Investing Update: New Highs Incoming?

What I'm buying, selling & watching

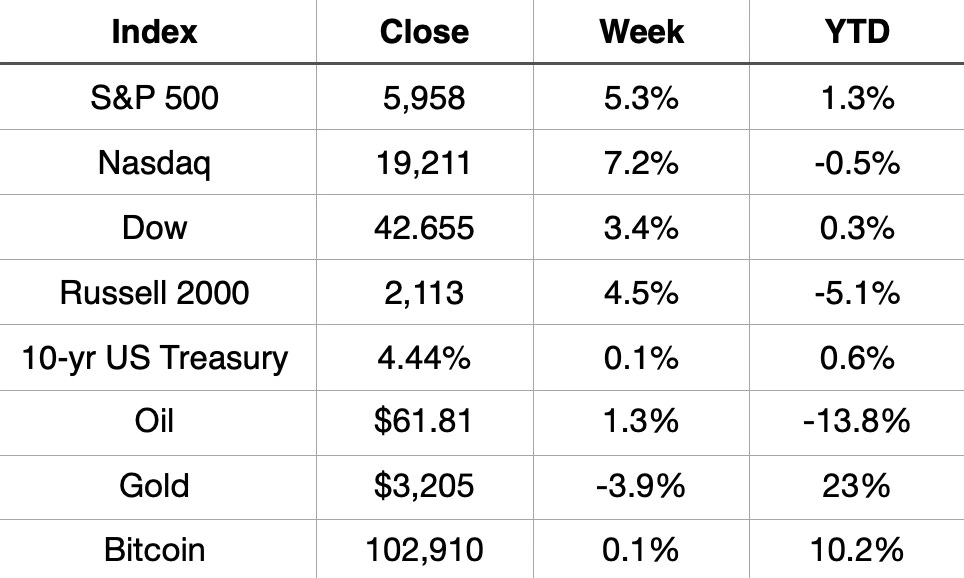

What a week! The S&P 500 started the week off with a 3.3% gain on Monday. That was the 3rd best day in the past 5 years. It ended the week green everyday and finished the week up 5.3% It was 2nd best weekly gain since October 2023. 3 of the past 4 weeks have been positive. It has only been down in 3 sessions since April 22nd.

The Nasdaq has its 2nd best week since November 2022 finishing up 7.2%. The Russell had its best week since November.

