Is This As Good As It Gets?

US households, the economy and stock market are riding high

In my a previous post I wrote the following.

As the book closes on Q1 of 2024, we really need to fully understand just how good so much is right now. Few times in my lifetime can match where things are at. Look at this list and try and tell me otherwise.

Stock prices (S&P 500, Nasdaq & Dow) are at an all-time high

Bitcoin is at all-time highs

Gold is at all-time highs

Housing prices are at all-time highs

Net worth is at all-time highs

The unemployment rate is under 4%

Economic activity is at all-time highs

Air travel is at all-time highs

You can get 5% on your cash

In addition to this list, two more things came to mind while I was on spring break with my wife and kids.

Silver is at the highest level in a decade

Equity in homes is at an all-time high

I felt this was worth revisiting again and I wanted to provide more detail and context on each of these. Below is a look at each one.

Stock Prices Are At All-Time Highs

The stock market has continued to set new all-time highs throughout 2024.

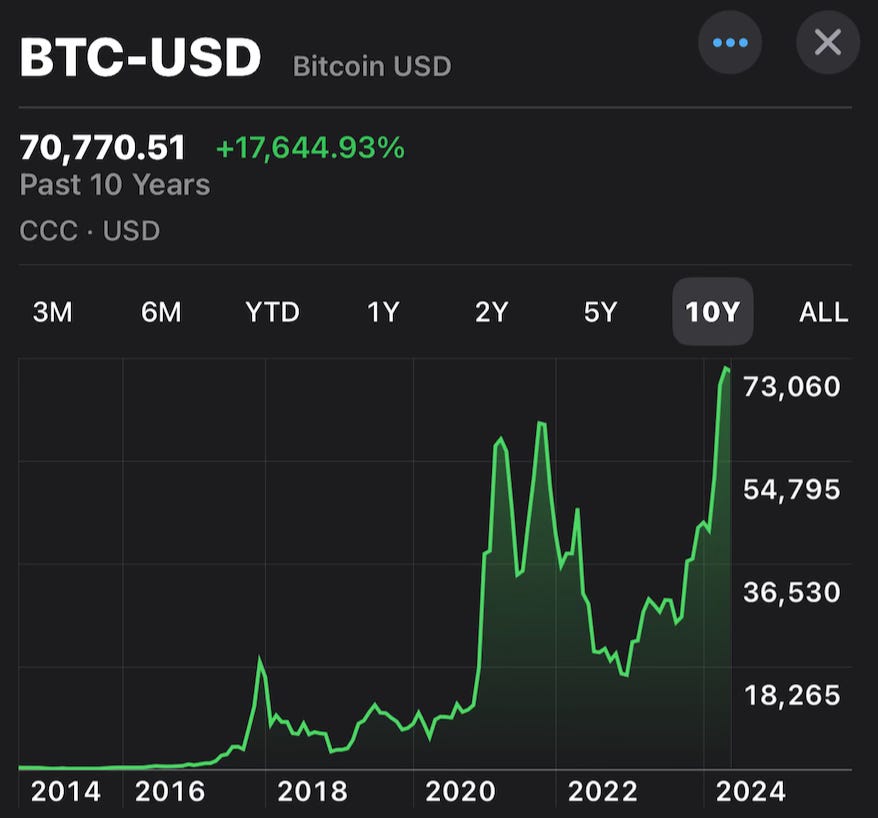

Bitcoin All-Time High

Bitcoin has also been setting new all-time highs throughout 2024.

Gold All-Time High

As I write this, gold closed at the highest price in its history.

Silver Highest Level In A Decade

Silver is now at the highest level in over a decade.

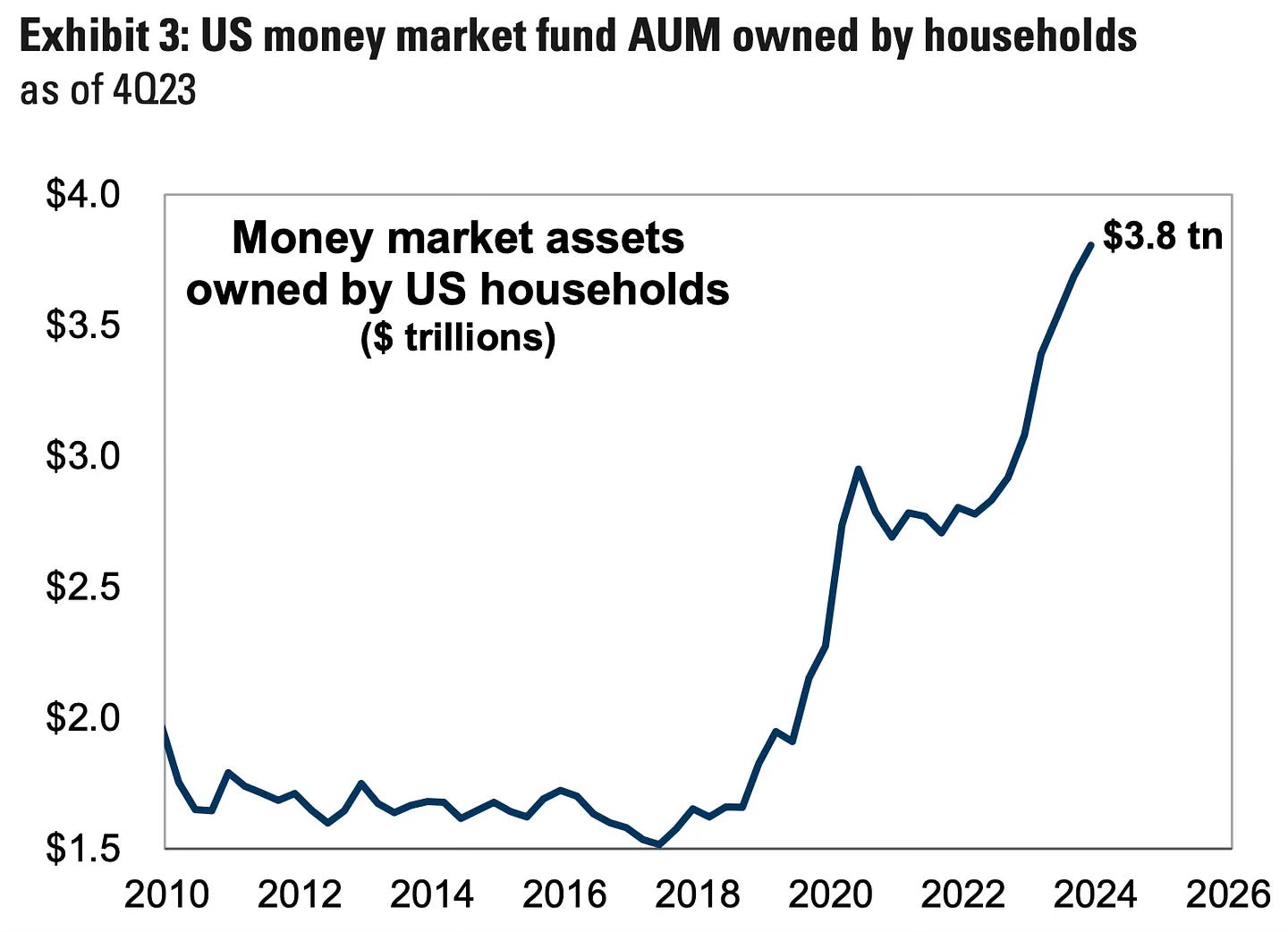

You Can Get 5% On Your Cash

We’ve seen how much money people have sitting in cash. Can you blame them when you can get over 5% on your money essentially risk-free?

