Investing Update: Why I'm Buying Nvidia

What I'm buying, selling & watching

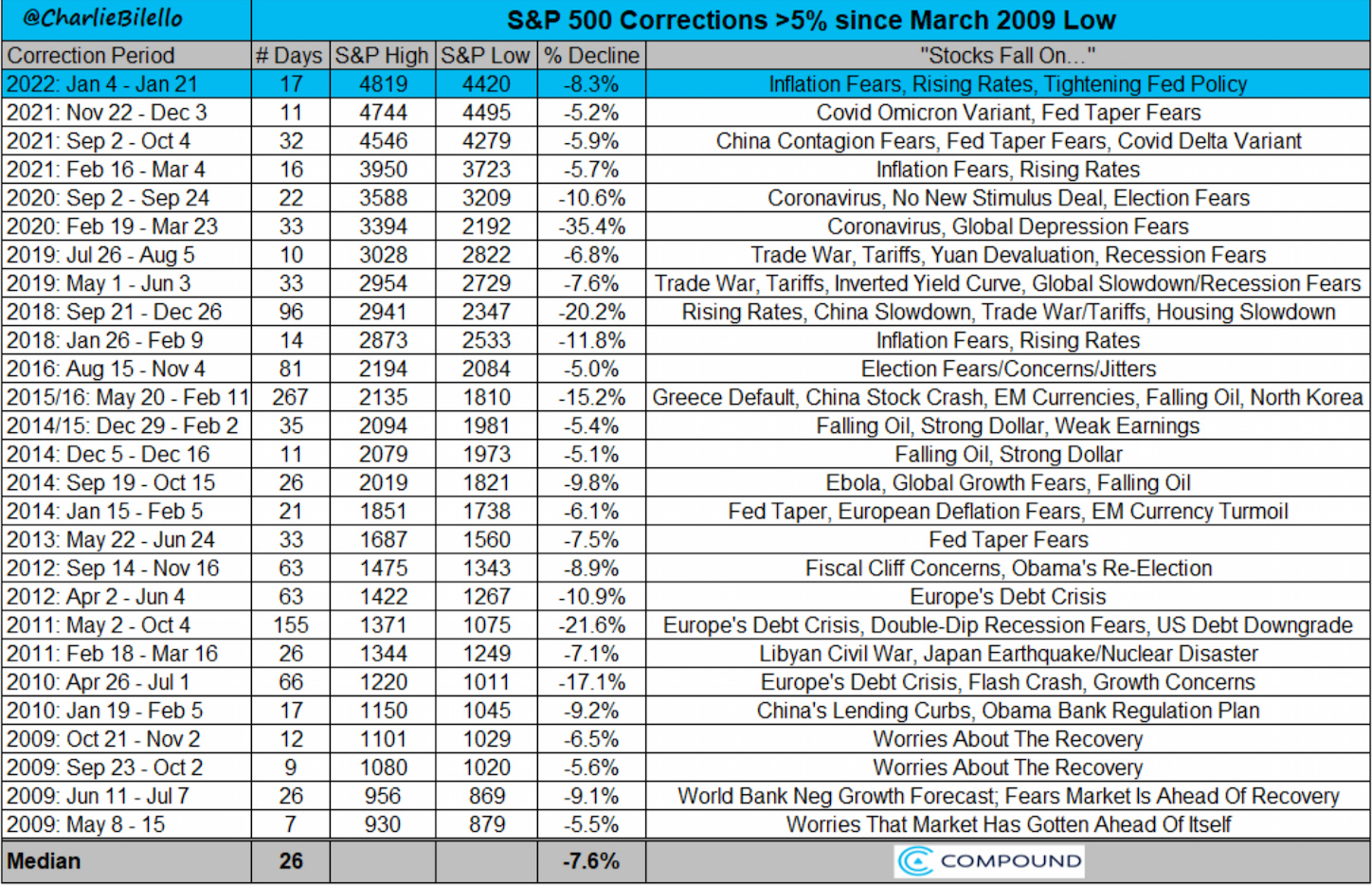

We just witnessed the most volatile week in the markets since March of 2020. As the chart illustrates below, we’ve entered only the sixth 5% or greater correction in the S&P 500 over the past two years.

