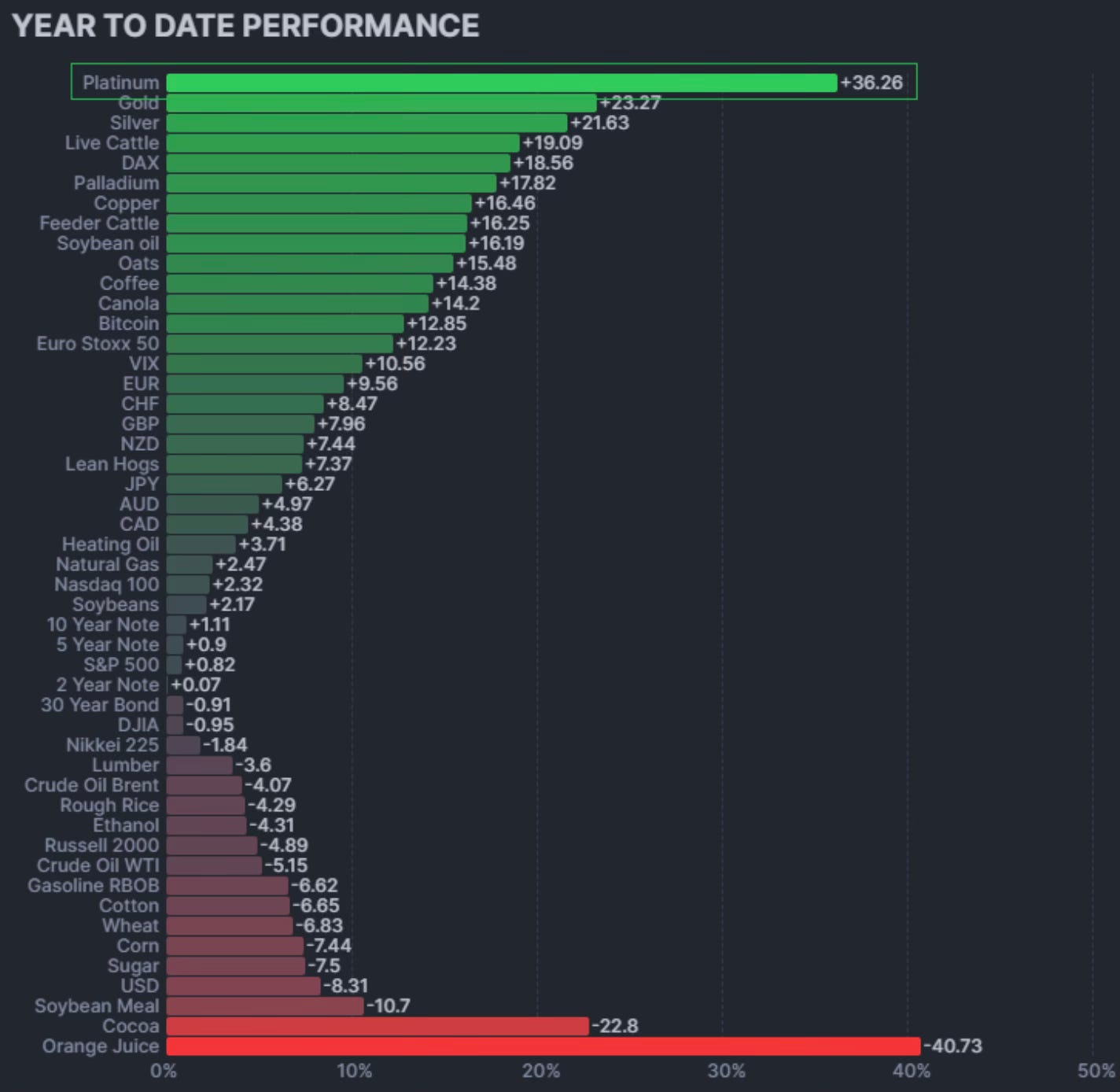

YTD Performance

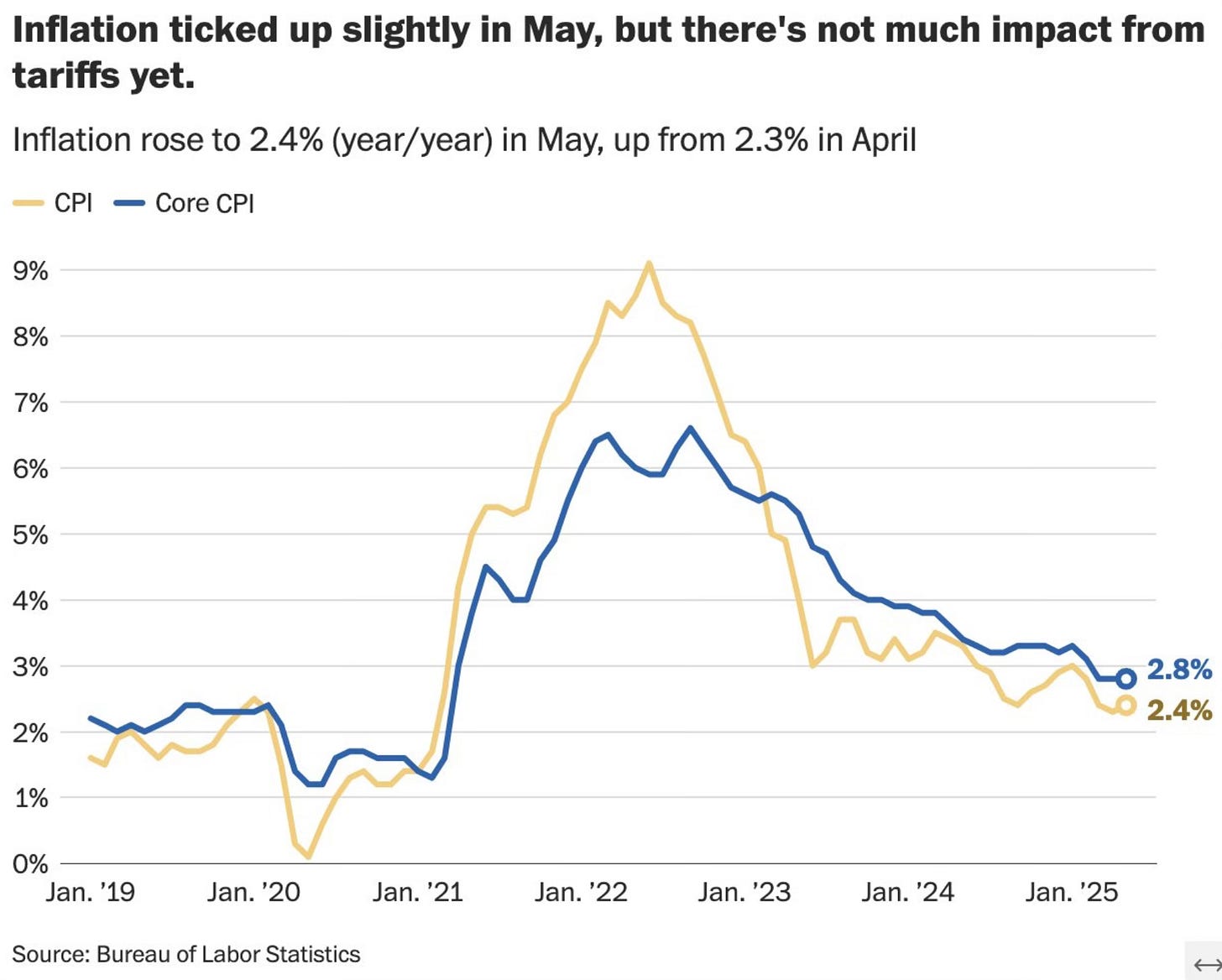

On a positive note, earlier in the week the inflation reading came in line with forecasts. It ticked up slightly in May to 2.4% from April 2.3%. Core CPI matched the lowest YOY number since March 2021. That’s a 4 year low!

