Investing Update: Is Mag 7 Leadership Returning?

What I'm buying, selling & watching

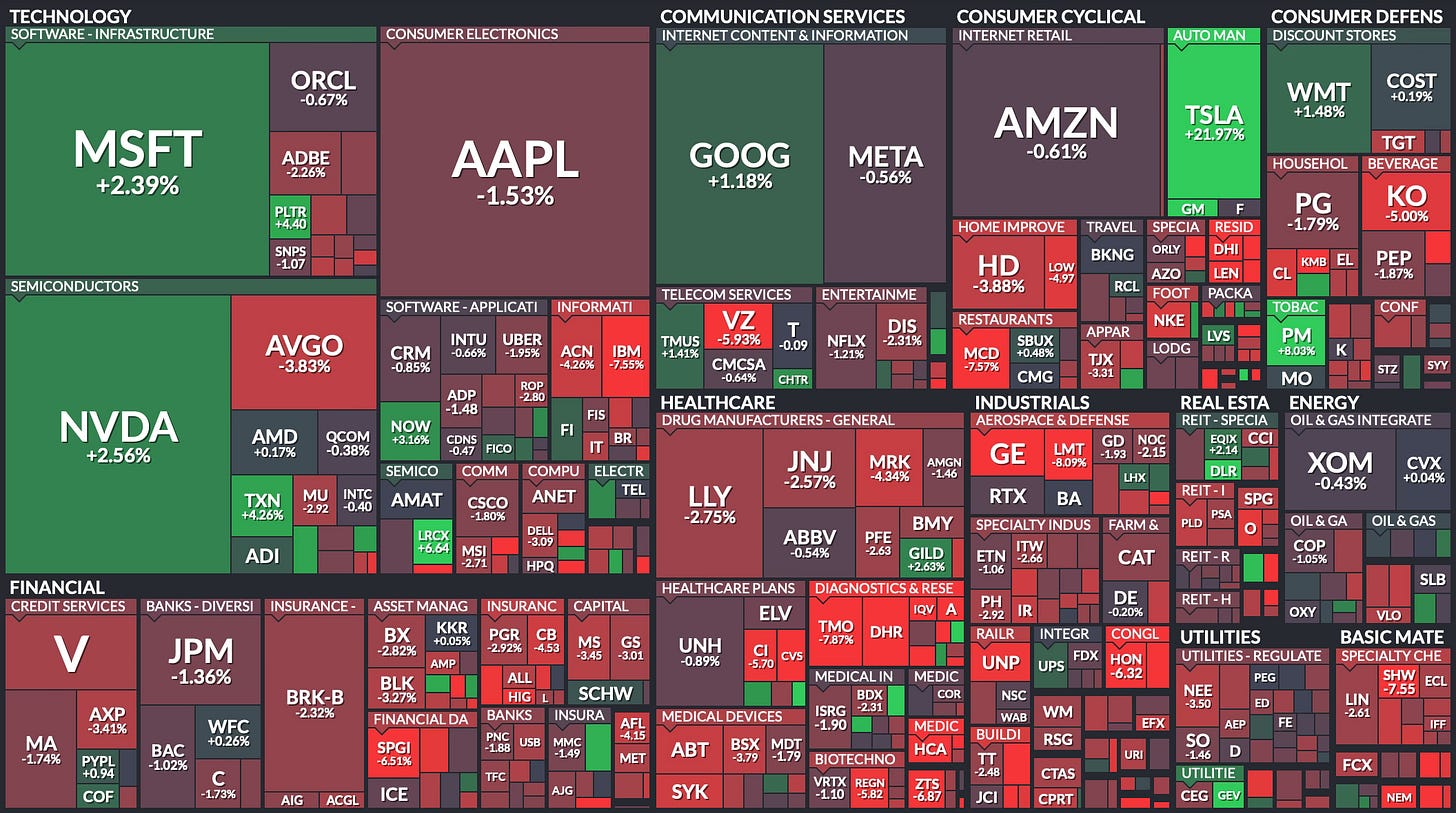

This week saw both the Dow and S&P 500 winning streak of six straight weekly gains end. The Nasdaq did hold positive to extend its streak to seven straight positive weeks.

