Learning From the Top Stock of the Past 20 Years

It's not the company that you think

If you were to ask people what stock has been the biggest winner over the past 20 years, you’d get a lot of Apple, Amazon, Google, Nvidia and Netflix. Warren Buffett’s Berkshire Hathaway is a good guess.

All those popular guesses would be wrong. The best stock investment over the past 20 and even 30 years has been hiding in plain site at your local gas station.

It’s Monster Beverage.

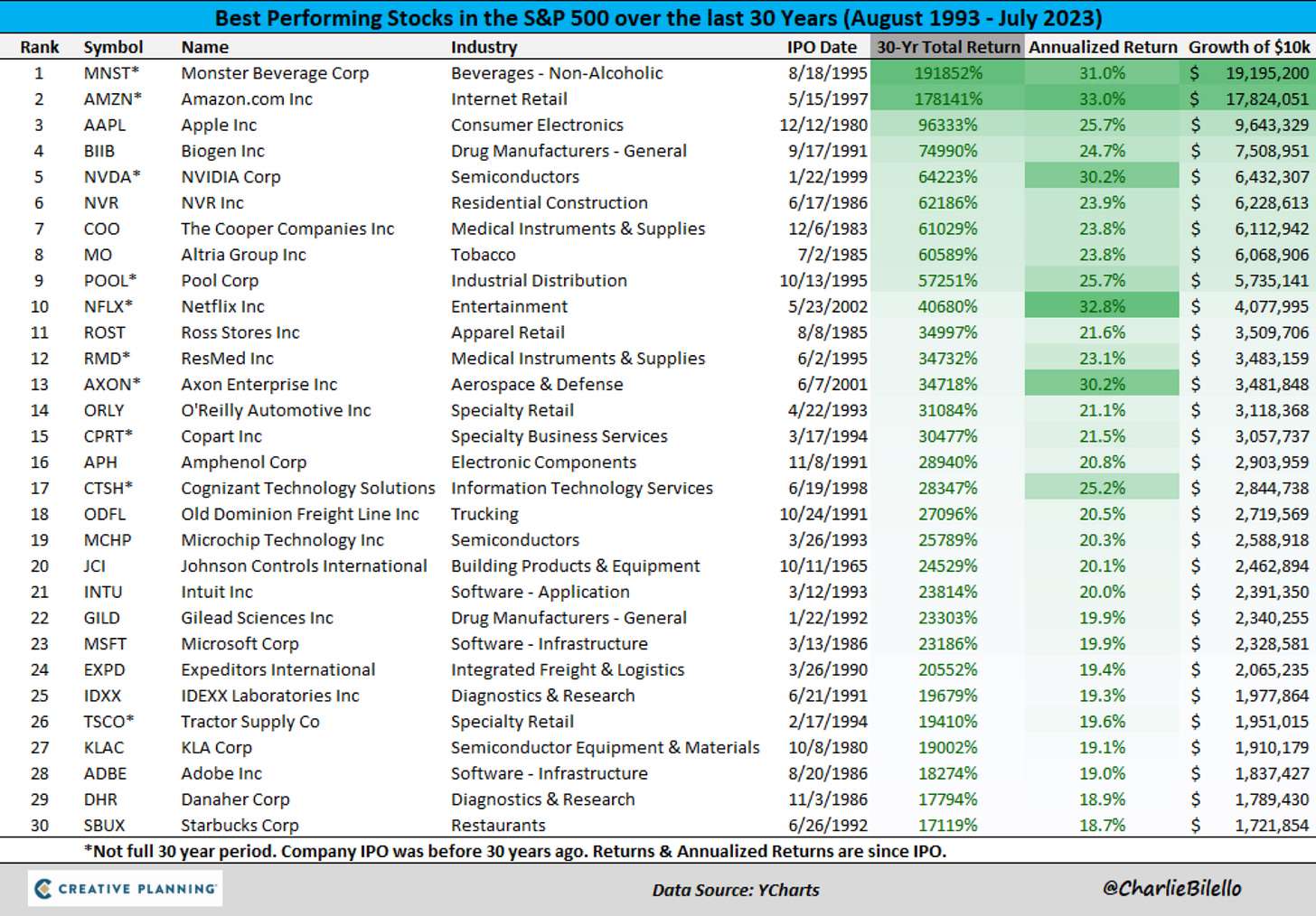

This chart is from almost two years ago, but you can still see the sizable gap from Monster to Apple and Amazon over that 20 year timeframe.

Even if you go back 30 years, Monster Beverage is still the leader.

How does an energy drink outperform everyone else? What makes it special over the tech giants and some of the greatest companies ever? Why have I never tried a Monster Energy drink?

Those were the questions that crossed my mind when I saw that Monster has been the best performing stock over such a long period of time and arguably the greatest stock ever.

