Is Housing in a Recession?

Why people are sounding the alarms around housing

I’ve been watching the housing market for a while now, and the trend has been steadily worsening.

This week, I noticed something unusual, two people I closely follow on the economy gave the same warning about housing.

Both Neil Dutta of Renaissance Macro Research and Warren Pies 3Fourteen Research have indicated that the housing market is in a recession.

It was interesting to me because I had not come to that conclusion just yet.

Let’s unpack what they’re saying.

Neil Dutta said the following in a recent note.

Warren Pies said the following.

Now let’s expand off what they’ve said to see if housing is indeed in a recession. Here is some more data that might further strengthen the case that housing is indeed in a recession or at least reaching that stage.

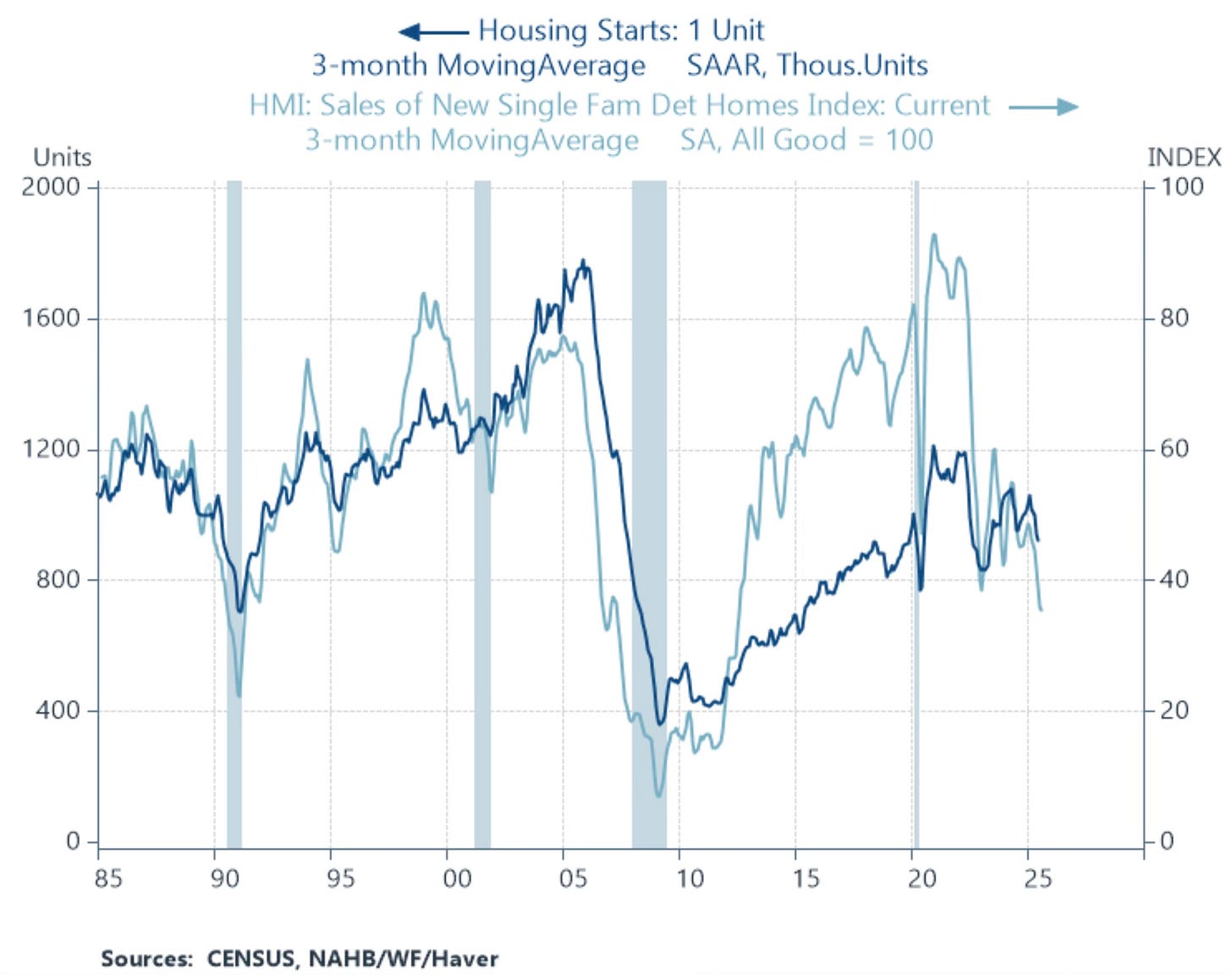

The National Association of Home Builders/Wells Fargo Housing Market Index fell to 32, matching the lowest reading since December 2022

Anytime this number has fallen to 30 and below we can see what has occurred. It’s getting awfully close to that number.

