Investing Update: Bear Market Rally Or New Bull?

What I'm buying, selling & watching

The two week rally came to an end as the market finished down slightly on the week. The S&P 500 finished down 0.5%, the Nasdaq down 0.3% and the Dow down 0.2%.

One of the major indices was positive and that was the Russell 2000.

The streak continues for the Russell 2000 as that makes 5 straight positive weeks. It’s up 11.5% in that time. Maybe the small-caps time to be a market leader will finally come.

Wednesday saw Fed chair Powell make no change to interest rates and say that the Fed is going to wait. Like everyone else, they don’t know what going to transpire in the economy either. It looks as though they’re going to be reactive.

Now the focus this week shifts to the U.S. and Chinese officials who will meet to have discussions in Switzerland surrounding tarrifs. Expect with each sentence and comment reported from the discussions to move the market one way or another. It might be popcorn worthy headlines, but nothing that happens this week should alter any long term investing strategies.

Market Recap

Weekly Heat Map Of Stocks

Bear Market Rally Or New Bull?

The debate over the last few weeks has been if we are in a new bull market or if this is a bear market rally.

It’s a plausible questions to ask. I just don’t believe that there is much of a debate in my mind.

Now the major investment banks don’t think we’re out of the woods yet. Clearly they all are in the bear market rally camp.

