Stocks just saw their best week of 2024.

The Dow, S&P 500 and Nasdaq all recorded their best weekly percentage gain of the year. You have to go back to November 2023 to find a better weekly performance. Both the S&P 500 and Nasdaq finished the week on a streak of 7 straight positive days.

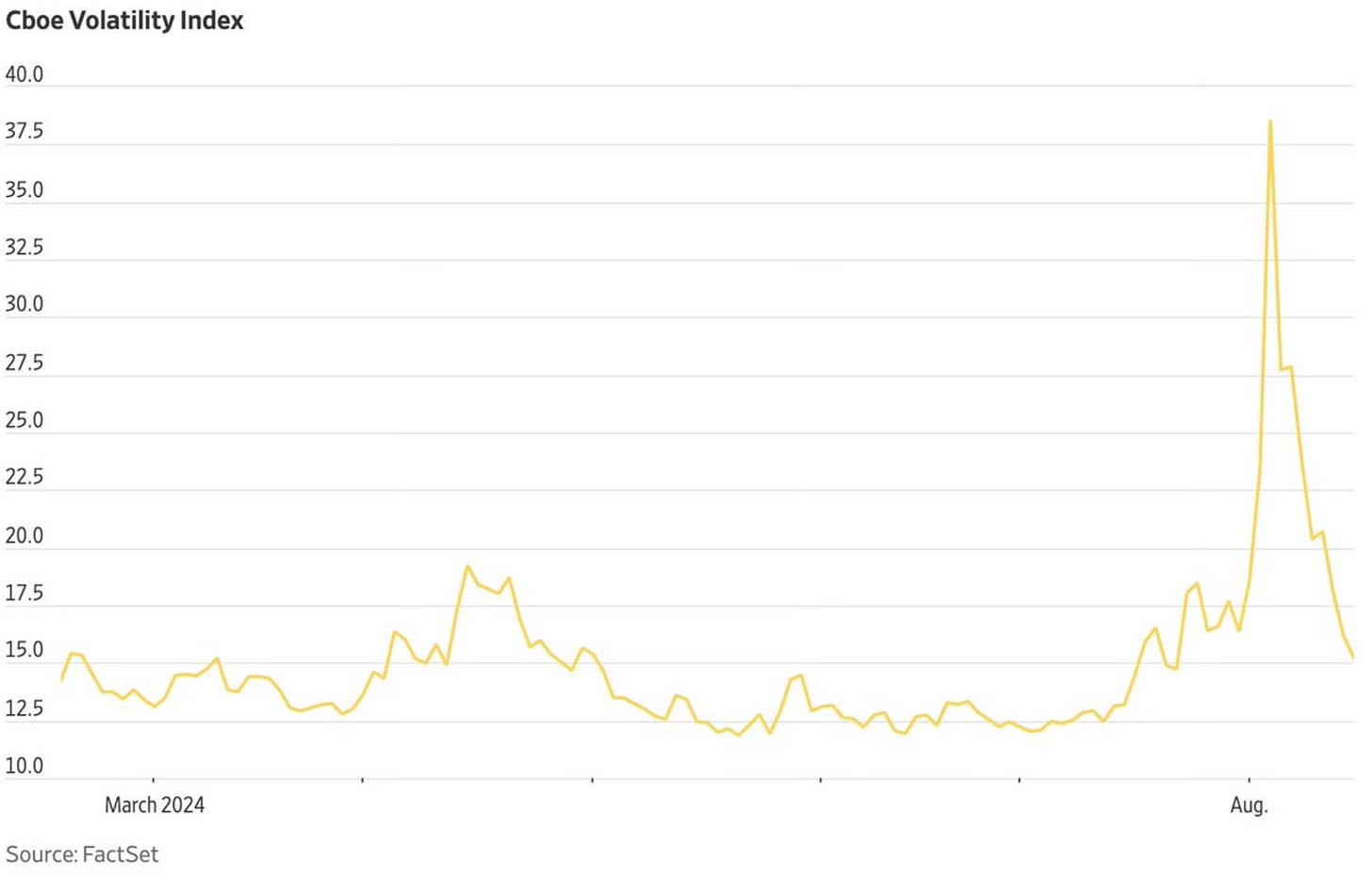

Apple has now had a streak of 10 positive days. Nvidia had its best week in 15 months. The VIX is now lower than it was to start the month.

It’s quite a reversal from where things were early last week. The market was in the midst of a 8.5% pullback and fear was running rampant.

How quickly things have changed.

Market Recap

The Bull Market Continues

After a week of record high volatility, we saw the stock market shrug it off and cement that the bull market remains intact. The bull market continues.

Last week in my update Investing Update: Is The Selloff Over? I said the following.

It doesn’t change the fact that we’re still in a bull market. Large selloffs like Monday can be viewed as days to buy the dip. These will be looked back on as buyable dips during a bull market. Nothing indicates this bull market is ending.

Since the Monday panic to today, the VIX has gone from in the 60s to the low teens.

