Investing Update: Where Are The IPOs?

What I'm buying, selling & watching

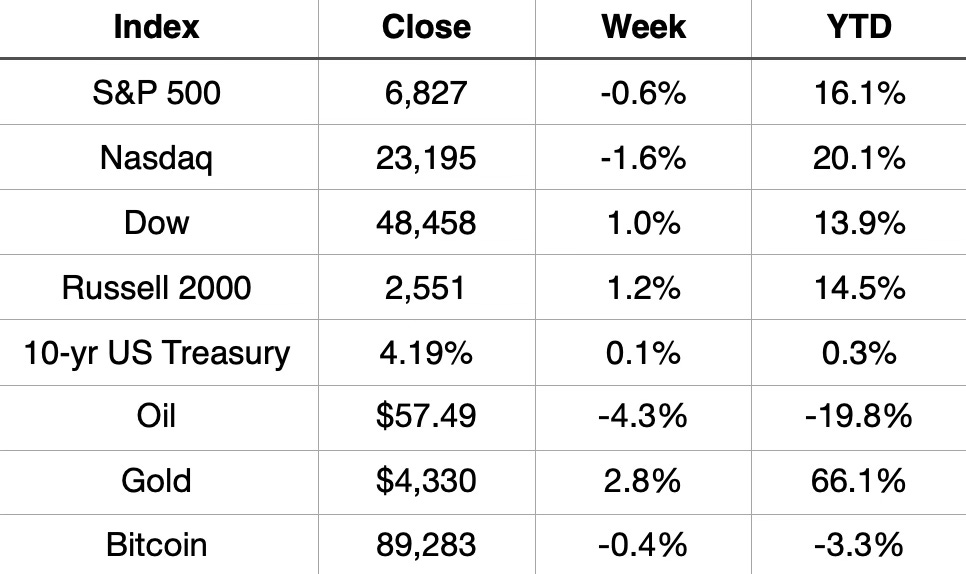

Stocks had a roller coaster week as investors weighed easing monetary policy against renewed tech stock concerns.

Friday marked the worst session in about three weeks for the S&P 500 and Nasdaq, with the Nasdaq underperforming due to sharp selloffs in key tech names after earnings updates and rising yields added stress.

