People Have More Money Than Ever

A look into the health of American consumers

It’s no secret that seemingly everything costs more today than a few years ago. Inflation has taken its toll on goods and services since the pandemic. Everything you buy has gone up in price.

But on the flip side, have you checked your 401K balance? Do you know how much your home has increased in value? Do you have a higher net worth, more assets and cash than you ever have before?

This has been a hotly contested financial arena over the past few years. On one hand, you have much higher prices on just about everything you buy. On the other hand, you have stocks at all-time highs and homes are worth more than ever before.

So how is the health of the American consumer?

Let’s first start with hourly earnings and wages. This has been one of the main drivers in driving up inflation. The cost to employ and hire people has risen dramatically. But who doesn’t like making more money? Aren’t rising wages good?

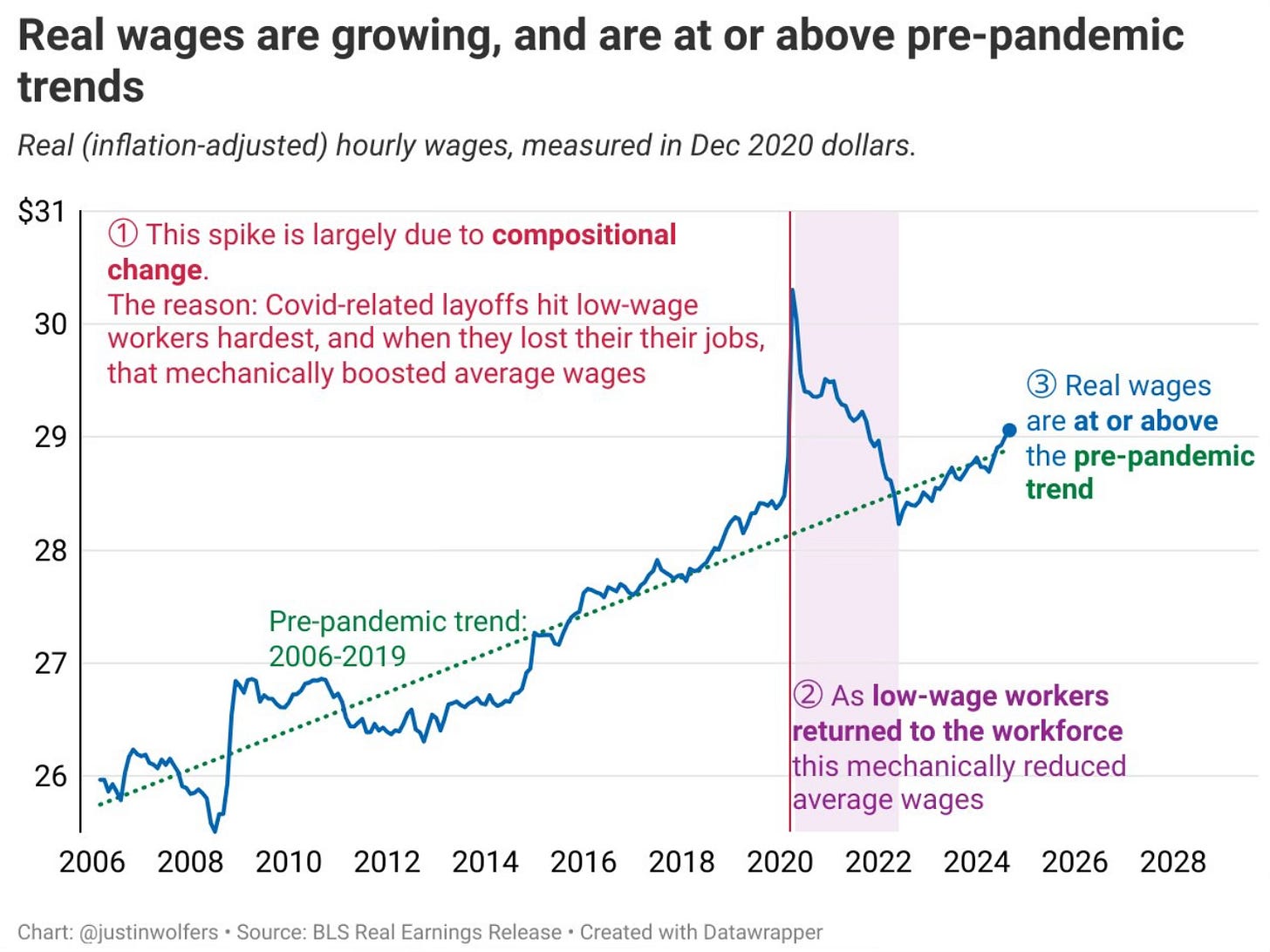

There was a record 25 consecutive months of negative real wage growth. That changed and wages have now outpaced inflation on a YoY basis for 17 straight months.

I love this chart that gives a look at how much real wages are growing. They’re now above the pre-pandemic trend.

This is a great sign for the American workers. I don’t think anyone will disagree with that.