US households hold $3.8 trillion in money market funds. This is the highest level on record and $1.5 trillion above pre-pandemic levels.

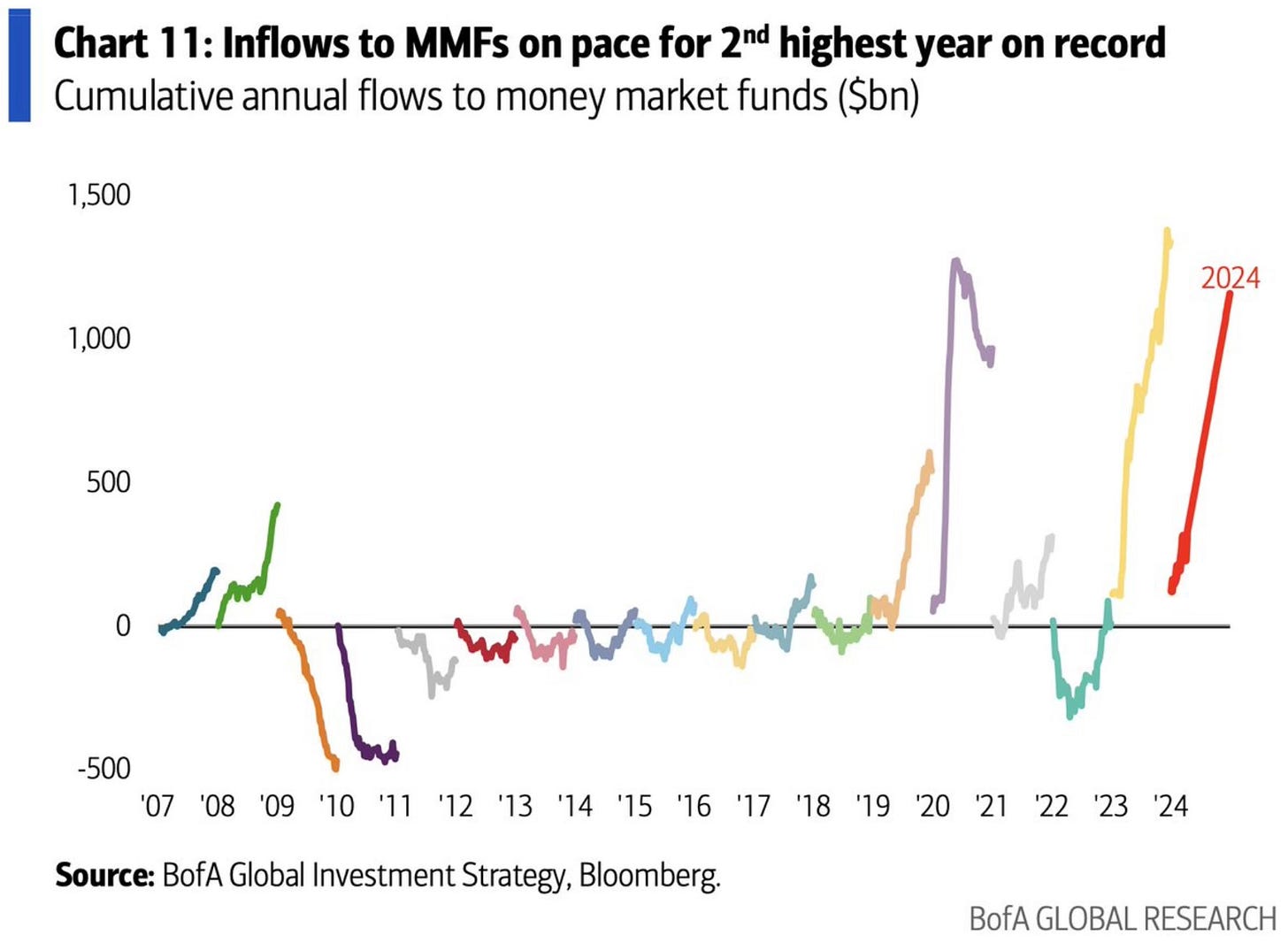

It should be no surprise that the inflows are continuing. 2024 is on pace for the 2nd highest year on record.