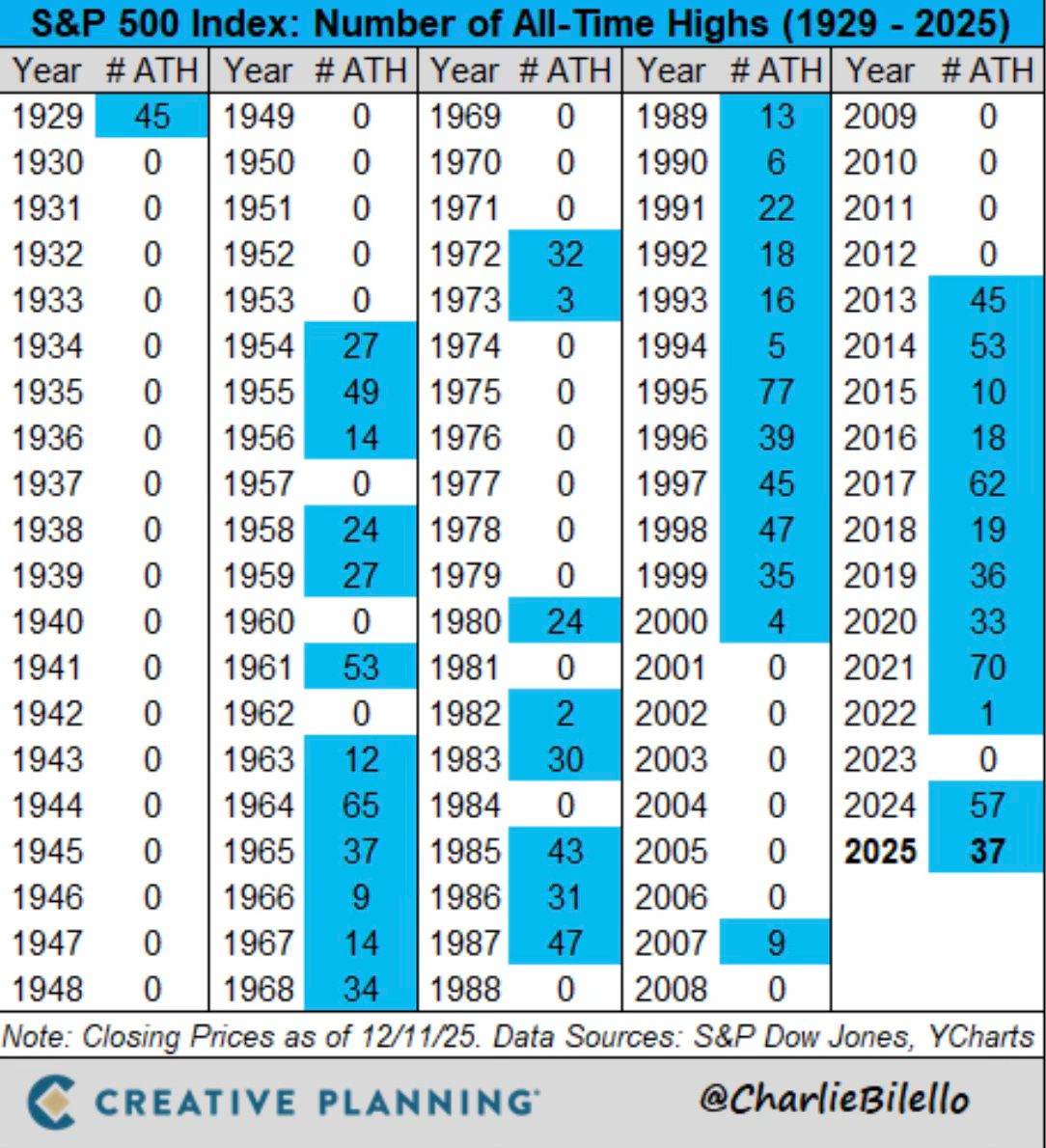

This came after Thursday saw the market get back new all-time highs. The S&P 500 hit its 37th all-time high for 2025 as the Dow set its 18th high for the year.

The new all-time high on the S&P 500 Thursday came as it hit 6,900. That also happens to be my year-end price target. (Investing Update: 2024 Recap & 2025 Outlook) We’ll see how close to 6,900 it finishes the year. It’s sure looking like it will be close.

To mark the milestone, a reader sent me this.

