What's a Credit Freeze and Why You Need One

A simple way to protect yourself

Twenty years ago, I received a letter from the stock transfer company who serviced the stock that I owned in General Electric. It said that some tapes were stolen and it was possible that personal information had been compromised. It had offered for free of charge to provide a credit freeze on my credit report at all three of the credit reporting agencies.

At that time, I had never heard of a credit freeze or knew what it did. You had to send a letter with certain forms of identification, along with payment to each of the three credit reporting agencies. It would then mail you a PIN and information on how to lift the credit freeze if it was added on.

If you wanted to lift your credit freeze at any or all of the three credit reporting agencies there was an automated number to call. You’d call the number, provide the PIN, select how many days you wanted the freeze to be lifted and then pay a $10 fee each time you lifted it. If you had to lift at all three agencies it cost $30.

By lifting the freeze, this allowed a bank or financial institution to run your credit report. Without lifting the credit freeze there would be no way to run your credit report, thus preventing anyone from opening anything under your name.

Fast forward twenty years and it has become much easier to setup a credit freeze. It’s quicker to setup by just going online. All those fees that used to be charged are gone. Now it’s free to place a credit freeze and to temporarily lift it, whenever needed. You just log into your account and lift the freeze.

In having a credit freeze for over twenty years, I can say without a doubt that this has been one of the smartest financially related things I’ve done.

Here is what I’ve learned and what you should know.

What Is a Credit Freeze?

Everyone has a credit report. To access that credit report, a company has to request to run your credit report from one or all of the three credit reporting agencies, TransUnion, Equifax and Experian.

Whenever you open a new type of account it seems they run your credit report. On top of opening any type of financial institution account or loan, credit or shopping store cards, they also run your credit for a cell phone plan, television or internet providers, insurance policies and utility providers. This also increases the risk of fraud or your information becoming at risk.

A credit freeze makes your credit report inaccessible to lenders or any financial institutions from running your credit report. Thus preventing anyone from opening an account in your name or stealing your identity.

Why You Need One

How many times have you heard of security breaches at companies? Have you been notified that your personal data has ever been compromised? If you’ve ever known someone who had their identity stolen or financial accounts opened under their name, you know that you don’t want to deal with that.

The theft of social security numbers and other personal information means that people could have all of the information they need to steal your identity. A credit freeze won’t protect you from someone stealing your identity, but it will make it more difficult for them to use your stolen identity to open fraudulent credit accounts in your name.

This also prevents credit bureaus from selling your data. Credit bureaus can share your information with potential lenders without your authorization. When you freeze your credit, you stop the bureaus from sharing your data, which can help reduce those pesky pre-approval credit card offers.

With it now being free to setup and to lift a freeze temporarily for when you need to open an account at a financial institution or get approval for a loan, it makes it a no brainer. If someone does get your information, they won’t be able to open accounts in your name. Talk about peace of mind.

How To Set It Up

To setup a credit freeze, you will need to setup an account and place a freeze with each of the three credit reporting agencies. I have a link to each of the three agencies below, which will take you directly to the page where you can setup a security freeze.

TransUnion: TransUnion Credit Freeze

Experian: Experian Credit Freeze

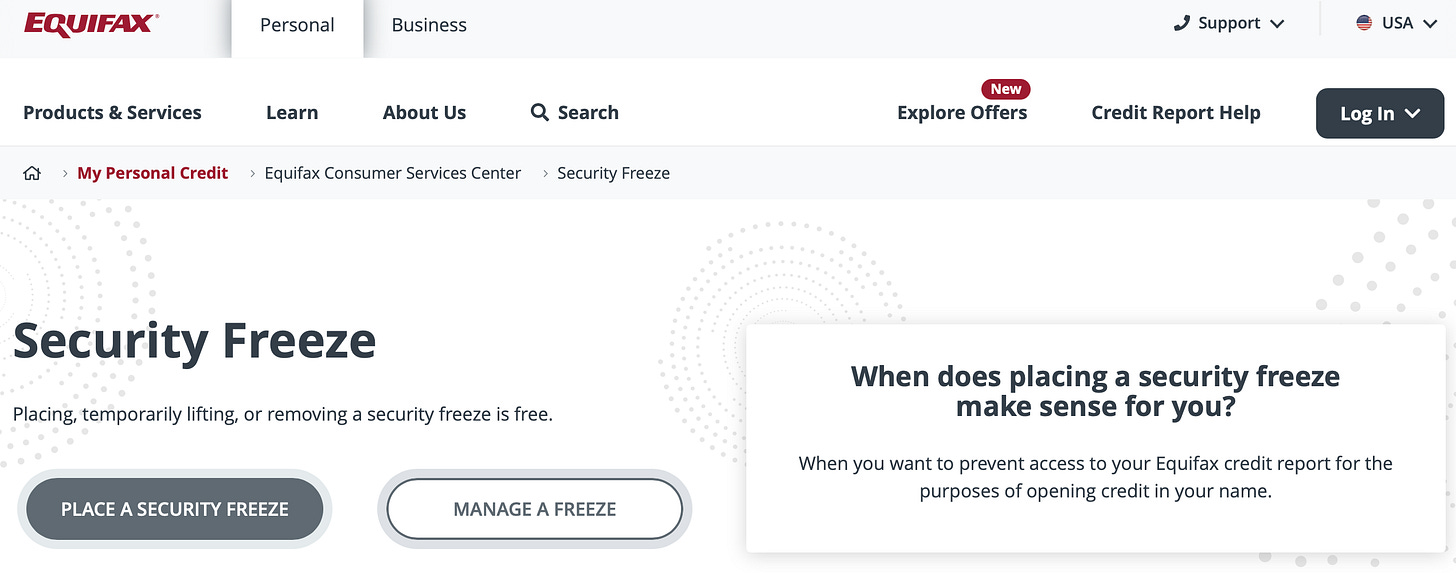

Equifax: Equifax Credit Freeze

Once setup, whenever you need to lift the freeze, you log in and temporarily lift the freeze for however long you want and then it goes back to being frozen.

This is one of the easiest ways to financially protect yourself from identity theft. It costs you nothing. Only your time to set it up.

The Coffee Table ☕

Kitces had a helpful article on when it’s time and how to best handle “firing” a client. Moving On From Clients Who Aren’t A Fit By Establishing ‘Kill Criteria’ To Protect Yourself. This article approaches it from a financial advisor’s point of view but there are very helpful and worthwhile ideas in this article that can apply to any business when the time comes to “fire” a client.

I really enjoyed Michael Antonelli’s post called Dear Reader. A perfect read for the end of summer about life and investing. I think everyone would agree with the following. “There are two things you can do every single day to improve your life: Walk 30 minutes and watch less news.” Then maybe it’s a Wisconsin thing but this take is 100% spot on correct! “Always order at least two appetizers. If they have fancy Brussels sprouts, you have to get them.”

Now that our pool, fire pit and backyard have been completed, it’s time to water the new plants and grass. I’ve gone through numerous sprinklers over the years. Most seem to leak and provide a terrible coverage area for watering. These tripod sprinklers that I found on Amazon have done an excellent job. Orbit Sprinkler They’re also very reasonably priced.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.