Investing Update: Why I Bought Peloton Again

What I'm buying, selling & watching

Right now it feels that the stock market is like a coiled spring. When we get some good news I think we see a big bounce. When is the last time the market had any good news to get excited about? On the days that see a rally, it gets sold off the next day. It’s not the buy the dip market we’ve become used to over the last few years. We’re now in a sell the rally type market.

When inflation stabilizes, I think we’ll see a market jump. If we see a cease fire in the Russia and Ukraine conflict, stocks are going to explode upward. Market aside, I think everyone in the world hopes for a quick resolution and that peace comes any moment so what’s happening over in Ukraine stops.

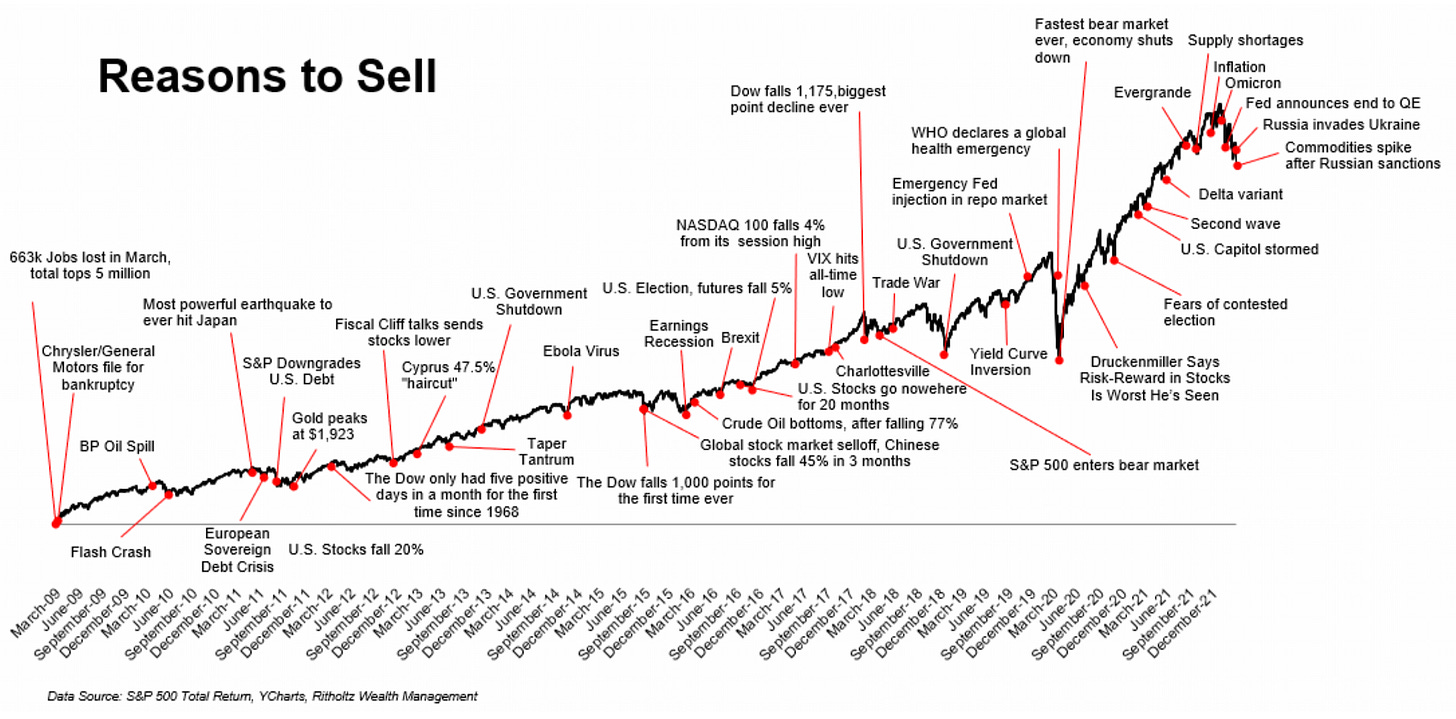

I think one of the best charts I’ve seen this year is below. It really puts into context long-term investing and having an investors mindset.