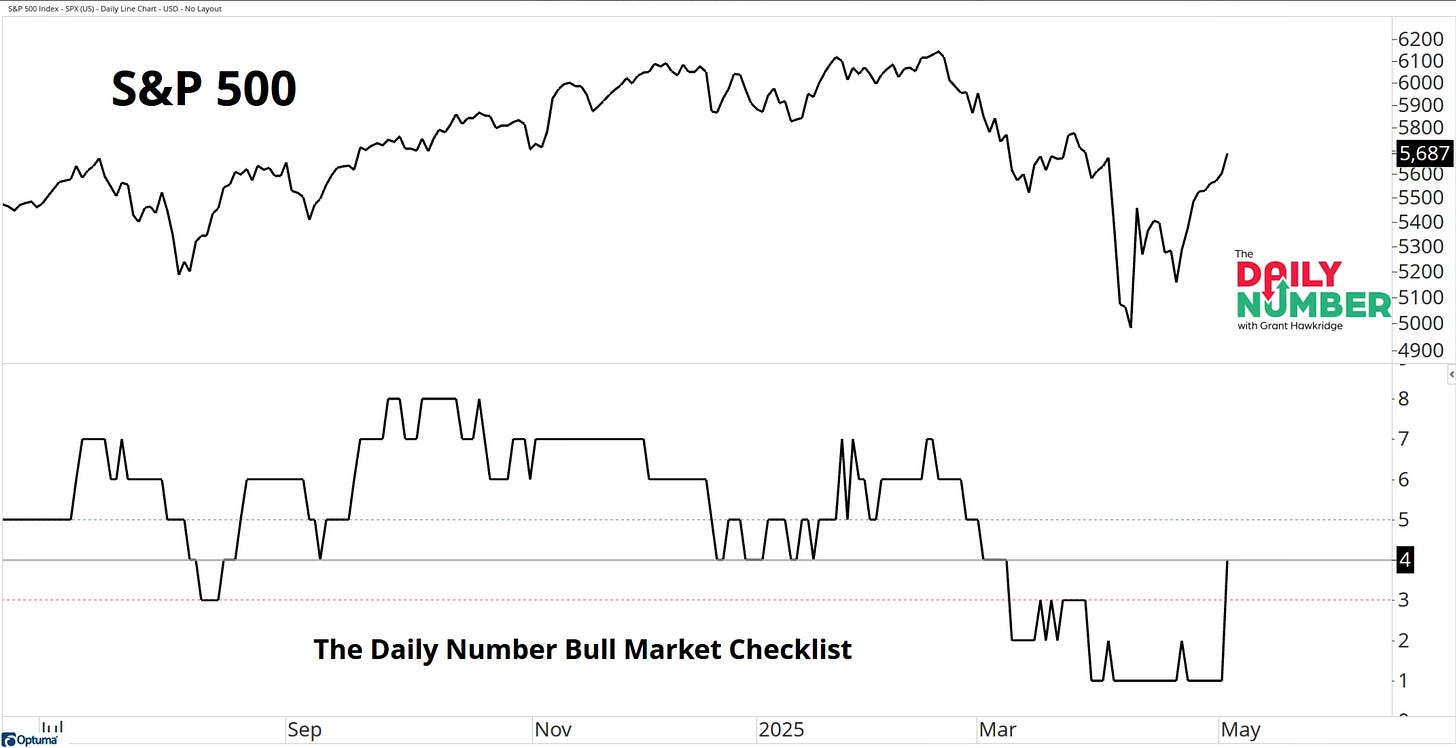

If we look at Grant Hawkridge’s bull market checklist. It’s the highest it has been since March.

Right now the short term trends are looking strong. The long term trends have not hit there yet. This is an important thing to watch to get further confirmation of a new bull market.

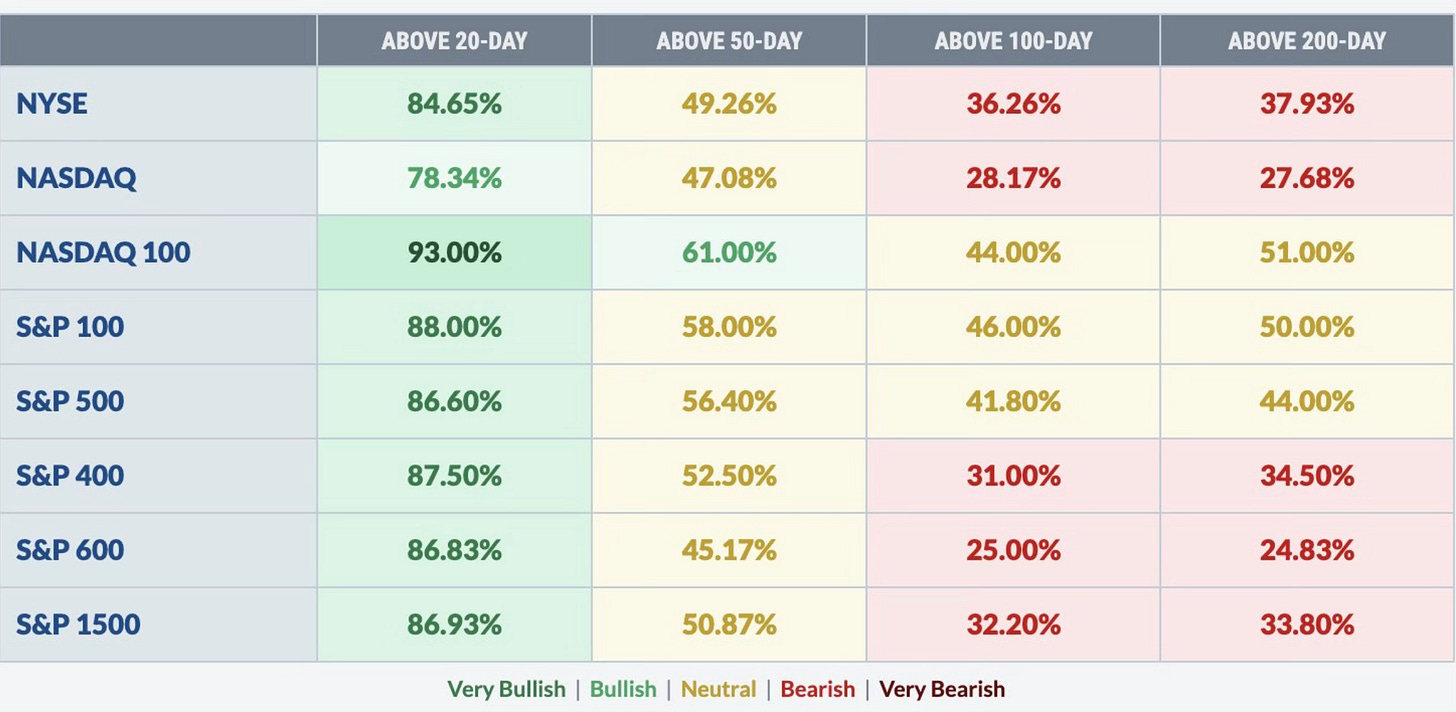

Then we have this from Bespoke.

