When people mention if the stock market is up or down, they are usually referencing the three indexes which you see in the papers or on television. The Dow, S&P and Nasdaq. What exactly do each of these three include?

The DOW (DJIA-Dow Jones Industrial Average) which is made up from 30 of largest and most traded stocks. The S&P 500 (Standard & Poor’s 500 Index) which is comprised of the 500 largest publicly traded companies in the U.S. Then the Nasdaq (National Association of Securities Dealers Automated Quotations) which is an index made up of over 3,000 stocks of the world’s foremost technology and biotech companies.

For many, investing means having money in the overall stock market. This is achieved through owning a S&P 500 index fund through their retirement plan. This is one of the best ways to receive broad and diversified exposure to 500 of the largest companies in the U.S.

Others prefer to buy individual stock of certain companies. The reasons that people have for owning a stock in a certain company are countless.

The reasons I have bought stocks over the years boils down to my concept of buying what I know, like and use.

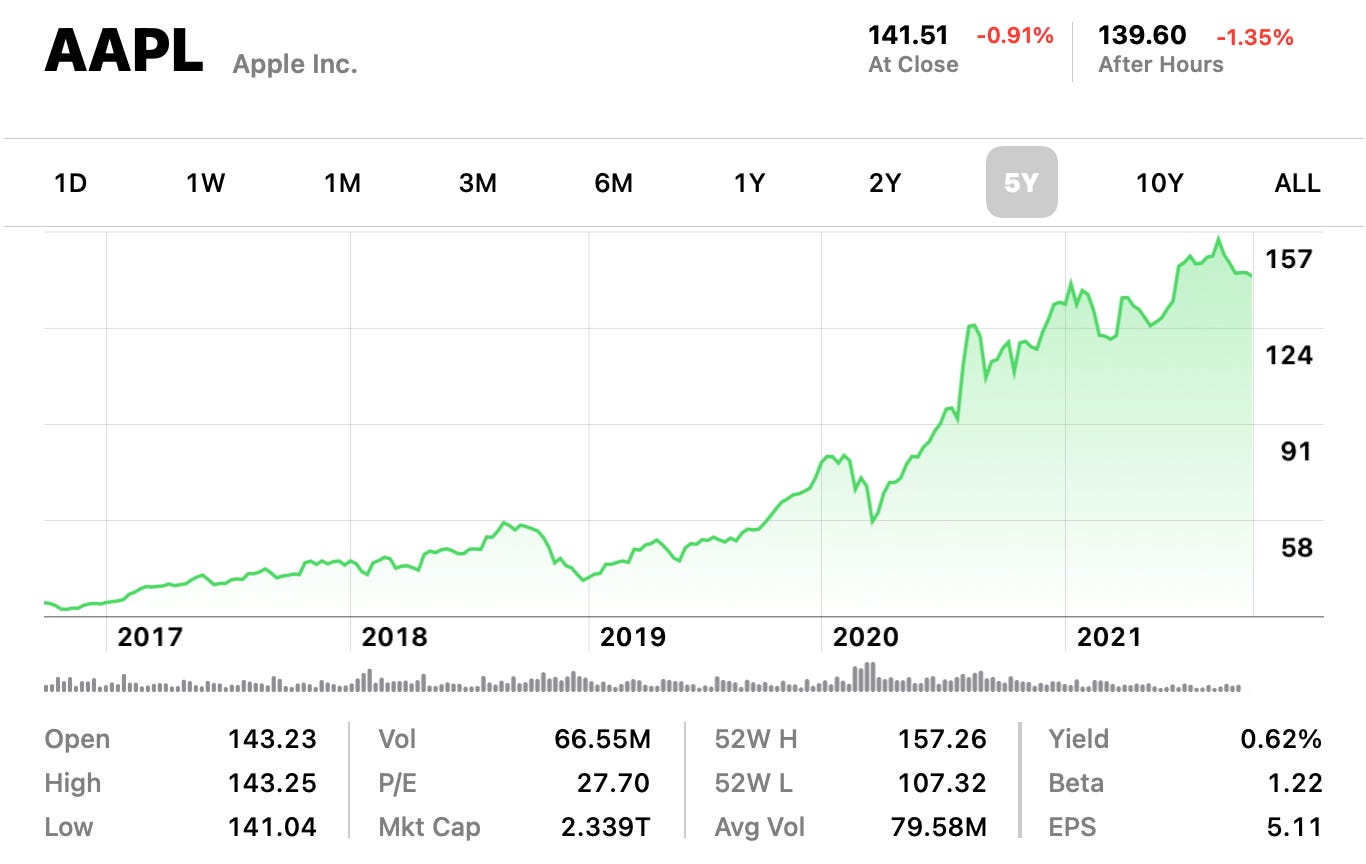

This has led me to the buying of Apple (APPL), Amazon (AMZN), Disney (DIS), DraftKings (DKNG), Starbucks (SBUX) and Peloton (PTON). I still own all of these stocks today. In the cases of Apple, Amazon and Peloton, these stocks have given me a return of 5x (500%) or more. One of my goals when I’m buying a stock is that I believe it can have a return of 5x or more over the long term.

One of the greatest investing books ever written is, One Up on Wall Street: How To Use What You Already Know To Make Money In The Market By Peter Lynch. Lynch is one of the most successful money managers in history. He managed the famed Fidelity Magellan Fund.

This has been the most influential investment book I’ve ever read. The first time I read it was in 2003, while still in high school. Since then I’ve read it three more times. It’s taught me many very simple investing principles that I still use today.

The back cover illustrates a key concept from Lynch. Investment opportunities abound for the layperson, Lynch says. By simply observing business developments and taking notice of your immediate world -- from the mall to the workplace -- you can discover potentially successful companies before professional analysts do.

Have you ever done this yourself? I know you’ve said to yourself, I should just own stock in this company or I wish I had just bought stock in that company. You are your best research for identifying some of the greatest companies in the world. Many times this can be done very early on by just looking at what you’re buying.

If you own or work at a company and there is a certain product or system that is just awesome and the best in class, why don’t you own stock in it? Is a product changing your industry or how you do your work? Why aren’t you owning their stock?

Let’s look at the stock of the following six companies. All of these companies are very well known and many of you and/or your spouses have probably spent a lot of money. Here are the charts showing what these stocks have done over the past five years.

Now I have to ask, do you own any stock in these companies? How much money do you think you’ve given these six companies over the years?

Here are some things to consider with buying what you know, like and use.

Look through your credit card statements. What companies are giving your money to?

Notice what brands friends and family are buying.

Is someone always talking about a certain company or brand?

What does your company use, sell or install that is superior to its competitors?

What products do you love?

What companies are you a huge fan of?

Think of the companies that fit this bill for you. Are you fans, buyers or users of Yeti (YETI), Canada Goose (GOOS), Ulta (ULTA), Home Depot (HD), Lowe’s (LOW), General Motors (GM), Tesla (TSLA), Ford (F), Polaris (PII), Salesforce (CRM), Lululemon (LULU), Netflix (NFLX), Airbnb (ABNB), Zoom (ZM), or Uber (UBER)? The list can go on and on. Buy stock in companies that you know, like and use. Make investing fun for yourself!

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe and/or give a gift subscription for others.

To share this post and Spilled Coffee with others, just click below to share it.

Disclosure: I’m an investor with a long position in the following companies mentioned above; Apple, Amazon, Peloton, Starbucks, DraftKings, Disney and Uber.

Disclaimer: This is not investment advice. You should not treat any opinion expressed as a specific inducement to make a particular purchase, investment or follow a particular strategy, but only as an expression of an opinion.