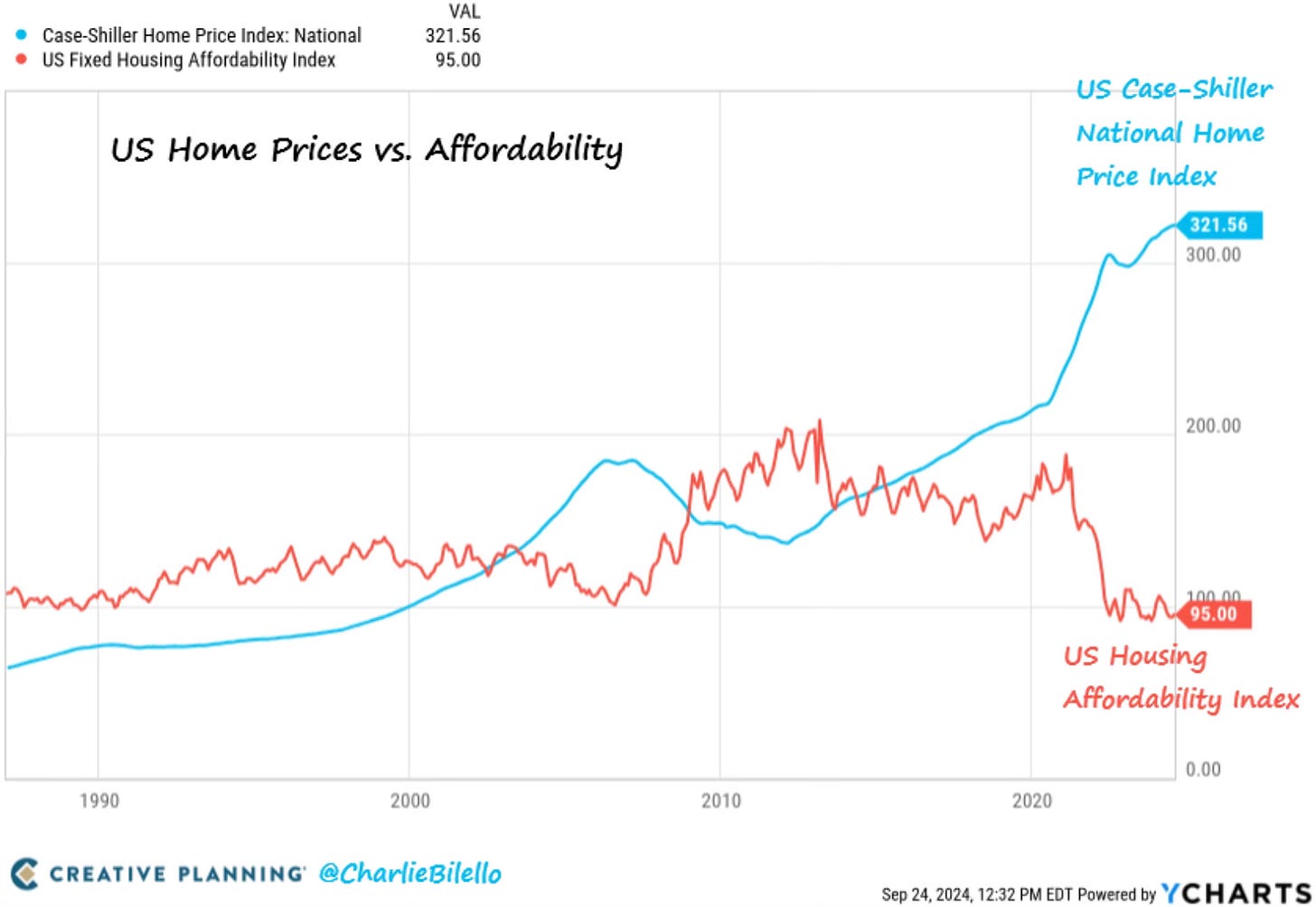

If we look at housing, the rise in costs has helped current homeowners as the value of their homes have jumped just by owning a home. If you don’t own a home, you’ve watched home affordability drop to an all-time low.

Record housing prices can be expected to hurt the affordability aspect. There are tradeoffs. You can’t have it both ways. It’s how economics and markets operate. Not everything can be perfect. In fact, is anything ever truly perfect?

