Investing Update: S&P 6,000 By Year-End?

What I'm buying, selling & watching

This week saw the Fed cut interest rates by 50 bps on Wednesday. On Thursday, the stock market shot to new all-time highs.

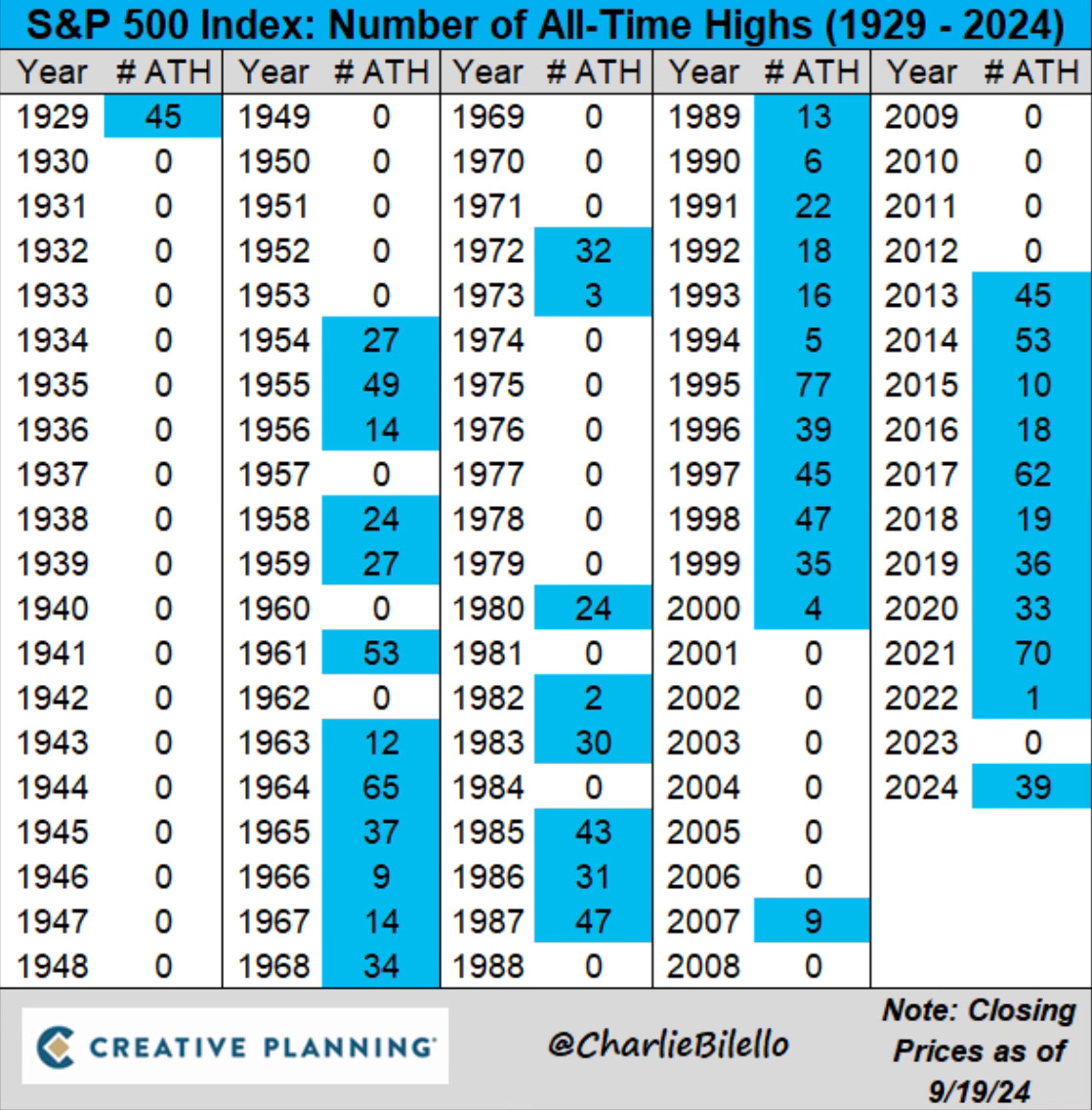

That marks the 39th all-time high of the year for the S&P 500. Through 9/19, it’s the 17th best start to a year since 1928.

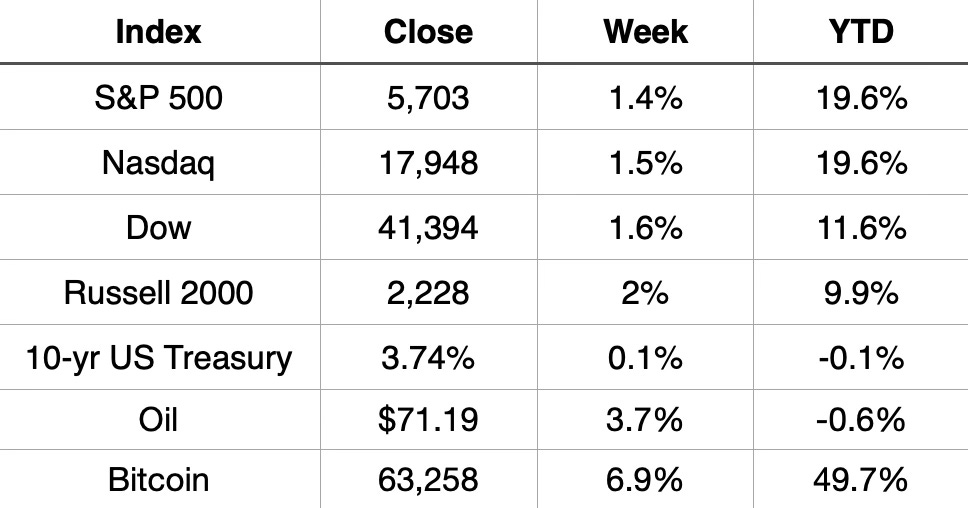

Both the S&P 500 and Nasdaq are up 19.6% YTD. The Dow is up 11.6%. The Russell 2000 has now been up 7 sessions in a row and is now up 9.9% YTD.

Market Recap

S&P 6,000 By Year-End?

With the rate cutting underway, the question now is how much farther does this bull market have to run? Is 6,000 by year-end possible for the S&P 500?

A lot of data is showing that it’s highly likely. The expanded stock participation has broadened this market. I’ve talked about this quite a bit the past few weeks.

