Investing Update: The Everything Rally

What I'm buying, selling & watching

This week saw the 7th positive week in a row for S&P 500. That’s the longest weekly win streak since October 2017.

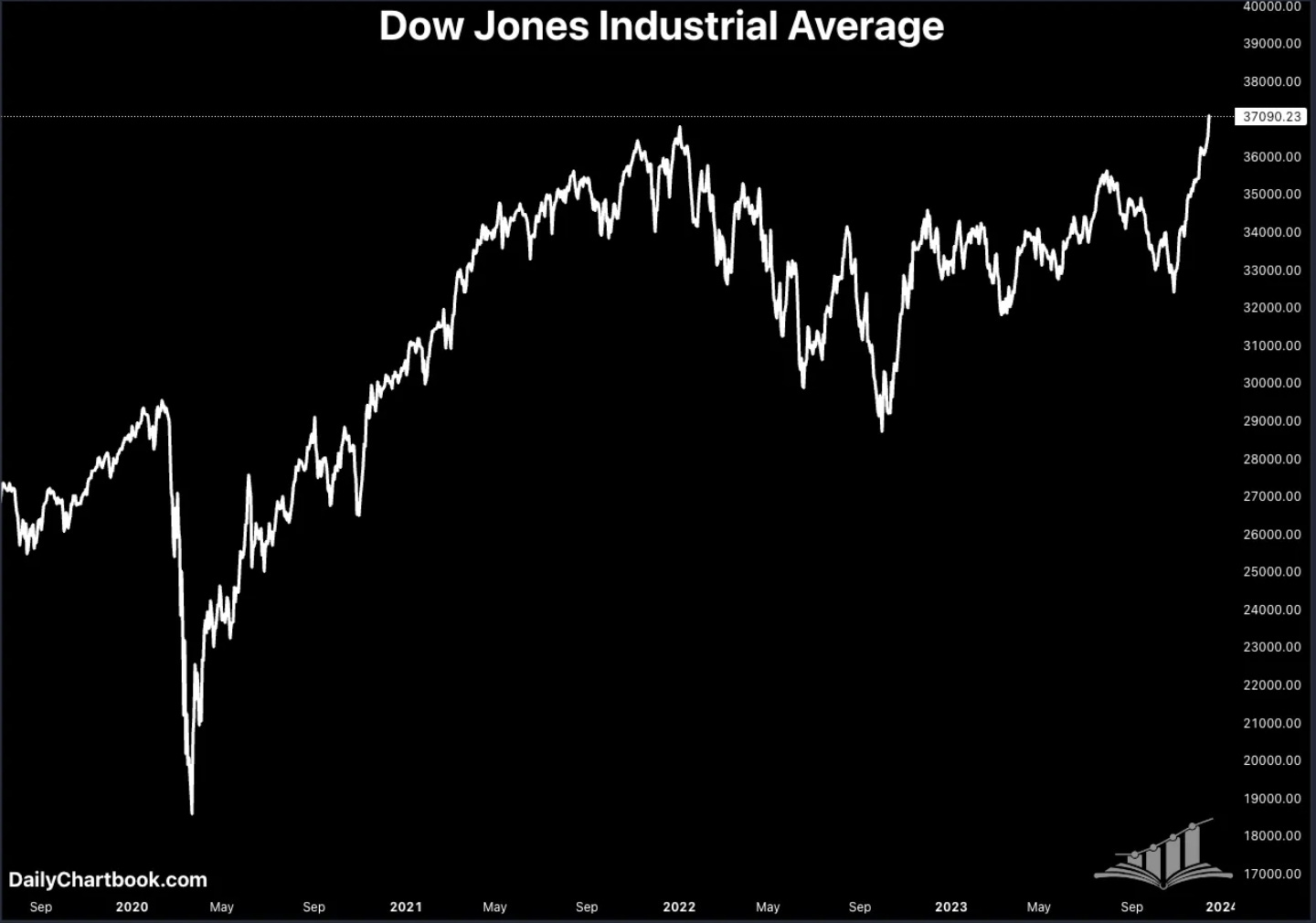

The Dow (+12.58% YTD) set a new all-time high this week.

The S&P 500 (+23.4% YTD) and Nasdaq (+42.62% YTD) are on the doorstep of new all-time highs as well.

What pushed the stock market to the next level was what happened on Tuesday and Wednesday of this week.

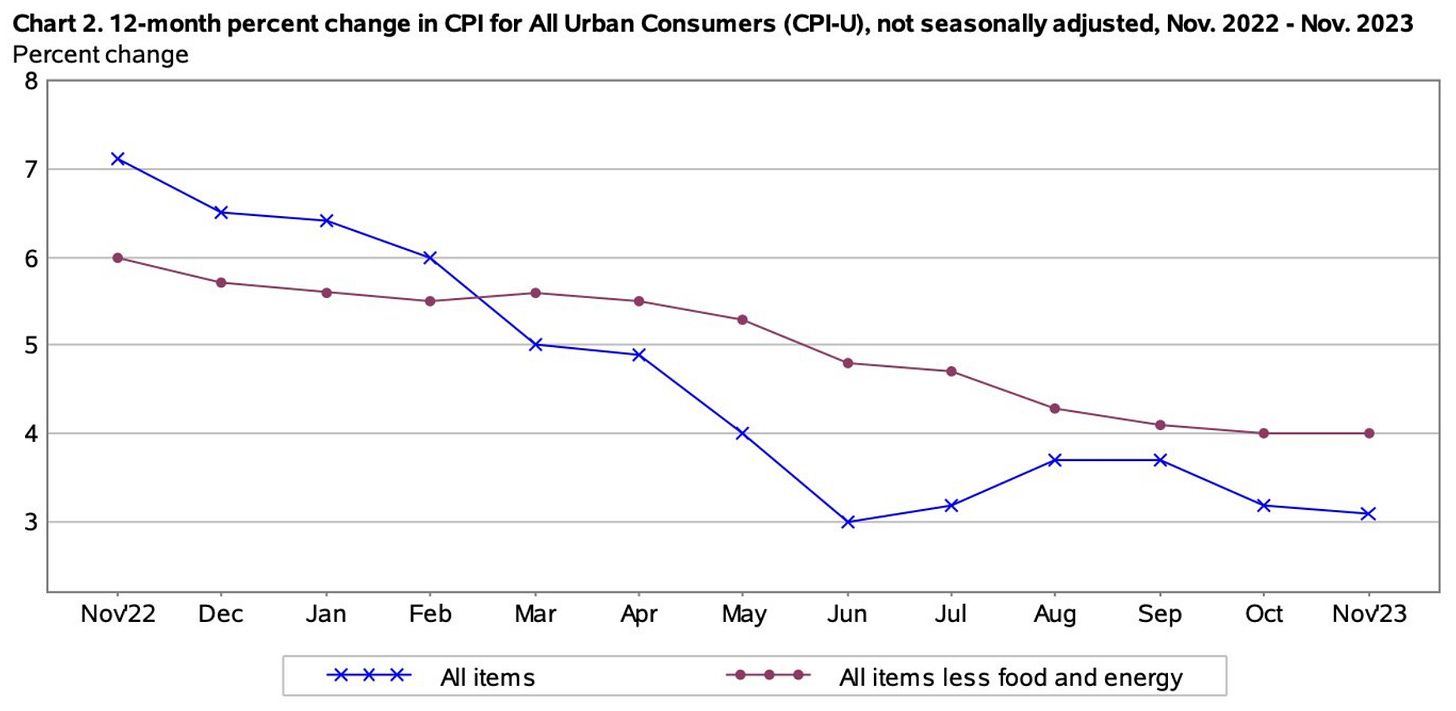

Inflation was in line with expectations on Tuesday. Shelter is still the largest factor and I found it interest that if you were to strip out shelter, we’ve actually had two months of deflation. Some positives on the inflation front.

Wednesday was Fed day. It turns out Fed chair Powell was Santa Clause and gave an early Christmas gift to stock investors.

The Fed signaled at rate cuts which pushed the 10-year treasury yield below 4% to 3.90. That’s the lowest level since July. The October high was 4.98%.