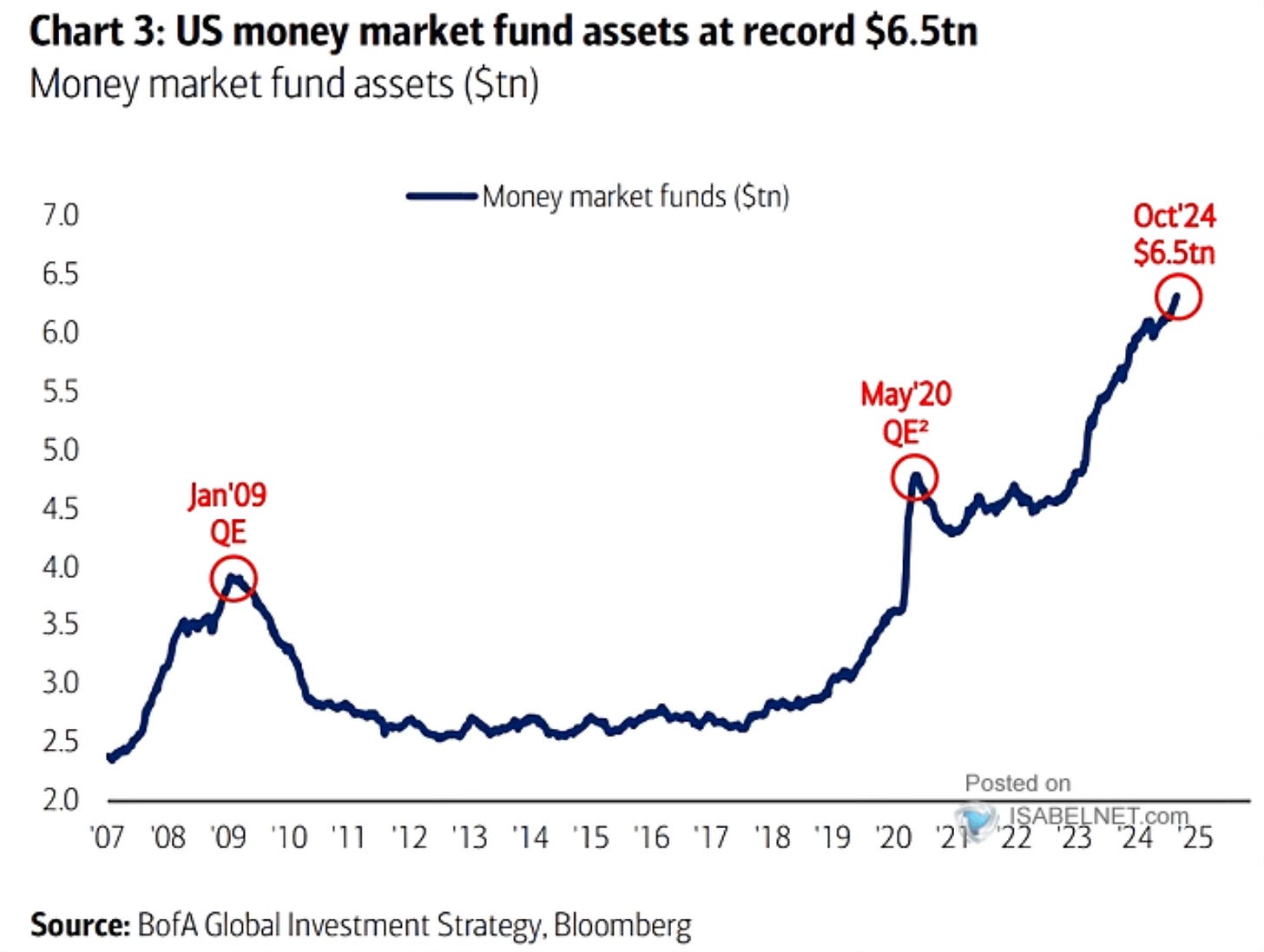

It has been many years since consumers were able to get any returns on their cash. As cash has been earning around up to 5%, look at where money market assets have gone to. People have a lot more cash.

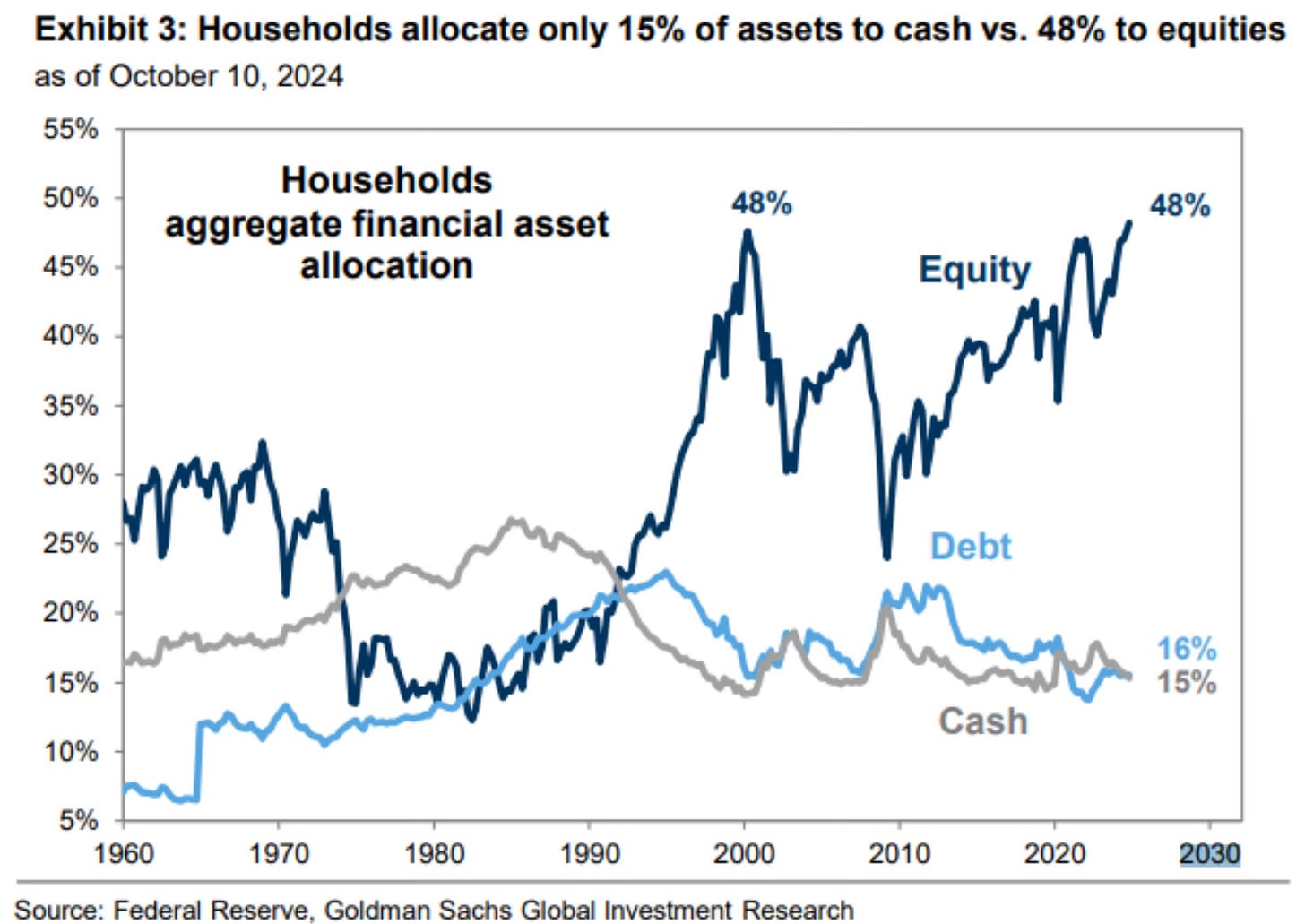

Even despite the large money market assets, the household allocation to cash is near record lows. 48% of financial assets are actually held in equities. With stocks at all-time highs, people are loving what their 401K statements are showing.