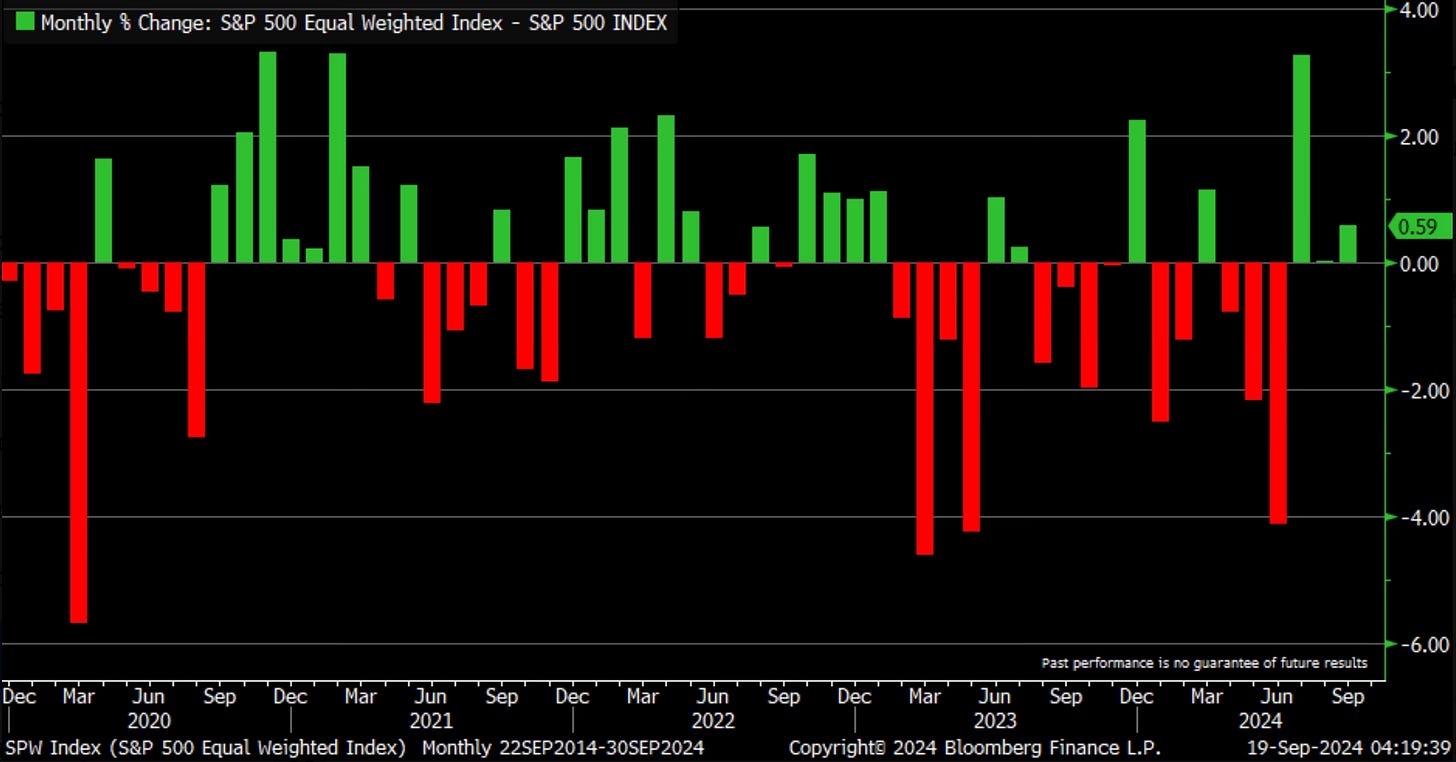

This chart was good proof of that from Kevin Gordon who said the following.

So far this month, the equal-weighted S&P 500 is outperforming the cap-weighted S&P 500 by 0.59% ... if it holds, it will be the third consecutive month of outperformance, which hasn't happened since the end of 2022

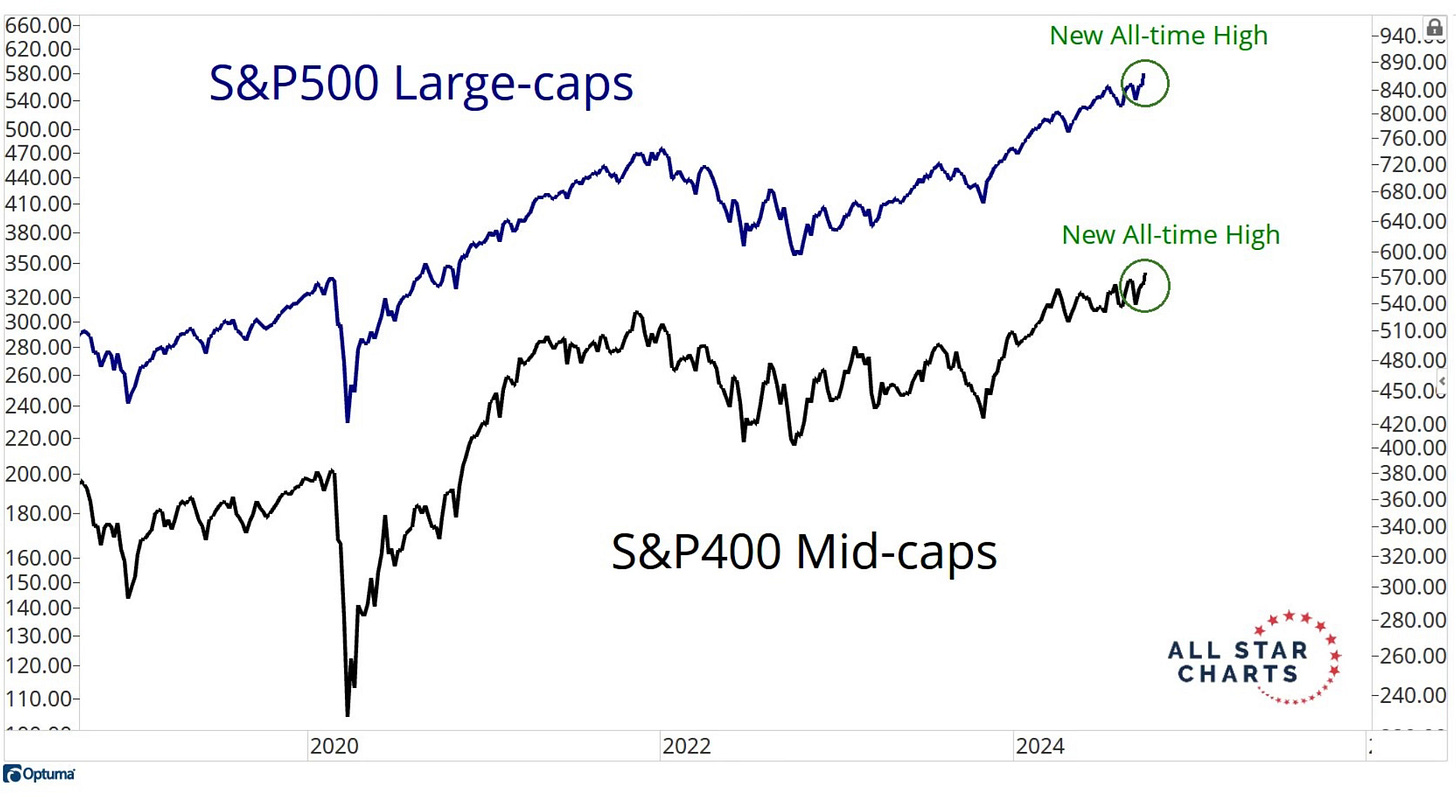

We also have the S&P 500 large-caps and S&P 400 mid-caps hitting new all-time highs. There is one word for that, strength.

