Investing Update: 2024 Recap & 2025 Outlook

What I'm buying, selling & watching

The holiday shortened week ended with the stock market finally seeing an up day on Friday, as both the S&P 500 and Nasdaq snapped 5 day losing streaks. The annual Santa Clause rally didn’t come this year for investors. Now all eyes turn to 2025.

Market Recap

Weekly Heat Map Of Stocks

2024 Recap

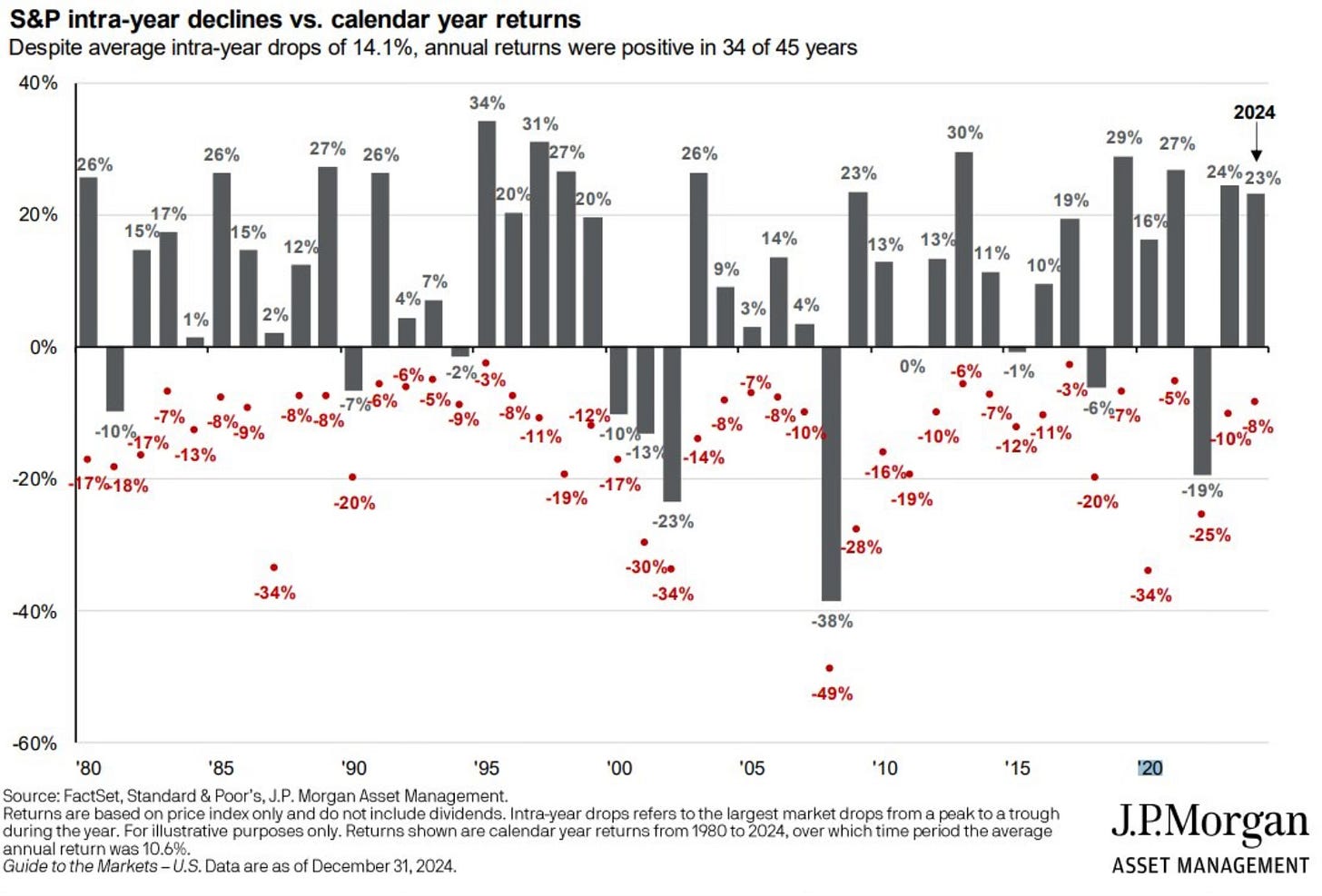

The S&P 500 finished 2024 with 57 all-time highs. The second straight year of over 20% gains. It was the best back-to-back years since 1997-1998. Many things worked well and rewarded investors in 2024.

