Investing Update: Q4 Top Ideas & Q3 Recap

What I'm buying, selling & watching

The S&P 500 just finished the week up for the 4th week in a row. 7 of the past 8 weeks have been positive.

Market Recap

September finished positive for the 5th month in a row. April has been the only down month so far in 2024.

It was the best September for the S&P 500 and Dow since 2019. The best for the Nasdaq since 2013.

It’s the best start to a year for the S&P 500 since 1997.

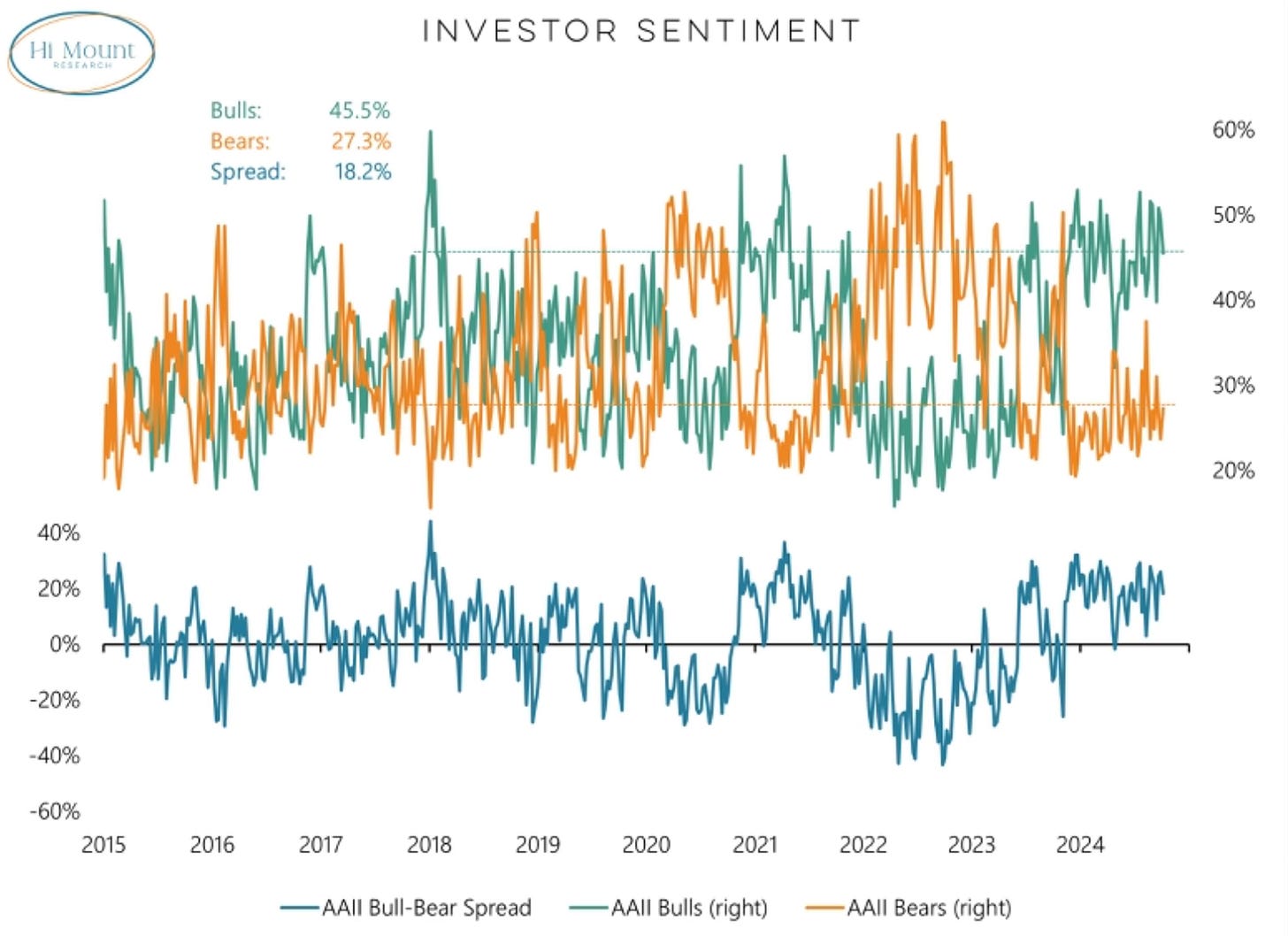

There has been such bullish strength this year that the investor sentiment reading has still only been bearish over bullish for one week in all of 2024. Optimism galore!

