Investing Update: My Thoughts On Nvidia

What I'm buying, selling & watching

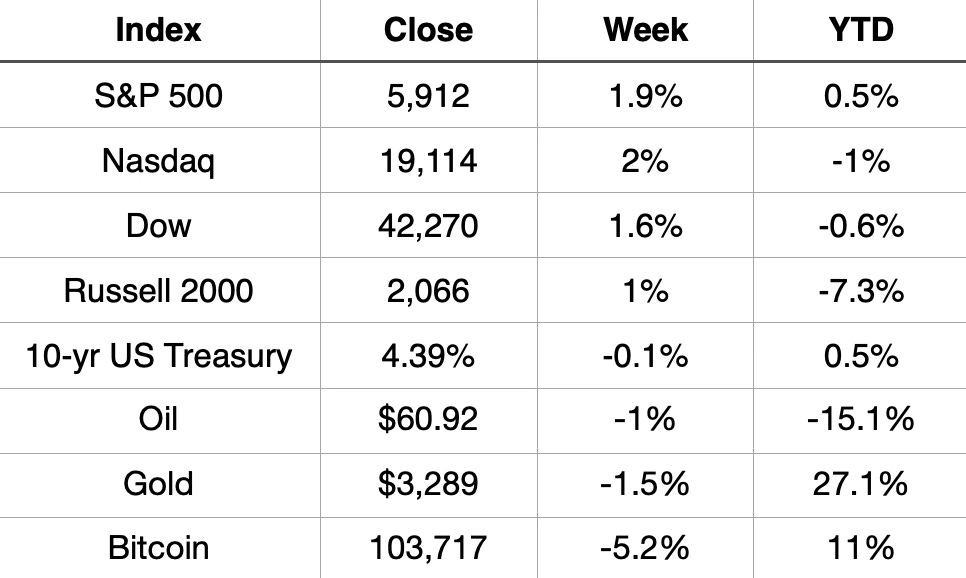

The stock market finished up May on a high note. For the week, the S&P 500 ended up 1.9%. That moved the S&P 500 into positive territory for 2025. Both the Nasdaq and the Dow are within 1% of also being positive YTD.