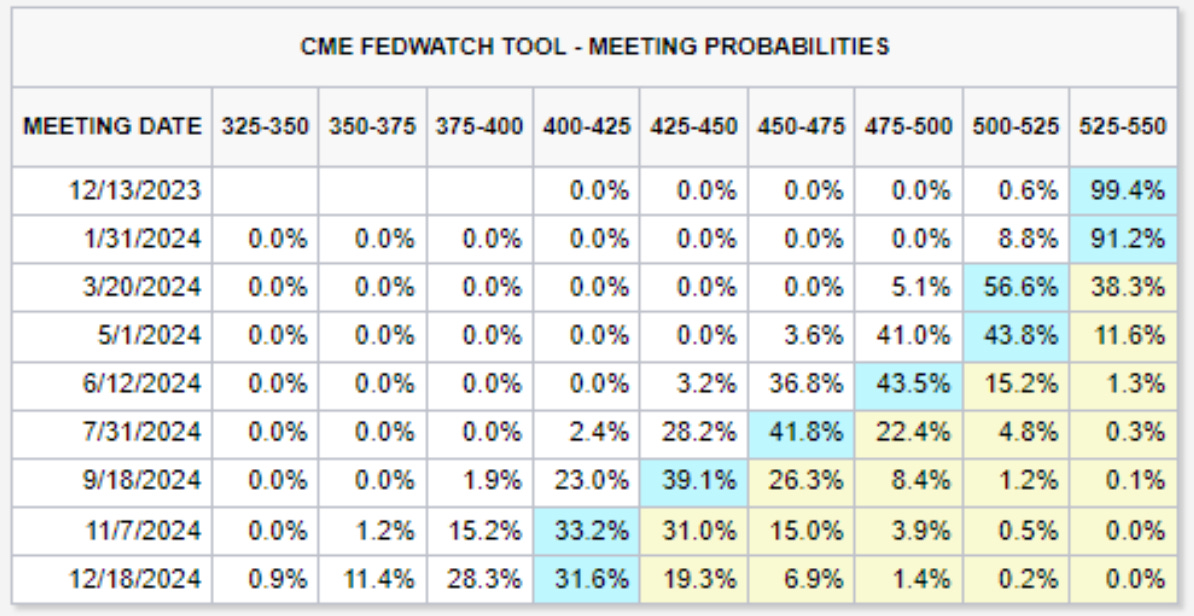

Interest rate futures now show a 57% chance of rate cuts coming already in March 2024. With a projection of five interest rate cuts coming next year. Now you can see why we saw an everything rally in the stock market this week.

3 Stocks For Year-End Update

In my November 11th Investing Update: 3 Stocks For Year-End I mentioned three stocks I liked for the final 7 weeks of the year. With only two weeks of the year left, I wanted to check in to see how they’re doing.

Since November 11th, the S&P 500 is up 6.88%. My three picks have done the following.

CrowdStrike +32.48%

Uber +19.93%

Celsius Holdings -13.60%

I’m happy with 2 out of 3. I own shares in Uber and CrowdStrike. I didn’t buy Celsius Holdings but still have it on my watchlist.

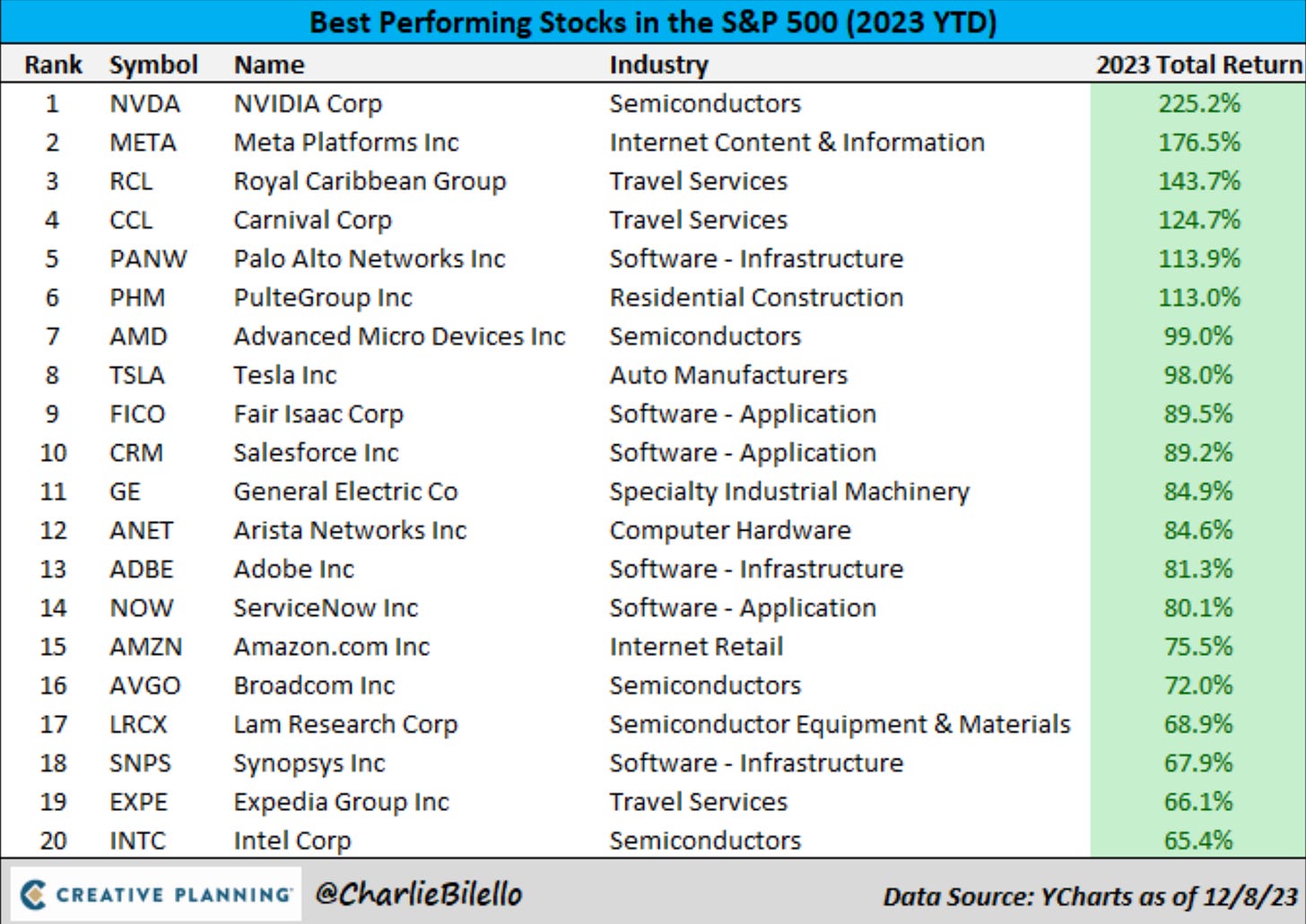

Here is an update on the best performing stocks in the S&P 500 YTD.

