Investing Update: Reasons For Concern?

What I'm buying, selling & watching

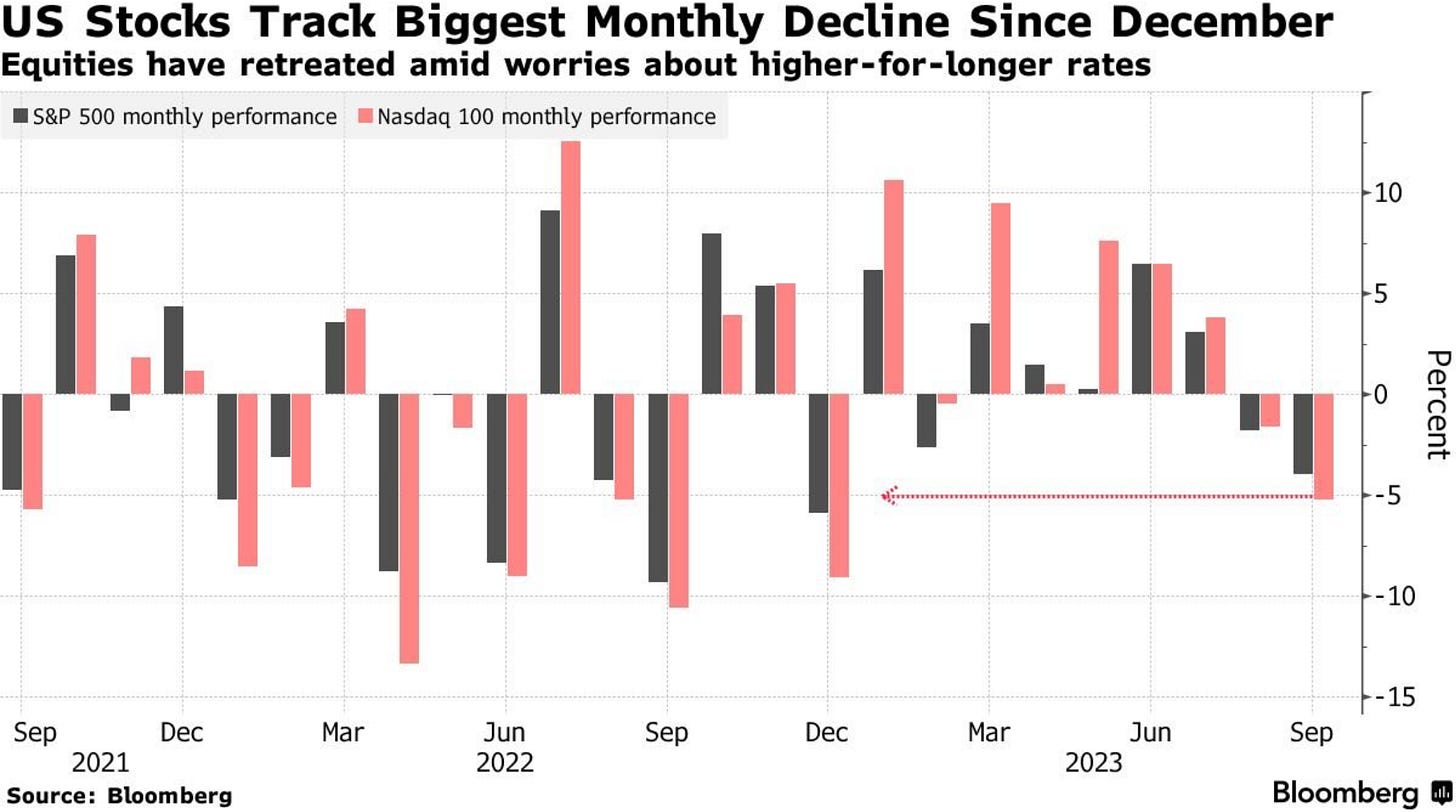

This week saw the S&P 500 fall by 3% and the Nasdaq by 4%. Thursday was the worst down day since March. The market ended the week on a 4-day losing streak and all sectors finished lower.

Wednesday the Fed signaled that we’re in for a period of higher interest rates. The higher for longer reality is being realized by investors. It brings the likely outcome where consumer spending is sure to weaken and a further cooling to the economy.