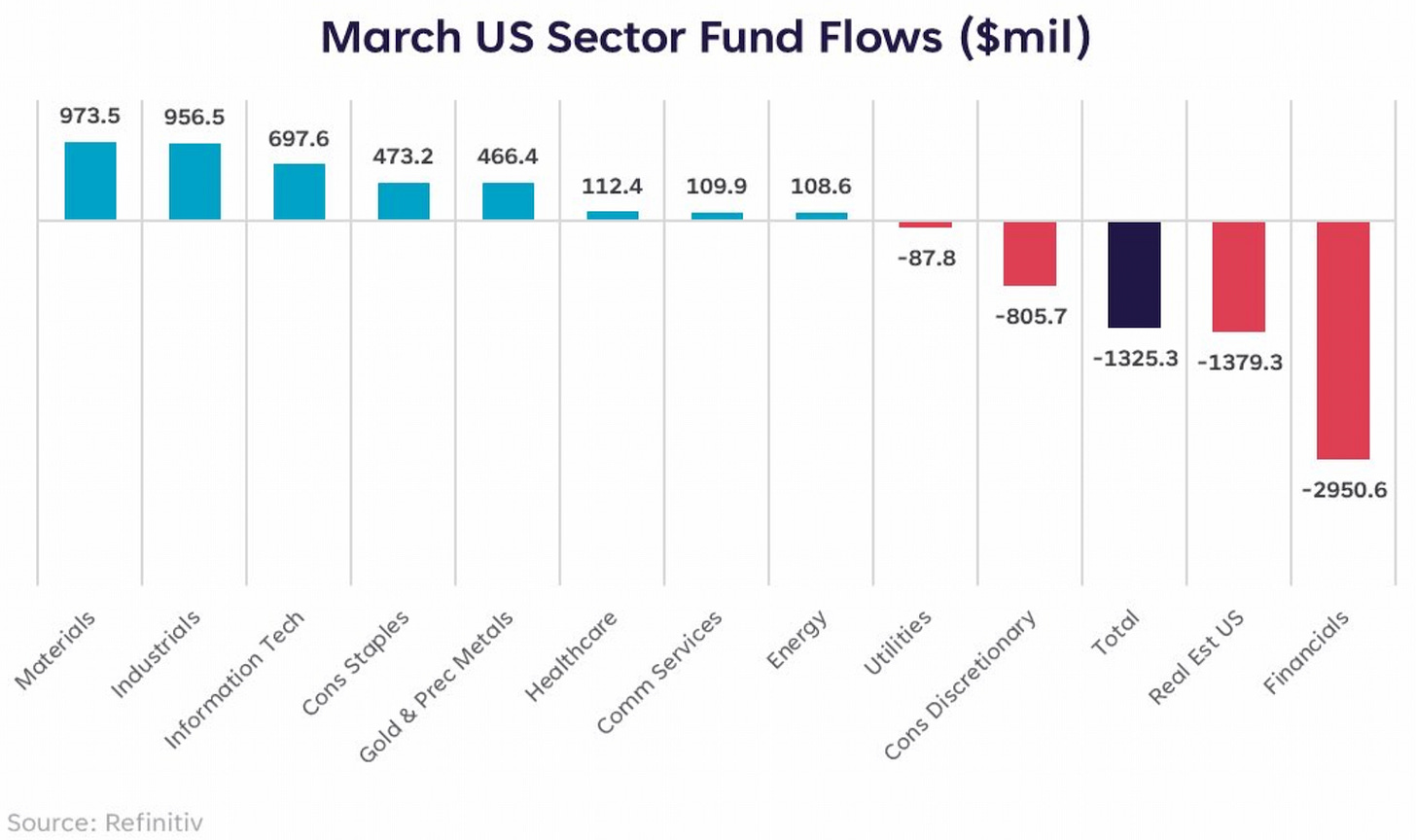

We’re hearing a lot of bearish talk from investors and market professionals. But this chart that shows where money is flowing. Eight sectors are seeing net inflows. Below is the March sector fund flows so far this month.

