My Investing Philosophy

Why invest how I do

When I was young and wanted to start investing, I figured the best way to learn was through reading books. Many of the world’s most successful investors have written books about investing. Why not read them, I thought.

So I started to read and read. I looked in my library to count how many books I’ve read on investing. To my surprise, I’ve read 48 books.

Some of those books were informative and helpful and others weren’t. Through this self-educating approach I was able to take something from a number of books to create what I thought was the best investment strategy for me.

Over the years I tried a number of different ways of investing. The way to learn was by trying. Trial and error has been my best teacher in life. Through trying I lost money and did some things I wish I could do over. But most importantly I learned.

I learned about what’s the best investment mix for me. I learned about selling too early. I learned about letting your winners ride. I learned about overtrading and when it becomes not investing. I learned about my time horizon and that it will likely be different from others.

So today, I want to share details on my investing philosophy and why invest how I do.

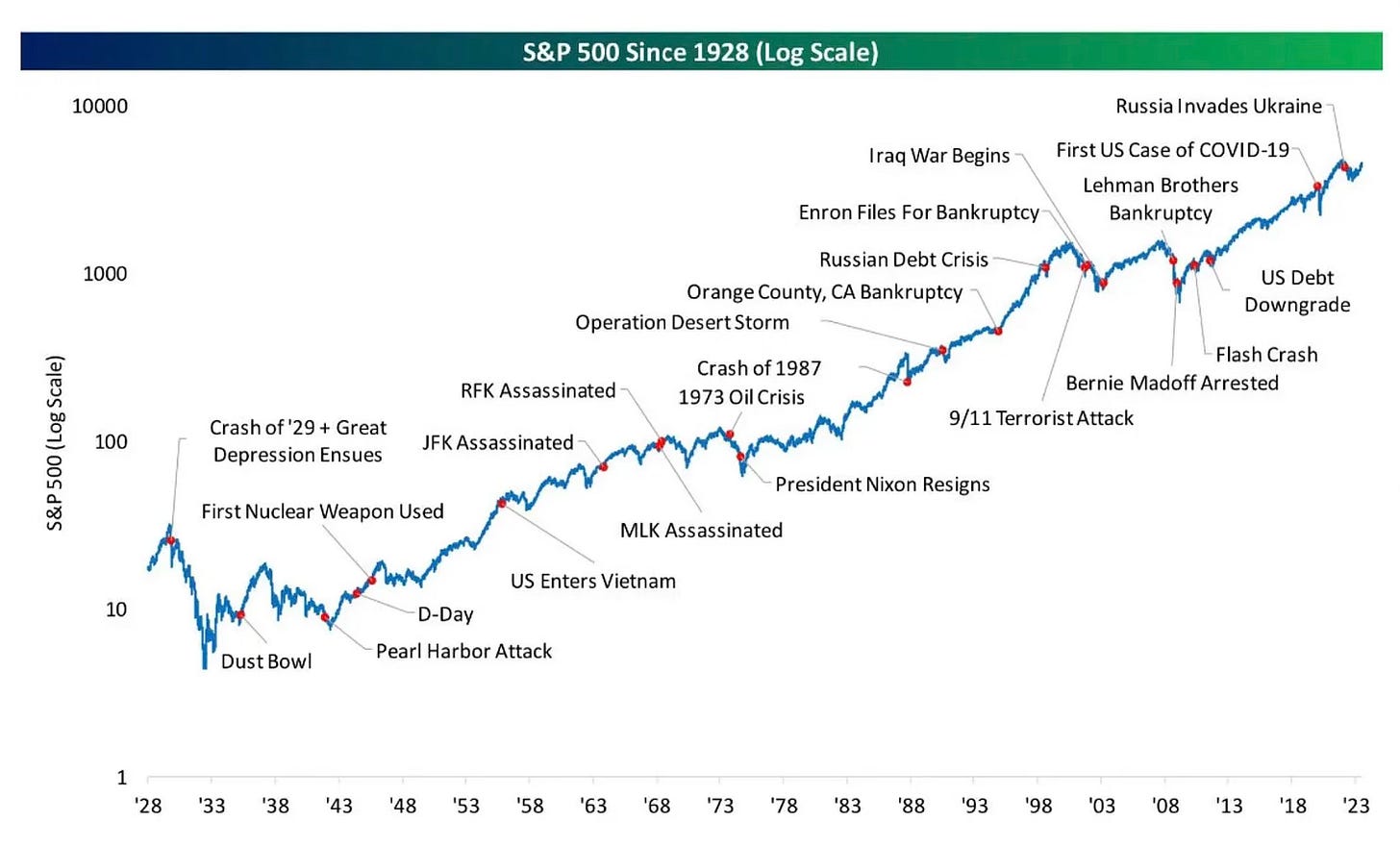

The first thing I learned early on was that it’s very tough to outperform the overall stock market. The S&P 500 is the benchmark for a reason. It’s hard to beat and it’s extremely hard to beat consistently.

