The Market’s Playbook for a Fed Rate Cut

What rate cuts mean for stocks, cash, and housing

When the Federal Reserve cuts interest rates, it’s more than a policy move, it’s a reset button for the financial system. Markets don’t wait around to debate, they move. But not everything moves in the same direction, and not all signals are created equal.

Stocks reprice risk. Cash stops paying like it used to. Housing gets a breath of fresh air. Some cheer, others scramble. But one thing is certain, nothing stays still when money gets cheaper.

Here’s the playbook for what may lie ahead, by taking a look back at history.

With the odds of a Fed rate cut above 96% heading into Wednesday’s meeting, it’s worth looking at what forecasts suggest for the path ahead.

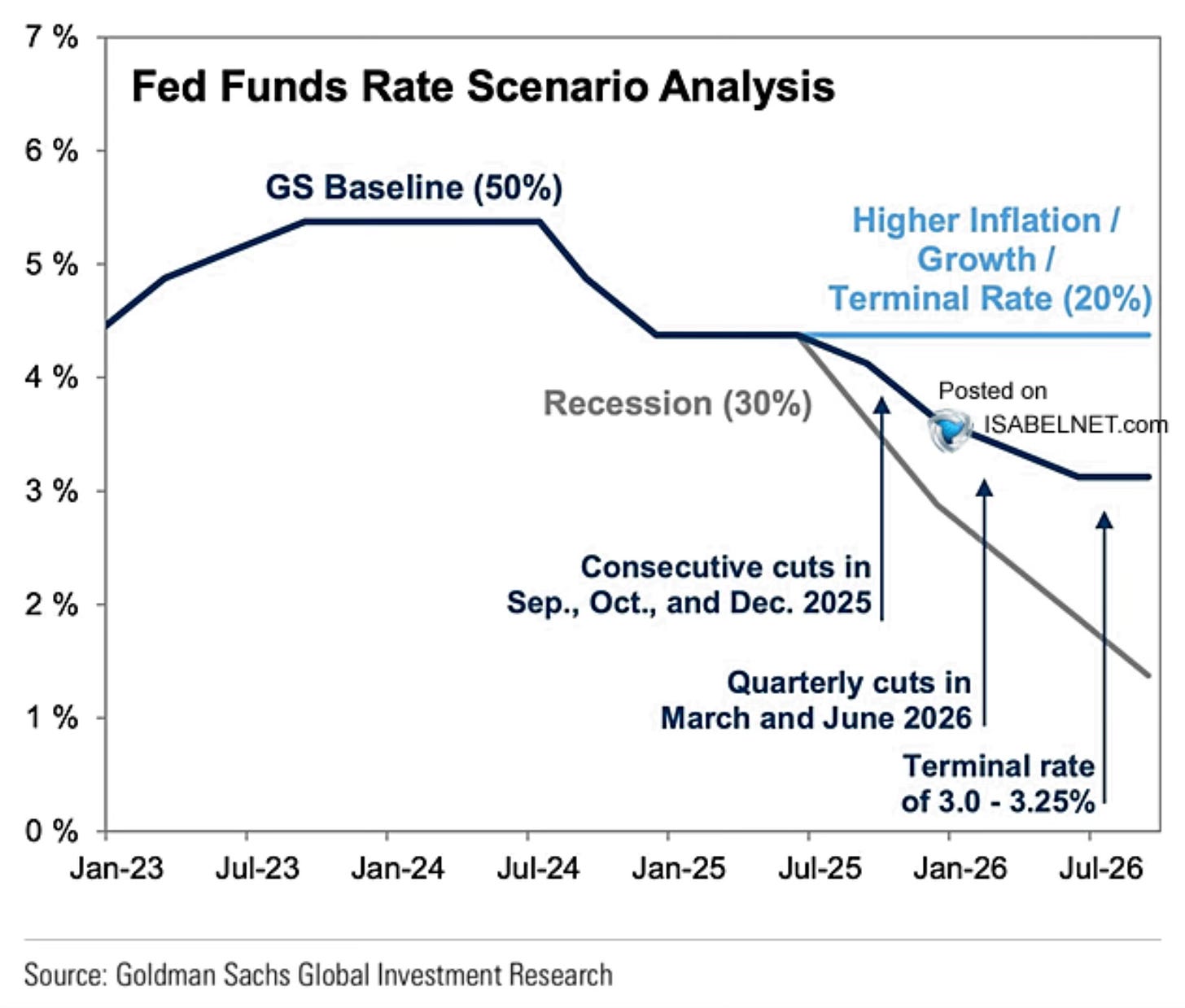

Goldman Sachs forecasts that the Fed will cut interest rates from 4.3% to 3.1% by the end of 2026.

