The Best Long-Term Investment

What do you think it is?

Have you ever wondered what the best long-term investment is?

Gallup recently released a poll which asked just that. They asked, what do Americans consider the best long-term investment?

They gave them the choices of stocks/mutual funds, bonds, real estate, savings accounts/CDs, gold and cryptocurrency.

The poll shows that 37% of U.S. adults view real estate as the best long-term investment. That was followed by gold (23%), stocks/mutual funds (16%), savings accounts CDs (13%), bonds (5%) and cryptocurrency (4%).

I actually looked back and real estate has been the top answer for 12 years in a row in this Gallup poll.

That really surprises me. But then I thought about it and I can see why do many Americans think real estate would be their answer.

I just don’t find myself agreeing with that.

Yes, you need to live somewhere. There is the ability to use leverage and it does have tax deductible aspects to it.

Your home price isn’t posted daily and you can’t see the volatility of the price like you can other investments such as stocks, bonds, gold etc. It’s not liquid so you aren’t tempted to quickly sell if the price dips a bit. It’s more of a safe haven. A slow appreciating asset.

When we think of assets though, we have to remember that there is much more than just the price you paid for a house, versus what it’s worth today.

Owning a home includes property taxes, maintenance & repairs, insurance, HOA or condo fees, remodeling, landscaping and I could go on and on.

What about the interest on your mortgage. Have you ever thought of that when you bought your home for $250,000 and sold it for $400,000 and think, I made $150,000. Not quite the case. Did you forget about the interest on your mortgage?

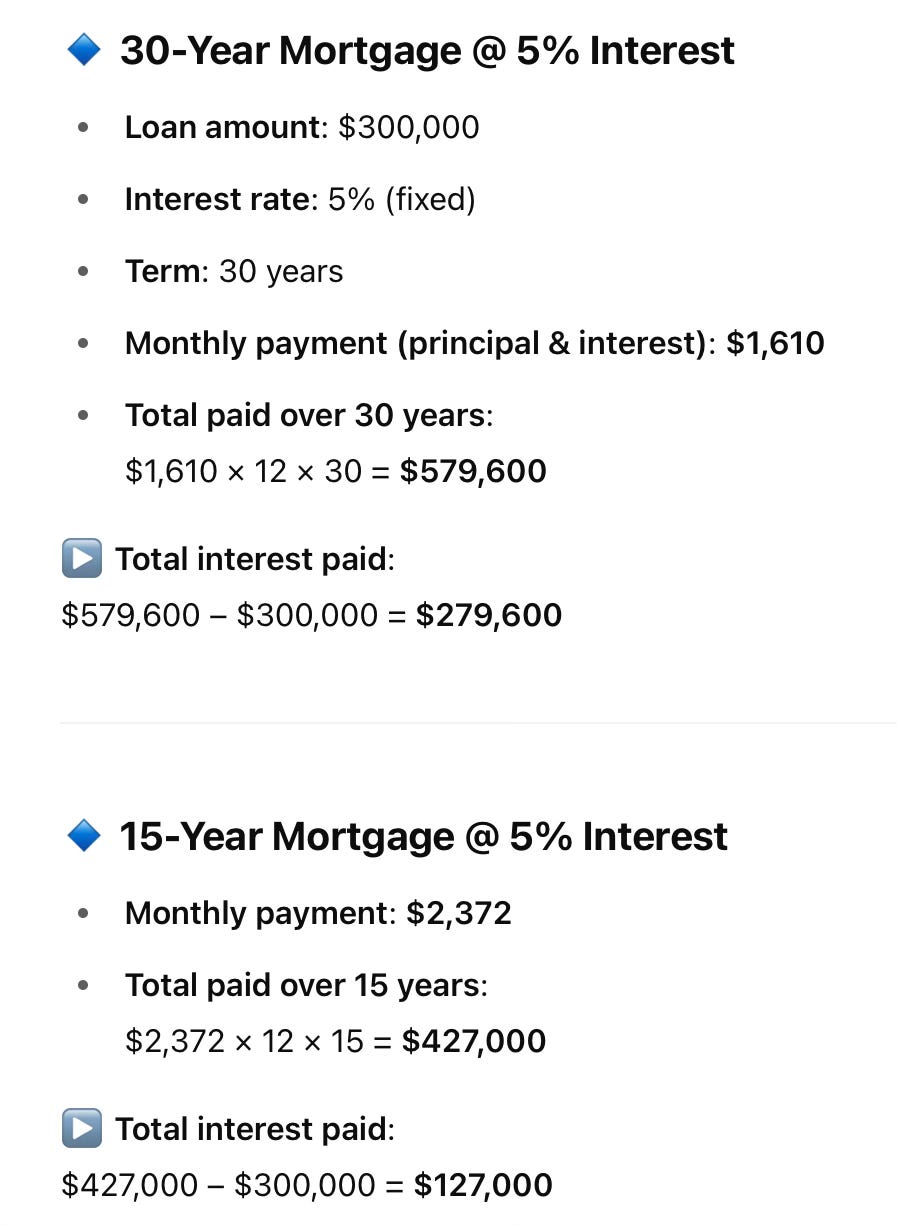

Here is a great example of a simple $300,000 mortgage at 5% and what you pay over time in total on a 15 and 30-year mortgage.

