Don't Mix Politics and Investing

The stock market doesn't care about politics

As the presidential election gets closer, it seems we need a reminder about how politics and investing don’t mix.

I hear it and I’m sure you hear it. So and so is better for the stock market. The so and so party is better for the economy. I’ve heard it from both sides and I hear it every four years.

It never fails and it’s tiresome. It makes my head hurt.

They’re wrong but it just isn’t worth engaging. They won’t listen anyway.

Instead, maybe they will read this.

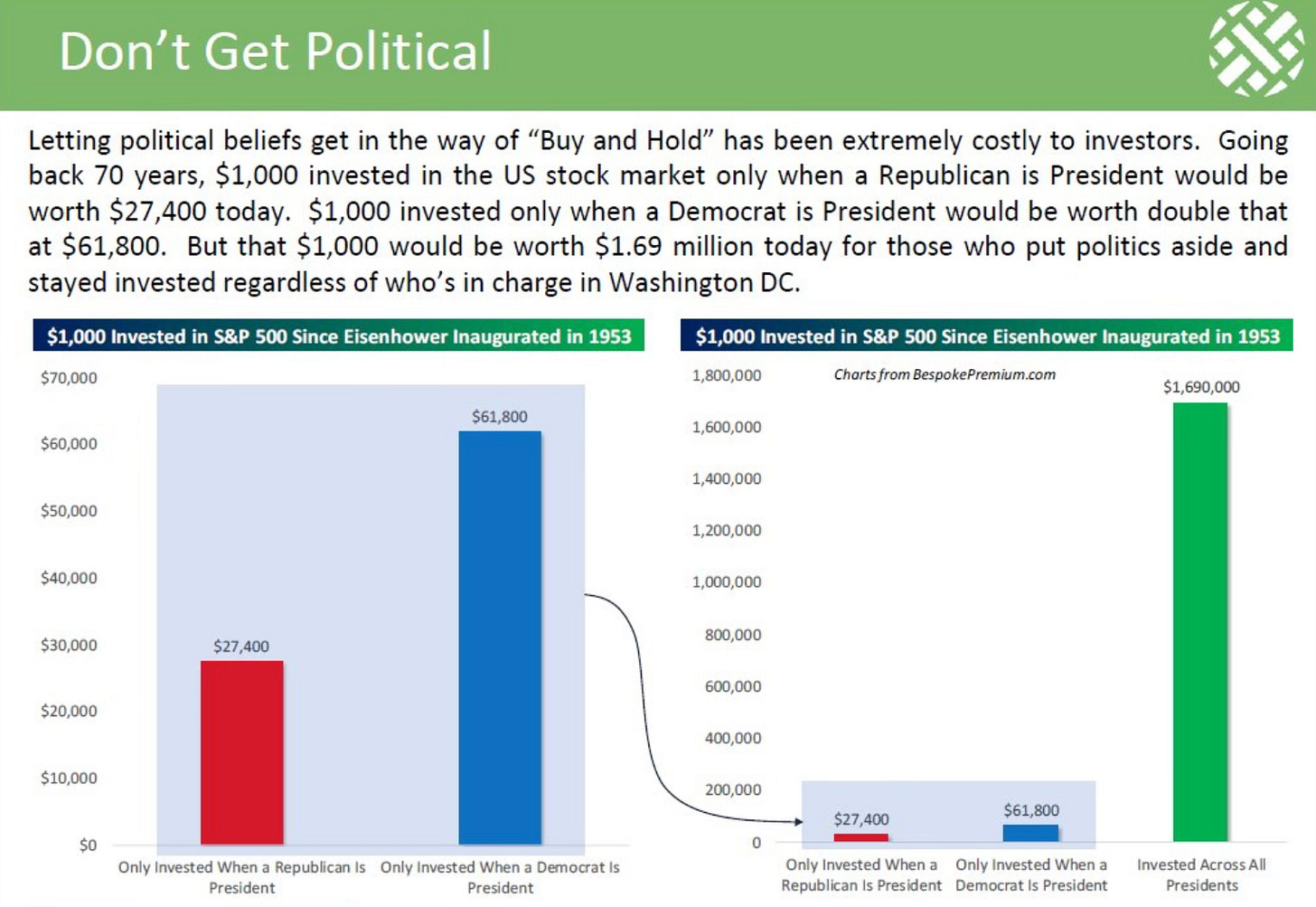

There may not be a better chart on investing and politics than this from Bespoke.