The S&P 500 and Nasdaq have now dropped for the third straight week. They both have fallen down to levels not seen since June.

With another week to go in September, this month is trending to be the biggest monthly decline since December.

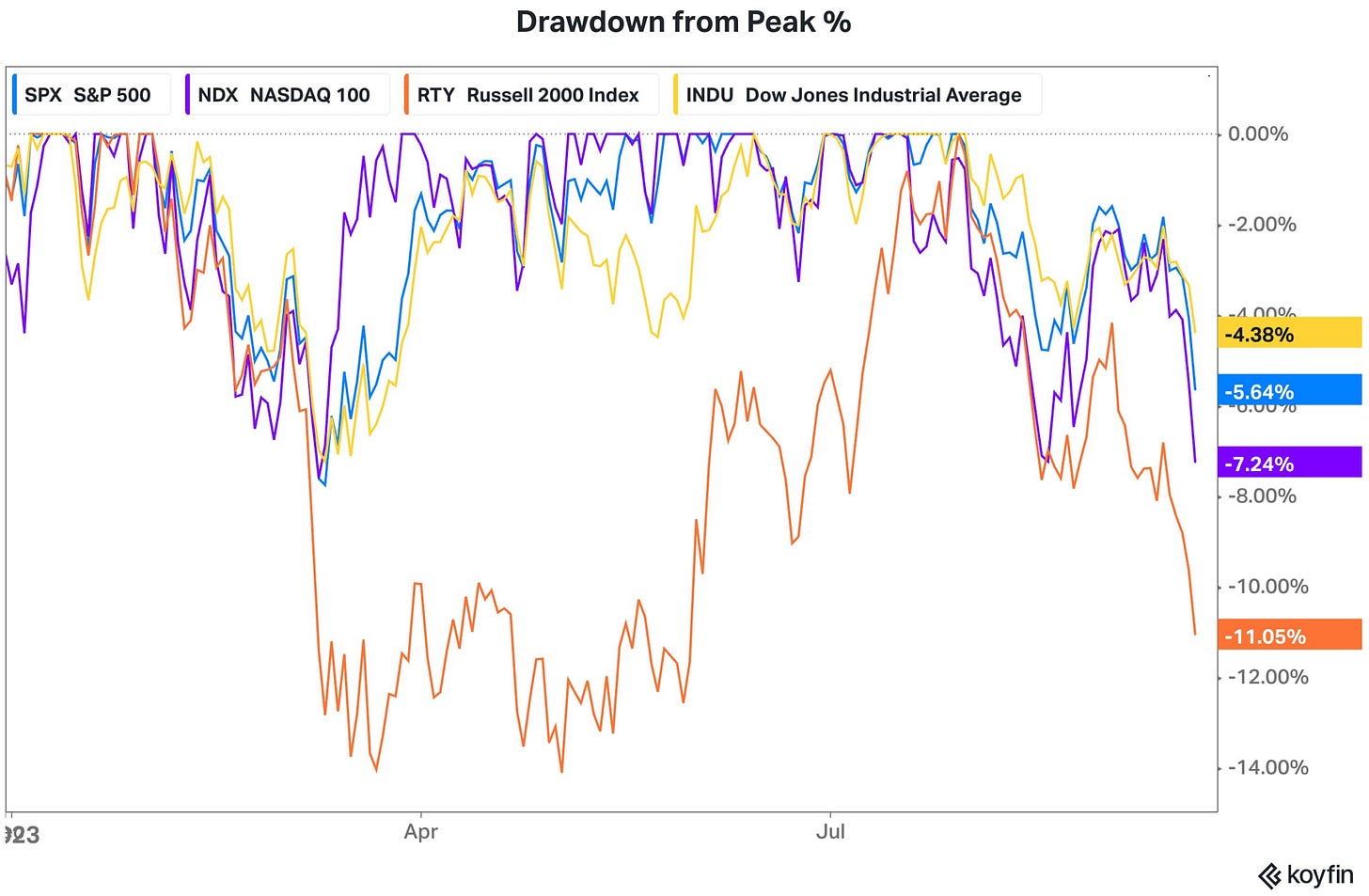

From the peak this year, the Dow is done 4.38%, S&P 500 is now down 5.64%, Nasdaq down 7.24% and the Russell 2000 down 11.05%.