Any fear over the tariffs causing a spike to inflation has yet to be seen.

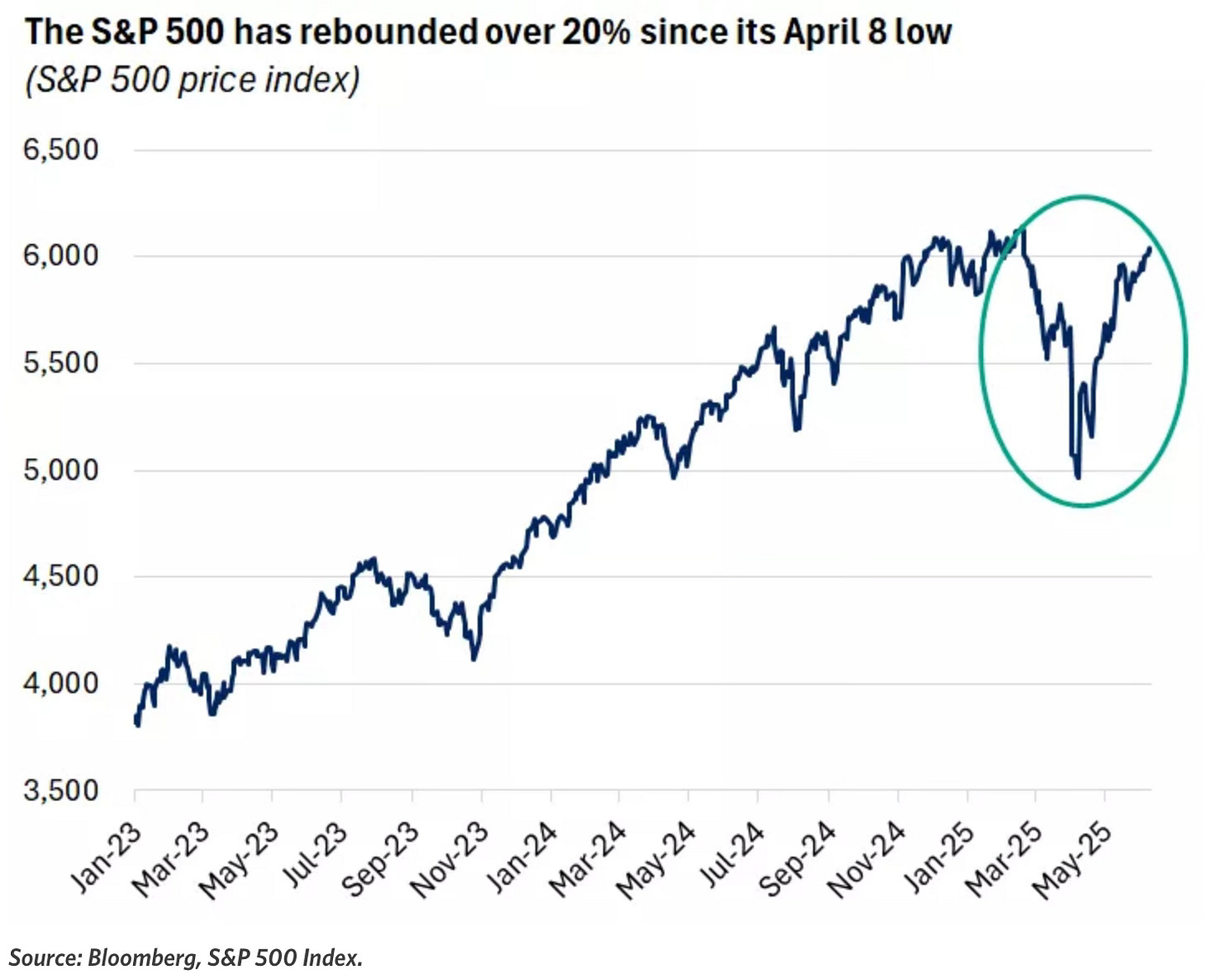

After a good inflation number and the escalation between Israel and Iran, the S&P 500 still only sits about 2% from new all-time highs.

Remember April 8th? That was the low for the S&P 500 and look how the S&P 500 has performed since that day. It has climbed over 20% in just over two months.

All 11 sectors are now trading above their 50-day moving average. That hasn’t occurred since October 2024.