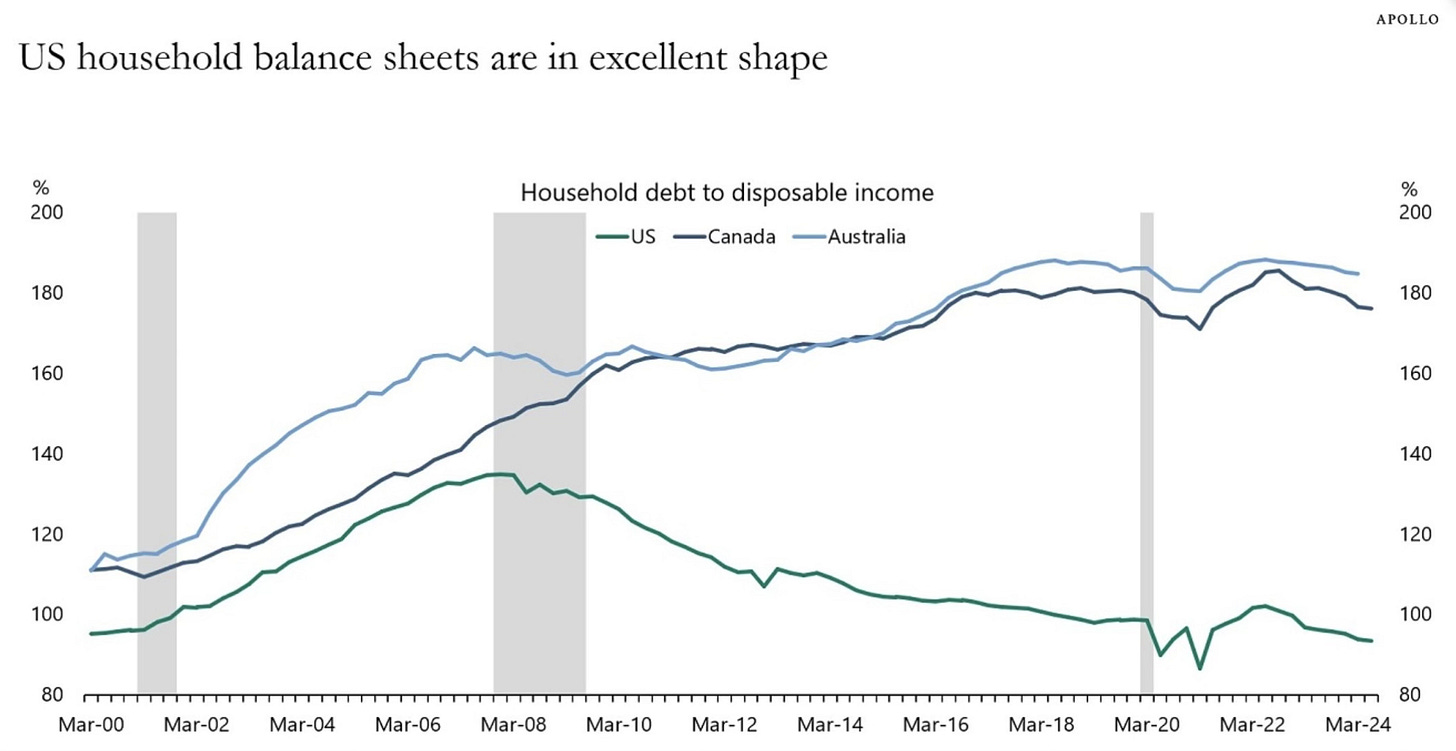

The balance sheets of American consumers are among the best on record. US household debt as a share of disposable income is near at an all-time low.

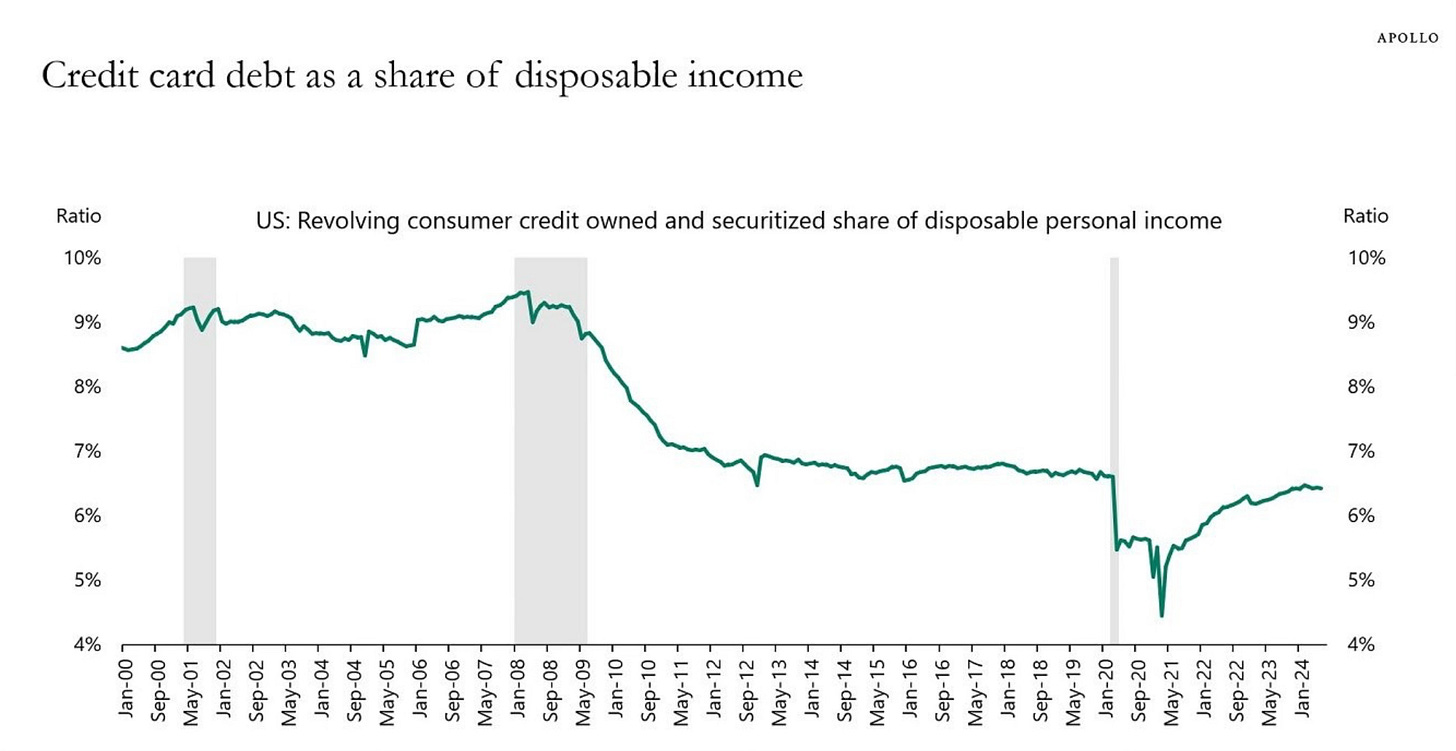

Credit card debt as a share of disposable income is also still at low levels.

