Retail Investors: The New Smart Money

How COVID Turned Retail Investors Into a Market Force

Wall Street has always had a condescending nickname for individual investors: “dumb money.” The institutions with their Bloomberg terminals, armies of analysts, and high-frequency trading algorithms were the smart money. Retail investors were just noise. They chased trends and provided liquidity for the professionals to profit from.

Then COVID-19 happened. And everything changed.

Retail Doubles Its Market Power

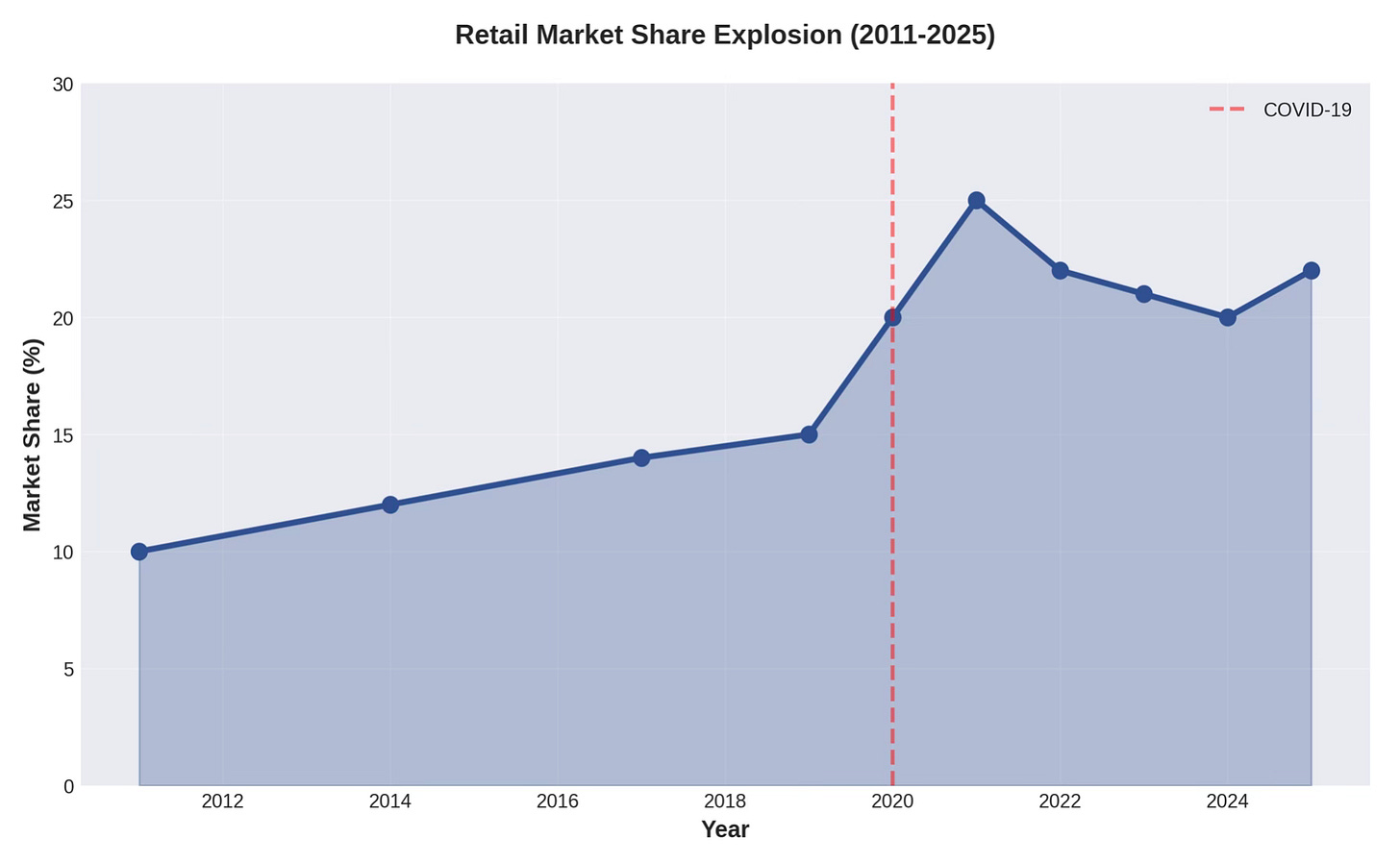

The numbers tell an incredible story. In 2011, retail investors accounted for roughly 10% of market trading volume. By early 2021, that figure had exploded to 25% and it hasn’t come back down. Today, retail maintains 20-23% of total market activity, representing a permanent, structural shift in market dynamics.