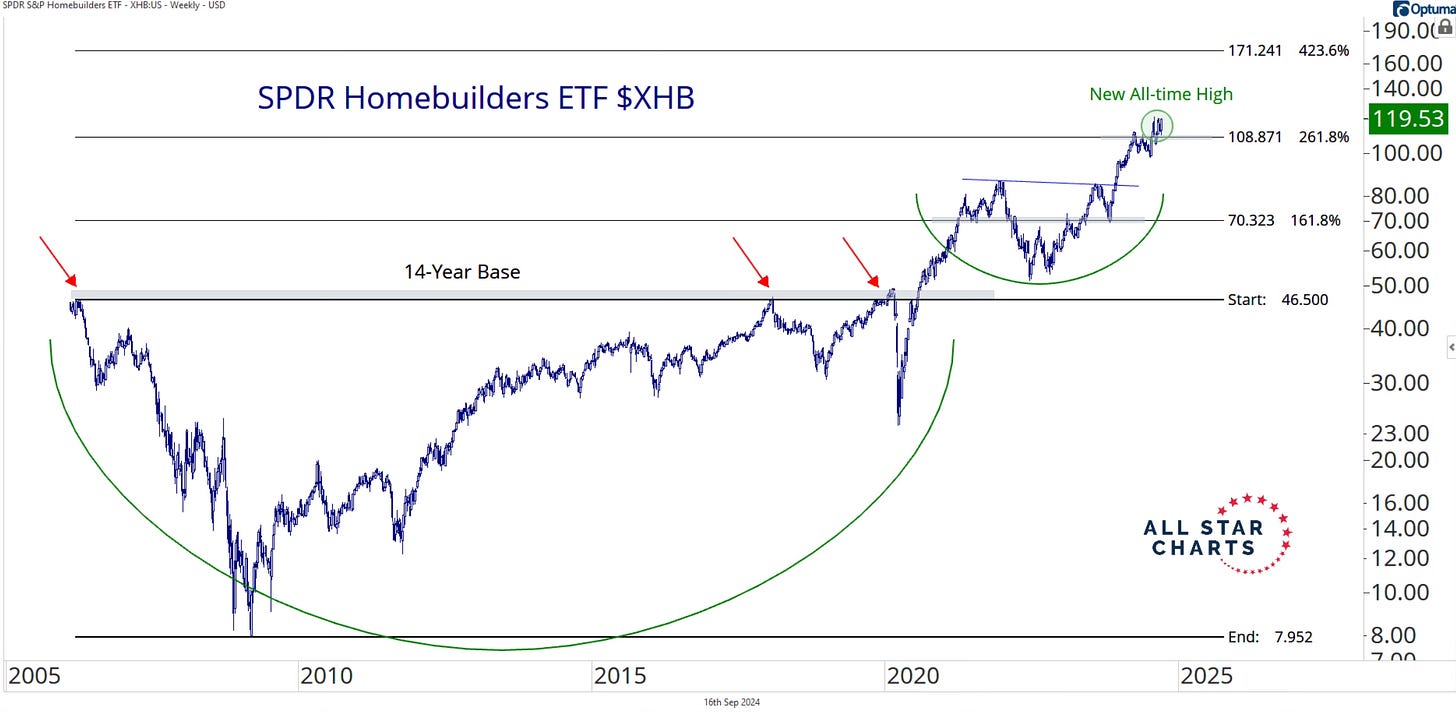

Two sectors of note that I feel are important to highlight that this week hit new all-time highs are homebuilders and insurance.

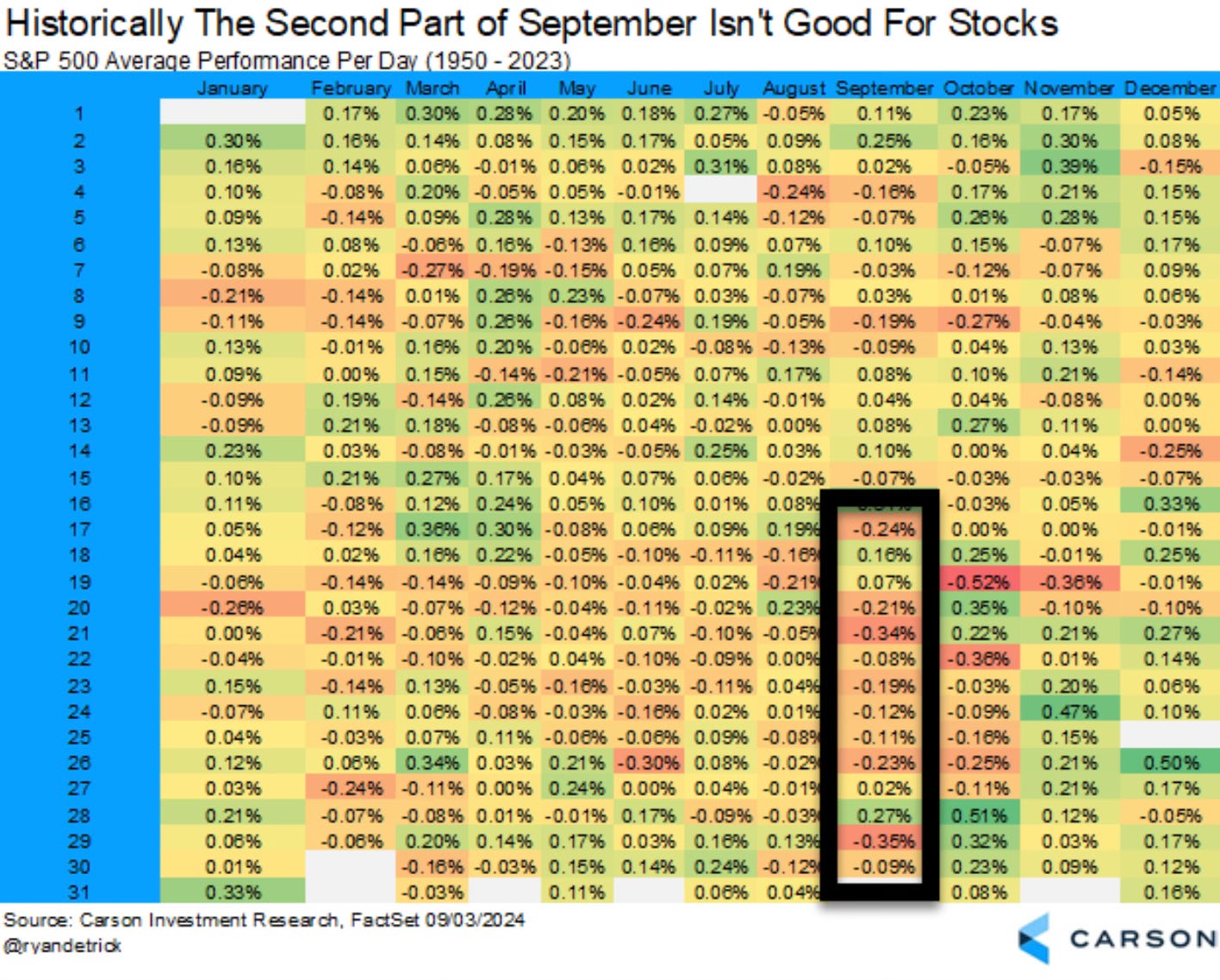

This all is occurring at a time when historically this is normally a weak period for the market. As Ryan Detrick pointed out, the back part of September is always the weakest part of the year. Instead of the market being down, it’s setting new all-time highs.