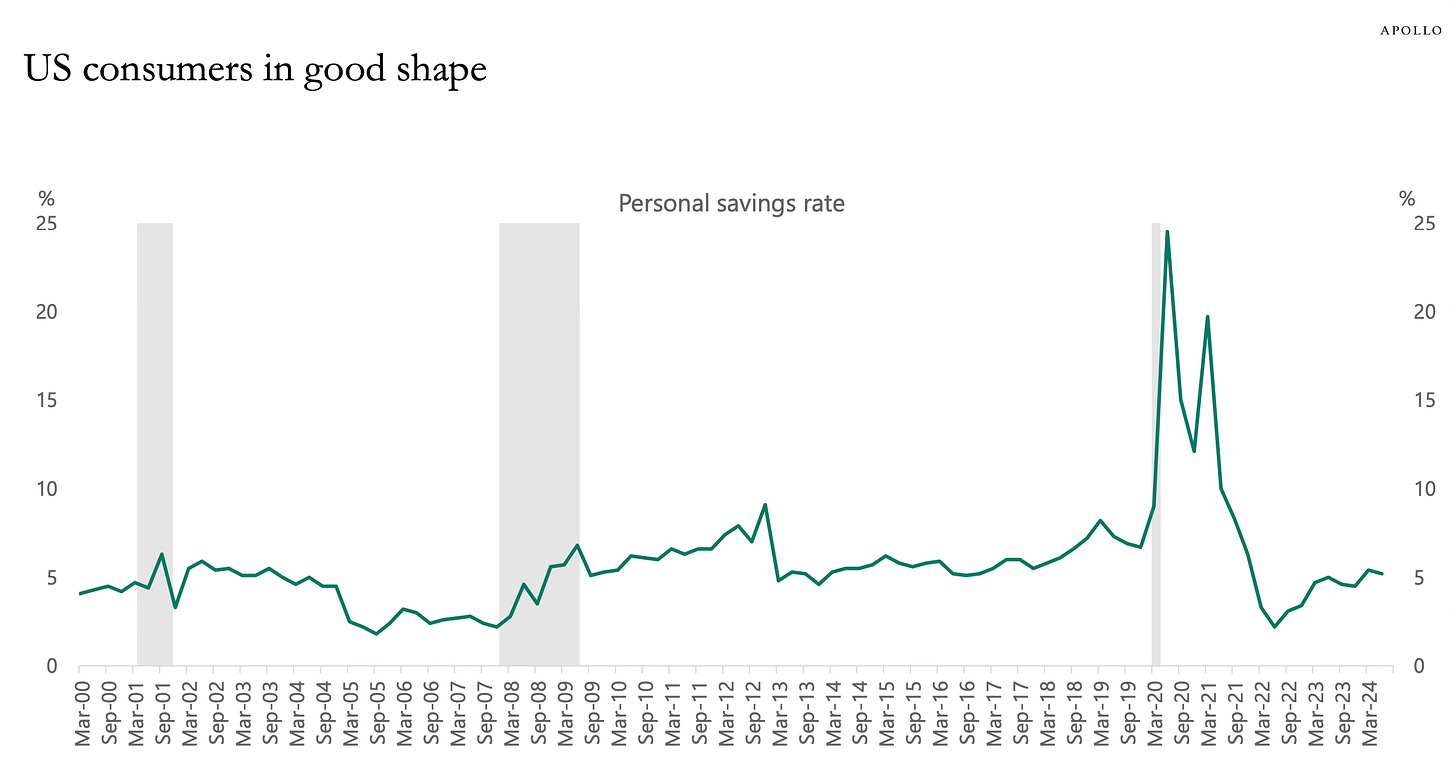

The personal savings rate has now even bounced off all-time lows and has ticked upward.