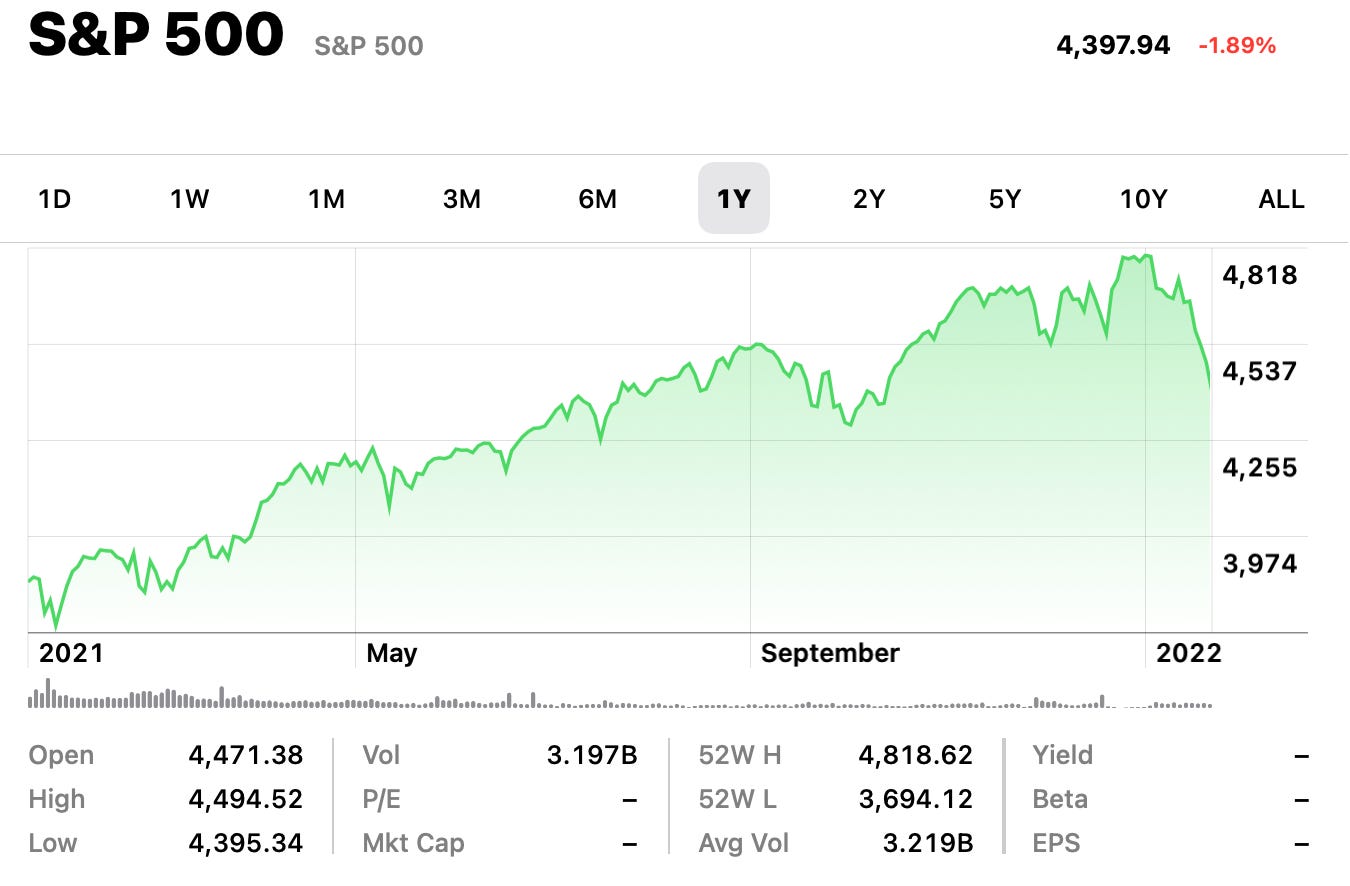

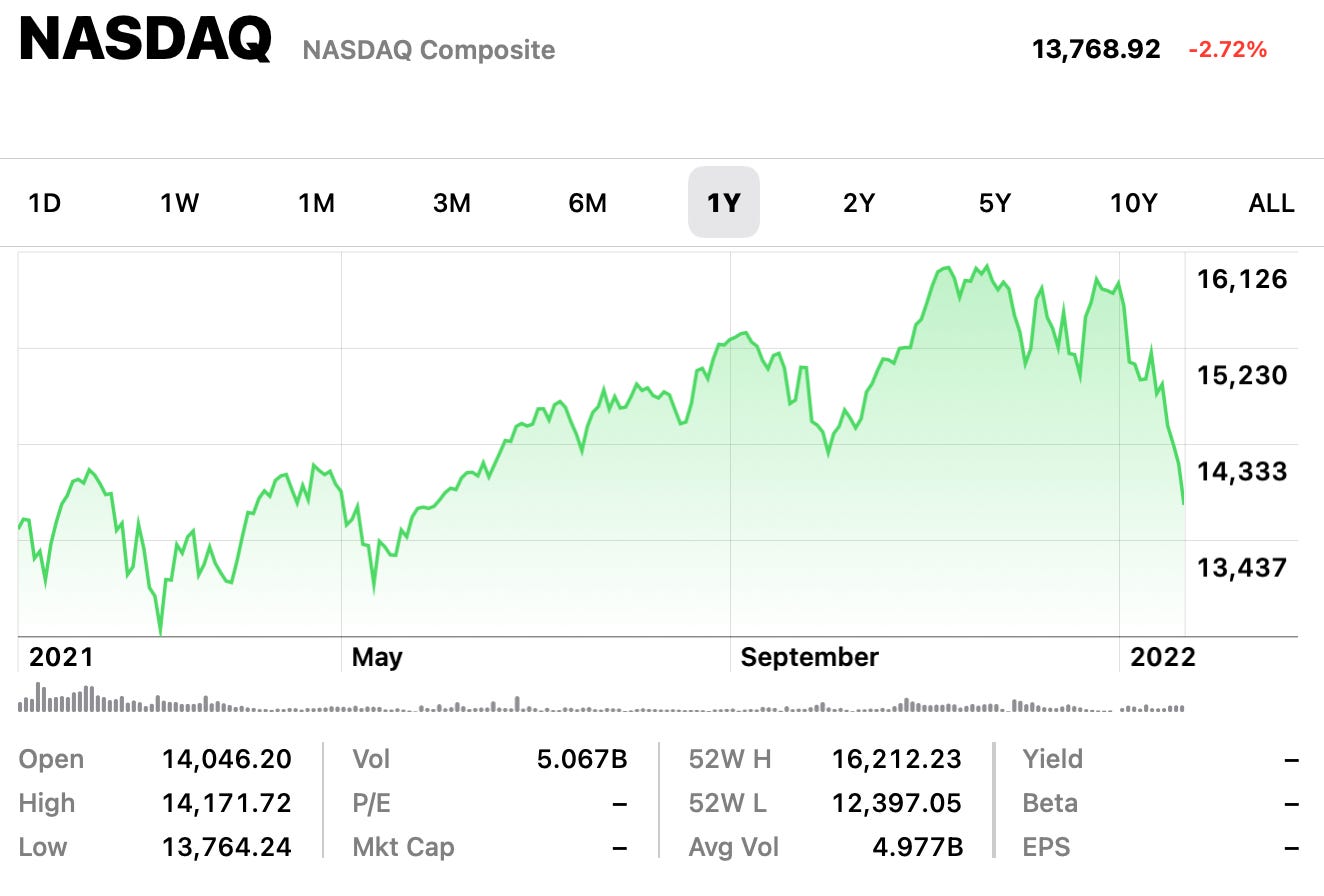

Both the Nasdaq and the S&P 500 closed below their 200 day moving averages. The S&P 500 is down 8.3% from its January high and the Nasdaq is down 14.3% from its November high.

This closing range really sets up an unpredictable week ahead. Everyone is wondering if the selling is done and is this the bottom? Or is there more downside to come?

If you do start some buying here you surely aren’t buying near the top. Keeping in mind that money invested in the stock market shouldn’t need to be touched for five years or more, this is a good level to put some money to work.

What I’ve done is evaluate my portfolio to make sure I’m positioned for this changing market environment. I reviewed the stocks that I own and asked myself if this stock falls 10% or more from these levels, would I buy more? If a stock I owned did not meet that, I’ve sold it. I also looked at stocks that I have profits in and if there is a 10% pullback how much exposure to the downside do I want to have. That led me to trim a couple stocks.

I’m currently at the highest level of cash in my portfolio as I’ve had in years. I’m watching a large number of stocks and indicators before I’m going to put some of that cash to work. Certain stop loss sales that were initiated have saved me from further losses of 20 to 30% in some stocks.

There are some stocks that I’ve missed the past few years that have run up so fast that have now come down to levels where they’re becoming attractive. I wrote many off because I missed the boat or their valuations became out of hand. With many coming back into sight, I have to do more research on those stocks.

Market selloffs bring a lot of anxiety and fear. Many great opportunities arise and establishing long term positions at discounted price levels is a key to successful investing.

Moves I’ve Made

Nvidia (NVDA) I started a position in Nvidia. I’ve wanted to get some semiconductor exposure in my portfolio. My view is that semis are going to be the new oil. We saw how important they are to most all things that are made nowadays. Anything that has any type of technology in them needs semiconductors to work.

