The Netflix Identity Crisis

Is the 36% Off Sale a Bargain or a Warning?

You’ve been asking. A lot.

“Why haven’t you bought Netflix yet?”

“It’s down 36% from the high. Isn’t this the dip?”

“Should I buy now or wait?”

Fair questions. Netflix is sitting at $85 today, down from a 52-week high of $134. The company just beat earnings, crossed 325 million subscribers, and is growing revenue at 16%. On paper, this looks like the opportunity everyone’s been waiting for.

Here’s what makes this so confusing:

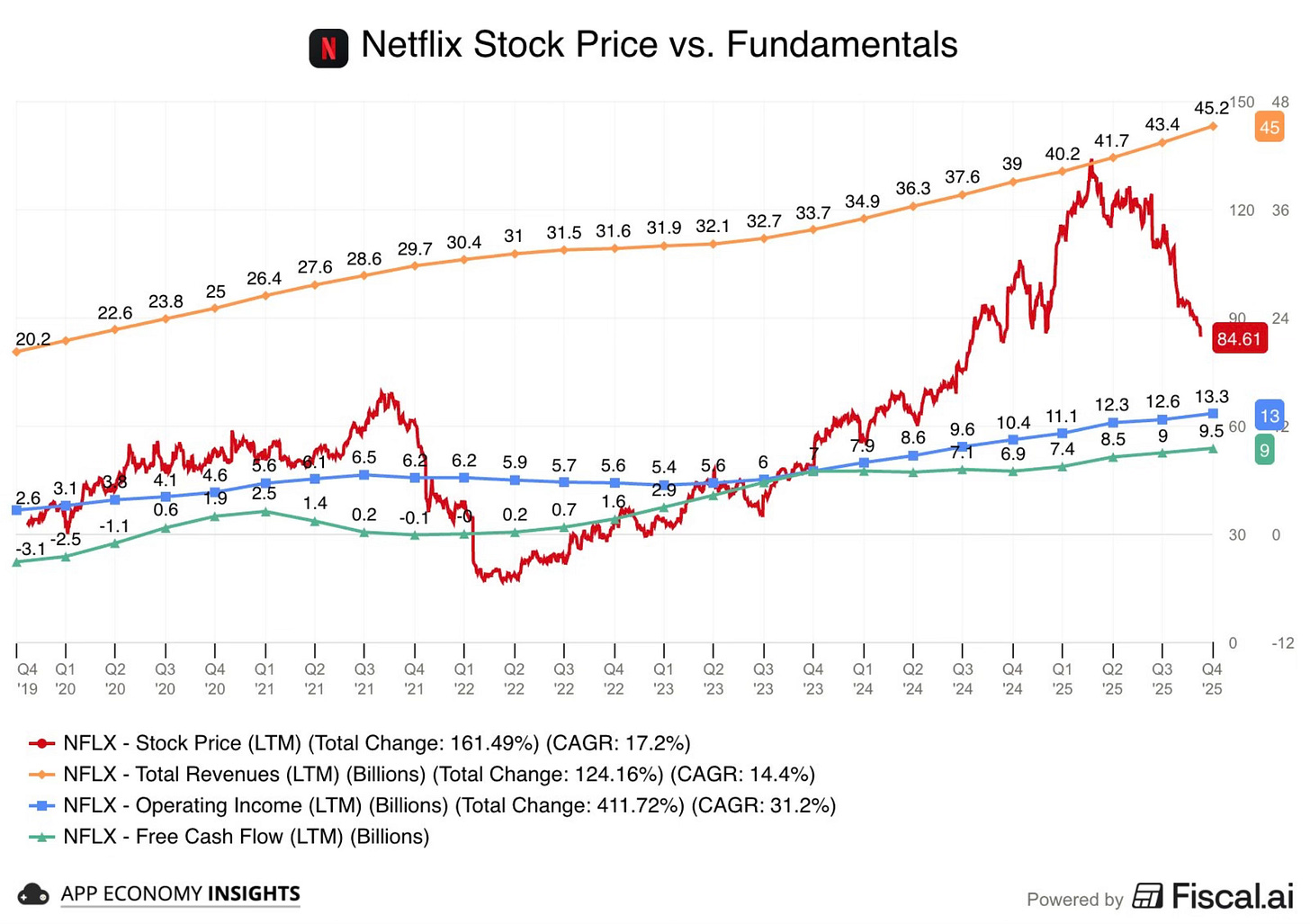

Look at that divergence. The stock (red line) is down at $84.61 after peaking around $150. Meanwhile:

Revenue (orange) climbed from $20B to $45B. Up relentlessly

Operating income (blue) surged from $2.6B to $13B. 400%+ increase

Free cash flow (green) went from negative to $9B positive

Every fundamental metric is screaming buy. The business has never been stronger. Revenue growth: 14.4% CAGR. Operating income growth: 31.2% CAGR.

So why is the stock trading like it’s 2022 all over again?

That’s the question. And here’s the thing: I’m not buying. Not yet.

Let me show you why, and more importantly, what price would actually get me interested.