Rising Rents Helping Fuel Home Demand

Higher mortgage rates aren’t cooling down housing

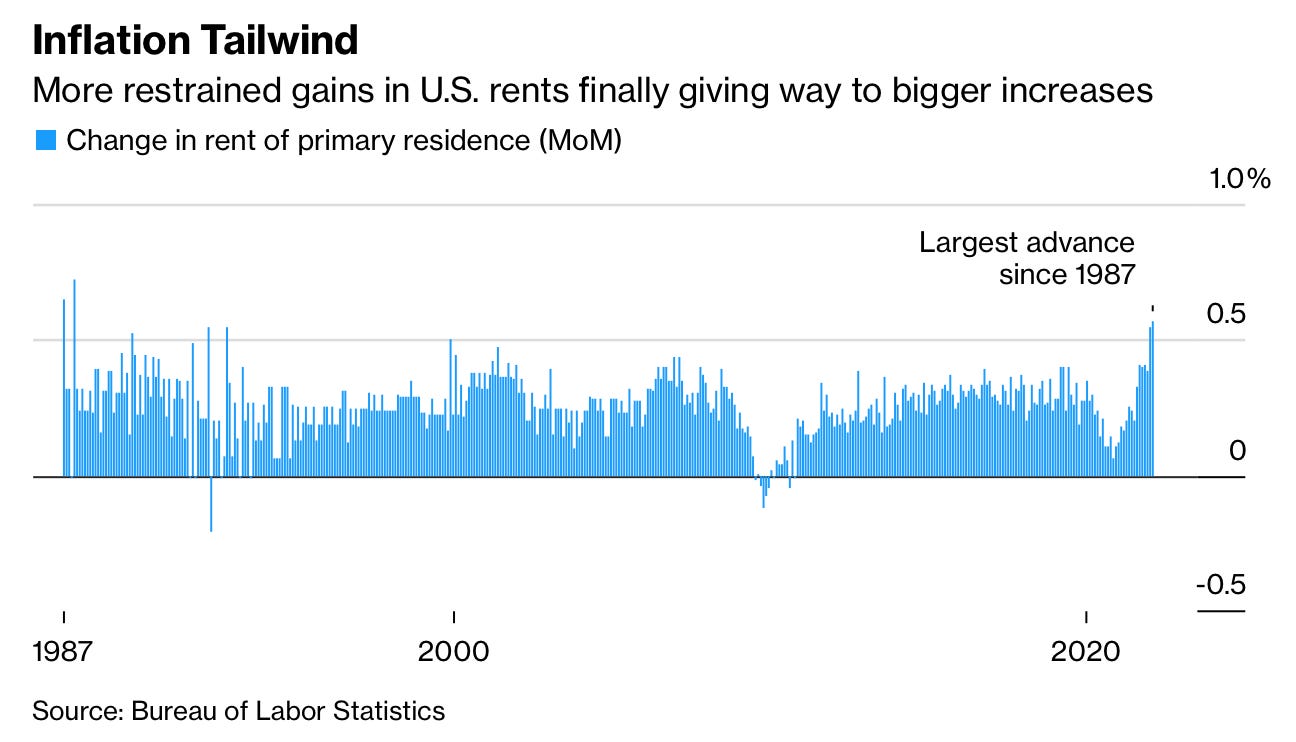

Rents across the U.S. just had its largest month-over-month increase in over 30 years. We can add the increased cost of rent to the list of things that seem to be setting multi-decade or all-time records lately.