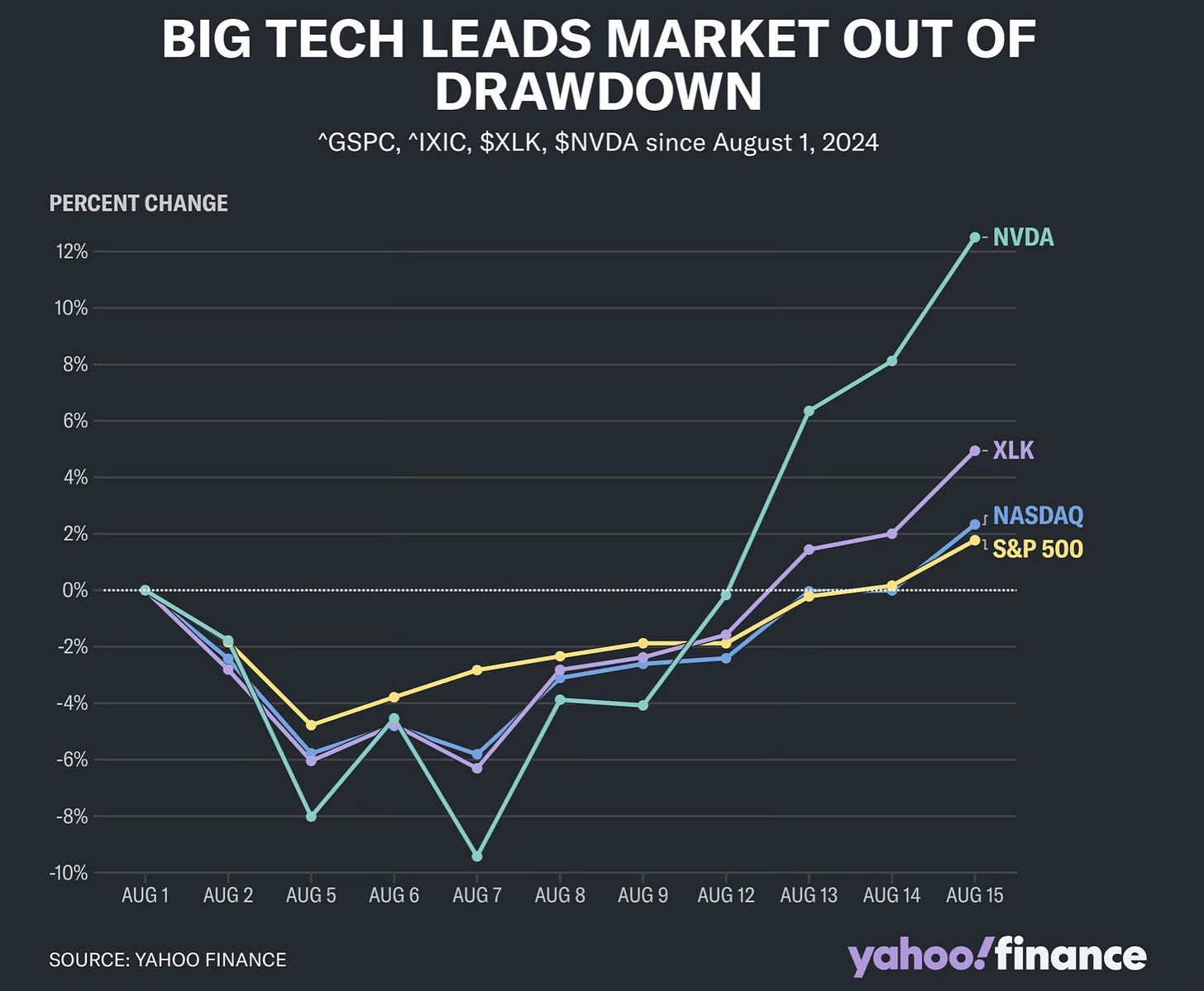

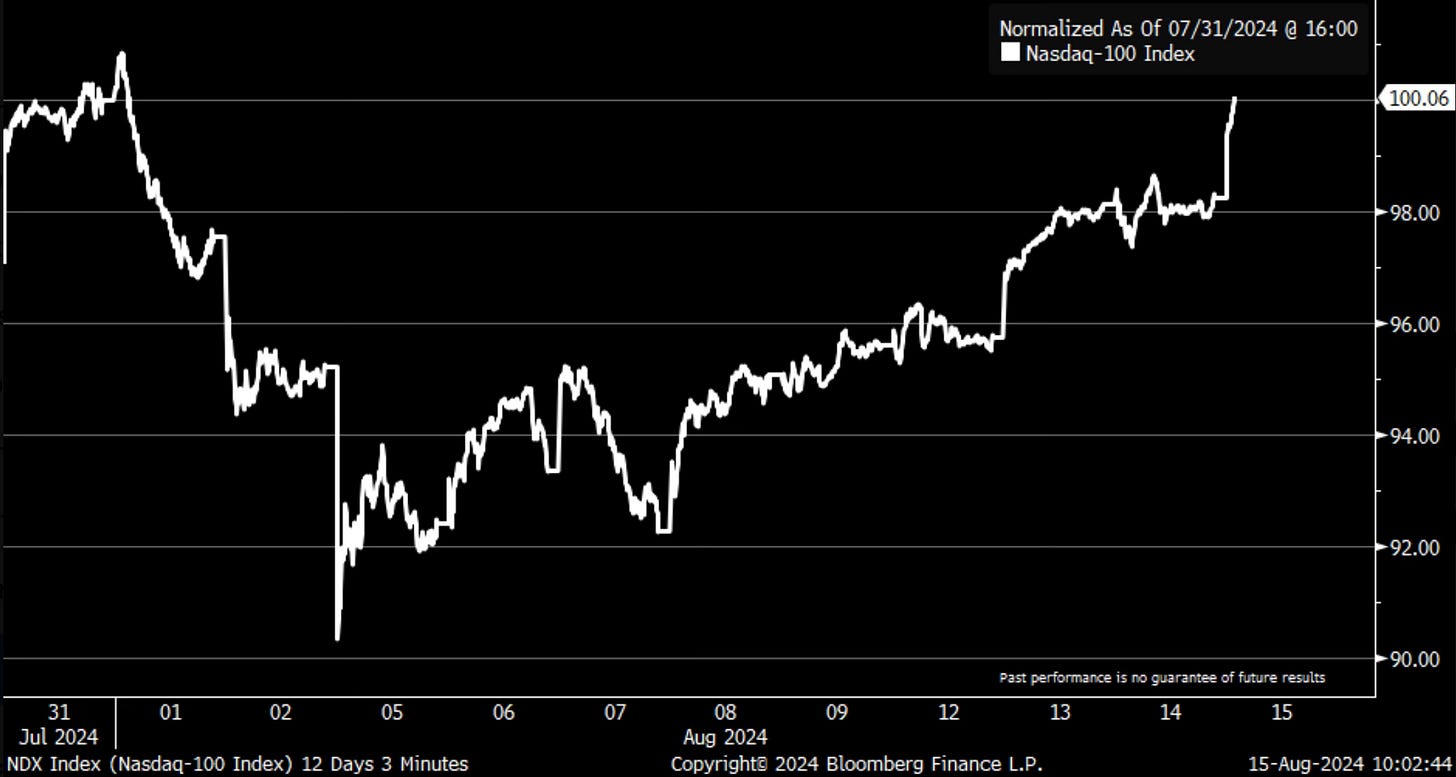

The S&P 500 saw a pullback of 8.5%, that has all now been erased.

All of the Nasdaq losses have also vanished.

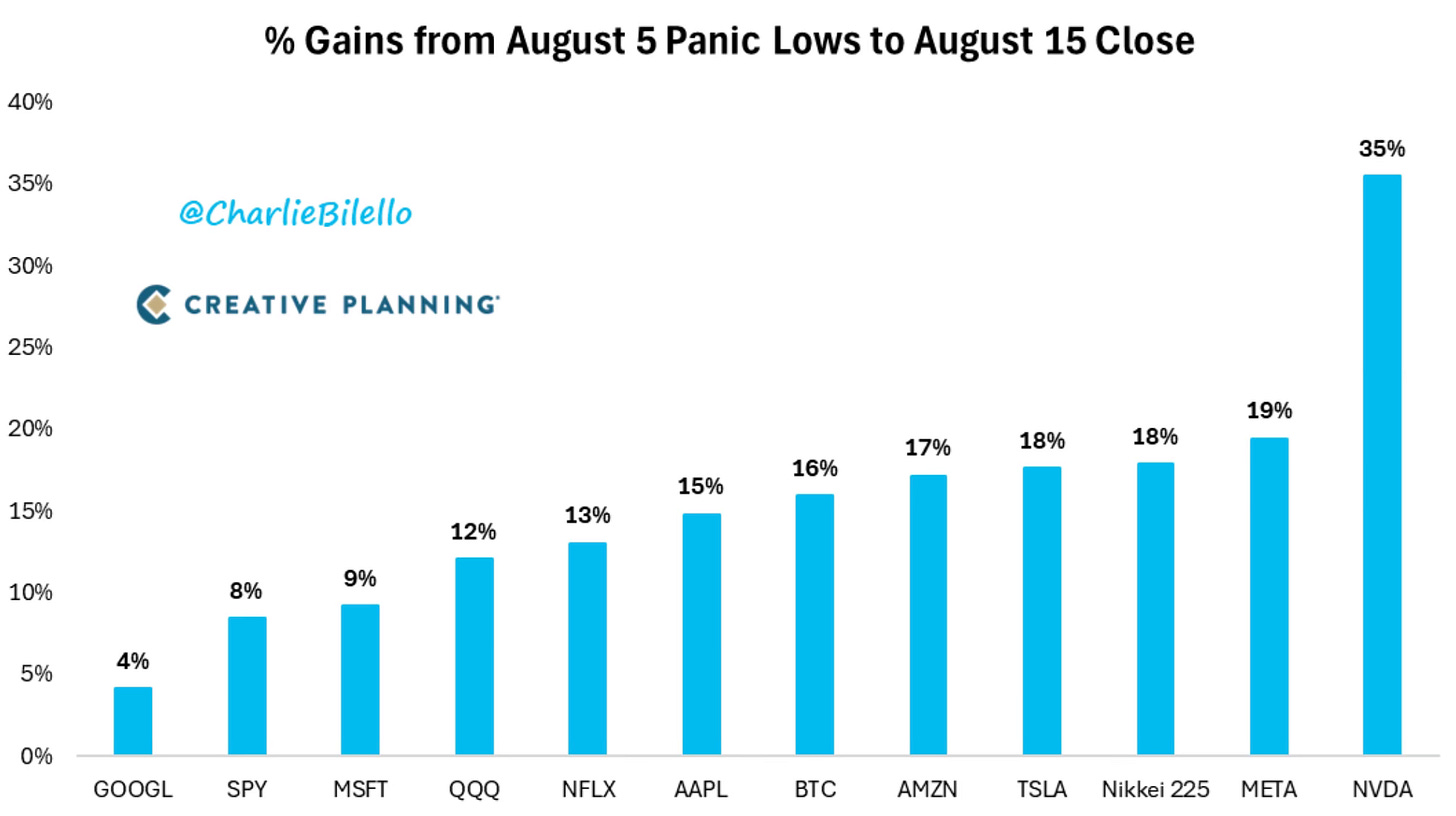

Take a look at what some of the returns have been from the August 5th lows.