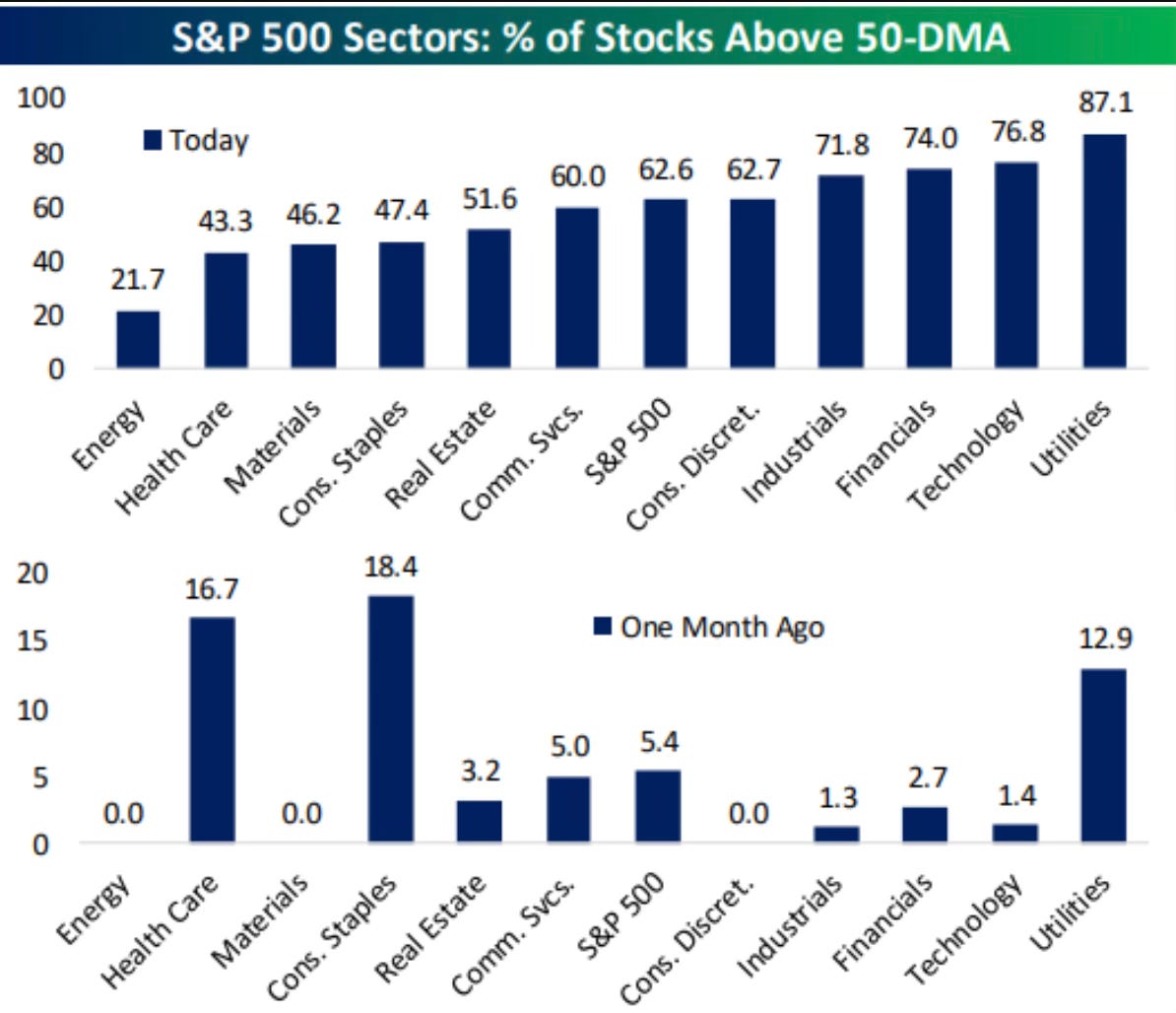

Seven of eleven S&P 500 sectors are back to having more than 50% of stocks above their 50-DMAs. A month ago, no sector had more than 19%.

