Investing Update: S&P 6,900 By Year-End?

What I'm buying, selling & watching

This week, all the major indices finished lower, marking the first negative week in the past four.

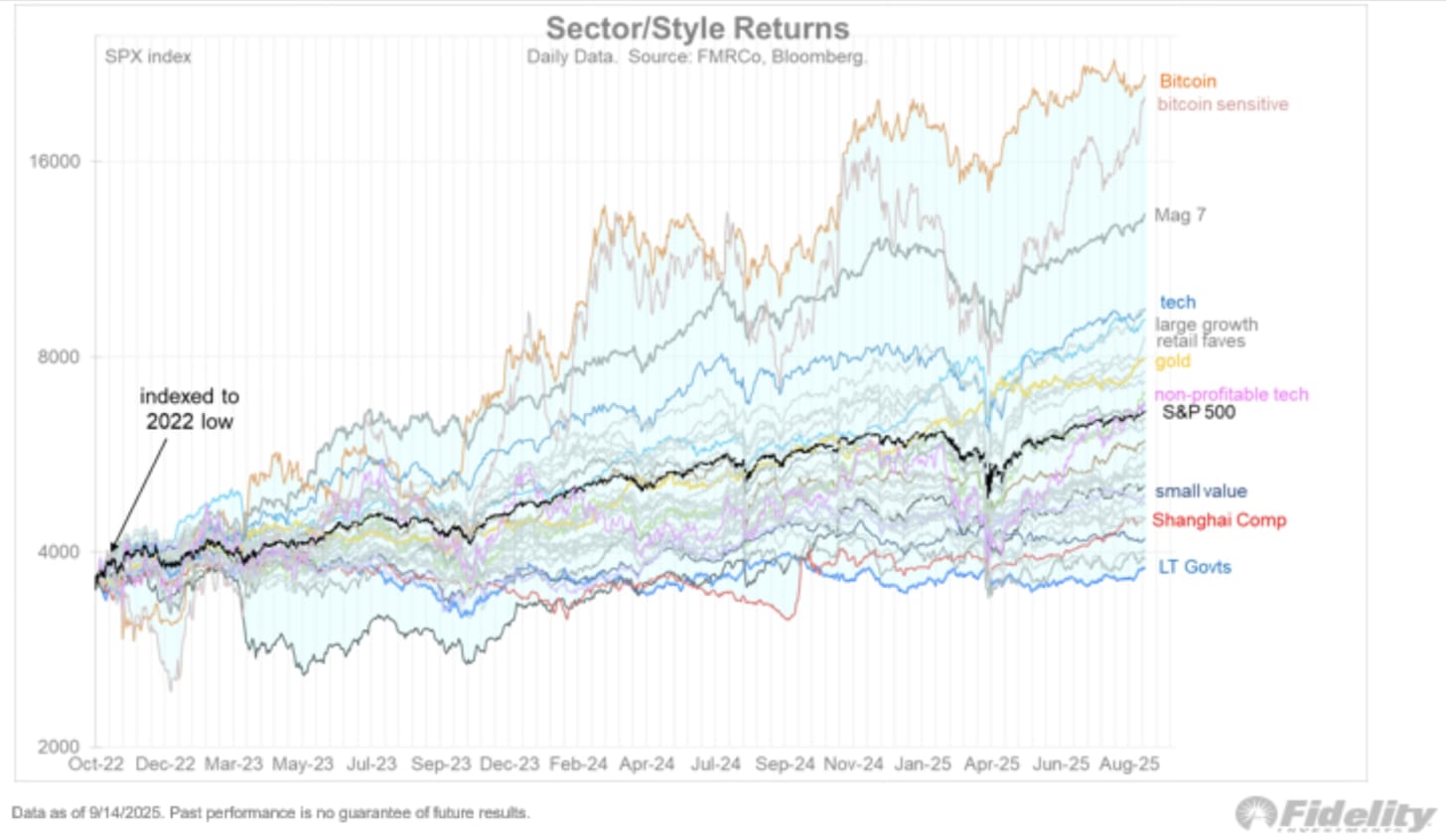

YTD the S&P 500 is up 13%, the Nasdaq is up 16.4% and the Dow is up 8.7%. Even the Russell 2000 has caught up to join the party, up 9.3%. Gold (+45.4%) and Bitcoin (+17.3%) are also up big so far in 2025.