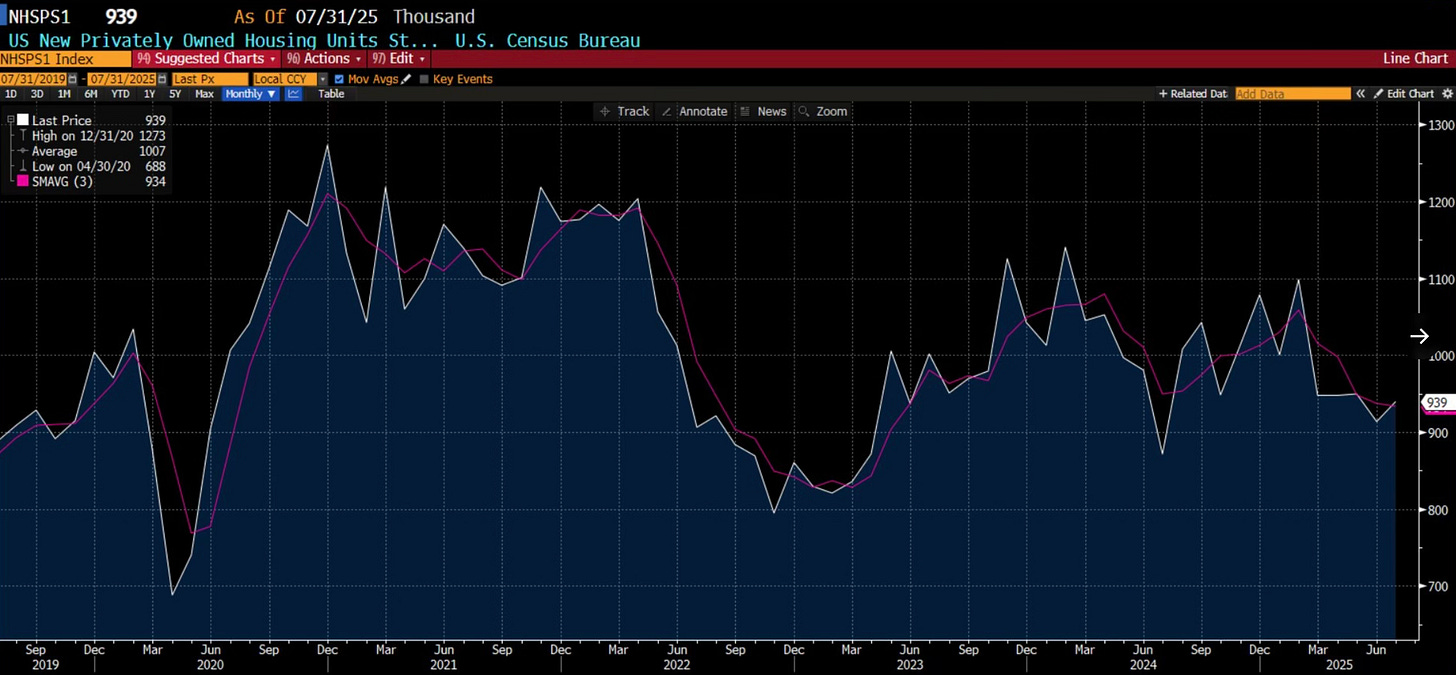

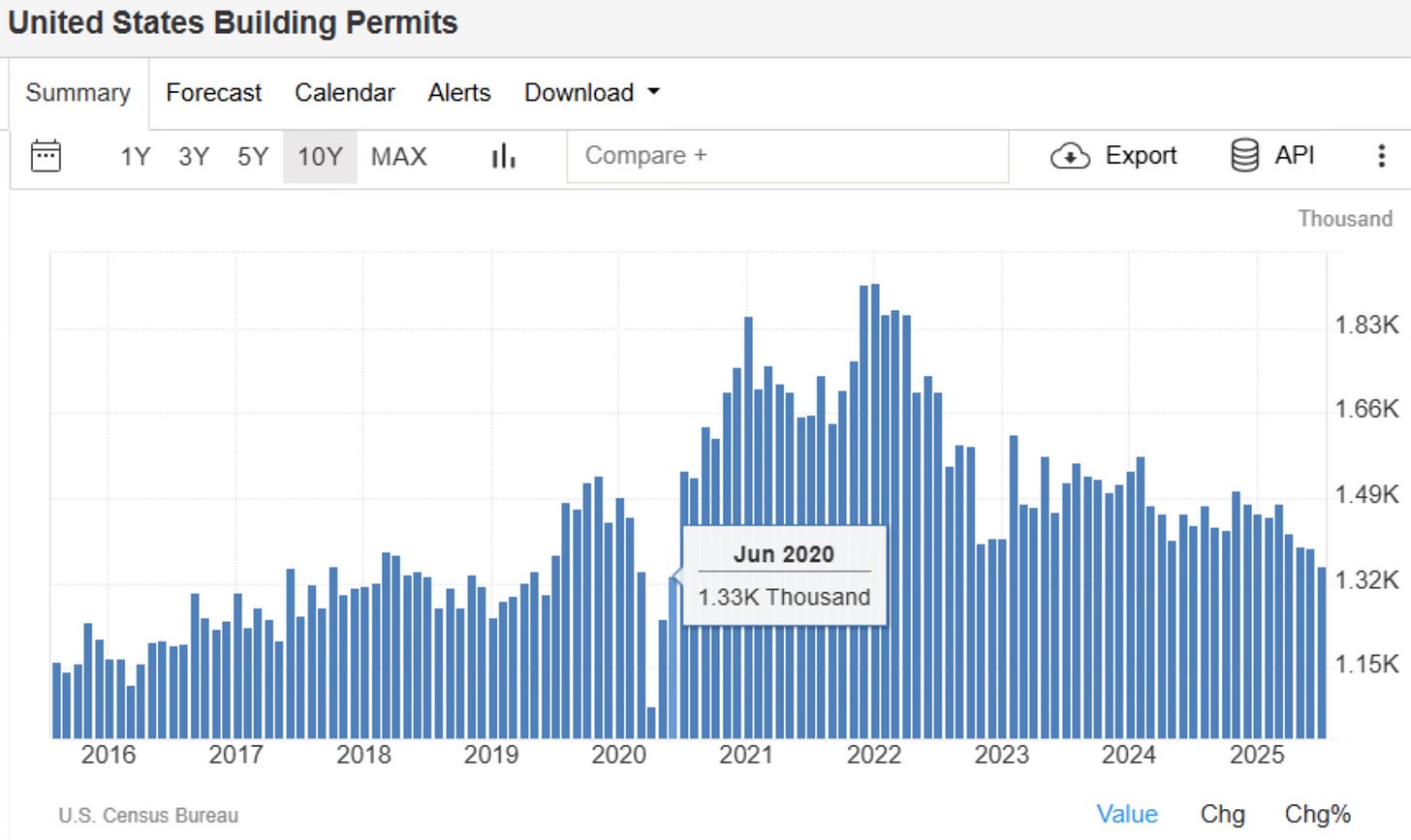

Building permits, which tend to lead housing starts fell to a new low. July building permits hit a 5-year low. They’ve now been down 7 of the last 8 months. A 4th straight