The Fear Over Tariffs

What to know and what the impact could be

Last week it was the DeepSeek news that dominated the financial markets headlines and had the stock market going up, down and all around. This week it’s the tariffs talk that has had the same impact.

Why has there been so much worry over these tariffs? The Trump administration had said they were going to do this during the campaign. Does it really come as a shock?

Will these tariffs even stay in place? If so, what type of an impact will they have? What’s most affected by them? Could this impact inflation or GDP? Are there certain stocks that this impacts more than the others?

I wasn’t exactly sure, so I did some research into what all the fuss is about. Here is what I found out.

The first thing to understand is that right now the 25% tariffs on Canada and Mexico are paused. They’re on hold for one month.

The tariffs on China are not paused. They’re in effect and it’s a 10% tariff on Chinese imports.

These tariff are some of the highest levels in a long time.

Here is a look at the history of U.S tariffs.

Odds are the negotiating will continue between the Trump administration and these counties. Where it leads or if the tariffs remain in effect and for how long, nobody knows. Your guess is as good as mine.

But let’s look at the potential impacts these tariffs may cause because they are a big deal if they are in effect. It creates uncertainty. That’s evident with how the stock market initially reacted to the news.

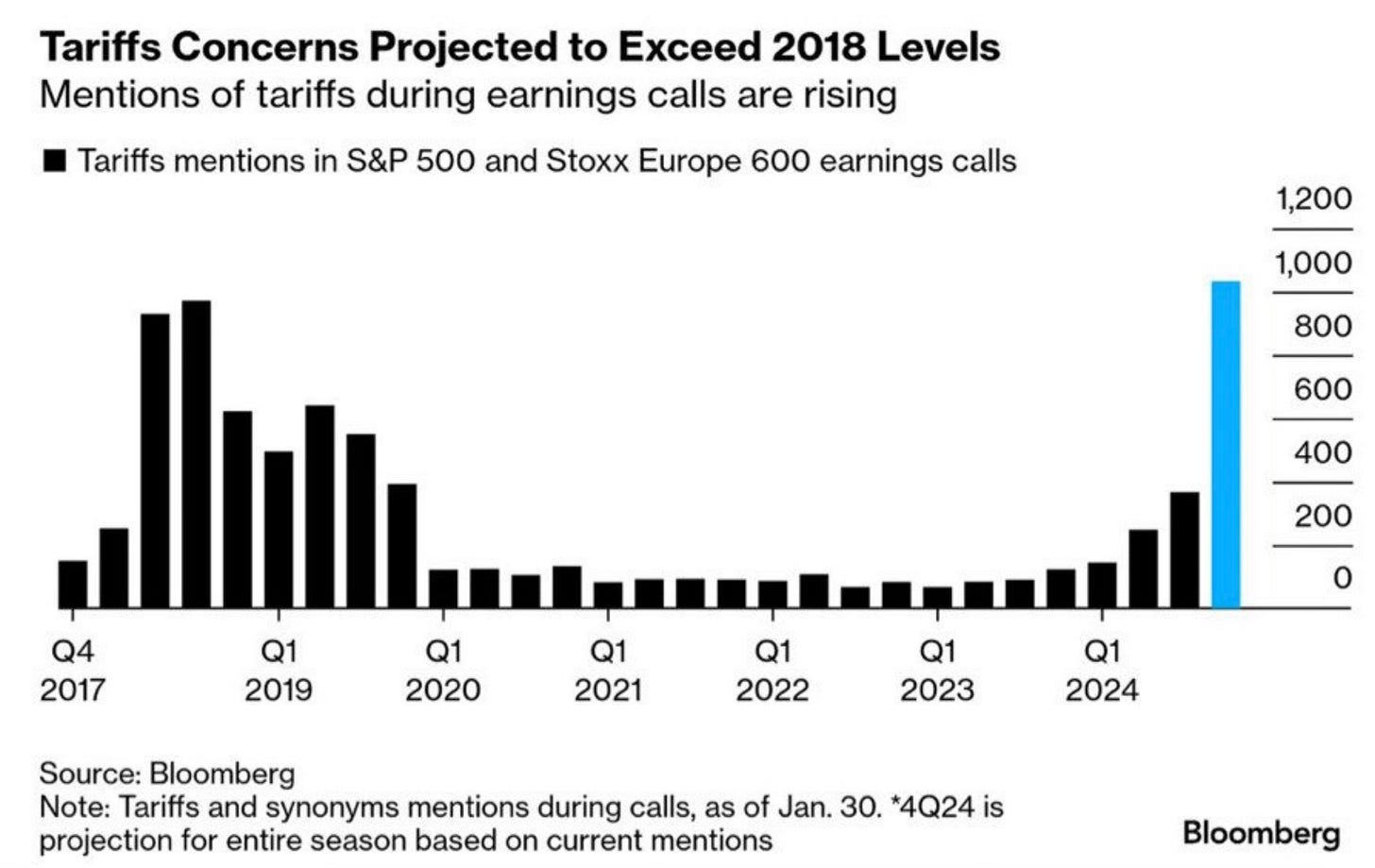

If you recall, tariffs resulted in similar levels of volatility back in 2018.

But tax cuts did help offset those tariffs in 2018. The stock market reacted with 18 new all-time highs that year. That was also a low inflationary environment. This time they’re occurring a high inflationary environment.

Will this push up inflation? It’s entirely possible.