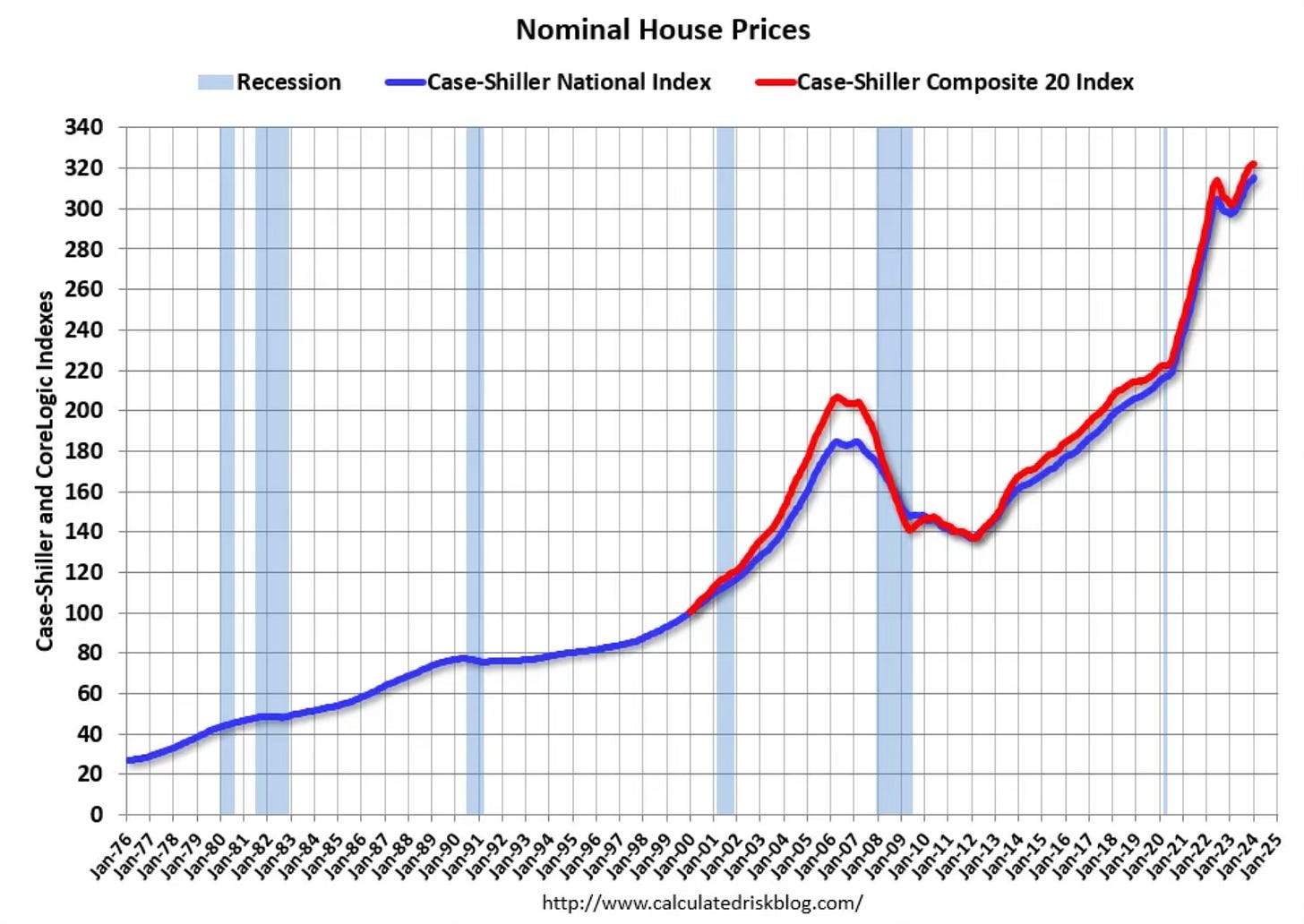

House Prices Are At All-Time Highs

If you own a house it’s highly likely that the value of your home is at or near an all-time high.

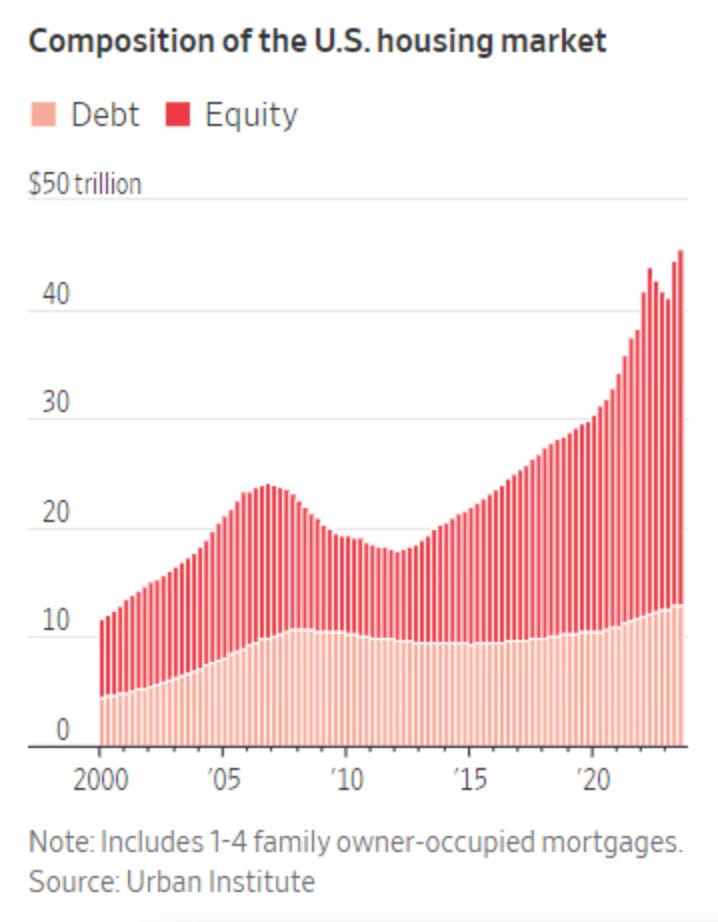

Equity In Homes Is At An All-Time High

Record home prices have helped push equity in homes to an all-time high. The debt to income ratio for the US housing market is the healthiest it has ever been. Between the high cash balances and the record high amounts of equity in homes, consumers are well positioned for any type of financial setback.

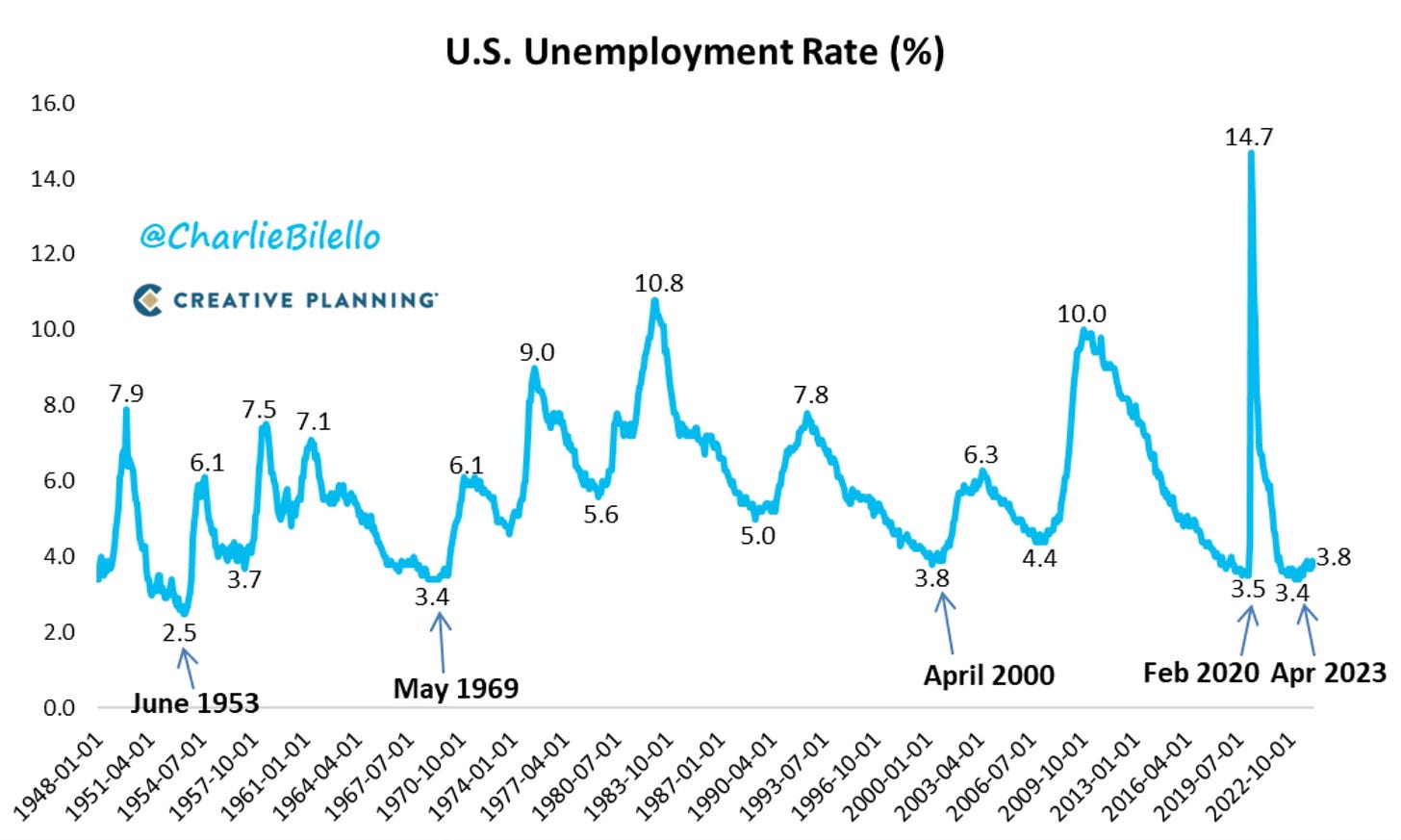

The Unemployment Rate Is Under 4%

The unemployment rate continues to remain under 4%. It has now been under 4% for 26 consecutive months.