Look at the difference if you go back to 1953 and are invested across all presidents, versus just being invested during a Republican or Democratic president.

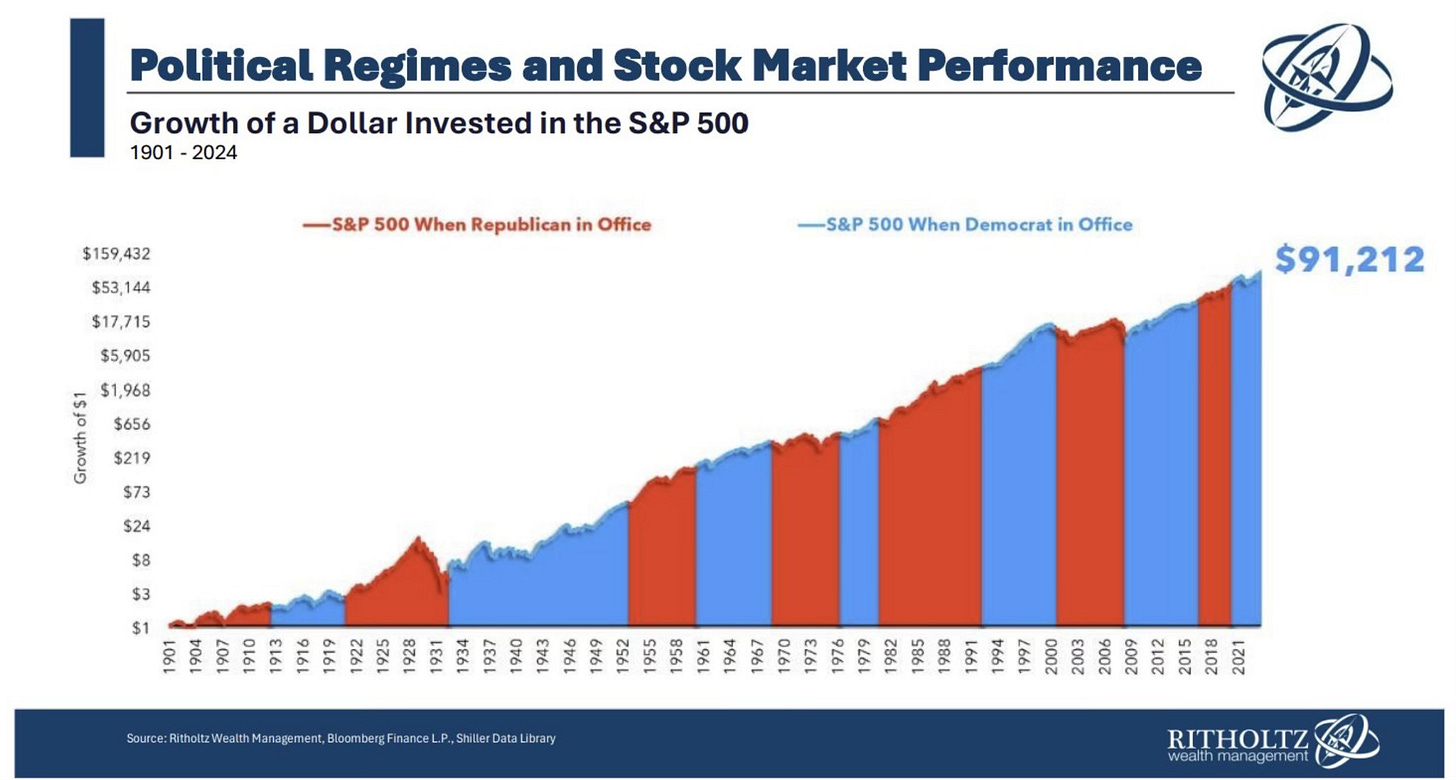

This is what the S&P 500 looks like going back to 1901. It’s up regardless what political party is in the White House.