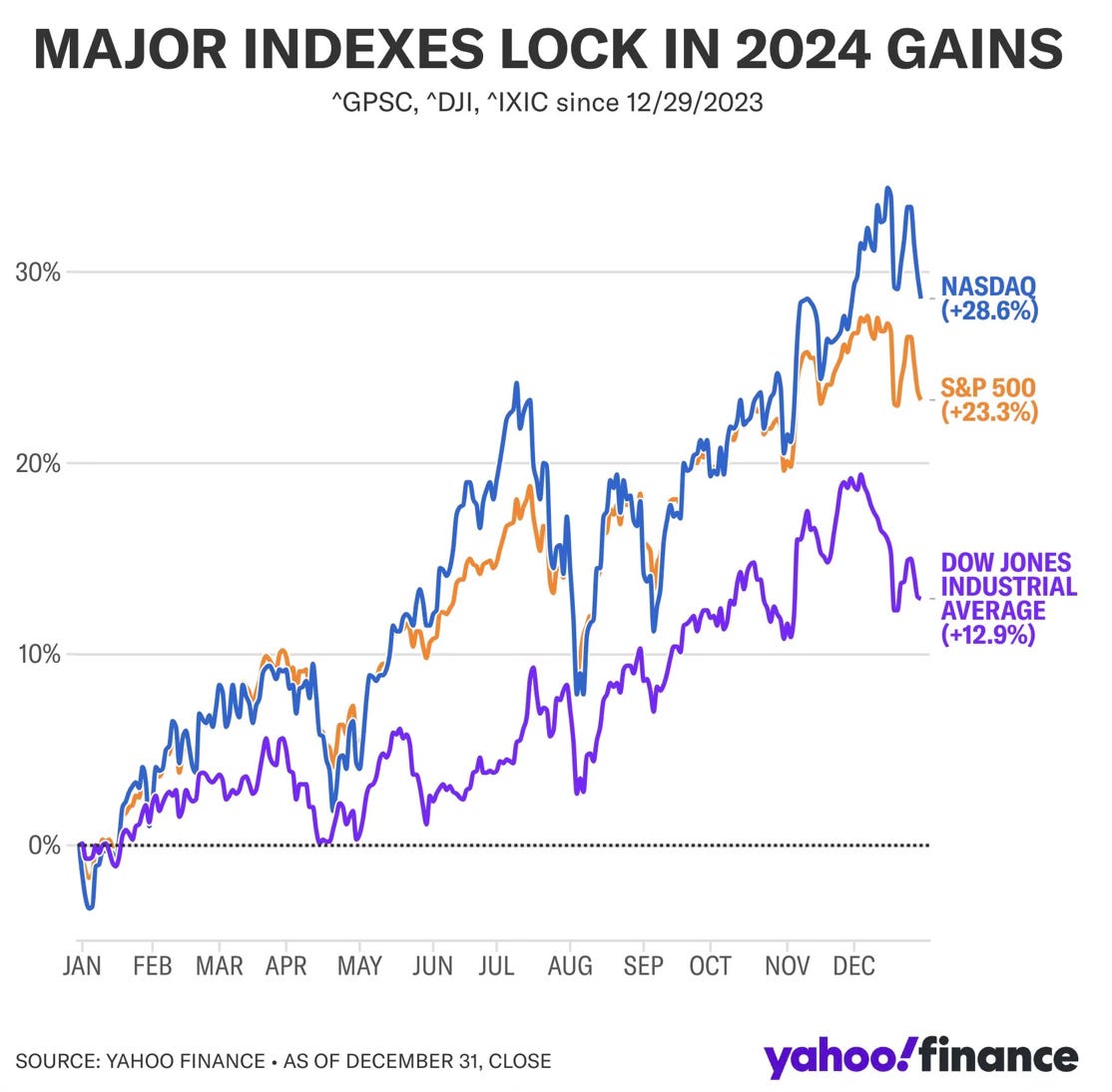

Dow: 12.9%

S&P 500: 23.3%

Nasdaq: 28.6%

Small Caps: 10%

Cash: 5.2%

Emerging Markets: 6.5%

REITs: 5%

Gold: 26.6%

Bitcoin: 121%

60/40 Portfolio: 14%

It was a relatively smooth ride in 2024 as the largest drawdown was only 8% for the S&P 500.