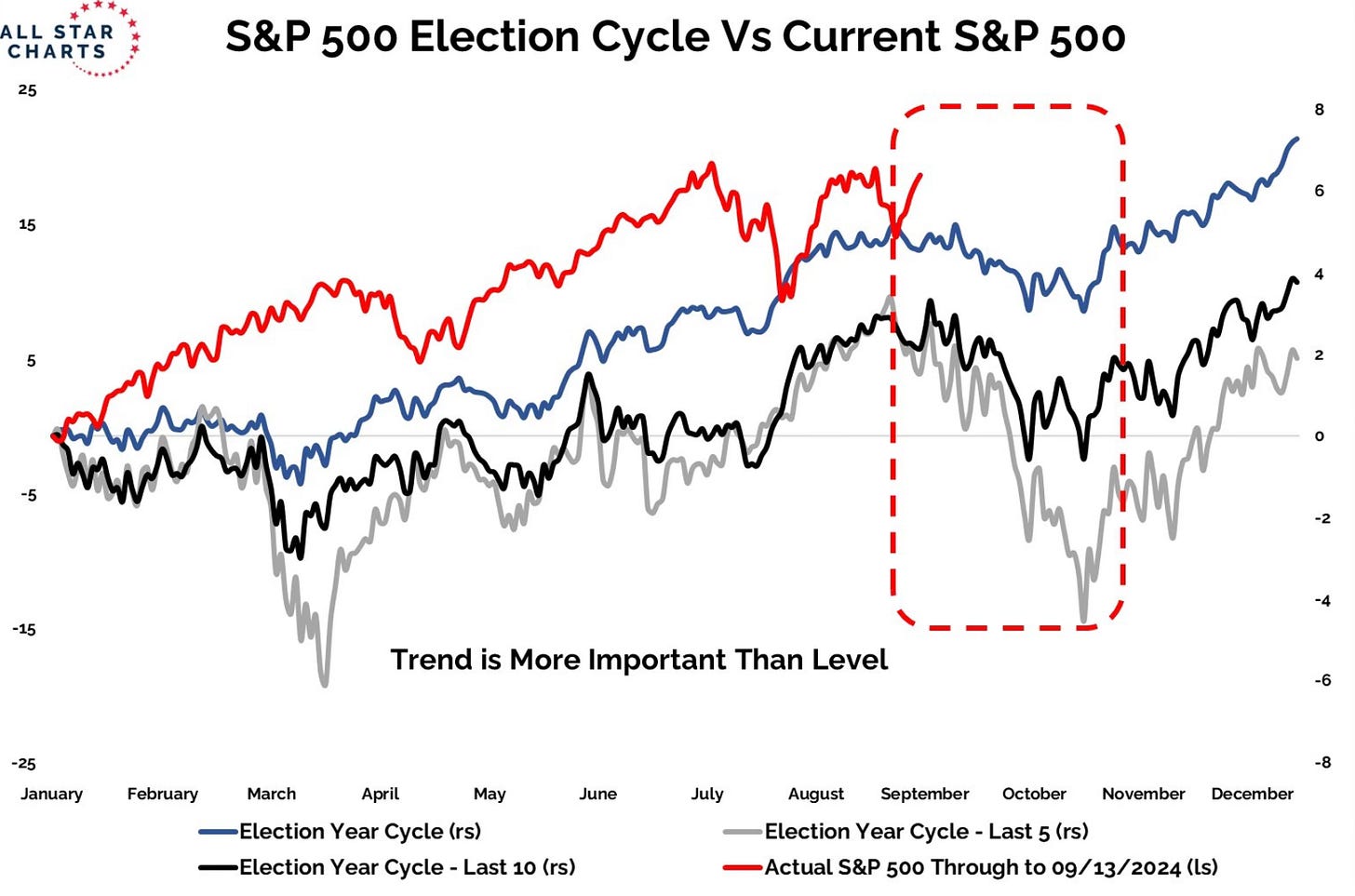

Also as Grant Hawkridge points out, this time in an election cycle is also a historically weak period. This is where the market normally falls off and then recovers after the election into year-end.

It’s odd to actually see a strengthening stock market into the election. Like it or not, and whether you agree or disagree with it, this bull market is now getting stronger.

The rate cutting cycle adds another layer to this bull market. I would still expect some volatility as we get closer towards the election. It will make some investors hesitant. But it will pass. Investors will then chase and the market will run up into year-end. Don’t be surprised when the market hits 6,000 this year.

Where Interest Rates May Be Headed

With the first interest rate cut done, where are interest rates headed next? This is a great chart that shows where Fed officials expect rates will be. The back half of this year and into 2025 looks like rates will continue to fall.

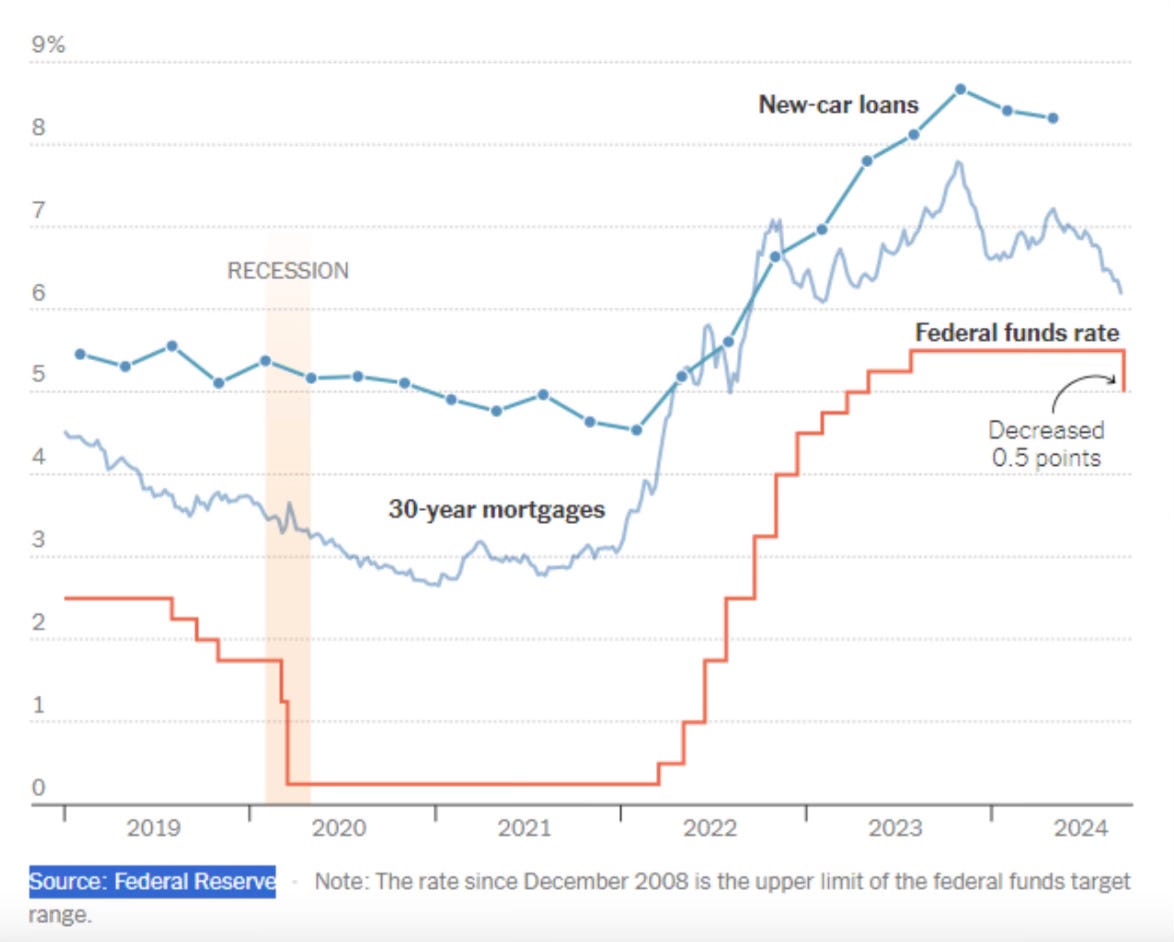

This is a great visual that shows how new car loans and 30- year mortgages follow the Fed funds rate. As interest rates continue to fall, the amount of interest paid on these items also falls.