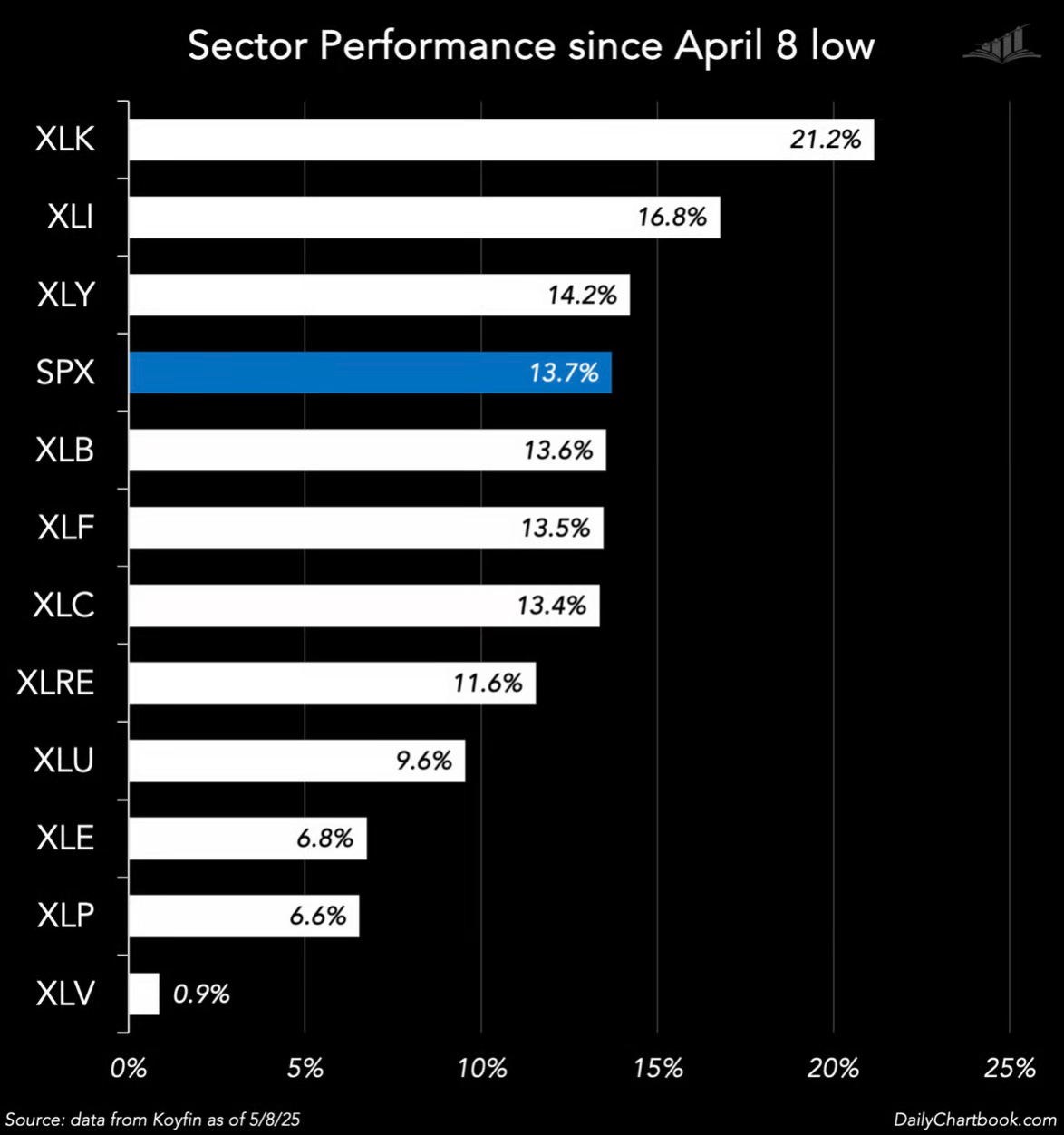

You can see the strength in overall sectors since the April 8th low.

They’re actually not all that far off their 52-week highs. I wouldn’t be surprised to see some sectors start to set a new 52-week high.