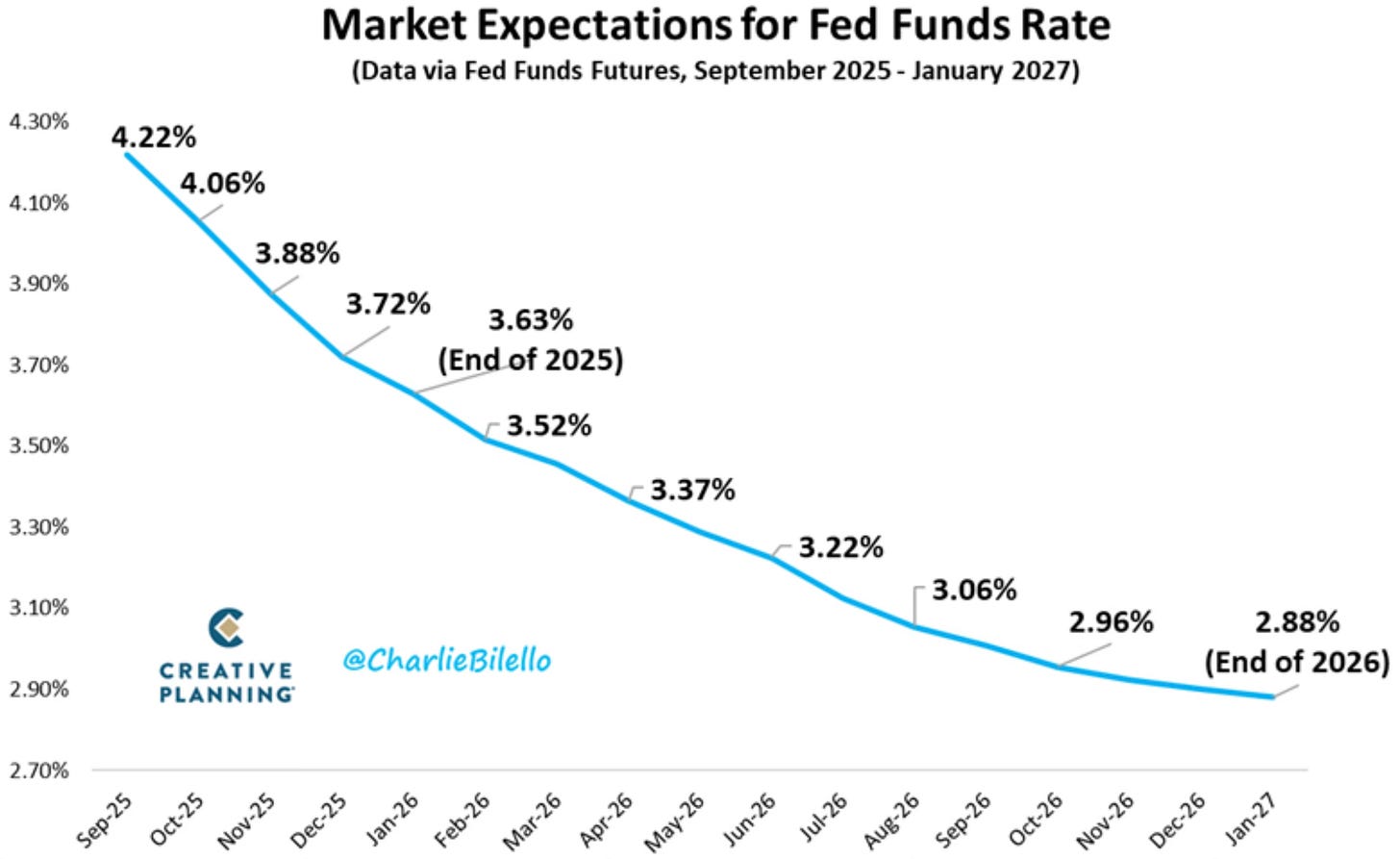

Fed funds futures show a similar rate path.

