Your Time Horizon

Everyone's is different and that changes everything

I recently asked readers to submit questions to me for a Q&A post that I will be doing in the coming weeks.

The two most commonly asked questions were the following.

What stock should I buy? What should I invest in?

As I thought about this, the answer that I gave everyone could be different.

Why is that? It’s because everyone’s time horizon is different.

Ask ten investors what long-term means and you’ll get ten different answers.

Think about it. A 25-year-old looking to invest for retirement, long-term may mean 40 years. A 63-year-old looking to retire, long-term may be less than five years. If you’re a trader that may mean less than a week.

Time horizon is the length of time you expect to hold an investment before needing to access the money. I believe it’s the most under-discussed piece of investing. But it might be the most important.

It shapes your risk tolerance, asset allocation, and emotional resilience. It’s the foundation beneath every financial decision.

I think of time horizons in three buckets.

Short-term: Emergency fund, cash, vacation, down payment, near-term spending

Medium-term: Home purchase, kid’s education, career pivot

Long-term: Retirement, legacy, generational wealth

For instance, to many it doesn’t matter if the stock market is up or down this year. What matters is when you need the money. If you’re investing for a home purchase in two years, a market drawdown is a much bigger problem than if you’re investing for retirement in two decades.

Do you see how blanket answers for investment portfolio construction, stock picks, and investment advice isn’t a one size fits all.

The questions isn’t, “What should I invest in?” it’s “When do I need this money?”

That one question can change everything.

Your time horizon is your time horizon. It’s likely different than mine. Different from your friends and parents.

The next time you're arguing about an investment with someone, remember that almost everyone you’re arguing with, has a different time horizon than you.

The right answer will be, it all depends on your time horizon.

On July 2nd, I will be publishing a Q&A piece. Spilled Coffee readers have been submitting questions and the answers to 25 of those questions will be coming. Be sure to watch for it!

The Coffee Table ☕

Nick Maggiulli just got married and did an interesting post on managing money as a married couple. The Separate + Joint Method: How My Spouse and I Manage Our Money. There are some interesting and helpful takeaways from this post.

This was a good watch on Yahoo Finance on how AI isn’t just for the big tech companies. It will also play a role in small businesses. I believe that AI use case stories are just scratching the surface. AI isn't just for Big Tech: What it means for small businesses

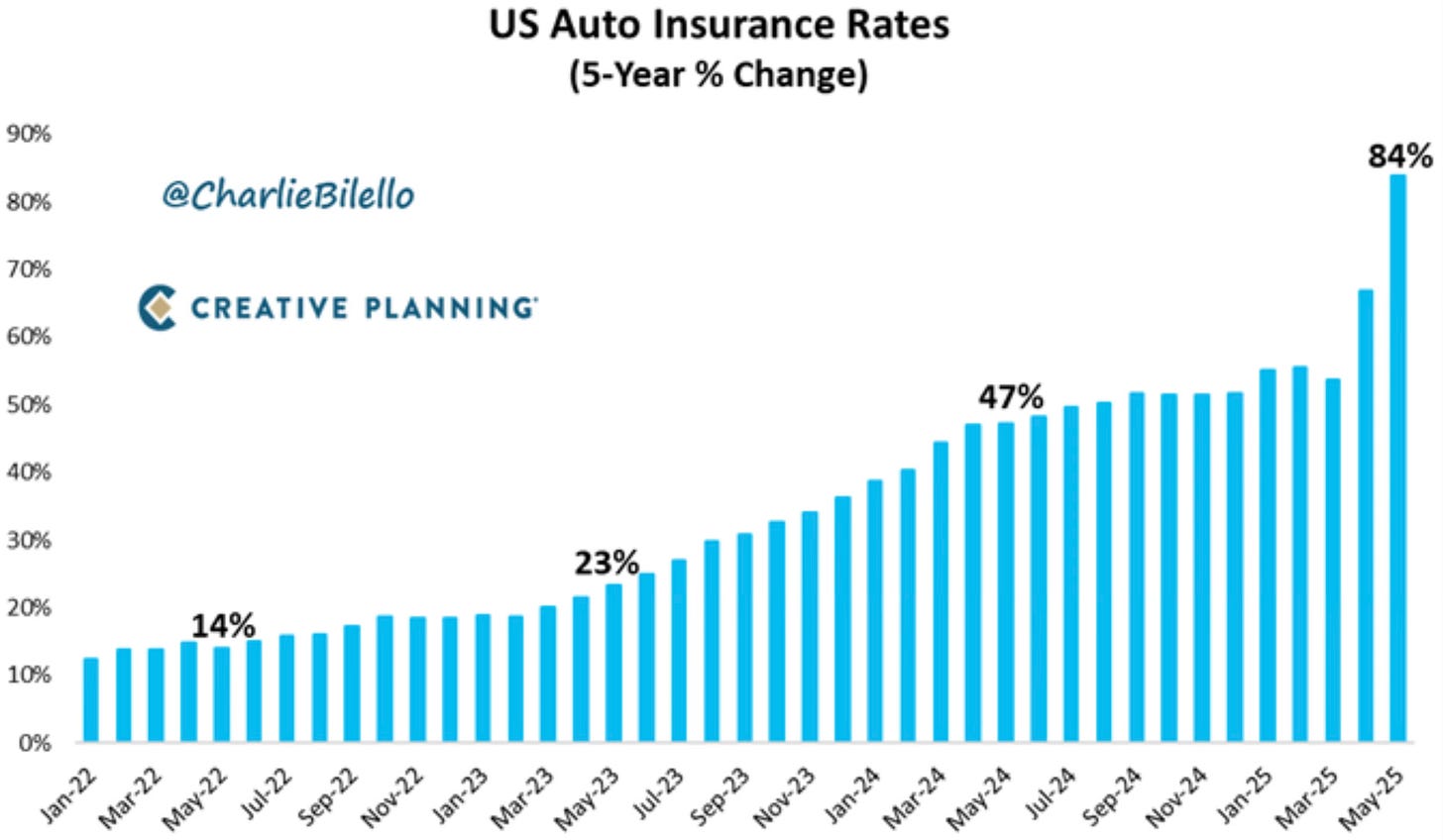

Feel like your auto insurance has gone up a lot the past few years? Auto insurance rates have increased by 84% in the past 5 years. That’s the biggest 5 year spike in history.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.