monthly drop. That hasn’t happened since October 2008.

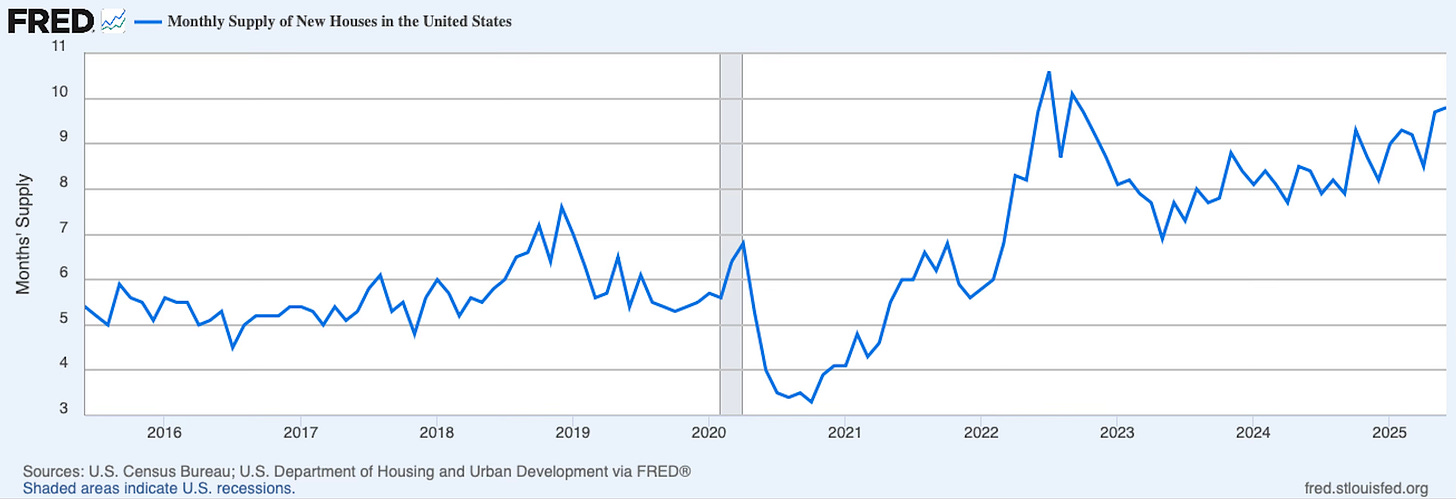

The month’s supply of new homes in the US is heading in the direction you would expect. It has spiked to 9.8 months and it’s approaching a 10 year high.

