Investing Update: All-Time Highs Here To Stay?

What I’m buying, selling & watching

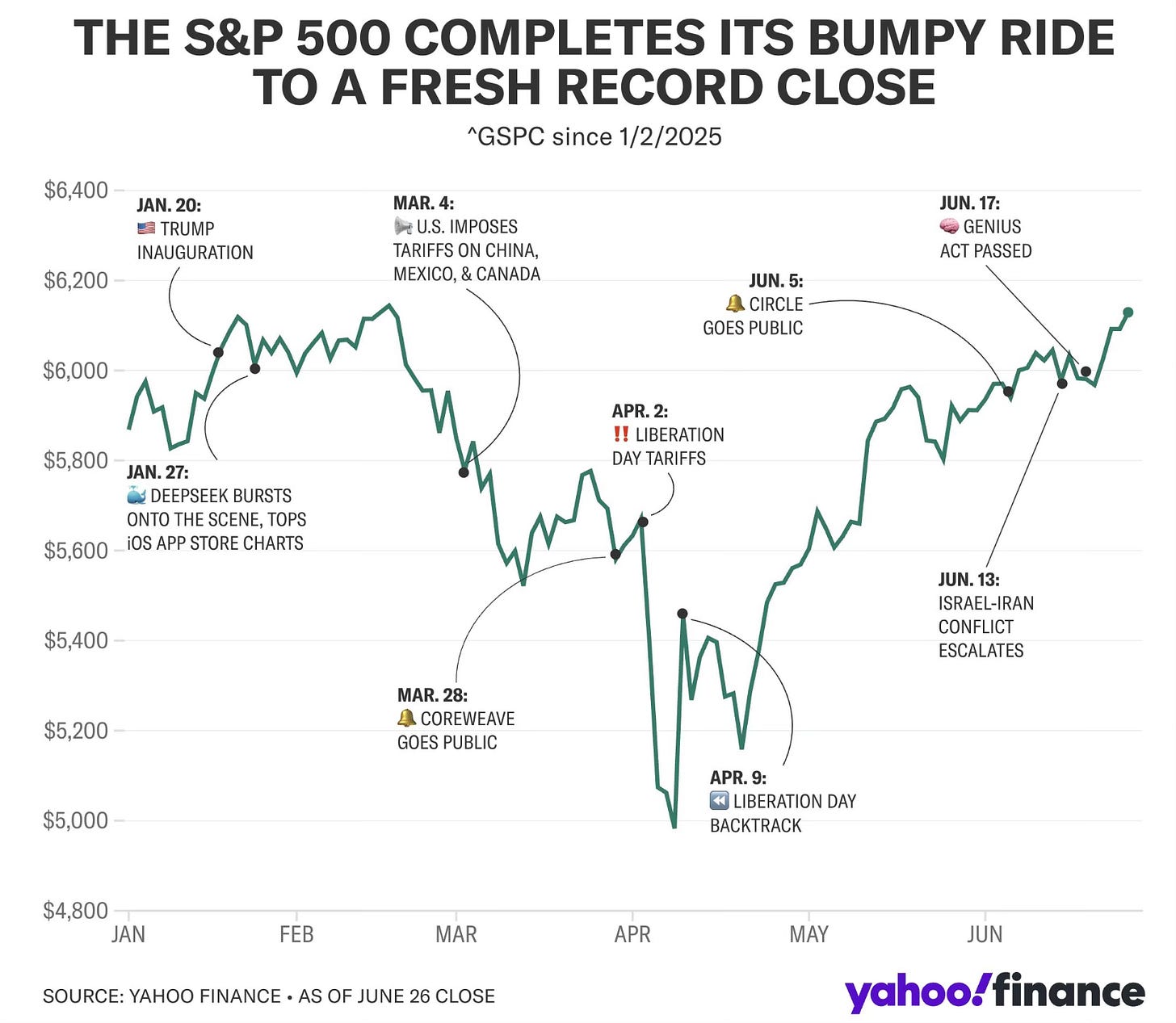

Who would have thought in April that we would be sitting here at the end of June at new all-time highs.