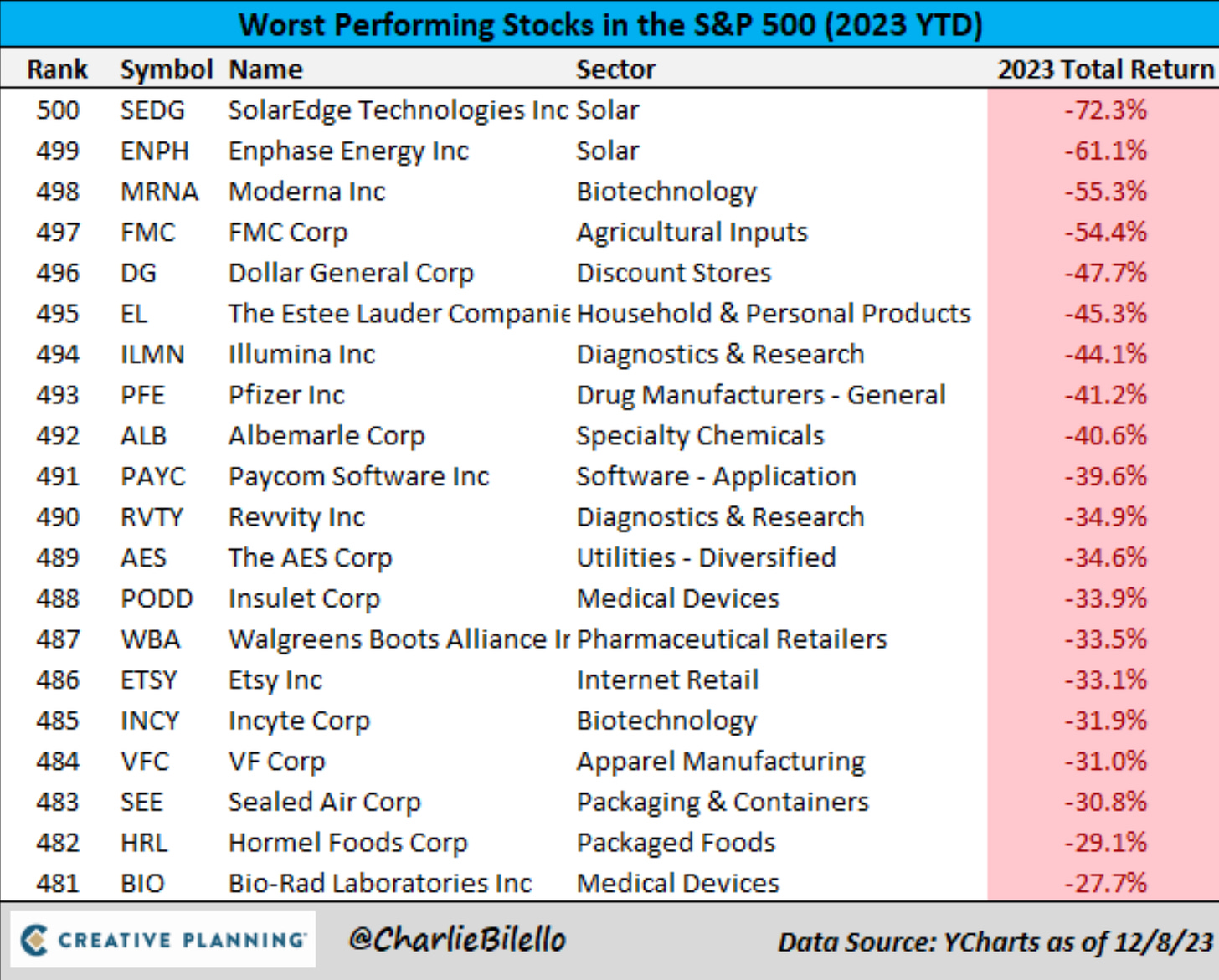

Here are the worst performs YTD in the S&P 500.

Money Is Moving

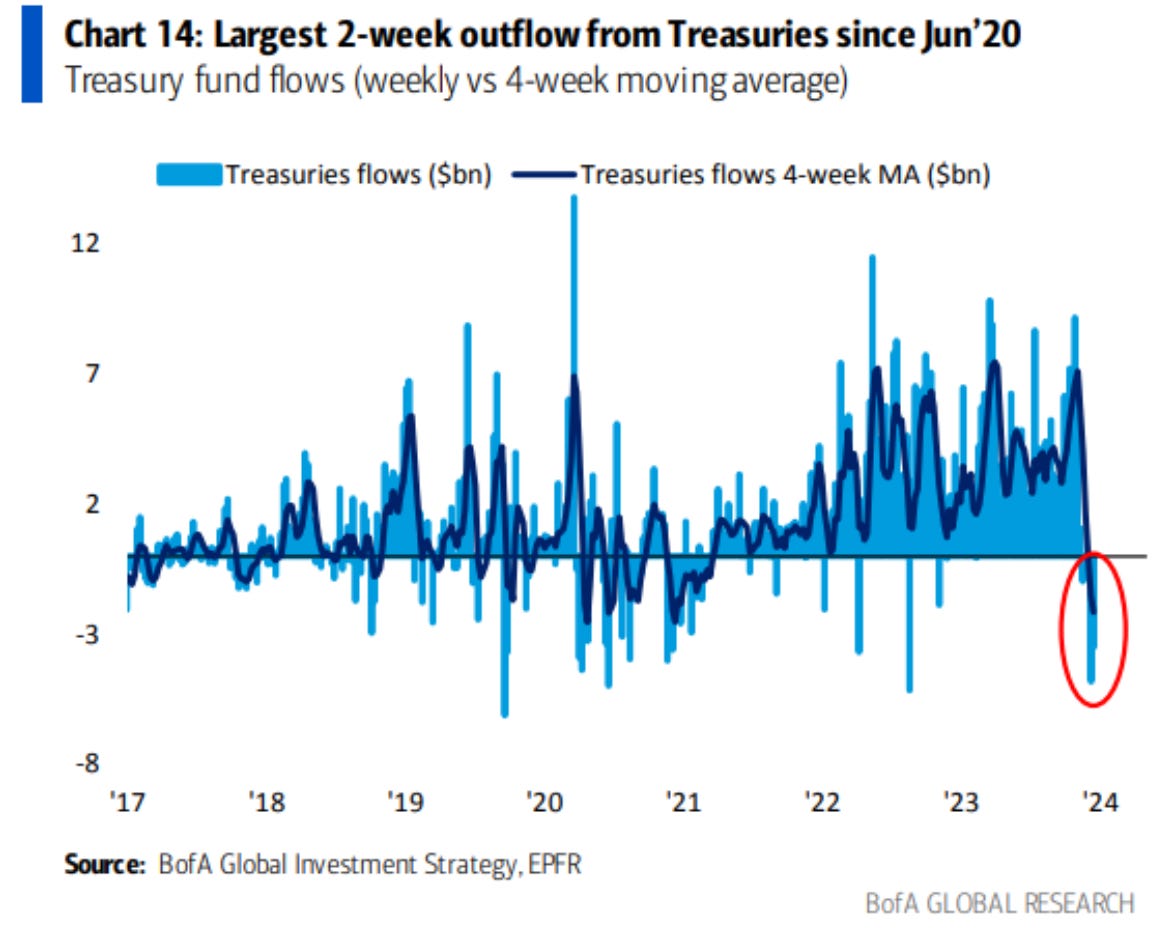

For most of 2023 we have seen the flow of investor money move to treasuries. 4% to 5% treasuries sounded nice. But once the market started to run higher, you knew FOMO would set in and money would start to funnel back into equities.

It’s happened. We just saw the largest 2-week outflow from treasuries since June 2020.

