Investing Update: Will We Retest the Lows?

What I've been buying, selling & watching

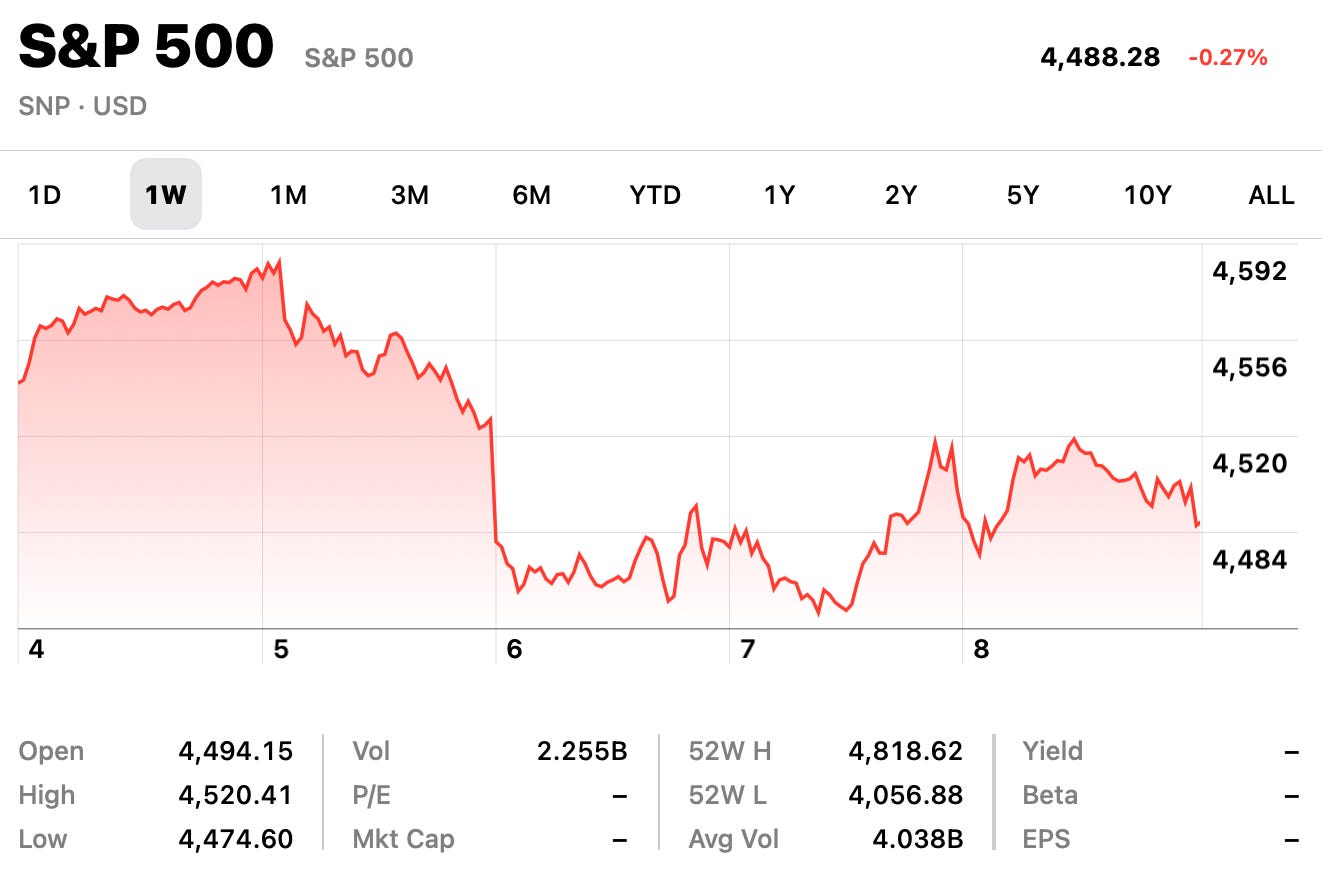

We had seen a nice two week streak of market gains until we saw a reversal on Tuesday. Then on Wednesday morning it took the next leg lower when Deutsche Bank became the first major bank to forecast a recession for the U.S. in 2023.

I did buy on that selloff as you’ll read below. I bought on Wednesday. The S&P 500 was down by over 7% at the time. I felt that was a good time to put some money to work.

My view right now is if you sit in cash you’re going to be starting in the hole by losing to inflation, so -7.5%. I have no interest in bonds. Stocks are where you have to be in my opinion. You need to remember that money always has to be somewhere. That’s why I’m still bullish on U.S. equities.

Does the increased recession talk point to a retest of the 2/24 lows on the S&P 500, or the 3/14 lows on the Nasdaq? Do more banks follow in forecasting a recession? Do we get an inflation read that shows a continued increase?

A worrisome sign is that this week has seen the banks, home builders and transports (trucking, rails & airlines) really flashing weakness. Home Depot (HD) has now reached new lows, -23.8% YTD. Not long ago this was one of the strongest and leading stocks in the market.