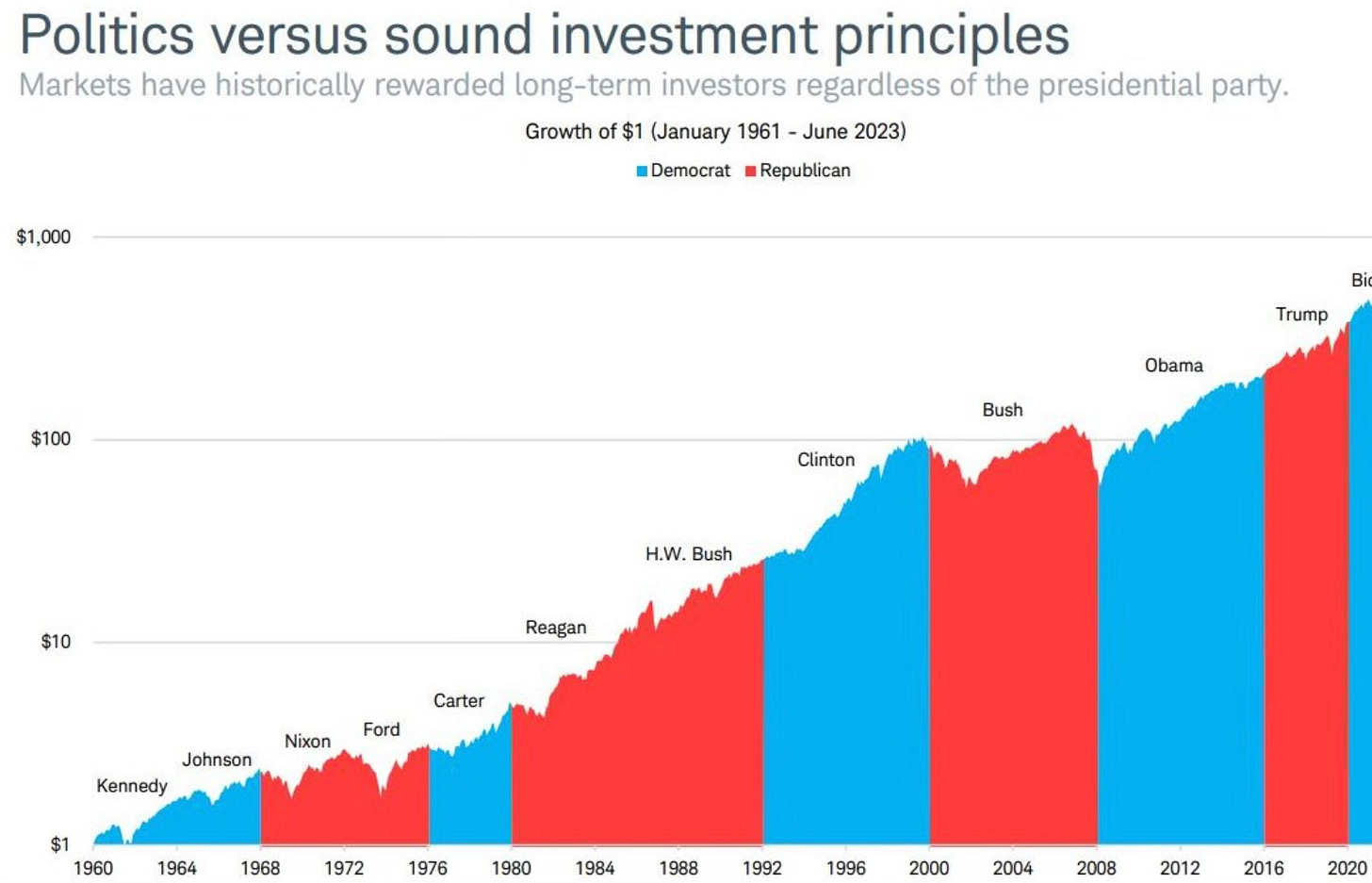

Need a refresher of which president was in the White House during each timeframe. Here you go. They’re still all up and to the right.

