The Boring Investor

A guide to investing in indexes, sectors & subsectors using ETFs

If you're looking for the next hot stock tip or a moonshot crypto play, this probably isn’t your kind of post.

This one’s for the boring investors. The ones who believe in long-term gains, low costs, broad exposure, and sleeping well at night.

The truth is, “boring” investing works. Some of the most effective portfolios are built using straightforward building blocks: market indexes, sectors, and subsectors. When combined strategically, these let you invest in everything from the entire U.S. economy to a niche like cybersecurity, fintech or renewable energy.

I’ve had a number of readers ask me over the past few months about which ETFs I would recommend for investing in certain indexes, sectors or subsectors. So I decided to create this guide.

In this guide, you'll find:

A breakdown of major U.S. stock market indexes

The 11 official market sectors, plus their key subsectors

An example ETF for each.

Whether you're just starting out or fine-tuning your asset allocation, this is your one-stop cheat sheet for investing the boring, effective way.

📈 Major U.S. Market Indices

S&P 500

What It Is: Tracks the 500 largest publicly traded U.S. companies.

Covers: About 80% of the U.S. stock market by market cap.

Type of Companies: Large-cap, across all 11 sectors (Apple, Berkshire Hathaway, JPMorgan, etc.)

Why Invest: Diversified, stable, market benchmark.

Example ETFs:

SPY – SPDR S&P 500 ETF (most traded)

VOO – Vanguard S&P 500 ETF (low-cost)

Nasdaq-100

What It Is: The top 100 non-financial companies listed on the Nasdaq exchange.

Covers: Primarily tech-heavy large-cap growth stocks.

Type of Companies: Apple, Amazon, Nvidia, Meta, Microsoft

Why Invest: High growth potential; tech exposure.

Example ETFs:

QQQ – Invesco QQQ Trust (very popular, highly liquid)

QQQM – Invesco Nasdaq 100 ETF (lower expense ratio)

Dow Jones Industrial Average

What It Is: 30 large-cap U.S. companies across key industries.

Covers: Blue-chip, legacy companies.

Type of Companies: Home Depot, Coca-Cola, 3M, Visa, McDonald's

Why Invest: Stability, dividend payers, historical performance.

Example ETFs:

DIA – SPDR Dow Jones Industrial Average ETF

Russell 2000

What It Is: 2,000 small-cap U.S. companies.

Covers: The smallest 10% of the investable U.S. stock market.

Type of Companies: Small regional banks, biotech startups, niche retailers.

Why Invest: Small-cap growth, domestic economy focus.

Example ETFs:

IWM – iShares Russell 2000 ETF (most common)

VTWO – Vanguard Russell 2000 ETF (lower fees)

Russell 1000 / Russell 3000

What It Is:

Russell 1000: Large- and mid-cap U.S. stocks (92% of U.S. market)

Russell 3000: Nearly the entire U.S. stock market

Why Invest: Broad market exposure, total market coverage.

Example ETFs:

IWB – iShares Russell 1000 ETF

IWV – iShares Russell 3000 ETF

Total U.S. Market Indices

What It Is: Covers virtually every publicly traded U.S. stock (large, mid, small, and micro-cap).

Why Invest: Maximum diversification in a single fund.

Example ETFs:

VTI – Vanguard Total Stock Market ETF

SCHB – Schwab U.S. Broad Market ETF

ITOT – iShares Core S&P Total U.S. Stock Market ETF

Below is a full breakdown of the 11 major stock market sectors, their key subsectors, and examples of ETFs for each. This guide can serve as a roadmap for building a diversified or thematic portfolio.