Market Recap

Weekly S&P 500 Leaders

Next week contains historically the best day of the year for the stock market, October 28th. That’s also the birthday of my friend Ryan Detrick. Happy Birthday Ryan!

Investors don’t seem to be waiting of the election results to put capital to work. Last week saw $18.5 billion added to U.S. stock positions. You can see that’s the most since early July.

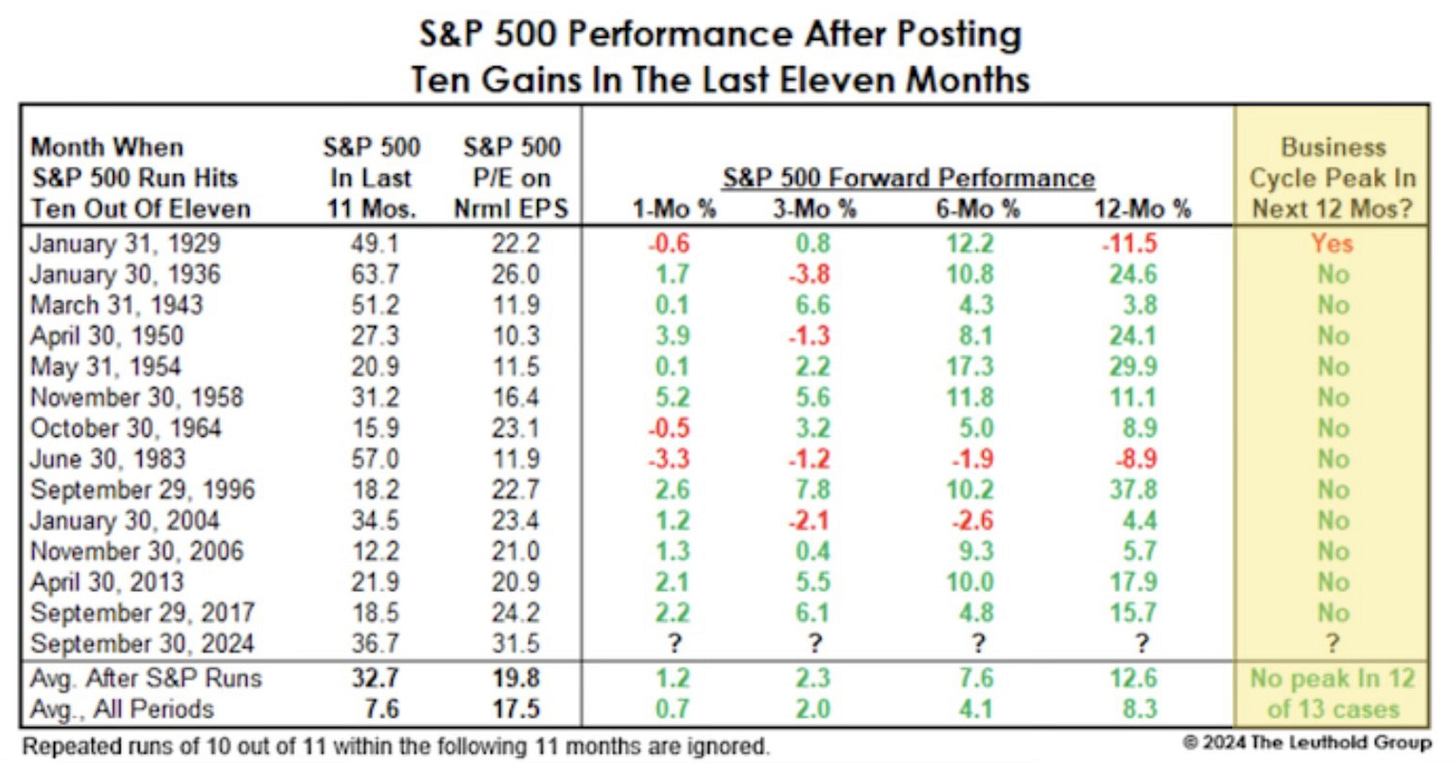

It’s hard to blame them when you continue to look at the strength in this bull market. This was a good point made by Seth Golden to further calm any recession fears.

S&P 500 is up 10 of last 11 months. Only 1 other streak in history found a recession when market was persistently this strong; all the back to 1929.