You can see the actual cost of the mortgage isn’t what you started it at. The interest really changes that. The true cost to own a home is much costlier than you think.

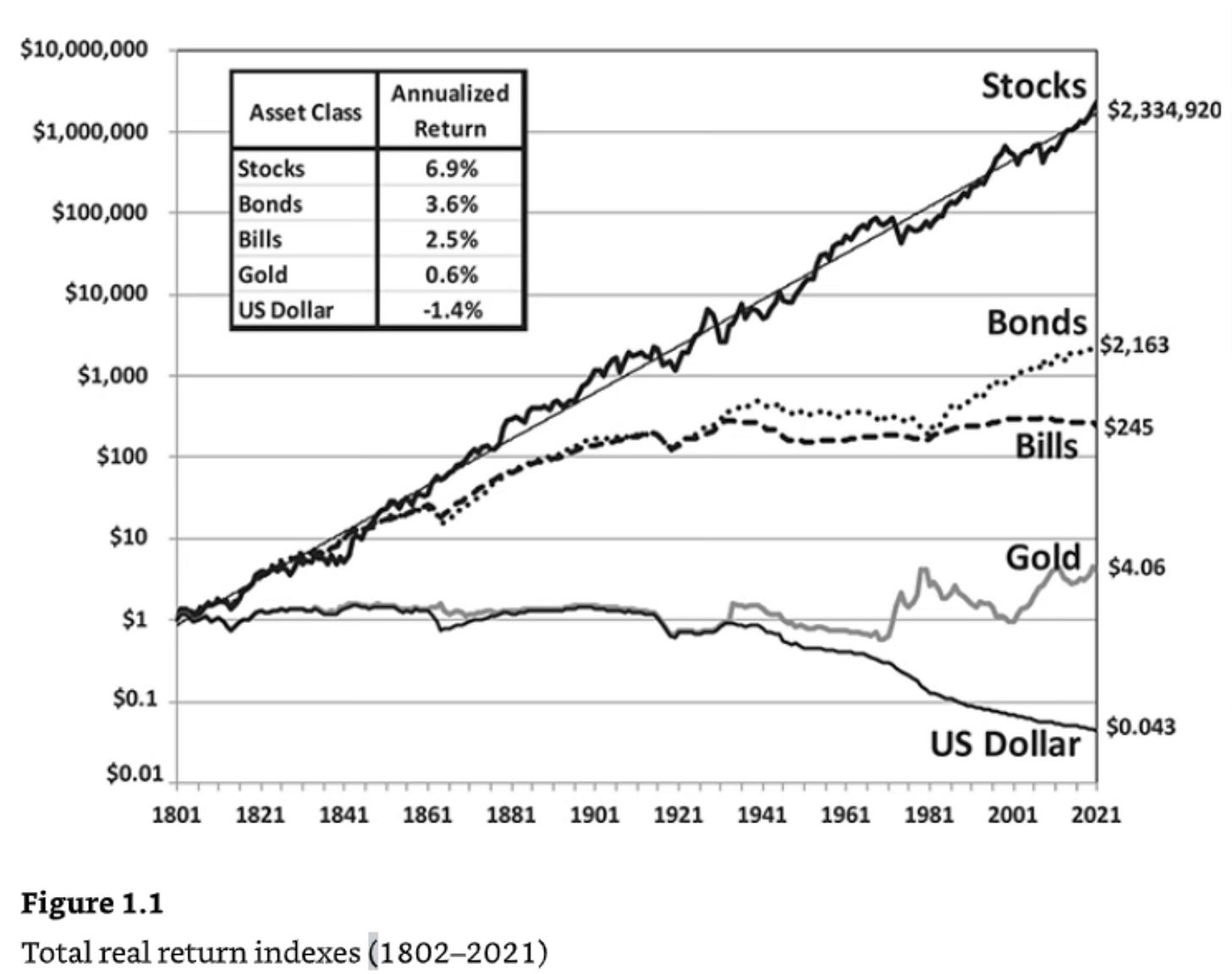

I like what Ben Carlson did here in trying to break the different asset classes out for their annual returns.

These are the annual returns from 1928-2023 for stocks, bonds, cash, housing and gold along with the annual inflation number:

Then this chart takes each into a visual to see what they have done going back to the 1800s from starting with $1.

In my view stocks still reign supreme as the best long-term investment.

$1 invested in 1950 into a no-fee S&P 500 fund, would now be worth $317. $100 would be worth $31,700. $1,000 would be worth $317,000. $10,000 would be with $3,170,000. All by doing nothing other than waiting.

There really isn’t any magic to it. The magic is in the waiting. Waiting through all the ups and downs. Regardless what has happened over the years, the stock market just continues to go higher.

So that’s my answer.

You can agree or disagree. Maybe you feel real estate is the best long-term investment.

The beauty is that what you think is the best long-term investment is your opinion. You decide how you invest your money. You can diversify or be as concentrated as you want.

It’s your money and you have the ultimate say. Don’t forget that.

The Coffee Table ☕

This was a great list in Forbes of the best finance podcasts. 14 Of The Best Finance Podcasts All Investors Should Listen To

I found this graphic to be very interesting.

Source: Vala Afshar

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.