Market Recap

Weekly Heat Map Of Stocks

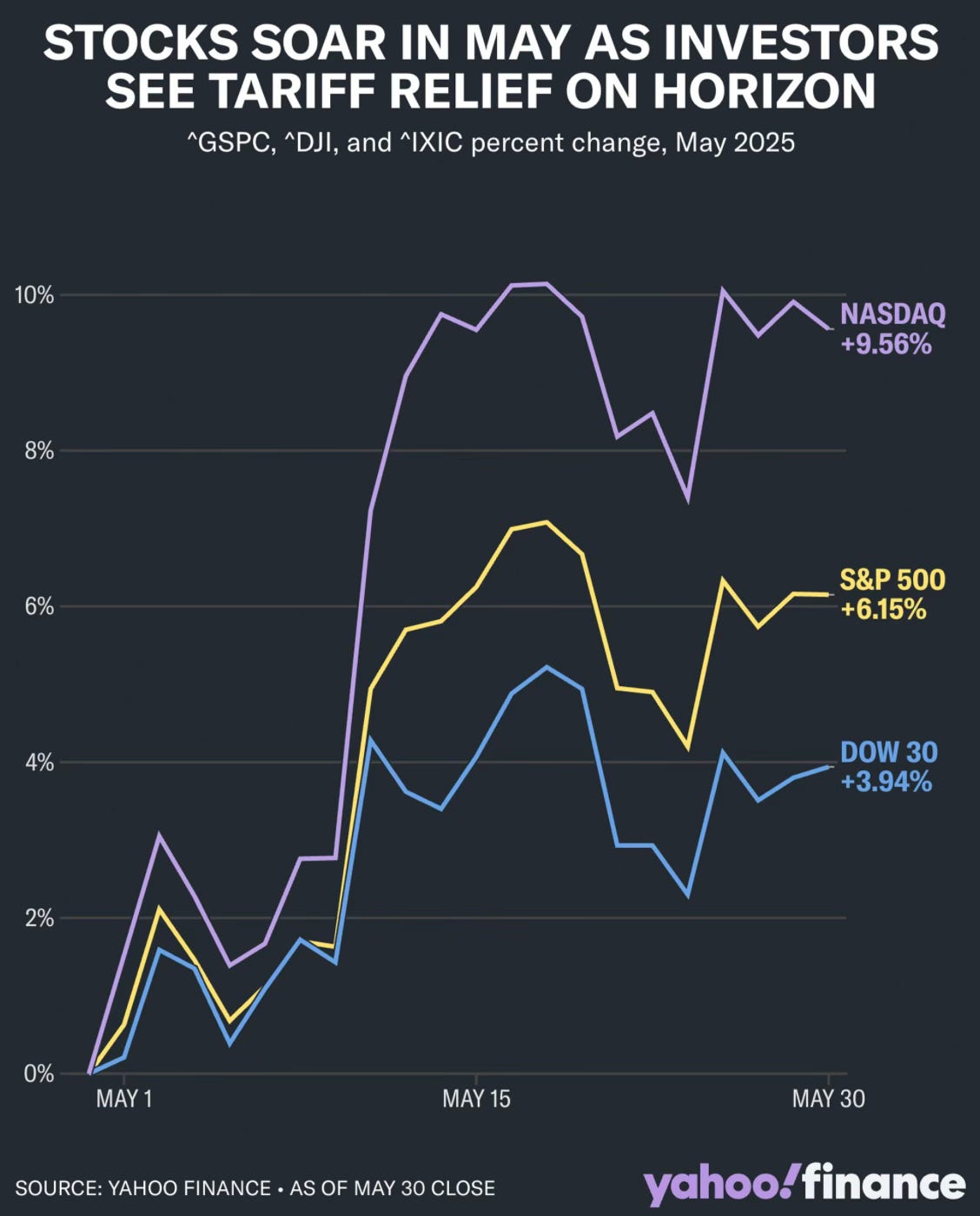

May was the first positive month since January. It was the best month for the S&P 500 since July 2023. It was the best month for the Nasdaq since November 2023.