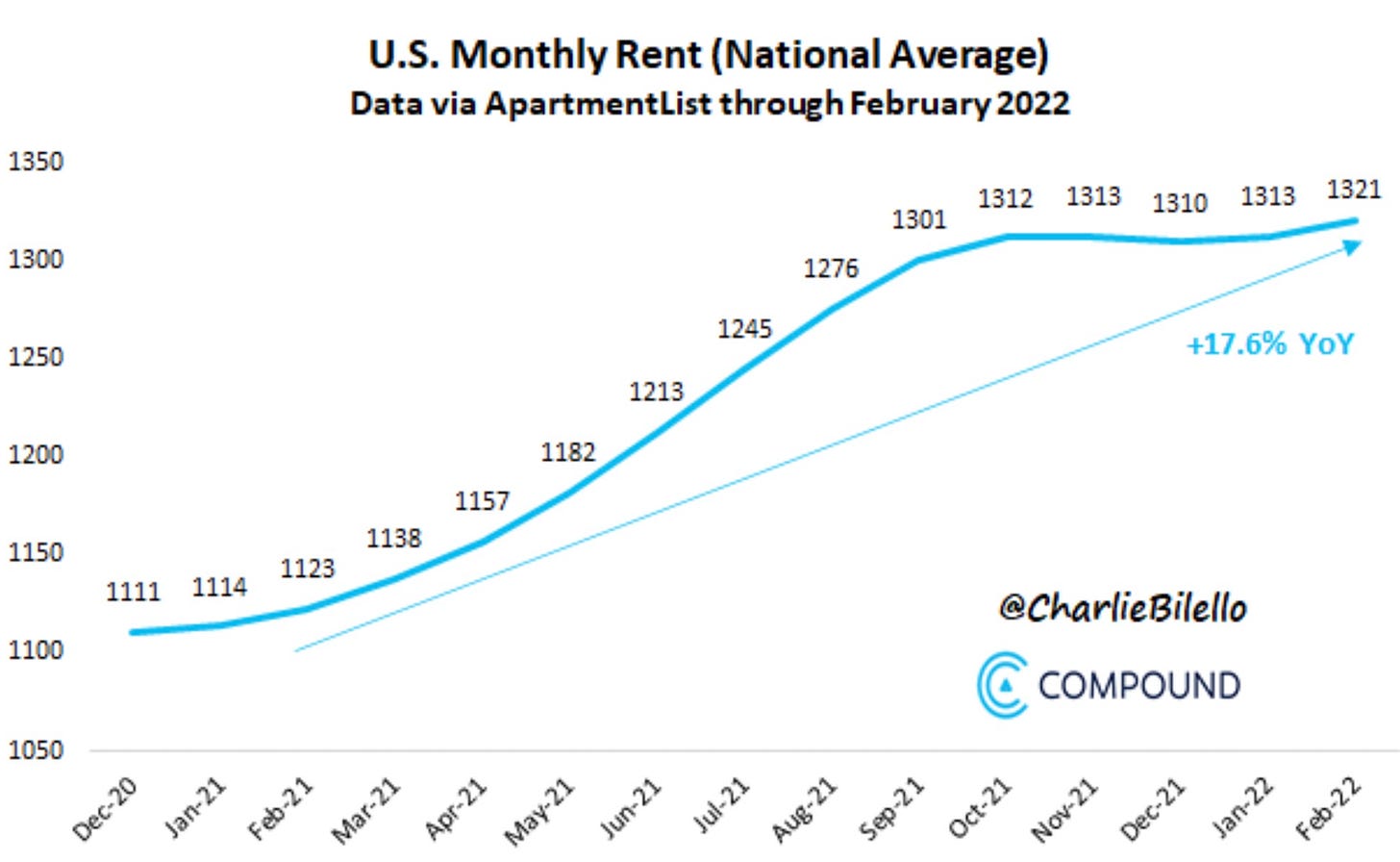

Over the last year rents are up by almost 18%. During that same time home prices are up about 19%.

