State of the Market

Why the stock market refuses to stay down

After spending the week in NYC, I took some time to catch up with a few friends and Spilled Coffee subscribers to talk about the stock market.

As I was talking with someone midday on Friday, we saw the market tumble. It was the worst day for the S&P 500 and Nasdaq since April. The worst week since May. The VIX had the biggest spike since April.

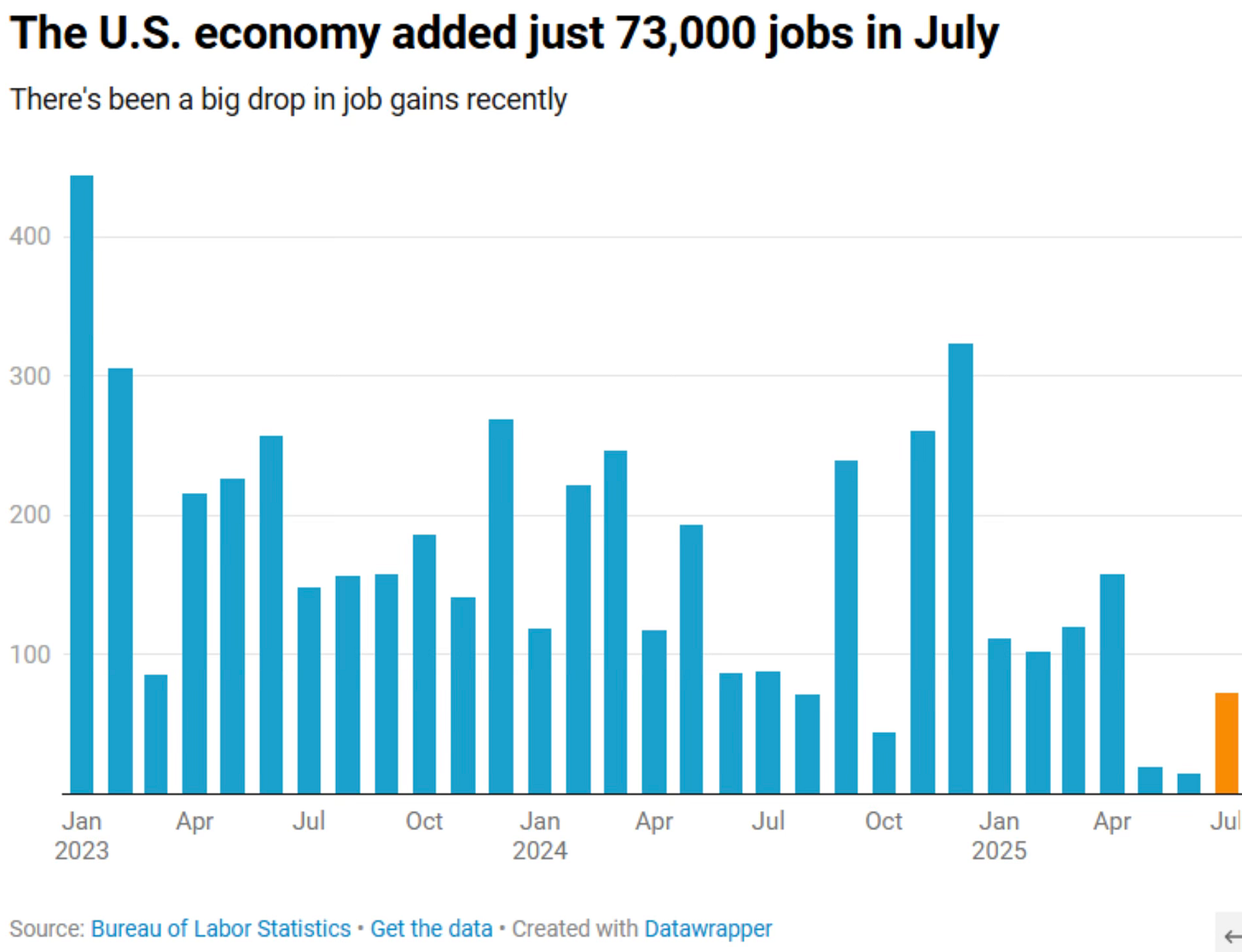

Weakening labor fears ran rampant on a weaker than expected jobs number and downward revisions for both the May and June numbers.

The July jobs number came in at 73,000 versus an estimate of 104,000. With 75% of those gains coming from healthcare.