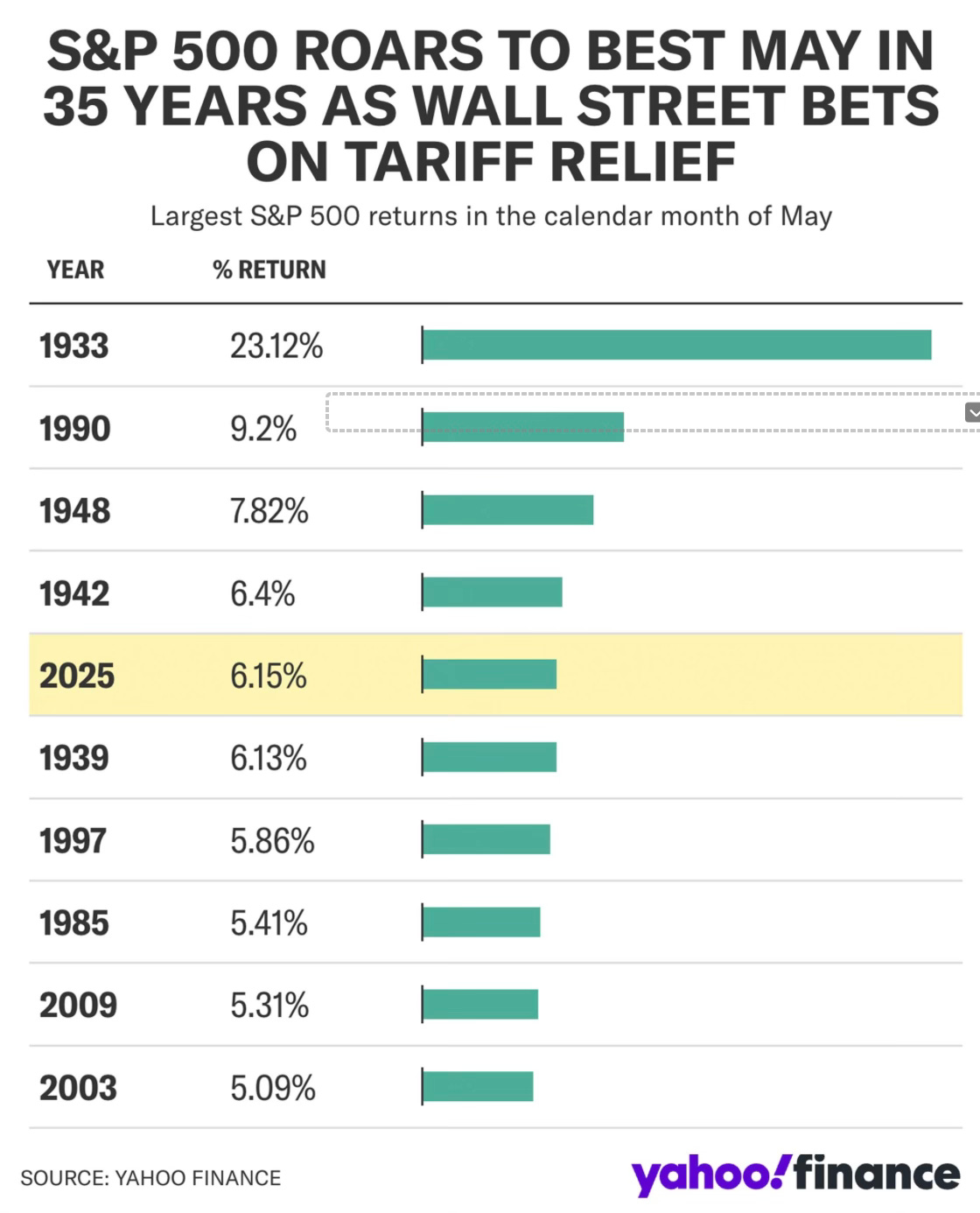

It turned out to be the best May in 35 years for the S&P 500.

It was the 5th best May on record!