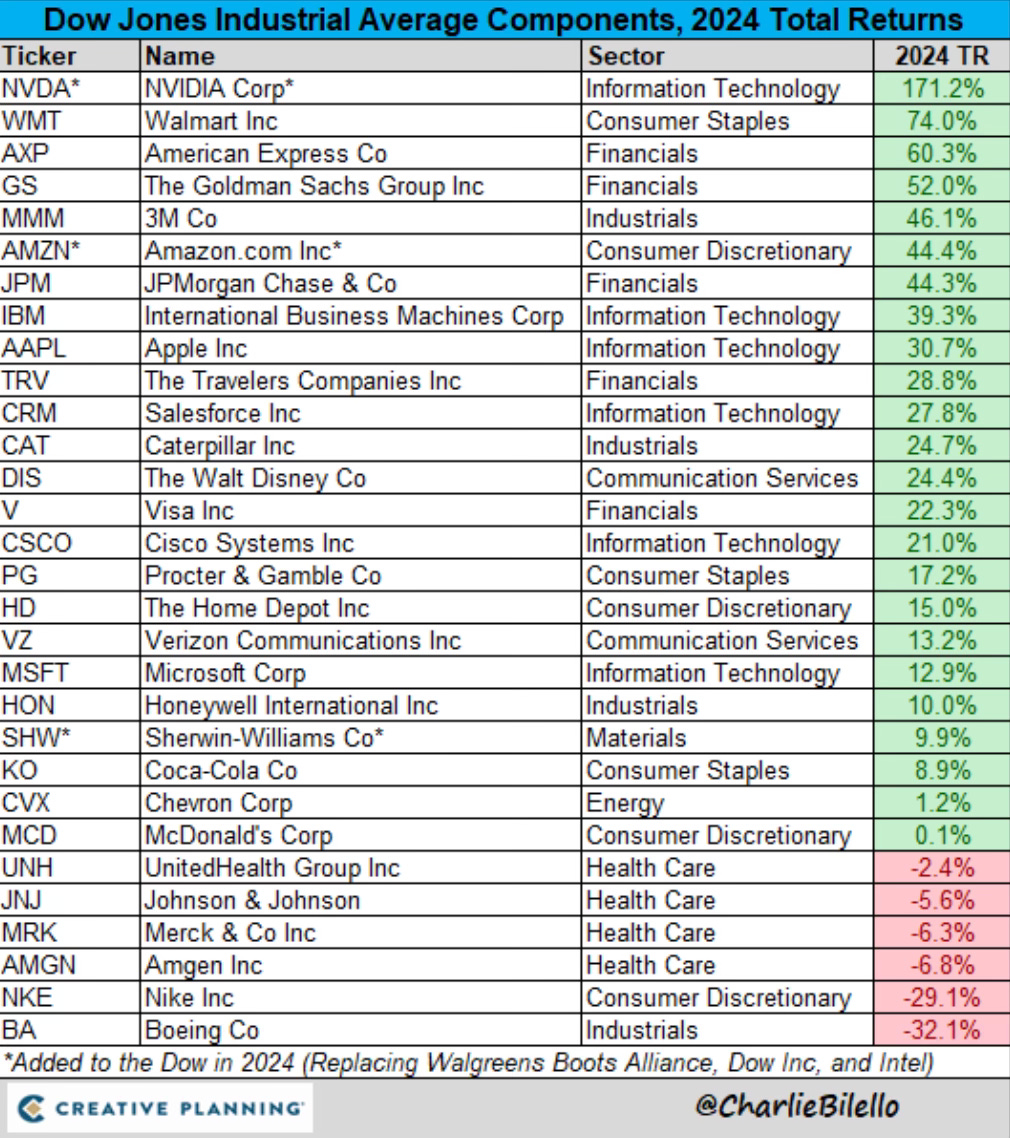

Here are how the Dow components finished out the year. Nvidia was the far and away leader. Walmart, American Express and Goldman Sachs all finished the year with returns over 50%. On the other end, Boeing and Nike had years to forget. I’m starting to do some work on Nike as it’s down over 38% in 2 years and down over 27% over the past 5 years.

Here is the heat map showing how each stock in the S&P 500 performed in 2024.

The best performing stocks in the S&P 500 in 2024 were led by Palantir and Vistra.