Q3 Recap

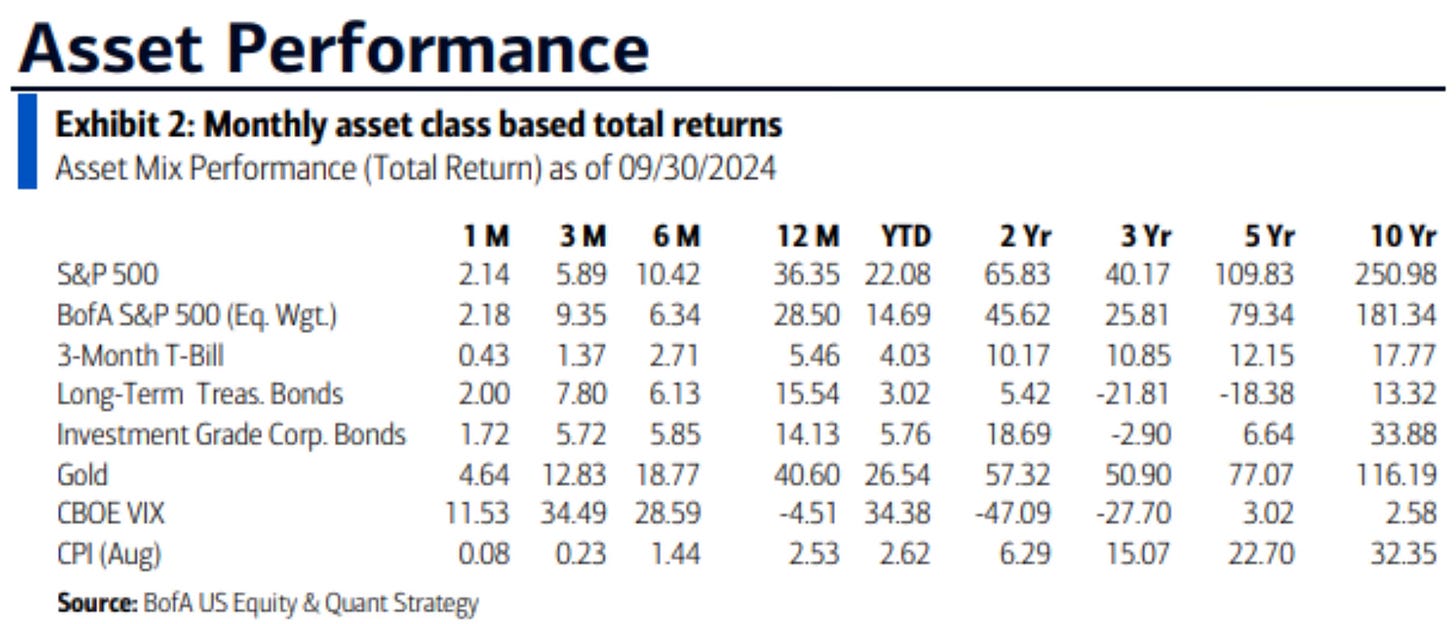

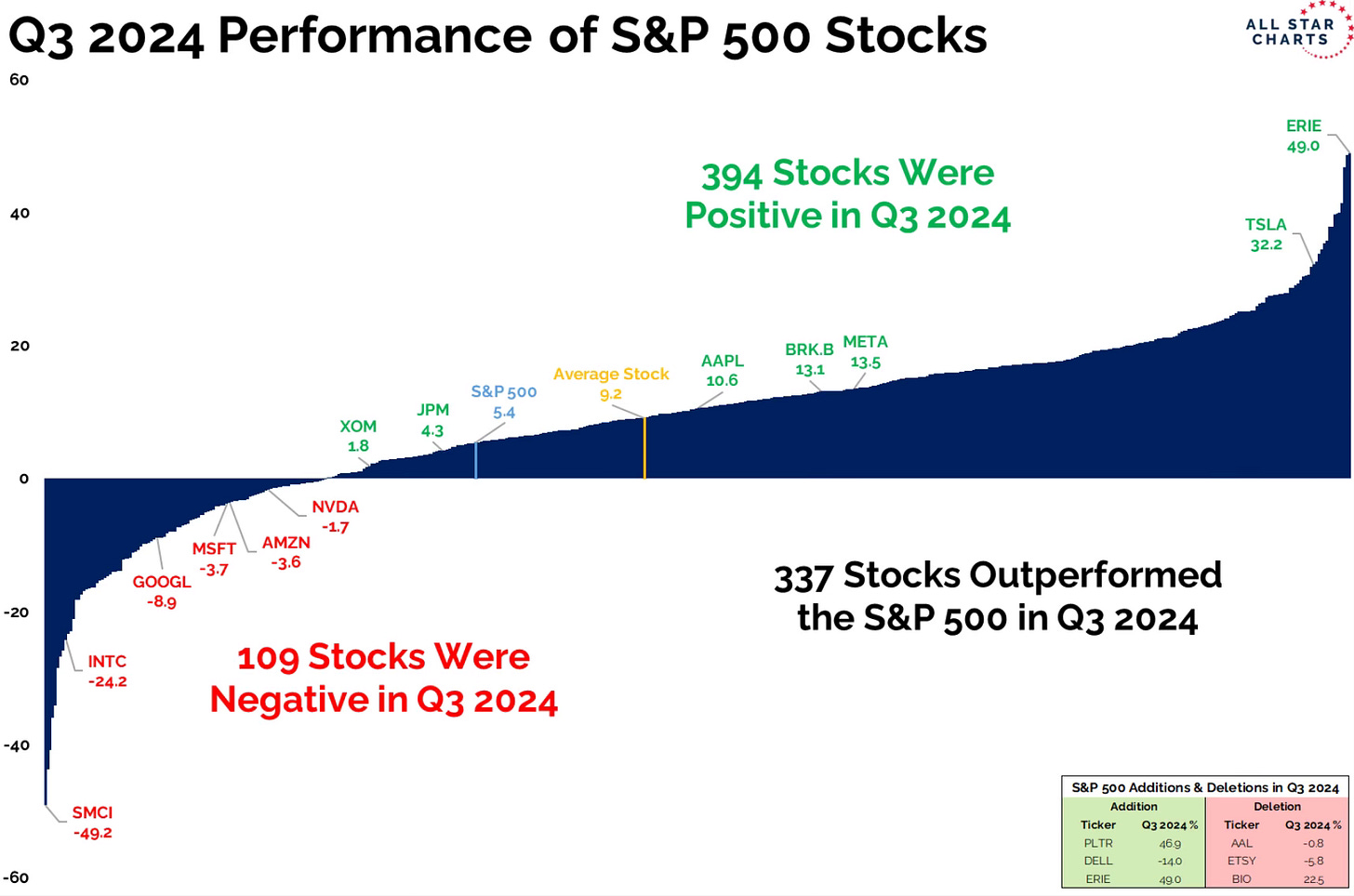

Q3 just finished up and it was the best for the S&P 500 since 2020. The equal weight S&P 500 was up 9.4%. That’s the best Q3 since 2010.

In Q3 the Dow was up 8.2%, S&P 500 up 5.5% and Nasdaq up 2.6%.

337 of the 500 S&P stocks outperformed the S&P 500 in Q3.

