My Portfolio Breakdown

How I invest and what stocks I own

When I started investing and buying stocks 20 years ago, I really didn’t know what I was doing.

After reading about successful investors and all the popular investing books, I figured the only way to figure this out was by doing it.

So that’s what I did. I started buying stocks. First I bought stock in the companies I knew. Then I learned more about valuations and all the metrics that go into measuring the financials of companies.

As I made more money, I invested more. I would max out what I was allowed to contribute to my retirement account. Then after that, I would invest into stocks.

20 years later that same process holds true today. I put the maximum in my small business retirement account and after that, I put money into stocks.

How I invest in my actively managed portfolio of stocks has changed. About 10 years ago I decided to adjust how I invested. There were traditional ways of investing in stocks and managing a stock portfolio that I didn’t care for. I wanted to invest in stocks my own way.

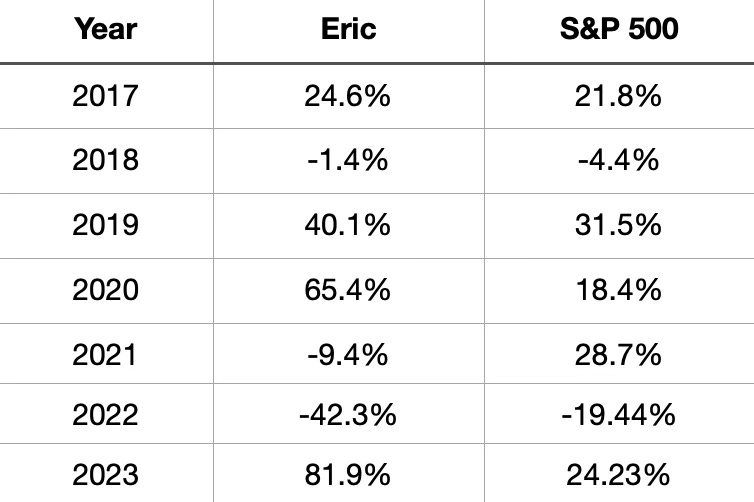

My way was working out well. So 7 years ago, I started to measure my performance against the S&P 500.

I’m very pleased with how my actively managed portfolio has performed over the past 7 years. Out of those 7 years, I’ve managed to outperform the S&P 500 in 5 of the years. YTD through August 31st, my portfolio is up 30.6%, while the S&P 500 is up 18.4%.

These have been my portfolio returns the past 7 years versus the S&P 500.

Let’s take a look at what’s inside my portfolio and how I invest.

Here is a breakdown of my portfolio as of 8/31/2024.