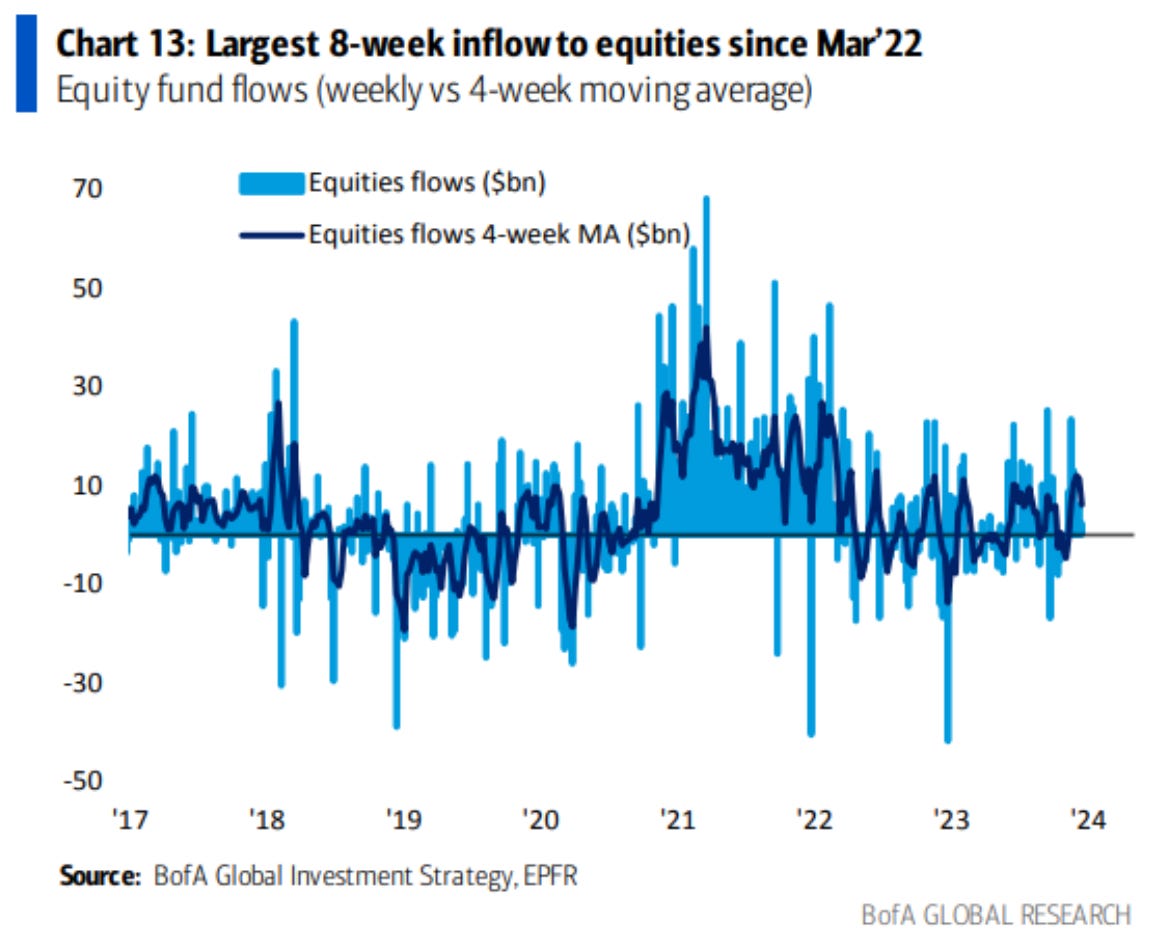

Where did it go? Right where you would expect, equities. Equity fund flows saw the largest 8-week inflow since March 2022. As more chase this rally nearing all-time highs, we will likely continue to see even more money flow in.

Companies Remain In Great Shape

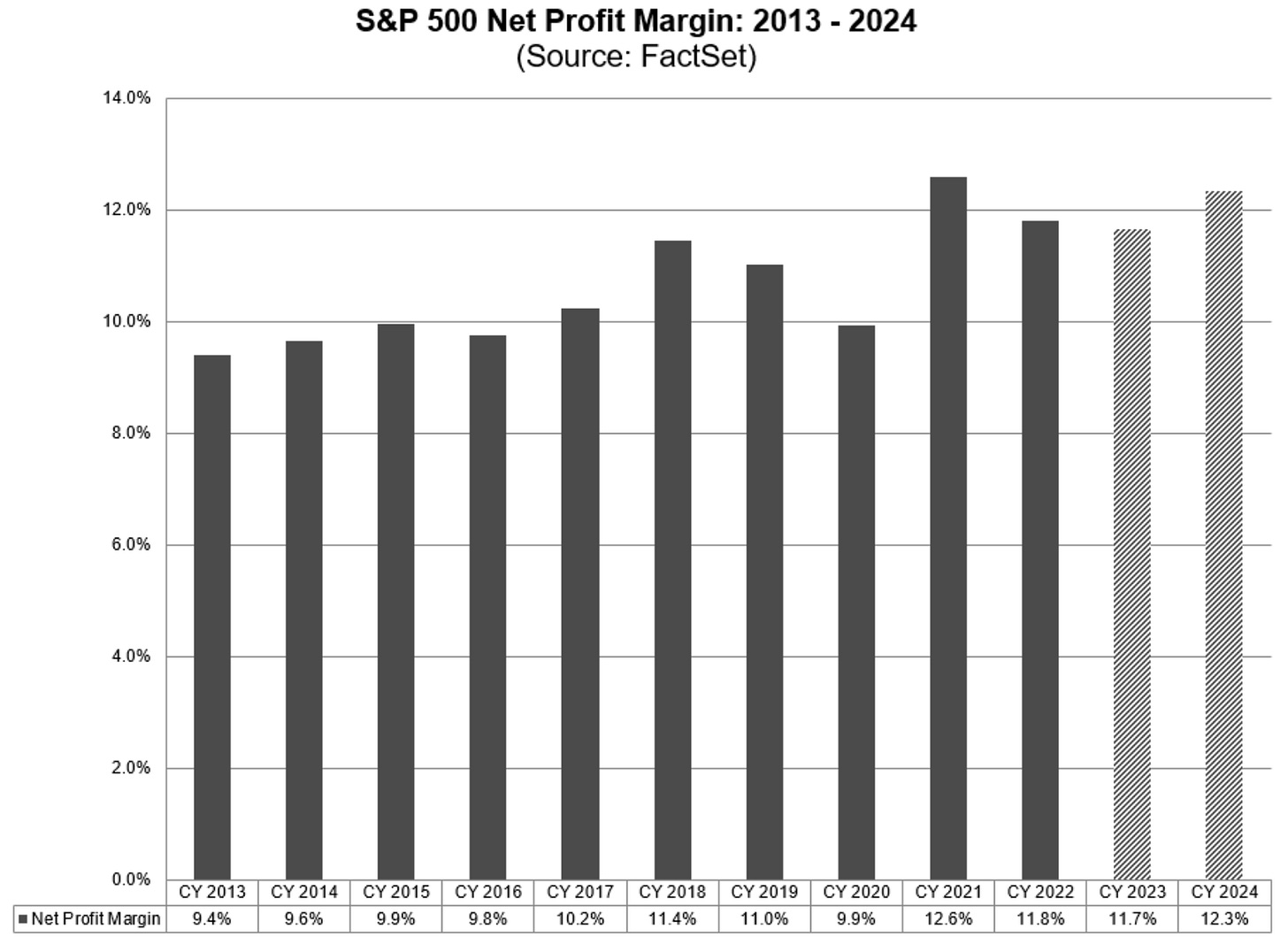

In addition to the strong economy and stock market, companies are also projected to continue with growing net profit margins. Analysts are expecting 2024 S&P 500 net profit margins to be at 12.3%. That would be the second highest number of the past 10 years.

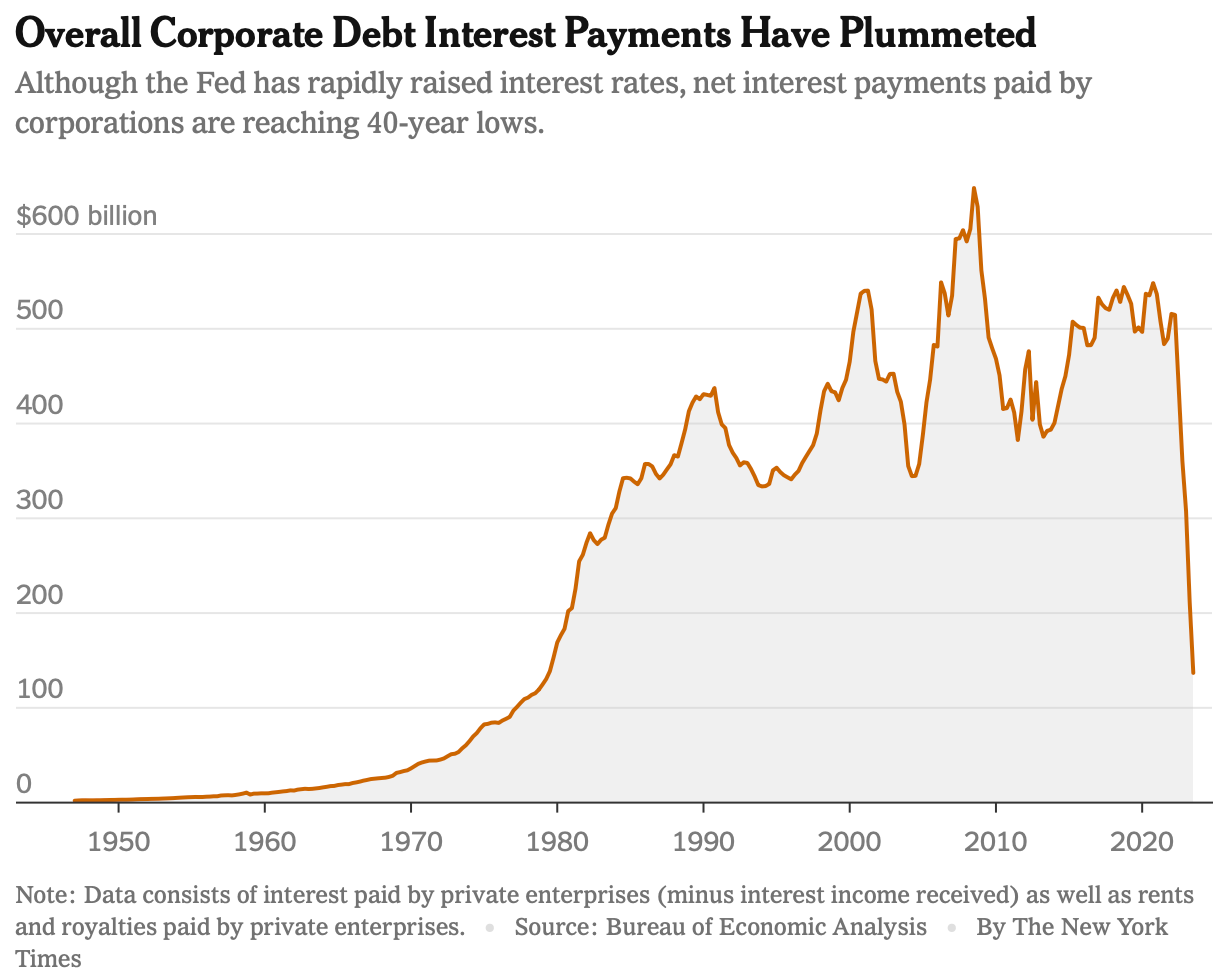

The other side of company’s balance sheets is corporate debt. That also is in much better shape than I was aware of. The interest payments on corporate debt has plunged and are reaching 40 year lows. This plunge comes while the Fed was hiking interest rates.