Some volatility as the election nears should be expected. I’ve mentioned this numerous times. The election is going to create some uneasiness among investors. I think those fears will resolve quickly if we get a quick verdict on the outcome. Any lingering worries and no resolution would not be good for the market in the near term.

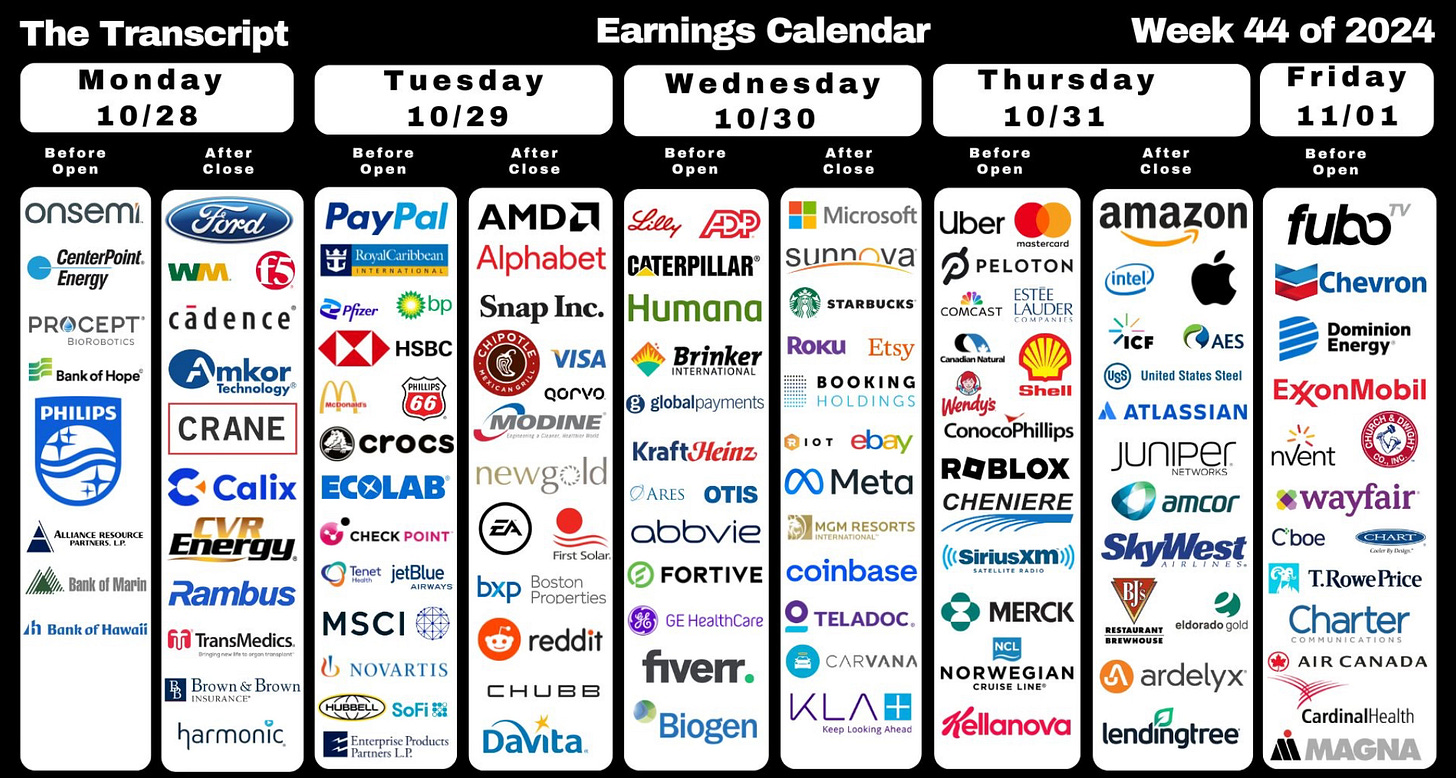

Instead of wasting my time worrying about the election. I will have my eyes on what really matters, earnings.

Upcoming Earnings

It’s another big week of earnings. 5 of the Mag 7 names lead the way in Microsoft, Amazon, Apple, Alphabet and Meta.

This is what’s worth paying attention to and not all the noise surrounding the election. The election creates more short term noise. It’s something for the media to try and connect to stock market performance. The results won’t matter to the market in the long run.