Market Recap

Weekly Heat Map Of Stocks

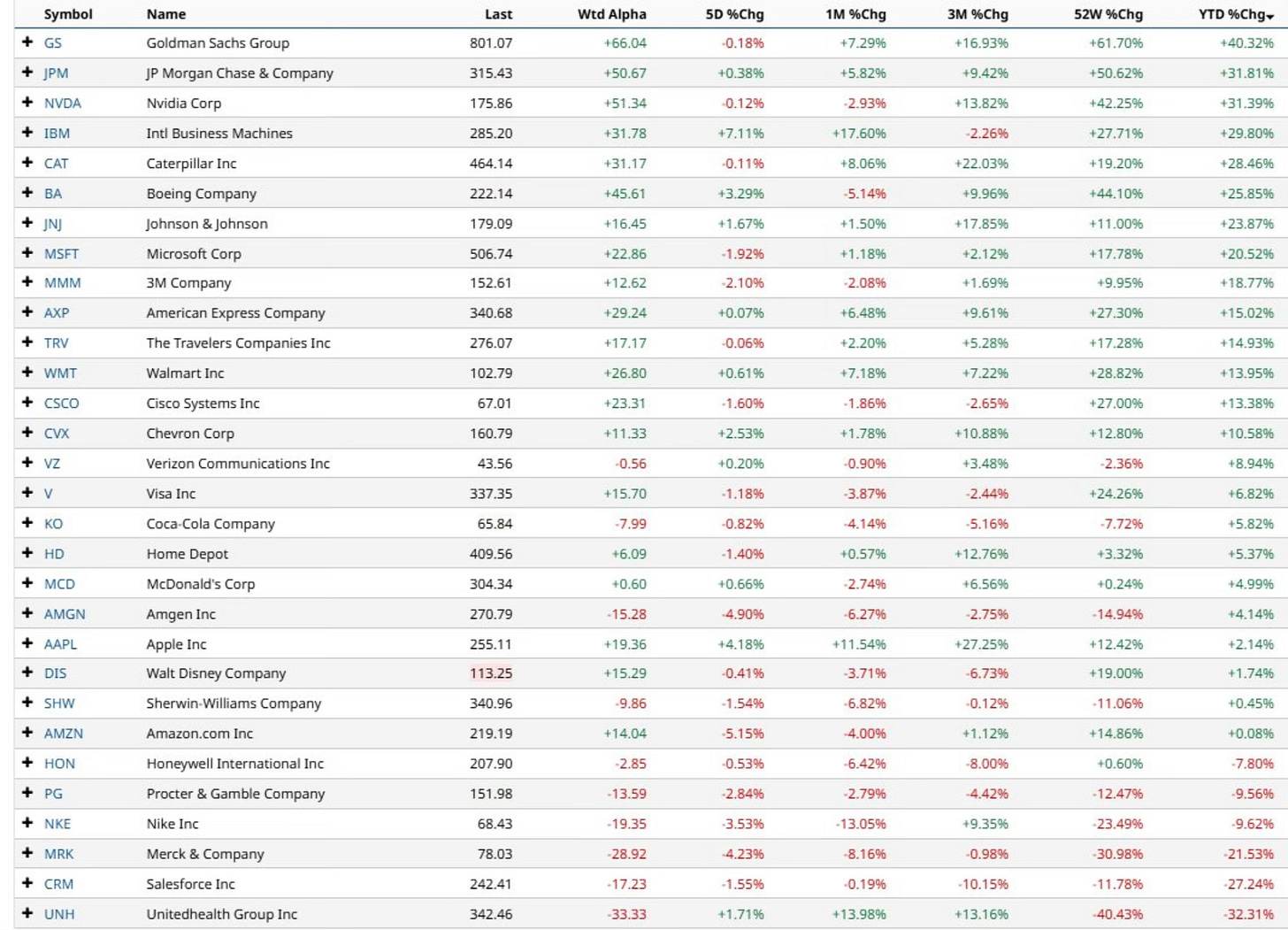

Dow Stocks YTD

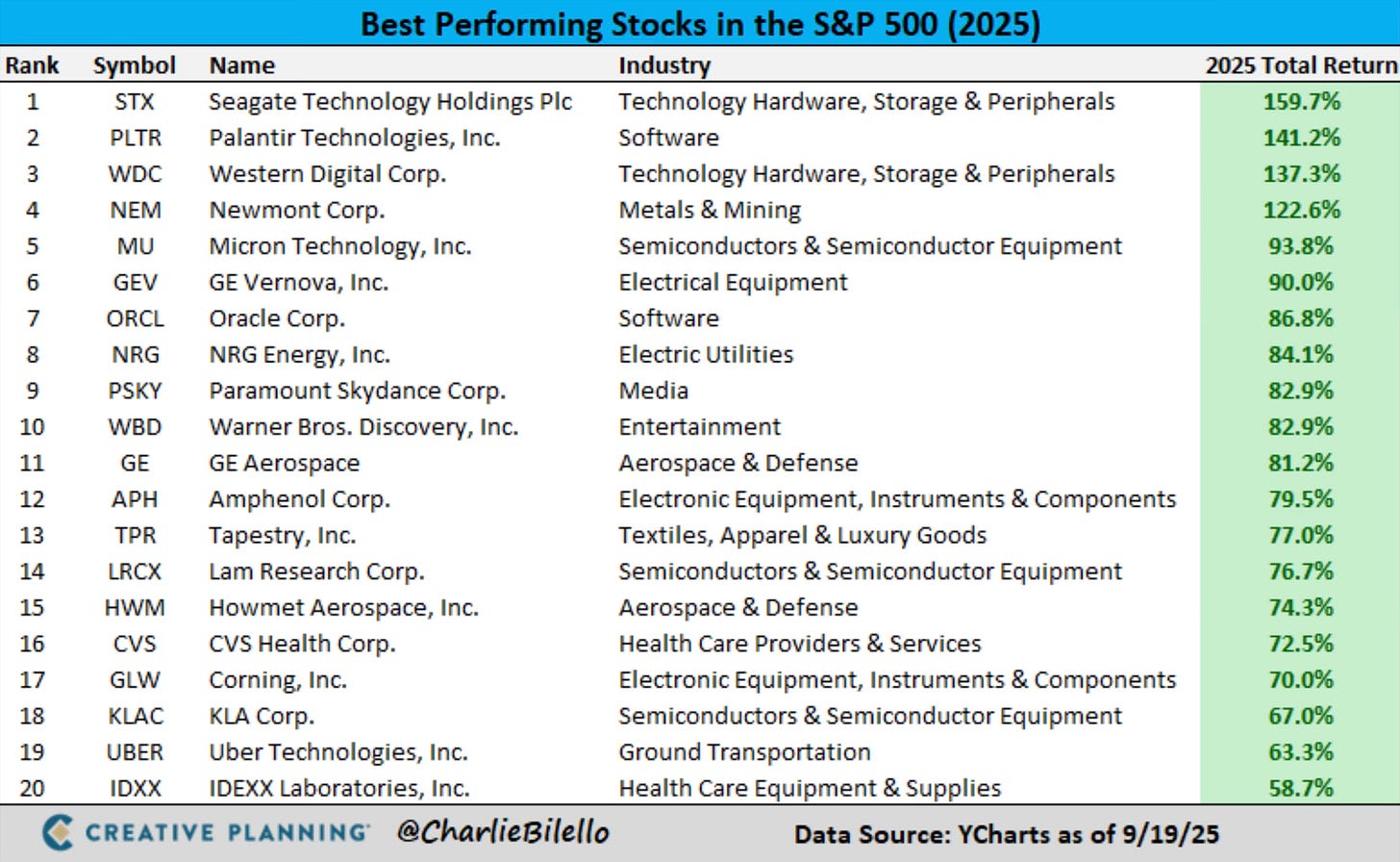

Best S&P 500 Stocks YTD

Worst S&P 500 Stocks YTD

Sector Returns

With September coming to a close. This will make the 5th straight month of gains for the S&P 500. Remember all the fear about September as it has historically been the worst performing month of the year. It didn’t matter. This bull market overcame it.

