Picking Stocks Is Hard

The challenge is as hard as ever

If you’ve ever bought a stock, you know the volatility that comes with it. There are the ups and downs. Odds are that you’ve even lost some money investing in individual stocks.

That’s the price of playing the game of picking stocks.

Picking stocks is hard for individual investors. It’s just as hard for professional investors.

Even with all the data, research teams and information that they have, they also struggle to pick the right stocks.

Just how hard is it by the numbers?

This may be one of my favorite charts on just how hard picking stocks is. It’s from Spencer Hakimian, where he stated the following.

Stock returns are so skewed to the 4% of stocks that are responsible for all equity market returns that have occurred in the past 100 years.

Statistically, it is virtually impossible to outperform an index over time since you would have needed to specifically own the tiny percentage of stocks that beat the index, and specifically avoid the vast majority of stocks that underperformed the index.

What an amazing stat. To think since 1926, out of 29,078 US stocks, only 4% of stocks are responsible for all market returns.

This makes the job for the professional portfolio managers extremely hard in trying to pick the right stocks. Then they have to outperform the overall market (S&P 500 index) which is most of their benchmark to beat.

Look at the high number of S&P 500 stocks that are underperforming the S&P 500 index. In 2023 and midway through 2024, roughly 2/3 of stocks have underperformed.

This has led to only 34% of large-cap mutual funds to outperform their benchmark. In 2023, it was 33%. Going back to 2007, the average percentage outperforming is only 38%.

If we zoom out even farther and look at an even broader view.

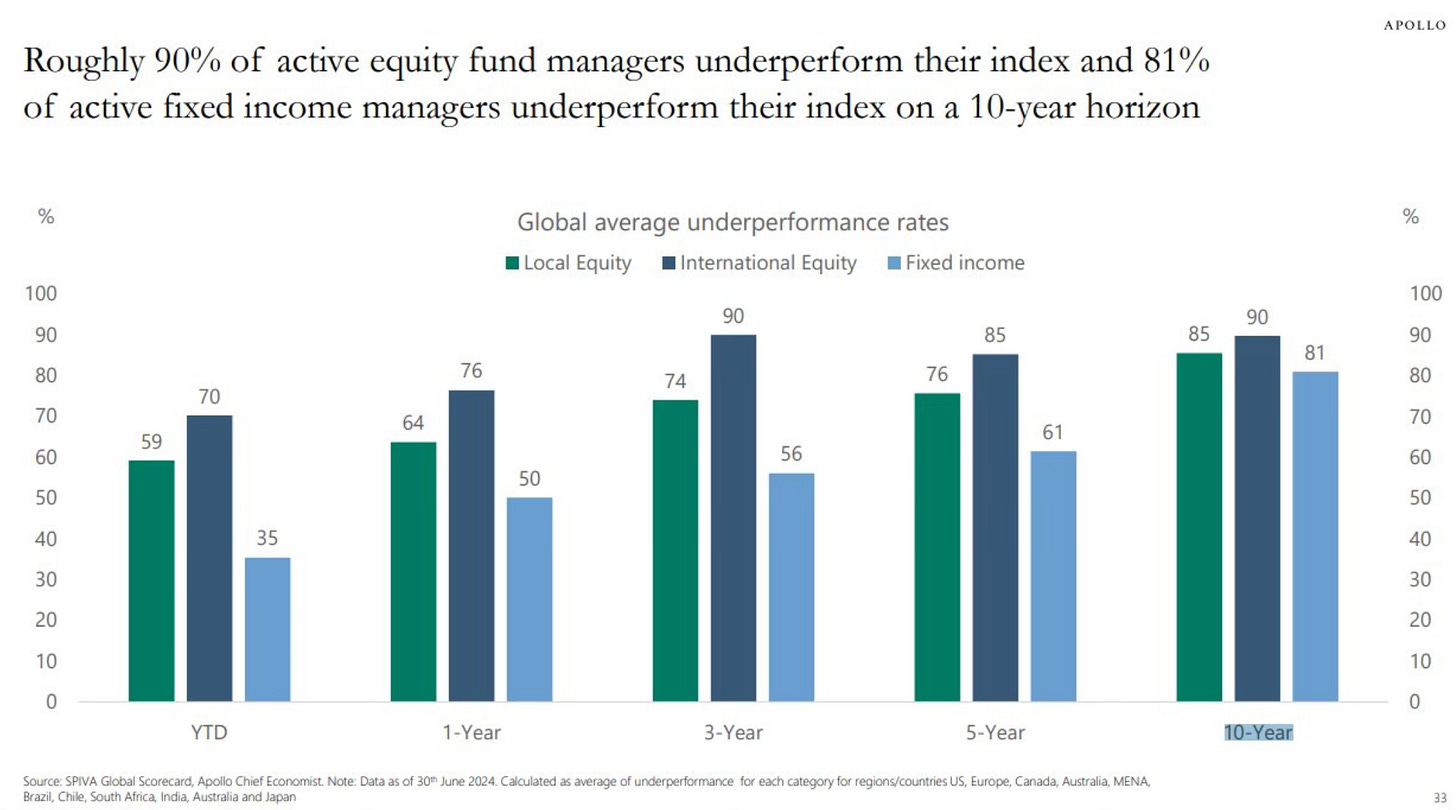

Over 90% of active mutual fund managers fail to beat their benchmark over 10 years.

Here is a breakdown by the percentage of US equity funds underperforming their benchmarks over 1, 3, 5, 10, 15 and 20 years.

It’s just so hard to outperform a benchmark because the biggest returns come from so few stocks. If you don’t own those few winners that outperform, there is little chance to beat the index.

The challenge of picking stocks continues to remain as hard as ever.

The Coffee Table ☕

Blake Millard wrote just a great piece about the life challenges we face and how people can move through them in Carry on my wayward son (there’ll be peace when you are done). As I read this, there are a number of things that I could relate to in my own life.

Here we go again. Lumber is back on the rise. It’s at a 6 month high.

Source: Barchart

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.