The Beginning Investor

What I would have told myself 18 years ago

Eighteen years ago when I started investing there was very little that I actually knew. Heck I had just graduated high school so there was a lot I didn’t know whether it be about life or investing.

What I did know, is that I wanted to start buying stocks. The first stock I ever owned was General Electric. That’s a name from the past. After that I had bought WalMart, Microsoft, Pfizer and Apple. These were the first five stocks I ever owned.

Since buying my first stock until today I’ve learned a tremendous amount about investing and buying/selling stocks. Looking back, I really had no idea what I was doing. But I was learning through experience. My knowledge level today is not even comparable to when I started.

There are a number of things that I wish I had known back when I started. Like you should start by putting your first $5-$10,000 in an S&P 500 index fund. I had read and read but until you actual do it for yourself that’s how you really learn. Trial and error in anything is our best teacher.

To help you and save you many years of screwing up and wanting to kick yourself for mistakes or goof ups. I’m going to break down some of the basic beginner steps when you buy a stock. These are things that I wish I would have had a better grasp and understanding back when I started buying stocks. The terms market order and stop limit loss will be explained and I’ll show how to use them. When you hear about protecting yourself or limiting your downside risk, you’ll see how to do that and what that actually means.

I wrote this as if I were teaching myself tips and how invest. This is what I would have wanted to know eighteen years ago.

Choose your broker

There are numerous ways to buy stocks.. You can contact your financial advisor and buy that way. Or if you want to do it on your own, there are a large number of discount brokers online. Here is a list of the most popular online brokers.

Pick what platform and company you like the best. Compare their interfaces and what the stock lookup screens and charts are like. All are $0 commission trades and should have rather low account minimums to start.

It’s important to see if you can open your account under a tax deferred account (Traditional IRA) or tax free account (Roth IRA). A Traditional IRA is like a 401K as you pay taxes when the money is withdrawn. Money grows tax free in a Roth IRA. It’s best to use tax-deferred retirement accounts if possible.

Without a tax sheltered retirement account, you would use a taxable non retirement account. You’re then taxed whenever you sell a security. You also would be taxed in the year any realized capital gains, dividends or interest are received.

Consult with your accountant on the qualifications and tax ramifications. If you don’t currently have an accountant, find one before you start investing. This is also where a financial adviser can help you out.

Buying a stock

The first step in your stock buying process is figuring out what stock you want to own. I’m not going to get into the thousands of ways to identify and find a great stock. I’ve never shorted any stocks, played the options market or bought on margin. I’ve always been long stocks, mutual funds or ETFs.

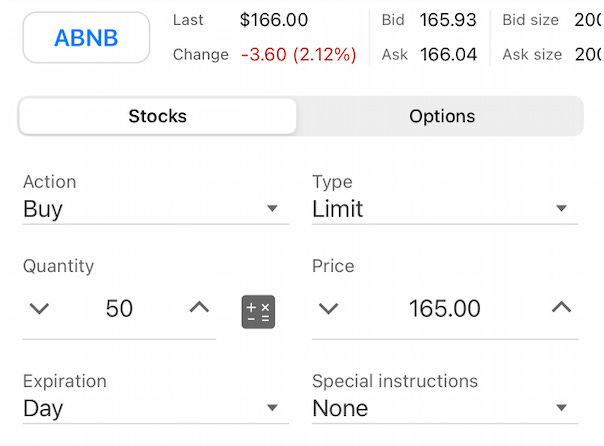

To best illustrate my thought process and what I do, I’m going to go through my purchase of Airbnb (ABNB) stock last week. I wanted to purchase Airbnb at a limit order of $165 share. This is how it looks.

After you buy a stock it’s going to go up or down. If the stock goes down in price and you want purchase more shares, you’re averaging down. It means you are lowering your cost basis. If the stock goes up in price and you want to buy more shares, then you’re averaging up. You’re buying more shares above your initial purchase price and therefore increasing your cost basis.

Protecting your downside risk

After I purchase a stock I will put in a stop loss order because big initial losses are hard to recoup. When you hear people talk about limiting your downside or cutting your losses this is what they’re referring to. My goal is to control my losses. Need to remember a 25% loss requires a 34% return to get back to even. A 50% loss requires a 100% return to get back to even.

Sometimes you get into the stock at the wrong time. Can chalk it up to bad timing. That doesn’t mean you never look at that stock again. When I sell out of a stock it usually gets put back on my watchlist and I continue to watch and monitor it.

Nobody knows the top or bottom in an individual stock or the overall market. It’s impossible, so don’t even try. The goal is to make what you feel is an educated and informed decision.

After buying ABNB at $165 a share I wanted to put in a sell stop-limit order at $125 a share. That’s an almost 25% loss. That is the maximum amount I want to risk in this stock. This percentage loss can be whatever someone is willing to stomach for risk. The expiration I selected is GTC (Good-Til-Cancelled).

I put in sell stop limit order so that I can enjoy life and not have to worry about watching the market every day. If I go a few days without looking at my portfolio, I know that if something causes the market to have a sudden drop, I have my automatic protection in place.

This also removes that in the moment anxiety and fear of will a stock go lower? Is this the bottom? You’ve predetermined the amount of risk you’re willing to accept.

When to sell

This is the single hardest question about investing. There isn’t a right or wrong answer to this. Everyone’s situation is different. You could ask ten different investors and you’ll get ten different answers. Only you can answer this question.

You have to know why you bought a stock in the first place and what you’re trying to accomplish. What is your holding period? I usually buy a stock with the intention to hold it for three plus years. If I’m buying something shorter term it’s for a trade. To try to turn a quick profit (ie. days, weeks or months). Remember there are traders (short term) and investors (long term).

A plan you could have is to sell when you’re up x amount. For example, once you’re up 50%, maybe you take out what you put in (original investment amount) and let the rest ride. Or if you are up 100% you sell half or all. Or you could never sell.

Just have a plan and objective when you buy the stock. Be disciplined.

Investing books

I started to learn investing by reading books. There are a lot of great investment books. A lot of them tell a similar story. Save as much as you can and invest it. Or that you should always contribute to your company’s retirement plan the amount they will match, at a minimum. Otherwise you’re giving up “free money.”

Some books will go into more detail and help you learn what to do if you want to do your own investing and picking your own stocks. Many prefer to just have a financial adviser do it for them. That is fine also.

If you want to read about investing and money, these four books had the greatest impact on me. I would read them in this order as they start out with the more basic fundamentals on investing and money, then advance into picking stocks etc.

If you remember anything, it’s that starting now and getting money to work is the most important factor in investing. Don’t wait! Time in the market trumps everything else with investing. Keep buying and buying. You’ll thank yourself later in life.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe and/or give a gift subscription for others.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.

Disclaimer: This is not investment advice. You should not treat any opinion expressed as a specific inducement to make a particular purchase, investment or follow a particular strategy, but only as an expression of an opinion.