Market Recap

Weekly Heat Map Of Stocks

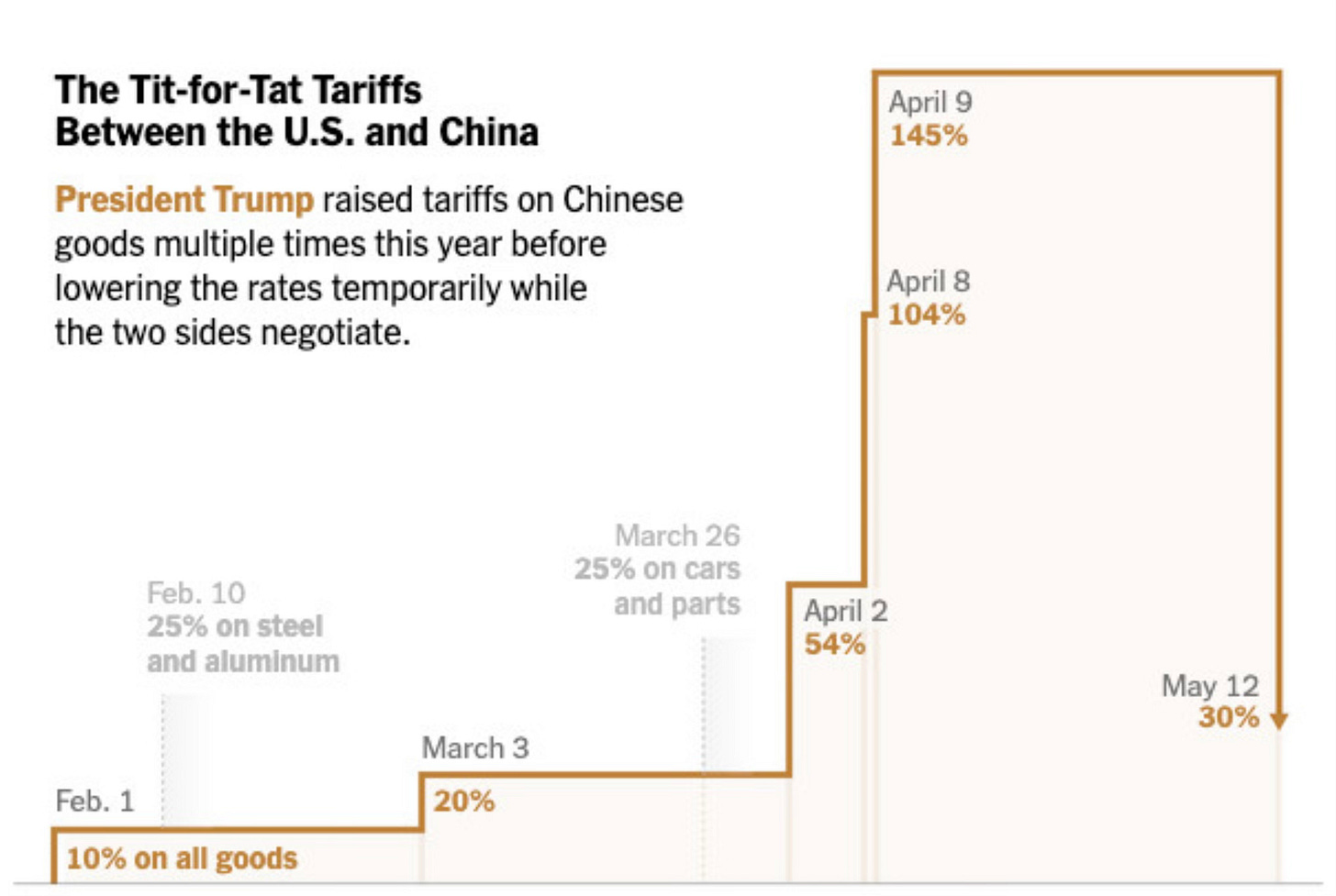

This week’s rally was ignited by the Trump administration temporarily lowering the tariff rates on Chinese goods.

The S&P 500 is now up more than 20% since the April 7th low. The last time the S&P 500 erased a 15% YTD decline in under 6 weeks was in 1982.