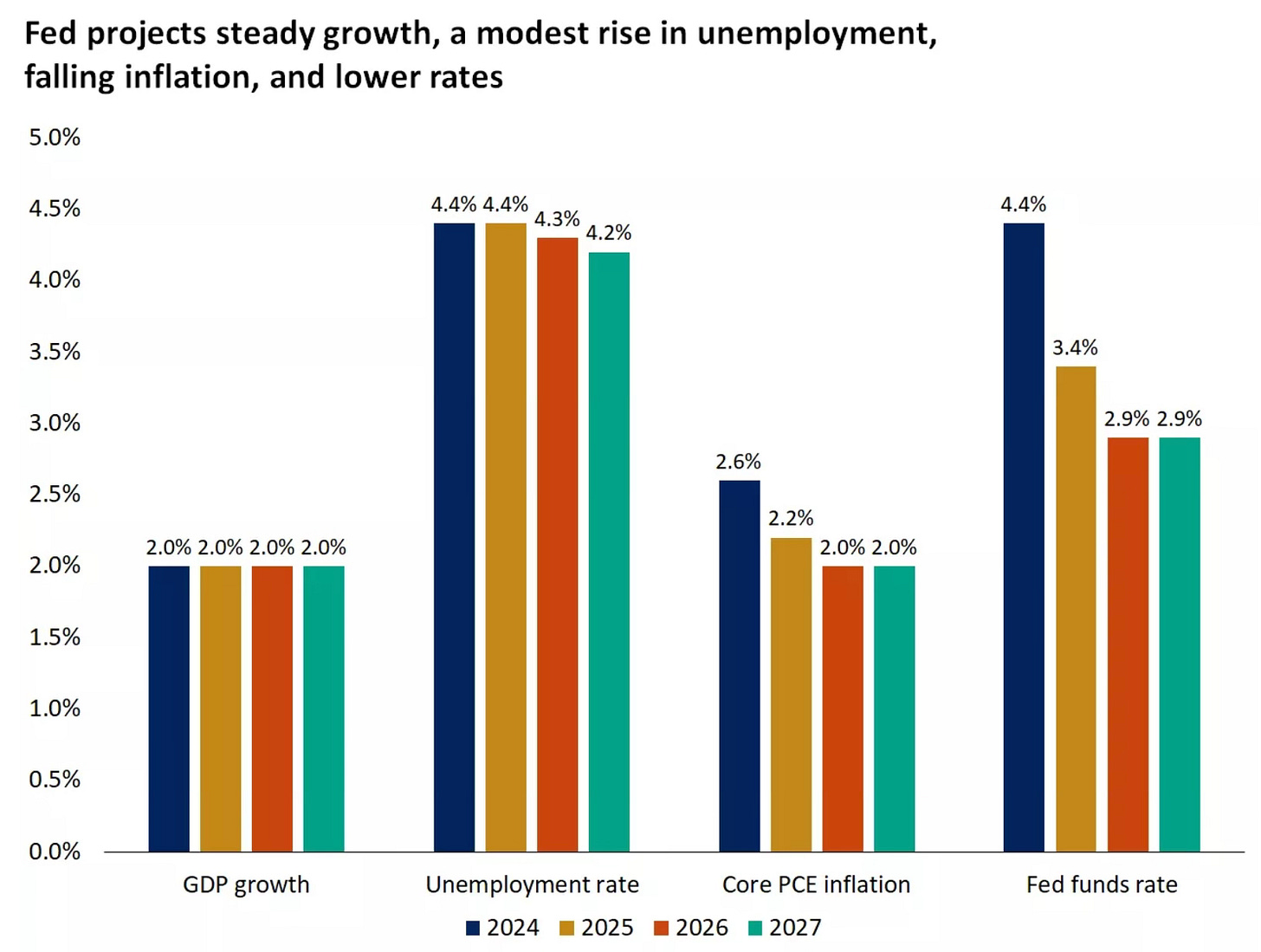

Here is what the Fed projects ahead for GDP growth, the unemployment rate, core PCE inflation and the Fed funds rate. This gives you insight into why they cut 50 bps and why it’s looking like another cut may come in November.

The AI Effect

We’re now starting to see some use case examples of what AI is starting to produce. Now we’re beginning to see how AI is going to drive margin expansion. BofA is actually predicting that AI will drive expansion in 23 of 25 industry groups. In time it really is going to have an effect on every industry.

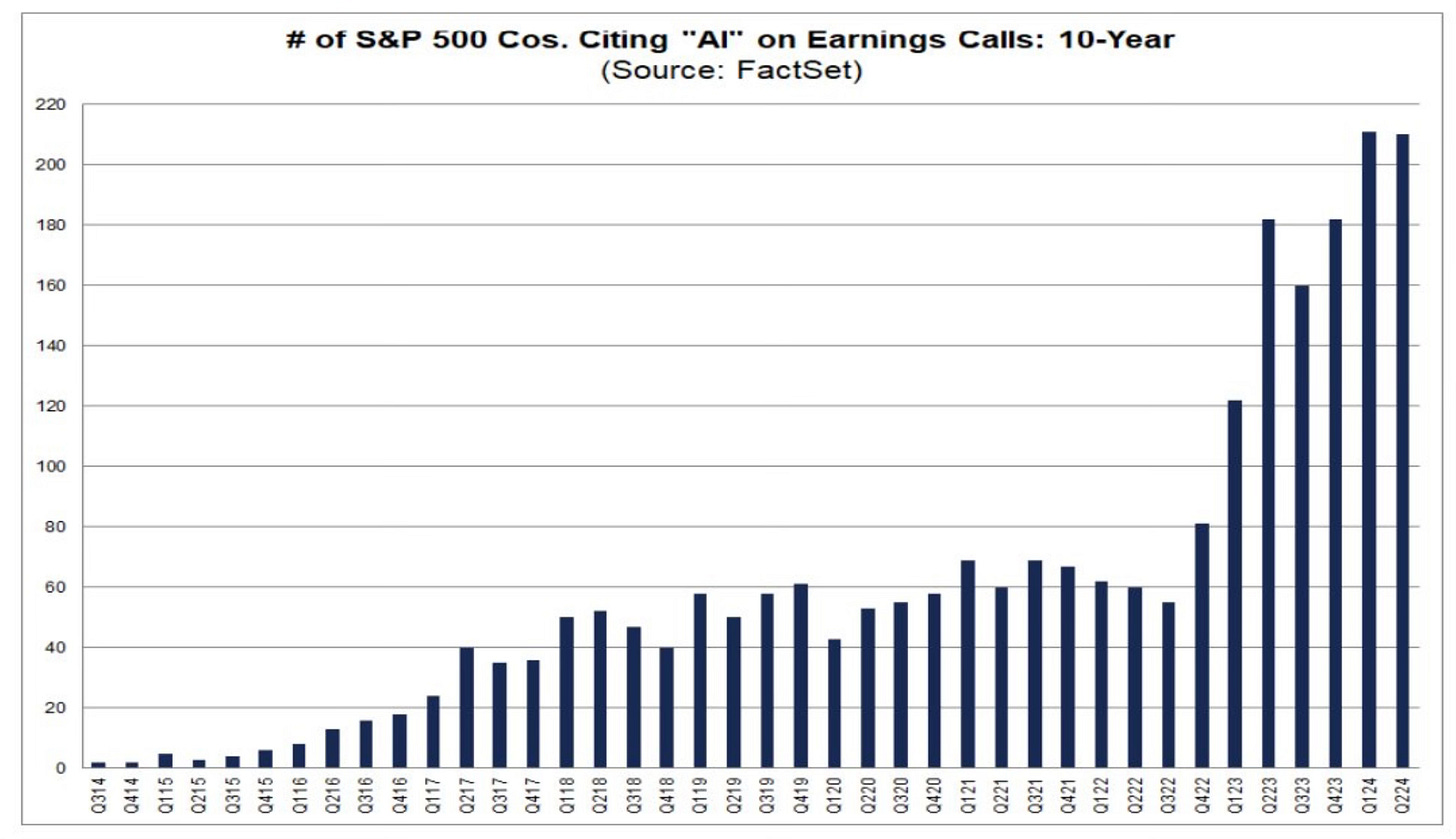

In Q2 more than 40% of S&P 500 companies cited AI on their earnings calls. You can see that percentage has only continued to climb. I expect in time this will be 100% of the 500 companies.

You can see from this chart that the Magnificent 7 has already seen a big bump in margin expansion. That hasn’t yet hit the other 493 companies. Eric Wallerstein at Yardeni Research thinks that’s coming.