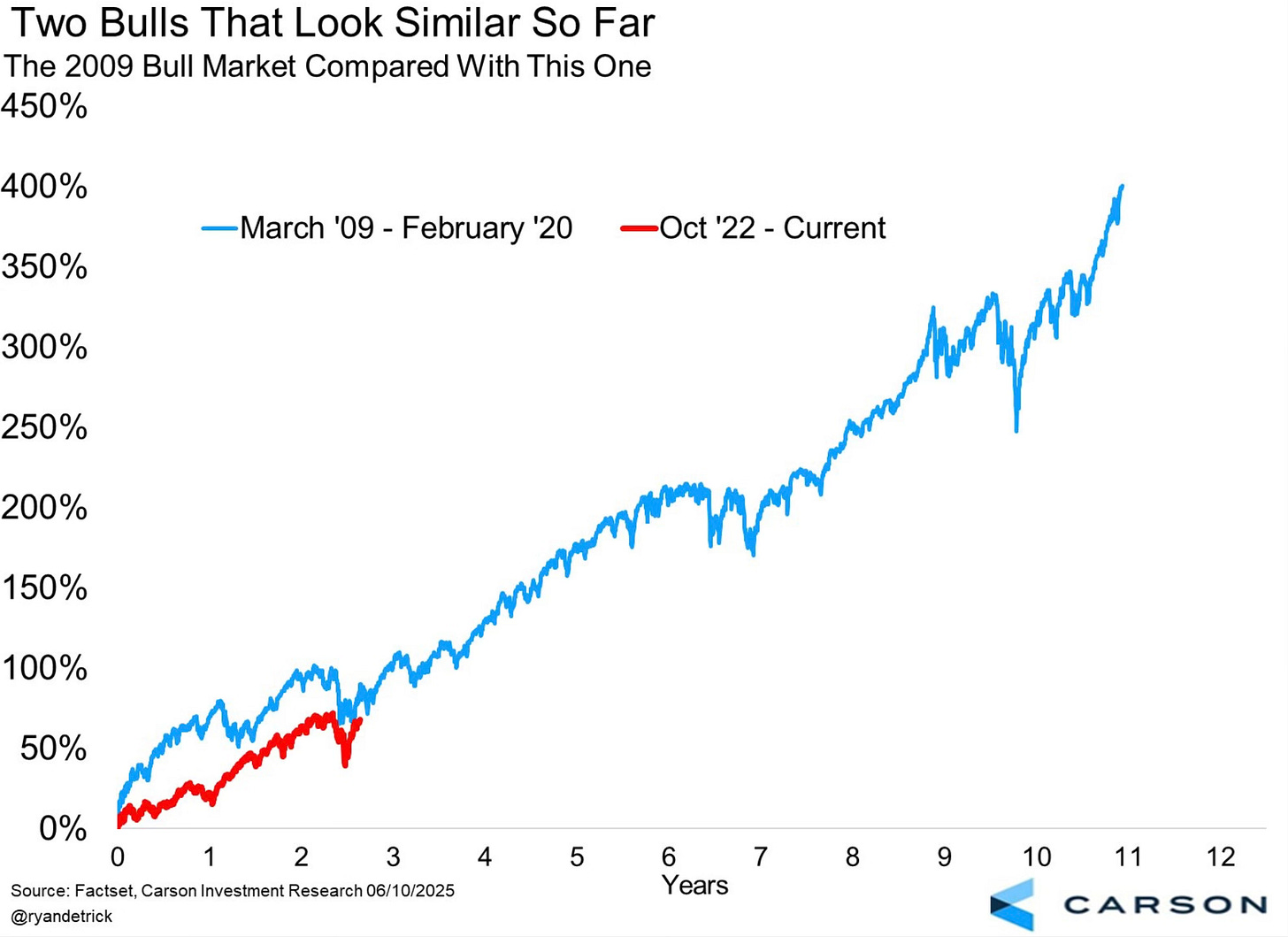

Look at how closely this bull market has been comparing to the 2009 bull market.

Over the past two months, I’ve continued to share my thoughts on the data I’m watching and why I’m coming to the conclusions that I have been. Here is some of what I have said about this bull market.

April 19th in my Investing Update: Is The Worst Over?

We saw concrete floor type support of 4,835. That’s also the 2022 high. I believe that 4,835 level will prove to be the bottom.

If there proves to be no recession, this will prove to be a tremendous buying opportunity. Now if down the line a recession happens, that may be a different story. But the recession piece to this puzzle is the unknown.

If it doesn’t happen, you don’t want to be in cash or even worse, be short this market.

Imagine what this market does on the news of tariff deals?

May 10th in my Investing Update: Bear Market Rally Or New Bull?

You have to really understand that even though many have been screaming recession, the market doesn't think so. According to the stock market, right now a recession is off the table.

If a recession does in fact happen, then all bets are off. I think we do retest the April 8th low of 4,835. Simply put, if a recession doesn’t happen, the lows of 4,835 will remain the lows and we will see new all-time highs by year-end.

May 17th in my Investing Update: New Highs Incoming?

Everything moves faster now in the stock market. The S&P 500 is only 3% from a new all-time high. Can you believe that?

We will see new all-time highs in 2025. It will even be in Q2 yet. The signs are still too obvious.

Readers of Spilled Coffee have seen that I have held to my opinion that we see a recovery going back to mid-April and that we will reach a new all-time highs in Q2.

There are still a few weeks to go in Q2 but I still believe we see a new all-time here very soon.

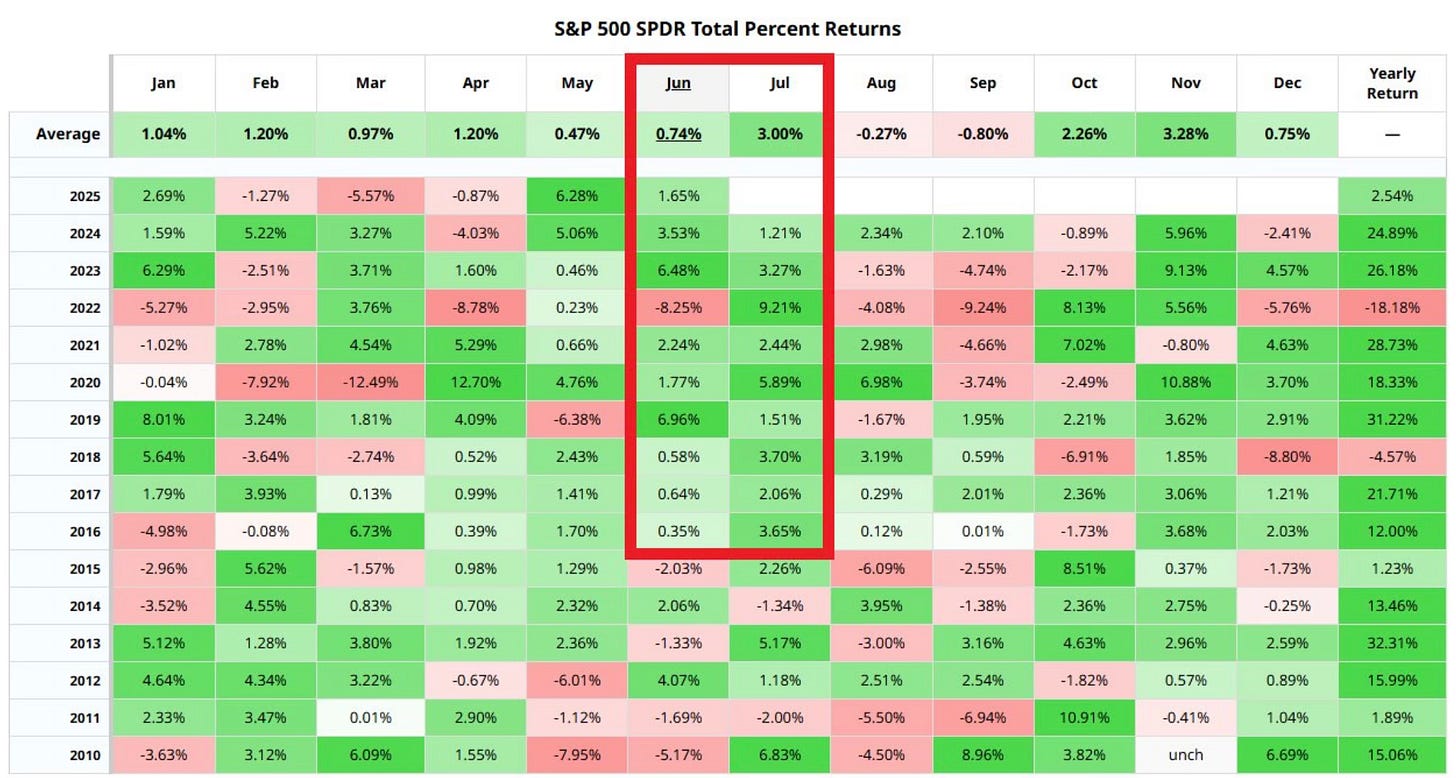

We’re also in a seasonally strong point of the year.