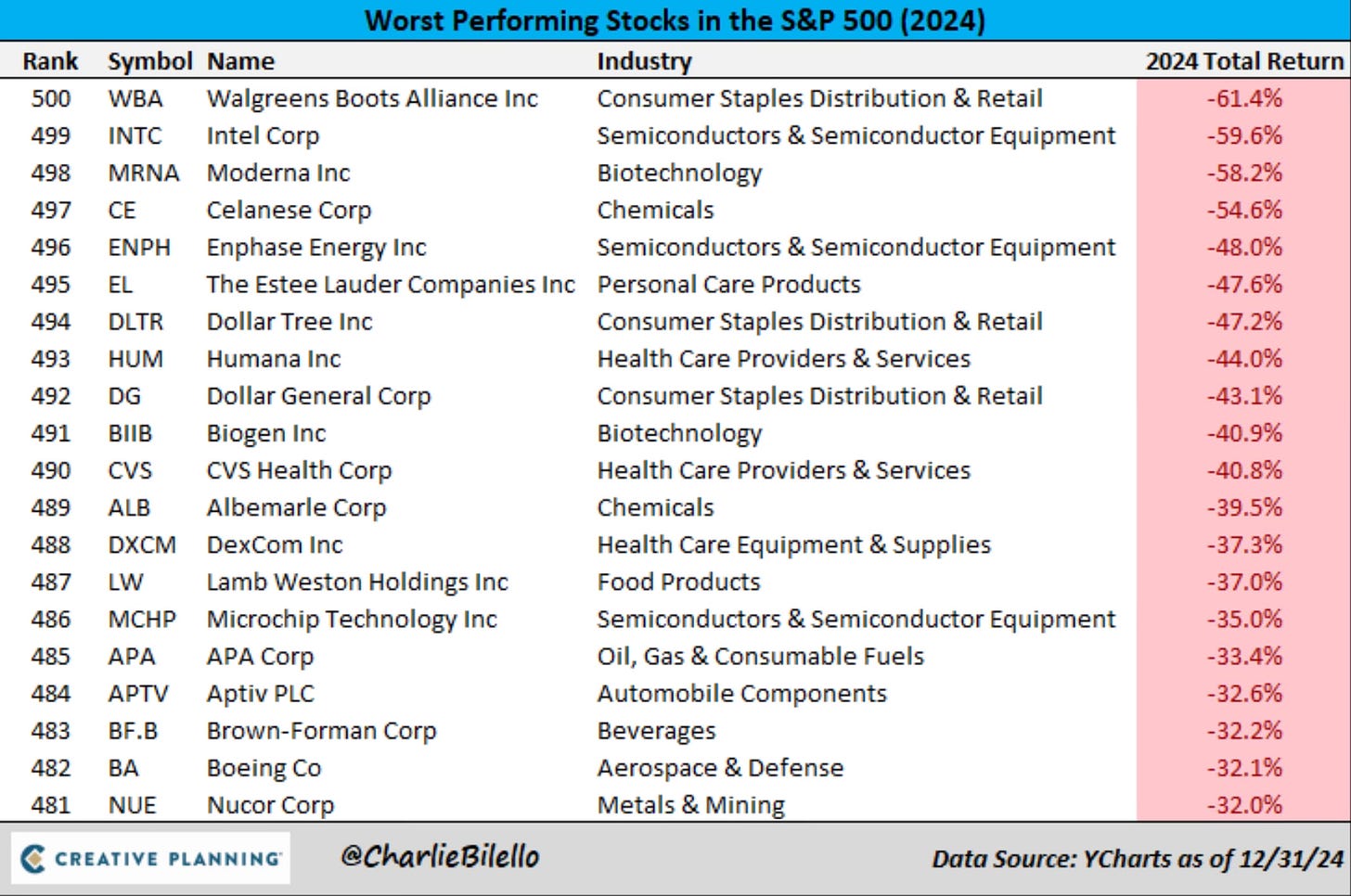

Then here are the worst performing stocks in the S&P 500. I will usually look this list over for interesting buys in the coming year, but I don’t see any that jump out at me.

From a sector standpoint, 8 of 11 sectors underperformed the S&P 500 in 2024. Materials was the only sector that finished in the red for the year. Communication services and not technology was the winner.

Here is a good asset class overview chart that shows how much the various asset classes were up and down throughout the year. A good way of showing the volatility among the asset classes.

Then there is my favorite chart of asset class returns looking back to 2011 through 2024.