Does it end up impacting GDP? It has to be discussed because this is affecting the largest U.S. trade partners.

Between Canada, China and Mexico, they make up 43% of U.S. imports. This does amount to about 5% of U.S. GDP.

This is a good look into where the U.S trade with China currently stands.

A tariff will cause prices to go up. Ultimately the U.S. consumer likely feels it.

I like the point that Seth Golden made here.

Tariffs ALWAYS cause a rate of change in price i.e. #inflation. We are not tariffing hopes and dreams, but goods prices after all. But the longer-term sustainability of said inflation is improbable, as inflation can cause demand erosion, spur recessions that bring about deflation. From former Trump presidency and recognizing that core PCE rose 60% during that regime, but from ridiculously low levels so nobody cared.

Now this is a pro-growth administration and they may have their ways of offsetting this. It may take some time to see it come to life. But it could very well happen.

Tariffs are a way to help pay for taxes and tax cuts. But it could slow growth. You have to think growth weakens and inflation strengthens. The consumer will likely feel it.

Why? Just look at all the things that these tariffs will touch.

Here are the top imports from Canada in 2023.

Here are the top imports from Mexico in 2023.

What about the food chain that the U.S. relies on so much from Mexico?

It’s definitely on Corporate America’s radar. It’s been a long time since tariffs have been a topic on the S&P 500 conference calls. Here is a breakdown by sector. Look at that spike.

Then here is a breakdown by category of who’s the most exposed to U.S. tariffs. It also shows the share by each trade partner.

From an individual stock standpoint, Goldman Sachs has a Tariff Risk Basket. It shows which stocks were hit the most upon the announcement of the tariffs. These are the stocks most at risk.