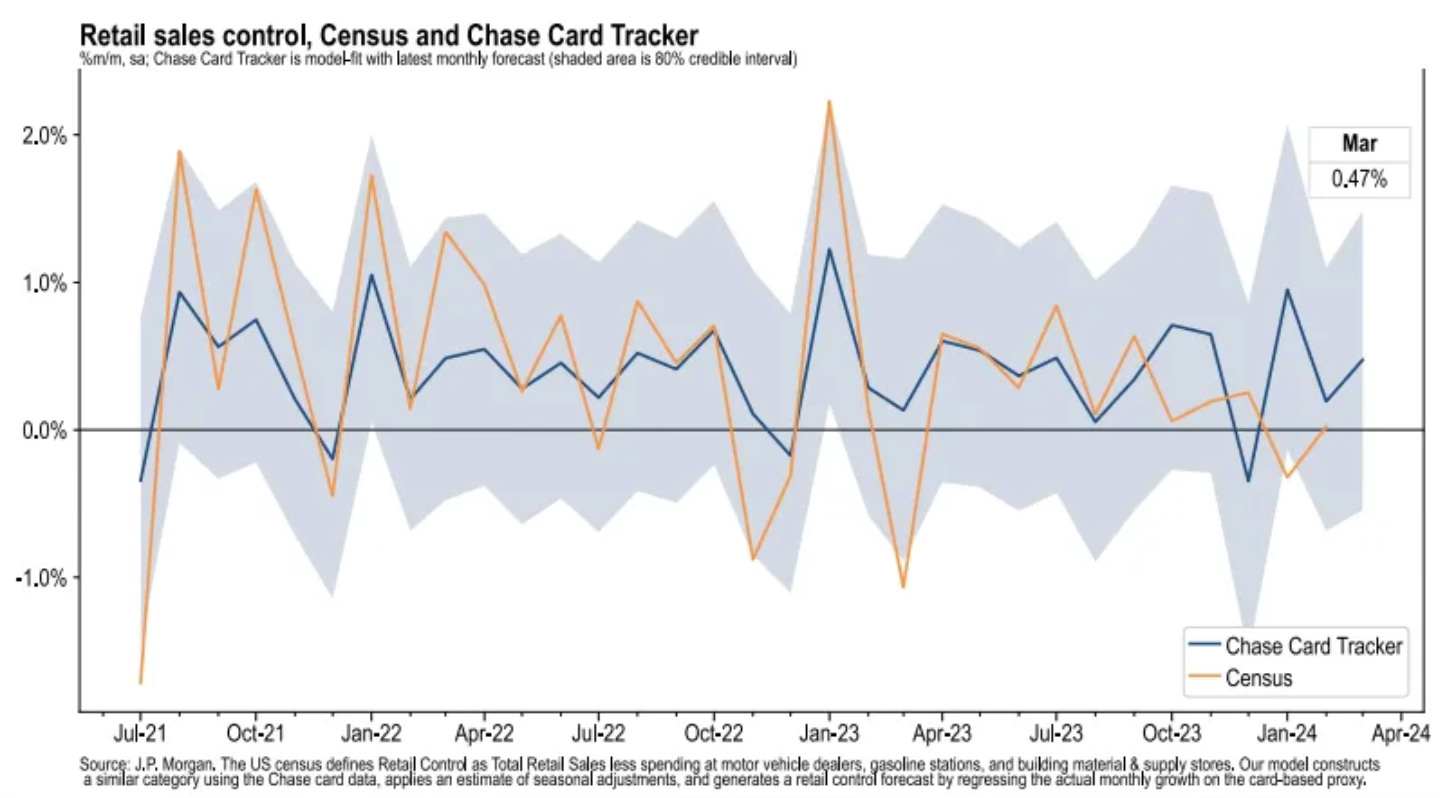

Economic Activity Is At An All-Time Highs

All of the above positives for the US consumer has led to record economic activity. Consumers continue to spend as shown below in JP Morgan’s Chase Consumer Card spending data. And who can blame them with seemingly all of their financial assets at all-time highs. When consumers are employed and feel secure financially they will continue to spend.

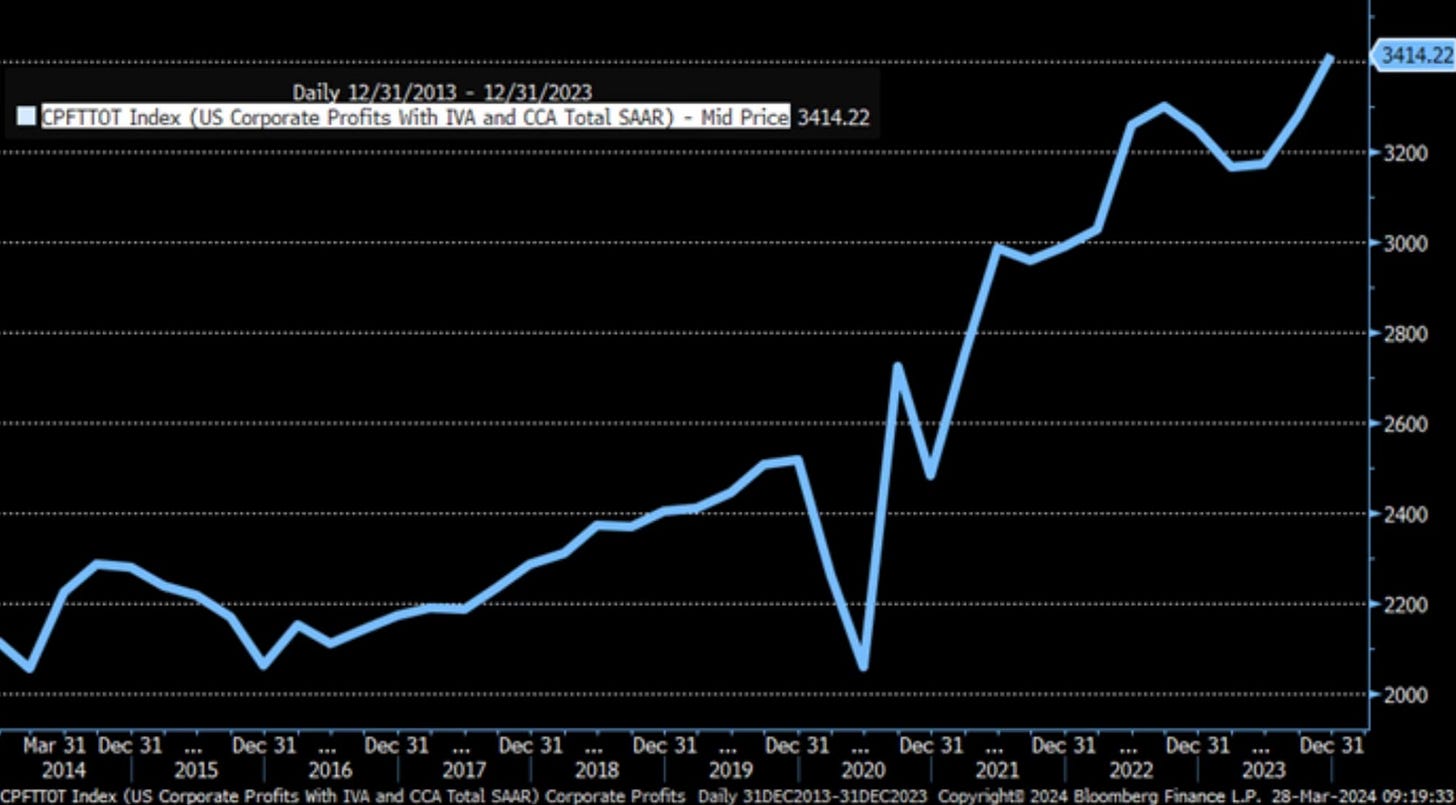

This has helped push corporate profits to a new all time high in Q4 2023.