The S&P 500 has only had 1 losing month during the June and July period going back to 2016.

The Chase Is On

This much hated rally has been reflected in the sentiment data. That has caused many to be way offsides, underinvested and short this giant rally. I’ve wrote about this a number of times and the catch up trade by chasing.

That’s exactly what we’re now seeing and this is where you’re seeing another leg to this bull market.

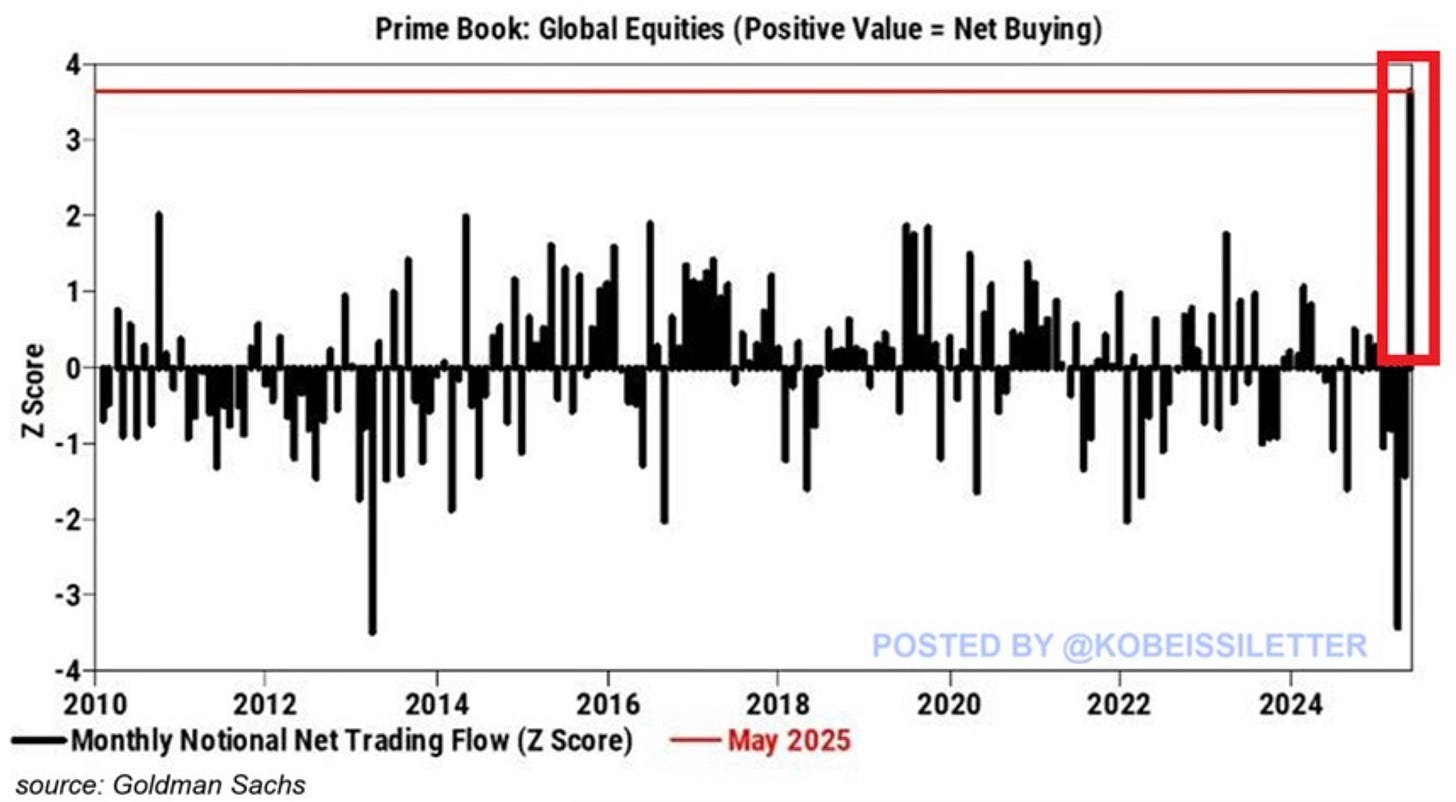

Hedge funds have now bought a record amount of global equities in May. This follows 4 consecutive months of selling. From The Kobeissi Letter who also notices the chase.

Last week, these funds' trading activity saw the largest increase in 2 months, driven by long buys outpacing short sales. Additionally, 4-week average hedge fund net inflows into US equities hit their highest level since October 2024, according to JPMorgan. This is a massive reversal from the largest net selling since the 2020 pandemic, seen in April. Hedge funds are starting to chase the rally.

We also just saw a new high in the advance-decline line. A screaming bullish signal.