With that in mind, one of the first investments I made was to buy the S&P 500 index.

I often think back to what Warren Buffett said were his plans for the trustee in charge of his estate upon his death. He instructed that 90% of his money be invested into a very low cost S&P 500 index fund for his wife after he dies.

You can see why.

Going back to 1928 there has always been risks and worries to the stocks market. None of it mattered over the long term.

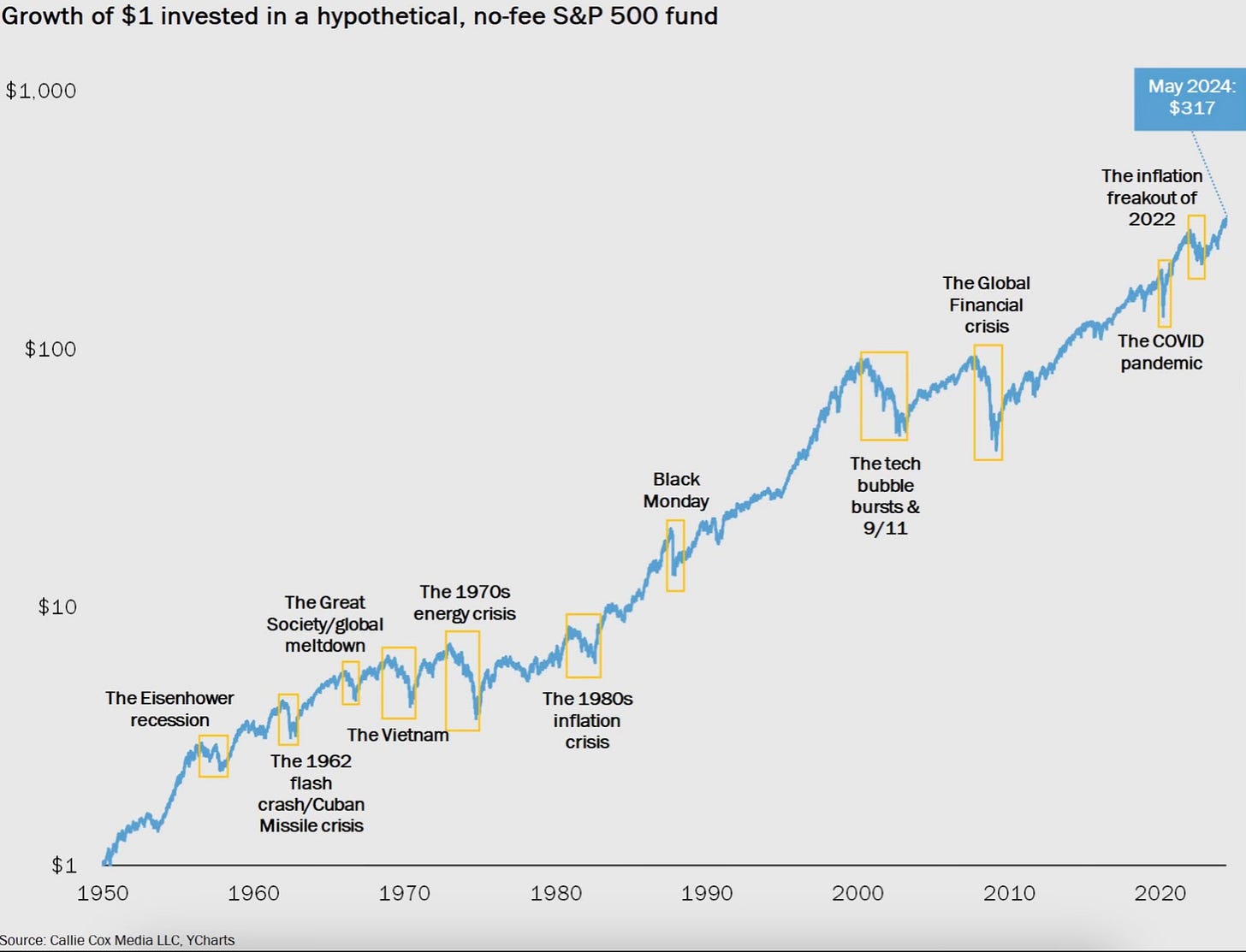

Here is another way to look at it with the growth of $1.