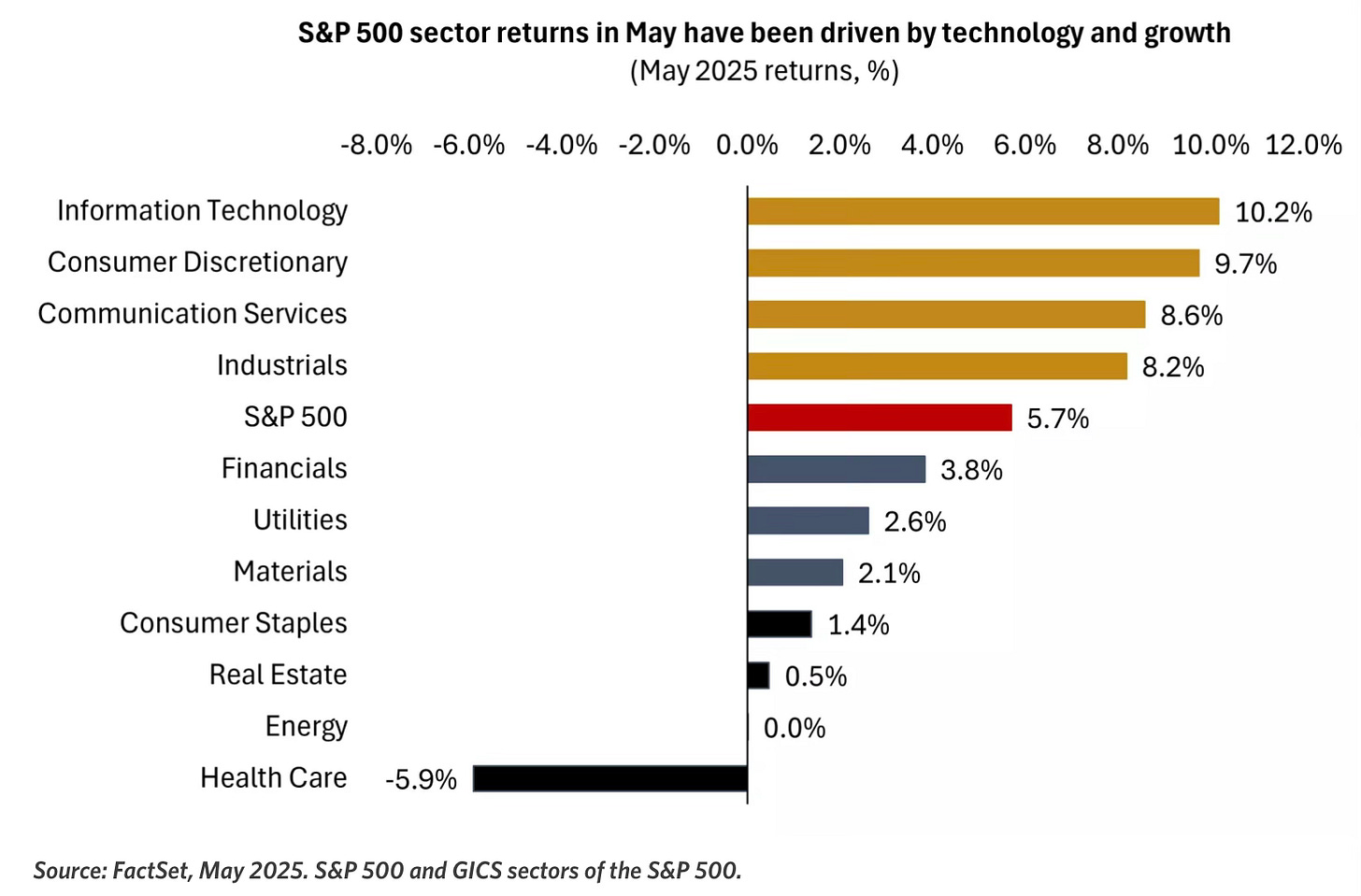

From a sectors standpoint, you can see that growth and technology led the comeback. Health care had a month to forget.

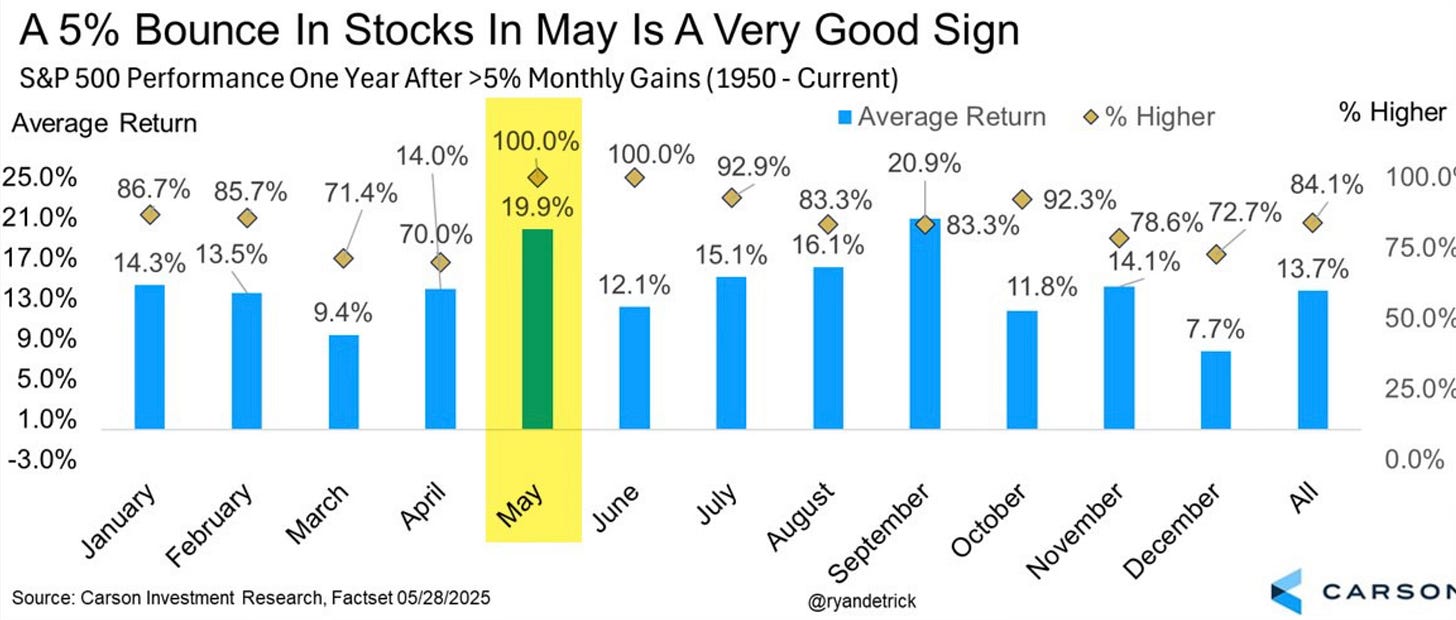

When May is up 5% or more, the S&P 500 has never been lower a year later. That’s good for an average return of 20%. History shows us that at 5% or higher, May is extremely bullish.

