Investing Update: What You Only See In A Bull Market

What I'm buying, selling & watching

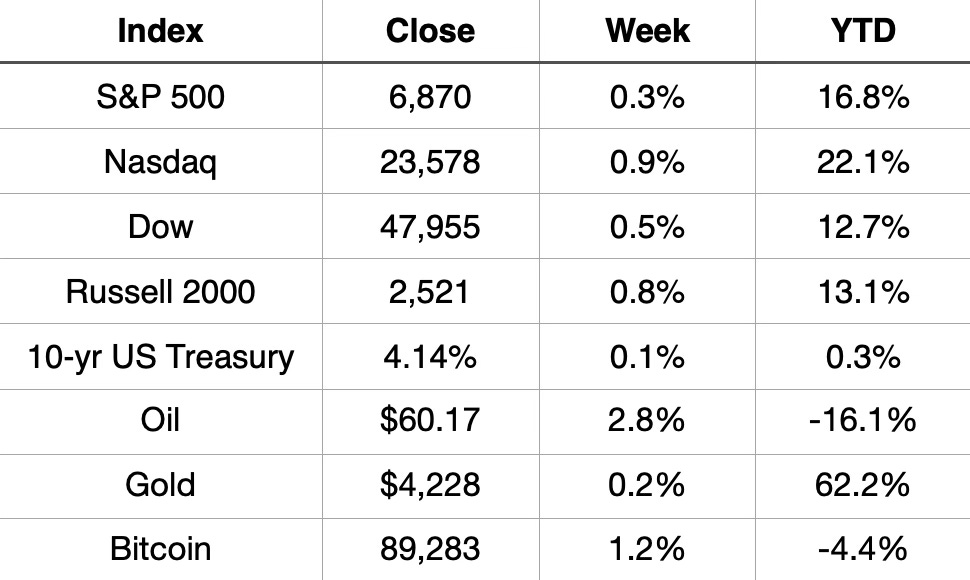

The market closed out its second straight positive week, with both the S&P 500 and the Nasdaq posting four day winning streaks to finish the week.

Year to date, the S&P 500 is up 16.8%. The Nasdaq continues to lead with a gain of 22.1%, and the Dow is higher by 12.7%.

