Investing Update: Has The Santa Rally Started?

What I'm buying, selling & watching

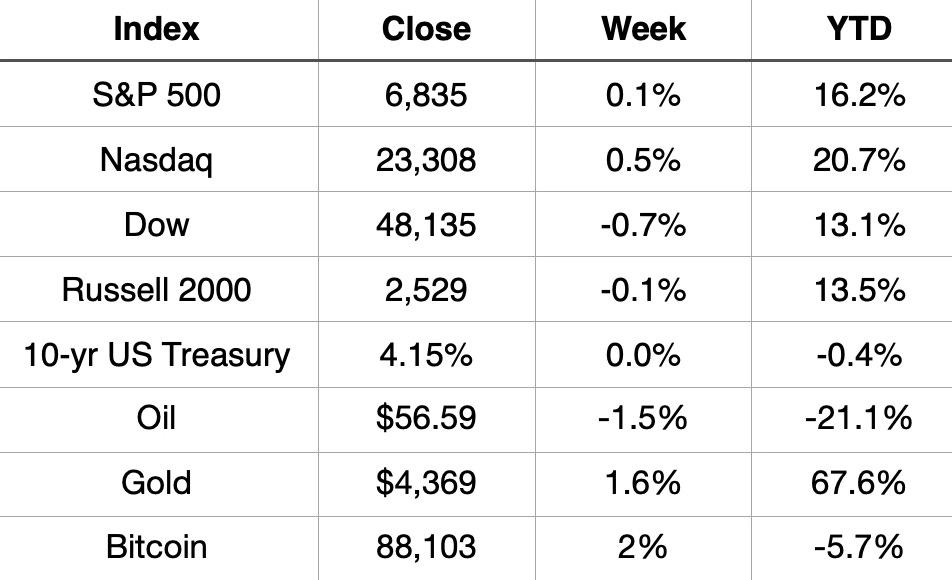

Stocks finished the week slightly higher after rebounding from early in the week weakness. Tech names, especially AI-linked leaders drove the late-week advance, helping erase earlier losses and push major indices back toward key levels.

The S&P 500 and Nasdaq closed higher for the third time in the past four weeks. The Dow finished lower, snapping a four-week winning streak but it remains on track for its eighth consecutive positive month.

Energy and real estate were the weakest sectors on the week, while discretionary and materials led the market higher.

My year-end target for the S&P 500 is 6,900. I made that call on January 4th in my Investing Update: 2024 Recap & 2025 Outlook. With the S&P 500 around 6,835 and only seven trading days left in the year, it looks like that 6,900 target may come right down to the wire.

My 2026 Outlook will be out on January 3rd.