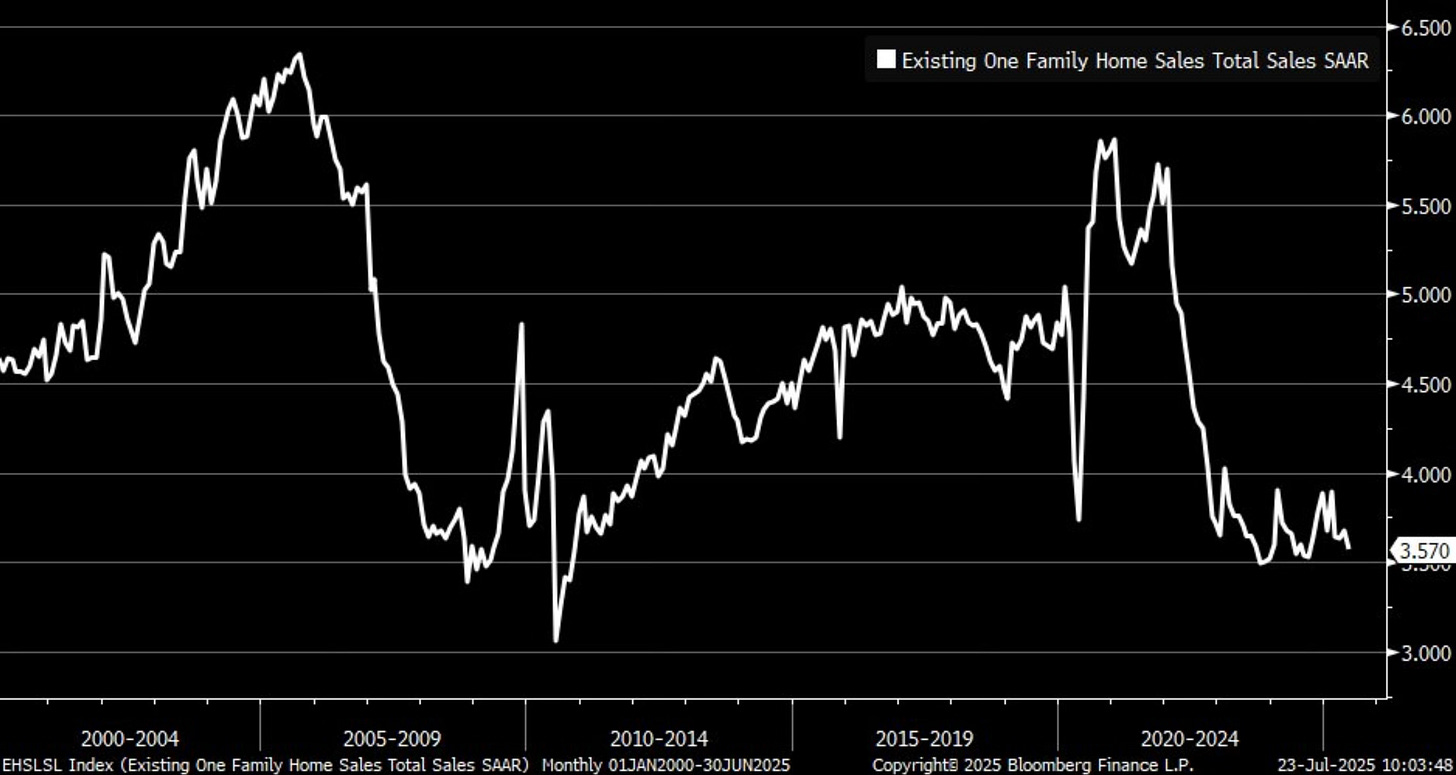

Existing single-family home sales fell in June to the lowest since last September. Existing single-family homes sales for July aren’t released yet. That will come out on August 21st.

