Just Own Stocks

It really is that simple

People keep asking if we are getting close to a bubble. It’s a fair question.

We might already be in one. It might be starting to deflate right now.

I do not know. You do not know. Nobody knows.

Not the talking heads on TV, not the hedge fund managers, not the strategists who adjust their outlook every time the market moves an inch.

But here is the thing. If your time horizon stretches beyond a few years, the label does not matter nearly as much as it feels like it does in the moment.

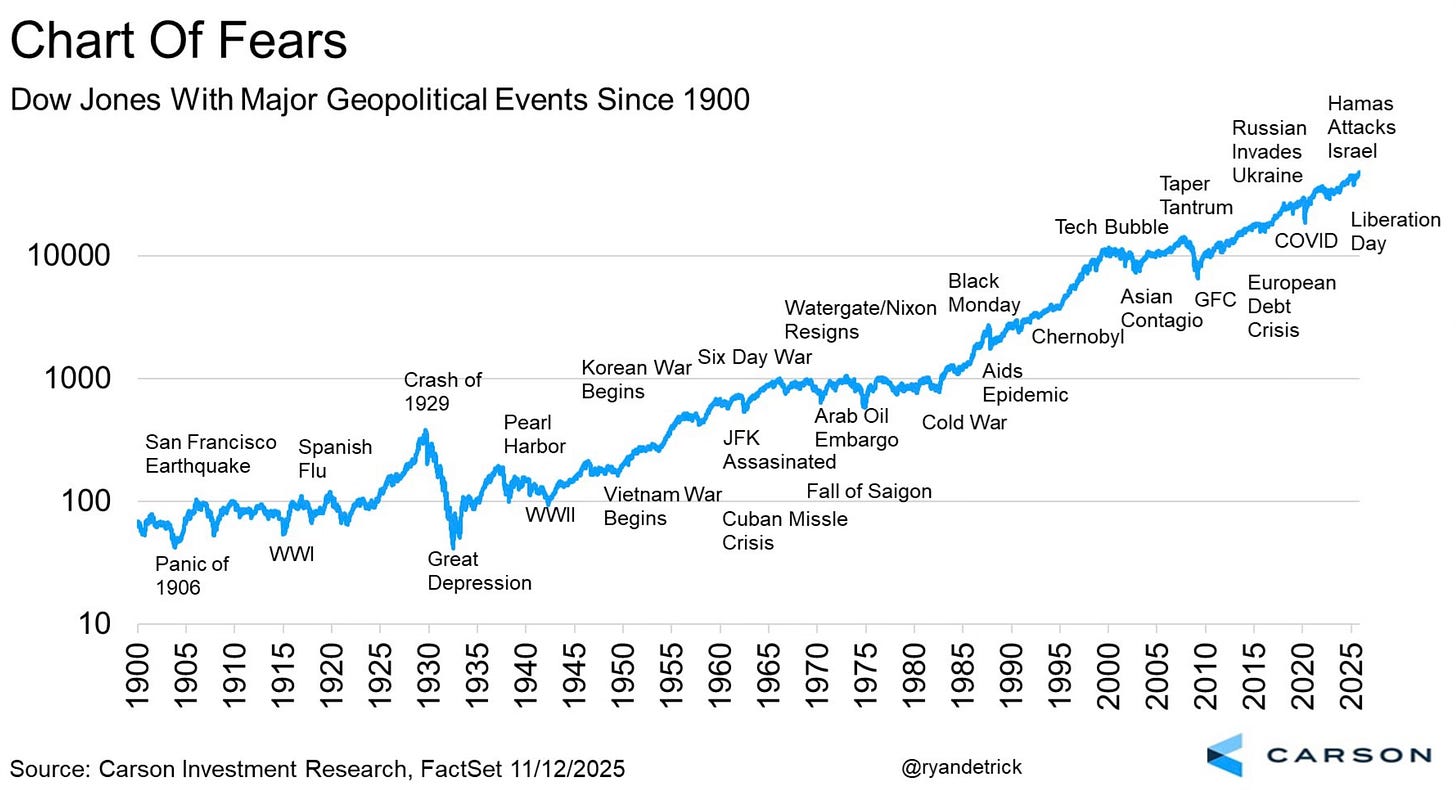

Bubbles, pullbacks, soft landings, hard landings, bear markets, every storyline the market can throw at you will show up eventually.

They always have. Yet the long run has consistently rewarded the investor who stays the course.

But it is not easy. We have lived through wars, presidential assassinations, housing collapses, terrorist attacks, pandemics, and plenty more.