How can that be? 90% of the corporate debt of S&P 500 companies is at fixed long term interest rates. Those rates were locked in while interest rate were low.

Worth Monitoring

With all the popping of champaign and new high on the stocks market, there are a very areas of concern worth monitoring.

Job openings are starting to trend lower and the S&P 500 continues to go higher. That usually isn’t the case if you look back through the early 2000s. In fact, I was surprised with how closely they’ve tracked each other in this chart from Barchart.

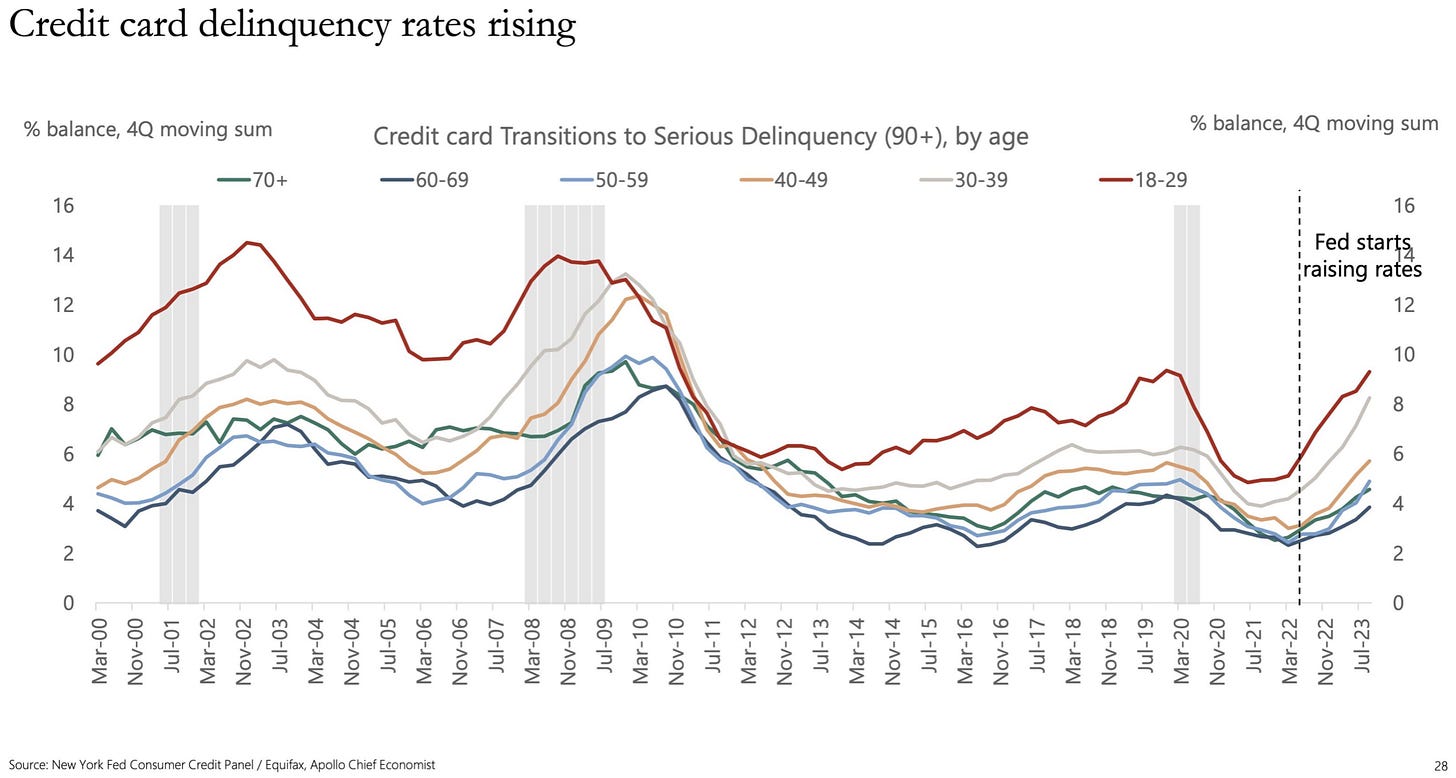

The credit card delinquencies rates have been rising. As these tend to climb higher, they usually will coincide with a recession. Now the increase in delinquencies does align with when the Fed raised interest rates. If those rates are lowered it may provide relief in delinquencies.

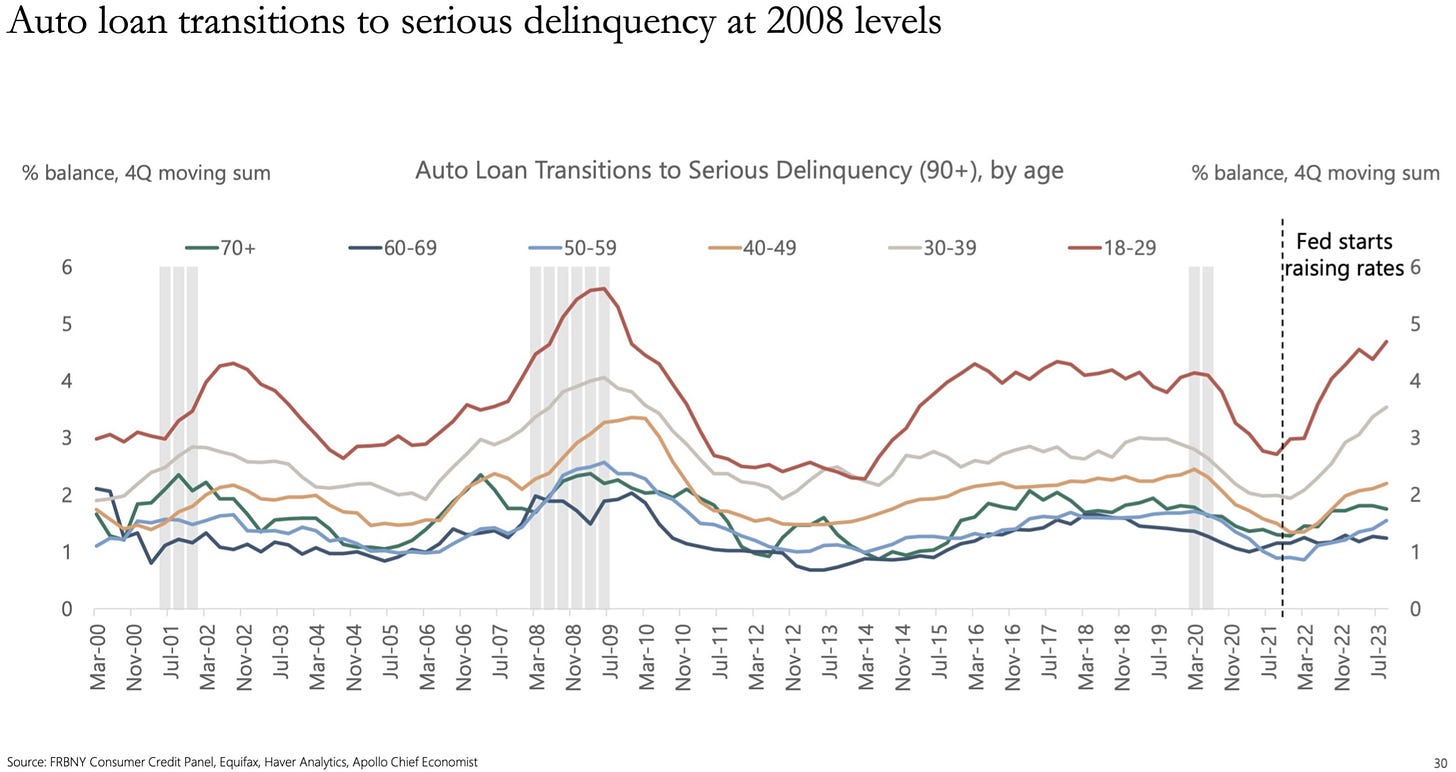

It’s a very similar story with auto loan delinquencies. They’re also climbing and near 2008 levels. But again, if the Fed lowers rates that may provide relief.