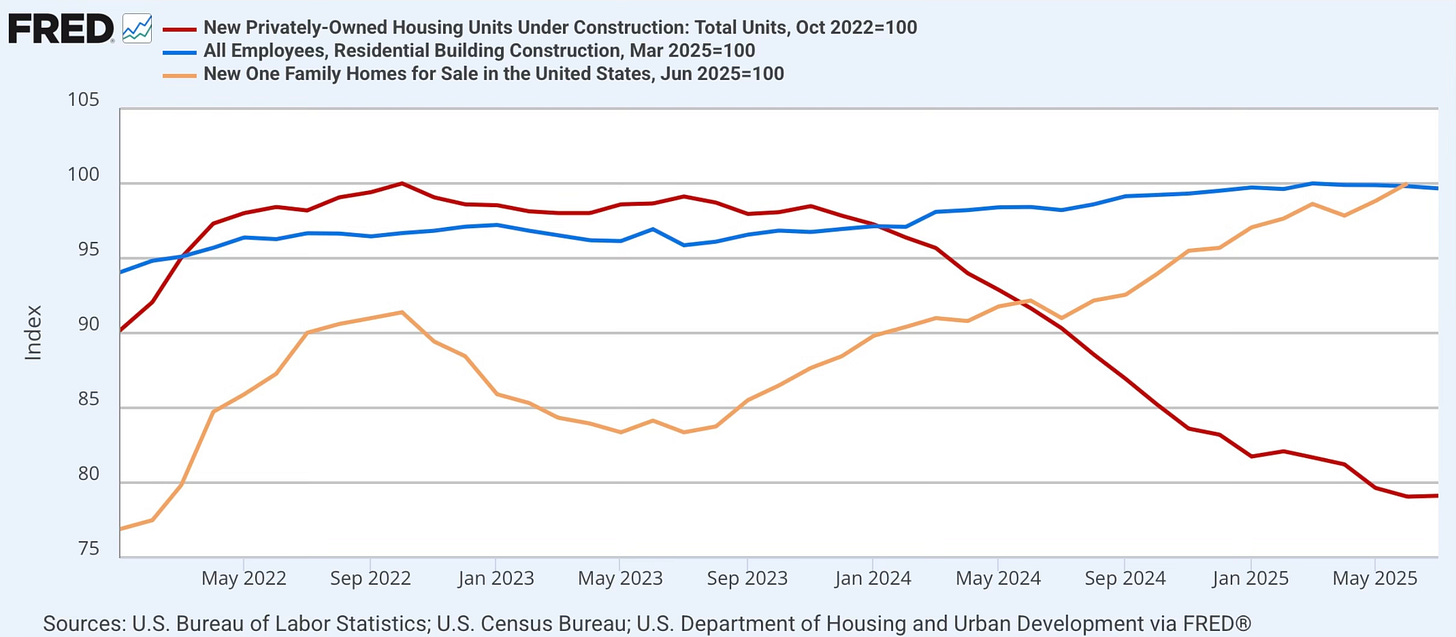

I like this chart which shows housing units under construction, residential construction employment and houses for sale.

We all know where residential construction employment is likely headed.

What about lumber? Wouldn’t that be a telltale sign?

Lumber is looked at to identify future demand because it ties directly into housing, construction and credit.

Lumber prices have collapsed. It has fading demand. People aren’t buying wood.

This might be the most important indicator in and around housing at the moment. We have to continue to pay attention to what it’s saying.