Market Recap

Weekly Heat Map Of Stocks

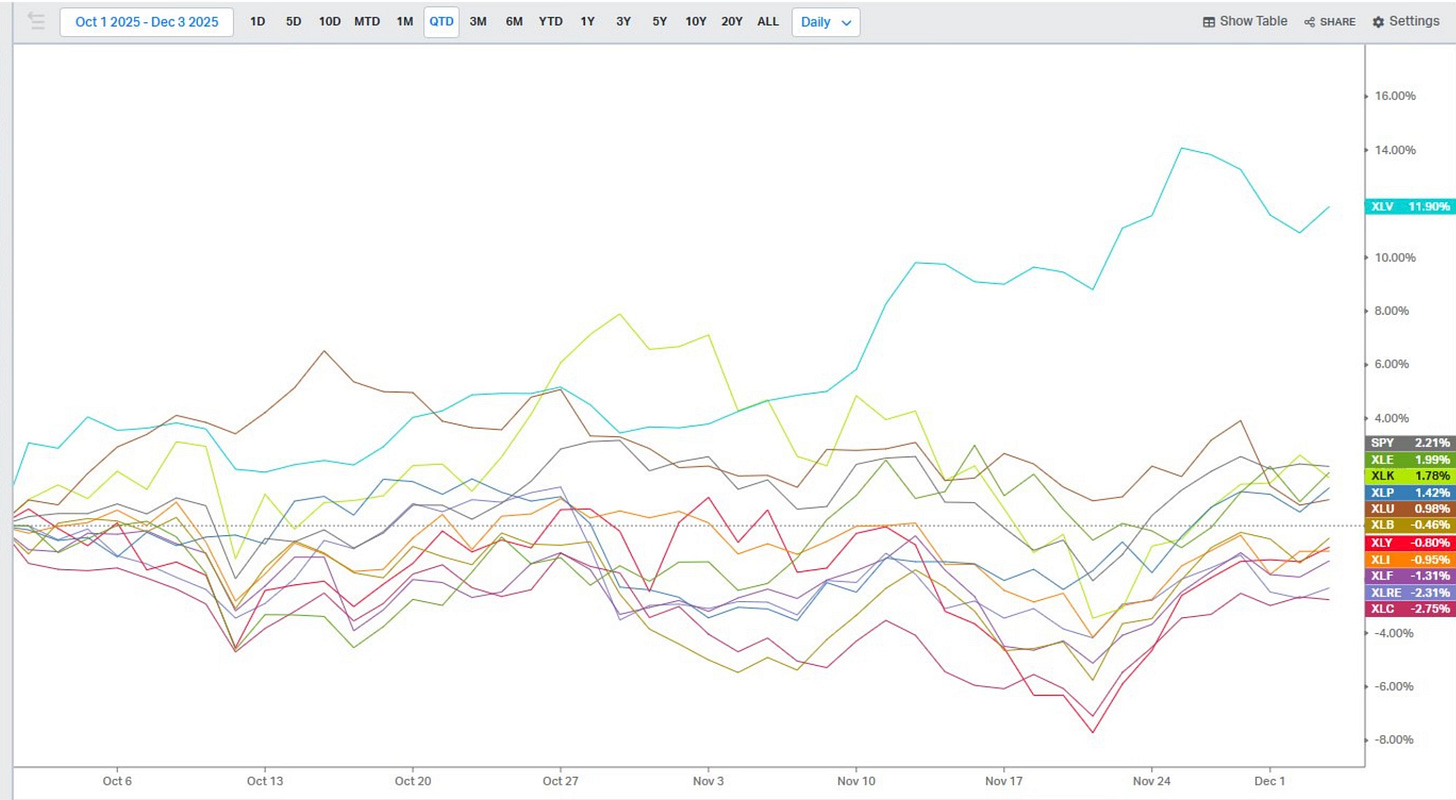

It might come as a surprise, but there is only one sector that’s outperforming the S&P 500 in Q4. It’s health care and by a wide margin.

The S&P 500 sits at 6870 and is within a stone’s throw of a new all time high.

My year-end price target for 2025 was 6,900. I predicted that in January in my Investing Update: 2024 Recap & 2025 Outlook.

With only a few weeks left in the year, it may come down to the wire to see how close my price target ends up.