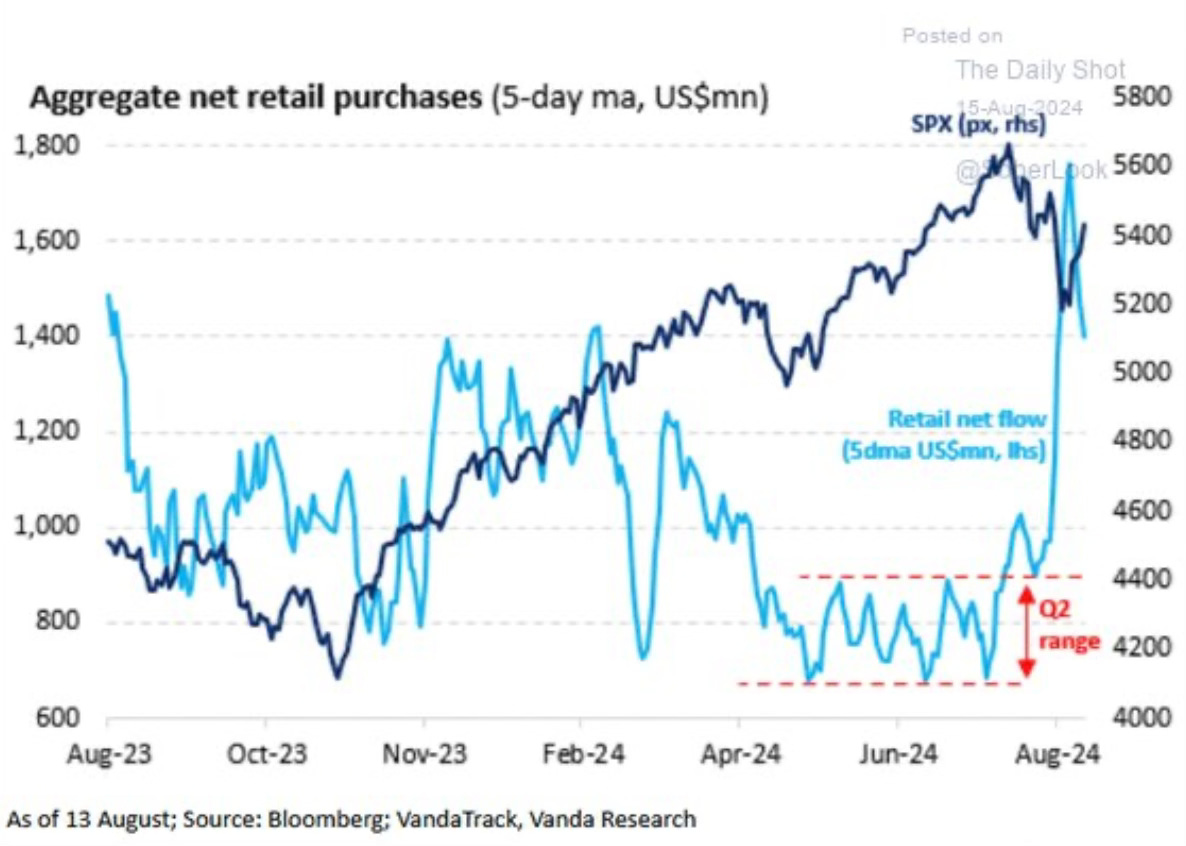

Retail investors bought the dip. In fact, they went on a buying spree as you can see from this chart.

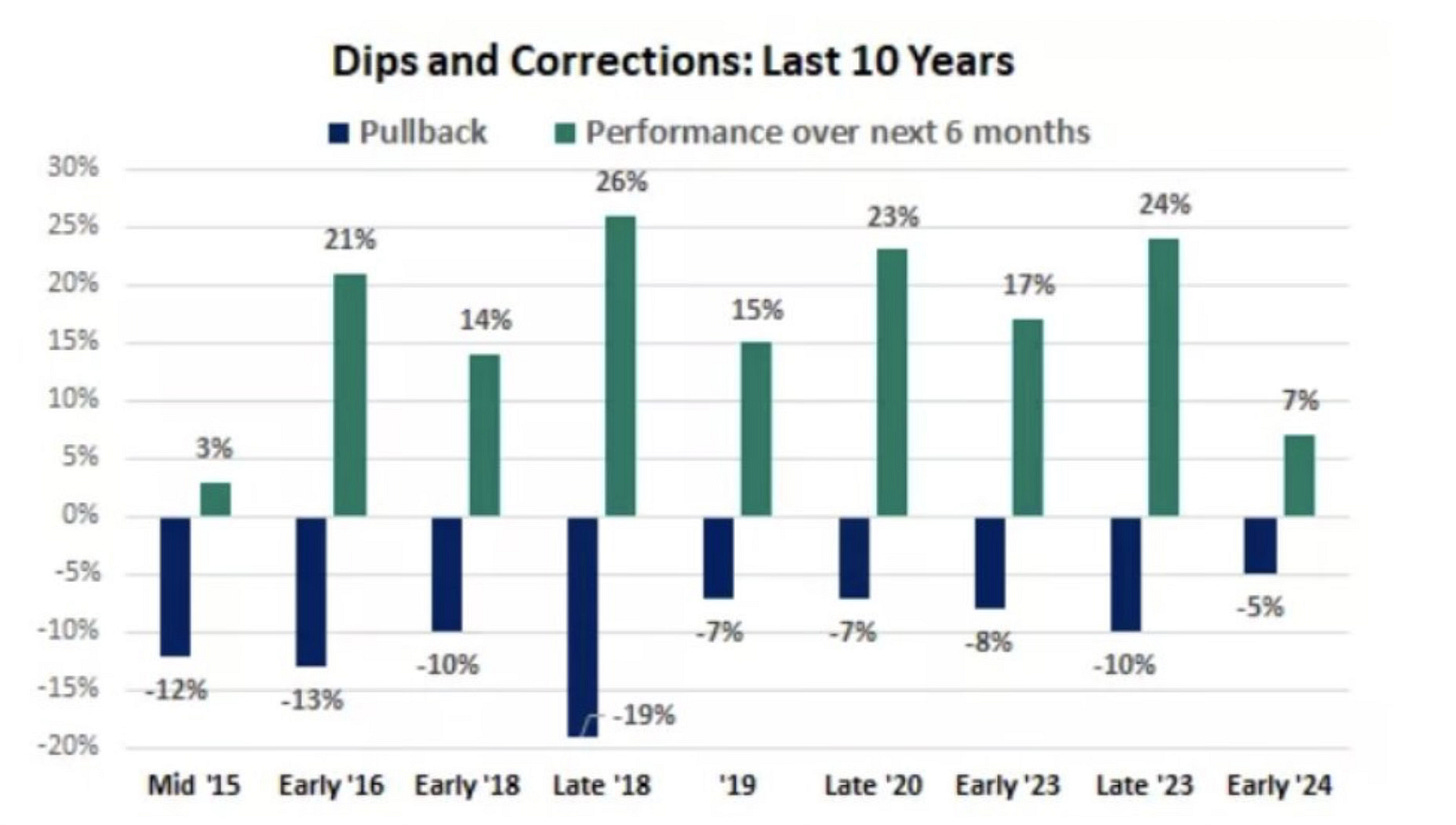

Is 8.5% the biggest pullback we see this year? It might be, it might not. Either way this is another reminder you have to take advantage of the dips. Especially in a bull market. The market always comes back. Or as Seth Golden put it in this chart he shared, “the ascent is usually greater than the decline.”