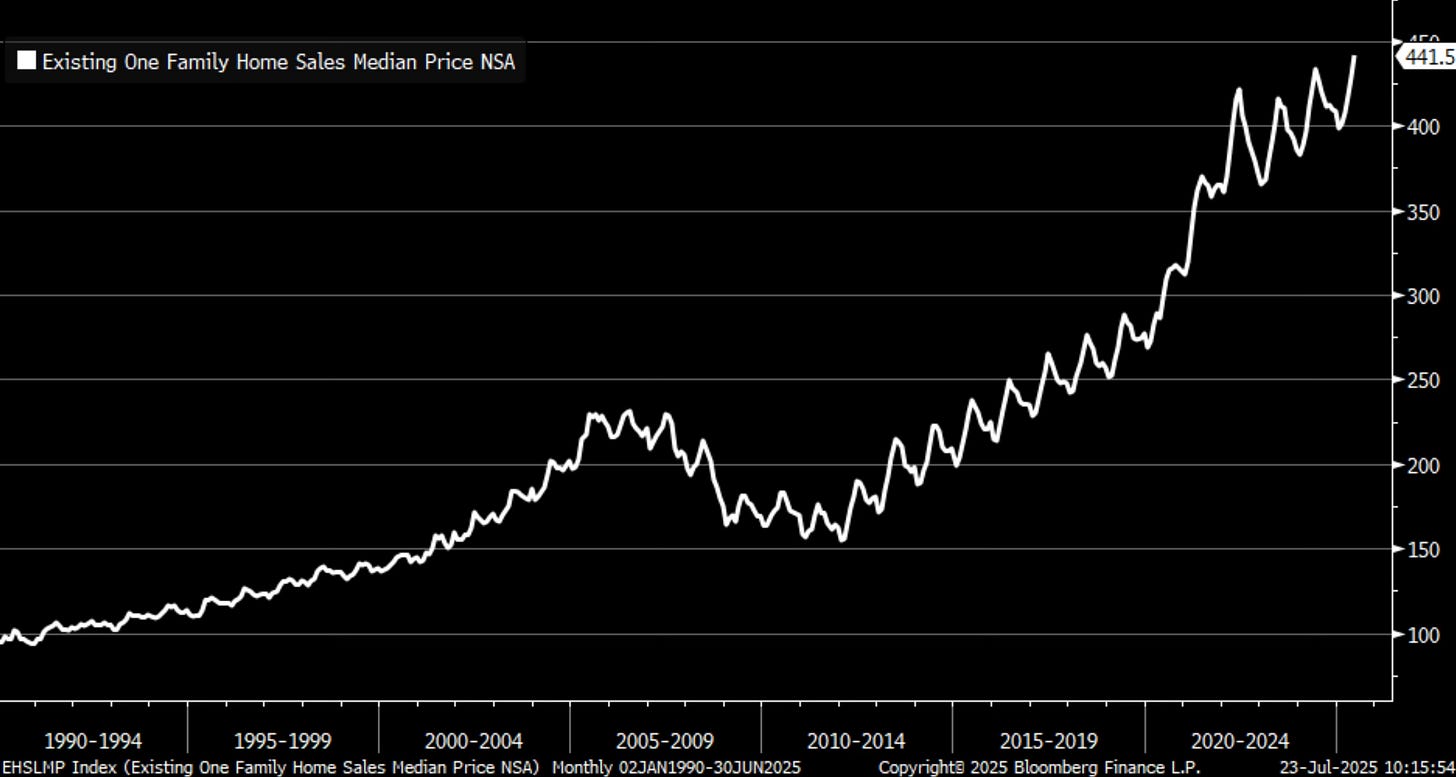

Despite all of this, there was a new record high for existing single-family home prices in June. We will see what the July data shows in the coming days when it’s released.