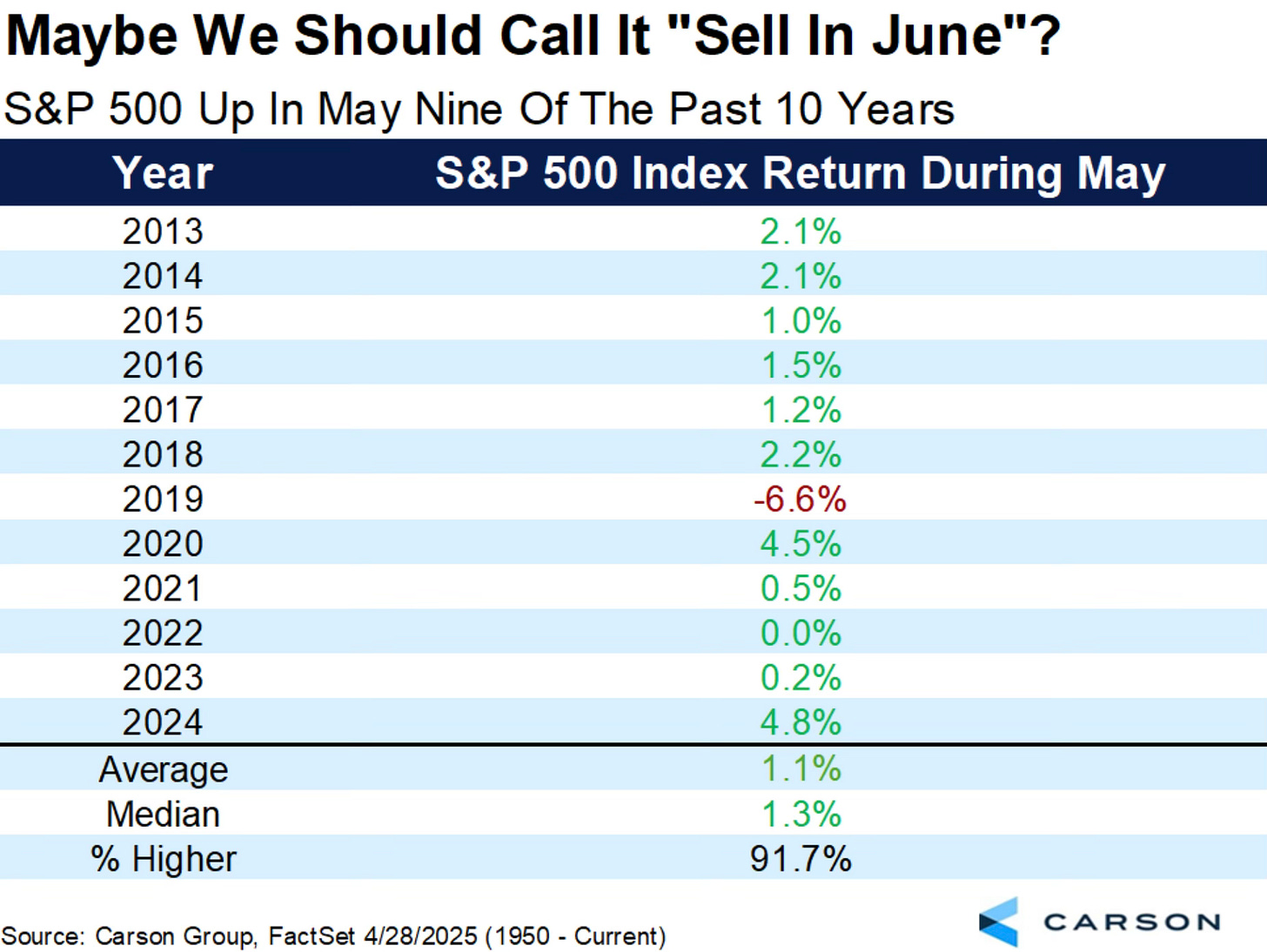

May has actually been one of the best months over the last number of years. May has finished positive in 11 of the past 12 years. Remember when everyone said sell in May and go away? That hasn't held true now for a long time. More like buy in May.