Market Recap

Weekly Heat Map Of Stocks

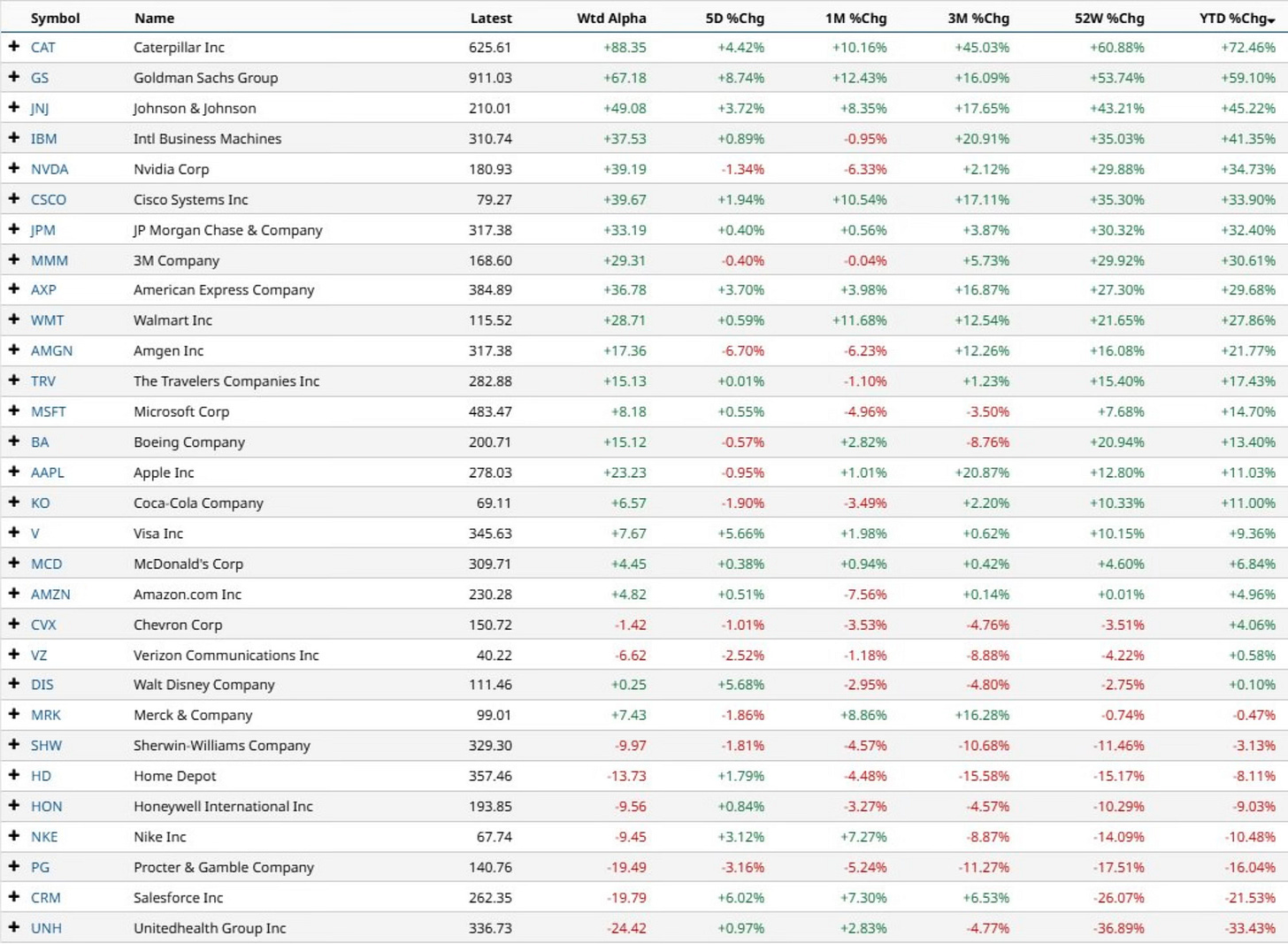

Dow Performers YTD

Caterpillar (CAT) still leads all the Dow components on the year with Unitedhealth (UNH) being the biggest laggard.

This week also saw small-caps, industrials and financials hit new all-time highs.

This market has moved beyond the AI trade. It’s not only a Mag 7 rally. It’s not only a tech rally. That’s all old news. If you’re still buying into that narrative you need to change the channel and listen to someone else.