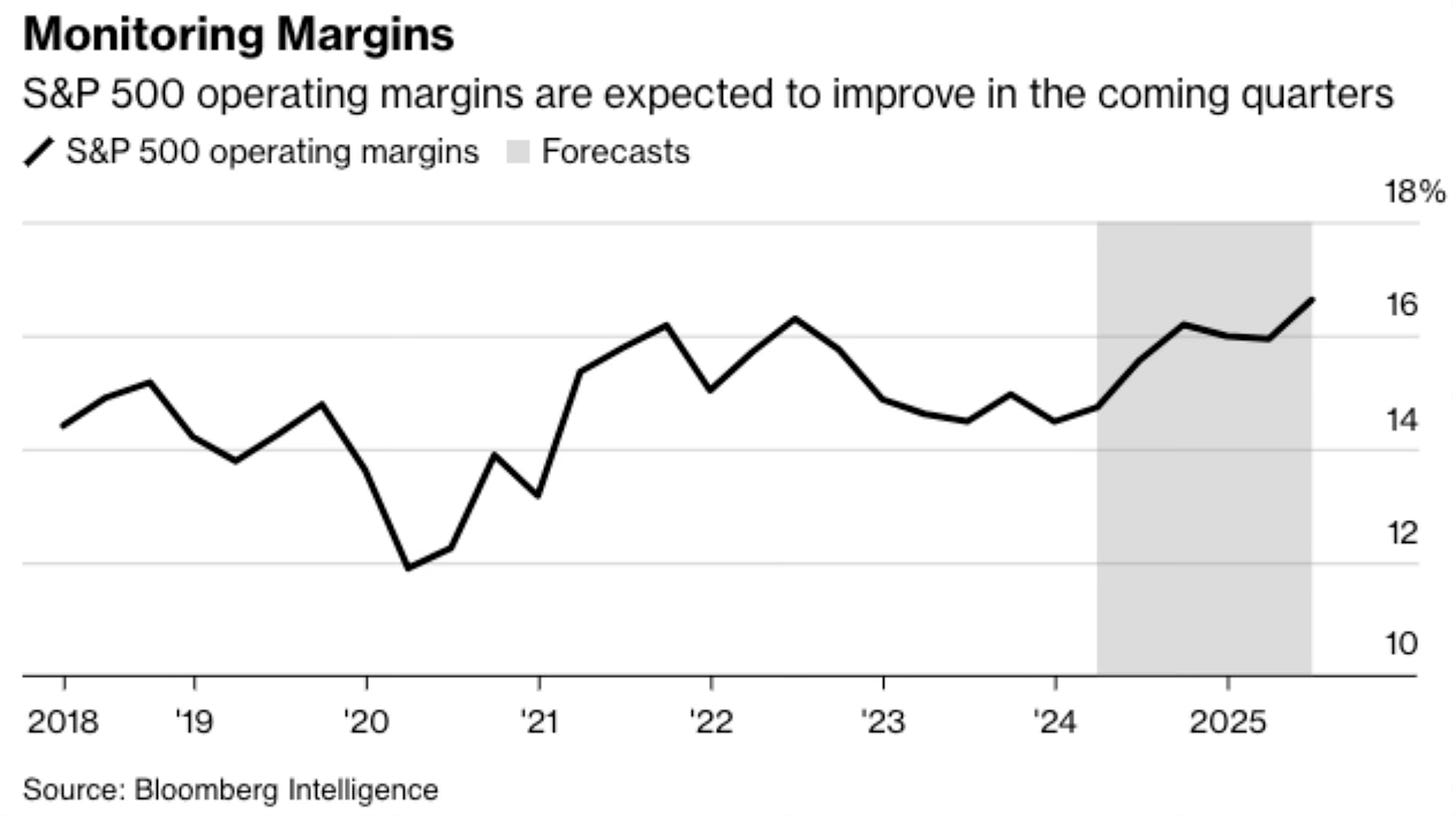

S&P 500 operating margins are at record highs and the projections are that they should even improve in the coming quarters.