The S&P 493 have yet to see the margin expansion from AI and other productivity-enhancing tech. They will. We expect S&P 500 forward profit margins to widen to 14% next year

Returns After Rate Cuts

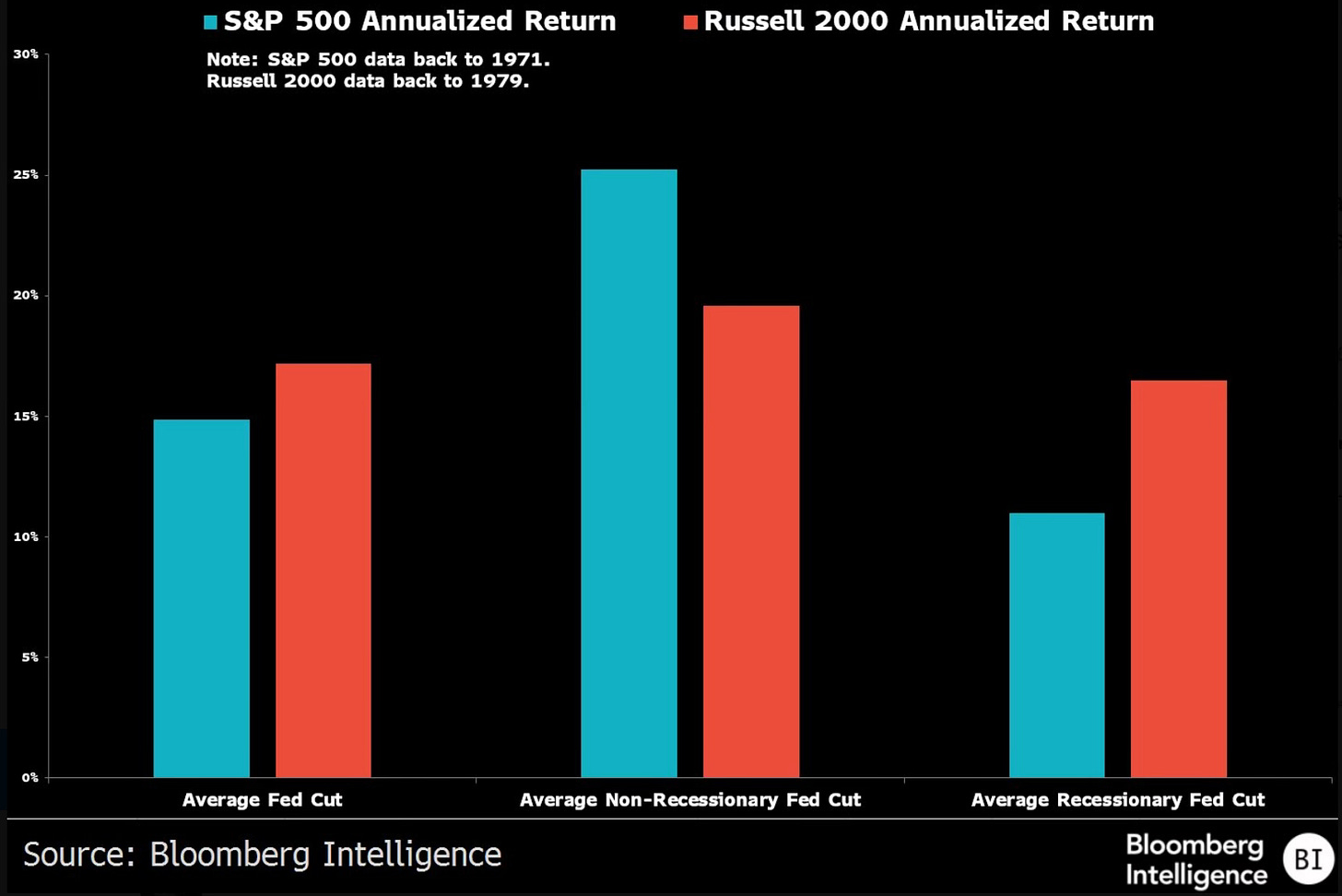

What exactly does the stock market do after rate cuts? The S&P 500 had a 14.9% annualized return back to 1971. The Russell 2000 gained 17.9% going back to 1971. An average non-recessionary (CPI below 3%) cut has seen the returns average 29.2% for the S&P 500 and 56.9% for the Russell 2000.

What have S&P 500 sectors done after the first rate cuts? Check out consumer discretionary.

Here is what some other assets have produced one year after the fed cuts rates.

YTD Performances

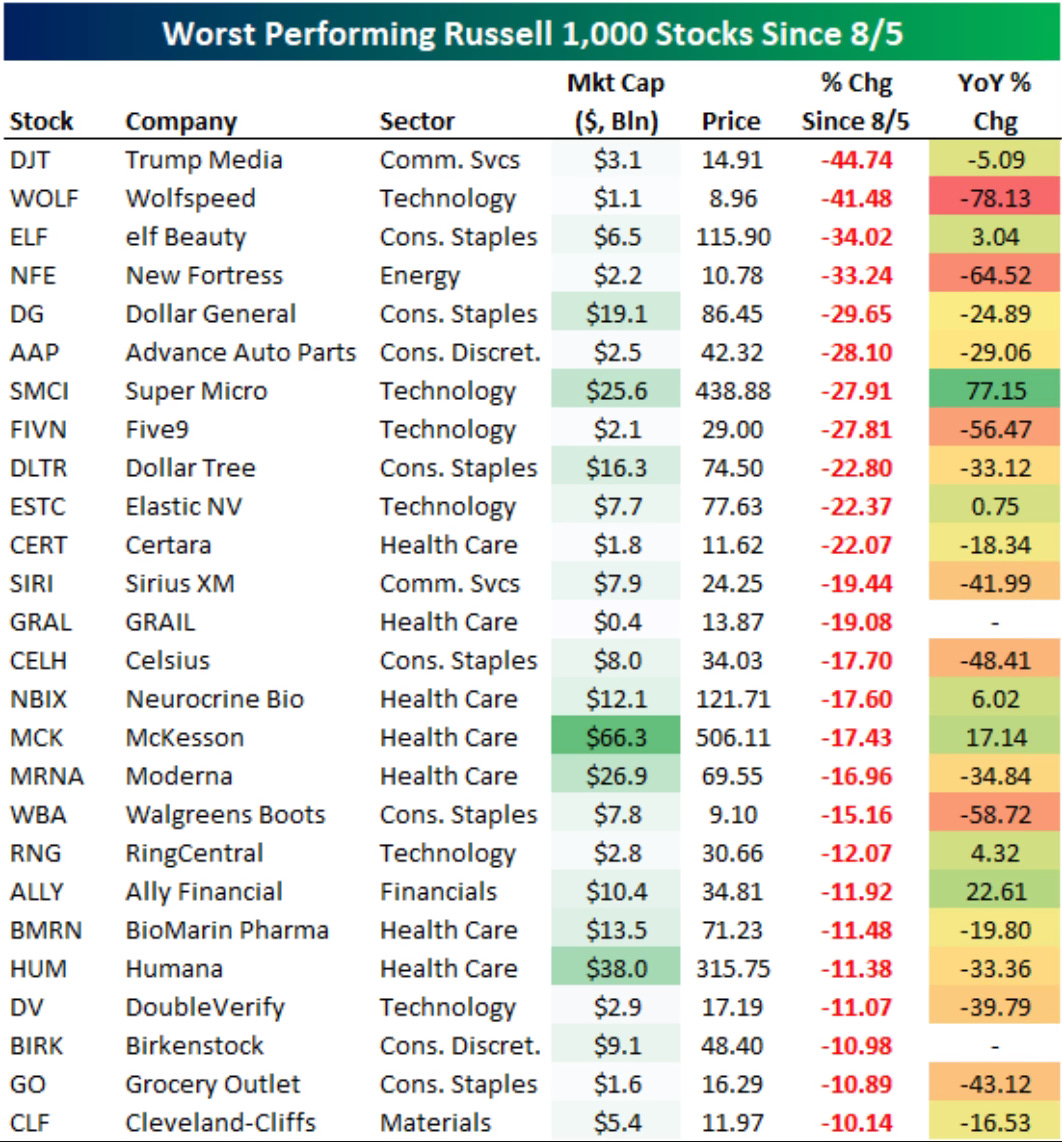

Since the low on 8/5, here are the worst performing Russell 1,000 stocks.

