Why Haven't Home Sales Taken Off?

Higher inventory and lower rates aren't helping and what it may mean

For over two years, we’ve watched the rise in mortgage rates. During this time, the inventory of homes dwindled.

The speculation has been that once mortgage rates start to fall, more inventory will come available and home sales will start to surge.

But like many things over the past few years, what you think should happen, doesn’t.

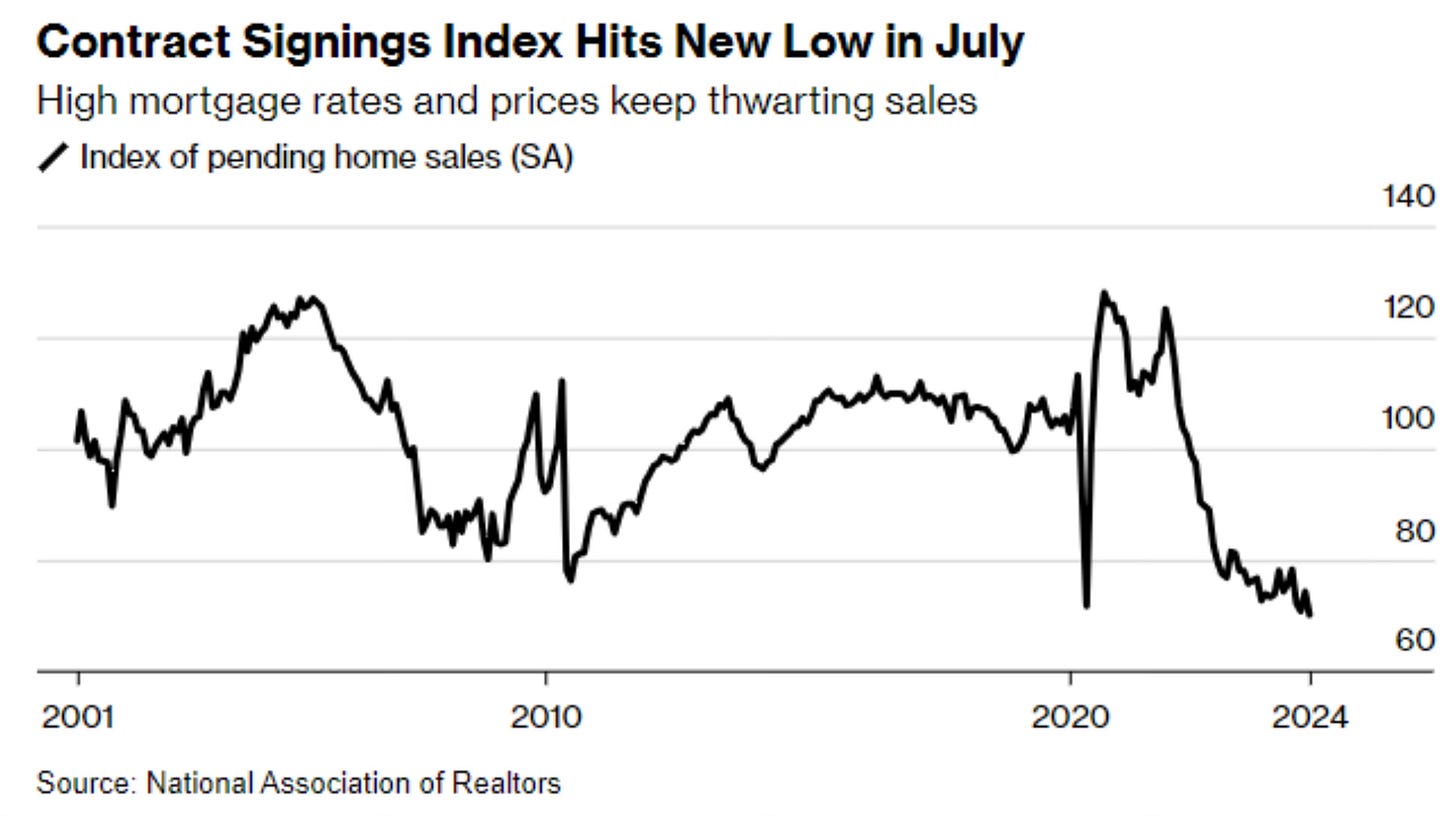

Believe it or not, US pending home sales just hit the lowest level on record.

30-Year fixed mortgage rates have fallen from the high of 7.79% in October of 2023, which was the highest level in over 24 years, to 6.35%.

Housing inventory levels have also risen substantially in 2024.

The surge of inventory as you can see has happened in just about every state.

None of that has mattered.