Keep in mind a selloff of 5% or more is normal. Every year since 1950 has seen an average of at least two drawdowns of 5% or more. It’s normal market behavior. Does that make this a buyable dip? Or is there farther to fall? Let’s take a look.

Where Do Megacaps Go From Here?

The 2023 stock market leaders have come from the megacap tech stocks. I think we’re all aware of that. I just don’t think we realize how wide of a gap this has become. First from Barchart.

The S&P 500 is outperforming its equal weighted counterpart by the largest margin in 25 years which shows just how dominating the mega cap names have been

Then to breakdown the visual of just how far the Magnificent 7 are ahead of all the other stocks in the S&P 500.

So who’s left to continue buying these stocks. Check out the percentage of ownership in the Magnificent 7 by active funds. One name that stands out as actually being very under-owned is Tesla.

No Lift From Beating Earnings

A worrisome sign that Warren Pies shared this week in just an outstanding chart is what has happened after companies have beat earnings in Q2. There has been no lift in their stock price after beating earnings. Investors have been selling off stocks that have beat earnings. Whether a company beat or missed earnings they both have sold off. Does this indicate that we’ve hit a short-term ceiling? It really brings into question what the market has already priced in.

Sector Fund Flows

What stuck out to me in this chart is just how overweight investors are to tech and underweight energy. With rising treasury yields, rising oil prices and entering the winter months with energy prices, this wide of a gap really caught my attention. This has me going back to review investing into energy. It’s just too wide of a gap to ignore.

Reasons For Concern?

On top of the Fed signaling higher for longer which brought a spike upward in treasuries. There are other reasons for investors to be concerned that came to light this week.

We’ve heard about student loans repayments kicking back in. They’ve now fully kicked in this month.

We’re now seeing the unemployment rate start to rise in California versus the rest of the United States.

Why does California matter and why are we looking there? Historically, California unemployment leads by multiple months. Here is how the unemployment rate has tracked dating back to the 1970s. California historically leads where unemployment is eventually headed. It’s sure looking like it’s headed higher.