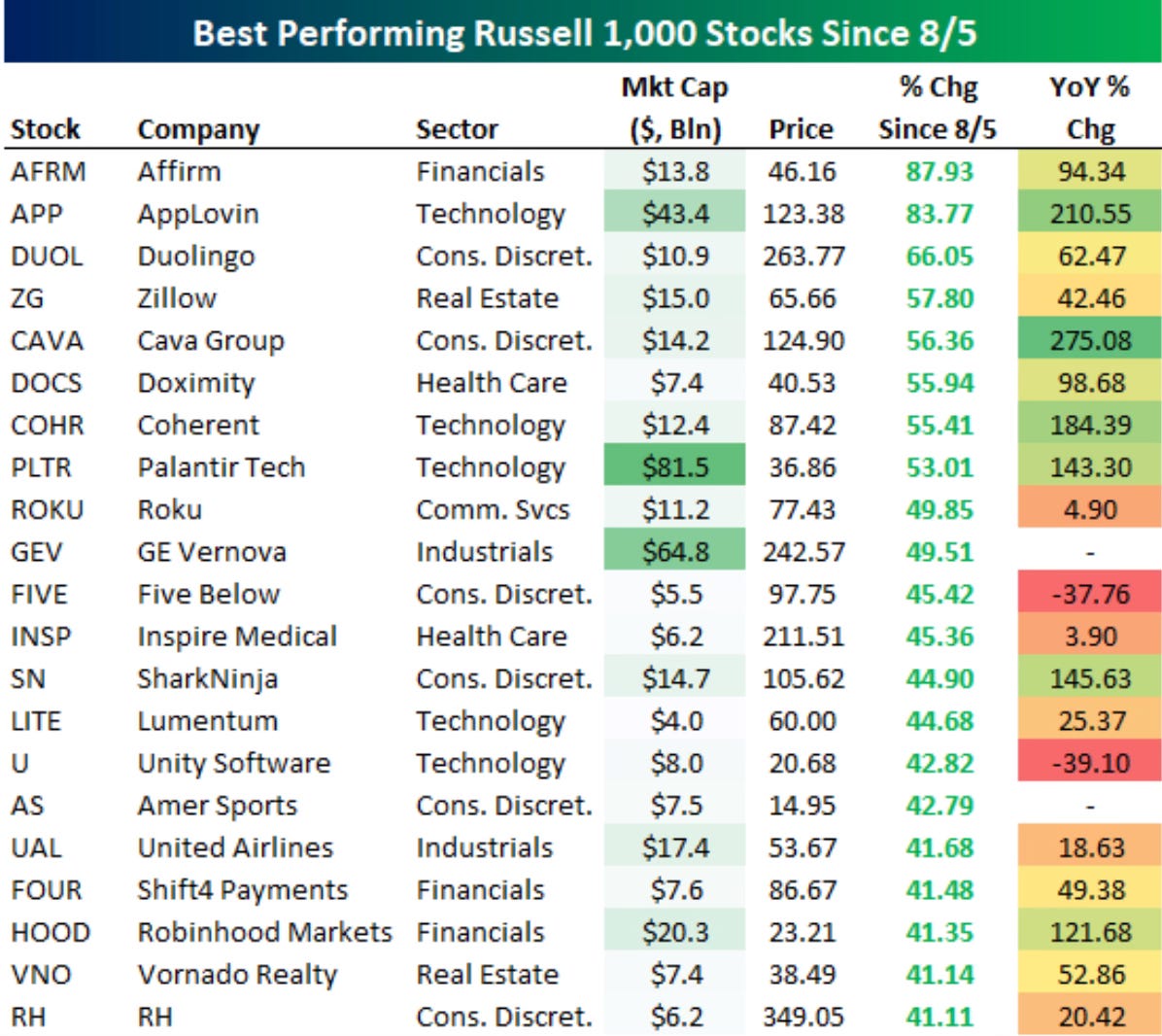

Here are the best performing Russell 1,000 stocks from the 8/5 low.

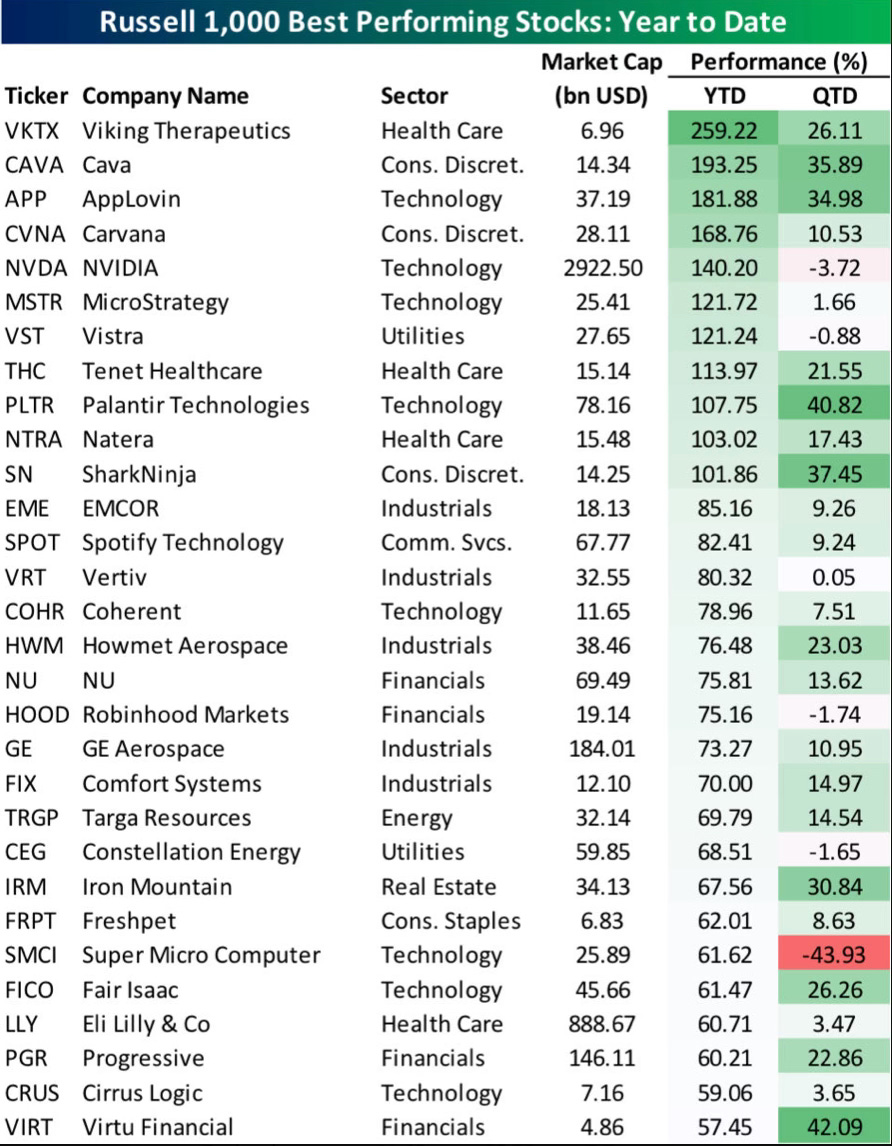

These are the best performing Russell 1,000 stocks YTD.