Never let a good dip go to waste!

Goodbye Inflation

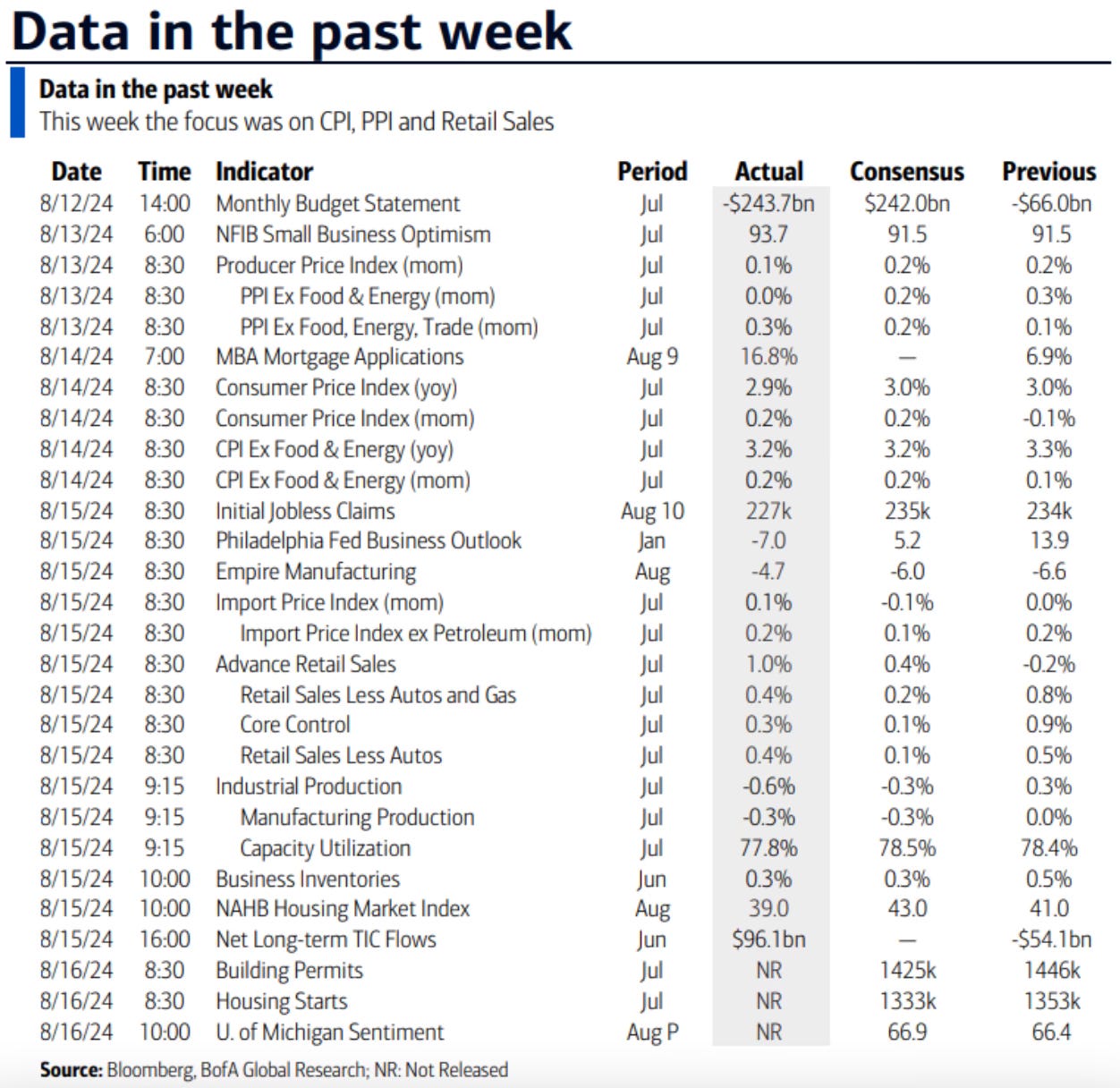

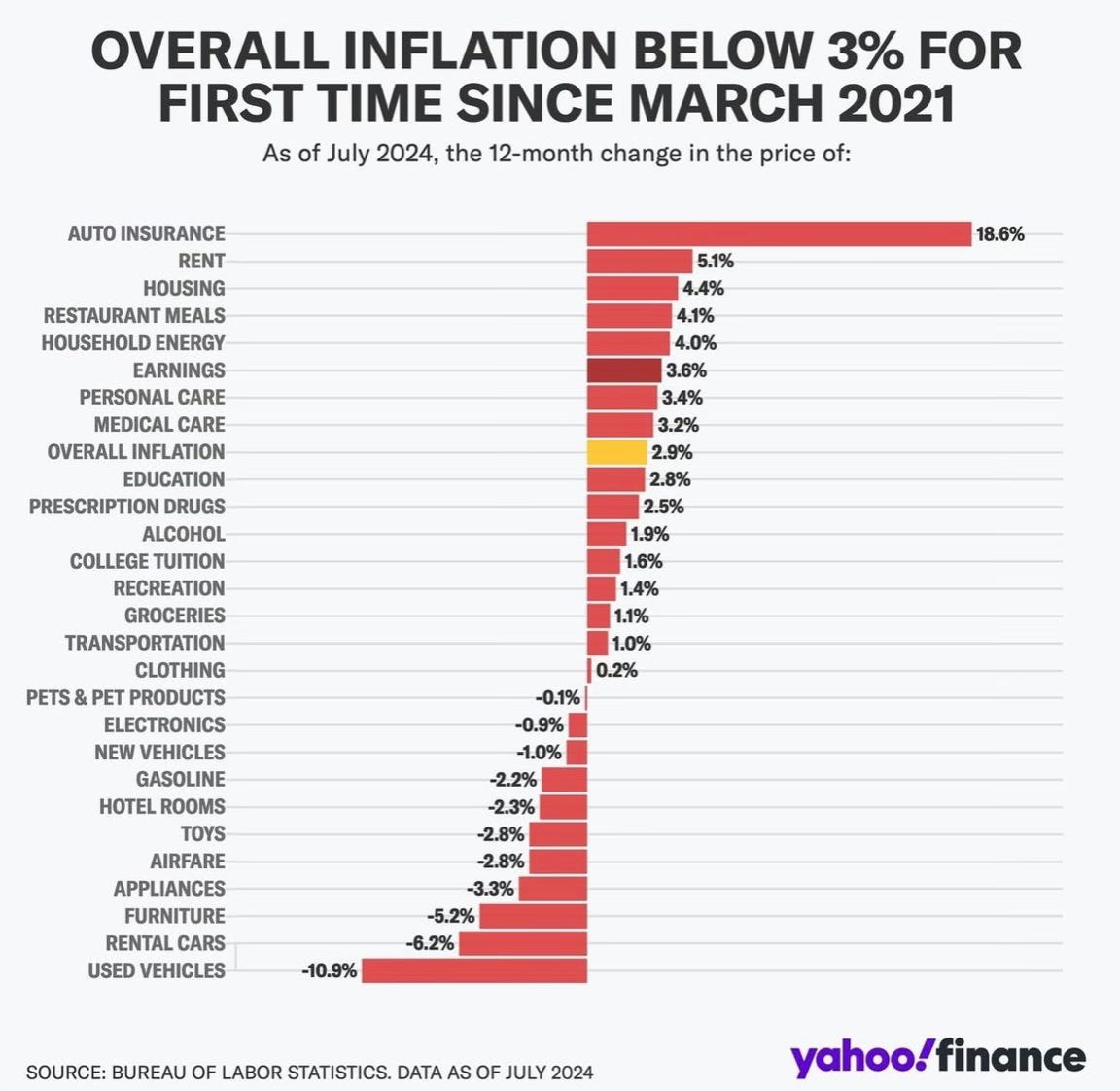

This week saw inflation fall below 3% for the first time since March 2021.