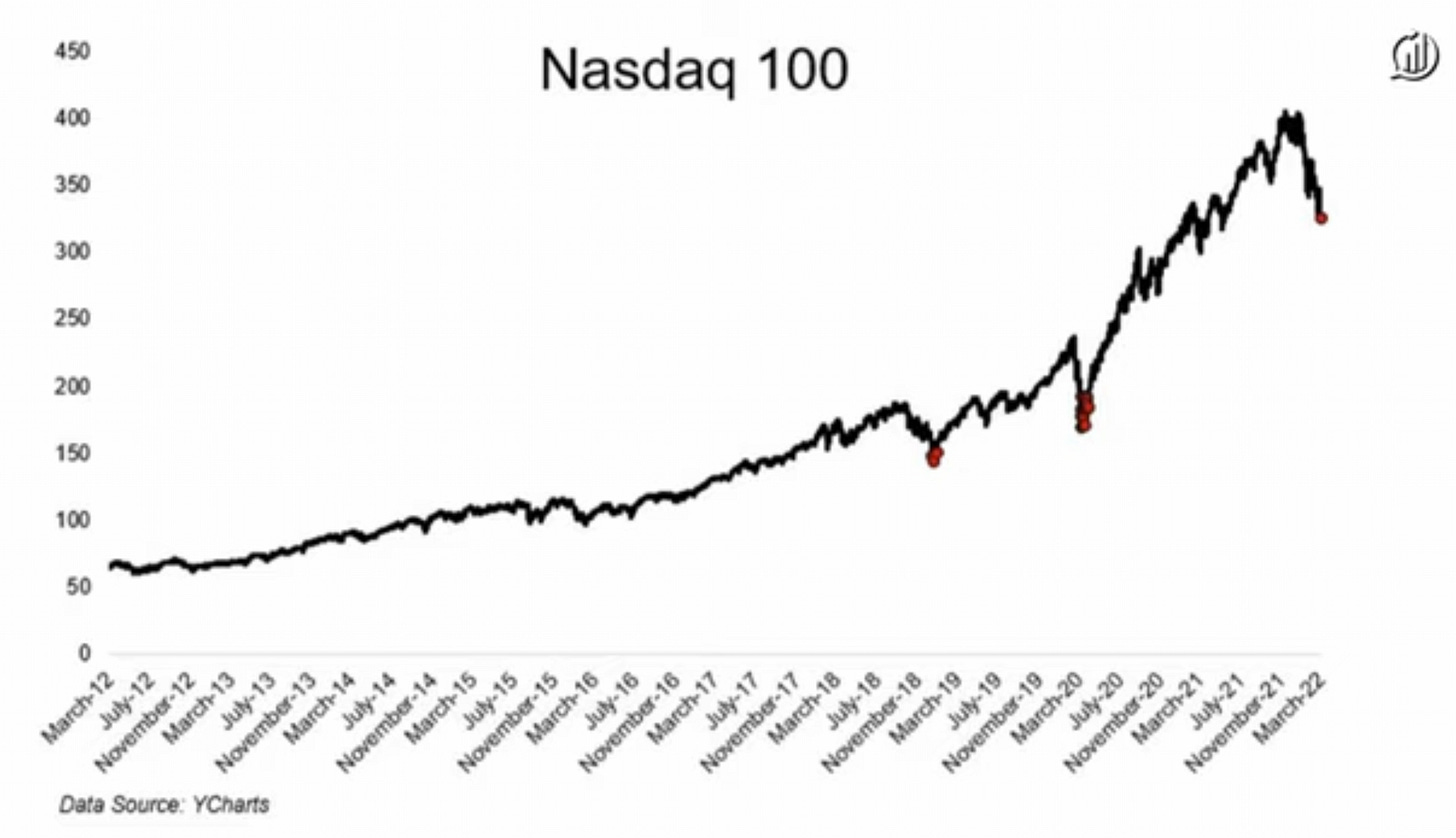

Here is what the Nasdaq total returns have been from 2012 until today. This index is starting to become intriguing at the current levels.