There is always risk. There is always volatility. Every single year delivers its own set of reasons to sell.

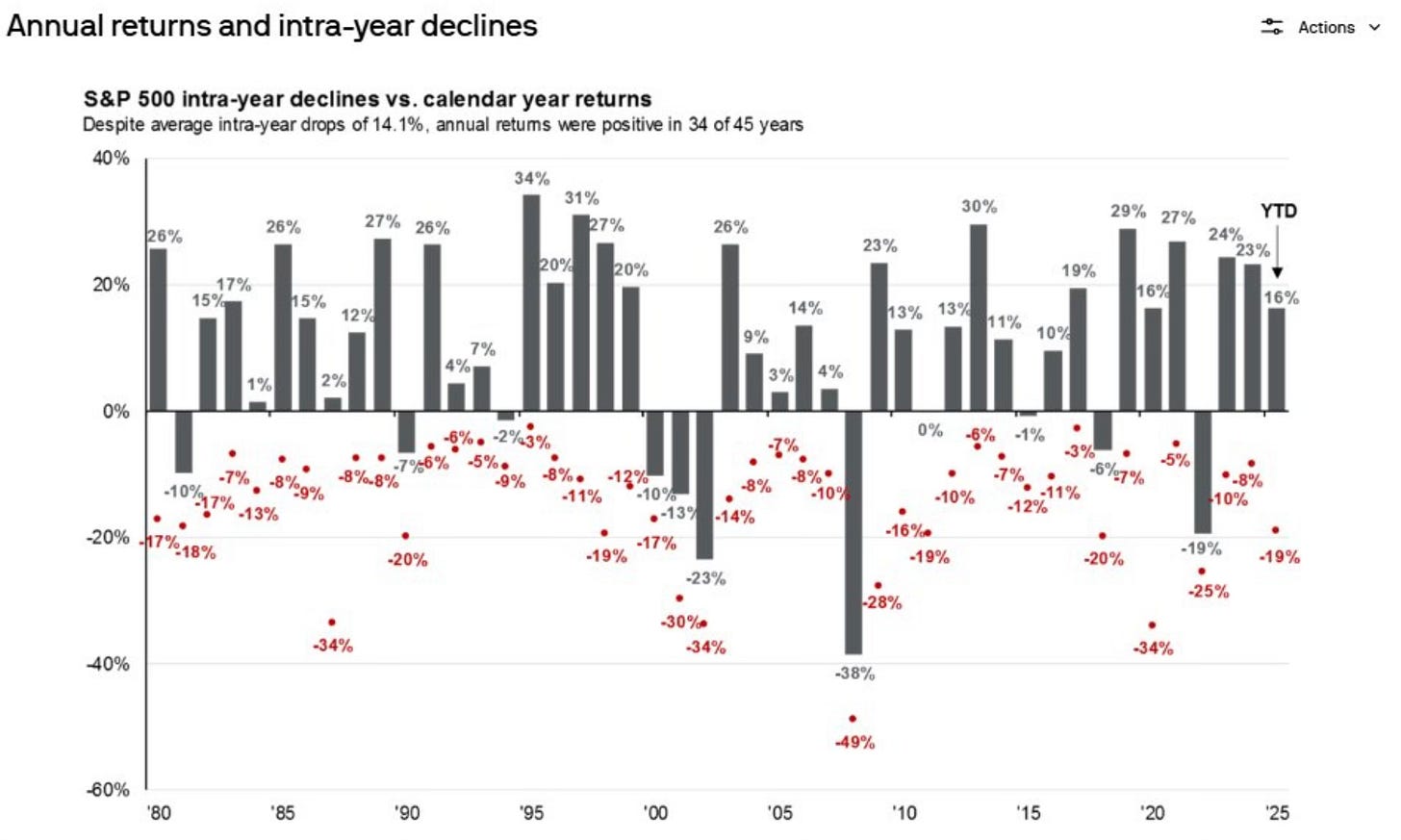

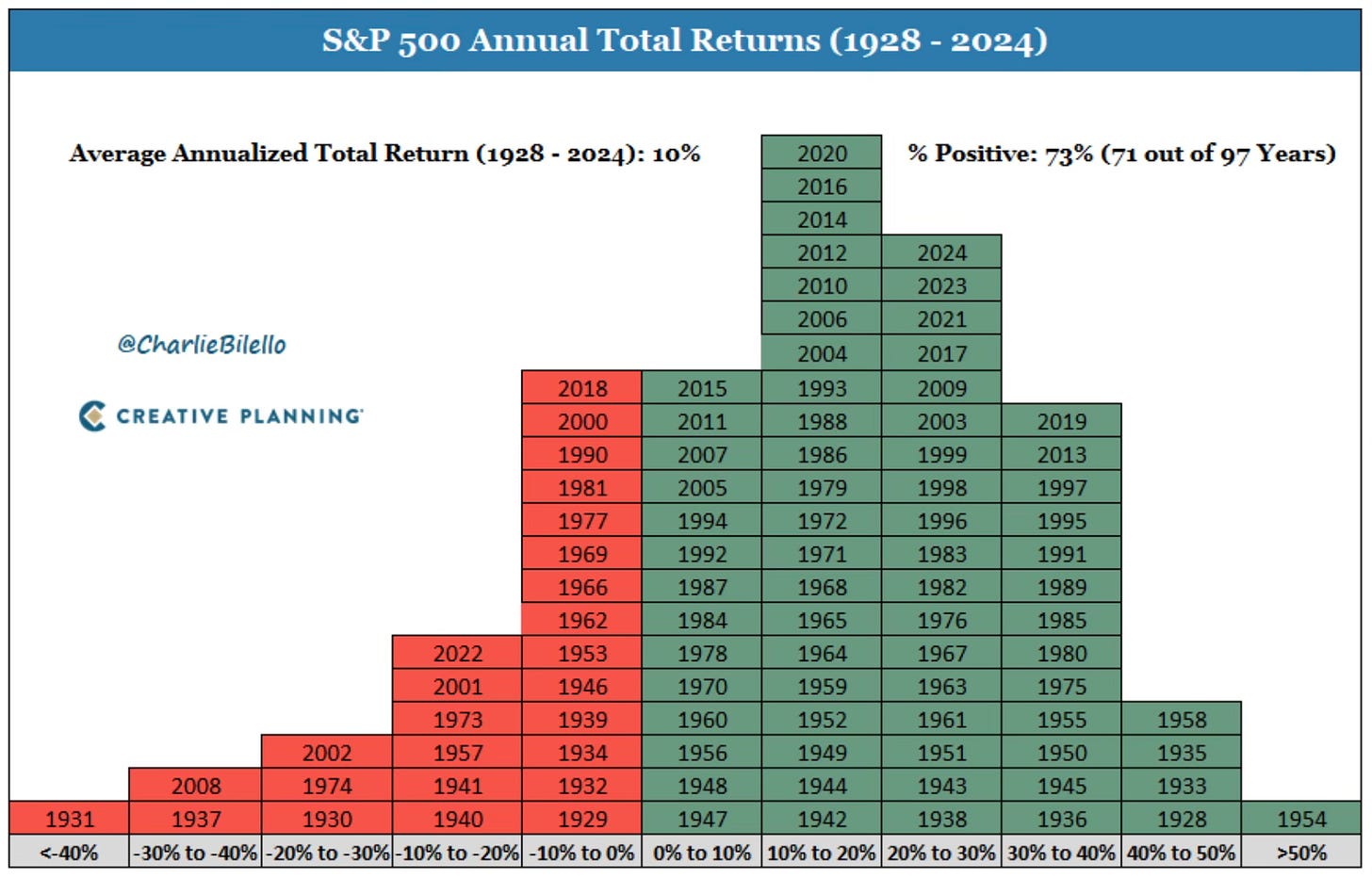

The math is simple. Bull markets dominate history. Markets rise far more often than they fall. Did you now that?

Over the past 97 years, the S&P 500 has been positive 73% of the time. The average annualized return during that time is 10%.

Judging by the news, you would think that the stock market is in a bear market 73% of the time.

It’s not. So stop giving so much weight to the fear mongers who make their living creating fear and amplifying every downturn.

