It seems lately we can’t escape hearing about China in the news. Whether it be business news or regular news so much of what we hear is centered around China. None of it seems to ever be anything good.

To gain some context on the issue I’m going to share some content that I received at an Economic Outlook Discussion last week by ITR Economics. I found it interesting, informative and important. That’s why I’m sharing it with you.

First, let’s take a look at how much each country provides to the World GDP (gross domestic product).

When we look at global parters and who is making direct investments into the United States below you’ll notice there is one big name missing from this list.

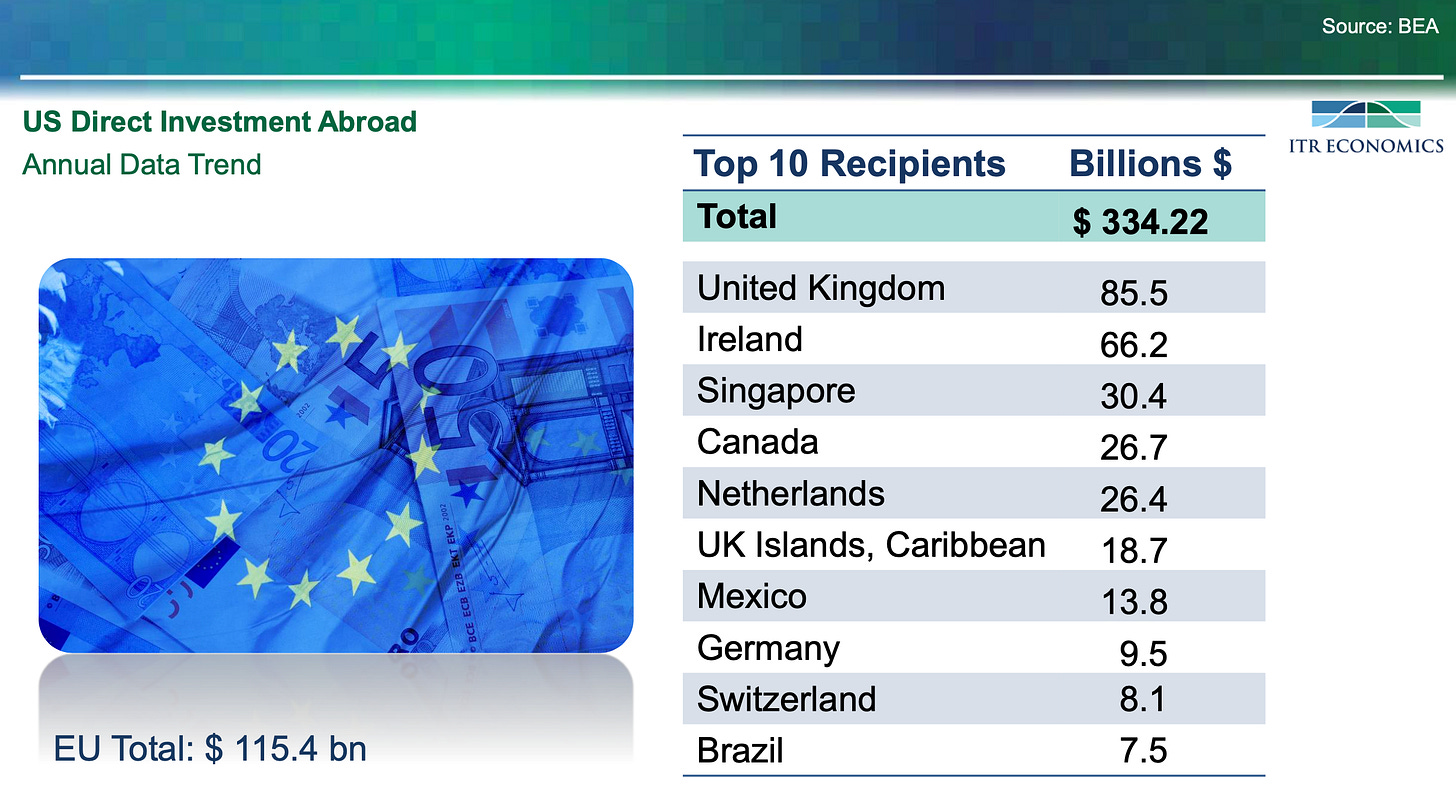

If we look into where the United States is making investments, there again is another big name missing from the list.

China is absent from both lists.

I’d like to see what these charts looked like pre-COVID and five years ago. But this leads me to the question, are individual companies still as reliant on China for products as they were in years past?

What about the most valuable company on earth Apple, who has long relied on China for majority of the production of their products. According to a December 2022 article in the WSJ titled, Apple Plans to Move Production Out of China.

In recent weeks, Apple Inc. has accelerated plans to shift some of its production outside China, long the dominant country in the supply chain that built the world’s most valuable company, say people involved in the discussions. It is telling suppliers to plan more actively for assembling Apple products elsewhere in Asia, particularly India and Vietnam, they say, and looking to reduce dependence on Taiwanese assemblers led by Foxconn Technology Group.

Nike, Samsung and Adidas have moved some of their production out of China. Companies are looking to India, Vietnam, Thailand, Malaysia and Bangladesh to fulfill factory orders.

How does this impact investors investments into China?

Axios ran a story in January titled China is looking less desirable to investors.

Why it matters: Investors are facing a new economic and investing environment this year and determining their revised positions.

Goldman Sachs' Investment Strategy Group advised consumer and wealth management clients last month to "carefully reassess their strategic allocation to Chinese assets" as well as "exposure to countries and companies with significant exports to China."

State of play: Investors have already shed their exposure to China.

In 2022, foreign investors became net sellers of Chinese fixed income and equities for the first time in 10 years, Goldman found.

I also found it interesting that Warren Buffet and Charlie Munger's Berkshire Hathaway bought a $4.1 billion stake in Taiwan Semiconductor during the third quarter of 2022. Then one quarter later (Q4 2002) it slashed that stake by almost 90%. Berkshire Slashes Stake in Taiwan Semi.

Long known for buying and holding for many years or decades, that quick flip doesn’t sound like a Warren Buffett and Charlie Munger move. Obviously something changed to move that quickly out of a position. Taiwan Semi is the world’s largest and most valuable producer of semiconductors. It’s also the leading producer of chips for Apple’s products. Apple is the single largest holdings in Berkshire's portfolio, accounting for almost 40% of its equity holdings. Could Apple’s announcement above from December of 2022 have played into it? We don’t know.

I can search and paste countless stories about the drawbacks about what’s going on between the United State and China. Everyone can draw their own conclusions and form their own opinions to the magnitude of disagreement there is between the United States and China. Things could eventually change but in the here and now you need to focus on where things are.

What I look at is the world’s largest companies, greatest investors and investment institutions are steering clear and unwinding away from China. This should give a clear indication where thoughts and opinions are at. It may be a good time to assess how much reliance you and your company has to China. Whether it be through your products or investments.

The Coffee Table ☕

Ben Carlson wrote a post on his 10 years in writing his blog, A Wealth of Common Sense. 10 Years of A Wealth of Common Sense. I’ve learned a lot from his writing over the years. Thanks and Congratulations Ben!

Last week my family and I watched the computer-animated remaking of The Lion King. Growing up everyone had their favorite Disney movie and mine was The Lion King. To see it done this way was really cool. The scenes, visuals and everything looked so realistic. We really enjoyed it. It was nice to sit and relax while watching something new that you already know how it goes.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe and/or give a gift subscription for others.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.