Nearly all the rise in CPI was due to shelter. As we know, that’s backward looking. One of the most important signs is that rent is showing signs of cooling. It’s down to 5.1%. That’s the lowest level since March 2022.

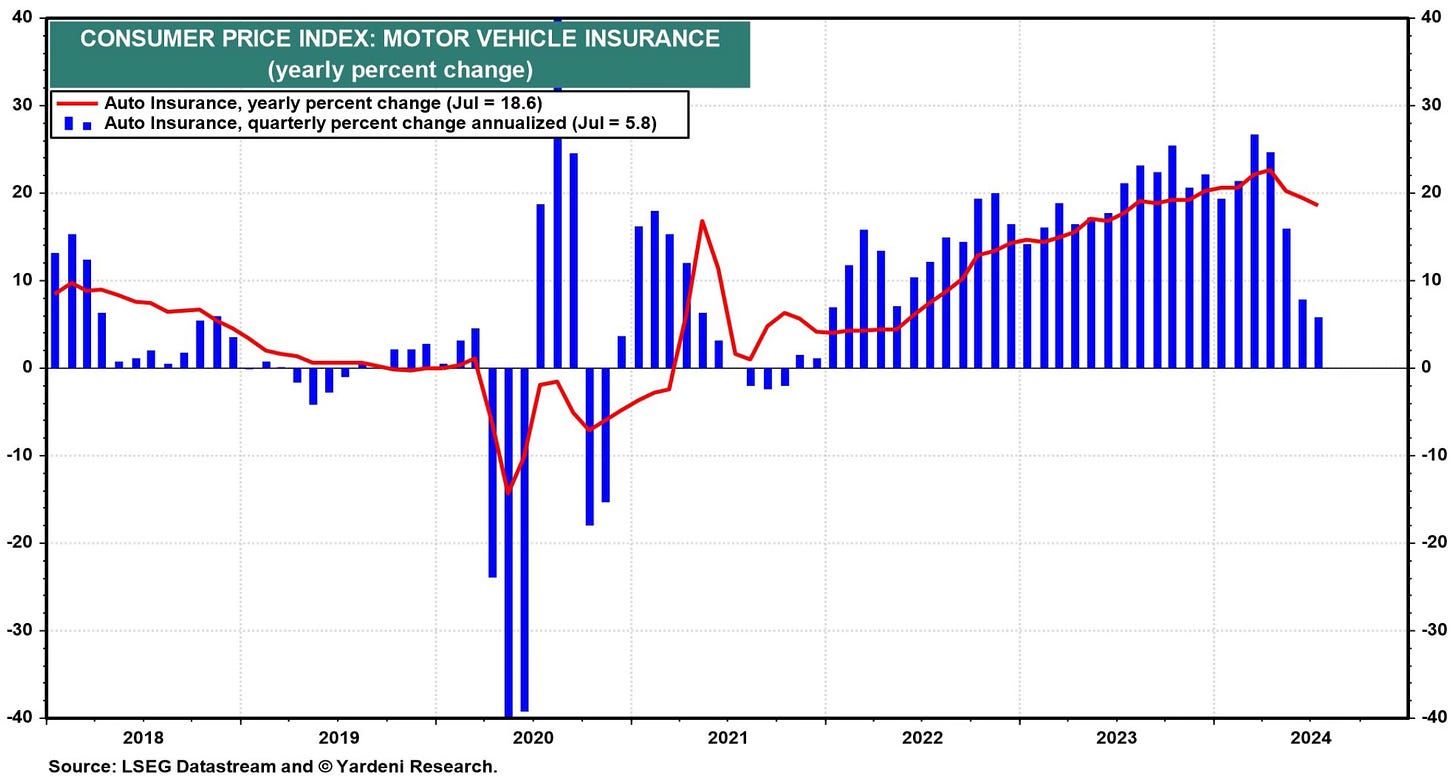

Auto insurance has been a problem but I expect that to start falling as well. This is a good visual of why from Eric Wallerstein at Yardeni.

You can wave goodbye to inflation. The battle has been won. This was a 2023 issue and now we can stop focusing so heavily on it.

One More Word On Recession

As you probably saw, I wrote about recessions this week, Recession Or No Recession?

After my piece came out, there were two important points that came up that I wanted to share.

The first comes from Ben Carlson. Did you know that over the past 15 years, there have only been 2 months of a recession? Think about that.

The other was that Walmart reported earnings on Thursday morning and their CFO said the following, “We don't see any additional fraying of consumer health."

They actually raised guidance and shares have set new all-time highs.

If there were any signs of the consumer worth listening about, it would be from Walmart. There was nothing. They see nothing and even raised their guidance. It’s time to stop with all the recession talk now.

Curious Charts

Every week there are charts or data that comes out that make you scratch your head or makes you curious. This week there were two of those charts.

The first is that container shipping rates continue to climb higher. They’ve actually set a new high for 2024. They now sit at their highest levels since 2022. This chart doesn’t look like it’s changing anytime soon.