I was looking at AMD as well but really like the long term future of Nvidia. Their chips are the most advanced and technological in the world. They also have one of the most visionary CEOs in Jensen Huang. When you talk innovation and building the future of technology, he is right there behind Elon Musk in my opinion.

Nvidia currently 30% off it’s previous high. If it goes down more, I will add to my position. Like Google, which I also recently bought, this is a buy with an eye on the long term.

Crowdstrike (CRWD) I trimmed some of my position in Crowdstrike. It’s done great for me and I wanted to lock in some more profits.

Uber (UBER) Just like Crowdstrike I wanted to lock in some of my gains in Uber. It’s done very well for me even after its price action lately. Simple portfolio management. This is one of my favorite stocks for 2022.

Coinbase (COIN) My stop loss hit in Coinbase. It fell fast and hit my limit for how much I’d be willing to lose. I’m glad I did as it has fallen much farther. Crypto has really been hit hard just like the overall market so Coinbase has really been hammered.

What I’m Watching

Nasdaq (QQQ) I’m watching what the Nasdaq does and if it can get back over the 200 day moving average next week. If it doesn’t, that brings more uncertainty into the market. It could rebound, or we could see a full on flush out. I would then be buying with both hands if that occurs. If you want to just buy the Nasdaq which gives exposure to the entire Nasdaq 100 and it’s a good way to own all the top tech stocks.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe and/or give a gift subscription for others.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.

Disclaimer: This is not investment advice. You should not treat any opinion expressed as a specific inducement to make a particular purchase, investment or follow a particular strategy, but only as an expression of an opinion.