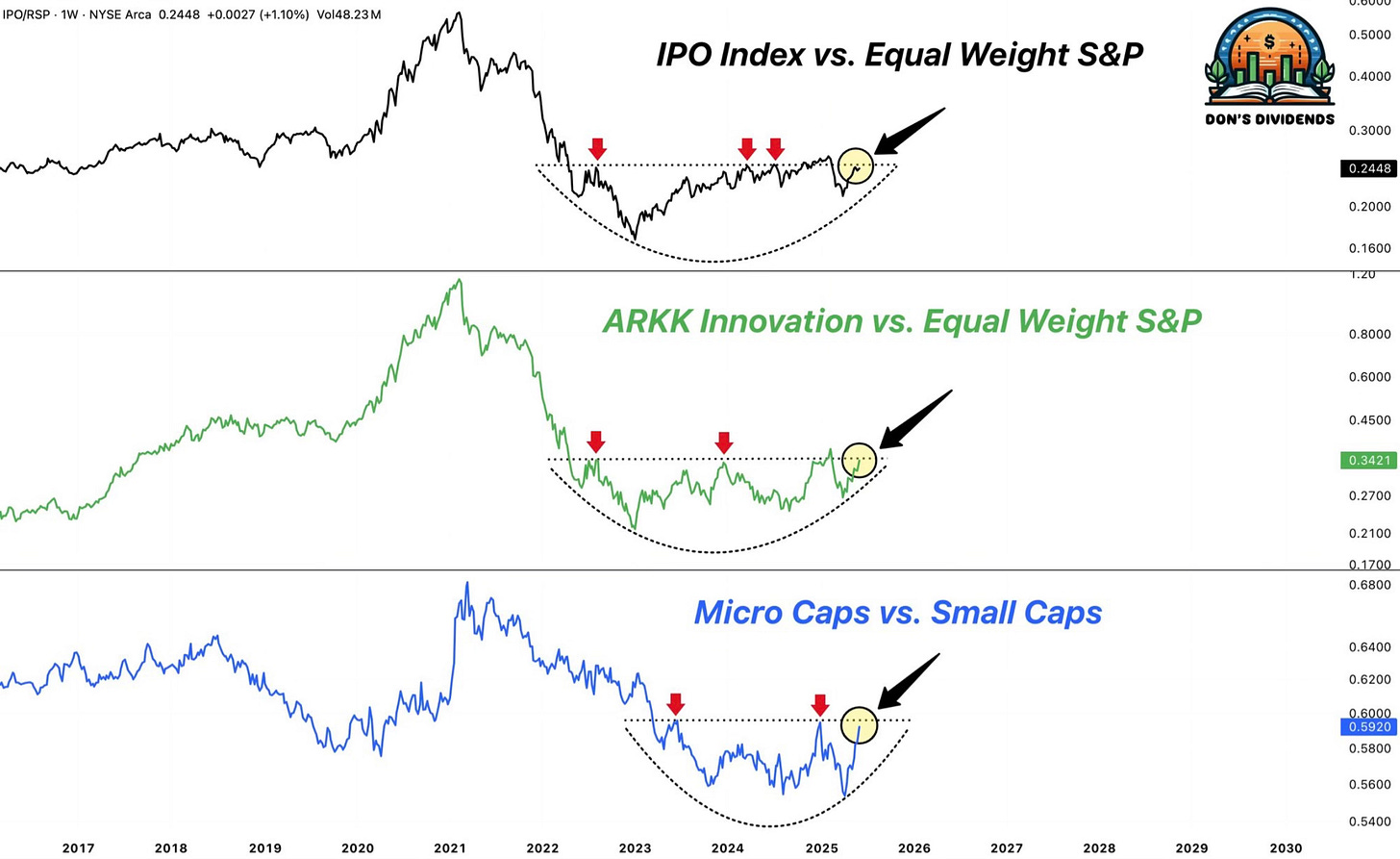

You can guess what shows for the IPO Index, ARKK and micro caps vs small caps. Great chart here from Donovan.

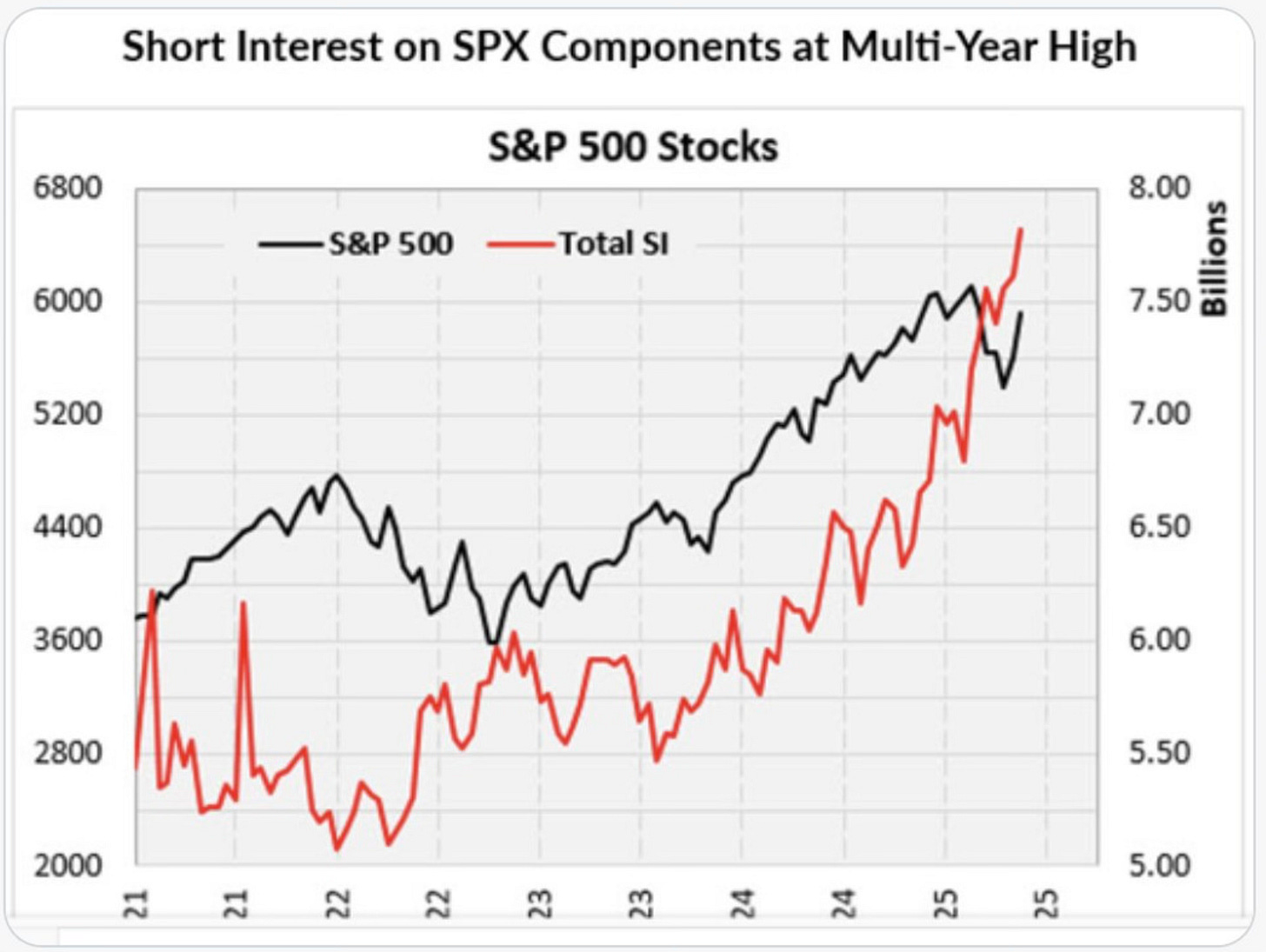

Short interest still sits a multi-year highs while the S&P 500 sits only about 2% from new all-time highs.

Short interest represents future buying power, with squeeze situations increasing during rallies.

