Investing Update: Who's Selling? You Need To Know

What I'm buying, selling & watching

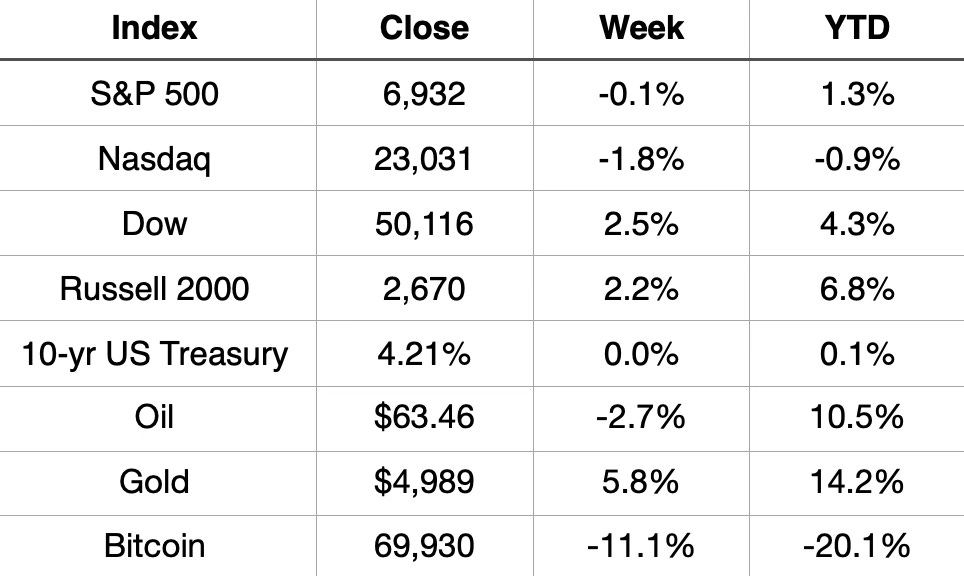

Wall Street delivered one of its most bifurcated weeks in recent memory, culminating in a historic milestone as the Dow crossed 50,000 for the first time ever, surging 2.5% for the week. But beneath this celebratory headline lies a market undergoing violent rotation. The Nasdaq fell 1.8%, suffering its worst three-day decline since April before Friday’s rally, while the S&P 500 barely held the line at -0.1% for the week.