2012: +18%

2013: +37%

2014: +19%

2015: +10%

2016: +7%

2017: +33%

2018: +0.04%

2019: +39%

2020: +49%

2021: +27%

2022: YTD -19%

A Question Answered

How do I buy the Nasdaq index like I can the S&P 500 index?

This gives you a way to track the Nasdaq-100 index rather than buying the individual stocks. It’s 100 of the largest non-financial companies listed on the Nasdaq based on market cap. You can invest in the overall Nasdaq index via an ETF like the QQQ (Invesco QQQ Trust) or via a mutual fund such as FNCMX (Fidelity Nasdaq Composite Index Fund).

Moves I’ve Made

Peloton (PTON) I had mentioned that I had a buy in for Peloton. It hit that level this past week at $22. I’m back on the roller coaster. As you recall I originally bought this at the onset of the pandemic at $32 a share. It skyrocketed up into the $160s where I started to sell and sold at various points down to $55 where I closed my position. It turned out to be a huge winner for me.

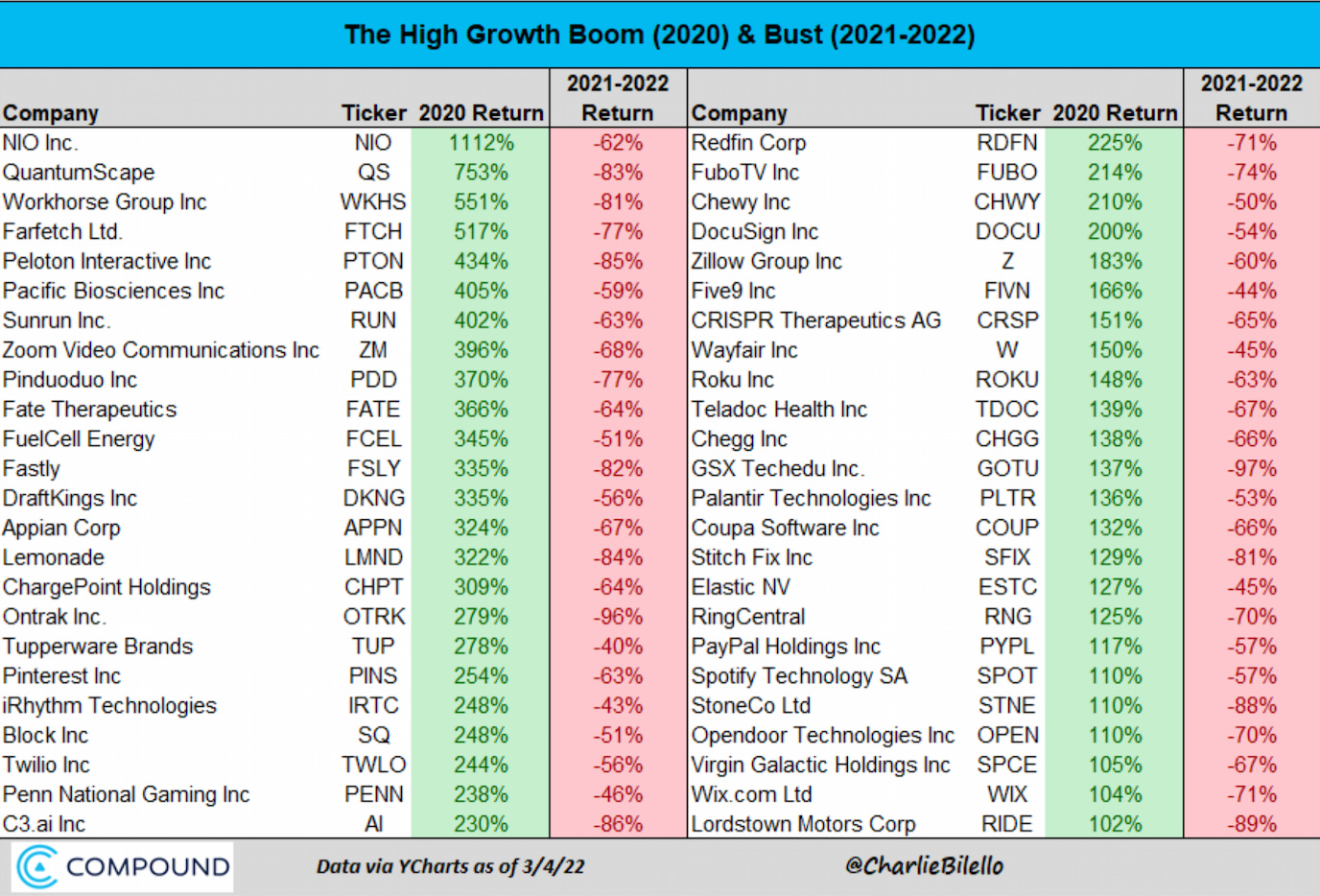

In the past year this stock is now down 81%. It has given up all of its gains through the pandemic. It’s now fallen 16.24% below the IPO price of $25.24 in September 2019. It’s almost as if the pandemic never happened.

I’ve written extensively about Peloton over the past few years. My love for the product is well known. Here is my post from last year, More Than a Bike. I believe we’re now in value territory for this stock. Plus I have a front row seat as a daily user. Any changes or improvements I can judge for myself and if it’s still headed in the right direction.

After doing research on new CEO Barry MccCarthy and his new chief supply chain officer Andrew Rendich, I’m more comfortable with the direction management is going. I’m expecting more people to join Peloton from the Netflix and Spotify pipeline. Hearing that one of my favorite investors, Bill Miller expressed that he was thinking of buying Peloton in February. That made me feel much better about hopping back on this roller coaster.

