Tariffs, Tariffs, Oh My

Is the real risk tariffs — or our reaction to them?

Every time the words China and tariffs hit the tape, the market flinches. Futures drop, headlines scream, and everyone scrambles to find their next “trade war” take.

But if you zoom out, the pattern is clear. The market keeps overreacting to the talk, and then snapping right back when the dust settles.

The selloffs have been more emotional than fundamental. Each time tariffs get mentioned, investors brace for impact. Yet most of the time, nothing actually happens. No sweeping policy change. No meaningful hit to earnings. Just another round of speculation and short-term volatility.

We’ve seen this movie before. Rhetoric flares up, algorithms trade on headlines, and social media amplifies every comment from Beijing or Washington. But when it comes to actual market behavior, the story is consistent: pullbacks fade fast, and the dip gets bought.

That movie just played again on Friday.

The 2.7% decline in the S&P 500 was the largest since April 10th. The cause back then? Tariffs — again. And we all know how the market has performed since then.

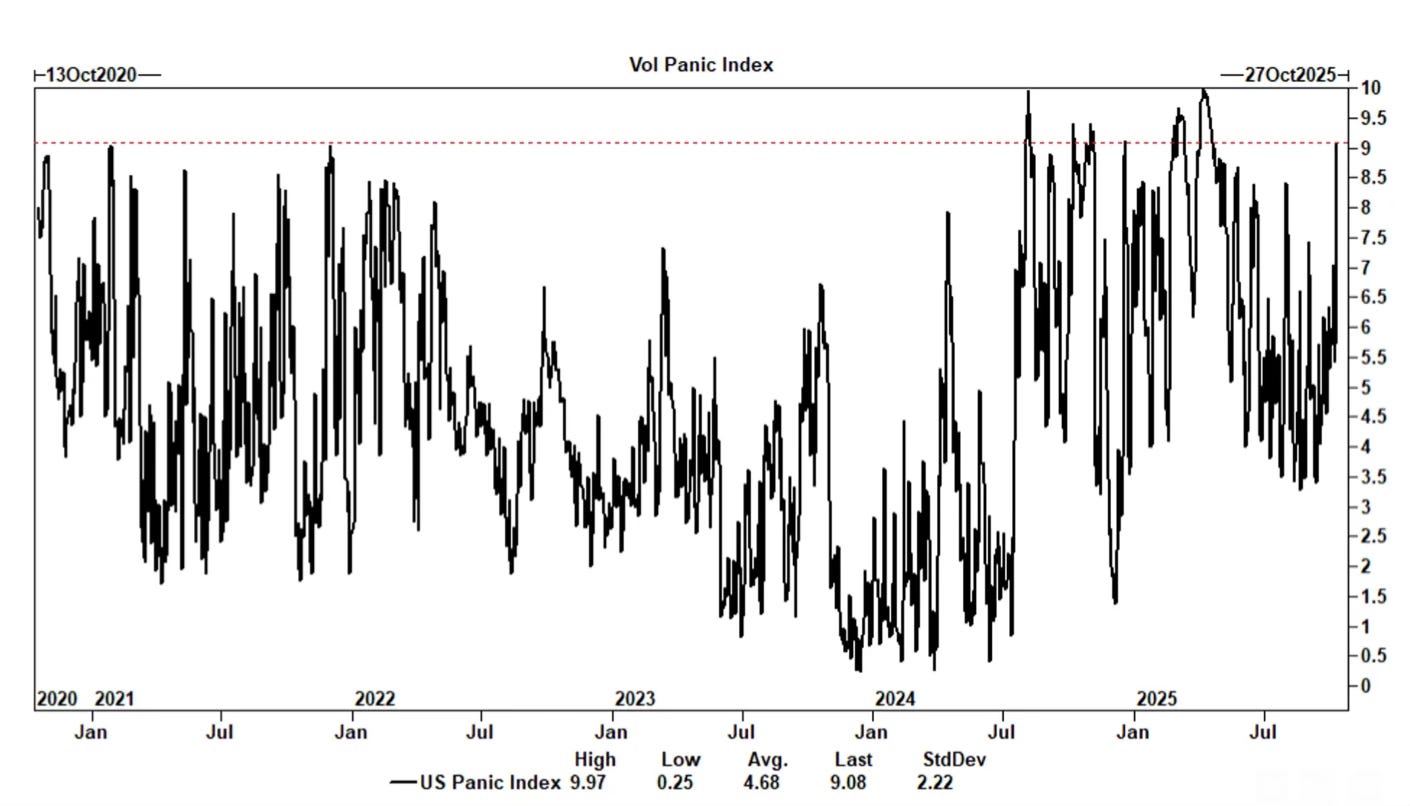

Friday saw the U.S. Panic Index levels rise to one of the largest one day increases ever.

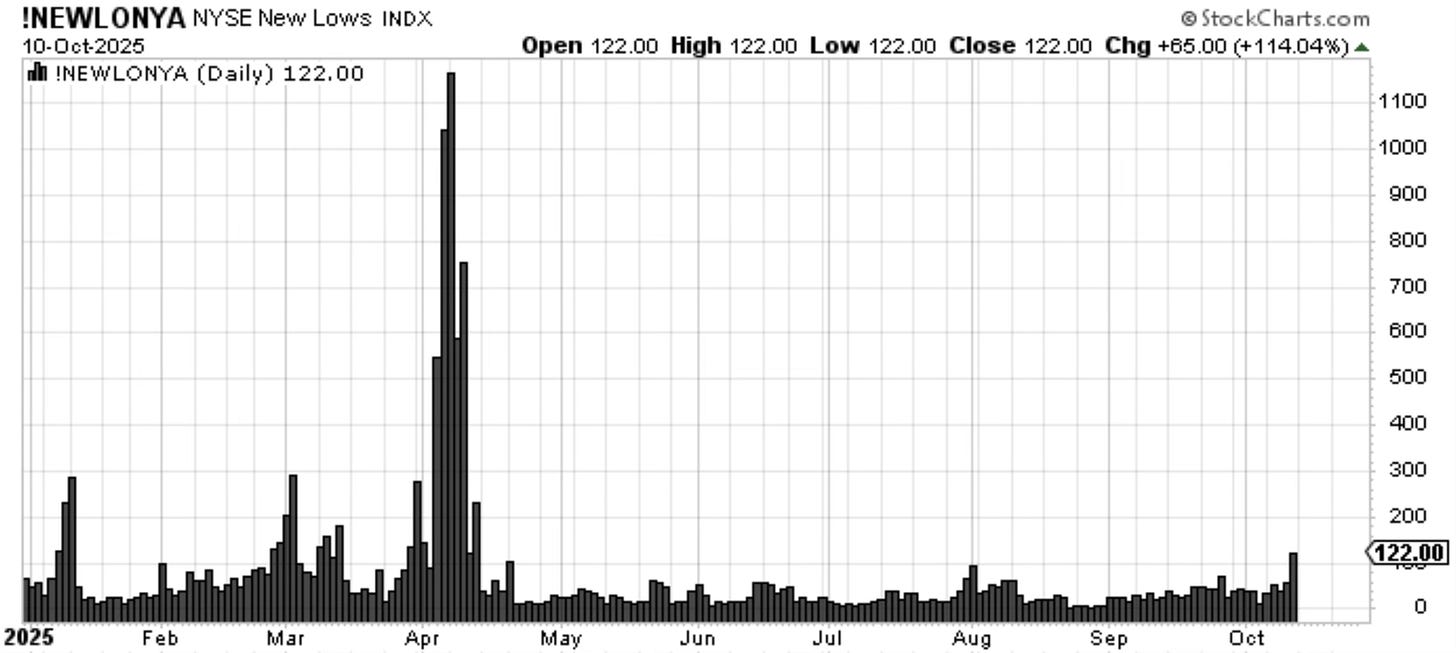

We saw the most new lows in stocks since April.

Was this just another overreaction to tariff news?