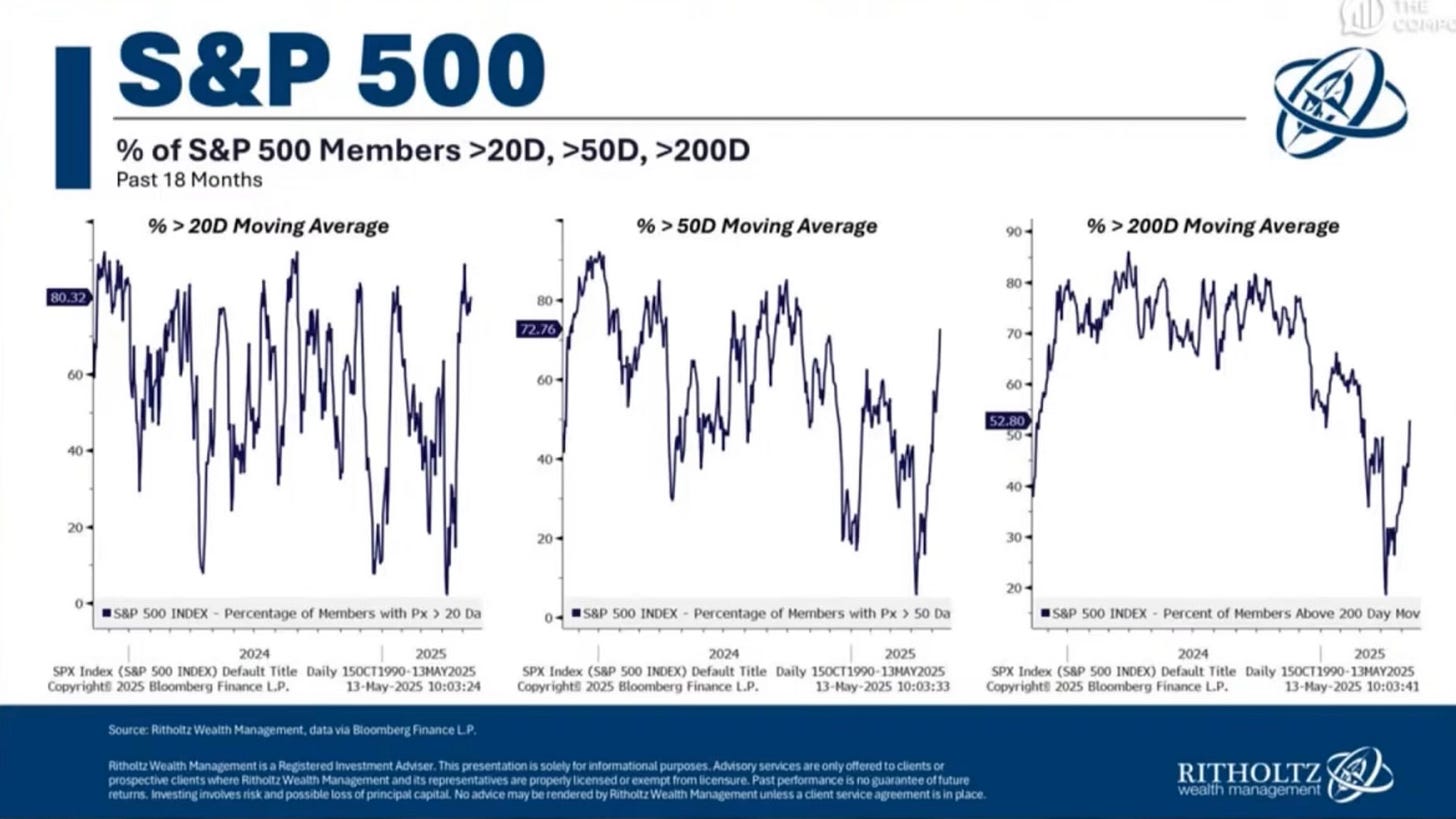

You’re seeing strength as the percentage of S&P 500 companies above their 20-day, 50-day and 200-day have all moved noticeably upward.

This quick drop and fast snapback is very similar to the Covid crash.

With the lowering of the tariffs on Chinese goods, it not only ignited a stock market rally but also flipped the odds a recession this year.

In a week the odds of a recession have dropped from 75% to 36% on Kalshi. It’s been cut in half since the April 30th peak. Remember that we’ve only had 2 months of a recession in the past 16 years.

This week also saw a good CPI reading kind of go unnoticed. The numbers came in line and prices rose at the slowest rate since February 2021.

There was no uptick in tariff related inflation fears. We will have to wait and see what the May numbers show.

The YoY rate dropped from 2.4% to 2.3%. That’s a new four-year low. You can see most all areas have now fallen quite a bit from where they were.

New Highs Incoming?

Where does the market go from here?

Let’s first take a look at what I’ve recently said.

Last Saturday May 10th in my Investing Update: Bear Market Rally Or New Bull?

You have to really understand that even though many have been screaming recession, the market doesn't think so. According to the stock market, right now a recession is off the table.

If a recession does in fact happen, then all bets are off. I think we do retest the April 8th low of 4,835. Simply put, if a recession doesn’t happen, the lows of 4,835 will remain the lows and we will see new all-time highs by year-end.

April 19th in my Investing Update: Is The Worst Over?

We saw concrete floor type support of 4,835. That’s also the 2022 high. I believe that 4,835 level will prove to be the bottom.

If there proves to be no recession, this will prove to be a tremendous buying opportunity. Now if down the line a recession happens, that may be a different story. But the recession piece to this puzzle is the unknown.

If it doesn’t happen, you don’t want to be in cash or even worse, be short this market.

Imagine what this market does on the news of tariff deals?

Well we just saw what the market would do on positive tariff news. Now what’s the next step from here?