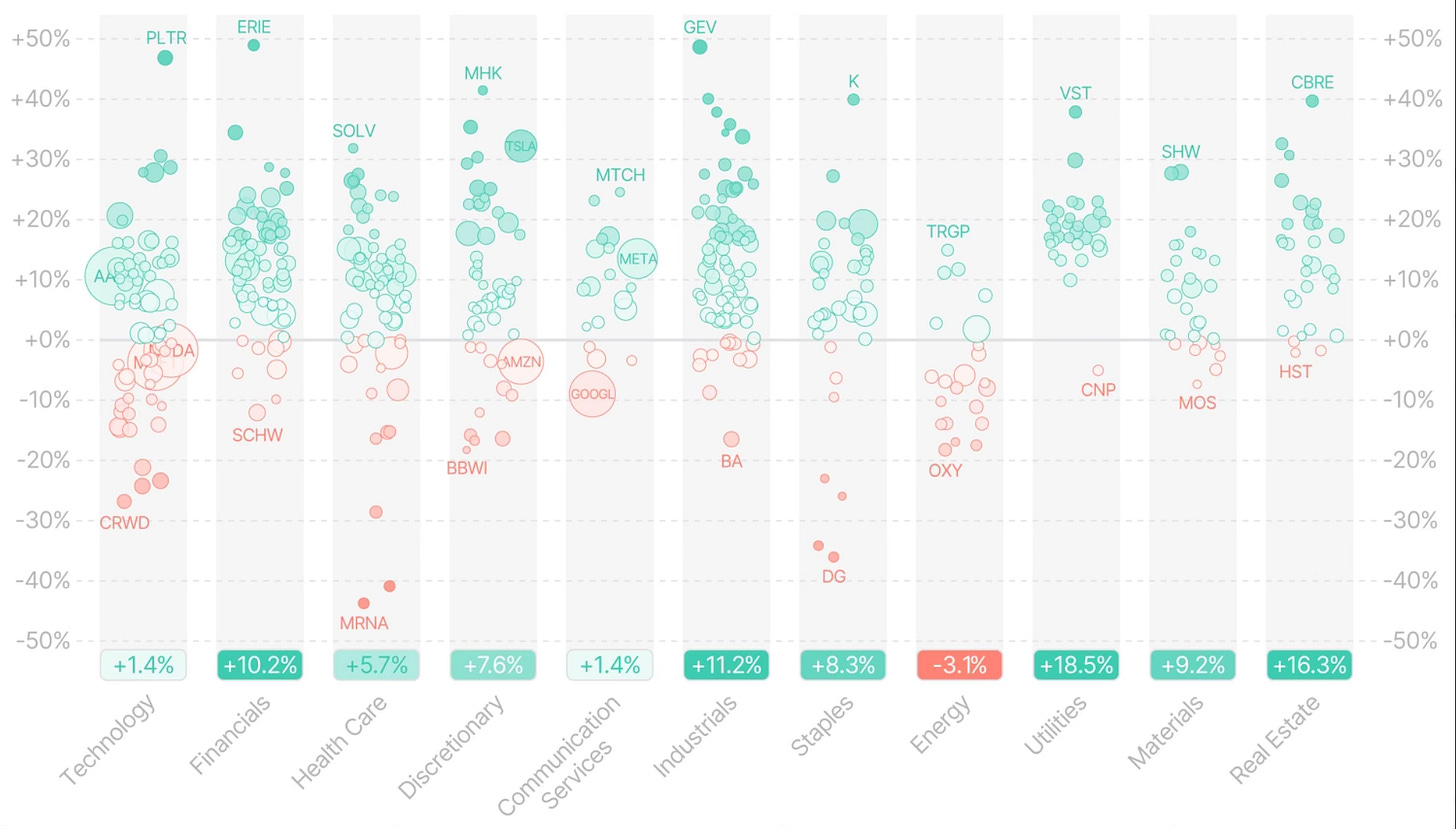

Sector performance was lead by utilities, up 18.5% in the quarter. Energy was the laggard, down 3.1%.