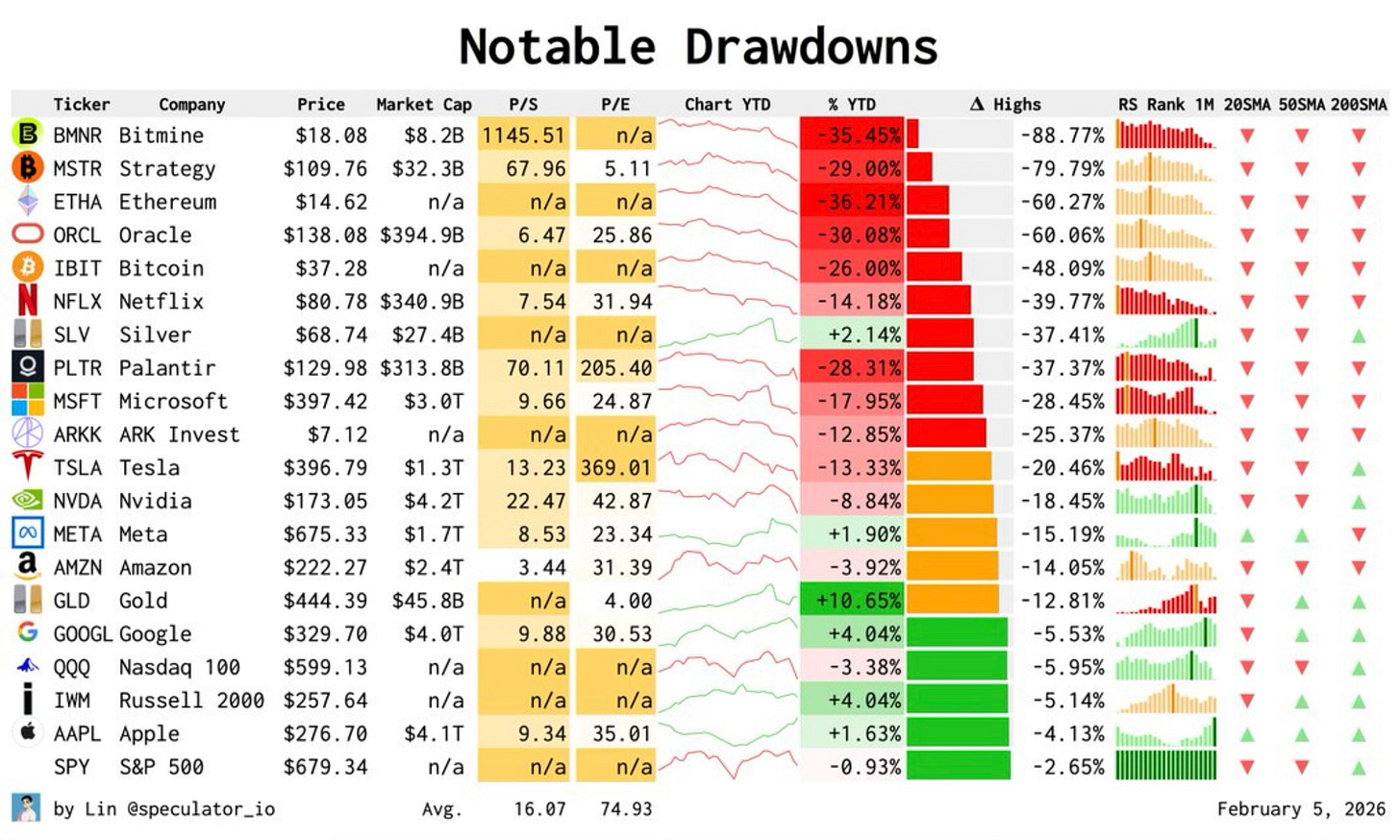

The real story emerged in the extremes: software stocks posted their worst week since the 2008 financial crisis, down over 9% and now off 24% year-to-date. Meanwhile, the Russell 2000 small-caps surged 2.2% and lead all indices at +6.8% for 2026. Gold rocketed 5.8% to nearly $5,000, Bitcoin crashed 11.1%.

The divergence is striking. Value and cyclicals are gaining strength as growth and tech confront an existential reckoning tied to AI disruption. This is not a simple rotation. It’s looking like a regime change.

Market Recap

Weekly Heat Map Of Stocks

While the Dow's 50,000 milestone grabbed headlines, the equal-weighted S&P 500 quietly closed at a new all-time high on Thursday, a critical signal that market strength is broadening, not narrowing.

