Investing Update: Record Highs Here To Stay?

What I'm buying, selling & watching

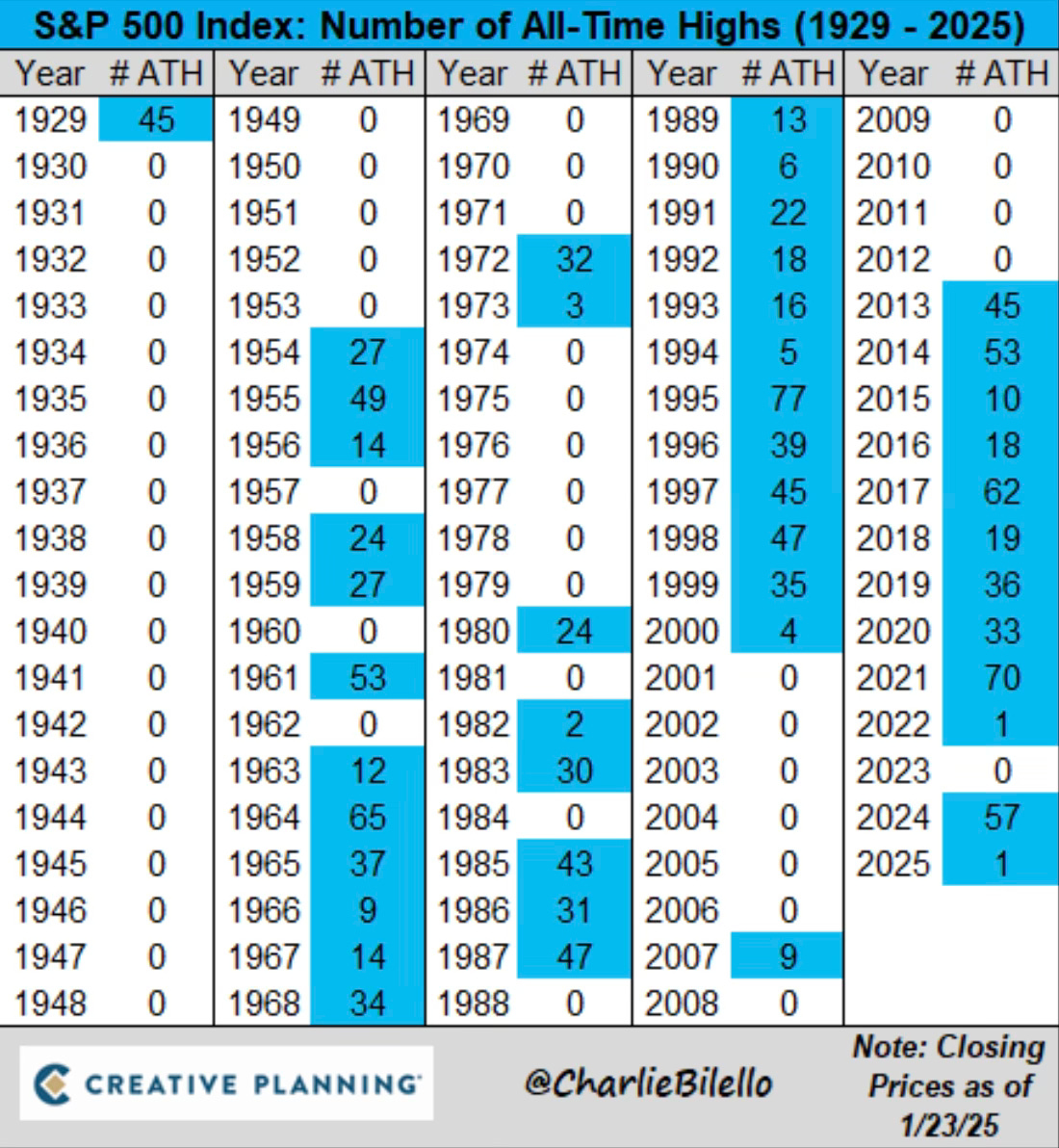

After a rocky late December and early part of January, the stock market roared back to new all-time highs this week.

After 57 all-time highs in 2024, this is the first record high of 2025.

After only a few weeks into the year, the S&P 500 is up 3.7%, the Nasdaq is up 3.3% and the Dow leads all the major indices so far as it’s up 4.4%.

Market Recap

Weekly Heat Map Of Stocks

A new all-time high isn’t something that you see in downtrends. There is a clear uptrend in this bull market. For the first time since December 16th there are more stocks in an uptrend.

Remember a bull market doesn’t end without stocks making new lows. In fact, the net new highs have started to expand again.

