Investing Update: Is This Peak Bullishness?

What I'm buying, selling & watching

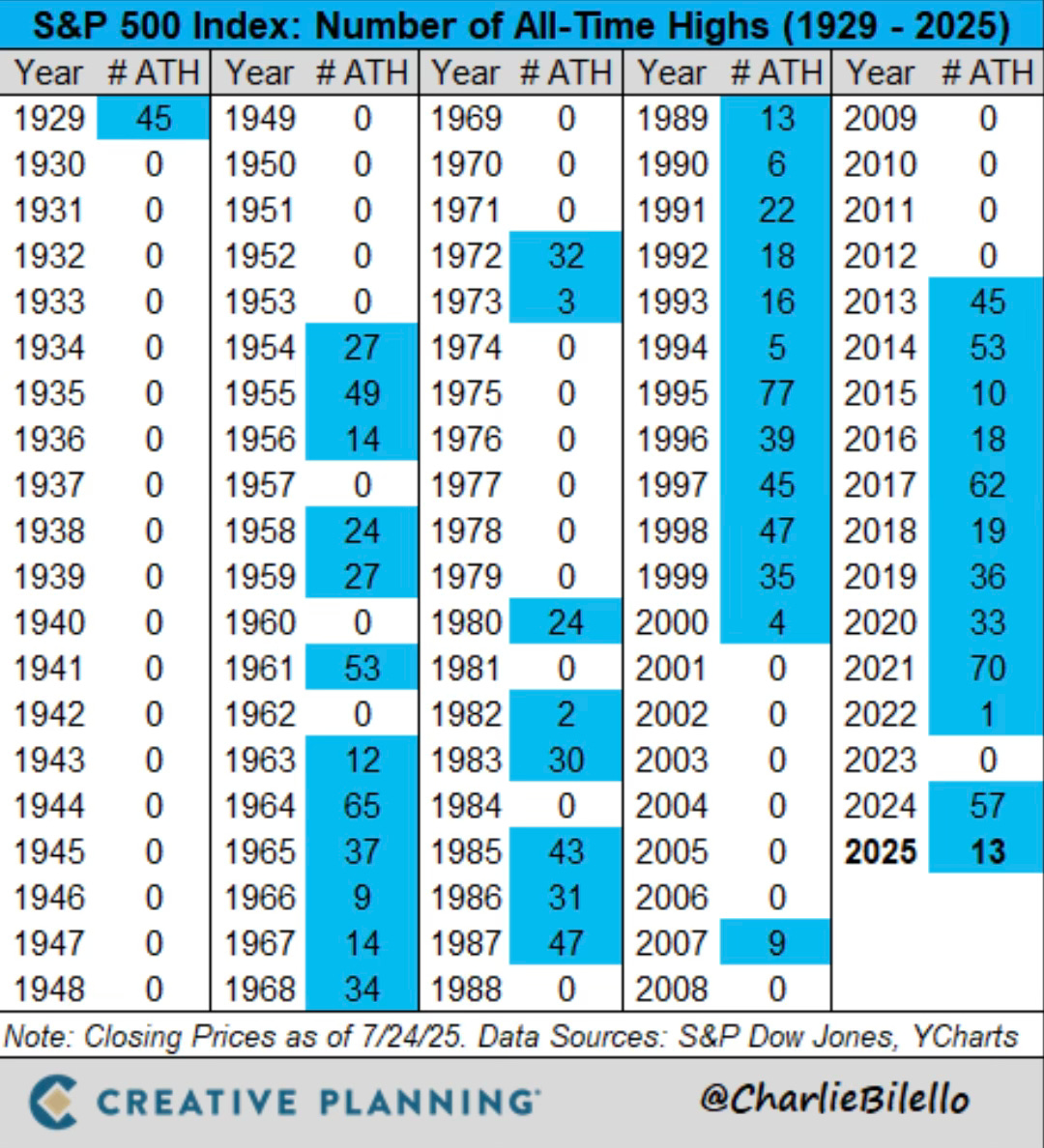

What a week! In the 5 trading days this week, there were 5 all-time highs for the S&P 500. Each day set a new record.

The Nasdaq also finished the week at fresh all-time highs.