The Everything Rally

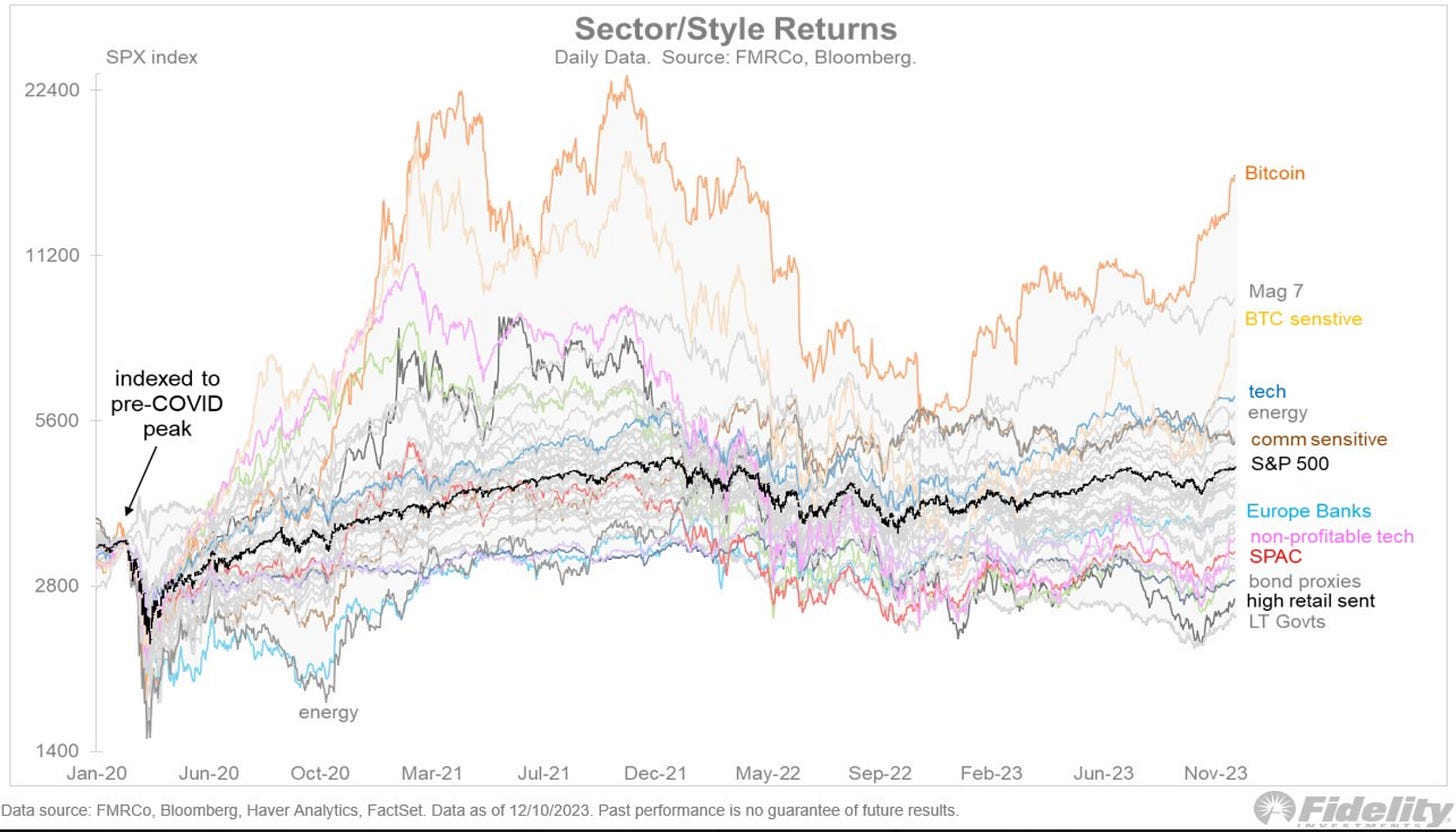

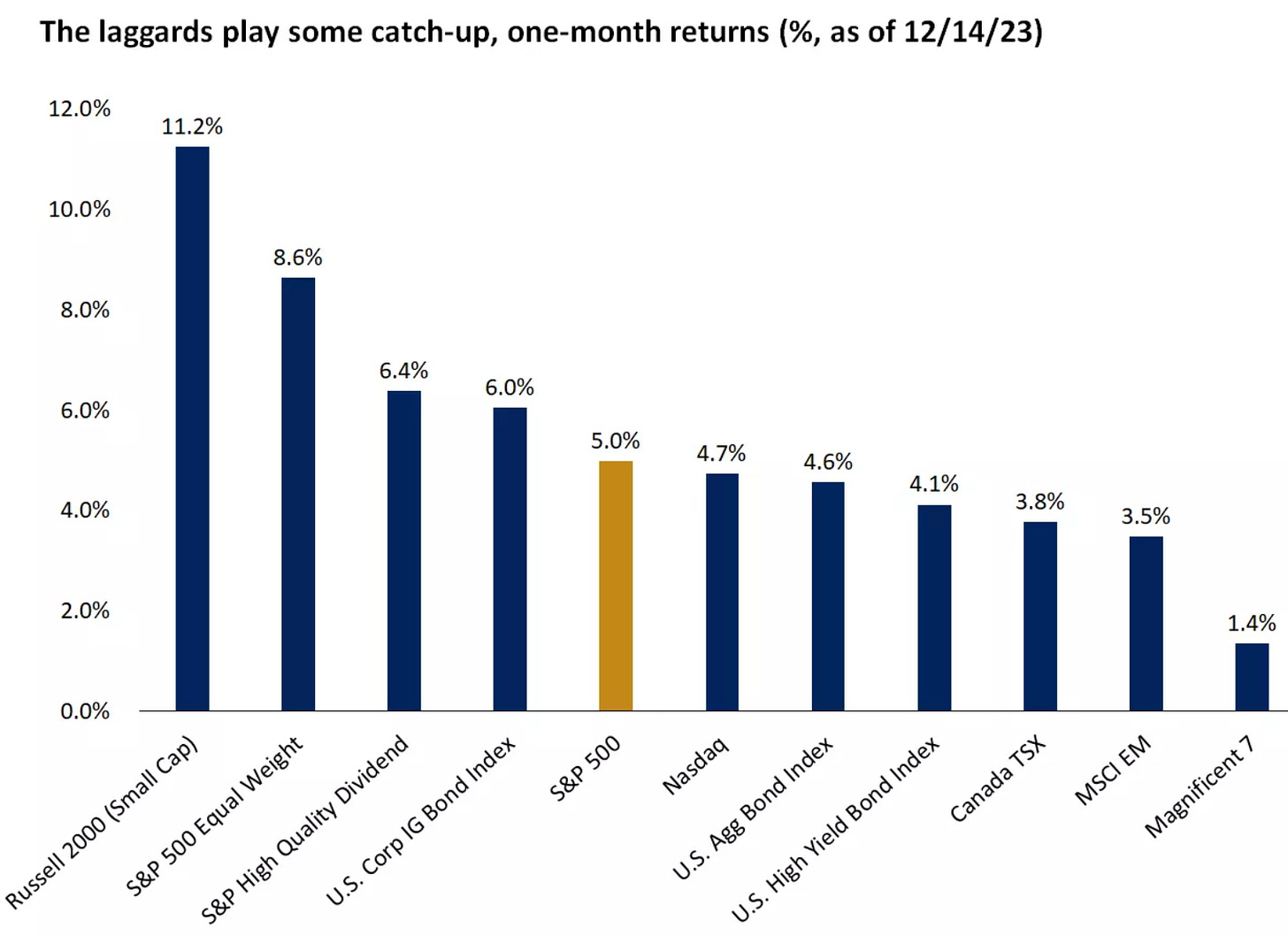

An everything rally is really what we saw this week. The rally broadened to all sectors. The worst sectors of the year popped. Small caps, utilities, home builders, regional banks, REITs, non profitable tech and ARKK all saw big moves.