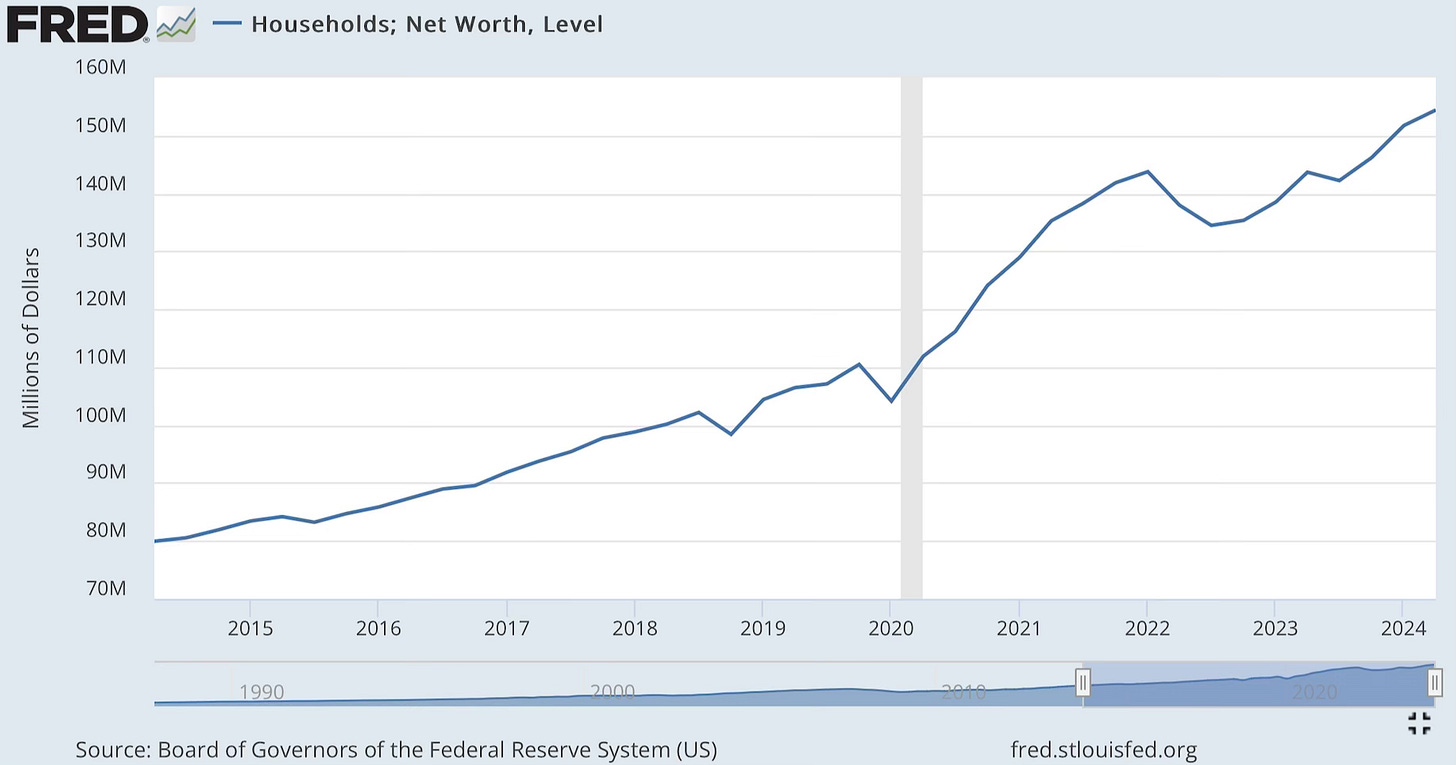

This has all resulted in household net worths being at all-time highs. In fact, in the past 5 years, US household net worth is up by over $50 trillion.

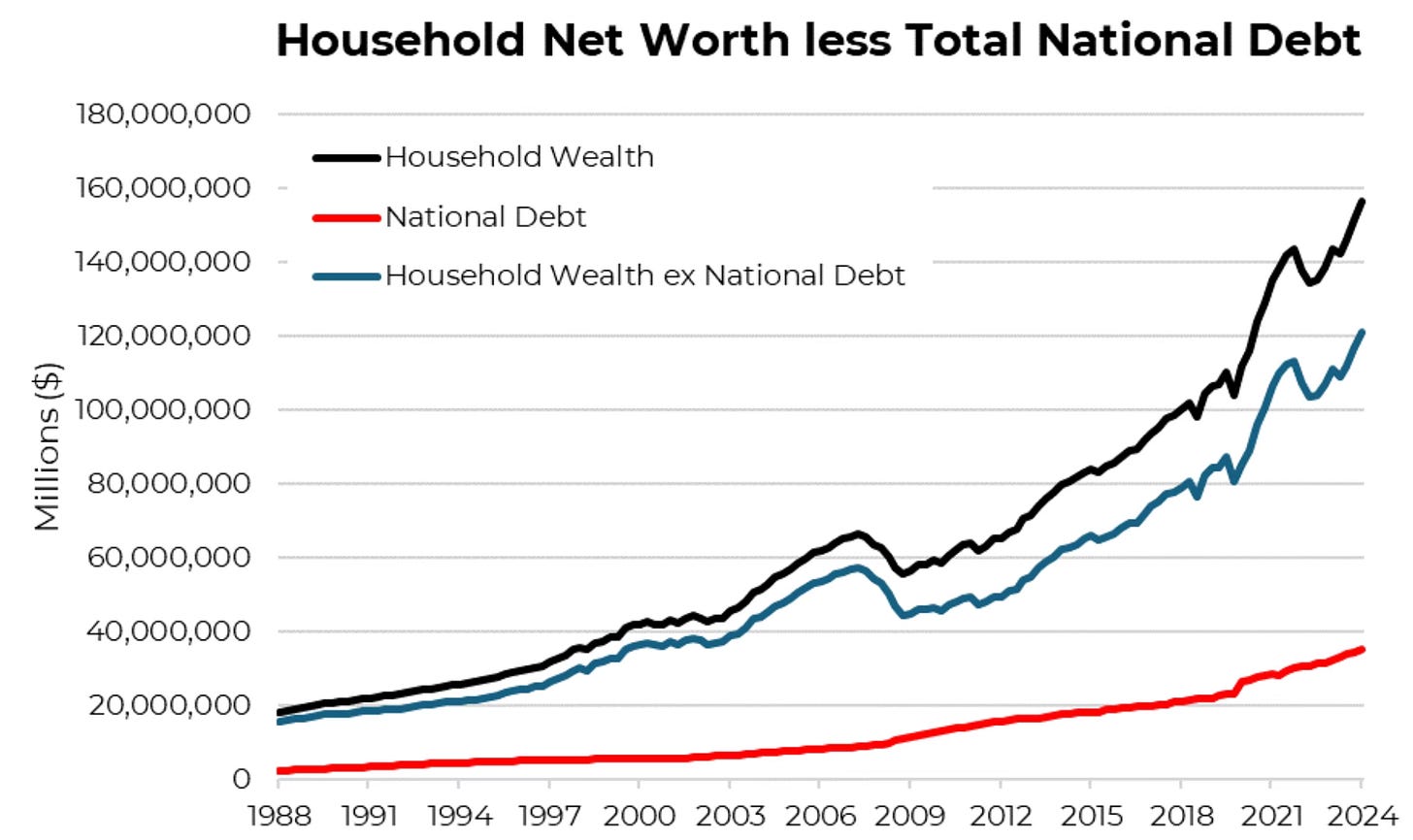

Yes the large amounts of stimulus helped boost this and also ballooned the national debt. But take a look at household net worth less the national debt. This chart is really something.

The owners of financial assets have seen the benefit by watching their net worth rise. It’s true the more financial assets you have the better off that you currently are financially. Is that statement different today than any other time in history? It’s why owning financial assets is a primary goal.