ETF inflows show that U.S. large caps were bought and bought very aggressively.

It sure looks like the recent pullback was another one to have bought in this bull market. Does this mean that more record highs are now on the horizon?

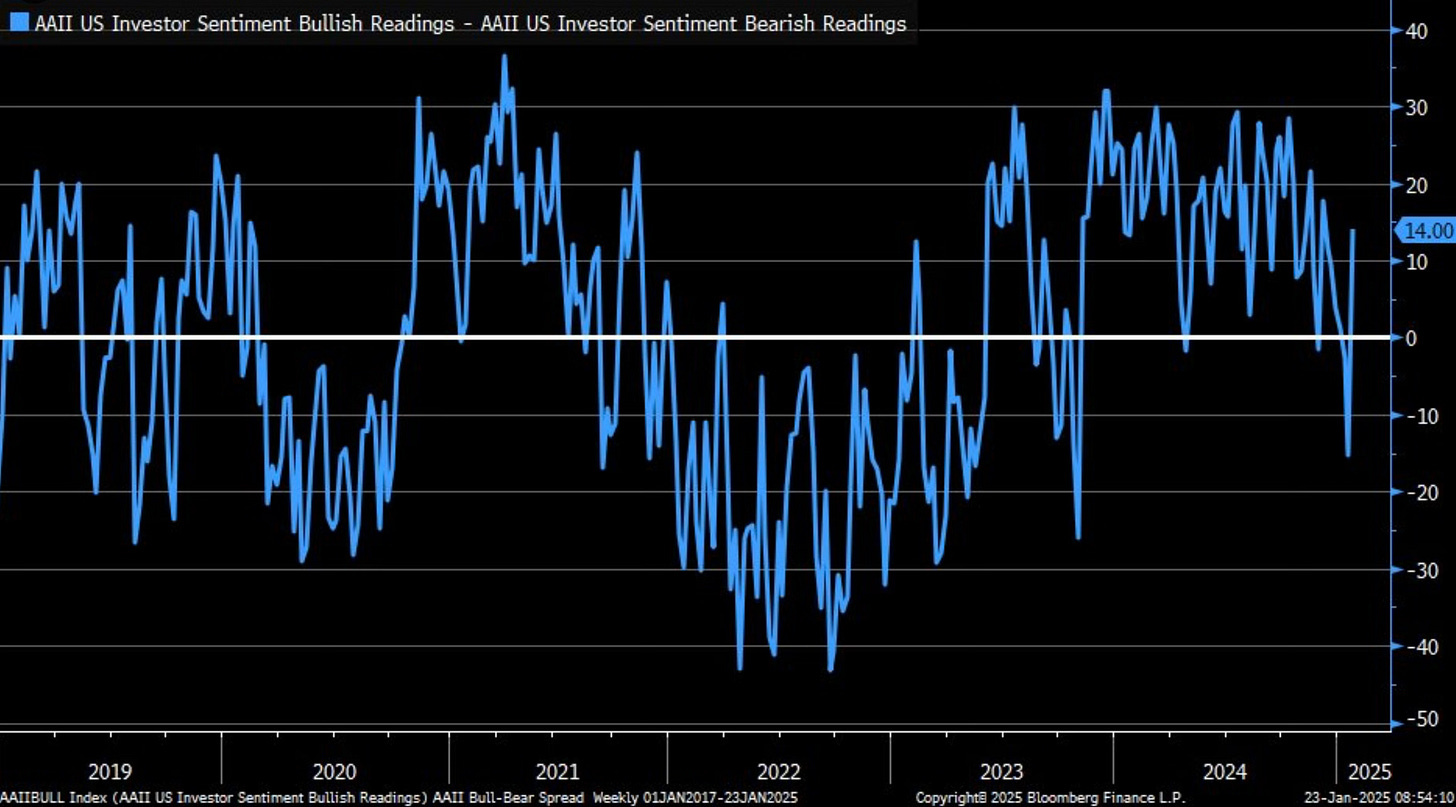

Investor Sentiment Flips

I said the following in that last week’s update. Investing Update: Has Sentiment Shifted?

These are the dips to be bought as we’re still in a strong bull market. We can’t forget that. Expect the year to be bumpy but this overreaction in bearish sentiment has set up a multi-week rally in my view.

It turns out that it was an overreaction and the market did in fact rally. It rallied to new all-time highs. The bulls are back!

Look at that jump out of bearish territory.

Remember when sentiment gets so far in one direction, it’s due to swing back the other way. It never fails. In the moment it’s hard to remember that. When everyone gets to one side of the boat, it’s time to move to the other side.