Well here we are on June 28th with both the S&P 500 and Nasdaq at new all-time highs.

The S&P 500 finished the week up 3.4%, to now go up 5% YTD. The Nasdaq climbed 4.2% and it also sits up 5% YTD. The Dow was up 3.8% and stands up 3% YTD.

Market Recap

Weekly Heat Map Of Stocks

It has been a remarkable climb from April. Since those lows on April 8th, the S&P 500 is up 24% and the Nasdaq is up 33%.

Not many predicted how things have played out since April.

Readers of Spilled Coffee know that I have hit this nail on the head since mid-April.

Here is a timeline of what I have said going back to April 19th.

On April 19th in my Investing Update: Is The Worst Over? I declared that the bottom was in at 4,835. That was also the level of the 2022 high. A level I was very confident in saying was going to be the bottom. It turned out to be the bottom.

I believe they have. We saw concrete floor type support of 4,835. That’s also the 2022 high. I believe that 4,835 level will prove to be the bottom.

Then on May 17th in my Investing Update: New Highs Incoming? I said that we would see new all-time highs in 2025 and it would even happen in Q2.

Everything moves faster now in the stock market. The S&P 500 is only 3% from a new all-time high. Can you believe that?

We will see new all-time highs in 2025. It will even be in Q2 yet. The signs are still too obvious.

Then on June 14th in my Investing Update: The Chase Is On. I reiterated that even with Q2 coming to an end. I still believed we would see a new all-time high in Q2.

Readers of Spilled Coffee have seen that I have held to my opinion that we see a recovery going back to mid-April and that we will reach a new all-time highs in Q2.

There are still a few weeks to go in Q2 but I still believe we see a new all-time here very soon.

Right at the end of Q2, here we are at new all-time highs.

All Time Highs Here To Stay?