The trading range right now seems to be following the VIX (Volatility Index). As the VIX approaches 30 you’re seeing the bulls coming into buy. Then as the VIX gets down to 20 and below, you’re seeing the bears take back over and sell. If you’re a trader, it’s a trader’s environment with a lot of options activity. That isn’t me.

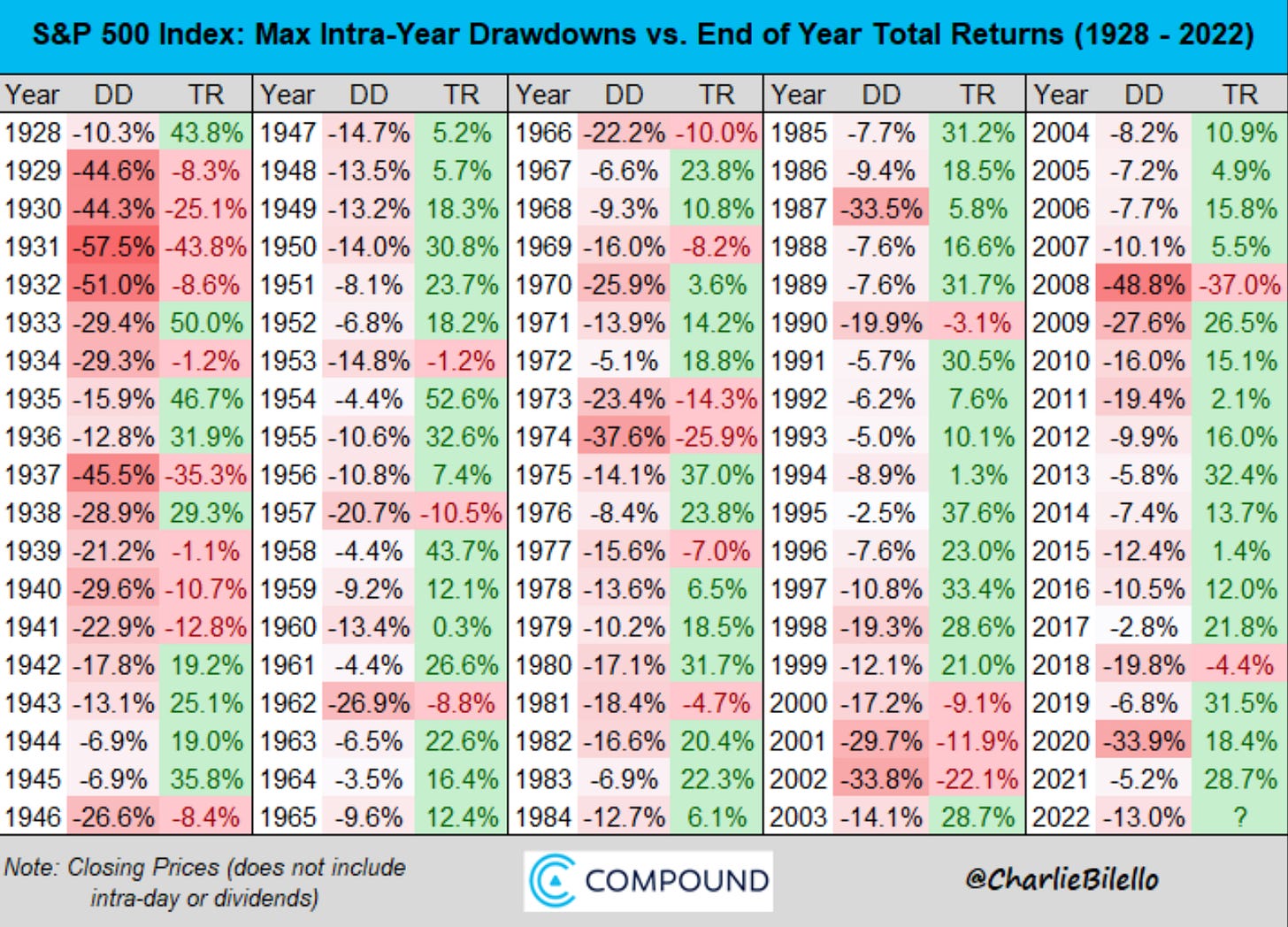

The max drawdown so far this year has been -13% on the S&P 500. We’re sitting at -6.4% right now.

I’m approaching my setup with the anticipation that we retest those lows on the S&P 500 as well as the Nasdaq. I think that those lows will hold and we’ll bounce and rally upward. I still am not ruling out new all-time highs before the end of the year. Right now that sure isn’t the popular belief. But as we know with the stock market, what the crowd and majority thinks will happen, rarely is what actually happens.