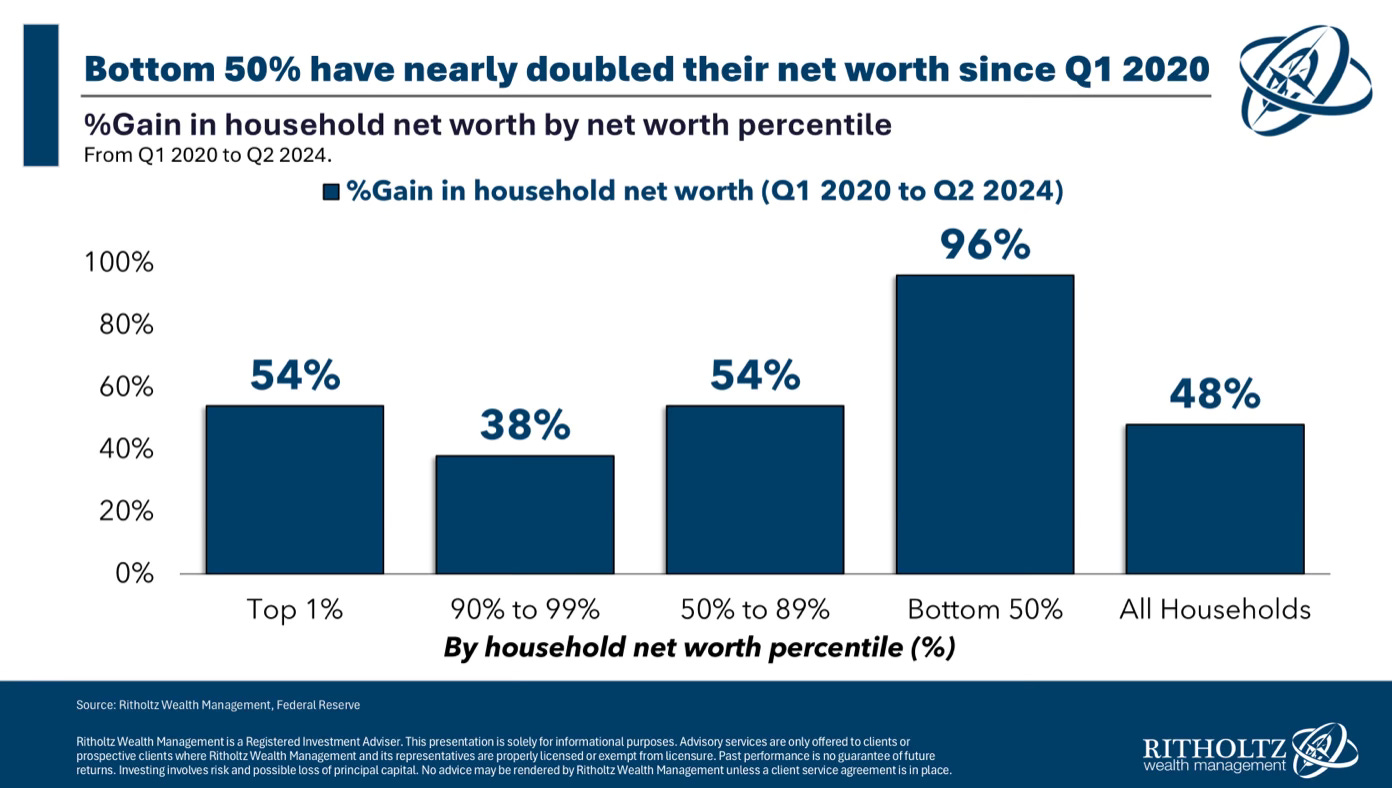

But this isn’t just only benefiting the rich and ultra rich. It’s everyone.