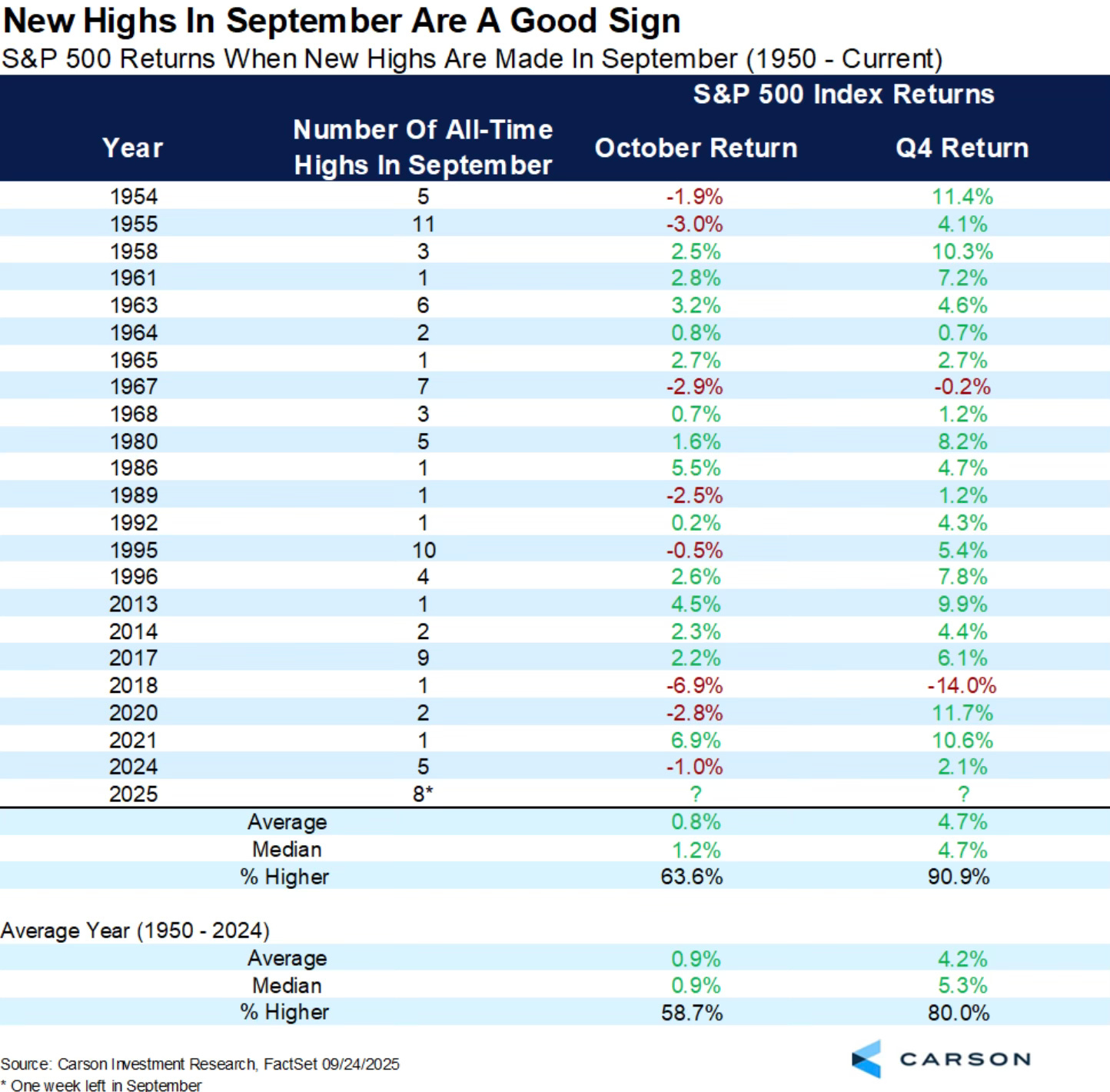

There were actually 8 new highs in September. When September makes new highs, Q4 is higher 90% of the time.