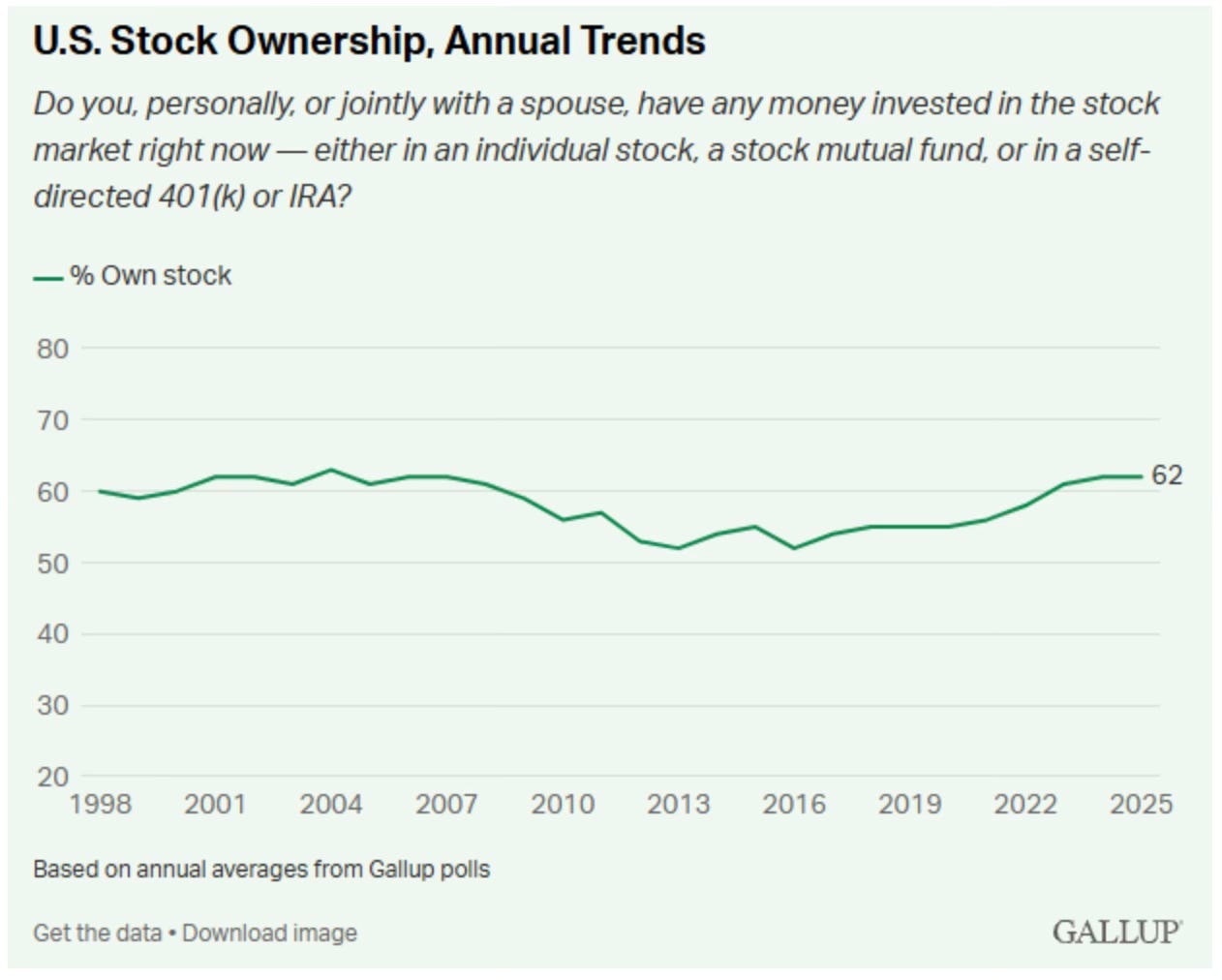

Yet, knowing all of this, most people don’t participate. Only 62% of U.S. adults own any stocks, directly or through funds.

That number feels low to me. It means more than a third of the country is sitting out the most reliable wealth builder of the past century. That is an expensive choice, even if it does not feel like one in the moment.