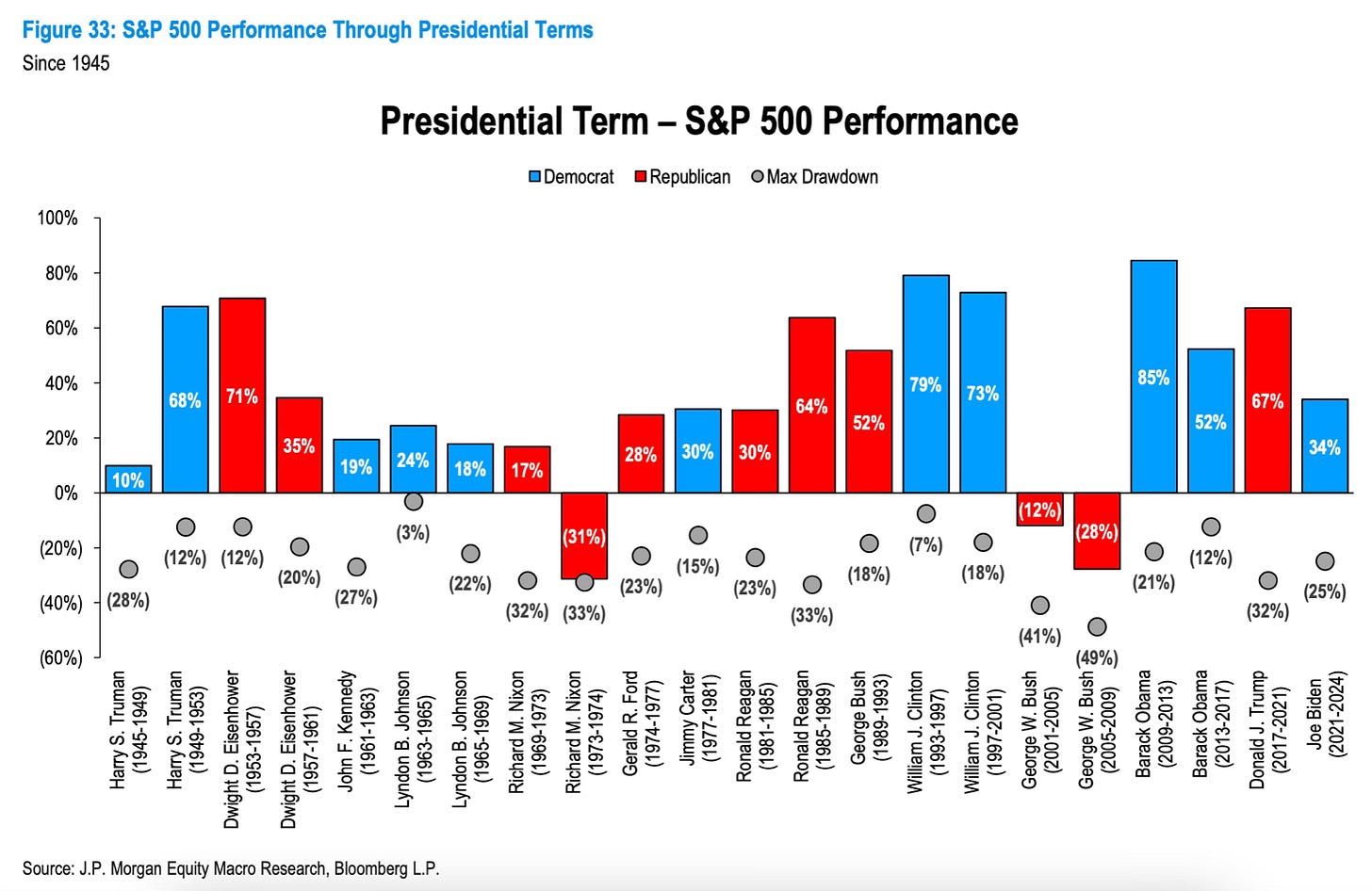

Here is the S&P 500 performance breakdown by each presidential term. It also shows the maximum drawdown during their term.

You can see that bear markets and bull markets happen for both Republican and Democratic Presidents. They all saw pullbacks.