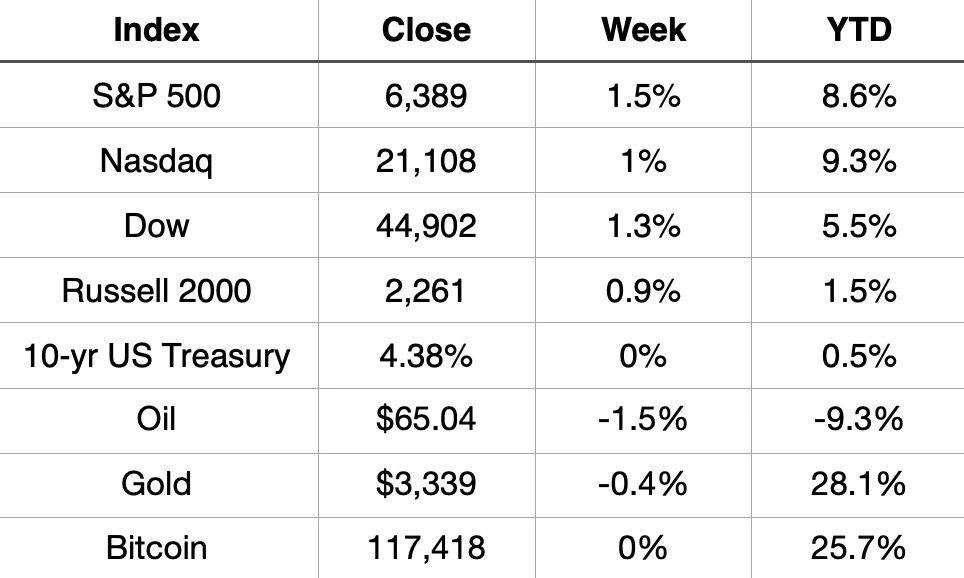

YTD the S&P 500 now sits up 8.6%, the Nasdaq is up 9.3% and the Dow up 5.5%.

Market Recap

Weekly Heat Map Of Stocks

This now makes 14 all-time highs in 2025 for the S&P 500.

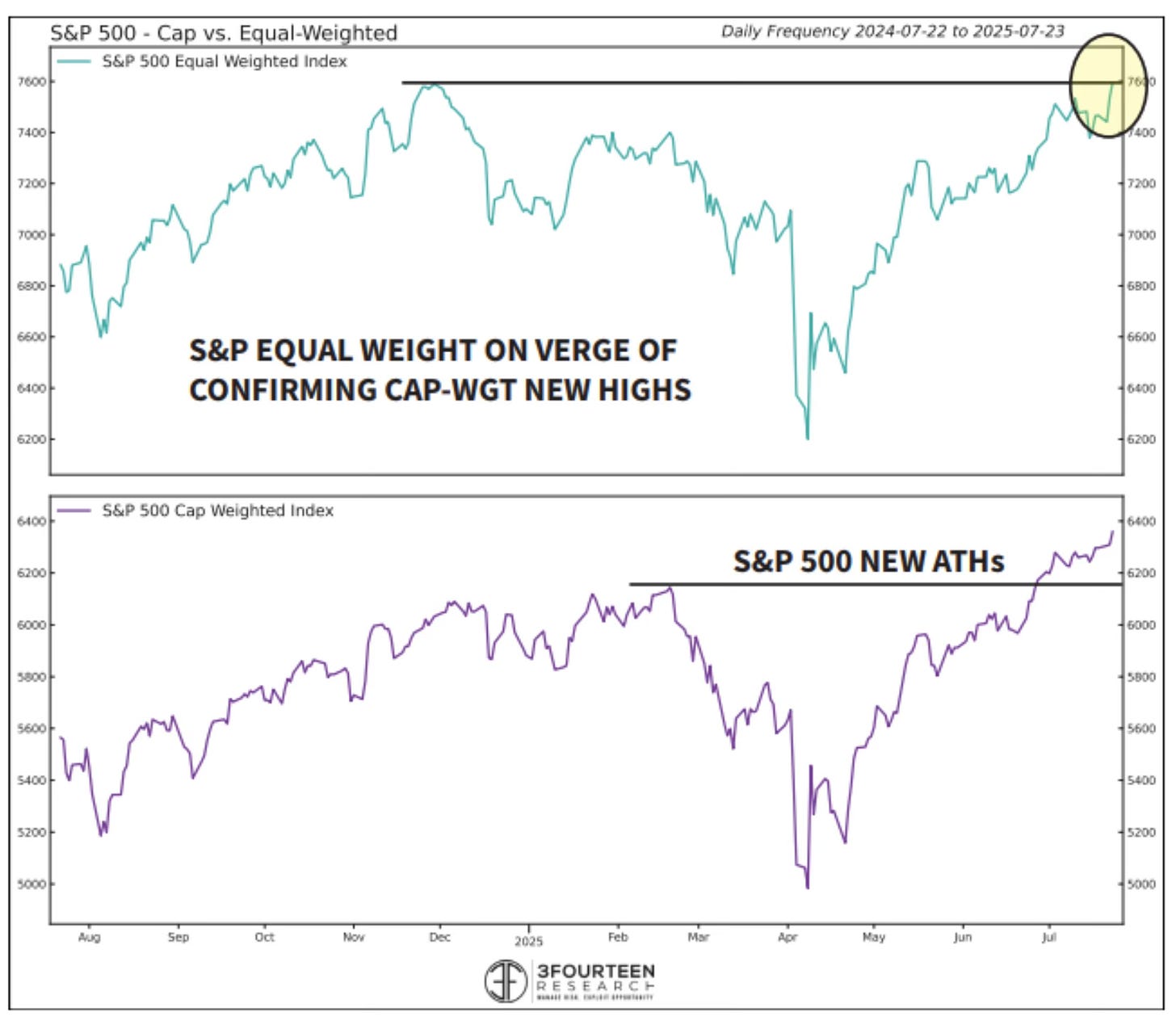

Now I think maybe the biggest news of the week came from the equal-weighted S&P 500. It made the first new all-time high of the year.