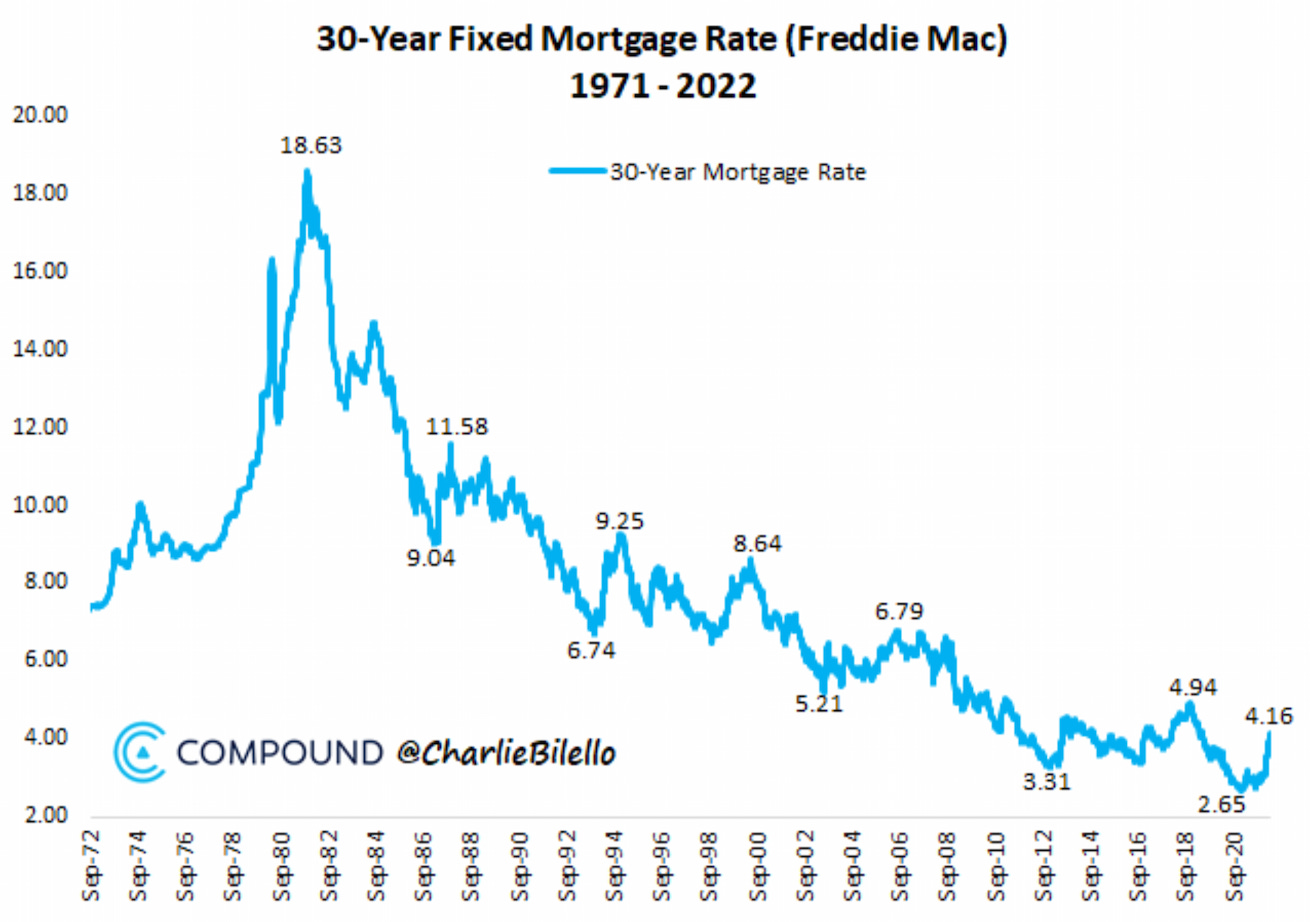

With the fed increasing interest rates last week, we’ve now seen mortgage rates rise to the highest levels since 2018. In January of 2021 mortgage rates hit an all-time low rate of 2.65%. As I write this, the average 30-year fixed mortgage sits at 4.55%.

What does the payment difference look like from the all-time low rate of 2.65%, to 4.55%? Then jump ahead and say we see interest rates rise to 6%. Here are the monthly payments at those interest rates for a 30-year fixed mortgage at $250,000, $500,000 and $1,000,000.

2.65% - $250,000 $1,007, $500,000 $2,014, & $1,000,000 $4,029

4.55% - $250,000 $1,274, $500,000 $2,548, & $1,000,000 $5,096

6.00% - $250,000 $1,498, $500,000 $2,997, & $1,000,000 $5,995

Are these increased costs enough to deter someone to change from renting into home ownership? I don’t believe so. People are seeing similar cost increases in their cost of rent. Owning a home adds many more positives financially versus renting, especially when your monthly cost outlay is about the same.

The increased cost of rents will continue to help bolster home sales. The WSJ had a good story that speaks directly to what is going into people’s thought processes.

Brooke Baenen, a Green Bay, Wis., area real-estate agent, said one of her clients—a first-time buyer in her 40s—felt moved to action by the rent increases. This client had been a lifelong renter, but when her rent increased—first by $50 a month, then by $200 a month—she grew interested in buying a home.

Ms. Baenen said she has talked with many people in similar positions. In her area, which has historically been affordable, she is seeing people living in small-city apartments but paying big-city prices.