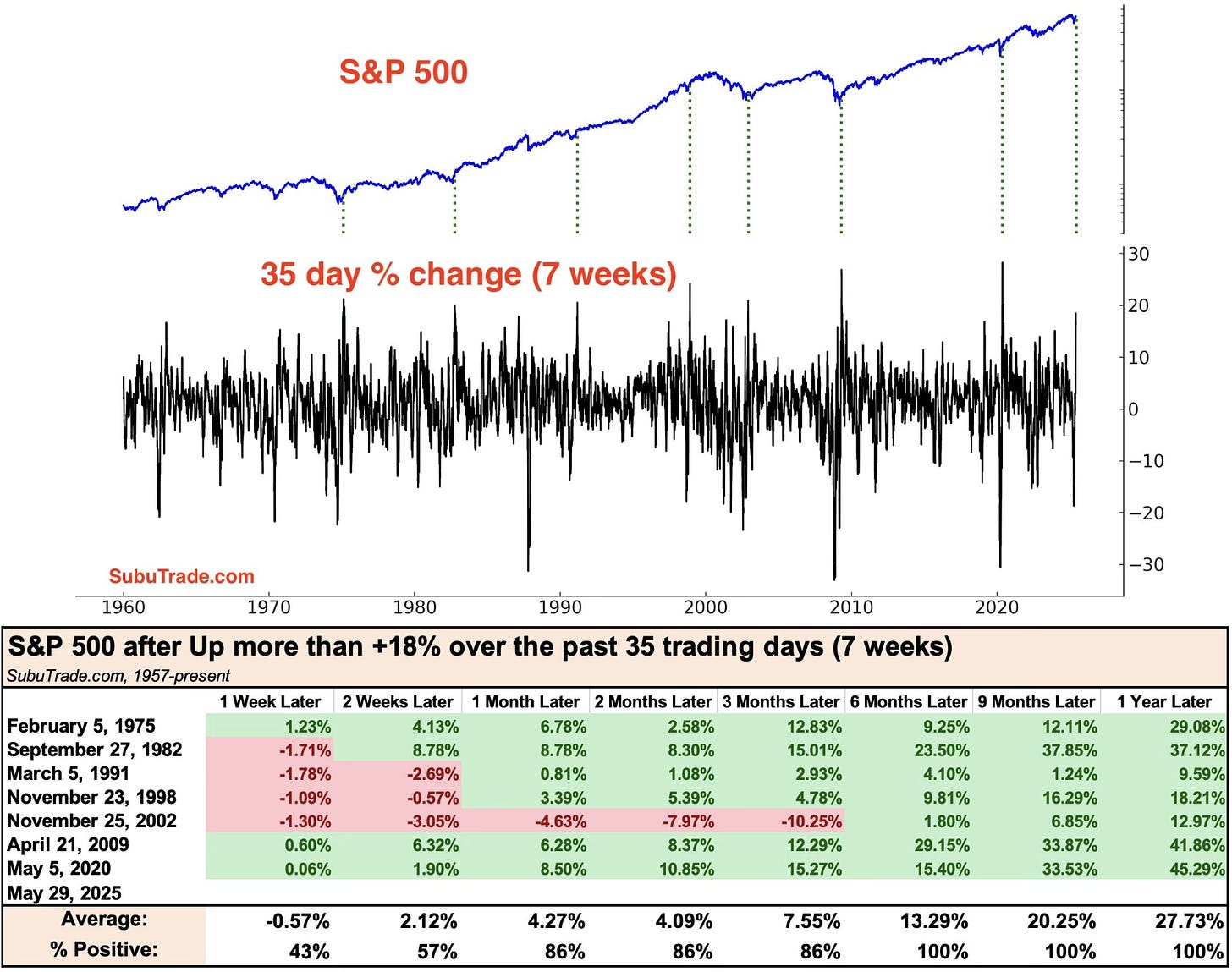

I didn’t quite realize that the S&P 500 has been up over 18% in the past 7 weeks. That’s occurred in only 35 trading days! That tells me that the market has been white hot! Does that mean we should expect some red now in the short to medium term? Not quite the case. A lot more green has followed.

My Thoughts On Nvidia

Subscribers of Spilled Coffee know that I have been a longtime fan of Nvidia and an owner of the stock. How much do I still like the stock? Did this week’s earnings change my view on Nvidia at all? Let’s take a look.