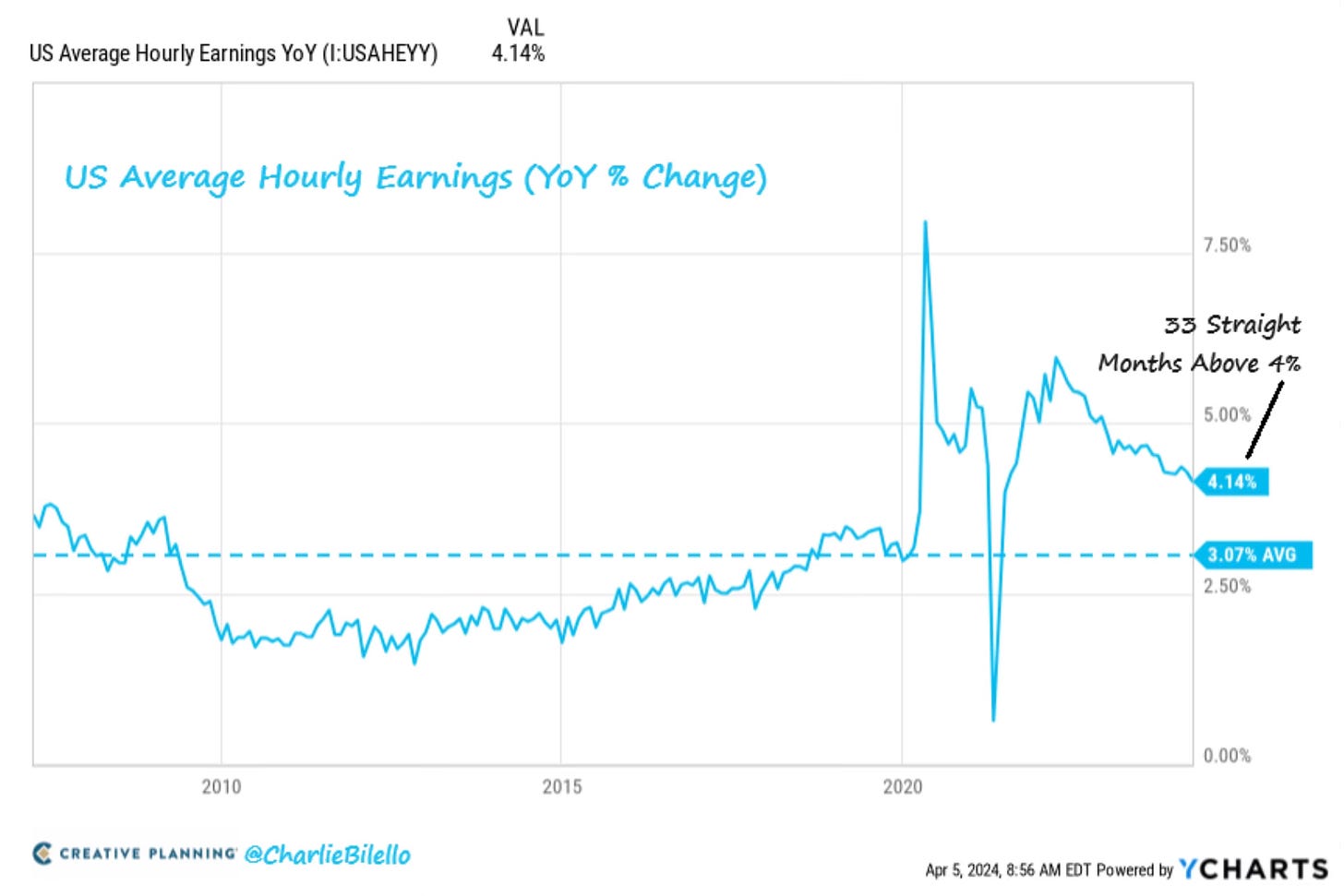

This has helped keep US average hourly earnings above 4%. In fact, wage growth has remained over 4% for 33 straight months. It currently sits at 4.14%.

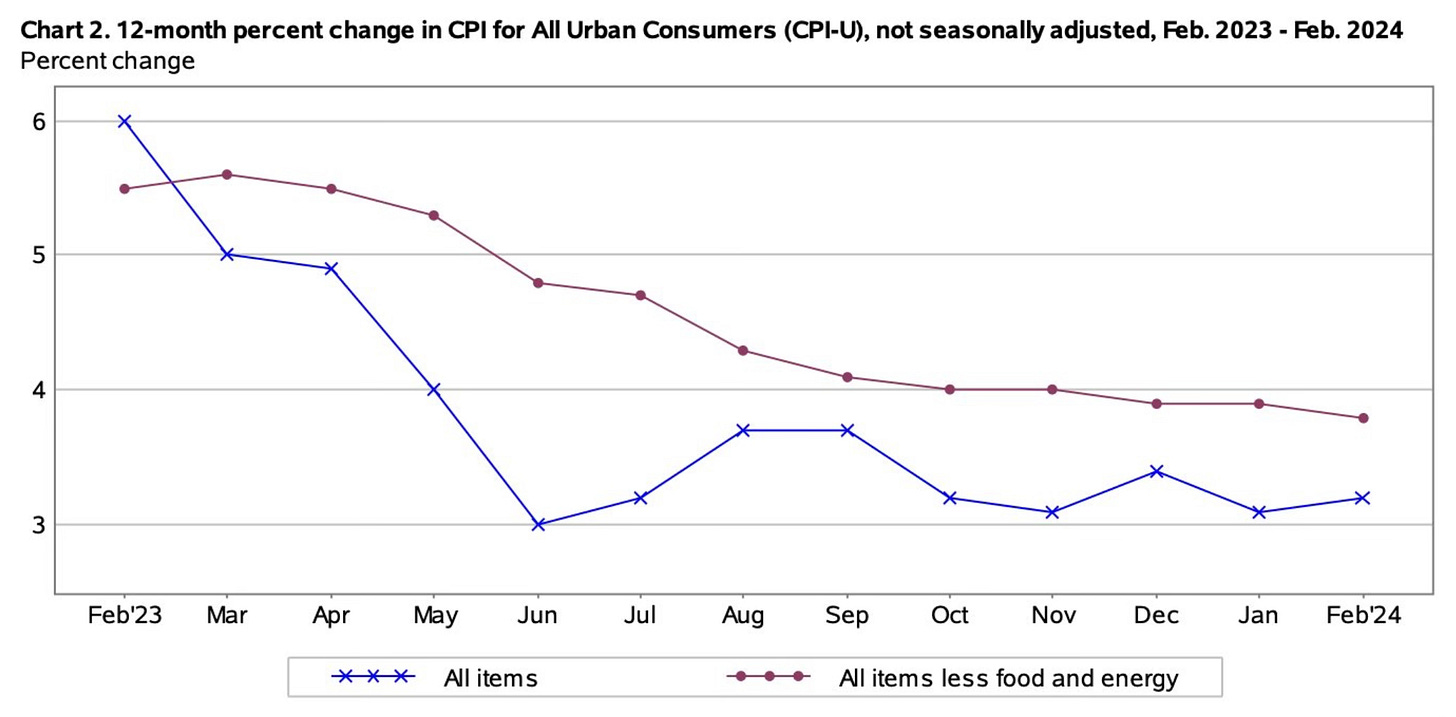

That 4.14% in wage growth has far outpaced the rate of inflation at 3.2% recently.