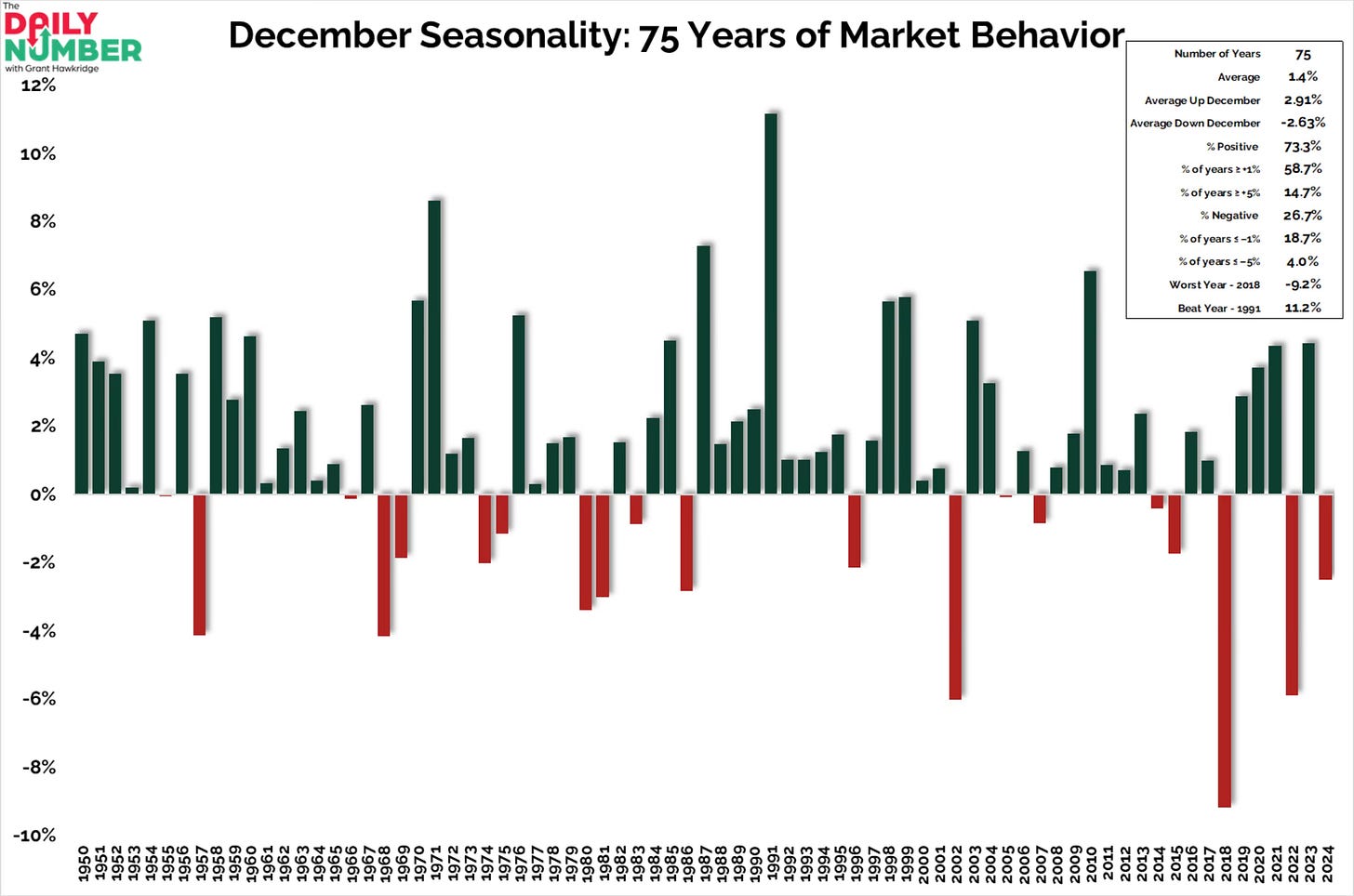

We are entering a historically bullish part of December. The average gain is 1.4% and 73.3% of the time December is positive.

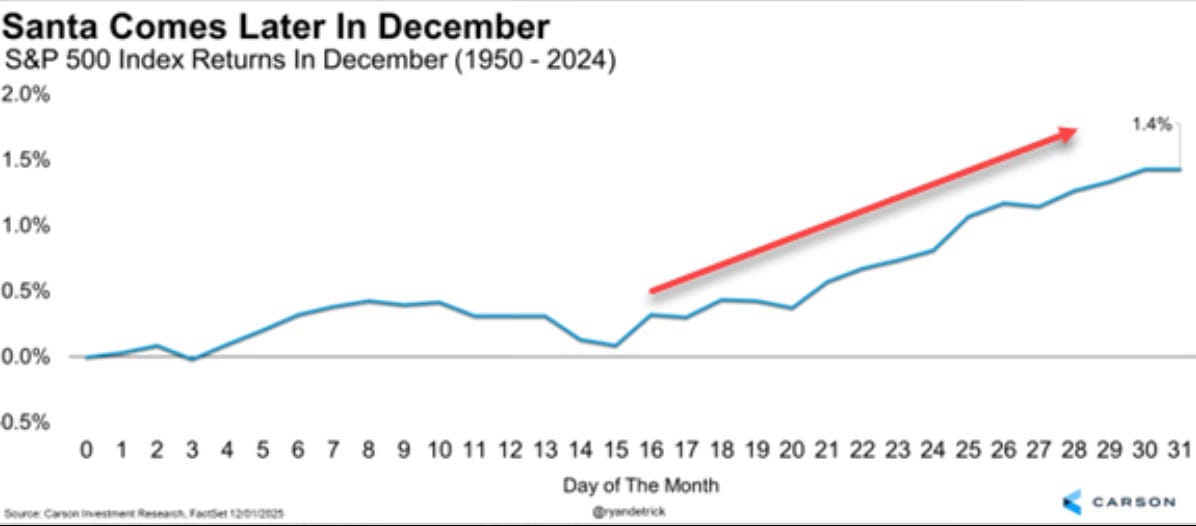

And who can forget the looming Santa Claus rally. Remember the Santa Claus rally doesn’t start until the 24th.