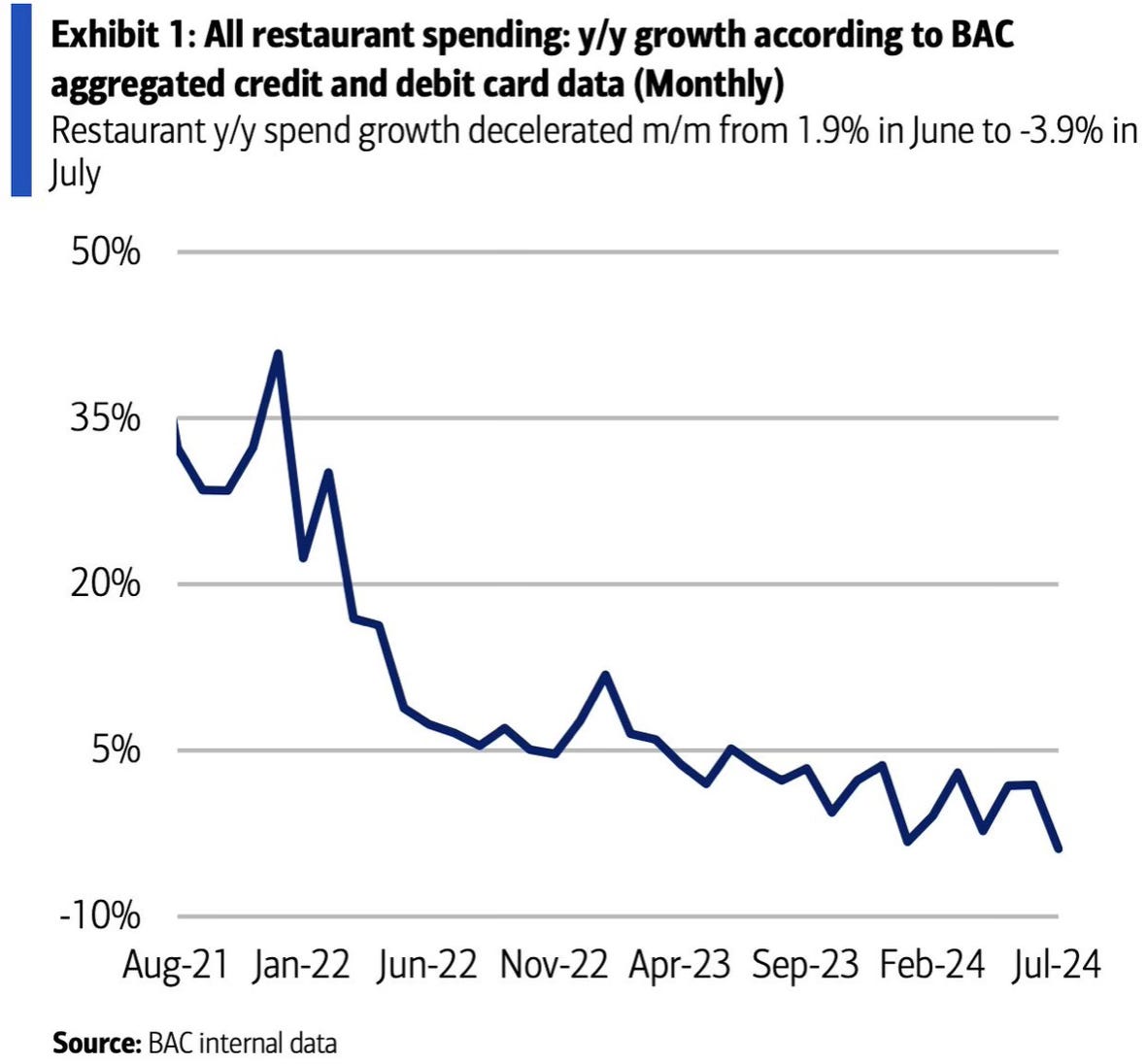

The next is the steep drop in restaurant spending. This area of consumer spending continues to tick lower. I really hope this changes course but the chart isn’t looking good.

Listening To What’s Said

When you try to identify areas or sectors to invest in, it’s important to pay attention what businesses and CEOs are saying. Sometimes you have to read between the lines. Other times it’s clear as day.

That’s essentially what this chart is telling us.

The Conference Board survey of CEOs listed cyber as the biggest risk to their industry. That also was the top items in 2023. As you can see the percentage has increased even further in 2024.

Bargain Stocks?

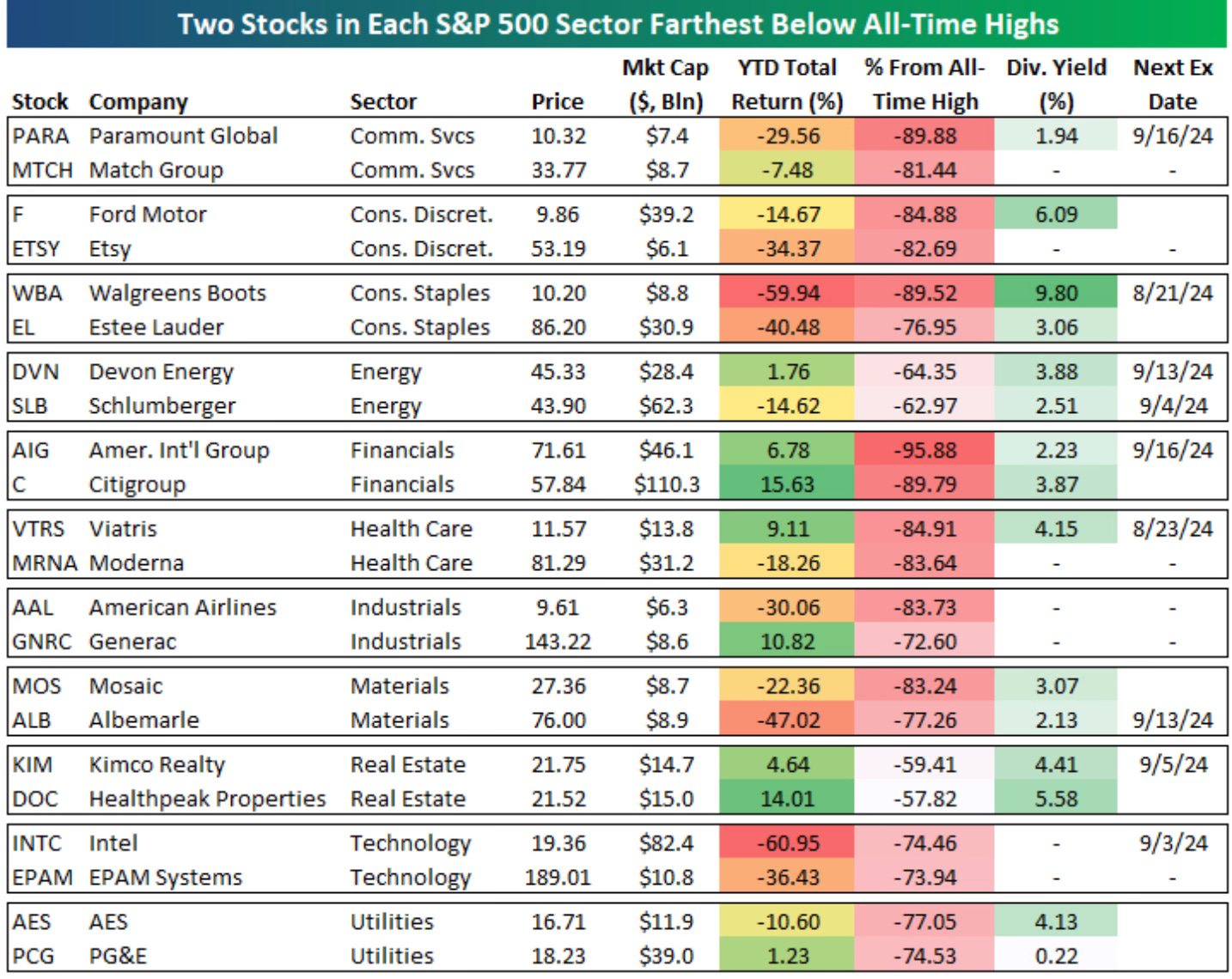

This was a good breakdown by Bespoke. They listed two stocks in each S&P 500 sector that are the farthest below their all-time highs. Does that mean these are bargain stocks or money losing traps?

Some of these may turn out to be good buys at these levels. A few names that stick out to me that seems a bit interesting are Generac, Moderna, Devon Energy and Schlumberger.