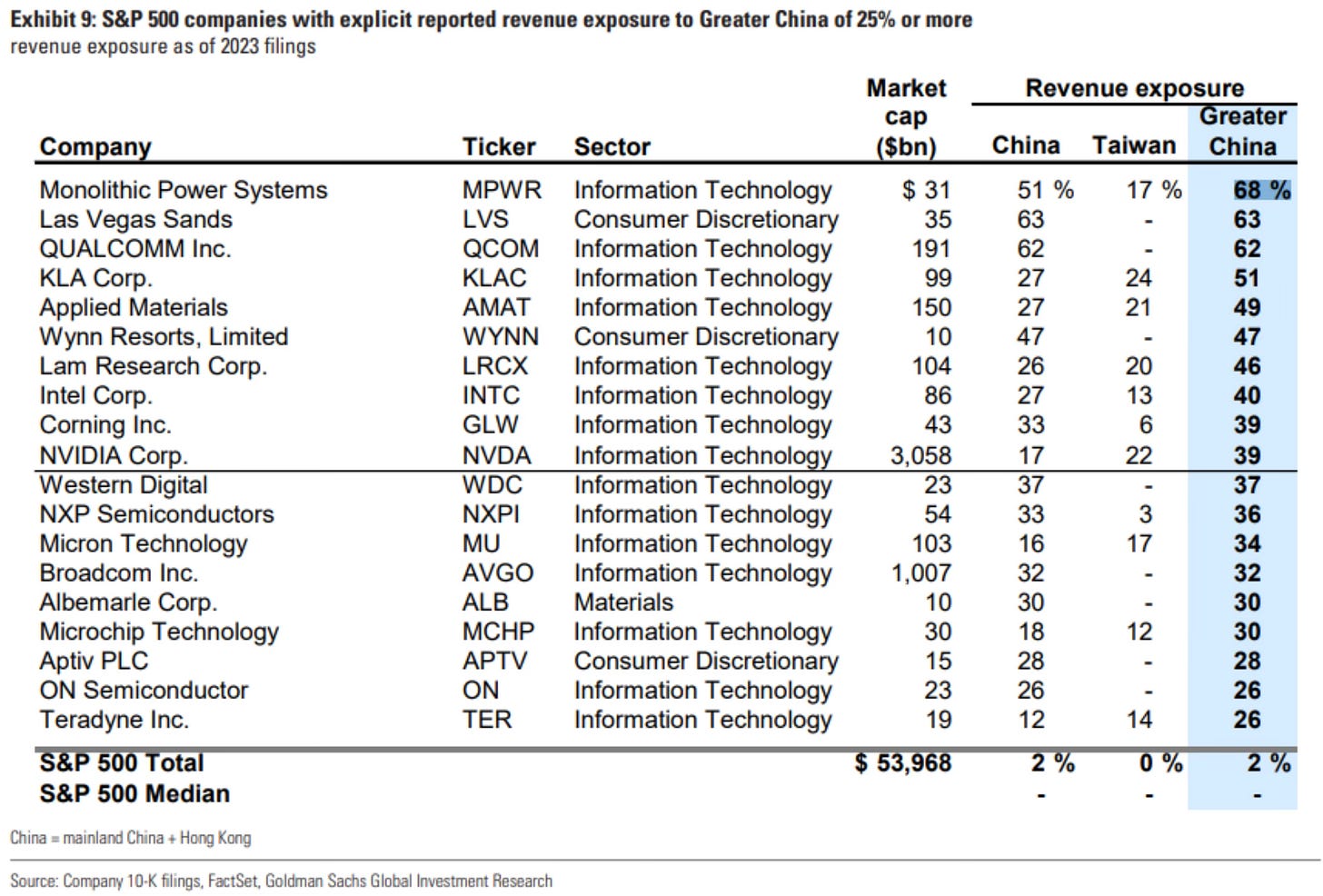

I liked this chart that shows the S&P 500 companies that have the highest percent of revenue exposure to China.

As an investor you’re monitoring this. If you’re a long-term investor it won’t really matter much. If there is a selloff due to tariffs, it’s a buying opportunity. If you’re a trader this creates a lot of volatility and unknowns in the short-term.

As a business owner with products or services that may be affected, you’re also monitoring this. It could have a material impact on your business.

You can see why there is volatility and uncertainty regarding the stock market and the economy. Tariffs touch a lot more than I think most realize.

The Coffee Table ☕

Two other good pieces that I’ve read that discuss tariffs was this piece by Sam Ro, 5 outstanding issues as President Trump threatens the world with tariffs and then this piece by Sonu Varghese, The Tariff Man Cometh, but What’s the Playbook? Both are very informative and from two guys who always have very reputable work.

Here is the top import partner of each U.S. state.

Source: Visual Capitalist

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.