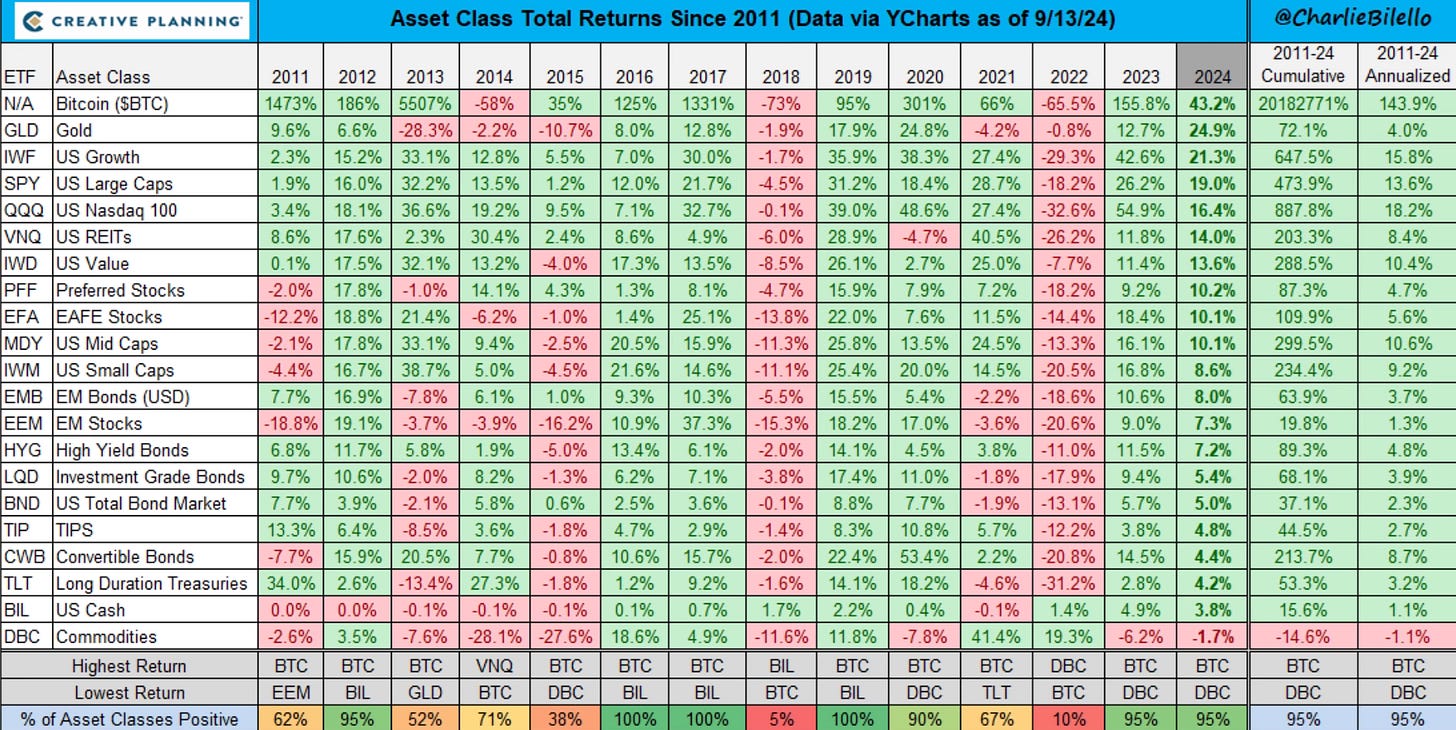

I can’t do a performance update without including one of my favorite regular charts. Charlie Bilello’s asset class total returns chart. I love looking at this thing.

Lastly, one thing you may have forgot about. After leaving the 60/40 portfolio for dead in 2023, it has come roaring back to new all-time highs. Diversification does still work.

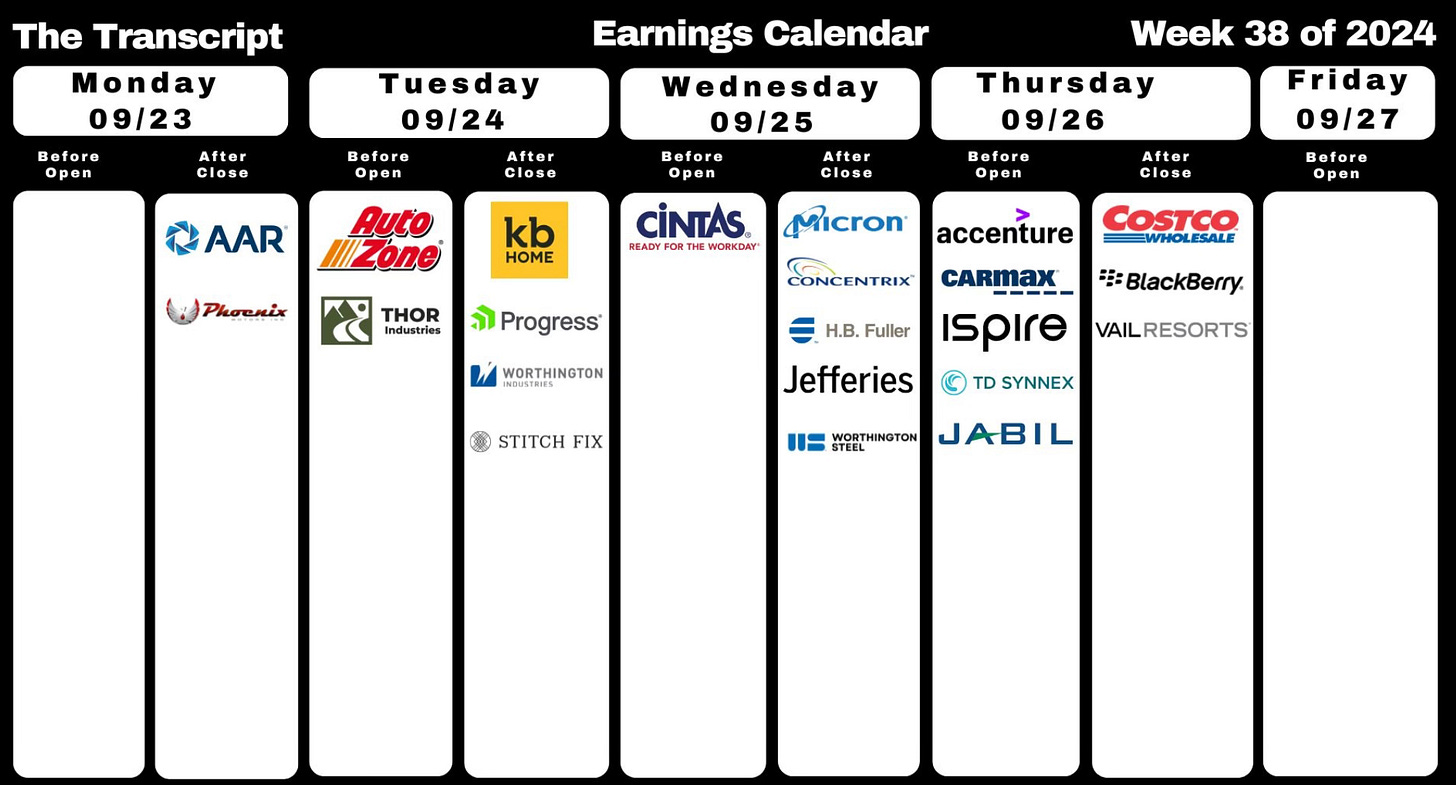

Upcoming Earnings

This week I will be watching Costco’s earnings. It’s one of my favorite reports every earnings season.

The Coffee Table ☕

I liked Tony Isola’s post Compound Interest Is Apolitical. That’s such a great title. It’s also 100% true. Compound interest doesn’t care about political parties. As the election comes closer everyone needs to remember that.

A lot was written the last few days about the Fed and its decision to raise rates. I really liked Sonu Varghese’s piece called The Fed’s Got the Back of the Labor Market. He had some great discussion points in his usual straight forward outlook where he lets the data tell the story.

Daniel Howley had a good piece in Yahoo Finance about Instagram rolling out Teen Accounts. Instagram debuts Teen Accounts as criticism of impact on teen mental health grows With having young kids and talking to other parents, this is one of the bigger discussions among parents. This is a positive thing to see being done by Instagram. I hope it helps the ongoing concerns with social media.

That was a cool visual of America’s Top Crops By Acres Harvested in 2023.

Source: Visual Capitalist

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.