If mortgage rates have tumbled and inventory has come on, why are purchases still at record lows? What could be the issue?

It likely starts with the ongoing affordability issue.

Lance Lambert had a great chart and note on the affordability issue plaguing buyers.

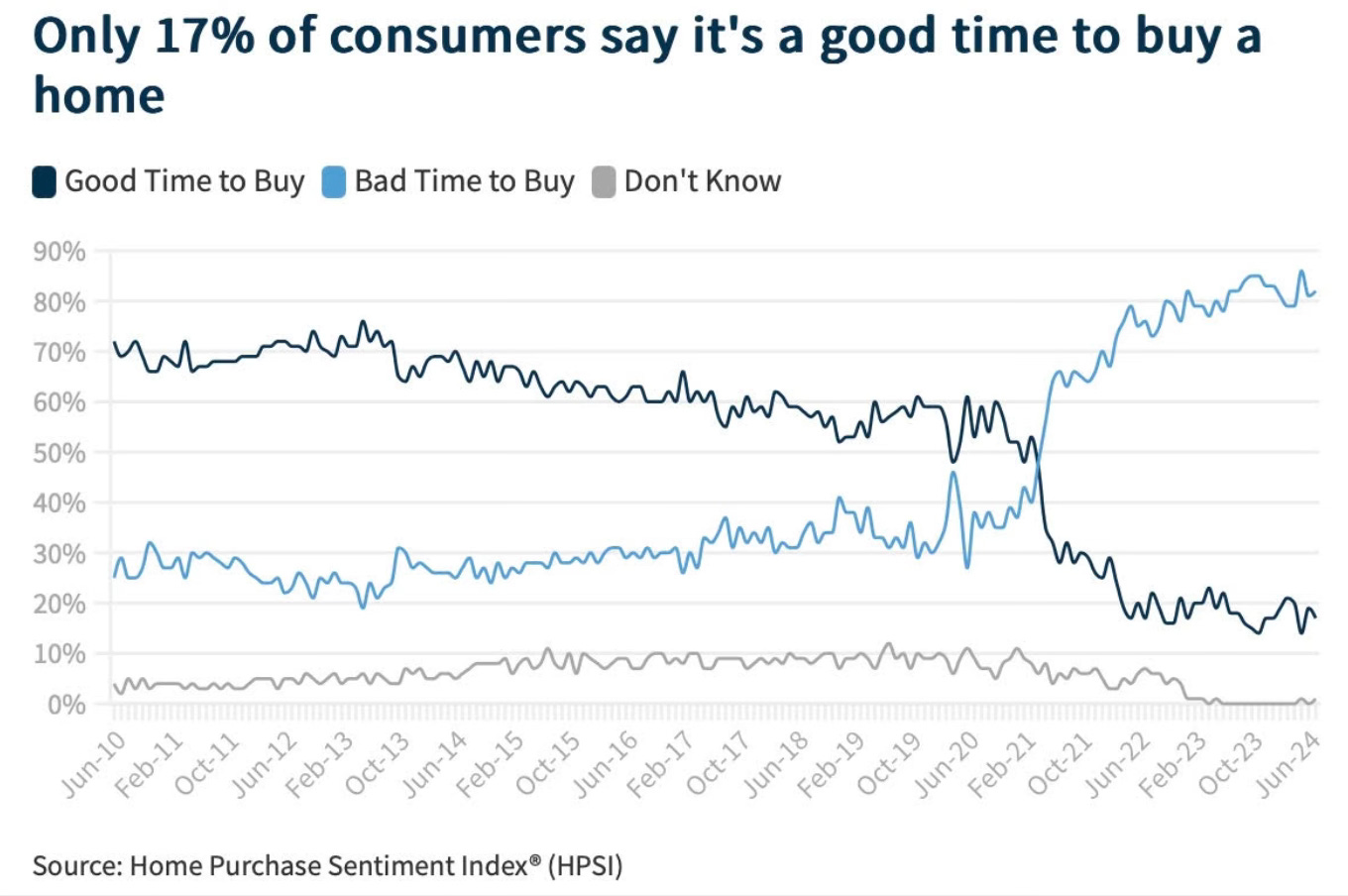

The unhealthy U.S. housing market, as told by one chart. High down payments. High monthly payments. Even 1981, when mortgage rates topped 18%, didn’t have both.

High down payments, high monthly payment, rising taxes and insurance costs all combine to make this time not look like a good time to buy a house. According to this survey, it isn’t. Only 17% of consumers think it’s a good time to buy a home.