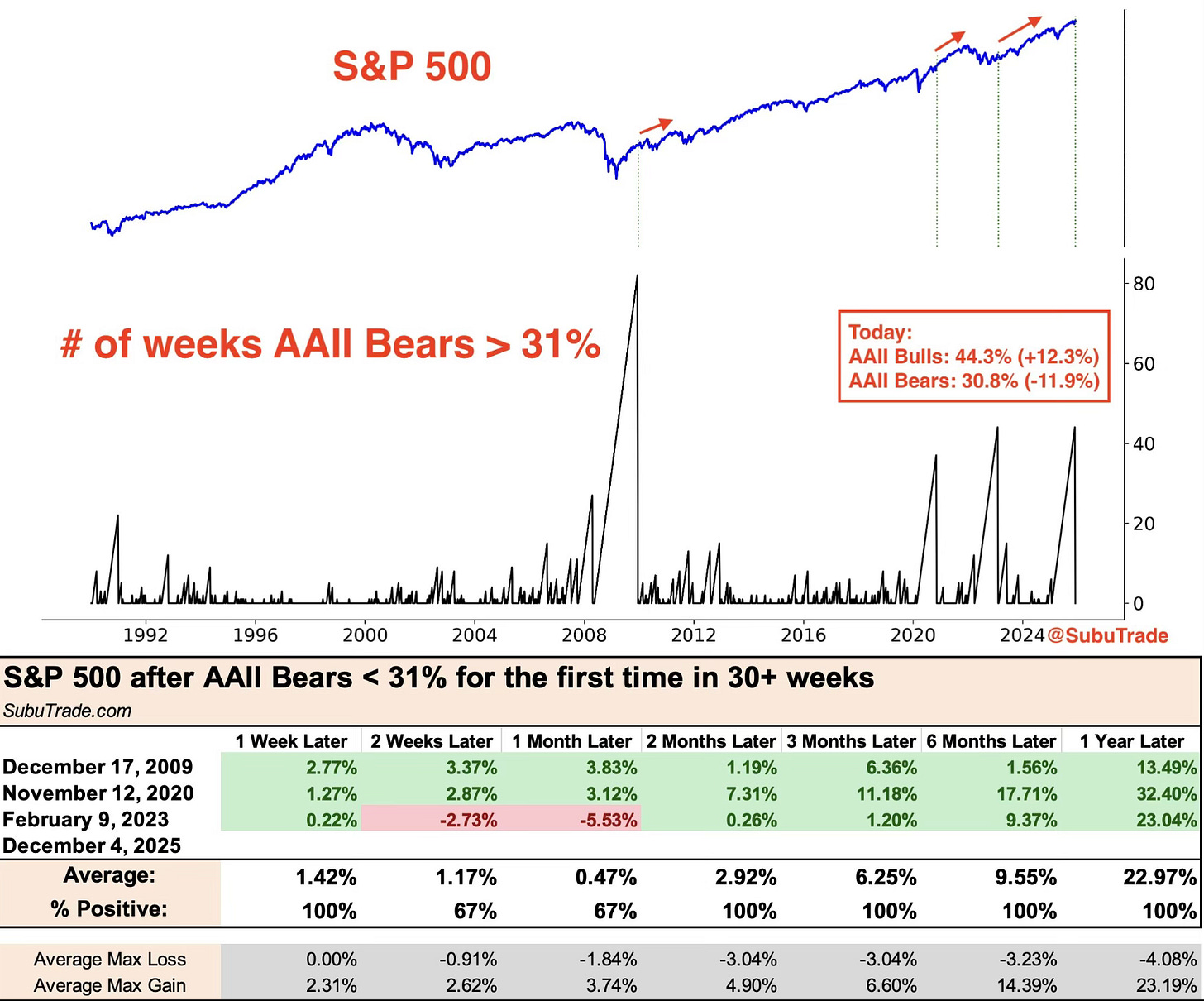

Sentiment is also improving. AAII bears fell below 31%. That’s noteworthy as that’s the first time it has been to that level in 44 weeks.

This is only the fourth time it has happened. In the previous three instances, the S&P 500 was higher two months, three months, six months and one year later.

It’s shaping up to be a strong run into year end. We’ll see whether the S&P 500 reaches my year end target of 6,900 or if that projection ends up being too conservative.