This isn’t a temporary phenomenon. Retail investors didn’t just show up for GameStop and leave. They’ve become a permanent fixture, now controlling approximately 52% of global assets under management and representing 58% of US households.

Retail Flows Hit Record Highs

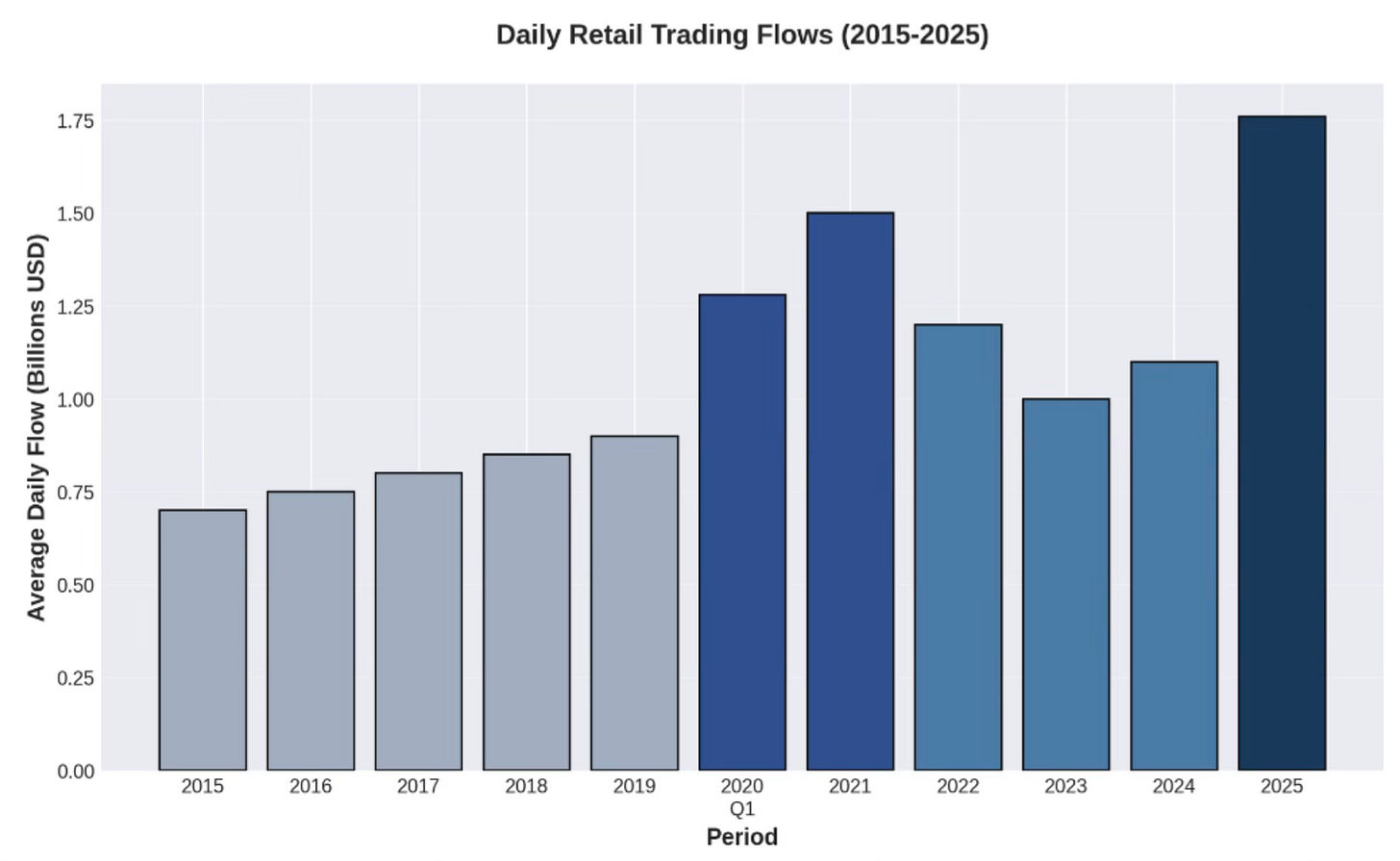

Here’s the part that should make Wall Street nervous: retail isn’t just maintaining presence, it’s accelerating. JPMorgan data shows that retail flows in 2025 jumped 60% from 2024 levels and are running 17% higher than the 2021 meme stock peak.