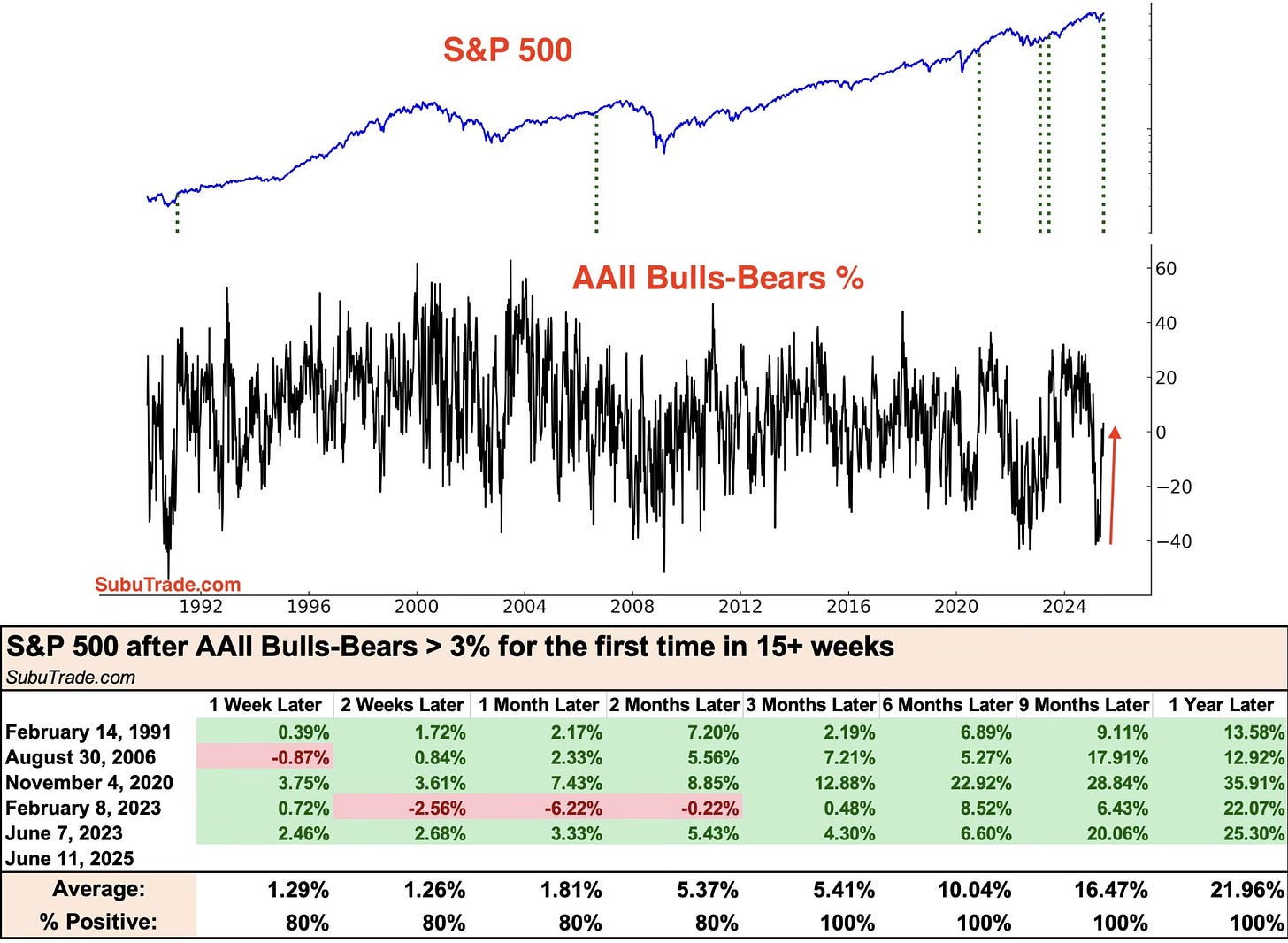

We’re starting to now see sentiment recover: The AAII Bulls-Bears just topped 3%+ for the first time in 15 weeks. Look how bullish this is over the next 3 to 12 months.

Goldman notes that asset managers are chasing the Nasdaq higher.

There are even more charts showing that there is a chase ensuing. I had to cut it off before today’s newsletter becomes a book. You can see the chase is already underway. Expect this rally to last as there is a lot of money to still come in and buy this rally.

Here Come the Semis

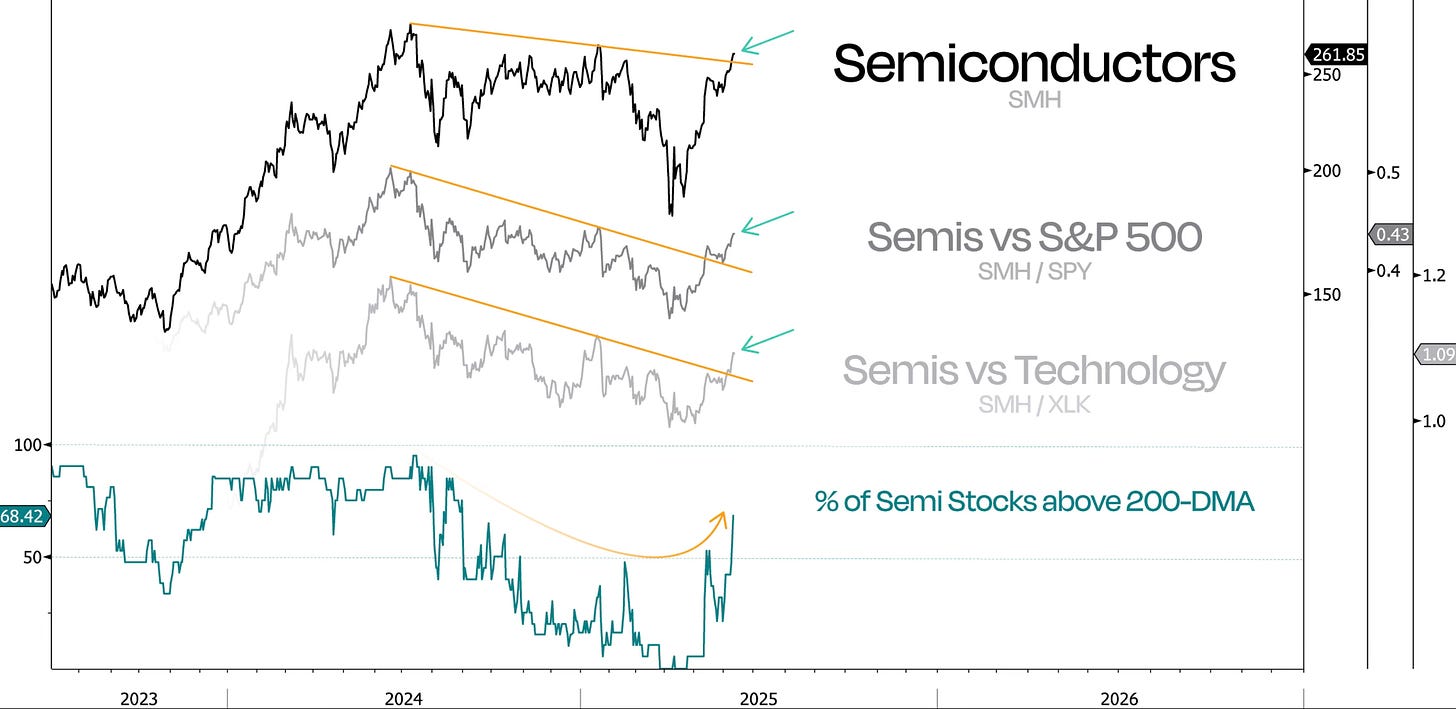

On May 10th in my Investing Update: Bear Market Rally Or New Bull?, I identified semis as a sector set to breakout and even identified the 7 most popular stocks in the semi space.