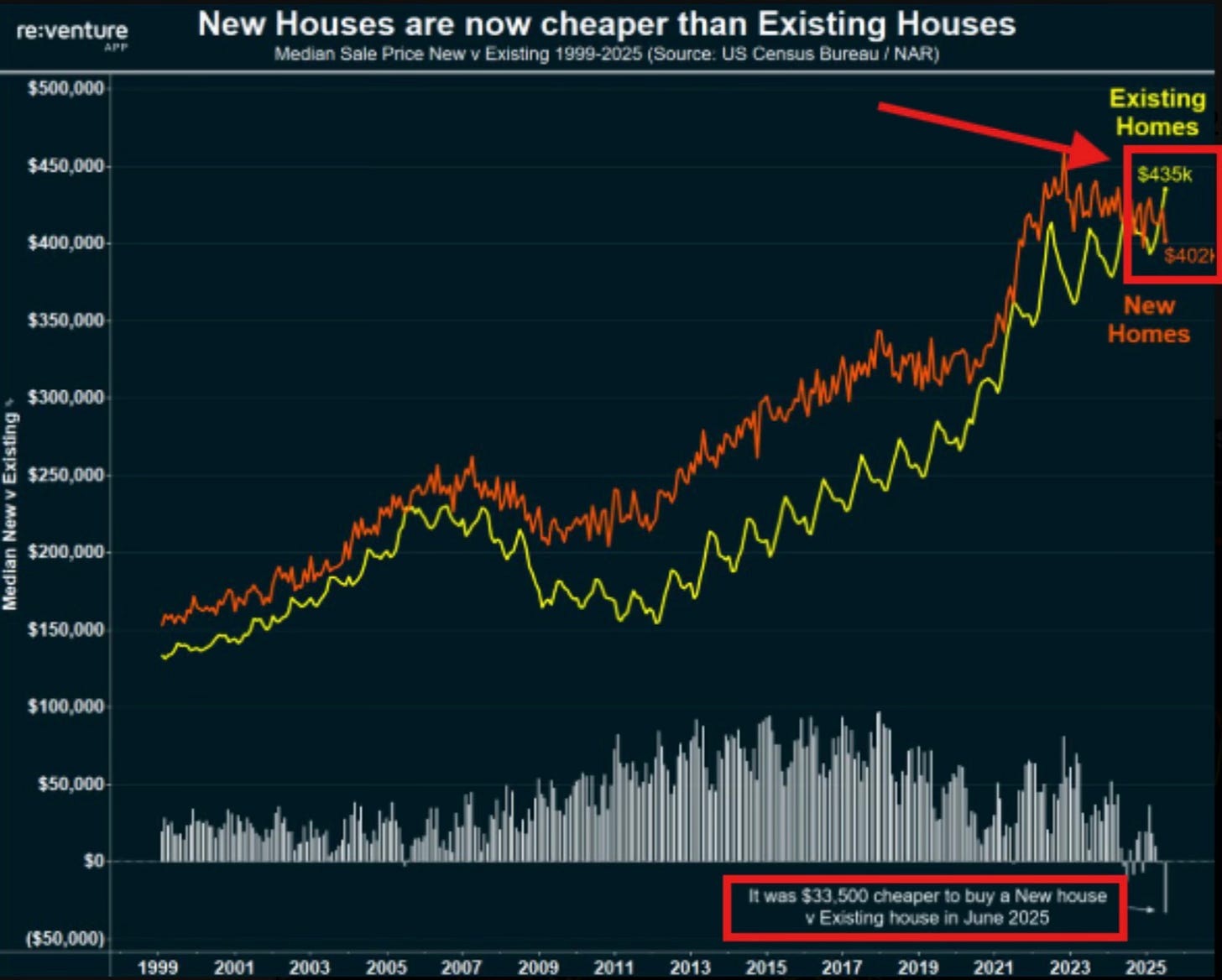

For the first time in history, it’s cheaper to buy a new home than an existing home.

If these conditions continue and further weakening happens, prices will have to change.

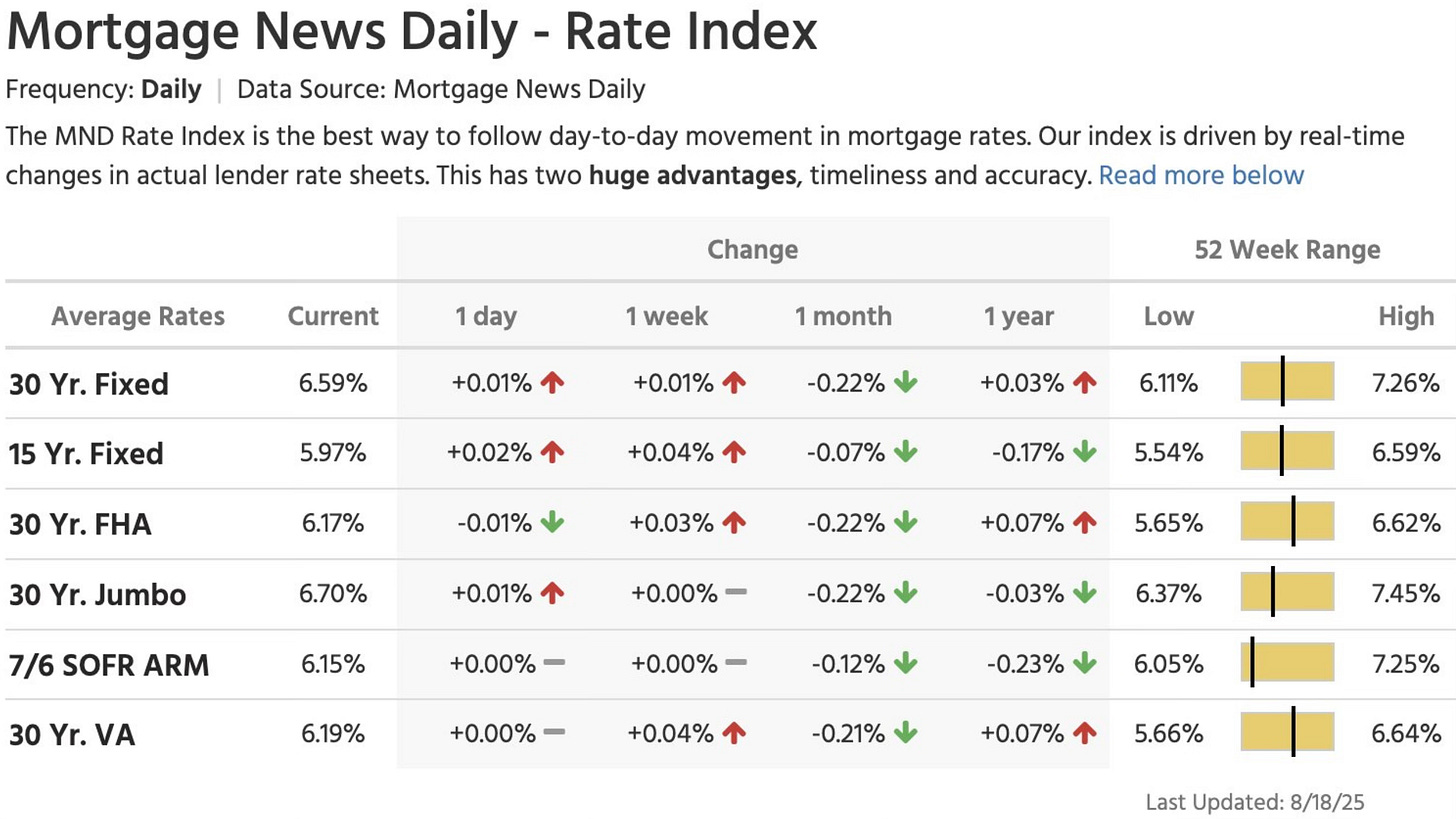

I continue to hear that this is entirely a rates story. I don’t believe that is the entire case here. Yes, it definitely plays an important part.

