Offsides

When caution becomes the bigger risk

Money on the sidelines has jumped back into the headlines.

When people say there’s “money on the sidelines,” they’re usually referring to cash, whether in money market funds, bank accounts, or simply not allocated to stocks or risk assets. But that money doesn’t sit idly waiting for a whistle to blow. It’s earning 5%. It’s part of the game already. The sidelines aren’t empty bleachers; they’re a high-yield lounge with bottle service.

That’s important context, because the idea that money will suddenly “come off the sidelines” and push markets higher oversimplifies how capital moves. Flows don’t just surge because someone’s sentiment meter flips from red to green. They shift based on incentives, fear, performance pressure, and often, pain.

That brings us to where money markets are currently sitting at. They’re at a new all-time high level of $7.24 trillion.

Now on that same line of thinking is where the cash positions are at for checking and savings accounts at banks. They’re also at very healthy levels.

What about the positioning of money that is allocated to stocks or risk assets?

I’ve shared this chart a few times that shows just how underweight fund managers are in equities. Even after the recent run in stocks, their allocations have not budged.

Fund managers are the most underweight equities since May 2023.

Goldman’s global equity positioning still shows a low appetite for risk. "After six consecutive weeks of rising, consolidated equity positioning at the 23rd percentile indicates a notably cautious environment, signaling that investors are hesitant despite the recent market uptrend."

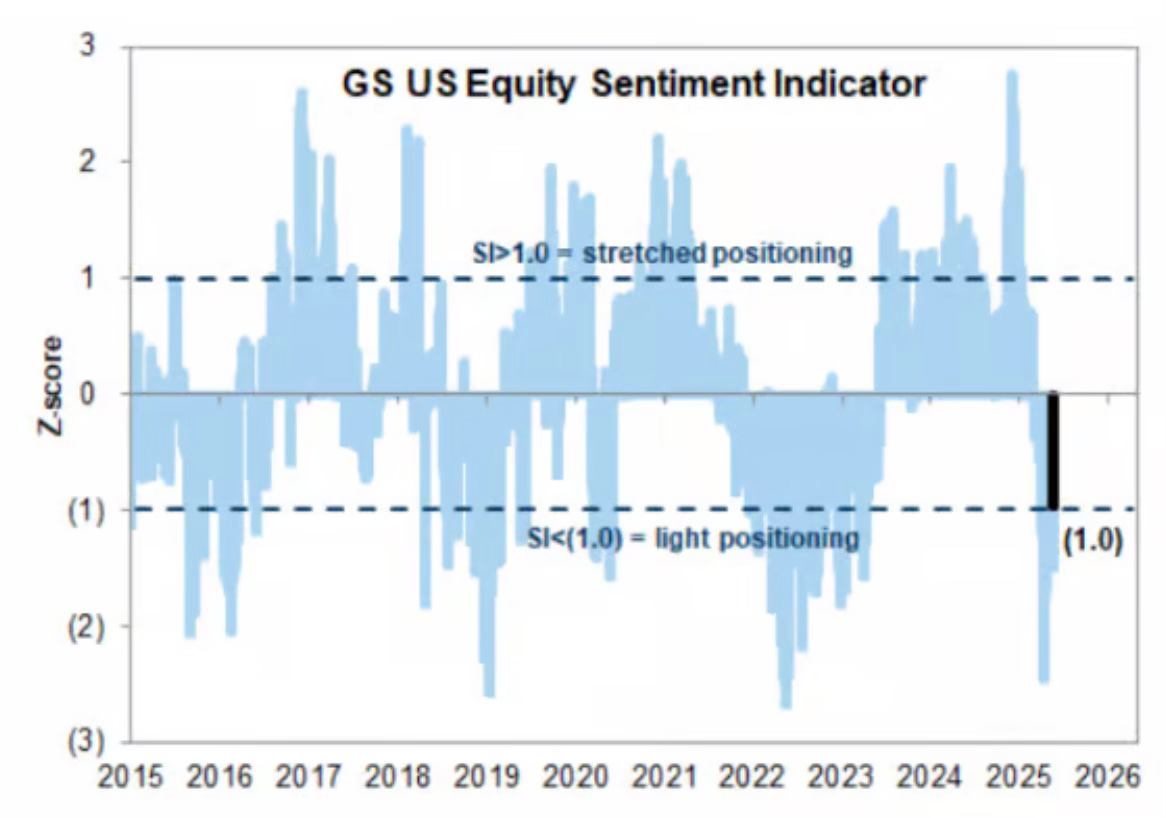

Goldman also recently released the U.S. equity sentiment indicator and it points to light positioning.

It’s also evident in the mega-cap growth and tech positioning. The appetite for risk just isn’t there. At least not, yet.