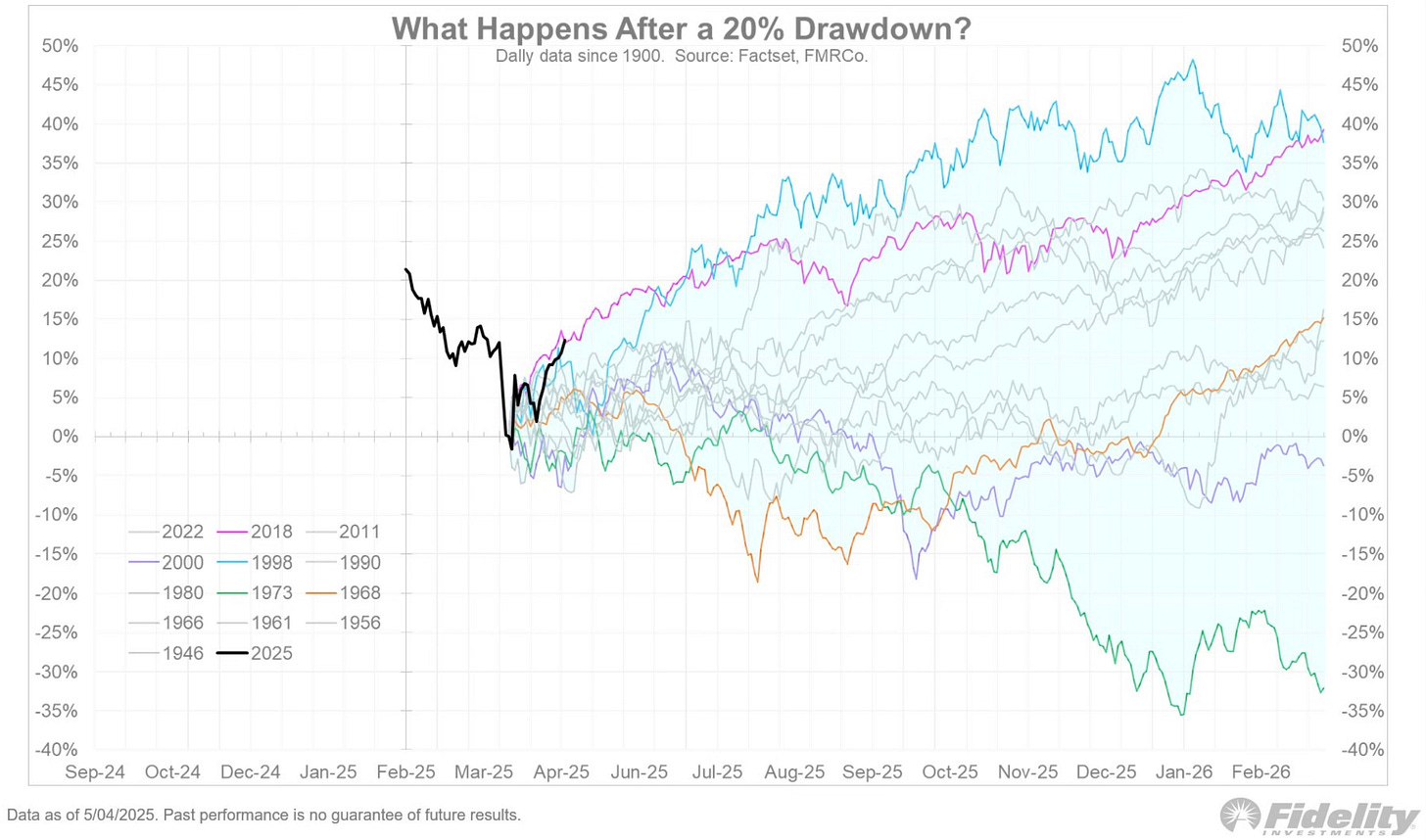

I think something else we have to remember is what happened in 2018 and how that path from its 20% drawdown occurred and then spiked higher and took off. 2025 is looking to be on a similar path.

This has been quite a comeback. You have to really understand that even though many have been screaming recession, the market doesn't think so. According to the stock market, right now a recession is off the table.

The AI build out continues. Earnings have held and still remain strong. The tariff news which was the reason for the volatility and uneasiness, has settled down. It shouldn’t come as a surprise that the market has also settled. The this too shall pass theme continues to remain.

If a recession does in fact happen, then all bets are off. I think we do retest the April 8th low of 4,835. Simply put, if a recession doesn’t happen, the lows of 4,835 will remain the lows and we will see new all-time highs by year-end.