After another year, the average annualized total return for the S&P 500 since 1928 is still 10%. Here is the pyramid of yearly returns.

My Performance In 2024

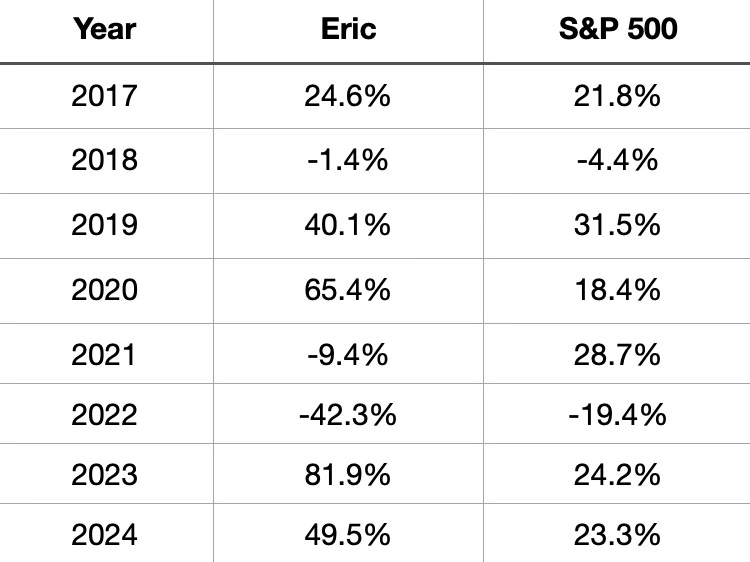

I wanted to look at where my actively managed portfolio and my 3 stock picks for 2024 finished up versus the major indices.

My Portfolio (Actively Managed): +49.5%

Dow: +12.9%

S&P 500: +23.3%

Nasdaq: +28.6%

Although I didn’t match my 2023 performance of 81.9%, I’m very satisfied with it being up 49.5% in 2024. It was officially 49.54% so I couldn’t round it up to the milestone mark of 50% and make it sound better. Oh well!

This will mark the 6th time in the past 8 years that I’ve outperformed the S&P 500.

Now let’s take a look at the stocks that currently make up my portfolio, as well as my 2025 outlook.