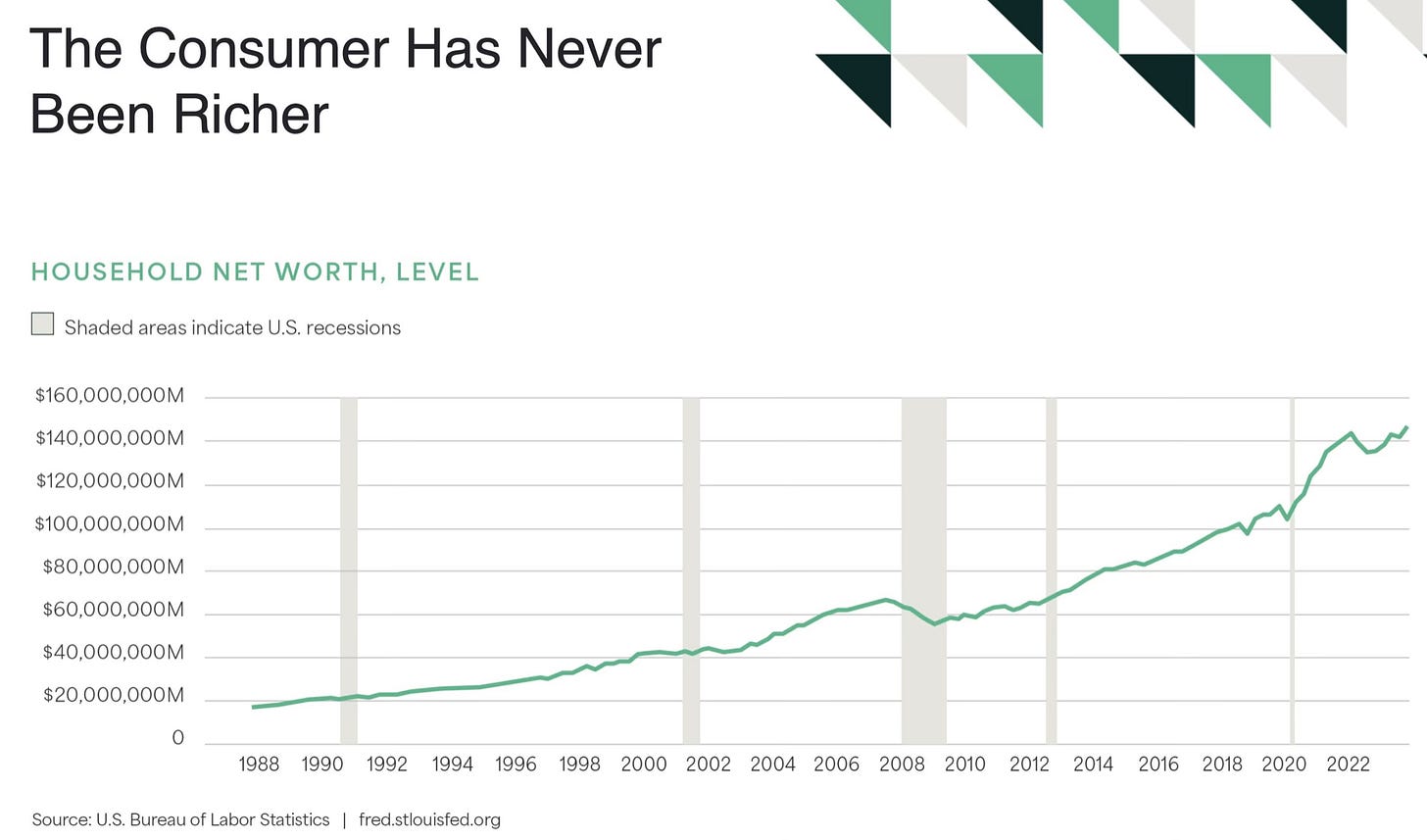

Net Worth Is At All-Time Highs

It should come as no surprise that household net worth is at all-time highs. This chart shows just how financially healthy households currently are.

Household net worth has never been higher.

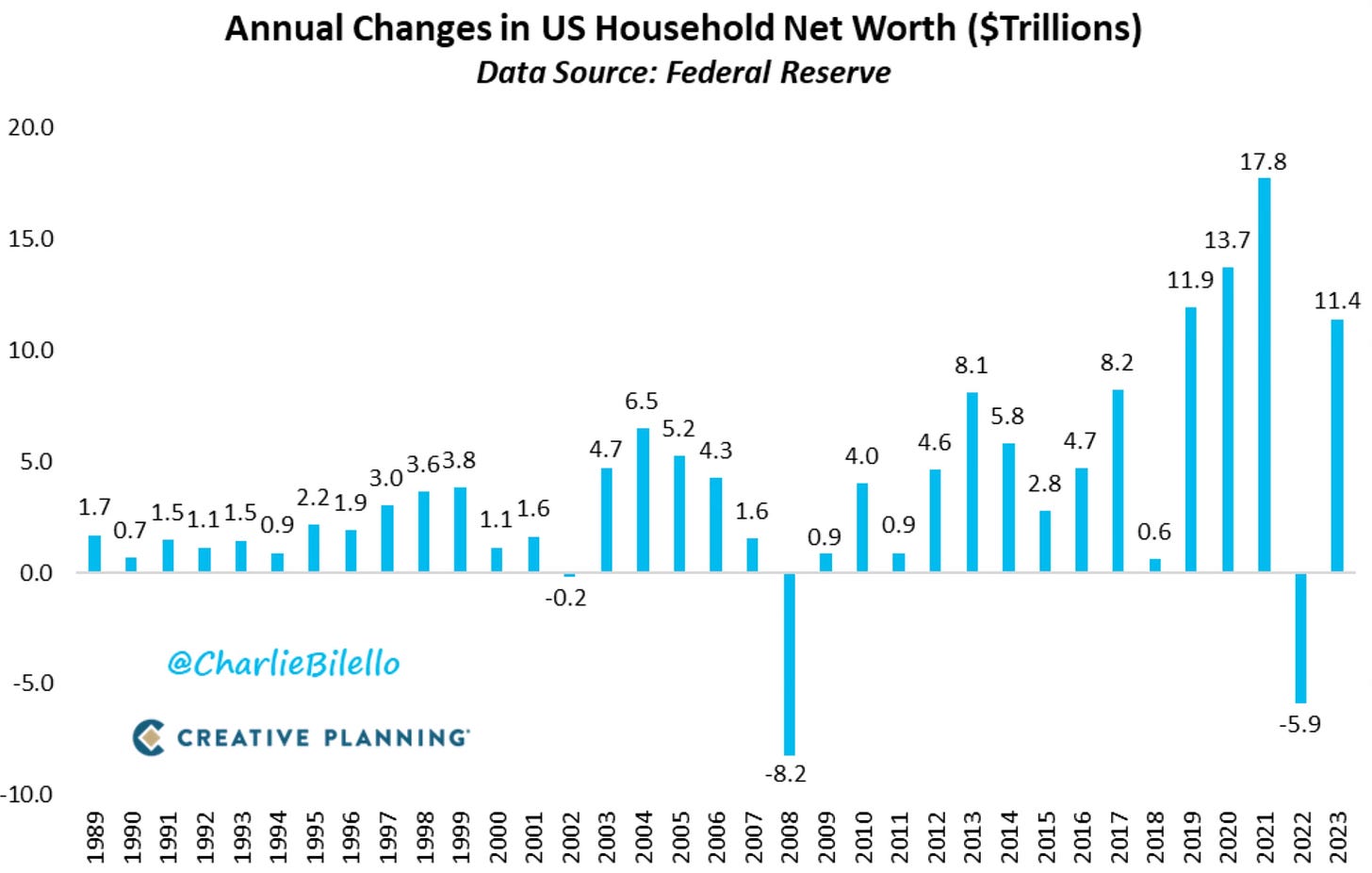

Here are the annual changes in household net worth. Look at how strong four out of the last five years have been.