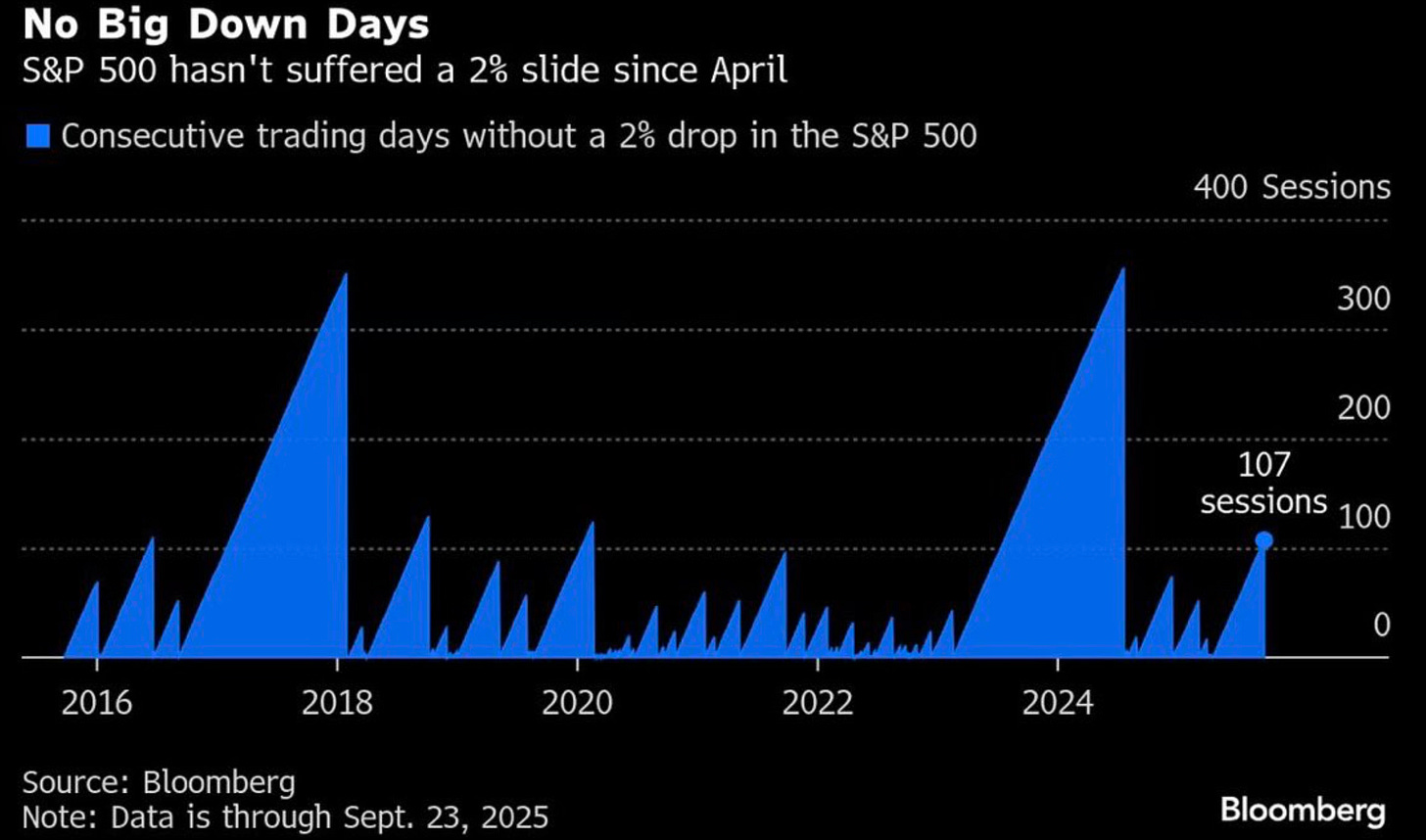

Volatility is still muted. The S&P 500 has now gone 110 sessions without a drop of at least 2%. It’s the longest stretch since July 2024.