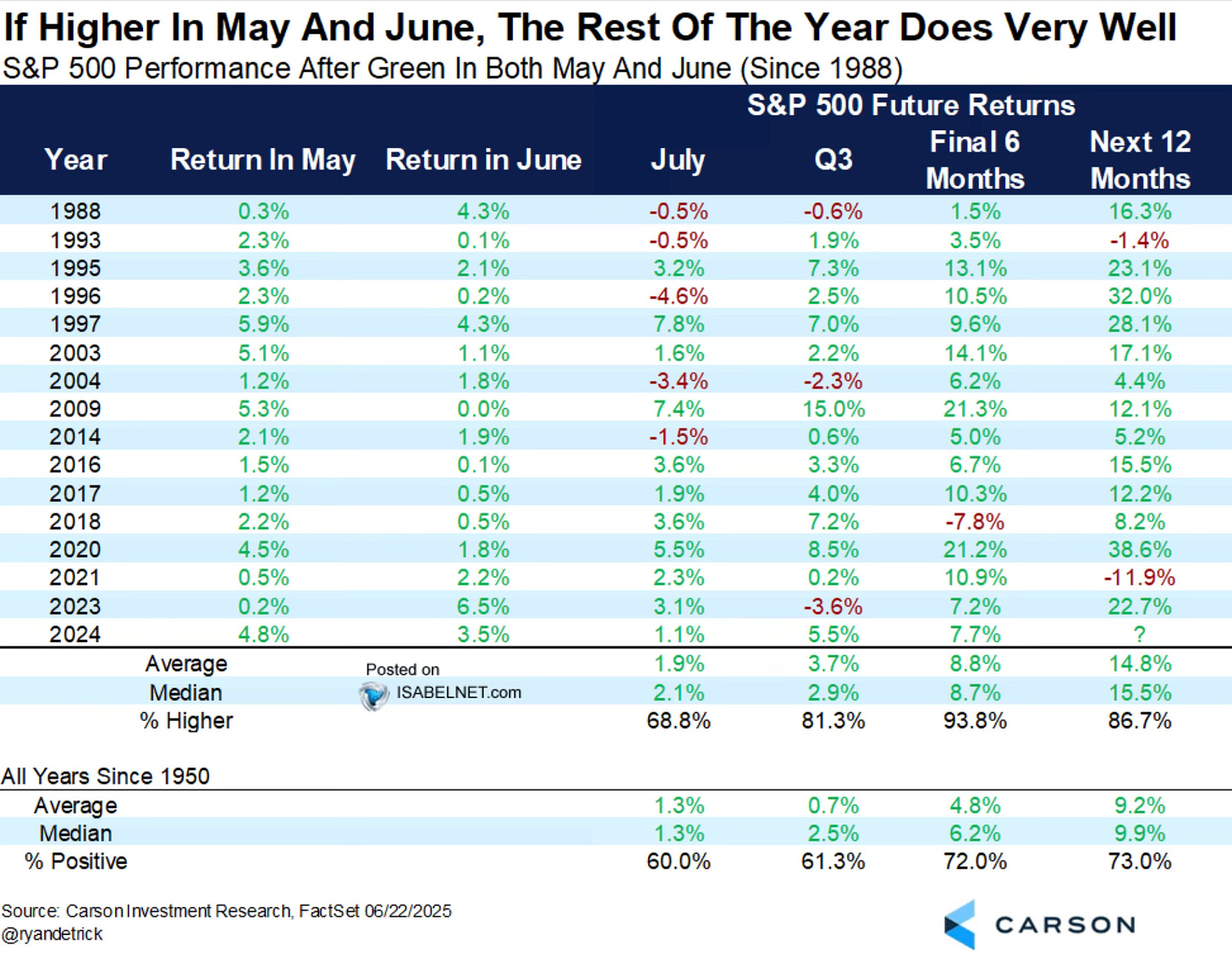

When the S&P 500 is green in both May and June, the rest of the year does really well.

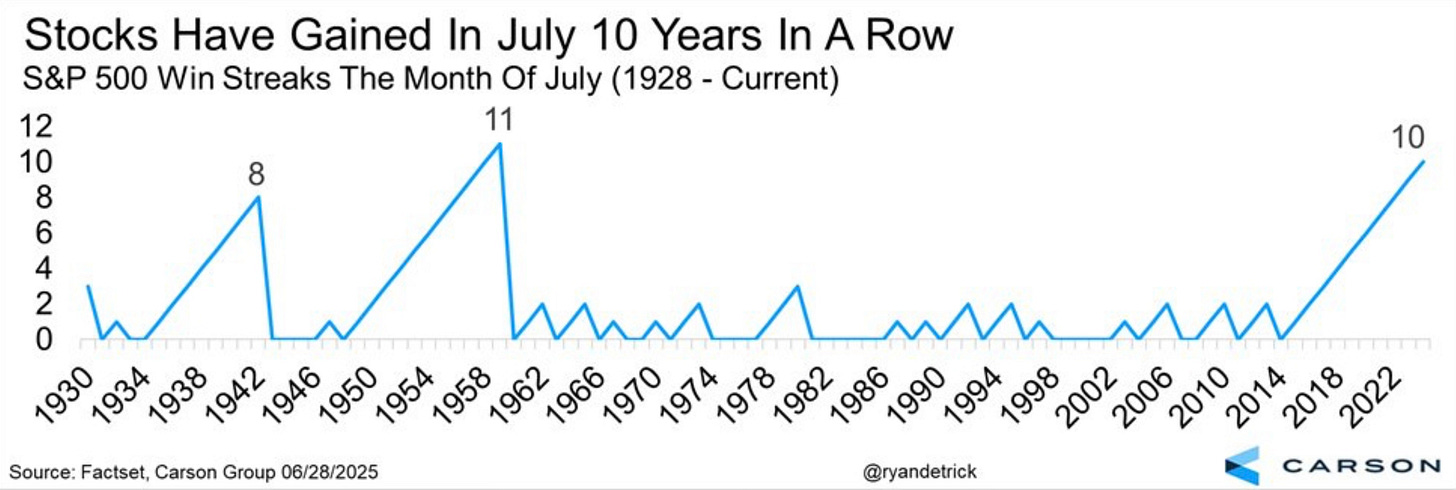

And in July over the past 10 years the S&P 500 has surged higher. It’s actually been higher every July over the past 10 years.