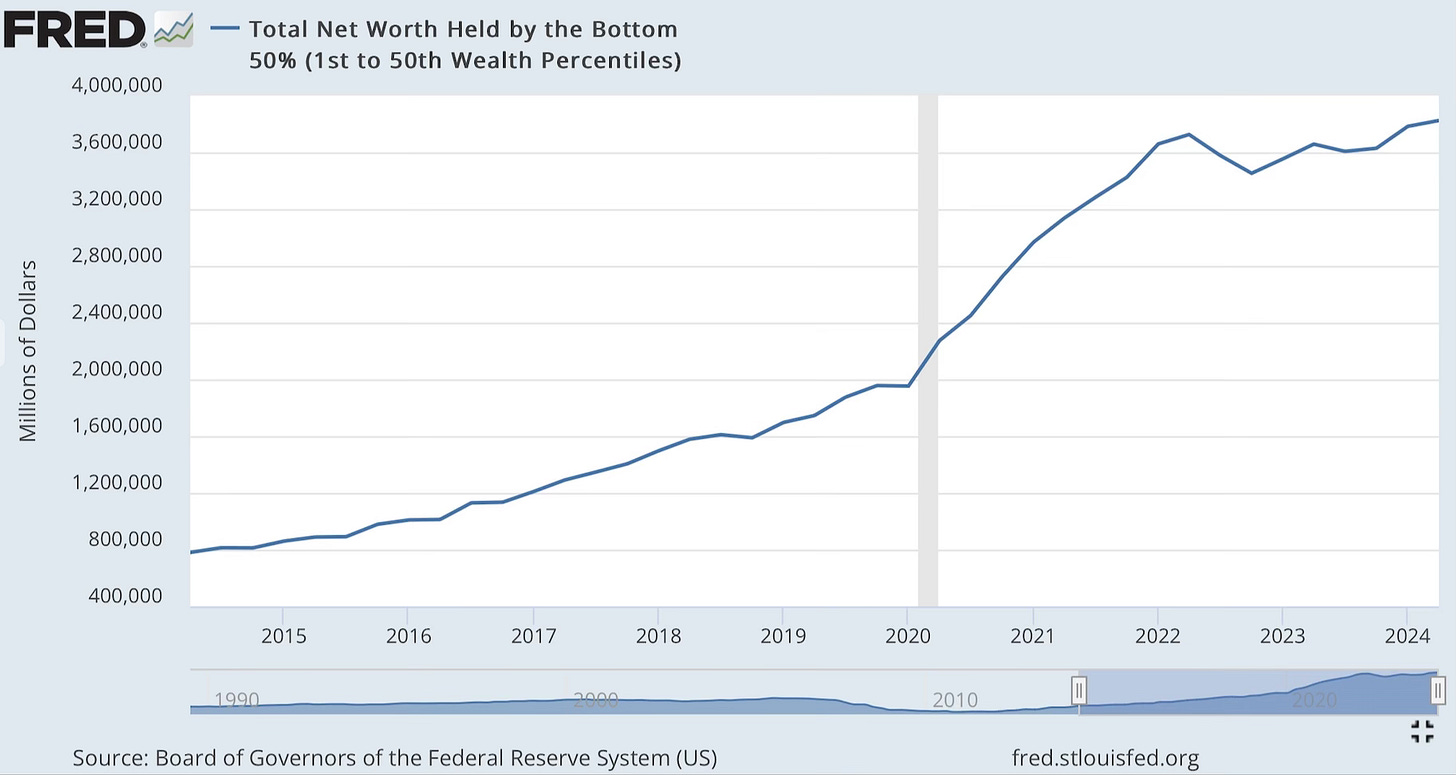

The net worth rise has also dramatically affected the bottom 50%. Their total net worth is also at an all-time high.

The bottom 50% have nearly doubled their net worth since the pandemic. Far better than another other household segment.

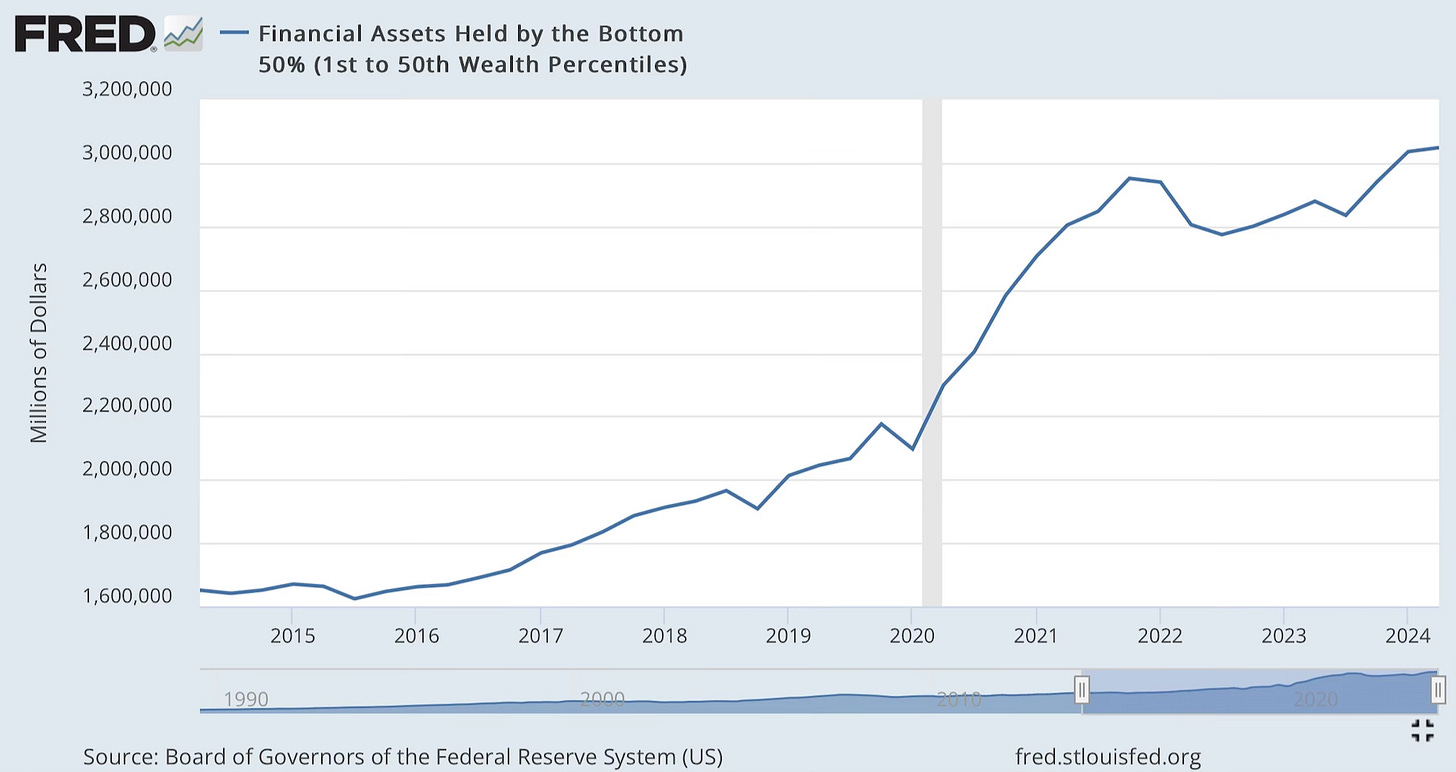

Look at what the financial assets of the bottom 50% are like now.

There is no debate. Yes things cost more but people are better off financially now more than any other time before.

Rising asset prices like stocks and homes at all-time highs, combined with rising wages really is the perfect situation. Has there ever been a better scenario than this for the American consumer?

People have more money now than ever.

The Coffee Table ☕

For a long time I’ve heard how Vanguard, BlackRock and State Street own and control everything in the financial markets. The statement has been flat out wrong. Nick Maggiulli had enough of it and wrote a great post on the topic called, Do Vanguard, BlackRock, and State Street Run the World? I like how Nick broke down this controversial topic.

The guys on The All-In Podcast had a great conversation about the looming issues surrounding homeowners insurance in Florida after hurricane Milton and all over the country. There is a short clip below from Twitter, otherwise you can view/listen to it on YouTube here or Apple Podcasts here. The first 30 minutes of the show is spent on this topic. It’s really interesting.

Source: QE Infinity

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.