Moves I’ve Made

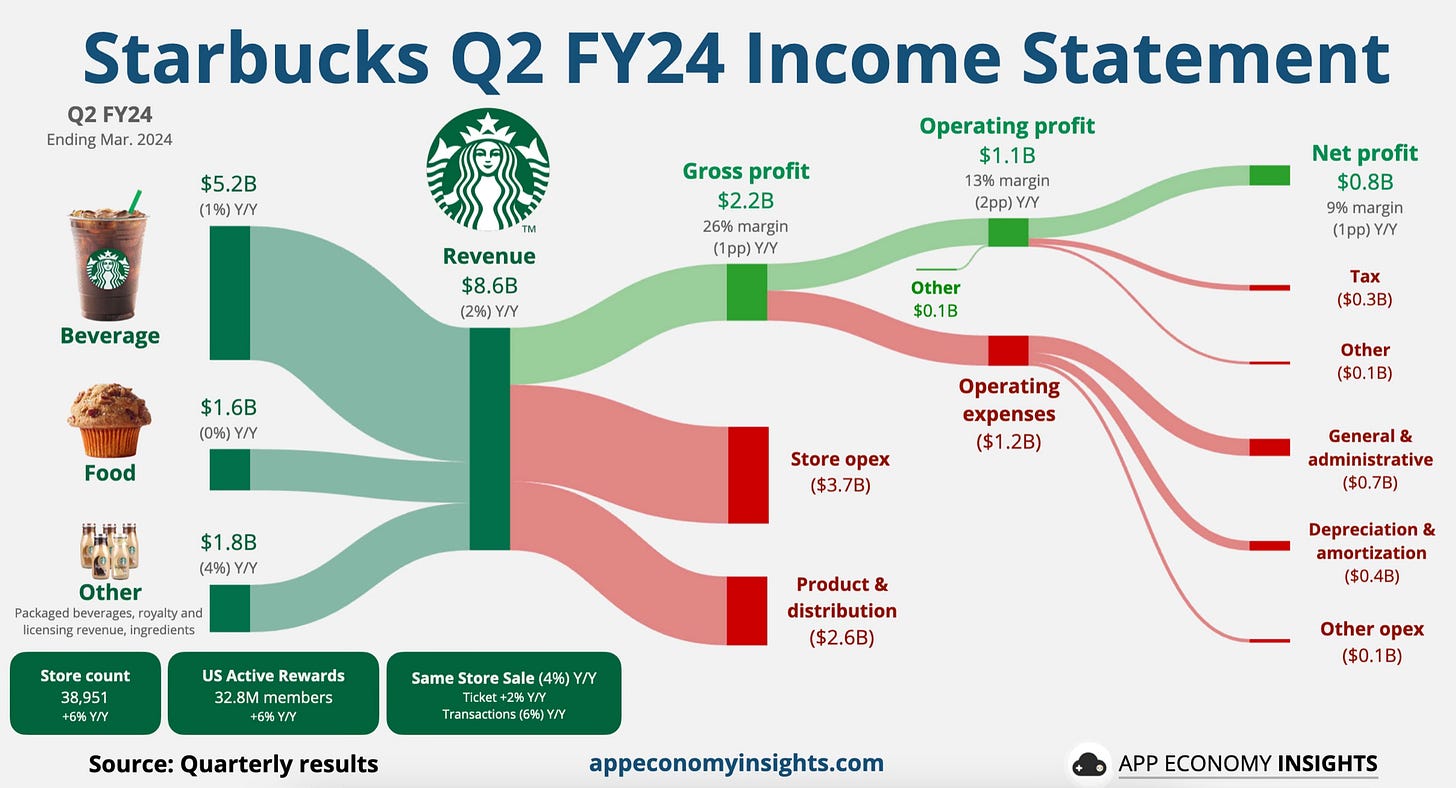

Starbucks I started a position this week in Starbucks at $92 a share. This is a name that I have been watching since I sold it back in late 2021 at $117 a share. It had returned over 200% for me when I sold it. You can read about why I sold it back in November of 2021 Investing Update: Why I’m Selling Starbucks.

A lot of these same issues that I cited back then are still an issue today. You can see it’s been a rough road as the stock price is still below 2021 levels. But like many others, I’m betting on the new incoming CEO Brian Niccol to turn this company around.

He comes from Chipotle, where since he took over in 2018 only 9 S&P 500 stocks have outperformed Chipotle during that time. Before that he was the CEO of Taco Bell. He’s already a Hall of Fame CEO in the restaurant industry. Starbucks badly has needed a management shakeup for a few years. Now they go and get one of the best in this industry to lead them.

I hope he fixes the coffee because it’s still undrinkable for me. I believe he will. They have very good food offerings which I think he will leverage. They’ve had a long running China issue. I wouldn’t be surprised to see him spin it off like he did at Taco Bell.

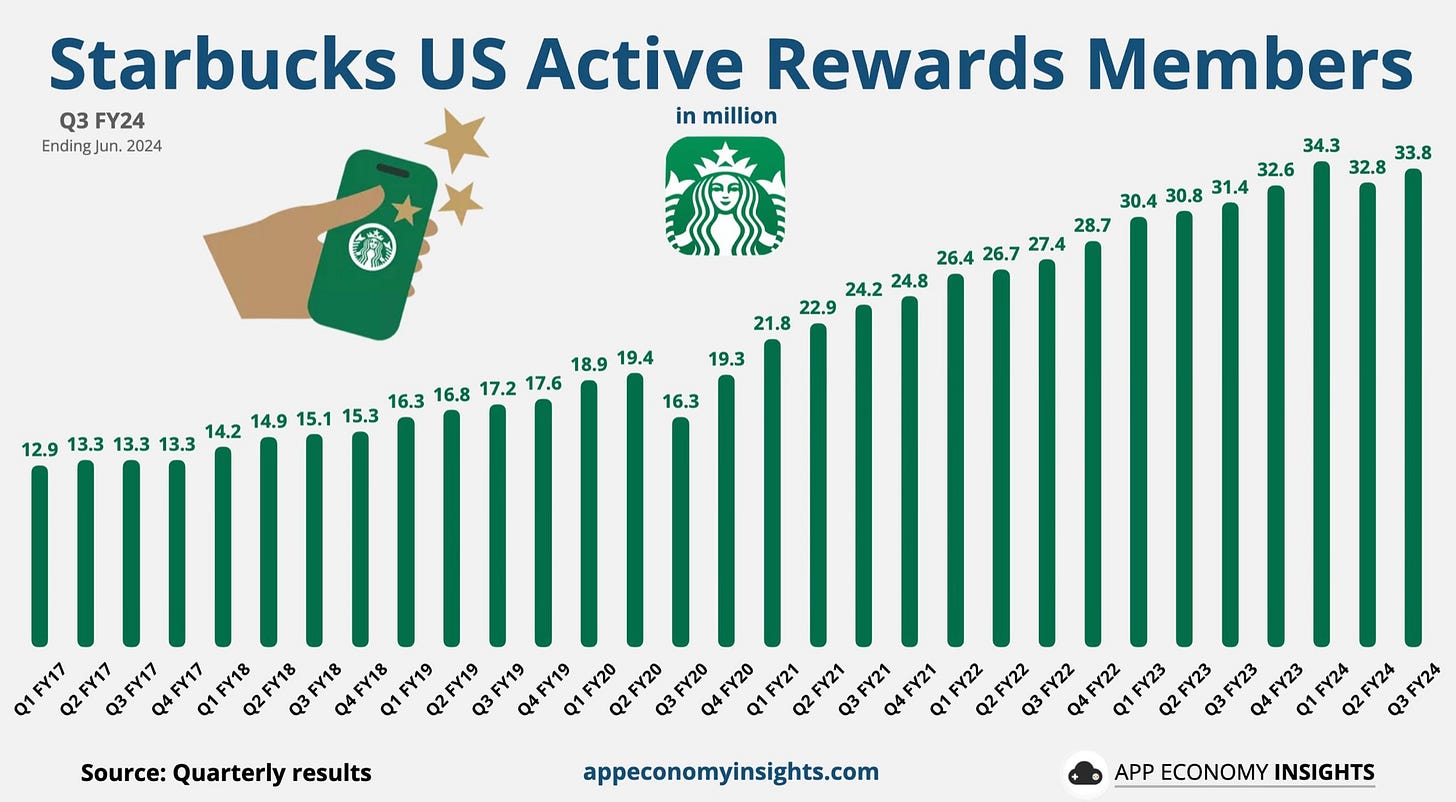

Their biggest advantage that’s not talked about enough is their member rewards program that now has 33.8 million members. Their technology and innovation through their app is highly valuable and is a big time strength.

The lines are still there. There is a love affair from people for this brand. This company just needed a better management team and operator. They have that now in Niccol.