So to this day, every single month, I make an investment into my retirement account that buys the S&P 500 index. Bull market, bear market, recession or all-time highs, it doesn’t matter. I buy every single month. I plan to continue doing this for as long as I have an income.

Having a solid foundation where I’m diversified in the overall stock market through a low cost S&P 500 index fund plays into how I operate my individual stock portfolio. It offers me the opportunity to be more aggressive in my actively managed portfolio.

After trying different ways of investing, I decided I wanted to use a high conviction strategy. What does that mean? A high conviction investing strategy is one that builds and maintains only a few investment positions. For me, I strive to own between 8 and 12 stocks or ETFs.

Here are four lessons that I’ve learned over the years that have helped me immensely in my high conviction strategy.

I don’t day trade. I may go weeks without making a move. I won’t sell or trim a position just to sell. I don’t sell unless a company’s story changes, or if I want to trim something for another opportunity I may like better. I overtraded in 2022 to try and recover my losses and that only made my performance worse that year.

Let your winners ride. If I believe a company goes higher, why sell? Don’t sell just to sell.

In 2008, during the GFC, I had bought Microsoft. Not long after it doubled, I sold my entire position. I had read that once you’re up nicely on a stock, you should sell and lock in your gains. It was a mistake and I should still own those shares. But I was 23 years old and still learning. It was a great lesson to learn while I was young.

So when I bought Apple in 2014, I applied what I had learned from the Microsoft mistake and didn’t sell it after it doubled, then doubled again. I still own it and have let Apple keep running to this day.

I bought Nvidia in January 2022 after it had got cut in half. It has since made a historic run higher and I’ve yet to sell a single share.

Often doing nothing is the best decision. Somedays you have to just sit there and do nothing. Sit on your hands. If you have high conviction on something there will be many days where you’re tempted to sell by giving into the panic and hysteria. You have to block out the noise and maintain focused on the long-term.

Invest how you want. Everyone has a different time horizon and investing objective. There is no one sized fits all approach to investing. There is no perfect portfolio. This is what works for me. It may not work for everyone and that’s just fine. It’s how I want to invest.

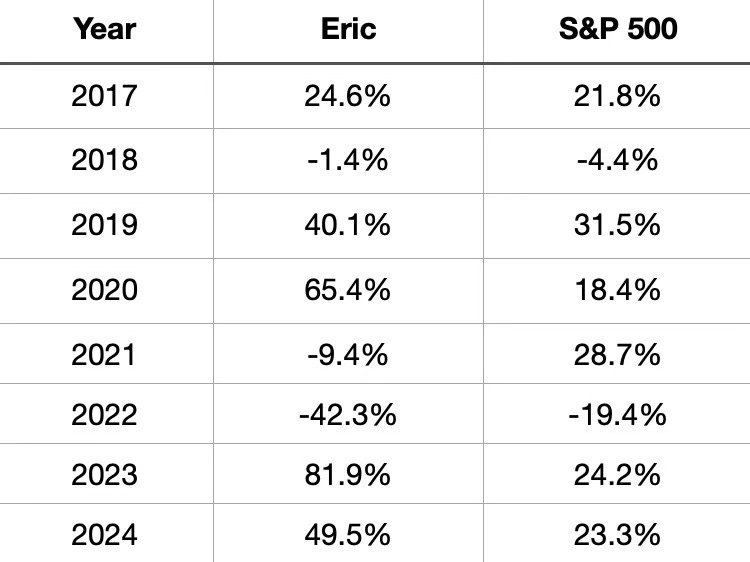

This investing approach has done well for me when I compare it against the S&P 500. My actively managed portfolio has outperformed the S&P 500 in 6 of the past 8 years.

If you’d like to take a look at my holdings I discussed it recently in, Investing Update: 2024 Recap & 2025 Outlook. You can also read about my 3 stocks for 2025 in, Investing Update: 3 Stocks For 2025.

The Coffee Table ☕

I liked reading Callie Cox’s piece called Apple investors' mental torture. She hits on just how hard it is to stay invested in stocks for the long-term. To see what people had to endure over the long-term with Apple is interesting. Most can’t handle all the big drawdowns. If you did, you were rewarded.

Were you aware that diamonds have gone in the complete opposite direction as gold? I didn’t. They each changed course in 2023.

Source: Isabelnet

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.