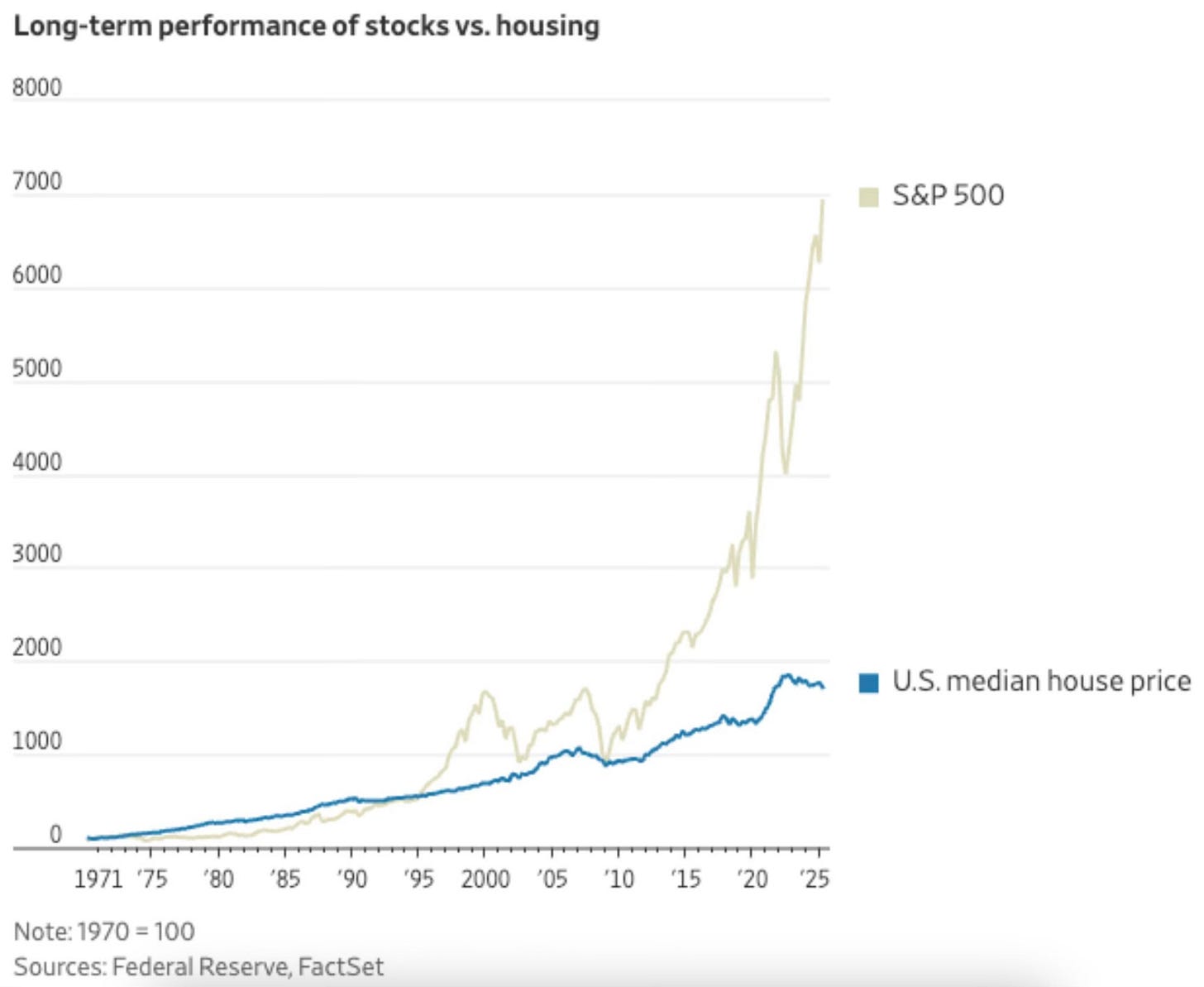

The common pushback is that for many people, their biggest asset and what they assume is their best path to building wealth is their home.

Homeownership has value. It gives stability, utility, and pride. You do after all have to live somewhere. But for most Americans, it’s not the most efficient long term wealth building tool.

A house is not the same engine. It comes with interest payments, taxes, repairs, insurance, and a steady stream of costs that quietly drag on the return.

People often overestimate how much they make on a sale. They remember the purchase price and the final number, but forget the mortgage interest, maintenance, insurance, taxes, association fees, the upgrades and repair costs that piled up along the way.

They do not come out nearly as far ahead as they think.

And that becomes obvious the moment you compare the long term performance of stocks with the long term performance of housing.

If you care about building generational wealth and giving your money the best chance to grow, the stock market remains the clear winner. Time in the market has consistently been the most powerful wealth building tool available.

Long term investors know the drill: plug your nose, cover your ears, and keep buying. Month after month. Year after year. They don’t try to time the next dip. They stay the course, knowing that history favors the patient.

So what if the market feels stretched? So what if sentiment is frothy or the rally looks tired? Short term headlines don’t change the long term math.

There will always be reasons to hesitate. Always a new crisis. Always a prediction of doom. Yet decade after decade, U.S. stocks have shrugged off turmoil, rewarding those who remain invested.

Stop worrying. Stop trying to time it. Start investing.

Just own stocks. Let time do the rest.

The Coffee Table ☕

There has been a lot of talk about the possibility of a 50-year mortgage being approved. Ben Carlson wrote a great piece breaking down the specifics of it. He is someone whose opinion and view I trust on the subject. The Economics of a 50 Year Mortgage

Joy Lere wrote a nice post on kids and what you teach them about finances. They really learn financial habits from you when they’re at home growing up. It really made me evaluate what I’m teaching my kids about money and finances. The Gifts We Give Our Kids

I saw this and can’t stop thinking about it.

Source: Emerging Value

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.