Shopify (SHOP) It seems like I keep trying to catch a falling knife and keep getting cut. I added to my position again at the $550 level. My cost basis keeps getting lowered, that is the good thing. The bad thing is that’s because the stock keeps falling. I fully believe in this company and feel this is one of the stocks that will lead the overall market higher when this downward trend turns.

What I’m Watching

I’m really starting to zero in on some of the high tech growth stocks that have been obliterated. They’ve been in a bear market since November. Some of them even longer. When they started to crack they’ve led the market down into this overall bear market everything is now experiencing.

Looking at things from the long-term view, some of these companies are deeply discounted. The tough part of course is which ones? I’m already making bets that Shopify, CrowdStrike and Peloton will be among the long-term winners. The next Amazon, Tesla etc. are among this group that has seen selloffs of 50-90% from their highs. Here is a chart that shows what has happened with some of these companies.

I feel that when the market turns back upward that you will first see an upward trajectory turn in what first led the market lower, the high growth tech stocks that right now nobody wants to own. But the window for not wanting to own, means what? A month, six months, a year? They will be in favor again and now is the time to start watching and nibbling at any you like long-term. They’ve been sold off at first due to interest rate hike worries, then it was the growing inflation and now due to the Ukraine and Russia war. Of course they can go even lower, but I feel some are bottom bouncing at these current prices.

I’m watching the following companies.

Twilio (TWLO)

Upstart Holdings (UPST)

SoFi Technologies (SOFI)

Sea Limited (SE)

MercadoLibre (MELI)

Snowflake (SNOW)

Dutch Bros (BROS)

Airbnb (ABNB)

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe and/or give a gift subscription for others.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.

Disclaimer: This is not investment advice. You should not treat any opinion expressed as a specific inducement to make a particular purchase, investment or follow a particular strategy, but only as an expression of an opinion.