Investing Update: Lower Returns Ahead?

What I'm buying, selling & watching

It feels like I can just keep the same opening line week after week. I just have to keep updating the number of new all-time highs.

This week marked two more all-time record highs for the S&P 500. That makes 47 for the year.

It’s the 6th straight week of gains. 9 of the past 10 weeks have been positive.

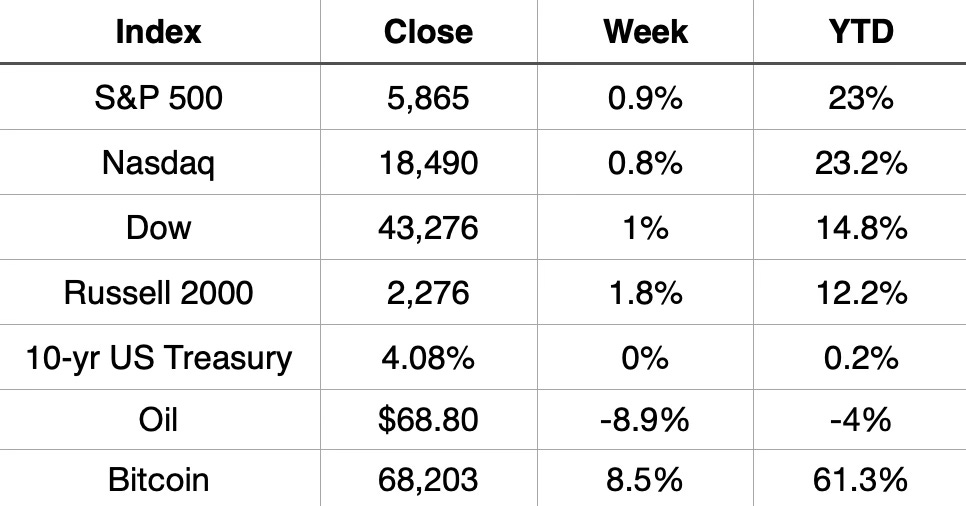

Market Recap

214 of the 500 S&P 500 stocks have made an all-time high so far in 2024. Not a 52-week high, an all-time high.

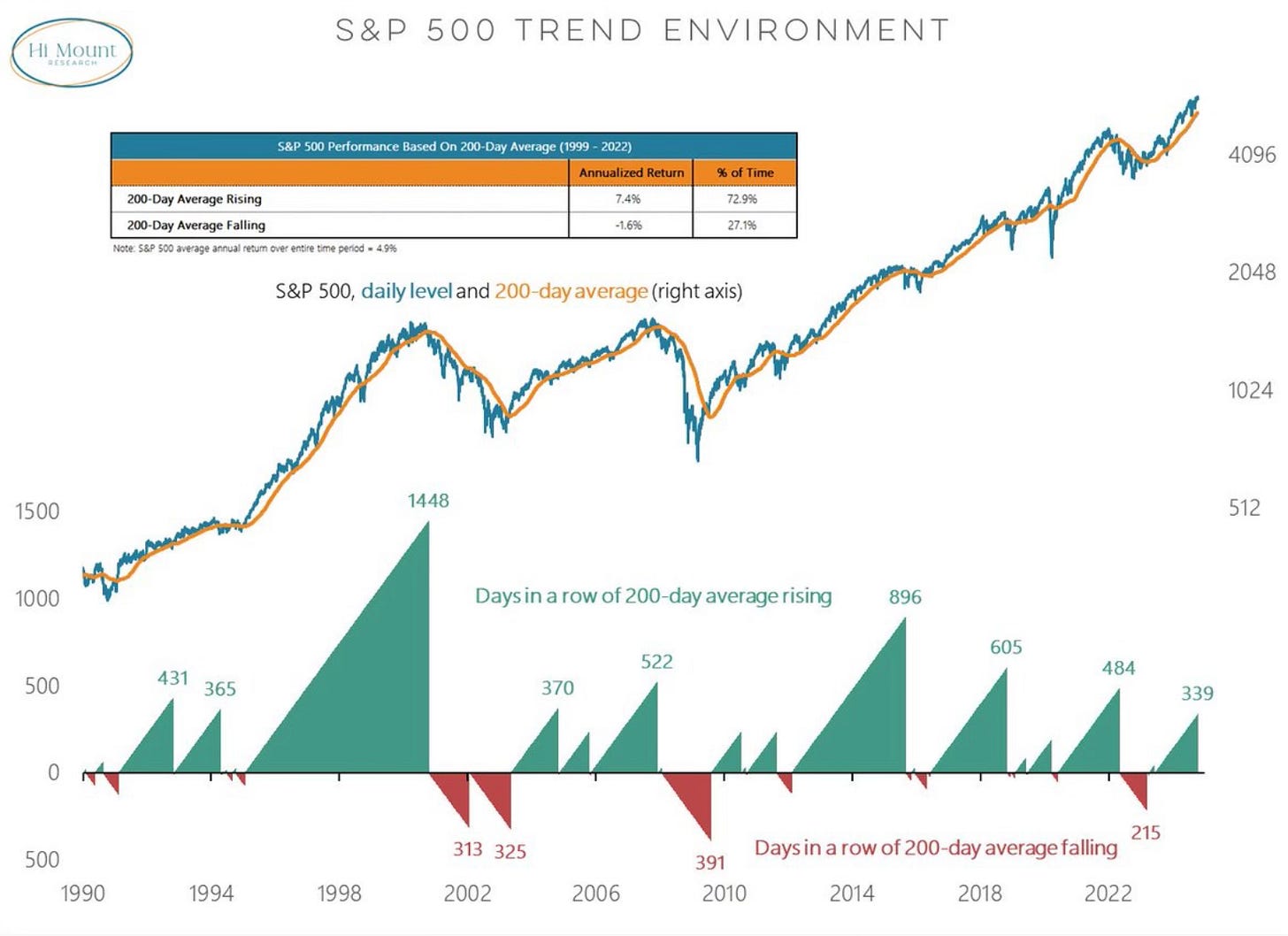

The 200-day moving average continues in the green. It has now been above that threshold for 339 straight days.