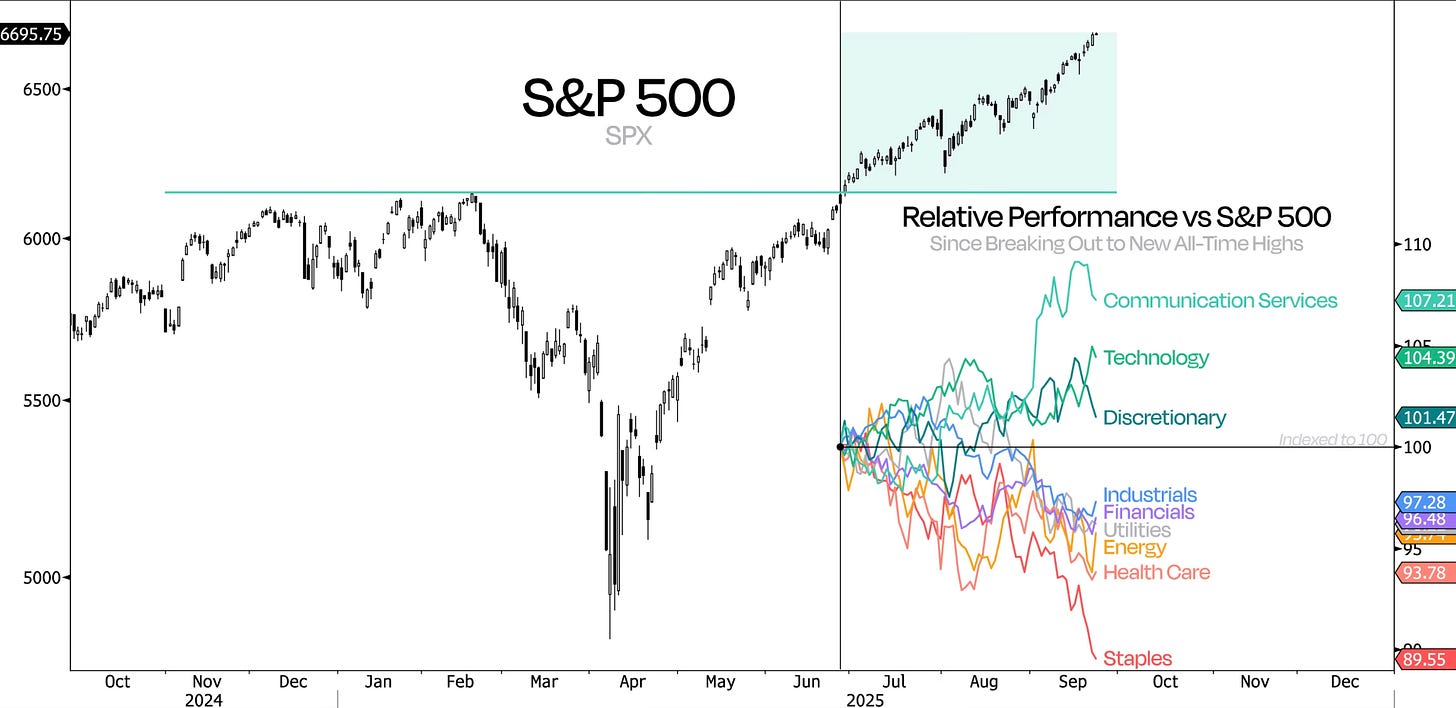

It shouldn’t come as a surprise because the bull market playbook continues to work. The leaders are still clearly leading and the laggards continue to underperform.

Sentiment shows that the bulls have regained control and it has been two straight weeks of bullish sentiment at 41.7%.