Professional investors are not positioned for a rally. Definitely not a rally that leads to new all-time highs.

Being underexposed when the market runs isn’t just a missed opportunity. It becomes a problem. Especially if you're managing other people’s money. That pressure of relative performance, of benchmarks you’re not keeping up with, builds and builds until it forces a decision. Eventually, they buy. Not because they want to, but because they have to.

There is nothing wrong with being cautious but being offsides at the wrong time can cost you. If institutions are underweight, retail is skeptical, and yet the market keeps drifting higher, it’s not noise, it’s a signal. Price is truth, and positioning tells the story.

The Coffee Table ☕

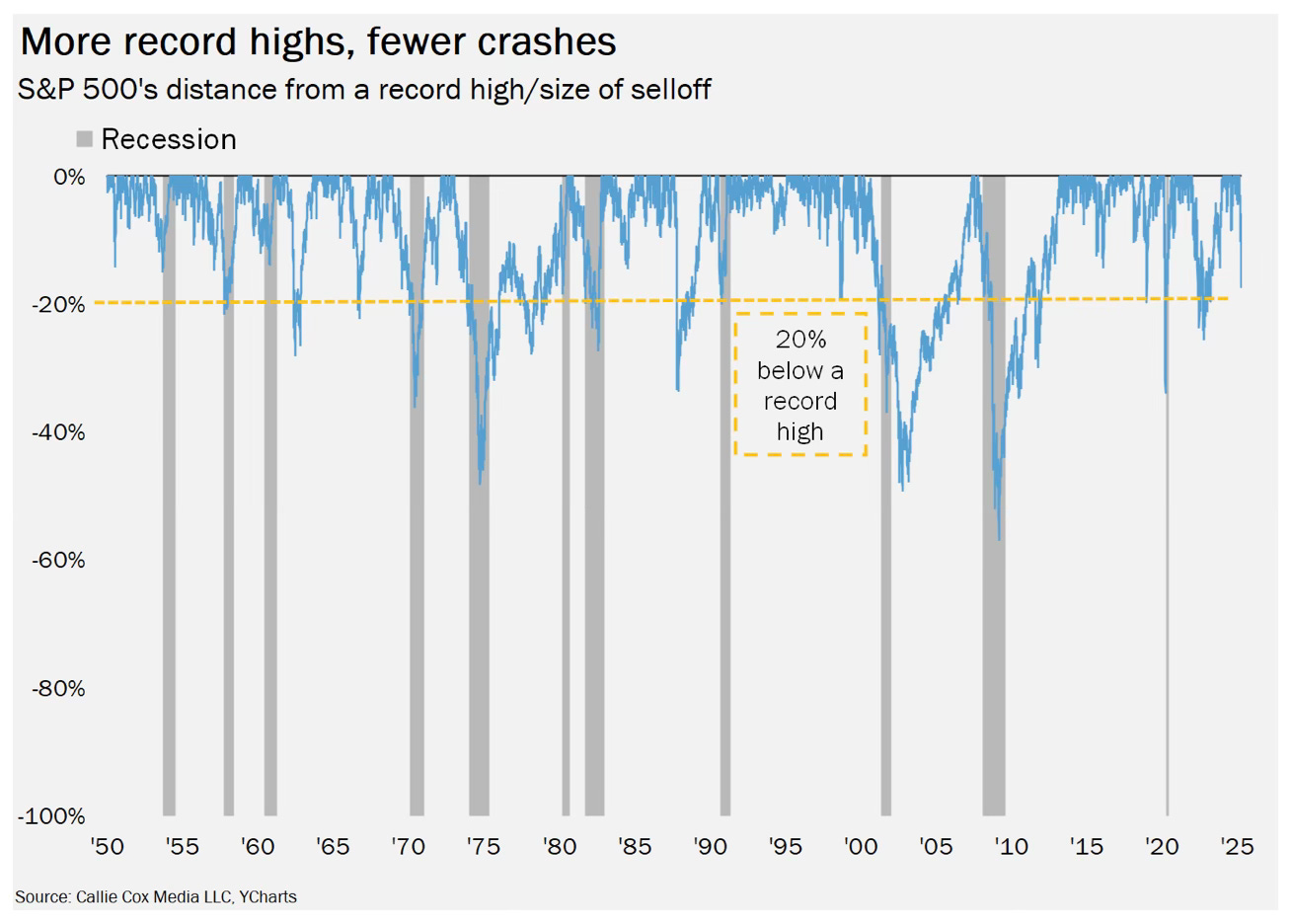

I liked Callie Cox’s piece called Five mind-blowing market facts that will make you a better investor. These are such good points to always keep in mind. My favorite chart and point was “the S&P 500 has climbed in 80% of all 12-month periods since 1990, and closed at or near a record high in one out of every four days.” Think about that.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.