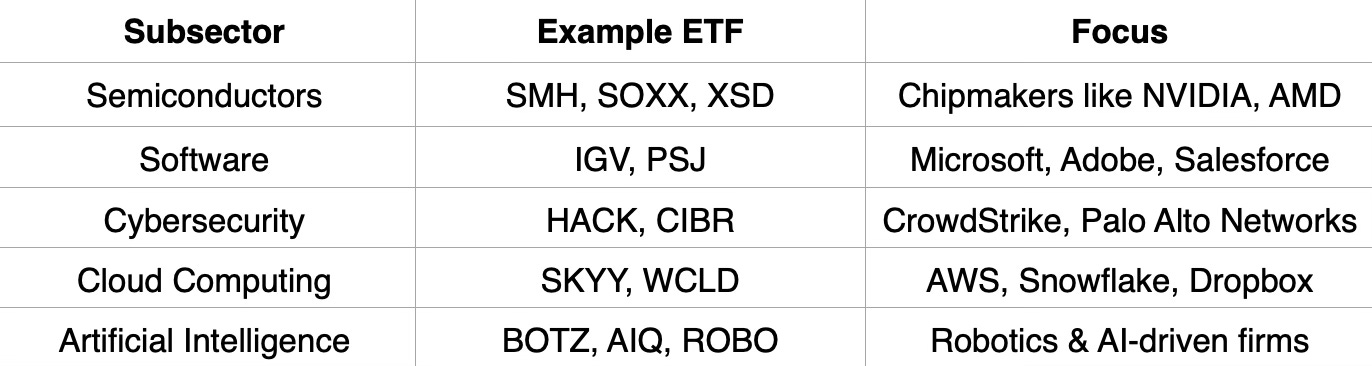

📊 Technology (XLK)

Companies involved in computing, electronics, and digital services.

🏦 Financials (XLF)

Covers banks, insurance, asset management, and fintech.

🏥 Healthcare (XLV)

Spans pharmaceuticals, biotech, and medical services.

⚙️ Industrials (XLI)

Includes manufacturing, construction, and transportation.

🛢️ Energy (XLE)

Energy production, both traditional and alternative.

🧱 Materials (XLB)

Covers resource extraction and raw materials.

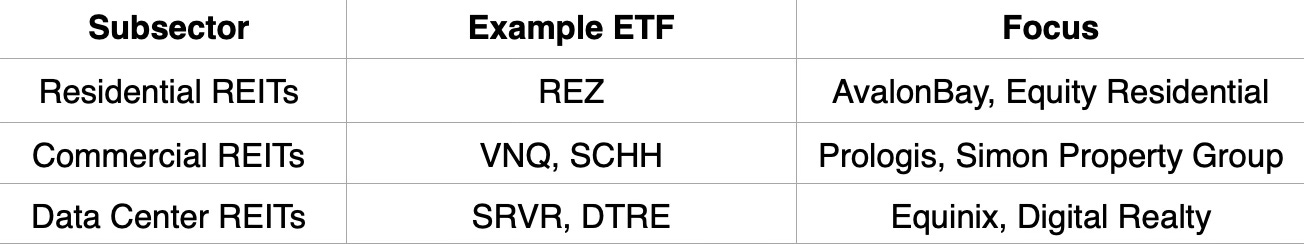

🏠 Real Estate (XLRE)

REITs and real estate management firms.

🛒 Consumer Discretionary (XLY)

Goods and services people buy with disposable income.

🧃 Consumer Staples (XLP)

Necessities like food, beverages, and household products.

🌐 Communication Services (XLC)

Telecom, media, and internet platforms.

💡 Utilities (XLU)

Electric, water, and gas companies.

The Coffee Table ☕

I liked Nick Maggiulli’s post, You Can’t Put a Price on Mental Freedom. He talks about why he no longer invests in individual stocks and how it can suck up your most important asset, time and attention. He makes some good points and owning active investments might not be for everyone.

If you own a business or operate in the sales arena, you’ve probably heard of niche marketing. Every company tries to find their niche. This was a great article in Kitces about how to market to a niche, even if you aren’t a niche provider, or developed your niche yet. How Financial Advisors Can Leverage The Effectiveness Of Niche Marketing Without Having One

Likely a surprise to you, just as it was to me. The median age of all homebuyers is now 56 years old. That’s up from age 31 back in 1981. What a drastic shift over the last few years.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.