Retail investors are now over 20% of the total U.S. trading volume. Retail has now become a bigger force in the market than institutional long only and hedge funds.

Translation: The “fad” theory is dead. Retail participation isn’t a pandemic anomaly, it’s the new normal, and it’s growing.

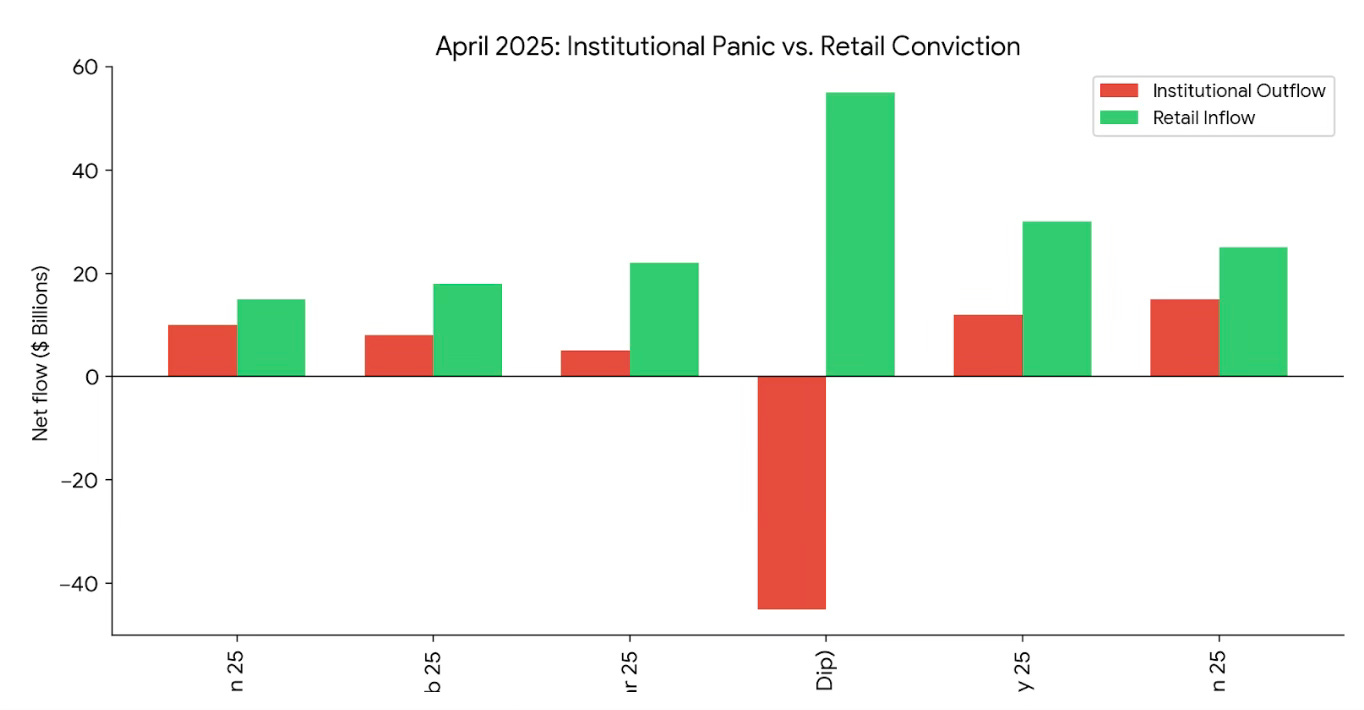

Buying the Dip (When Pros Panic)

The most significant shift is retail’s transition from “speculative gamblers” to “market stabilizers.” While institutional algorithms are programmed to sell into volatility (de-risking), retail has adopted a disciplined “Buy the Dip” (BTD) mentality.

In April 2025, when global markets wobbled due to the “Liberation Day” tariffs and institutional “fire sales,” retail investors poured in $1.3 billion per day.

When the “pros” ran for the exits, the individuals stepped up to provide the floor.