If you think we’re in a new bull market or that this stock market goes higher, you have to be on the semiconductors train. I believe there is an opportunity in semis.

This is not a sector that I would want to be short or underexposed if it’s breaking out and a new bull market is starting. This is a sector you want to be exposed or even over exposed to in a market rally. AI, robotics and autonomous self-driving. Don’t bet against the semis.

They are now in fact breaking out. They’re outperforming the overall market and pushing tech higher. Participation is the strongest in 9 months.

The SMH is now at its highest price since January.

Continue to stay long semis. This has been a bull market engine.

Do Valuations Matter?

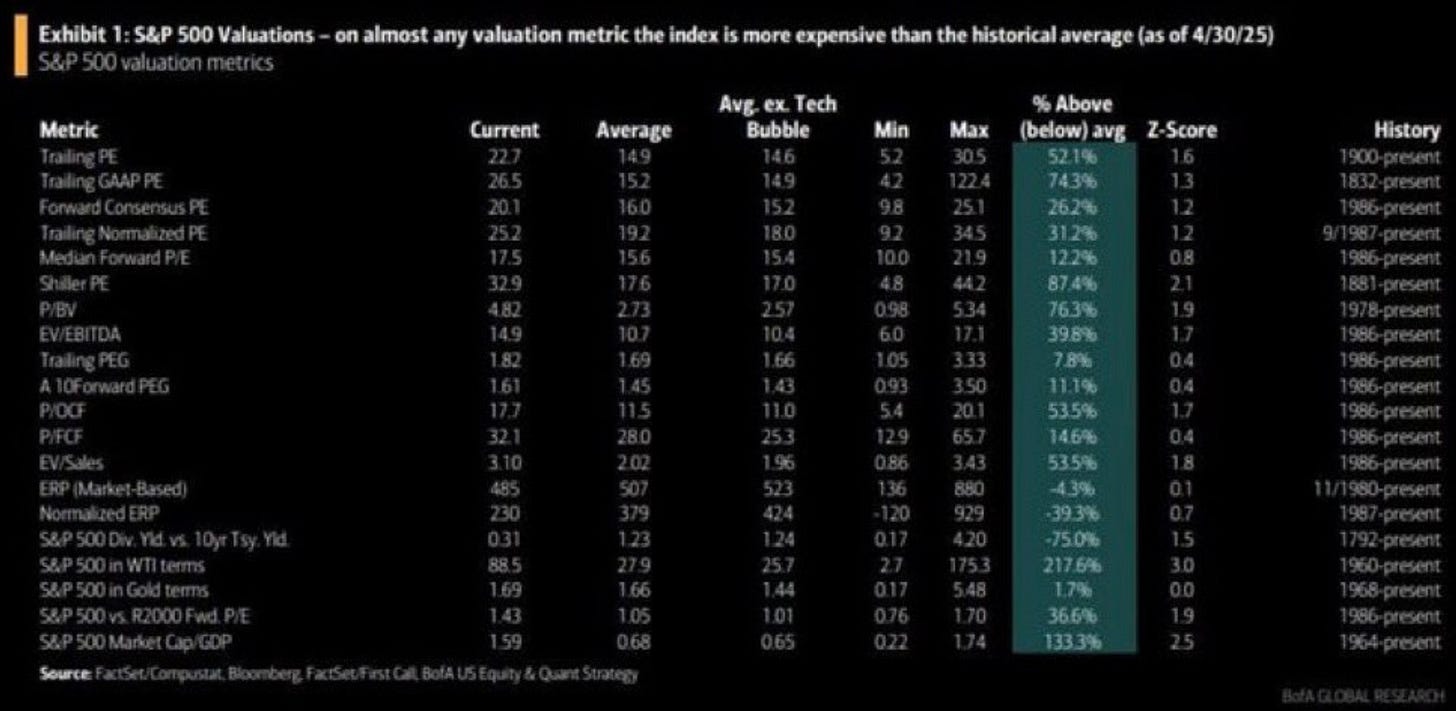

According to BofA, the S&P 500 is at historically expensive levels in every metric that they track.