If you’re still of the belief that who’s in the White House or what political party is in charge matters. I think you need to read this piece on Spilled Coffee from September 25th. Don’t Mix Politics & Investing

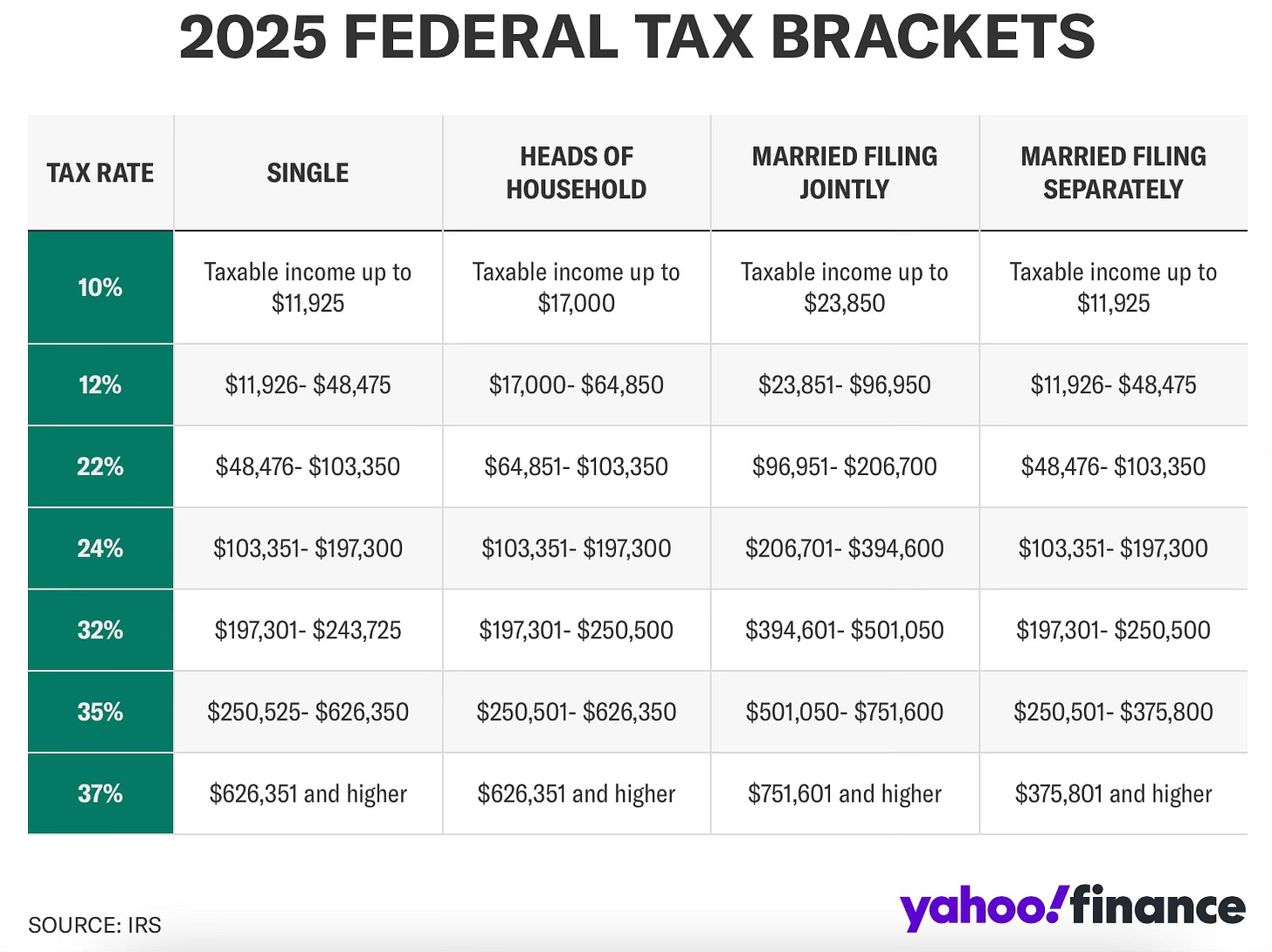

2025 Federal Tax Brackets Released

This week the IRS released the 2025 Federal Tax Brackets. It’s inflation adjusted, but to my surprise this was the smallest increase in four years.