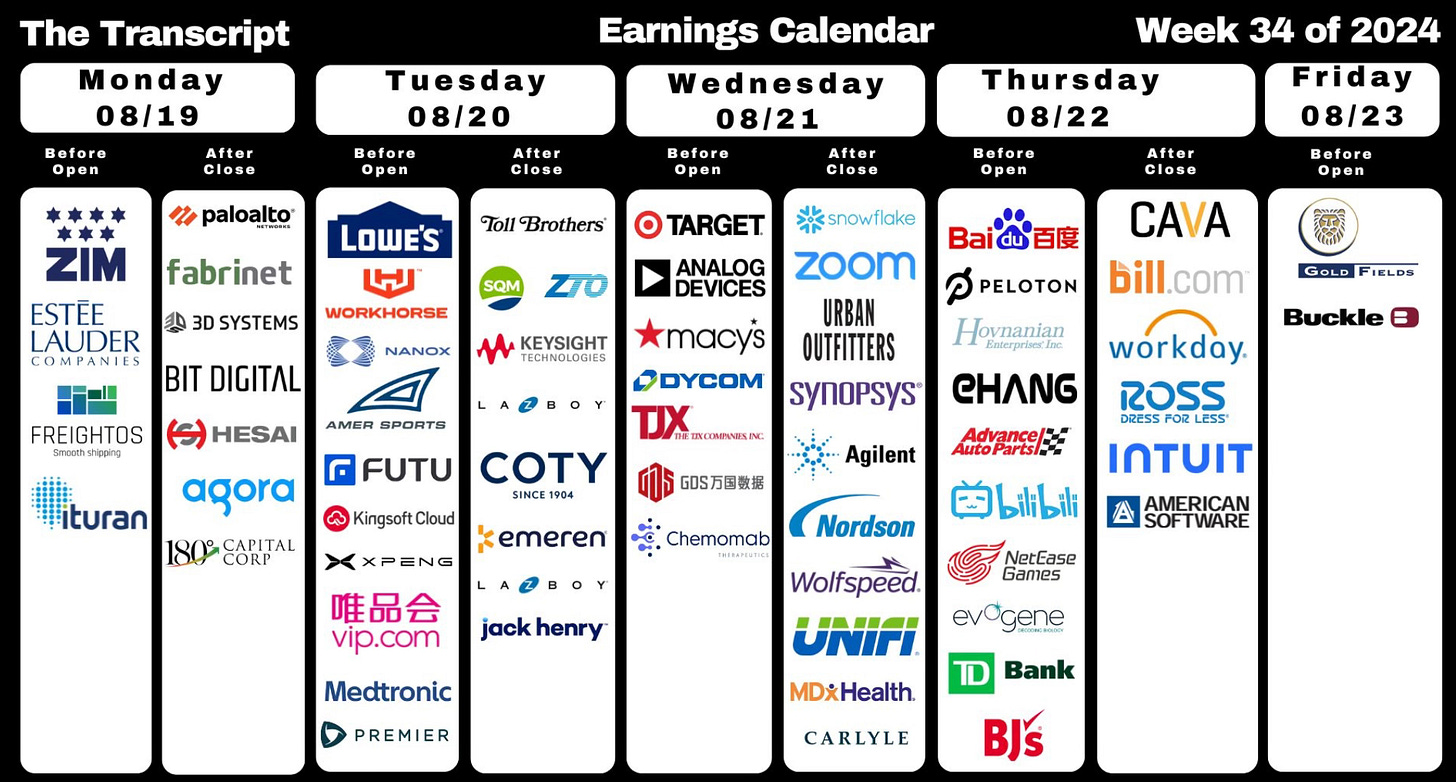

Upcoming Earnings & Data

16 S&P 500 companies report next week. I’m going to be closely watching what Target, Snowflake, Lowe’s and Palo Alto Networks have to say.

The Coffee Table ☕

This week my wife and I watched Beverly Hills Cop: Axel F on Netflix. It has been 30 years since Beverly Hills Cop 3 and 40 years since the original came out. I absolutely loved the first three and have watched them many times. The new one brought back all the originals (Axel, Taggert, Rosewood, Serge and Jeffrey). It was very well done and they tied in a lot from the old Beverly Hills Cops as well. If you liked the first three, you’ll love the 4th.

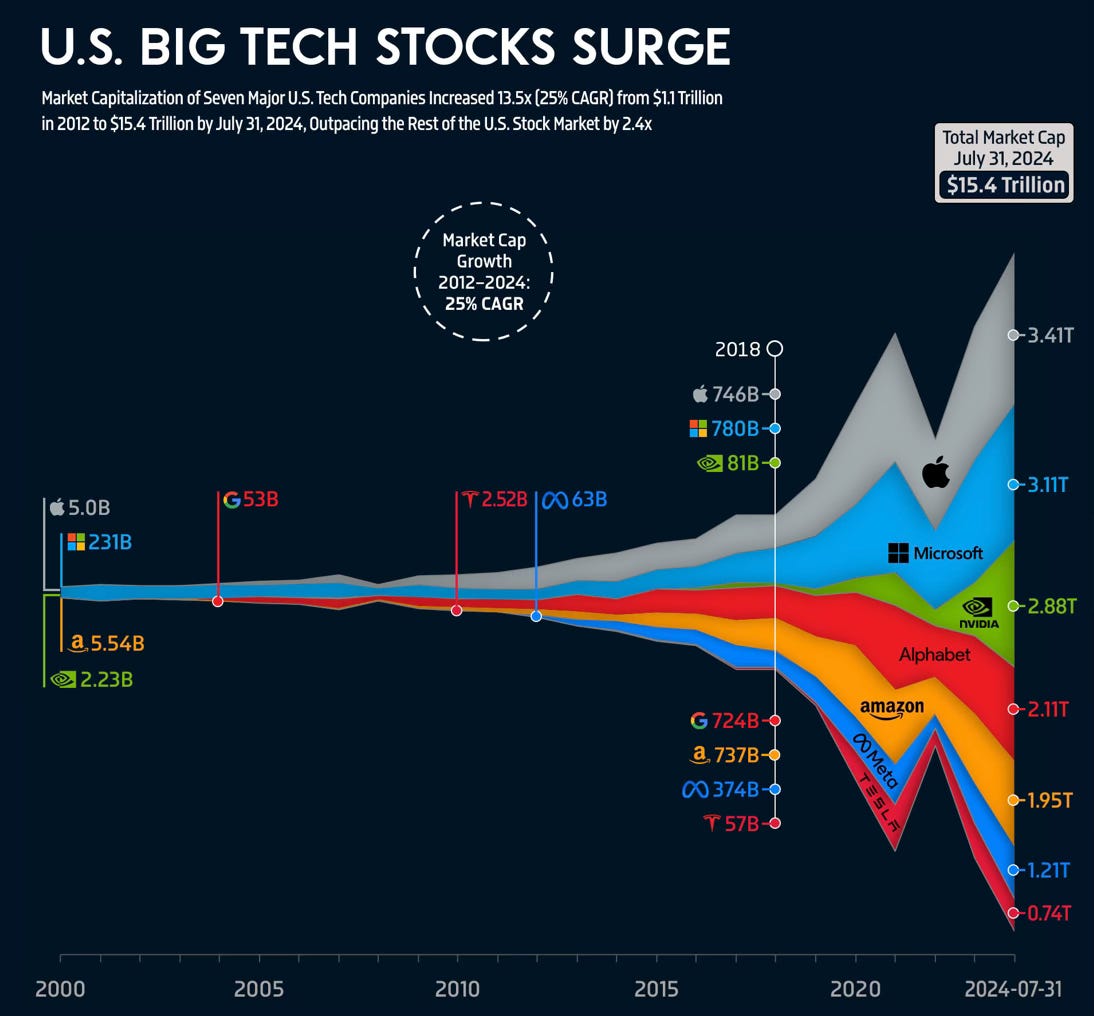

What a chart this is. It shows the path of each of the Magnificent 7 companies from the year 2000 until today. To think that back in 2000, only 4 of these were even public companies (Apple, Microsoft, Amazon and Nvidia). Tesla and Meta weren’t even founded yet, and Google was still private.

Source: Econovis

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.