Why is this so important? We’ve continued to hear how this market is being led by only a handful of stocks. The breadth wasn’t strong enough. It wasn’t a sustainable bull market.

The equal weight now at an all-time high debunks all of that. The broadening has occurred and now it isn’t just the leaders that are leading. You have a broadened bull market. That’s about the best market-wide momentum you will find.

62% of S&P 500 stocks are above the 200-day. That’s a new high for 2025.

85% of Nasdaq 100 stocks are trading above their 100-Day moving average. That’s the most since February 2024.

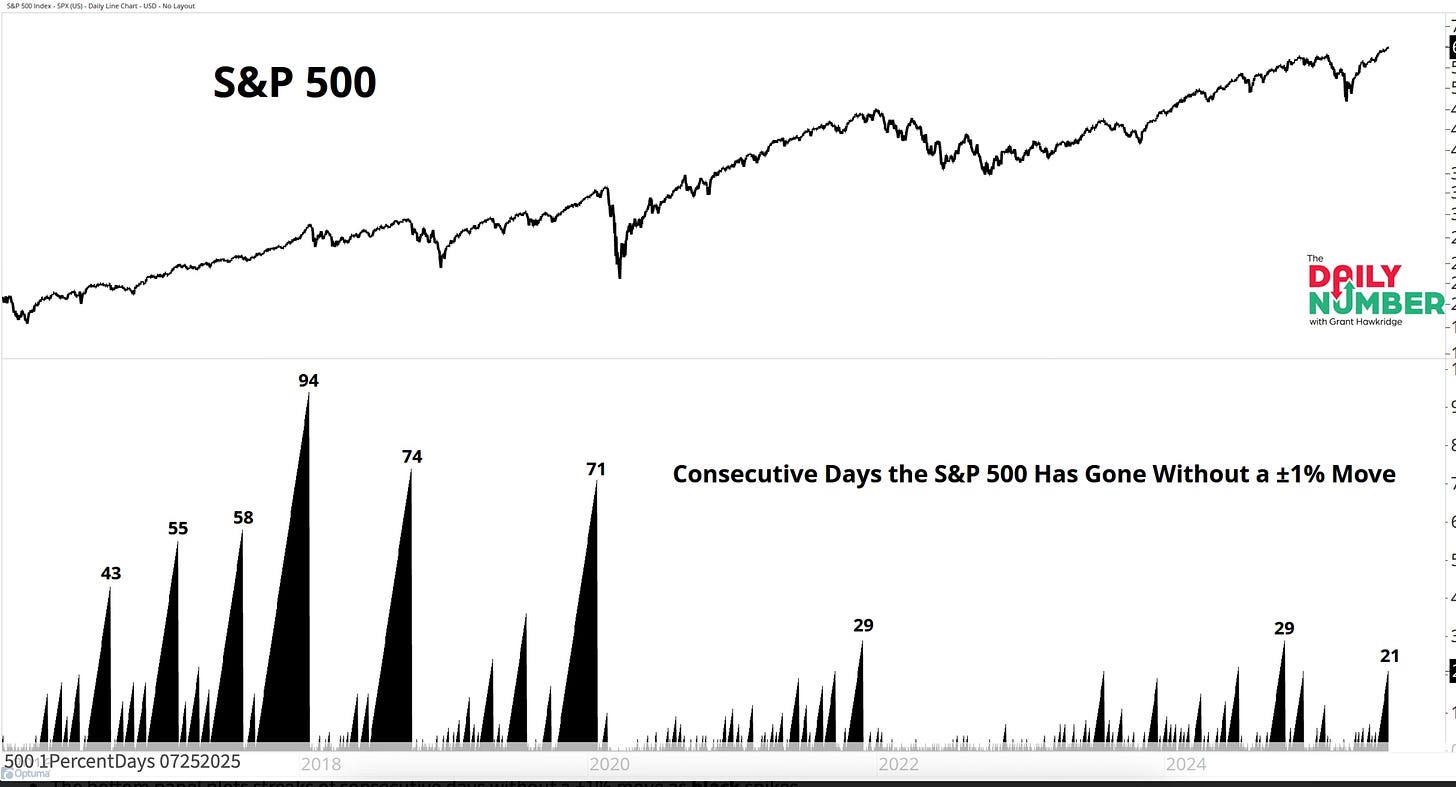

The S&P 500 now has gone 22 consecutive trading days without making a 1% move in either direction. It’s now the longest streak since October 2024.

This is what you see when you have low periods of volatility. It has been a steady march higher and with that you don’t see the whipsawing of over 1%+ moves.

Do you remember April? Those large moves in both directions happened multiple times a week. That was a different market. Times have changed.

We’ve seen an orderly march higher. It looks like that march higher will continue.