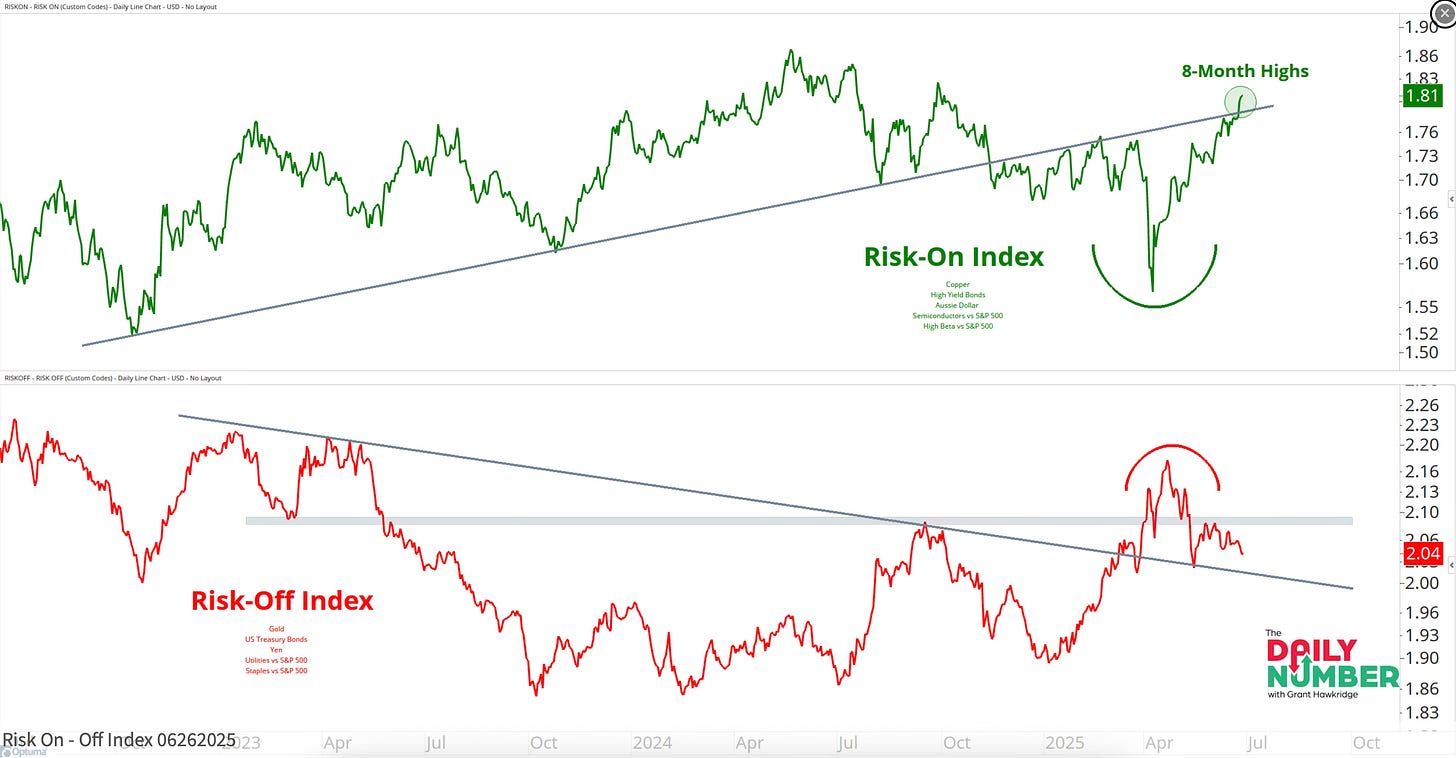

As Grant Hawkridge points out, we have crossed above a key trend line and are definitely in a risk-on environment now.

So does this mean we stay and climb higher from these levels?