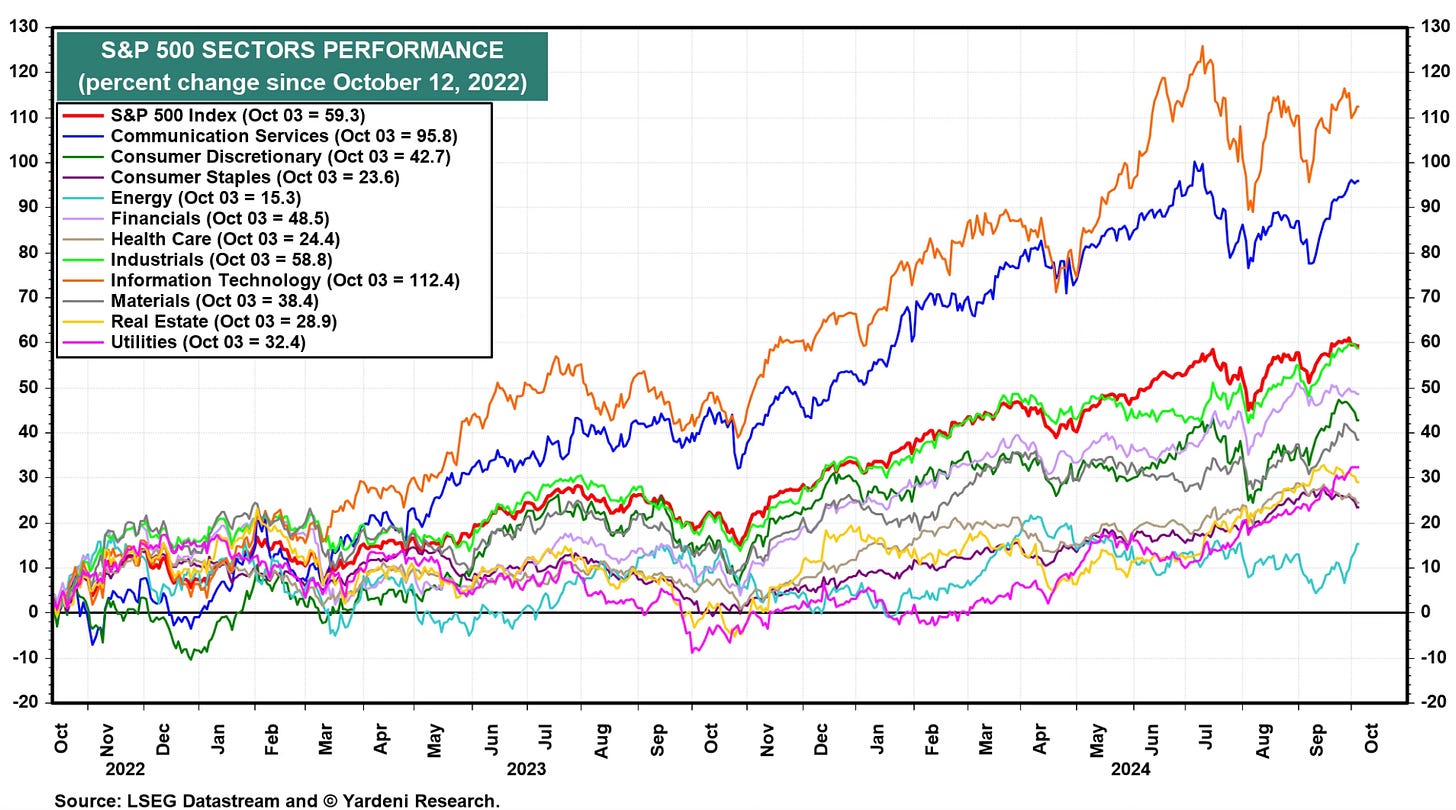

This is a great sector chart that goes back to the start of this bull market cycle on October 12, 2022 up to now. Information technology and communication services are the outperformers by a mile. Energy is lagging behind everything else.

Here is where things stand YTD through Q3.

Dow: 12.24%

S&P 500: 22.08%

Nasdaq: 24.65%

My Portfolio (Actively Managed): 35.24%

My 3 Stocks For 2024

Alphabet: 20.03%

CrowdStrike: 13.60%

Home Depot: 17.42%

Here is the link to my 2024 stock picks article. Investing Update: 3 Stocks For 2024