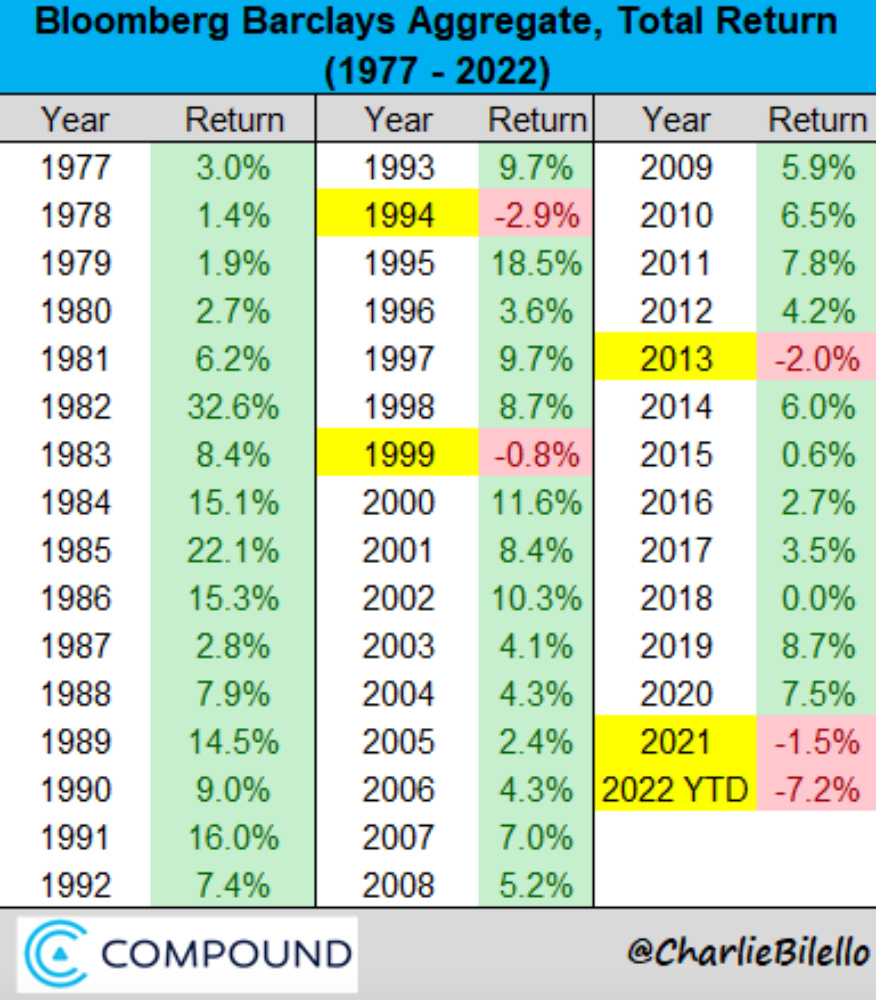

Bonds On Pace For Worst Year In History

Usually investors head to fixed income and bonds for safety. It’s long been viewed as the conservative investment. In 2022 it has been anything but.

After Q1 bonds are on pace for their worst year in history and it isn’t even close. Prior to 2022 the worst year was -2.9% in 1994. Currently they sit at -7.2%. The year still has nine months to go, but it has been a brutal start for an investment that usually provides a conservative return. 2022 is anything but certain or normal.

A Question Answered

Where do I start with buying stocks or funds? How do I begin?

I wrote a post entitled, The Beginning Investor last year. I wrote it as if I were teaching myself tips and how to invest back when I started investing at age 18.

One book I just reread recently that I would add to the list of books to read is, The Little Book of Common Sense Investing By John Bogle. It’s very short, simple to read, understand and apply. Plus it’s written by one of the most respected and influential people in the history of investing and the stock market in Jack Bogle. He is the founder of Vanguard and created the first index fund.

Moves I’ve Made

Vanguard 500 Index Fund (VFINX) This week I bought more of the S&P 500 index. With the S&P 500 being down 7% Wednesday, I decided to add more to this holding. This mutual fund is currently my single largest position.

What I’m Watching

Since we’ve been stuck in this current market range I have not been making a lot of moves. The market ran up and now looks to be coming back down. We may retest the lows again. If we reach those points again, I will be looking to add to some of my existing positions. I’ll also be looking to start a few positions if my price targets hit on a couple stocks.

A few stocks that I have been monitoring are Snowflake (SNOW), Generac (GNRC), Target (TGT) and Microsoft (MSFT). SoFi Technologies (SOFI) had been on that list, but after the student loan interest moratorium was extended the company trimmed their outlook and the stock tumbled. There really are not a lot of stocks that jump out to me and are a screaming buy right now.

Over the past year I really was able to reconstruct my portfolio to position how I want it and in anticipation of this current environment we’re experiencing. The large pullback allowed me to buy and position myself in certain stocks for the longer term, at what I view as very cheap levels. If we fall further from here and retest, or fall to new lows, most of my buying will be in adding to my existing positions.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe and/or give a gift subscription for others.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.

Disclaimer: This is not investment advice. You should not treat any opinion expressed as a specific inducement to make a particular purchase, investment or follow a particular strategy, but only as an expression of an opinion.