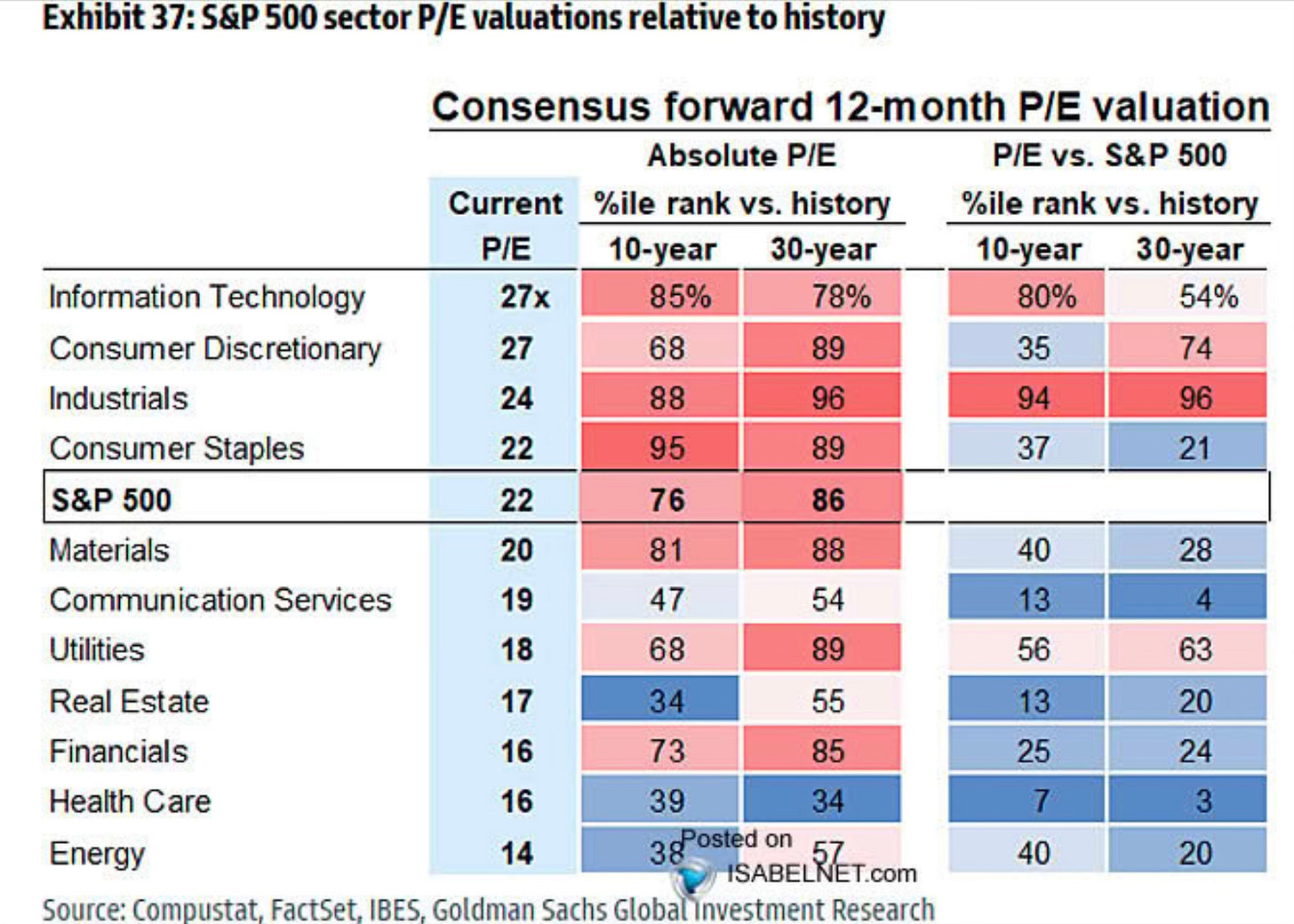

Even valuations on the sector side are very overvalued relative to their historic norms.

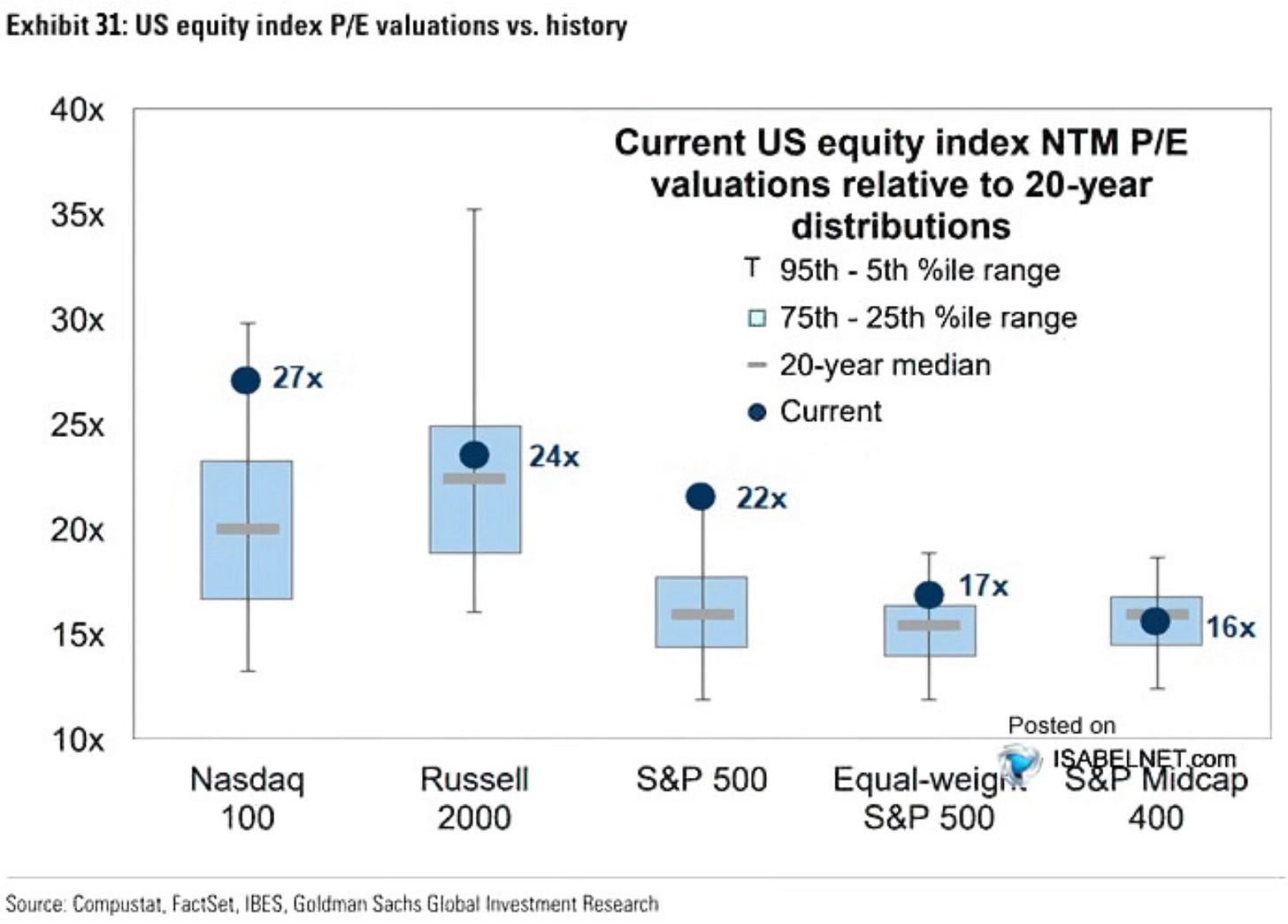

The forward P/E on the major indexes are below. Right now only the Russell and midcaps aren’t outside their historical norms. The S&P 500 and Nasdaq are way outside the norms relative to history.

Valuations don’t matter until they do. In a ragging bull market, valuations take a back seat as momentum dominates. People think about FOMO and how this time is different. Then when you get pulled back down to reality in a market selloff or bear market, we’re reminded that valuation matters. At some point in time, valuations do always matter.

An Eye On Employment

Jim Paulson made a great point in what’s going on with the job growth rate. He noted the following.

Many perceive today's job report was okay. The Fed can wait. But the chart below shows YOY% job growth is "very weak". With 1.1% job growth, the US has been in a recession or close to one in each of its 12 recessions since 1950. The Fed needs to ease!

That 1.1% YOY job growth rate flashes a big red light. That level has coincided with periods right before or even during a recession going back to 1950. He believes the Fed should ease monetary policy soon.

I wrote about a hiring slowdown last week in my Investing Update: Mag 7 Falling Out Of Favor? before I saw this data. This adds even more fuel to the cooling labor market story and that there may be some worries brewing here.

Upcoming Earnings

The Coffee Table ☕

Ever wonder how to get money out of a 529 plan? This is a good article that shows how to get money out of your 529 plan. How to Get Money Out of Your 529

Hopefully you aren’t getting divorced, but this is a very good article in the WSJ on five financial mistakes people make when getting divorced. Five Common Financial Mistakes People Make When Getting Divorced

How much of an outlier has Nvidia been ? Take a look at this from Charlie Bilello. He compared Nvidia to the other S&P 500 companies over the last decade for earnings growth and shareholder return. You can see that it has been on a completely different level from all the other companies.

Source: Charlie Bilello

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.