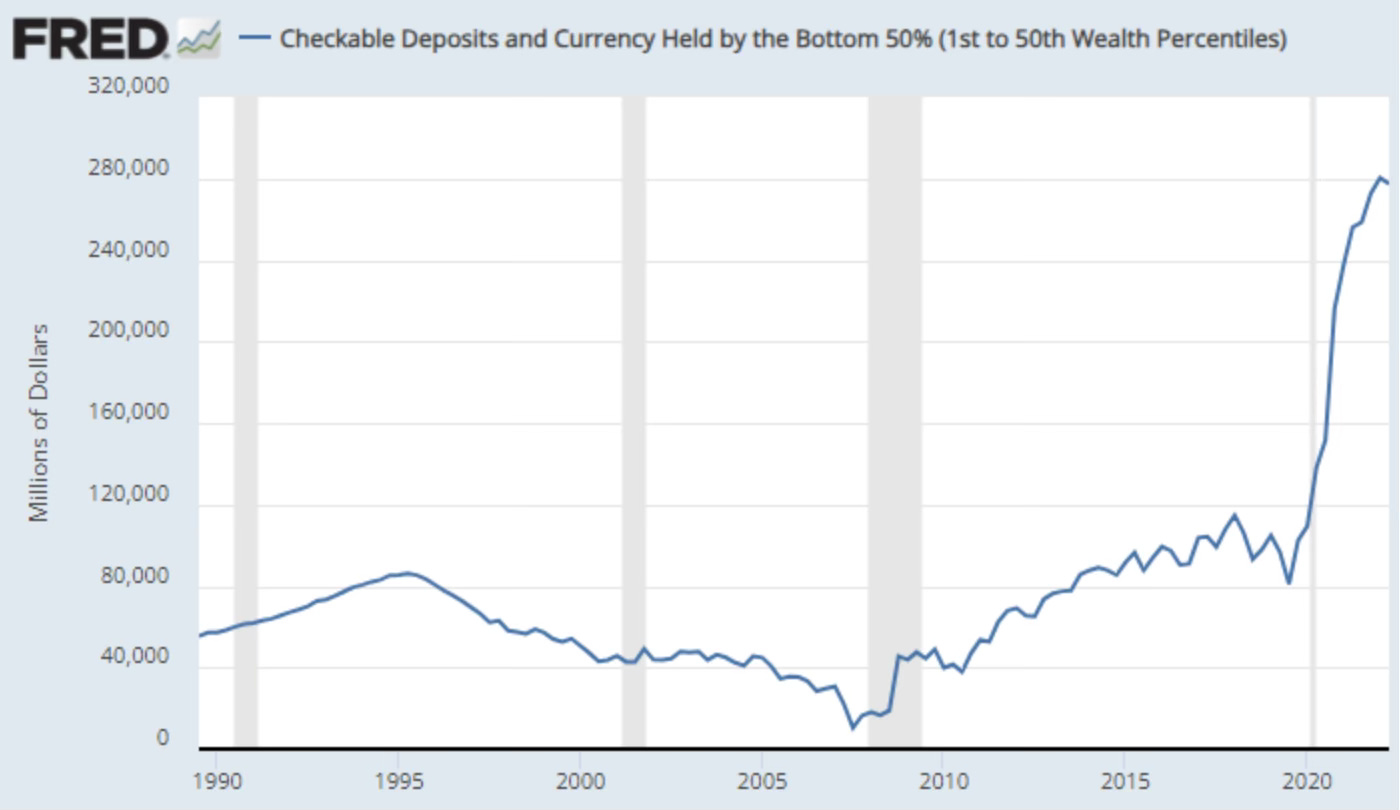

I’ve heard how this is only for the wealthy. But it isn’t only the wealthy. Here is the bottom 50% by wealth. They’ve also seen a dramatic rise as well.

Air Travel Is At All-Time Highs

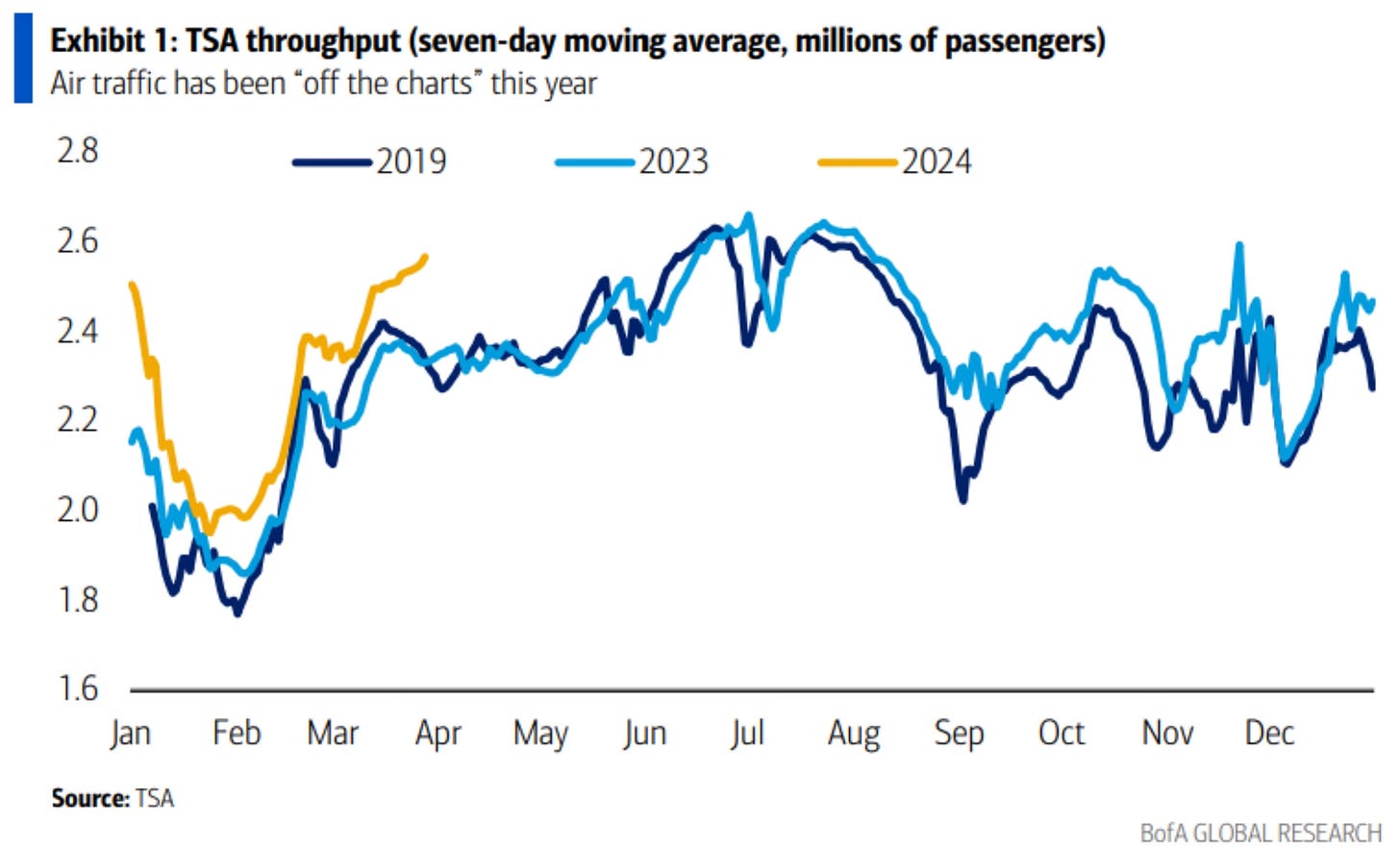

With as much wealth that people have, it should come as no surprise that air travel is back at all-time highs.

That’s a whole lot of good! Like a rising tide lifting all boats. It’s rather impressive to think this is where we’re at when not long ago we were all but certain to have a recession.

Yes, there are other areas that we can point to as negatives. If you want to look for negatives you can always find them. Nothing is perfect. It never is.

Is this as good as it gets? Maybe. Could this point to a top or bubble? Possibly.

Or it might not be. I have no idea, just like you have no idea. This could even continue on for much longer. Good luck trying to figure that out.

In the meantime, just sit back and enjoy it.

The Coffee Table ☕

There was a great post in Persuasion by Brendan Ruberry called The Future of American Sports Isn’t Pretty. He talks about the dangerous rise in gambling among sports and what led it to this point. I think we’re starting to see the affect it’s having. I’ve started to notice this and it has made the experience of watching sports worse. It’s seem to have become the central theme of games. This may be the new norm for sports viewing.

Last week I shared what has been happening with cocoa (chocolate) prices. Now a similar trend is starting with one of the world’s most loved things, coffee. Coffee has hit another all-time high. We’ll see if coffee prices are the next to follow cocoa.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.

Order my book, Two-Way Street below.