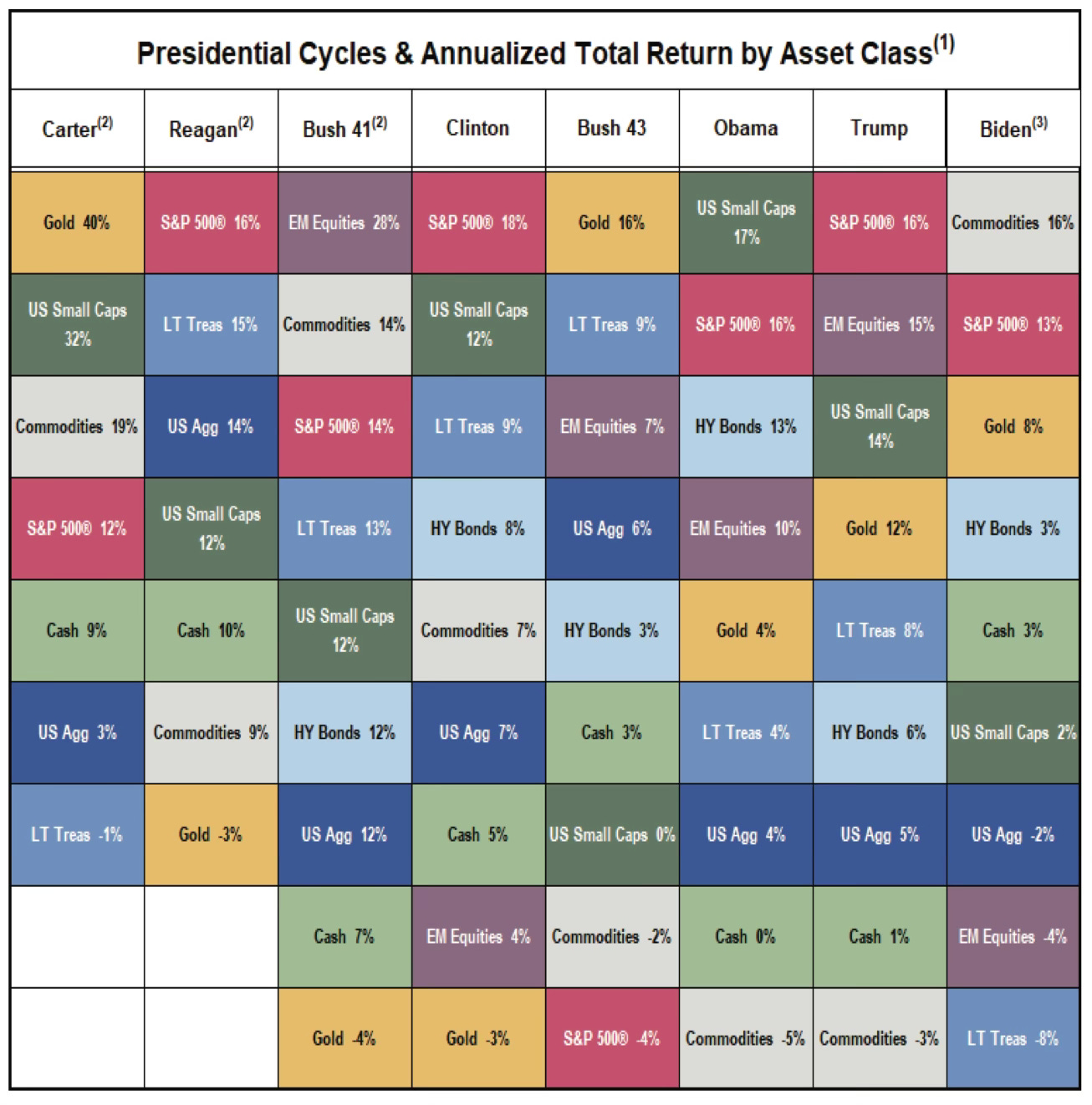

We also hear that certain assets or sectors are better under a Republican or Democratic President. Well that’s isn’t the case either.

When we look at the historical asset class performance, you can see that there is no pattern whether a Democratic or Republican President is in office.

This can also be said about there being no consistent pattern in historical sector performance under a Democratic or Republican President.

The same can be said for economic growth. This illustration looks identical to the historical S&P 500 chart doesn’t it?

US GDP has continued to grow through both red and blue presidents. Like the stock market, the economy doesn’t care who occupies the White House either.

Political party affiliation many times clouds your judgement of the truth. If you support one color or another, that’s the color in which you see things.

History shows us that presidential elections are not near as important to the stock market as the media tries to tell us that they are.

Presidential election results don’t result in a stock market or economic crash. That has never happened.