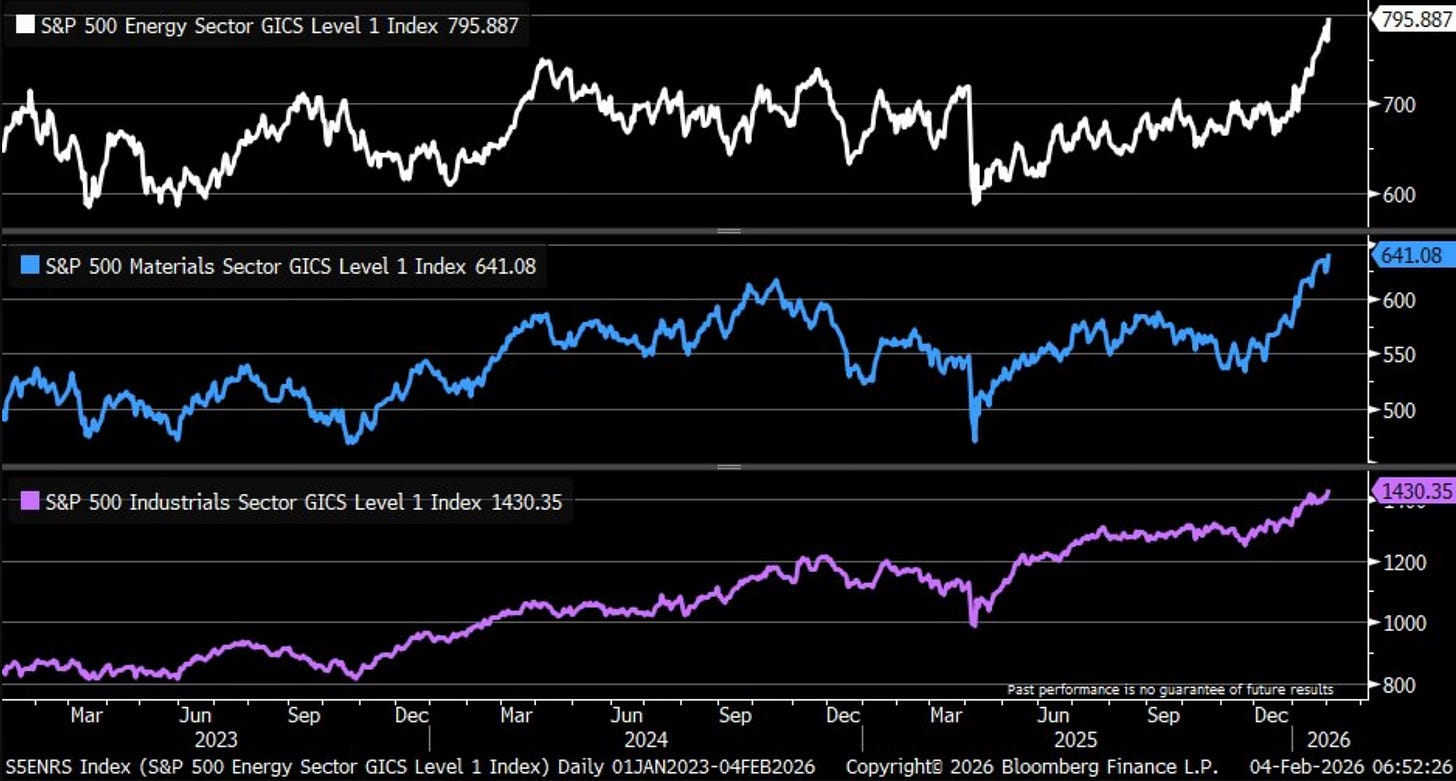

Energy, materials, and industrials all hit record highs this week, confirming this isn’t a one-sector story.