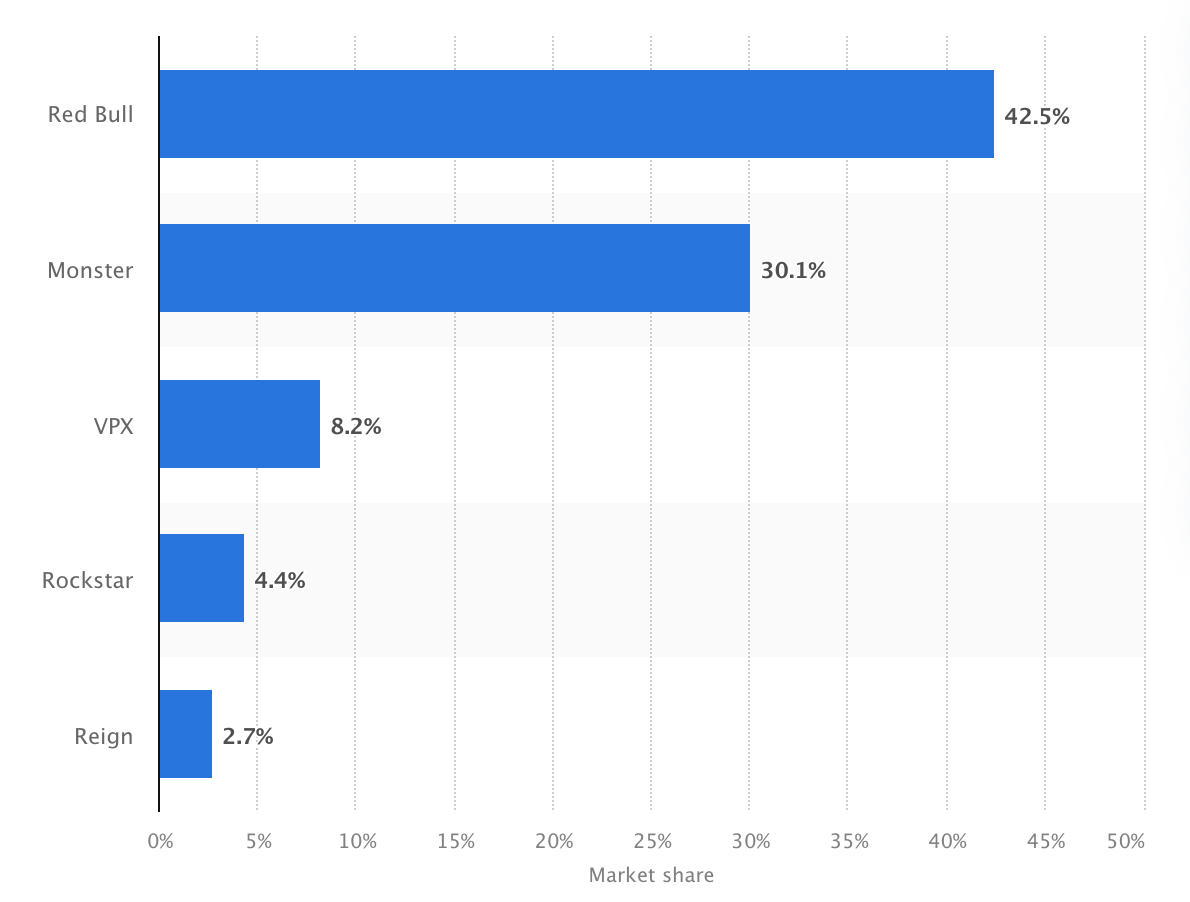

This is even more impressive as it isn’t like Monster has one market all to themselves or no competition in their industry. In fact, they aren’t even the leader in market share for energy drink brands. They’re a distant second to Red Bull.

Here is the market share of the leading energy drink brands in the United States in 2022.

What Monster does is it excels at finding untapped niches that can keep sales coming.

Monster started with the energy drink business. That’s obviously what grew the company and made it what it is today. They grew that by finding a niche, then embracing it and by going all in.

They’re now tapping into a new segment with adding alcoholic beverages and energy drinks targeted at women. That’s interesting as nobody else is currently doing that.

Their niche targeting has been different from what others do. They know who their customer is and have built around it. I’ve written about both of these topics recently.

What exactly is that niche and how do they target off of that?

Monster is well-known for its sponsorships and connections to those who love adventure, sports and action. Anything across land, water and snow. Motocross, wakeboarding, drag racing, mountain biking, skateboarding, snowmobiling and other outdoor sports. They also target those who enjoy gaming (esports).

The deep connections to those sports, its athletes and fans have built a fierce brand loyalty. That has allowed Monster to have aggressive marketing campaigns targeting these groups in the ages of 18 to 34. Who else is targeting these events and its fans? It’s the textbook definition of knowing your target market and growing a niche around it.

Monster is also the alternative to coffee and tea. Although those are extremely popular, there is a segment of people who don’t like them. Everyone seems to have to drink something in the morning. Monster has become their alternative. It’s the morning substitute for coffee and tea.

They also sport a larger can at a cheaper price than their main competitor Red Bull.

This all comes together to tie into one of its benefits, availability. You can buy it at almost any convenience store and supermarket.

Monster highlights some interesting marketing and branding ideas. As well as identifying your niche to then go after your target customer. A blueprint like this could help a business establish what its north star is. Businesses and business owners can take a lot away from what Monster’s business approach has been. The results speak for themselves.

When it comes to looking into Monster’s stock fundamentals, what stood out? When I went back to research it’s cataclysmic rise, there wasn’t much to find that was that much of an outlier from the other great stocks. I did come across this data from Motley Fool.

Revenue has grown at a 20% compound annual growth rate (CAGR) since 2000. Over that same time period, its price-to-sales (P/S) ratio has expanded by over 1,000% from under 1 to approximately 9. Why is the market assigning a higher P/S to Monster Beverage? Because its operating margin has grown from around 10% in 2000 to 25% in 2022.

To me, it looks like just a rock solid performance by the management team at Monster quarter after quarter and year after year. To take a guess at the management teams mindset, I’d bet it has gone something like this. Maybe this is a mindset more investors should take.

While everyone searches for the next big stock winner or asks others for their stock picks at the next gathering, sometimes you may just have to look around you or what’s selling at your local gas station.

The Coffee Table ☕

I just finished reading the book, Company of One by Paul Jarvis. This is a book that will change and improve your trajectory and perspective around business. There were so many quotable lines I couldn’t decide on which one to include. I found so much good from this book that I may have to do a post in the future on it. A book I wish I had found sooner.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.