I love this chart from Jurrien Timmer. It takes the sectors back to pre COVID levels up until today. You can see the recent move higher.

Then this chart takes a one-month return view at the laggards and you can see the participation widening for some big one-month moves.. Everything is moving higher and that is an extremely bullish sign.

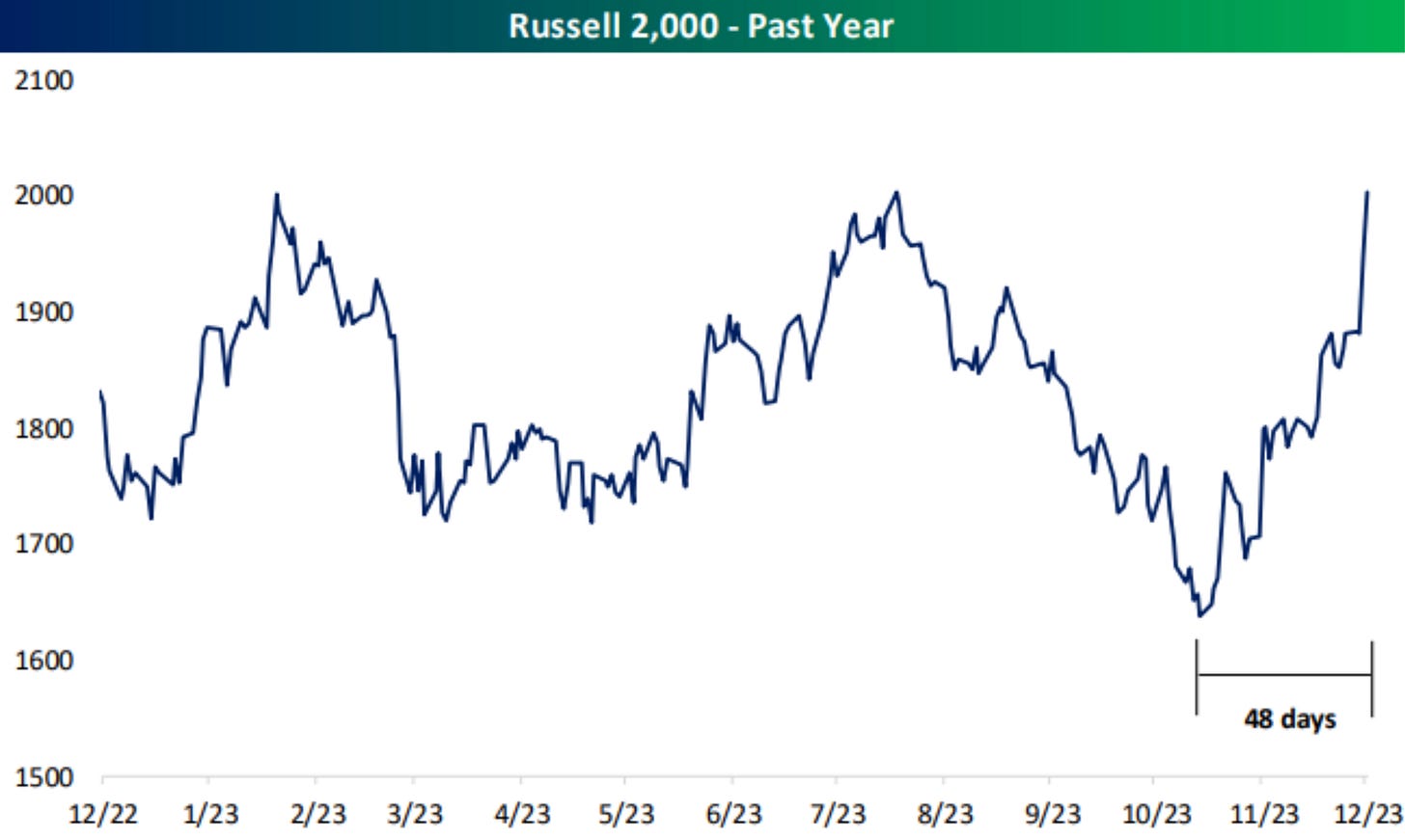

Small caps had been just getting crushed this year. They had hit a 52-week low in October, but then in a span of only 48 days, they reversed course to set a new 52-week high. That’s the fastest turnaround ever for the Russell 2,000.

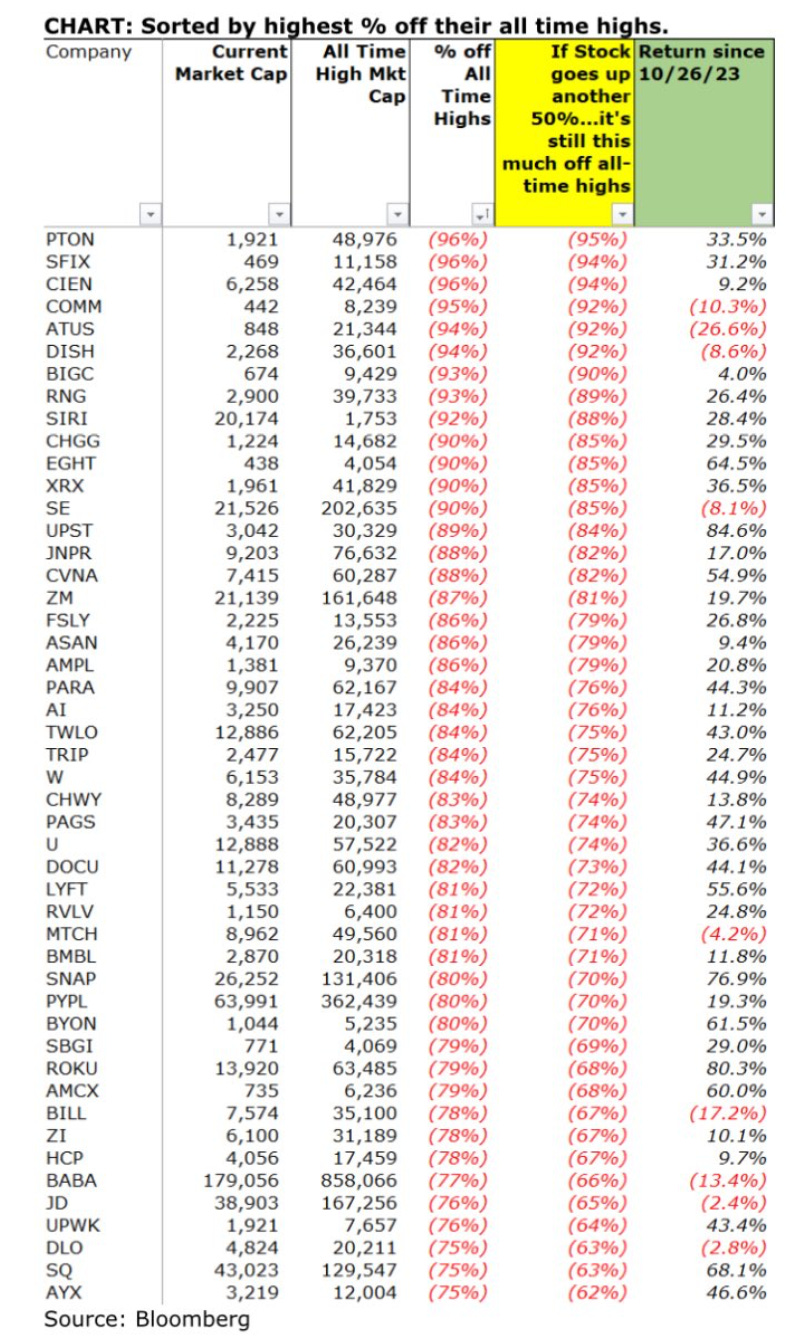

This then might be one of my favorite charts of the year. There is so much to digest in this. It’s is a list of stocks, sorted by the highest % off their all-time highs. Then it shows how much of a return these have made off the late October bottoms. Just some giant moves in a short amount for time.