The Rotation Could Not Be Clearer

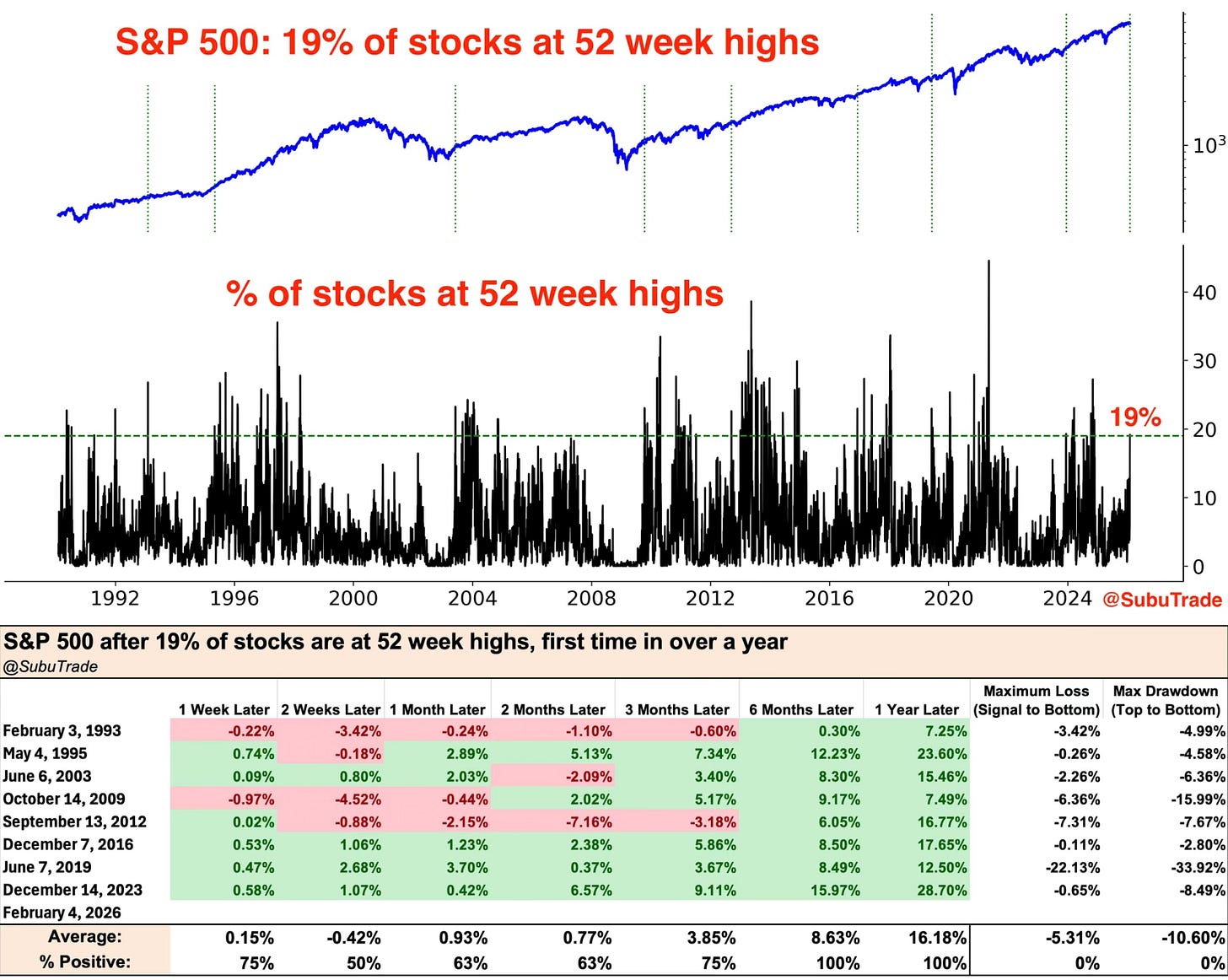

Tech is weighing down the S&P 500, but breadth keeps expanding. For the first time in over a year, 19% of S&P 500 stocks are hitting 52-week highs. Historically, when breadth expands like this while tech consolidates, the S&P 500 has been higher 6 to 12 months later every single time.