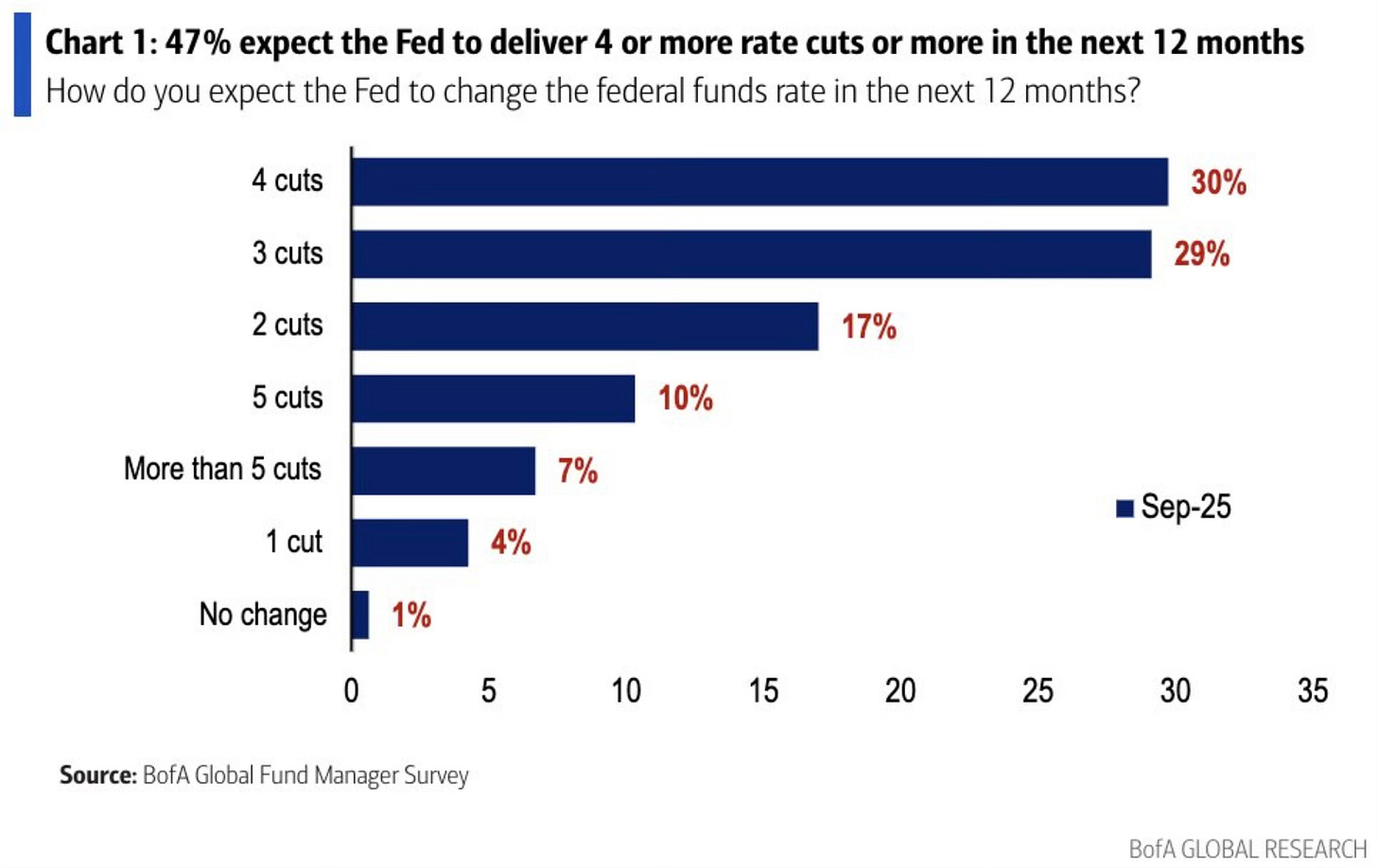

The BofA Fund Manager Survey shows that 47% of respondents expect at least four Fed rate cuts in the next 12 months.

With rate cuts on their way, what can we expect to happen? What has happened in the past? Let’s look at the playbook for stocks, cash and housing.