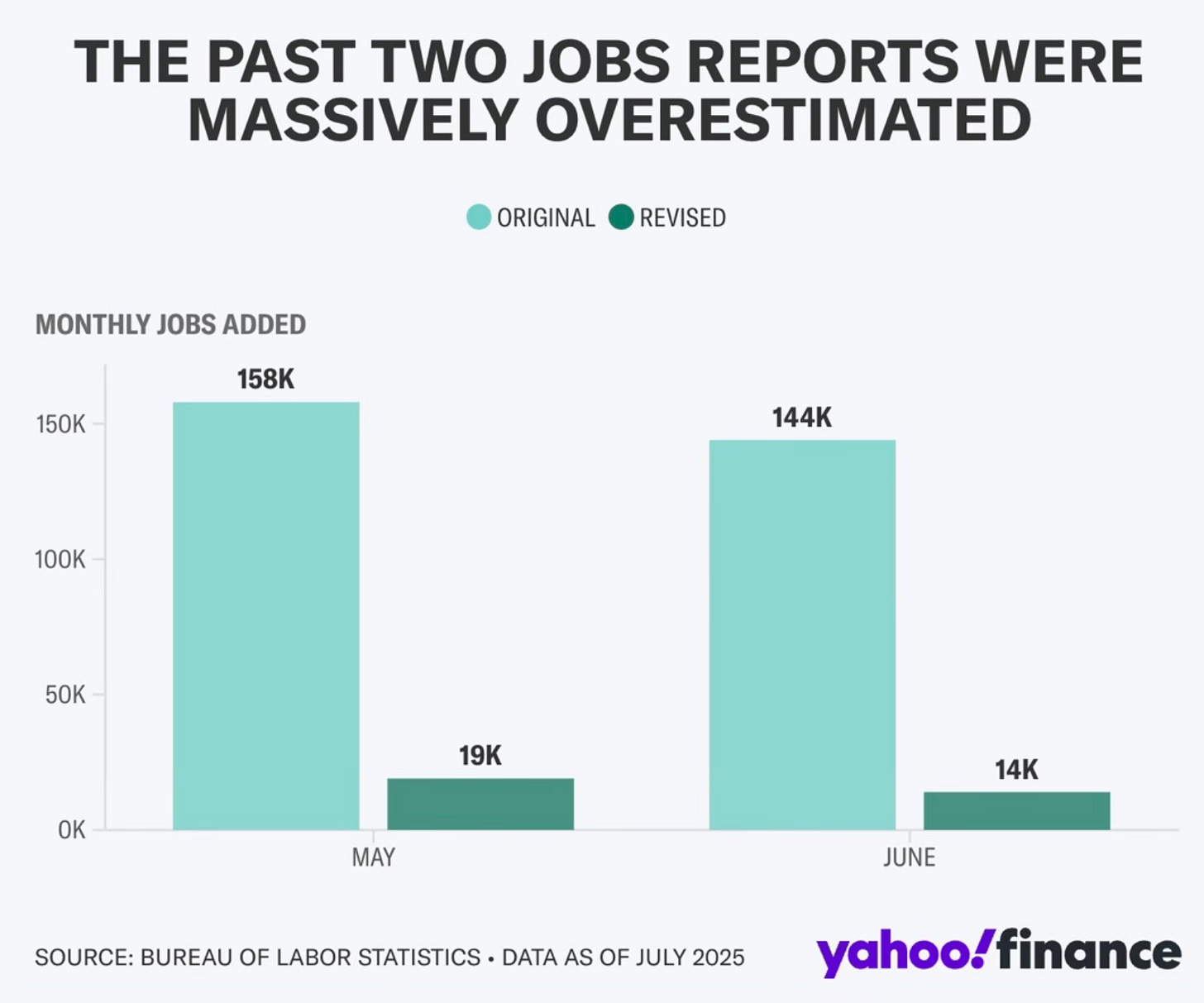

The bigger worry came from the revised job number for May and June.

May was revised down by 125,000, from 144,000 to 19,000. June was revised down by 133,000, from 147,000 to +14,000. Those are giant numbers. 258,000 jobs just were removed from the data.

Worrisome? Yes! It does show that there is a weakening job market.

As the trading session closed Friday , we jokingly agreed that despite this, come Monday the market would be up and Friday would be a distant memory.

Sure enough. It bounced back on Monday.

The S&P 500 closed Thursday the 31st at 6,341. Monday the 4th closed at 6,330.

It was like Friday didn’t even happen.

With the market bouncing right back off those concerns, you have to ask, did this get priced in during the April selloff?

The United States bombing of Iran couldn’t shake this bull market off course. The continued tariff worries haven’t done it. The Elon and President Trump spat did nothing. A terrible jobs number along with giant revisions for the prior two months had no lasting impact.

Regardless of the news that’s thrown at this market, it refuses to stay down. Why is this?