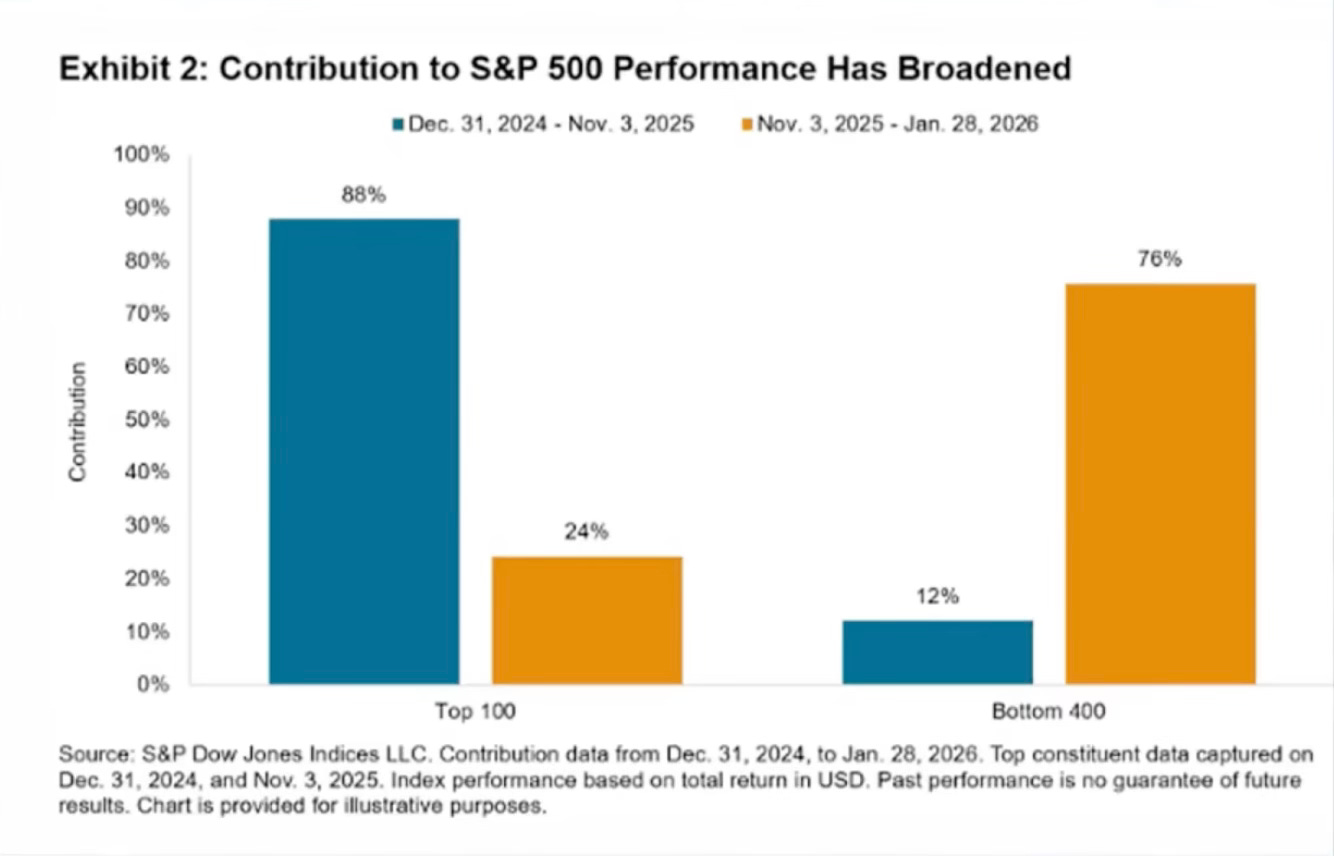

The broadened rotation couldn’t be anymore clear than this chart here. Look at that shift in contribution to the S&P 500 performance.