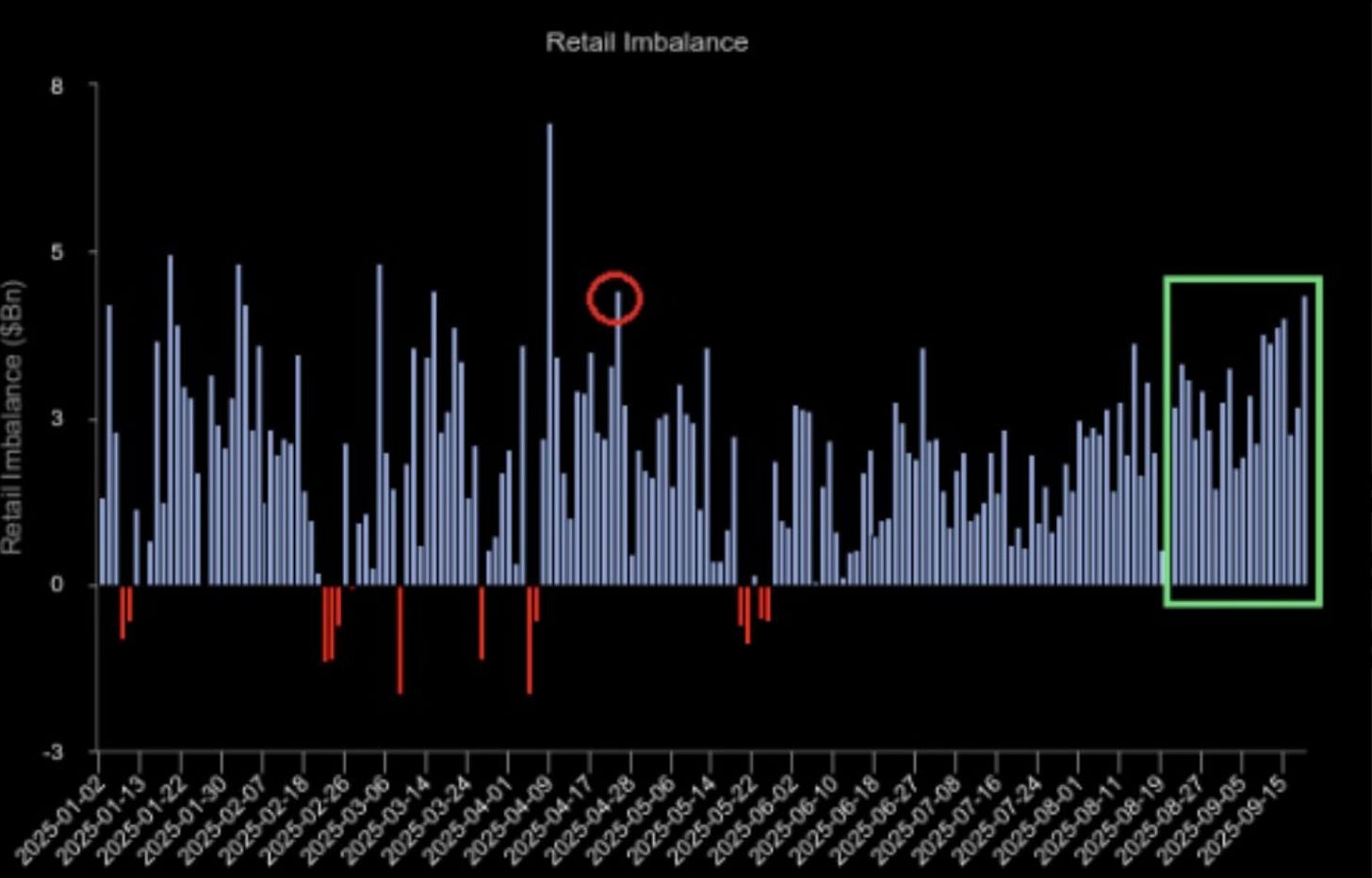

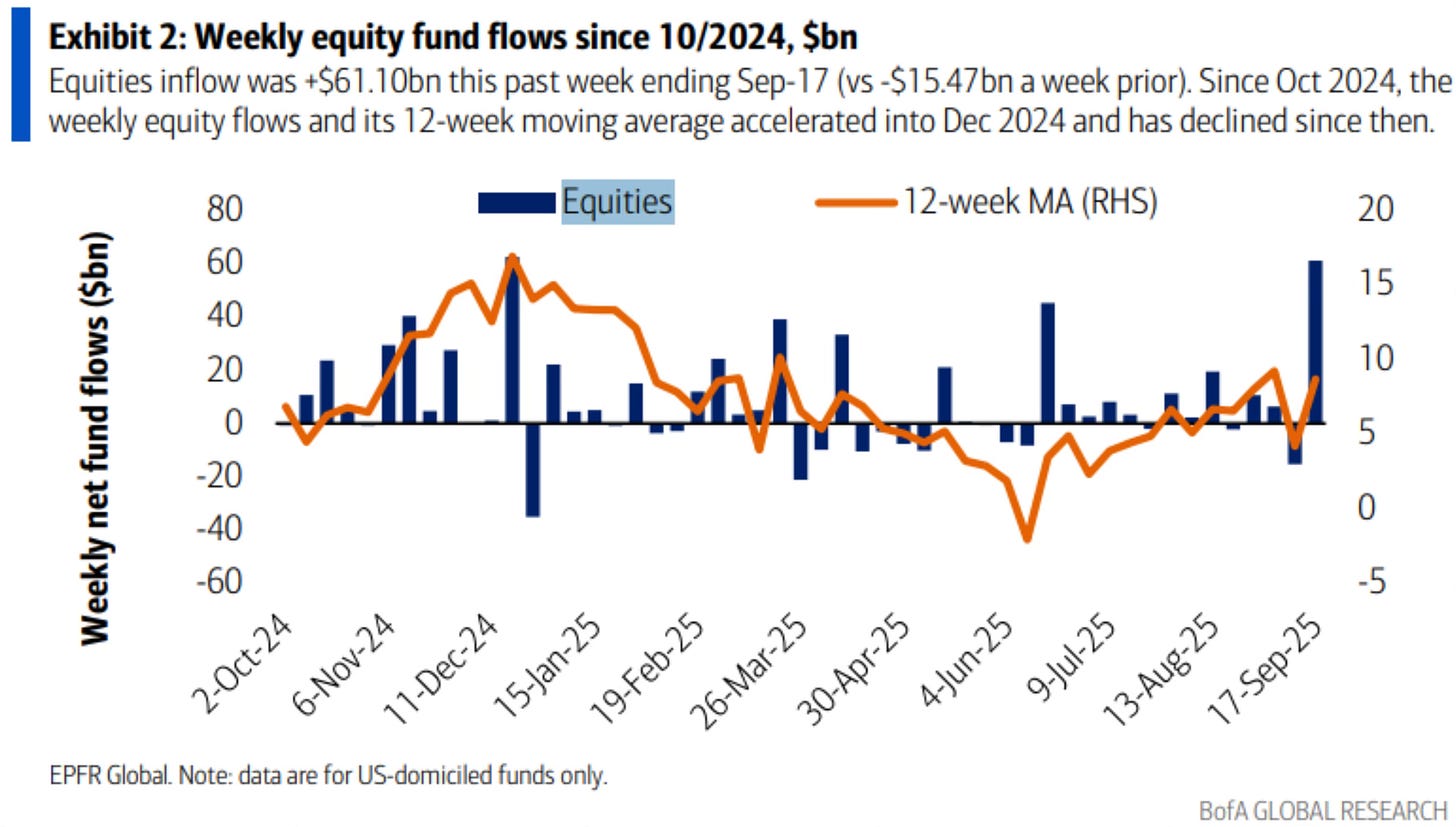

Flows validate that as stocks just saw the largest weekly inflow from retail investors all year. If retail investors are getting more bullish, it’s worth paying attention to.

Equities just had their biggest inflow since December 2024.

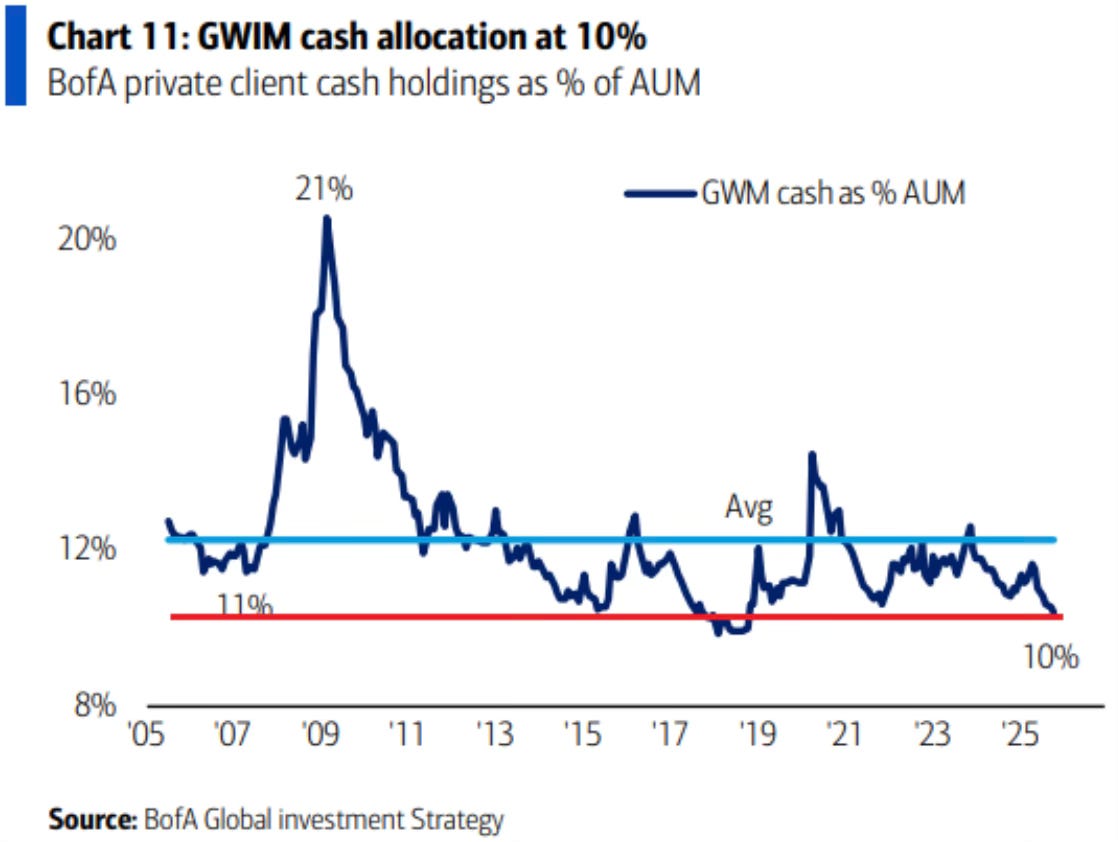

BofA clients are holding 10% in cash. That’s nearly the lowest level in the last 20 years.

I’ve said for a number of weeks that you can’t fight this bull market. Sure it’s one of the most hated bull markets in recent memory, but you can’t deny the strength this bull has.

I’ve watched for bearish signals. I actually spent extra time searching to find charts and data to tell that story. There just isn’t a story there to be told.

Minus a black swan type event, this bull market is going to carry on. This was a timely tweet from Alexandra Semenova on what has been said at JP Morgan’s trading desk.