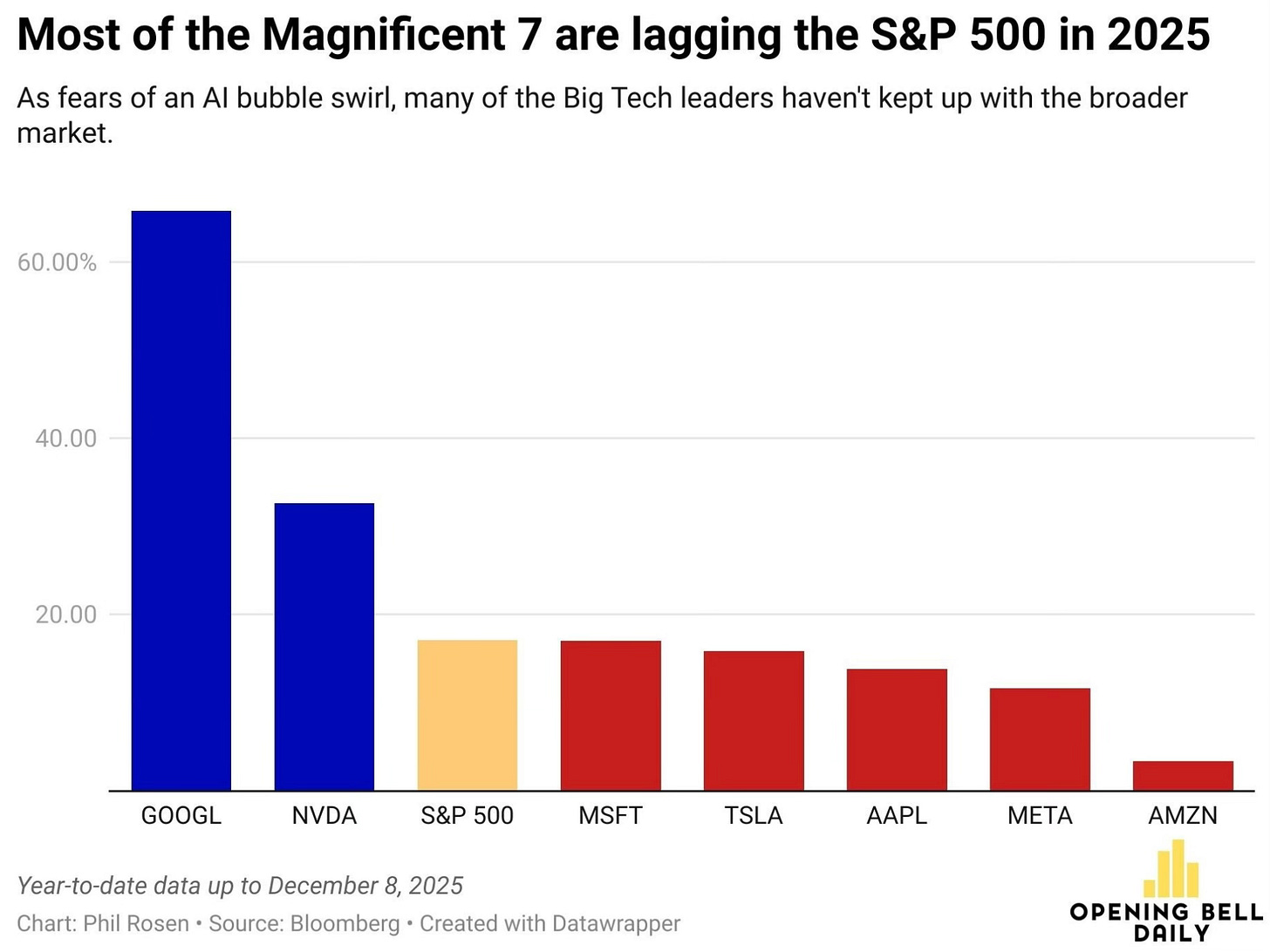

Did you even realize that 5 of the Mag 7 are underperforming the S&P 500?

You really don’t need much more confirmation than the broadening story is happening by understanding what the S&P 500 Equal Weight is doing.

The “breadth bear” case is impaired. S&P 500 Equal Weight hitting fresh highs confirms this isn’t just a mega-cap story. When the average stock participates, the floor rises.

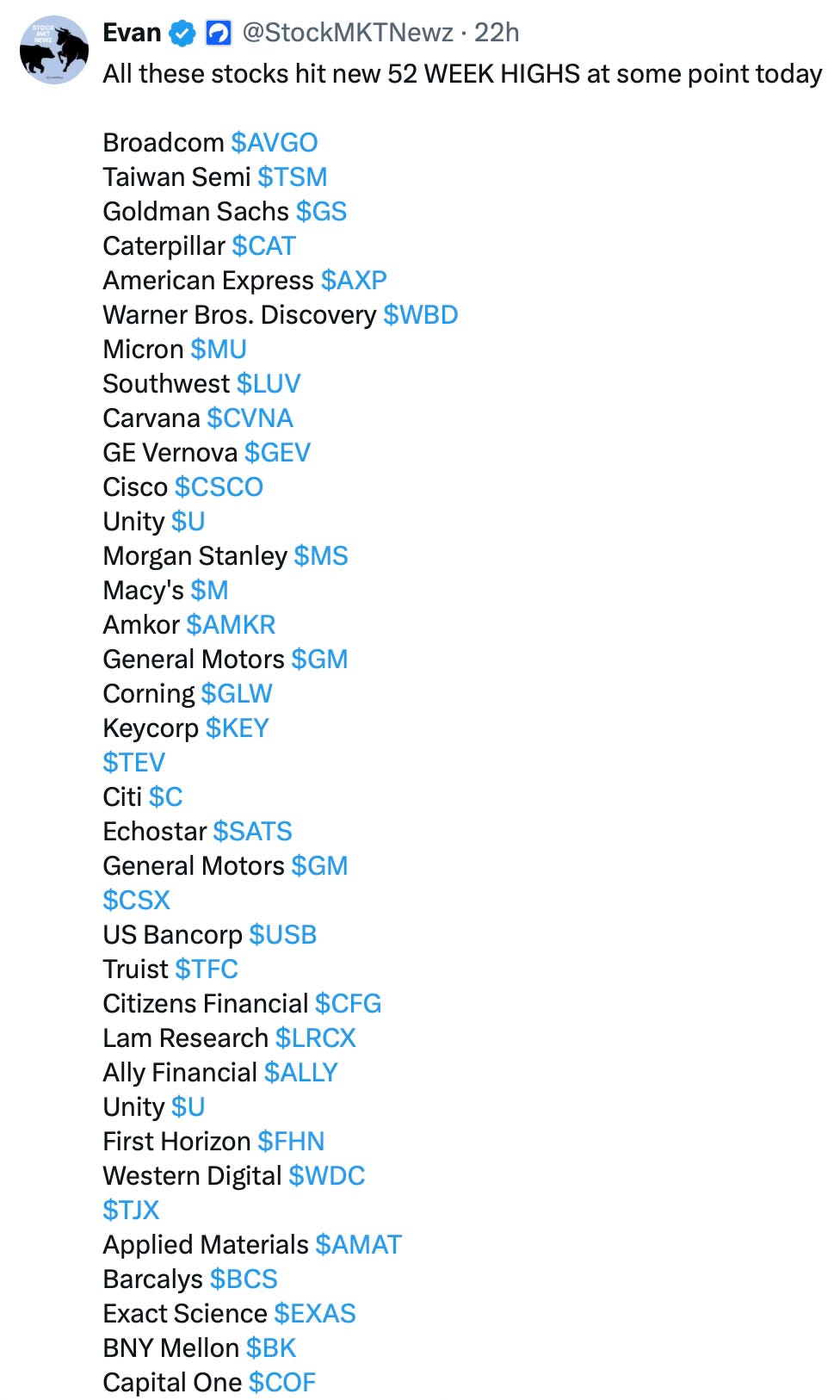

Just look at what stocks were hitting new 52-week highs while the S&P 500 was hitting new all-time highs on Thursday.