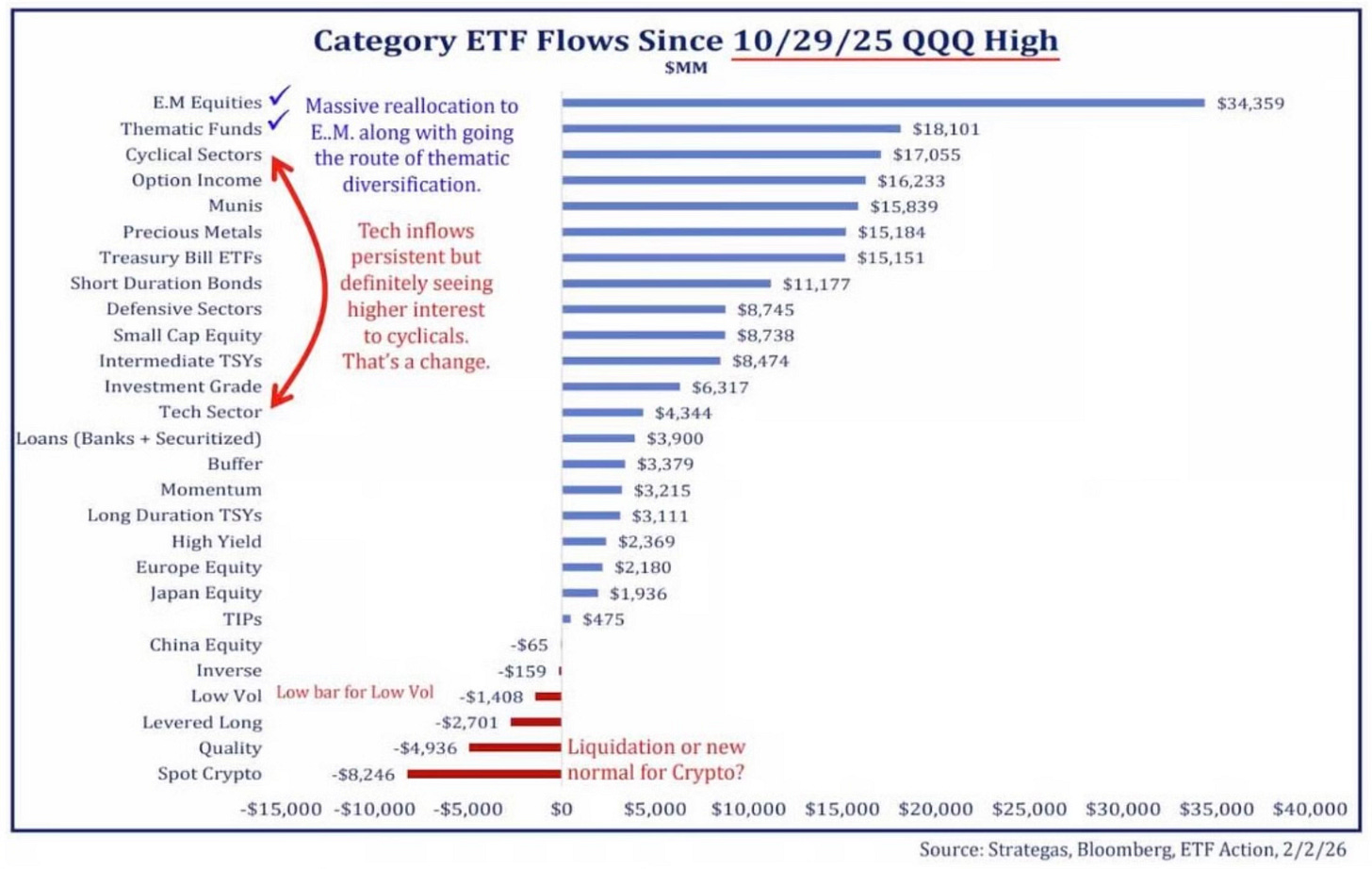

Since the Nasdaq peaked on October 29th, the money has been flooding into emerging markets, thematic funds, and cyclicals. ETF flow data shows a clear exodus from mega-cap tech into overlooked corners of the market.

Contrary to what you hear in the media doom loop, yes, some former high-flying AI names and crypto have struggled, but this is exactly why you keep a diversified portfolio. High beta names? Ouch. But the market is far healthier than the Nasdaq’s -1.8% weekly decline suggests.

Some may argue these violent cross-asset rotations signal an unhealthy market. Maybe. But expanding breadth, record highs in equal-weight indices, and capital flowing into previously unloved sectors? That's not distribution, that's rotation. And rotation, historically, has been the fuel for the next leg higher.