Don’t let your political beliefs influence your investment decisions. Worse yet, don’t be the one telling others how this president or political party is better for the stock market than another.

Over the long term the stock market doesn’t care about politics. It never has.

The Coffee Table ☕

I really enjoyed Phil Pearlman’s post The Busy Addiction. It’s so spot on. I loved this line from him and couldn’t agree more, “We’ve deprioritized the most important things in the world and prioritized the unimportant things.”

Last weekend my kids had me watch a movie with them that they recently saw and wanted to watch again. It was called Wonder and what an enjoyable movie it was. It was wonderful and something great for kids to watch. A great message. I’m glad my kids liked it enough and had me watch it with them.

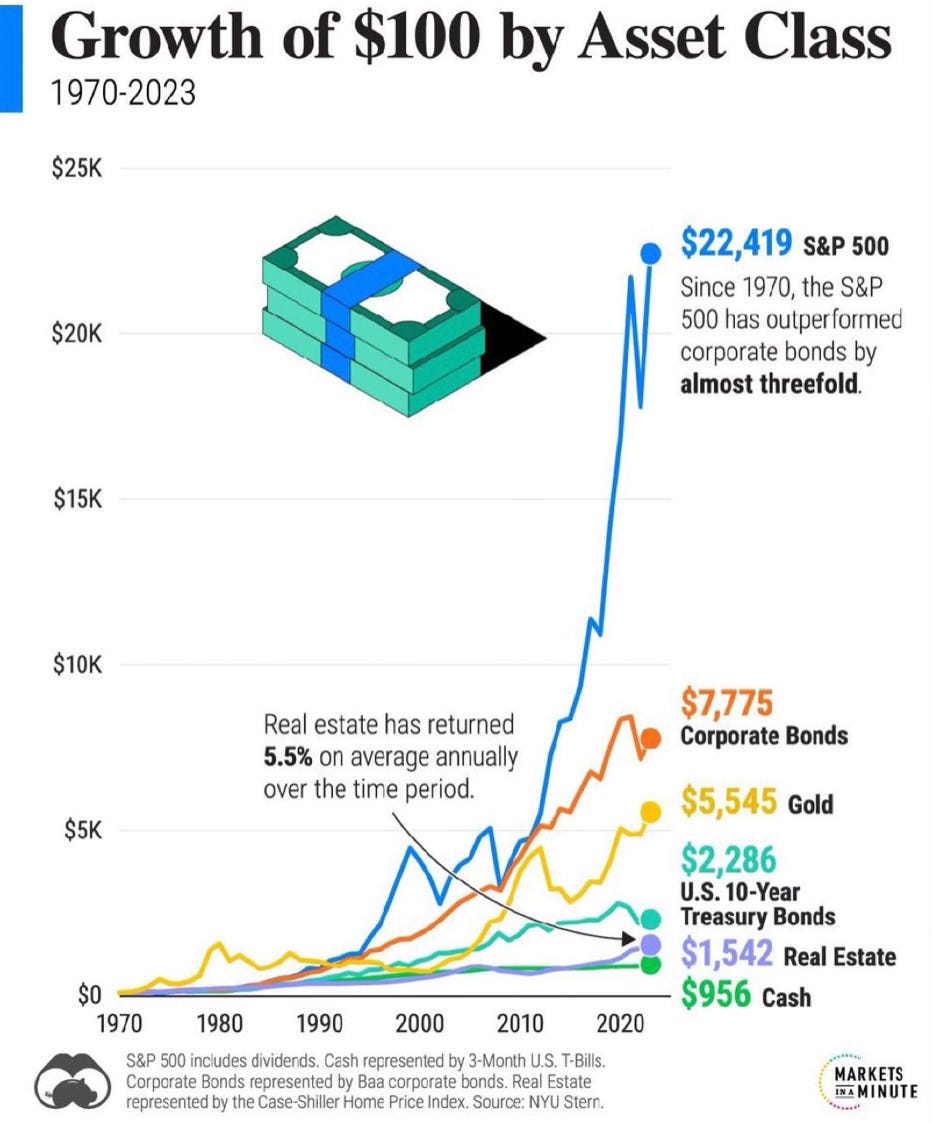

Here is what $100 invested in 1970 by asset class would be worth in 2023.

Source: Evan

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.