Market Recap

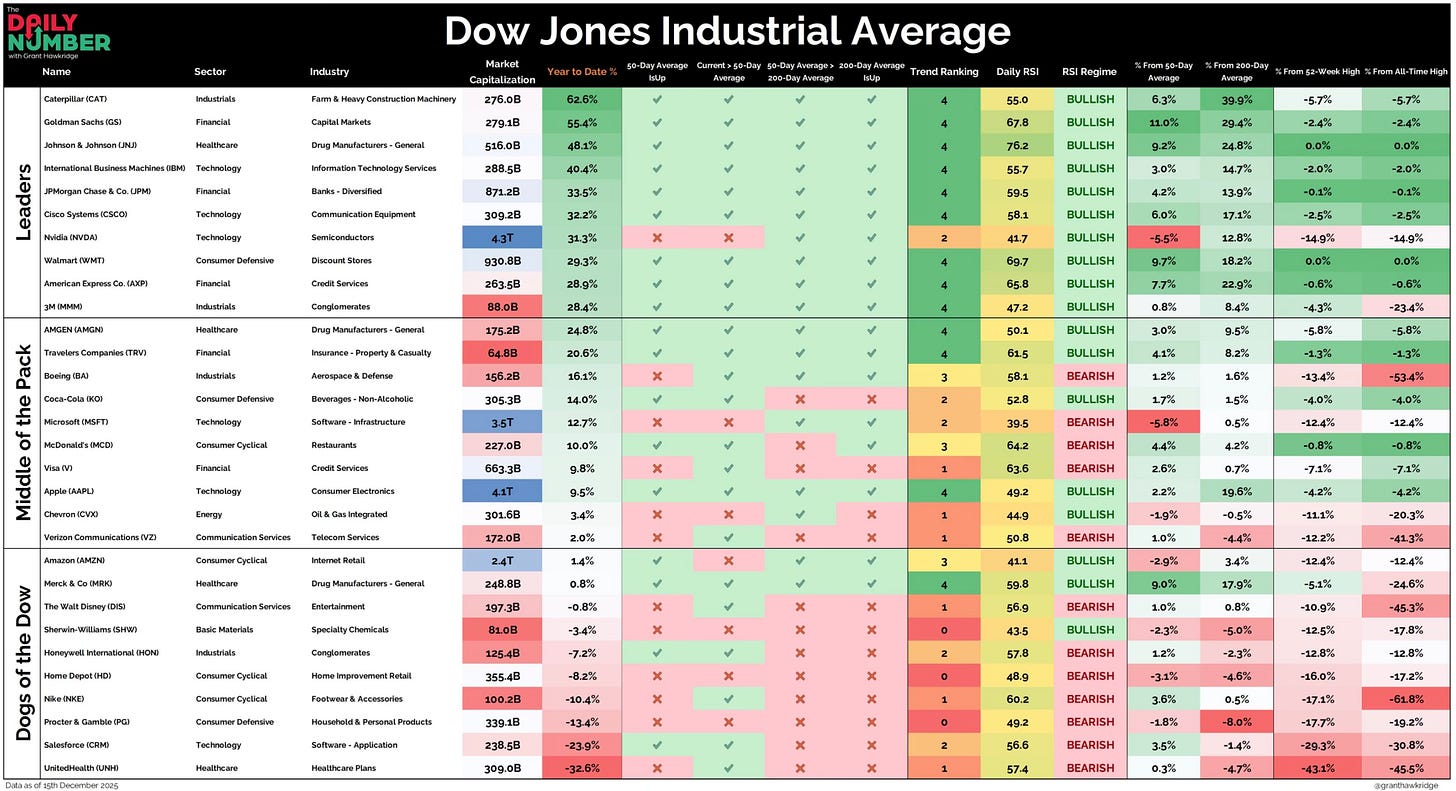

Weekly Heat Map Of Stocks

Dow YTD View

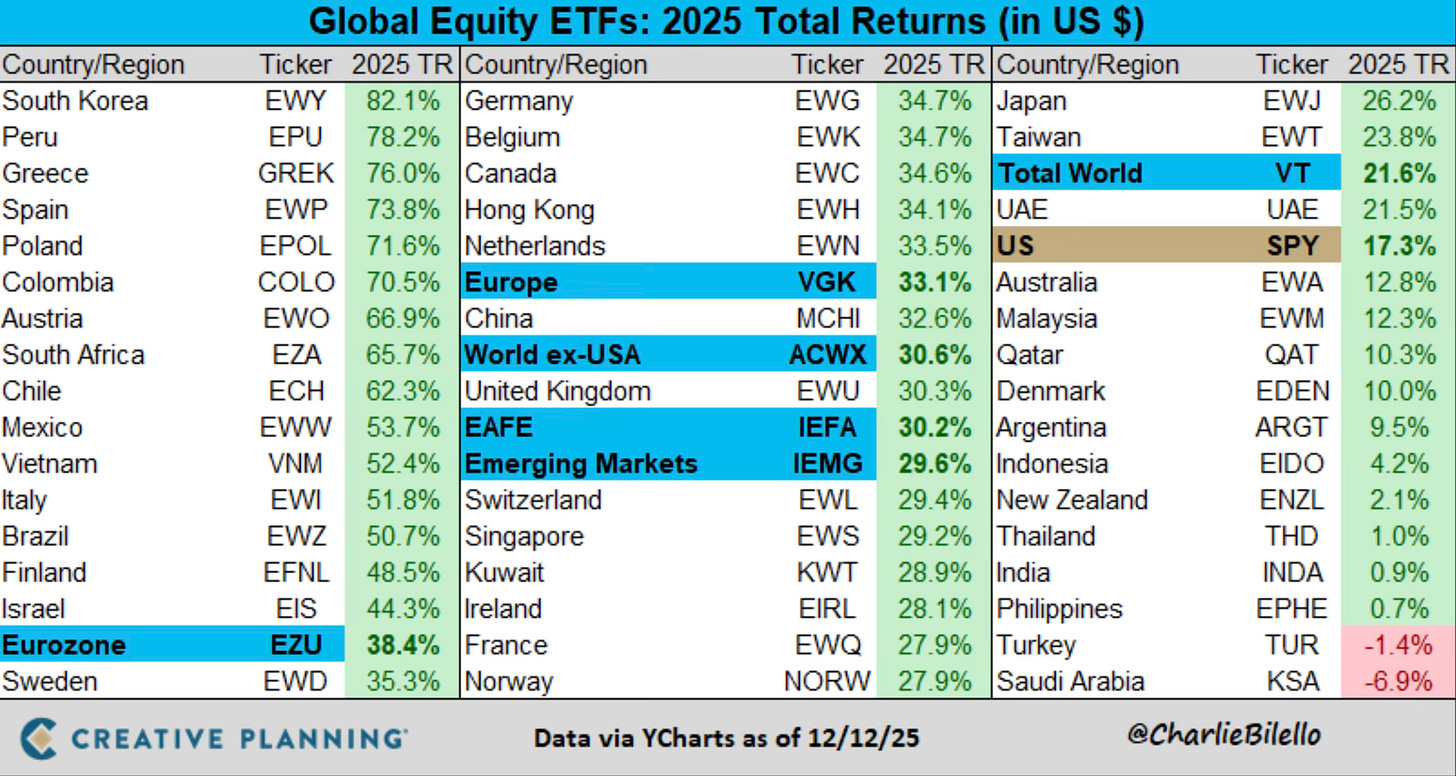

Global Equity ETFs YTD Returns

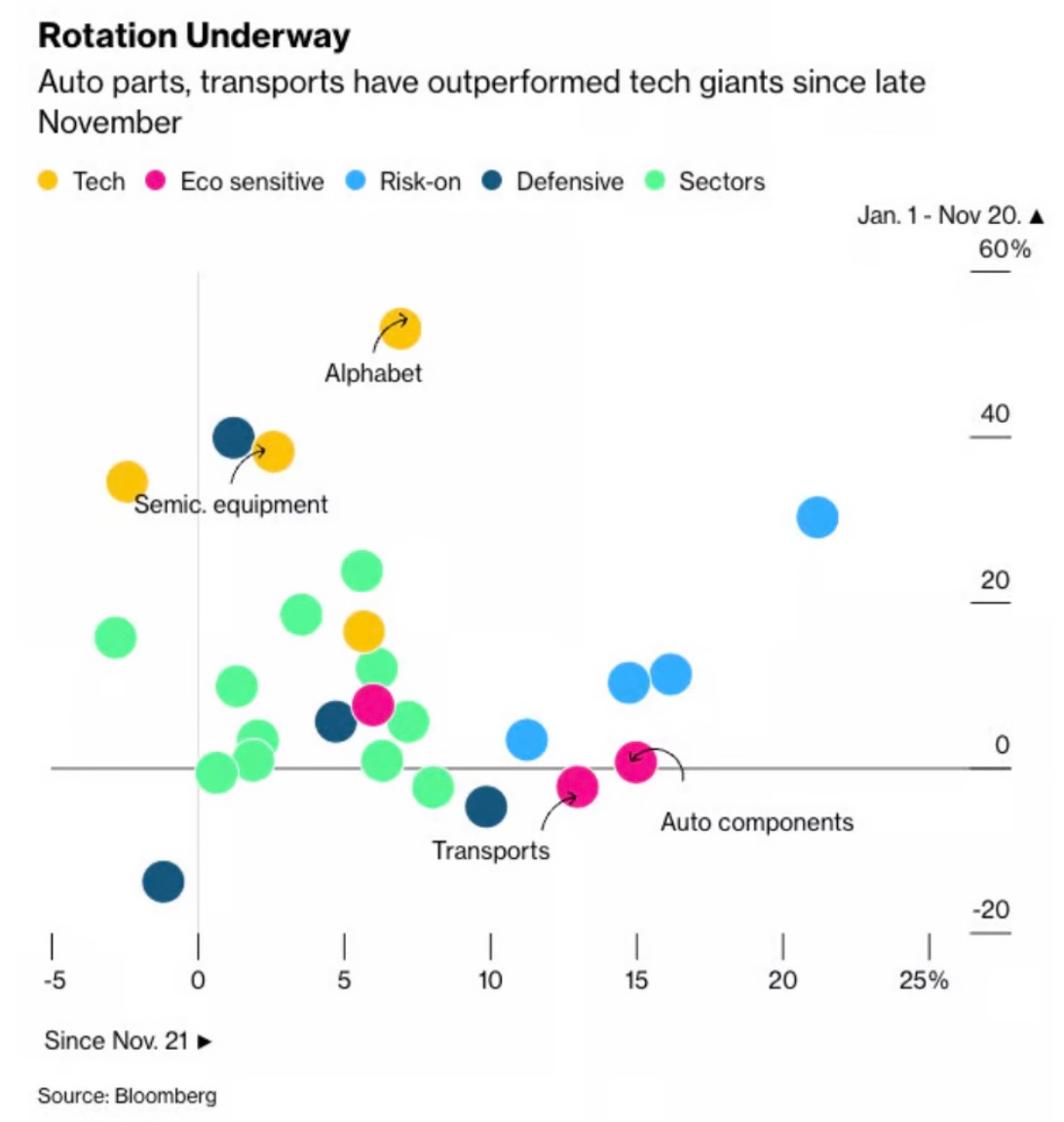

As we come into year-end, I’m starting to watch the rotation closer.

We’re starting to see more movement into the undervalued cyclicals and economically sensitive areas of the market.

You can see in this chart what led the market from January 1st through November 20th. Since November 21st, leadership has shifted.

This is driving many calls for the Magnificent 7 to underperform in 2026, as recent shifts point to some rotation away from AI leaders.

That view may be the popular narrative right now, but it could be short lived. I’m not convinced it’s time to move away from them just yet. I will dig into this more in my upcoming 2026 Outlook.