83% of S&P 500 stocks are above their 100-day moving average. That’s the highest level in 6 months.

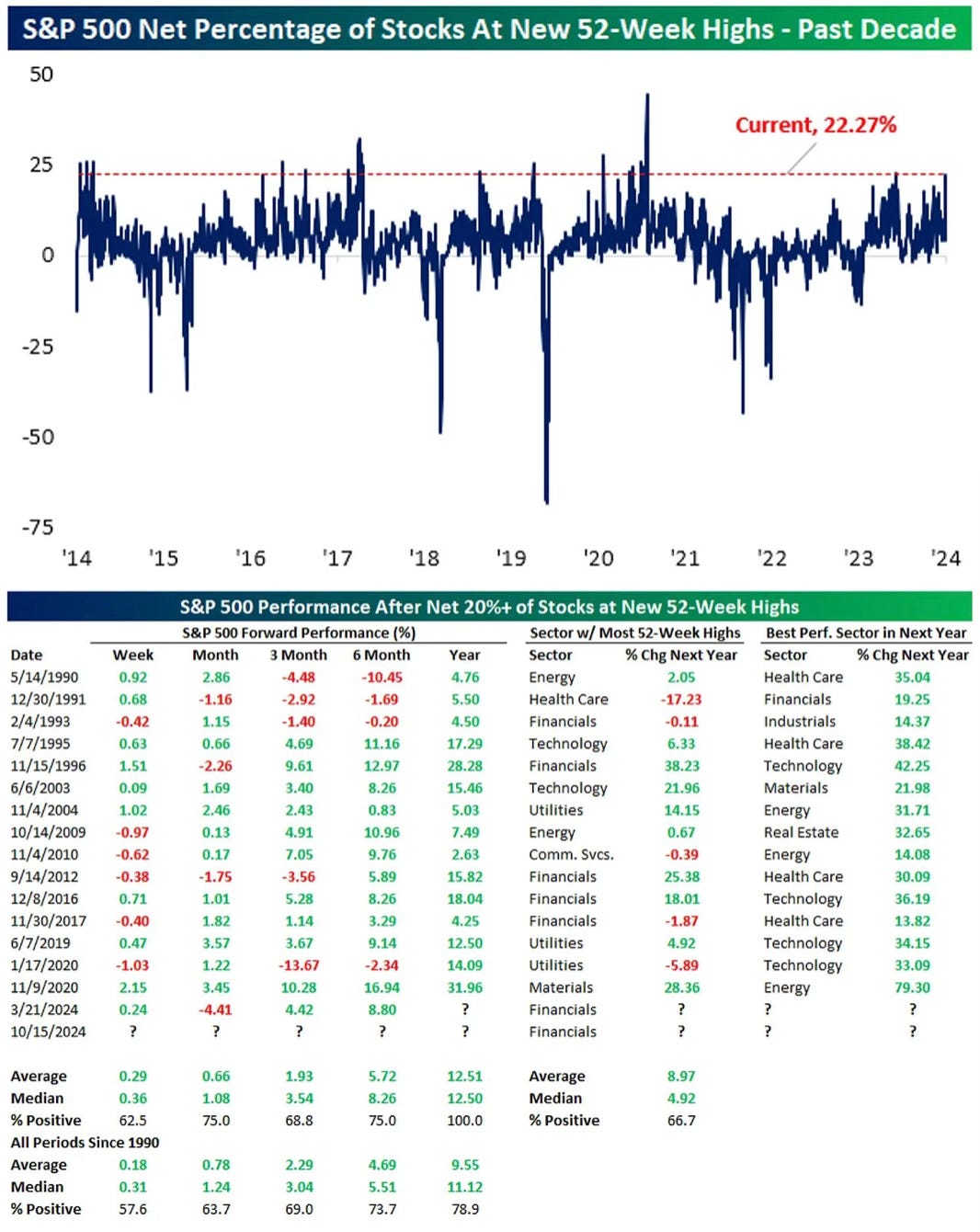

Bespoke had this detailed chart about 52-week highs and said the following.

The net percentage of S&P 500 members hitting 52-week highs reached the highest level (22%) since March ... Forward returns for the S&P 500 have consistently been positive after strong readings in net new highs.

This points to continued market strength. I also found it interesting that the sector with the most 52-week highs, was never the best performing sector the next year.

A lot is going right for the stock market. Momentum and sentiment are really helping fuel this run higher. Now we have earnings which will likely provide even more fuel.

The bear case for a market pullback is hard to find. The seasonal tendencies that we historically see in October drawdowns and especially in election years haven’t happened.

On September 21st I wrote about the likelihood of seeing S&P 6,000 by year-end in Investing Update: S&P 6,000 By Year-End?

In it I said, don’t be surprised when the market hits 6,000 this year. When I wrote that the S&P 500 was at 5,703. It’s already up to 5,865. The way it looks, we may be seeing that 6,000 number much sooner than year-end.