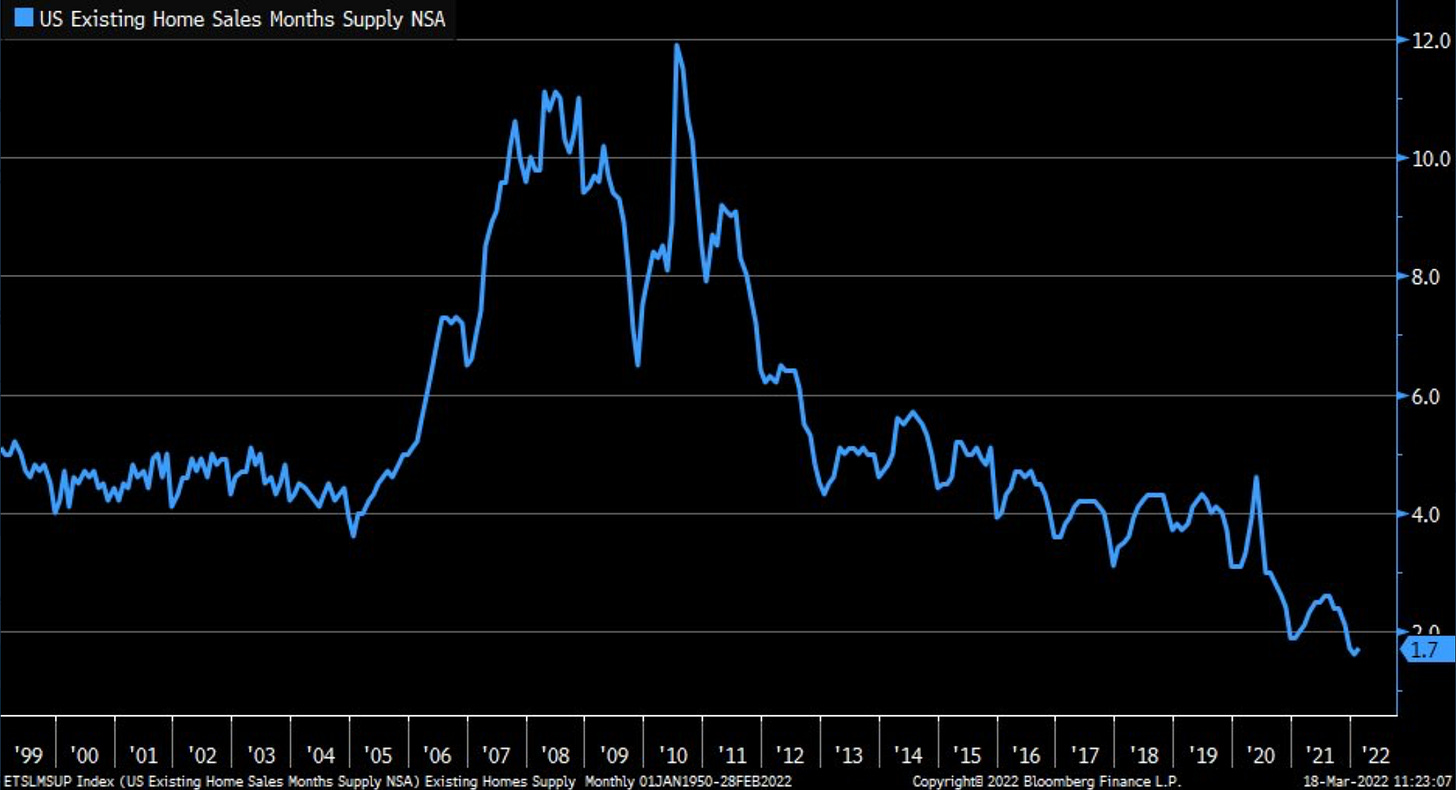

Combine rent increases with near record low inventory and you’re seeing the demand problem we’re in. The current housing inventory would only take 1.7 months to sell all the available homes in the U.S.

The U.S. home inventory is in dire need of more homes. I discussed this topic a few weeks ago in my post, We Need More Houses.

First time home buyers, baby boomers looking to downsize, and families looking to move-up in a home are all facing very limited inventory and crowds of competition for what’s available.

We’re going to need more than just increasing mortgage interest rates to slow the white-hot housing market.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe and/or give a gift subscription for others.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.