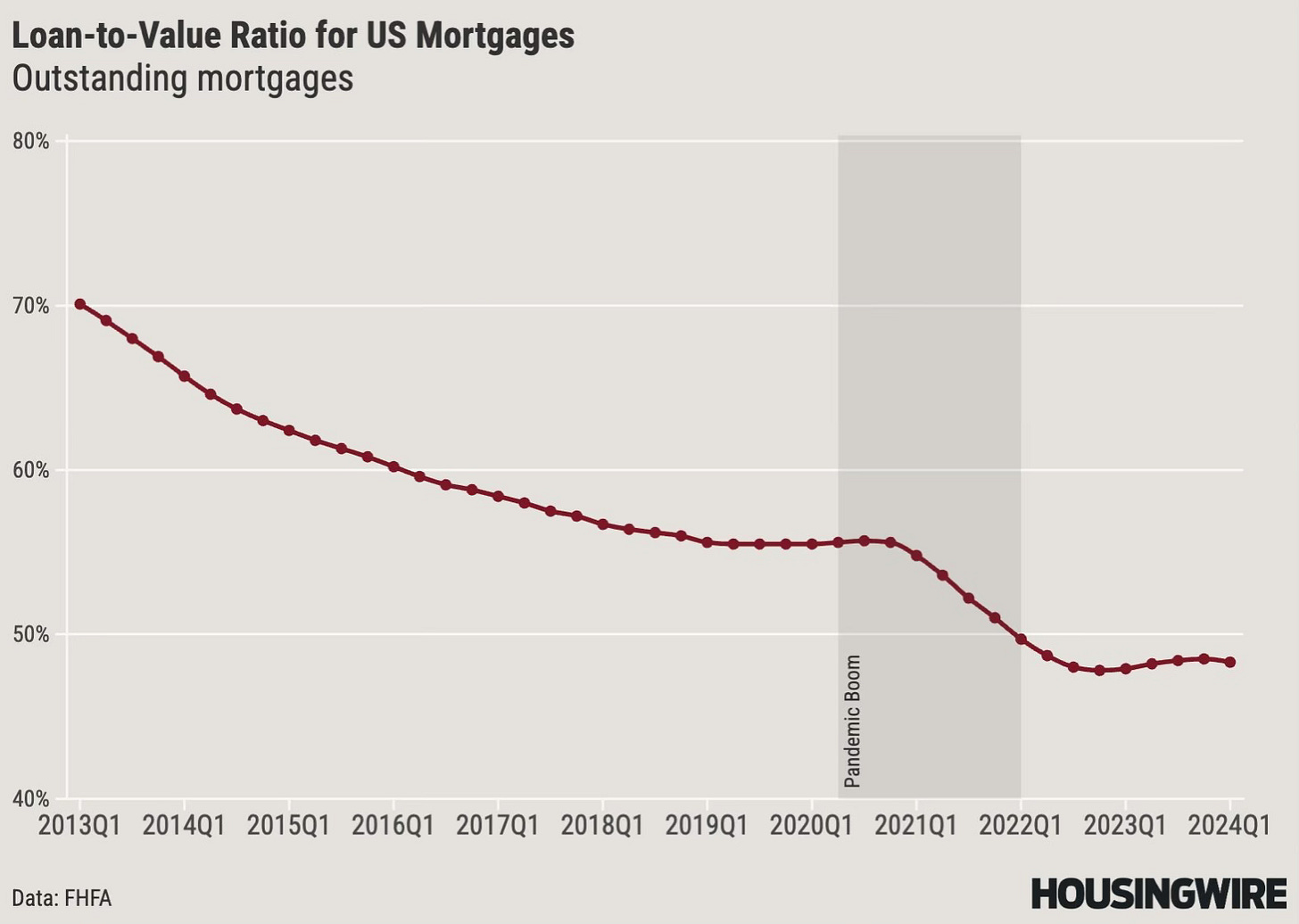

This also opens up the question about if demand was pulled forward. Due to the affordability crisis, have the people who can buy, already bought?

If people are already in a home they have a lot of equity. That’s proven in this chart which shows that the Loan-to-Value ratio for mortgages is 48%. That’s down from 70% just over 10 years.

And if you have a current mortgage, you’re rate is still much lower than where rates are currently at.

The effective outstanding mortgage rate is 3.9%. 22% have a rate below 3%. 57% have a rate below 4%. 86% have a rate below 6%. 63% of mortgages were issued after 2018.

This sets up for an interesting fall and winter. The labor market is weakening along with a slowing economy. The Fed is to be cutting interest rates which will likely push mortgage rates even lower. But will that really matter enough to offset the affordability challenges?

What if home sales don’t start to respond to lower rates? Is this signaling something about the economy and the stock market? History shows us that it does.