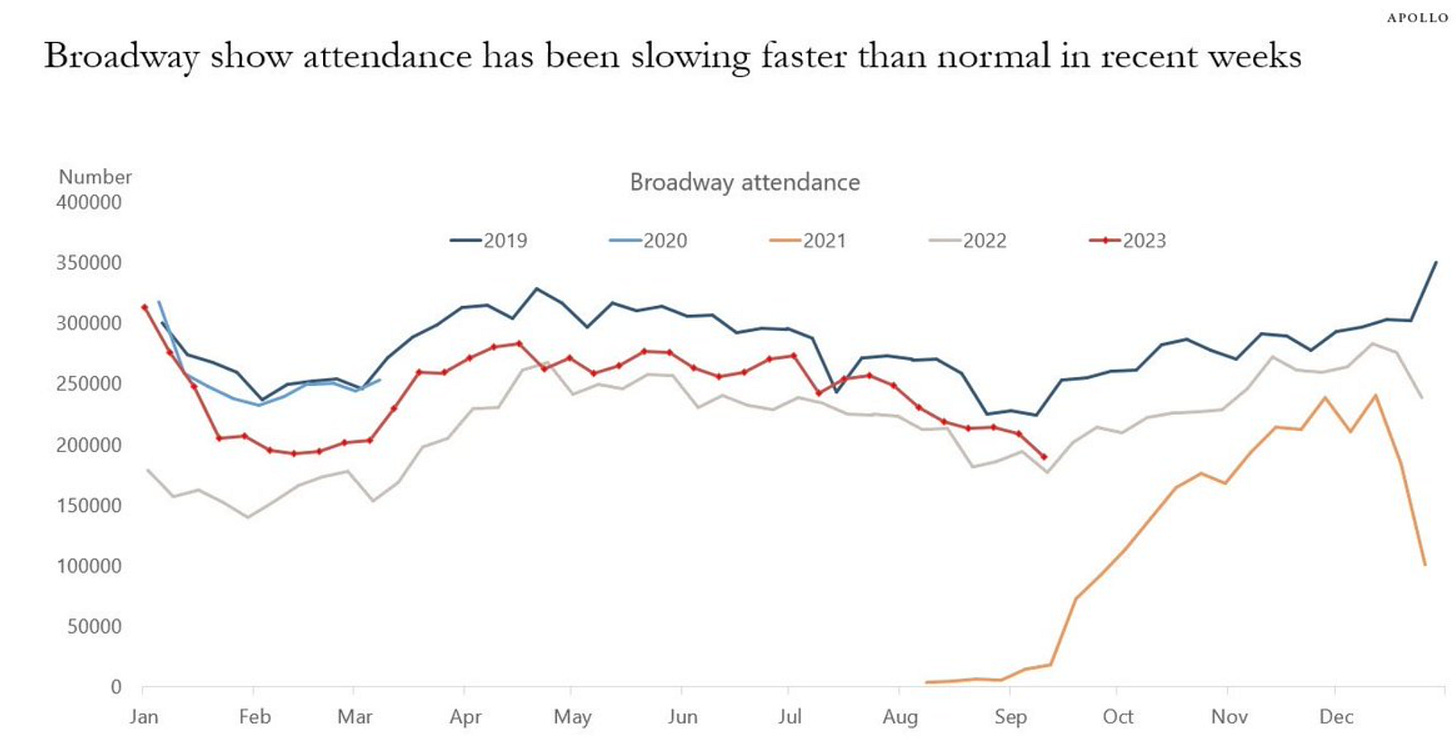

On the other side of the country, another indicator to watch is Broadway show attendance. It has really been slowing faster than normal recently. More proof the consumer may be slowing spending.

What I’m Watching

We’re in the midst of a pullback. Over half of the S&P 500 is now below their 200-day moving average. The Nasdaq now has over 70% of stocks below their 200-day moving average. The new lows are expanding.

What if this is a normal seasonal drop for this part of September? In fact, as Ryan Detrick points out, this is the worst stretch of the year for the S&P 500 average daily performance dating back to 1950. From September 20th through September 30th, negative performance is in fact normal.

This also brings into play what I wrote in my last Investing Update on September 9th Investing Update: Is a Recession Still Coming?

As you can see, this month is playing out like a normal September if you look back at historical data. I was already expecting this to occur as we hit the back-end of September. It’s why I’m not a bit surprised by this current drop we’re experiencing. This has me actively looking for opportunity as I still think we rally into year-end. Here is what has my attention as we head into next week.

I noticed an interesting group of stocks hit new 52-week lows on Friday.

Pfizer (PFE)

Target (TGT)

Raytheon (RTX)

Paramount (PARA)

Southwest (LUV)

Dollar Tree (DLTR)

Dollar General (DG)

General Mills (GIS)

There are some stocks that I have had my eye on with this pullback. These are getting near levels where I will look to buy on further weakness.

Target (TGT)

Lululemon (LULU)

Deere (DE)

Home Depot (HD)

Uber (UBER)

Tesla (TSLA)

The Coffee Table ☕

Michael Batnick had a good post called The Not-So-Magnificent 493. He looked into how they’ve performed and how they stack up against the rest of the S&P 500. There are some great charts showing just how big they are relative to all the other 493 companies.

I found Ashlea Ebeling’s story in the WSJ important reading for young investors and parents. The Secret to Saving for Retirement: Start Before You’re 20. I can relate to it as I started invested at age 18 and the first thing I did was open a Roth IRA. A starting point is as simple as using the earnings from summer jobs, which can be invested for decades of tax-free growth.

Matt Phillips wrote a good piece in Axios about what’s happening with auto insurance. He hits the nail on the head. Car-related costs are still boosting U.S. inflation.

On my trip to Buffalo, I finally got to try out my new Apple AirPods Pro. I just got them and wanted to see how they worked to replace the noise cancelling over the head type headphones. They were excellent. While in noise cancelling mode in the air, I heard no background noise. They’re smaller than my Apple AirPods 2nd generation. Plus, they come with multiple earbud sizes to fit your ear.

Thank you for reading! If you enjoyed Spilled Coffee, please subscribe.

Spilled Coffee grows through word of mouth. Please consider sharing this post with someone who might appreciate it.