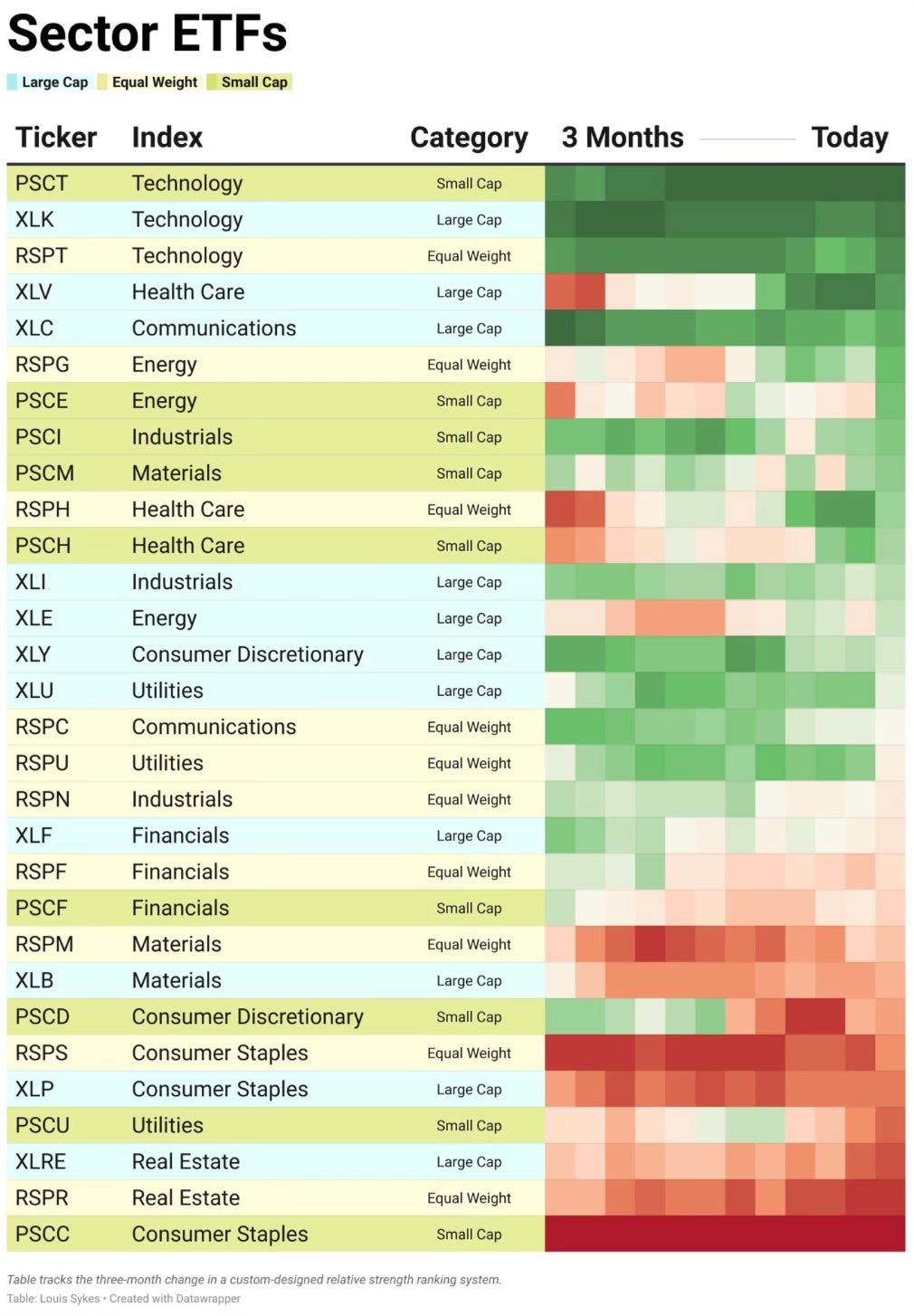

I love how this visual of the sector ETFs shows how the sector rotation has been playing out. Don’t fight the tape.