As of writing this, the 30-year fixed mortgage rate is at 6.59%. That’s the lowest level since October. A year ago, it was almost the same rate.

Rates have to fall substantially to do what so many believe will fix the housing crisis.

To pull out of this housing recession, I think we’re going to need the 30-year mortgage rate to start with a 5. Even then, that may not be enough to spark an immediate turnaround. And let’s be clear, we’re not going back to the 3–4% days anytime soon.

Something beyond rates might be needed to change the direction of this housing recession.

Yes, I said it. I agree with Neil Dutta and Warren Pies: we’re in a housing recession.

The most important question now is, where does it lead next?

The Coffee Table ☕

In the spirit of housing, this was an excellent post by Hamilton Nolan on how much is real estate really worth in the age of climate change. This was sure a thought provoking piece that I enjoyed reading. Cheap Tricks for Hard Problems

Good reminder from Nick Maggiulli on how important it is to save your first $10,000. The First $10,000 is the Most Important It sounds simple but so many overlook this simple personal finance tip starting out.

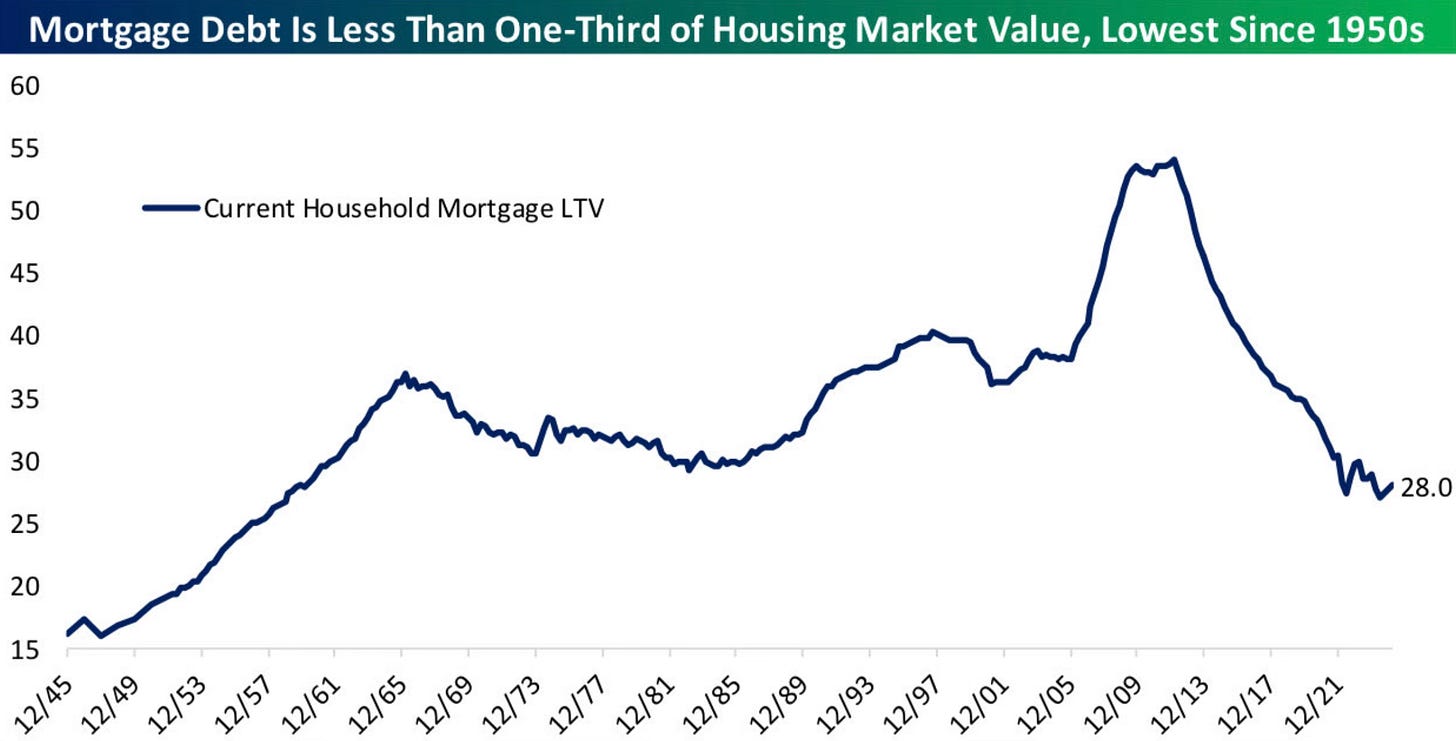

Mortgage debt is now 28% of the U.S. housing market value. That’s the lowest level going back to the 1950s.

Source: Bespoke

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.