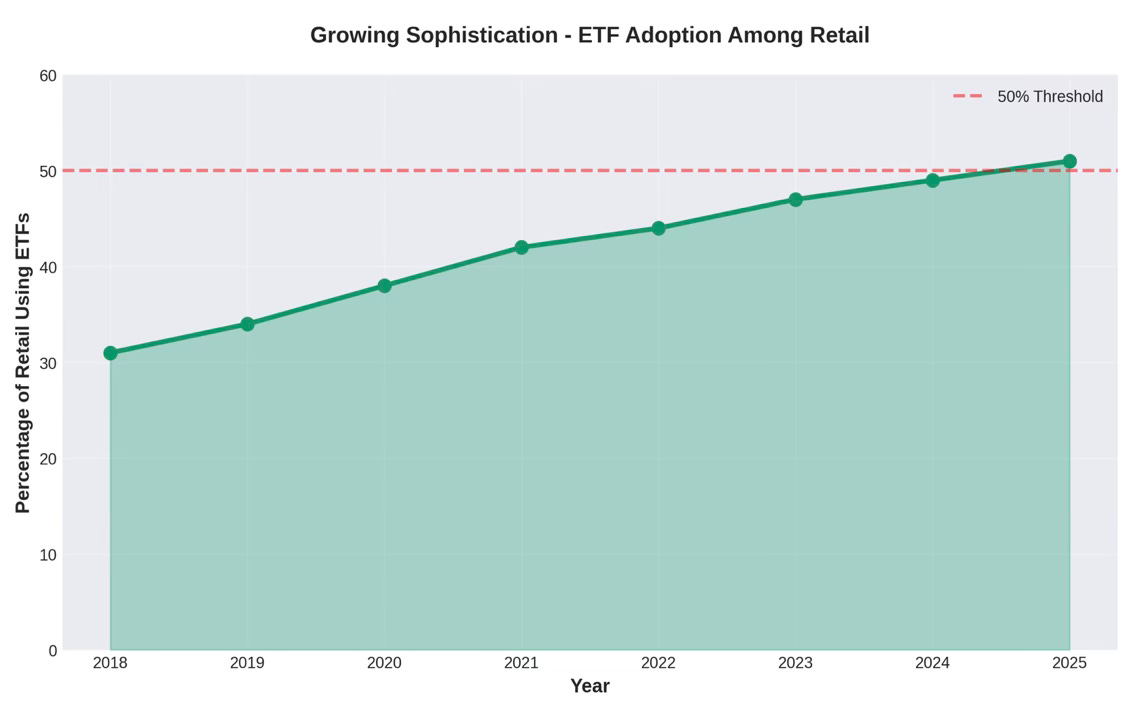

The Sophistication Curve: ETFs and Beyond

Broadridge’s 2024 study tracking 40+ million retail investors reveals a striking evolution: ETF adoption among retail investors has surged from 31% in 2018 to 47% in 2023, with projections to exceed 50% by 2025.

ETF usage signals sophistication, diversified exposure, lower costs and tax efficiency. This isn’t the behavior of unsophisticated gamblers. It isn’t gamblers just putting all their money on the hottest company that’s the most talked about on Reddit and X. This is the behavior of informed investors building proper portfolios.

112 Million Strong

The sheer scale of retail’s expansion cannot be overstated. The top six brokerages alone now service over 112 million retail investor accounts. That’s more than double pre-pandemic levels. This represents a fundamental democratization of market access.

Commission-free trading, fractional shares, mobile apps, and instant execution have transformed investing from what used to require $10,000 and a phone call to a broker now requires $1 and a smartphone.

Information Asymmetry Collapsed

Pre-COVID, institutions had Bloomberg terminals and armies of analysts. Today, retail has real-time data, social sentiment analysis, and crowd-sourced research that can rival or even surpass institutional reports. Reddit’s WallStreetBets alone has more than 15 million members sharing analysis and trade ideas.

Now Wall Street is tracking retail investors as closely as, if not more than, hedge funds. They want to know what retail is buying and selling.

The New Market Reality

The “dumb money” label was always Wall Street’s arrogance, not retail’s reality. Individual investors didn’t suddenly become smart in 2020. They simply gained the tools, access, and platforms to demonstrate the intelligence that was always there.

Today’s retail investor controls 20-25% of market trading volume, 52% of global assets under management, demonstrates contrarian buying behavior, uses sophisticated instruments like ETFs and options, maintains balanced portfolios with proper risk management, and can coordinate at scale to challenge institutional positions.

Institutions that dismiss retail as noise traders do so at their peril. The data is clear: individual investors have become a permanent, sophisticated, and powerful force in modern markets.

They’re not trying to beat the institutions. They’ve already changed the game.

The retail investor revolution isn’t coming. It’s here. The only question left is: who’s still calling it dumb money?

Sources: JPMorgan Chase Institute, Bloomberg Intelligence, MEMX, Claude, Broadridge U.S. Investor Study (2024), Vanda Research, Gemini, State Street, ScienceDirect, Gallup & Daily Chartbook

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.