The Next Big Test

Student loan payments resuming will test consumers and the economy

One of the last remaining pandemic related pauses or stimulus is about to come to an end. Since March of 2020 student loan payments have been paused. The technical word you hear used is forbearance. Consumers have not had to pay any money towards their student loans nor worry about any interest accruing.

The Education Department says borrowers will be expected to make their first post-pause payment in October. Meanwhile, interest will start accumulating on borrowers’ debt on September 1.

Student loan debt in the U.S. totals nearly $1.8 trillion.

In October, 40 million Americans will have to resume paying back an average of $350 a month. Per CNBC, the 3-year pause saved the average borrower $15,000.

That’s a $168 billion a year or $14 billion dollars a month debt burden that’s coming back on the American consumer. This comes on top of everything else that has risen in costs for consumers.

The average $350 a month payment is something that consumers have not had to worry about for three years. If chosen to, that $4,200 a year has been able to be spent on other things such as travel, clothes, entertainment, restaurants or whatever else anyone has wished.

This is where the economic warning signs have started to catch notice. What type of an impact will this have on the American consumer, businesses, the economy and the stock market?

We saw notes start coming out last week from JPMorgan, Morgan Stanley, BofA, and Barclays.

JP Morgan: JPMorgan’s chief US economist Michael Feroli said that the end of the payment moratorium will reduce annual disposable personal income by $38 billion, which will reduce consumer spending.

Morgan Stanley: Via Business Insider. Morgan Stanley analysts see an economic hit coming in October, when spending levels shift lower due to higher debt service costs. According to a recent survey of about 2,000 consumers by Morgan Stanley, concerns over upcoming debt and mortgage payments have soared to the highest level since the survey began. "Only 29% of consumers who have federal student loans are confident they will have enough money to start making payments without adjusting spending in other areas," Morgan Stanley said.

Meanwhile, 37% of respondents said they will need to cut their spending in other areas to make the student loan payments, while a whopping 34% of respondents said they will not be able to make the payments at all. In this case, the restart of payments will negatively impact low-income households the most, according to the survey.

"Overall, the majority of consumers surveyed (61%) continue to say they are likely to cut back on spending over the next six months," Morgan Stanley said.

BofA:

Barclays: Via MarketWatch. From a team of Barclays analysts, led by Adrienne Yih who see about an impending $15.8 billion monthly hit to U.S. spending, as the average student loan holder faces a monthly payment of about $390 starting this fall.

“For most, this will be the first time making payments since the early days of the pandemic in March 2020. We regard the incremental ‘essential’ nature of the debt payments as likely to reduce discretionary spending by an approximately equal amount,” said Yih and the team.

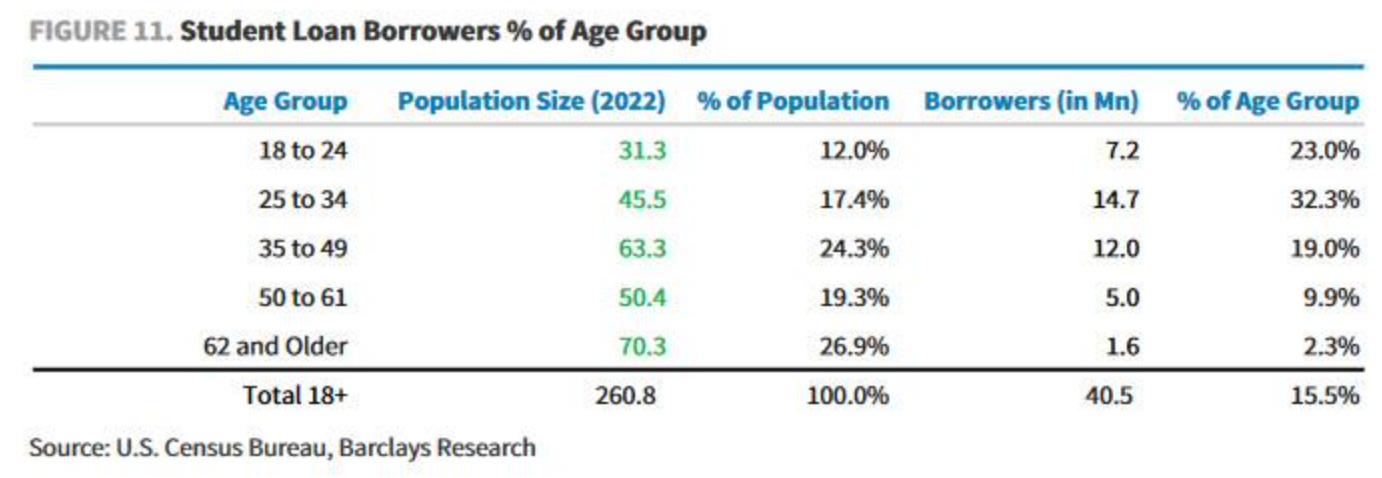

In short, that will amount to a roughly 8% headwind to monthly personal income, hitting 16% of the U.S. population and adding pressure on consumer discretionary and apparel stocks, they say.

The Barclays analysts say their monthly estimate is on the conservative side, given it only takes into account federal student debt, which is 87.2% of total student debt.

As for the stocks, the analysts advise looking out for those with a consumer base that “skews toward higher income, higher education, and in the 18- to 34-year-old cohort.”

Here are the charts breakdown from the Barclays report via Tyler Durden.

Since the pandemic ended we’ve continue to hear of how resilient the consumer has been. People just continue to spend. That has been the case and it’s why the country has avoided a recession to this point.

The money that was saved from having to be paid towards student loans was able to be repurposed and spent in other ways. But what happens when now that average payment of $350 month comes back each month? For some it’s less but for some it’s much more. $350 is just the average. That student loan payment for some essentially amounts to a car payment, cost of rent or even a mortgage.

I have a hard time believing that this debt payment being restarted doesn’t have a material affect on the consumers ability to spend. They will have gone 3 years and six months without this payment. That’s 42 straight months of having money to spend on other things.

I could be wrong and the consumer could again prove economists and strategists wrong by continuing to be resilient and keep spending to further grow the economy. You’d think eventually the money spending would start to slow or run out. But maybe not.

The back half of the year will truly show just how resilient the consumer and the economy is with no more pauses or subsidies in effect from the pandemic. It will give a true gauge of how well the consumer and the economy is post pandemic.

The Coffee Table ☕

Thomas Kopelman wrote a helpful post for business owners called 11 Tax Planning Moves For Business Owners To Consider. There are some good tips in this.

Why You Believe The Things You Do is just another excellent post by Morgan Housel. I found myself really agreeing with a lot of points he made in this. This line really stuck out to me, “Memories of past events are filtered. You keep what makes sense and throw out the confusing details.”

The Rational Walk had a great post Fooled by Fanatics on how masters of a craft make their difficult accomplishments look so easy to do. But it’s what we don’t see, “Sometimes their success comes at the cost of many sacrifices elsewhere in their lives.” Then truer words couldn’t be spoken, “You cannot reach the top if you do not have genuine interest in what you’re doing.”

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.