But it’s fascinating to see just how far off they still are from their all-time highs. There are some interesting names on this list.

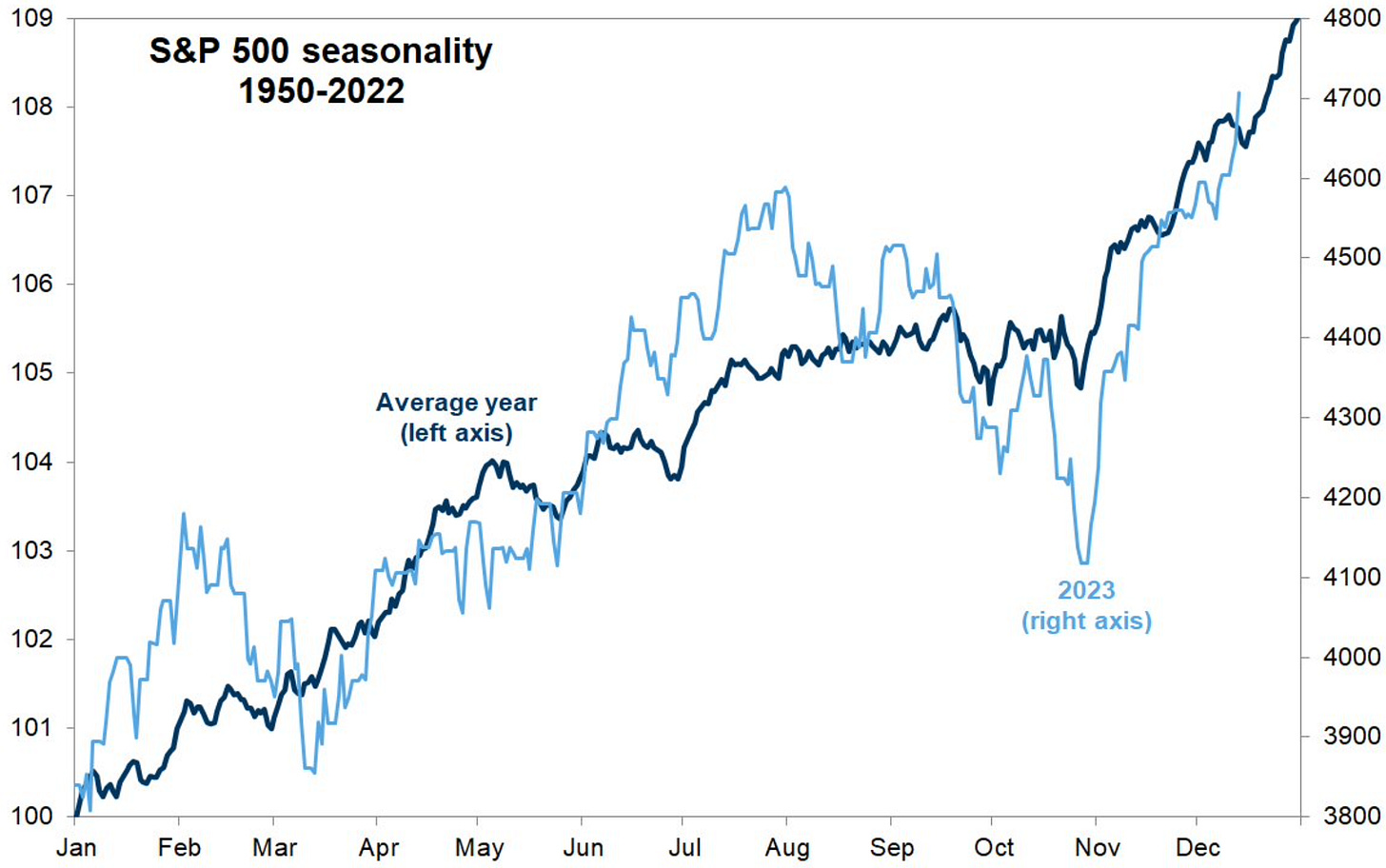

We’re about to hit the peak seasonality period. So the runway for even more gains seems to be very possible judging by the historical data.

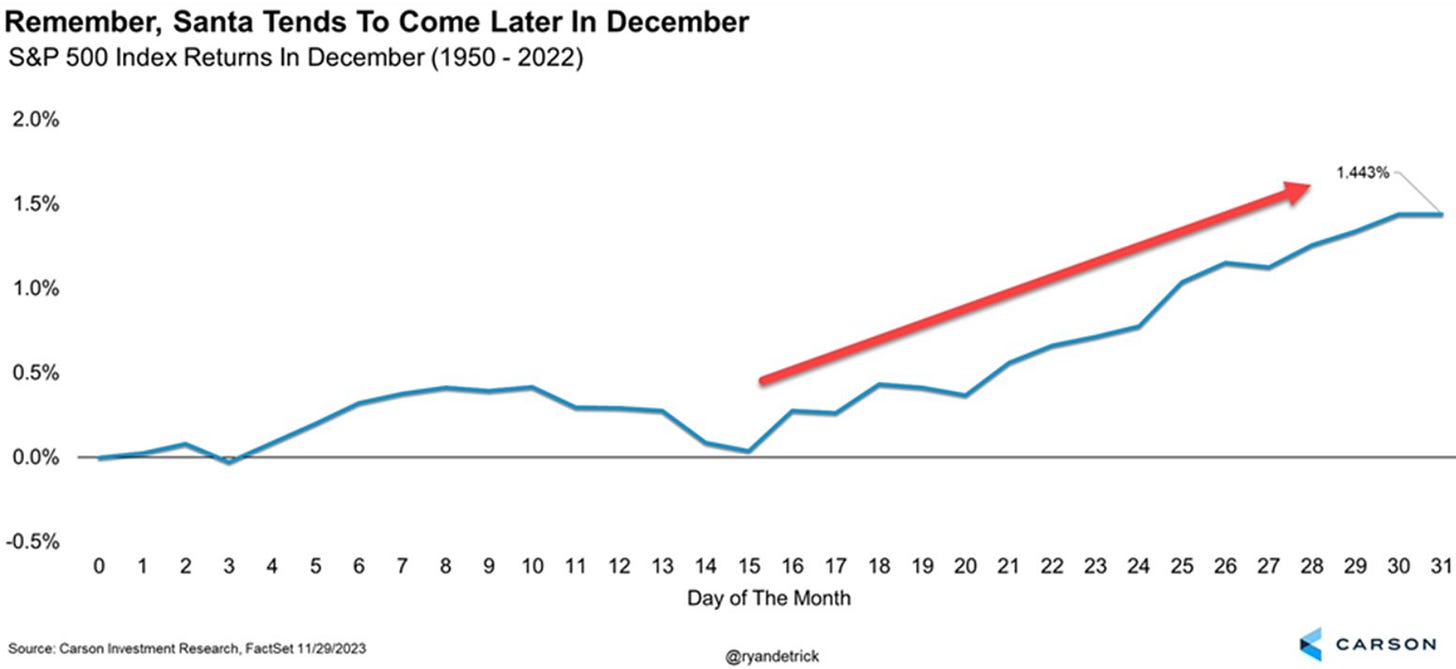

As I shared in Investing Update: Here Comes Santa Clause, Ryan Detrick’s chart shows that the annual Santa Clause rally typically happens at the back half of December.

I’m interested to see if the historic trends stick and the annual Santa Clause rally does come towards the back half of this month. If that happens after this everything rally, we’re going to have all-time highs across the board. What a way that would be to ring in the New Year!

The Coffee Table ☕

I was planning to write a post about why people try and predict the year ahead as nobody has any idea what’s going to happen. It’s basically only for fun. Then I read this post from Joe Wiggins and decided to share this instead. He hit on everything I had planned to cover. A good read. How Will Equity Markets Perform in 2024?

With Christmas shopping in full swing, I wanted to share this post by Paul Bloom on Small Potatoes. The best gift-giving advice I've ever received I found it to be very helpful and it isn’t something I’ve ever considered. A great gift giving tip!

Ben Carlson wrote 8 Things I Think I Think. Ben covers a wide range of topics in his 8 things and as I normally find his writing, it was very interesting. I found myself agreeing with the majority of Ben’s 8.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.

Order my book, Two-Way Street below.