Investing Update: Is This As Good As It Gets?

What I’m buying, selling & watching

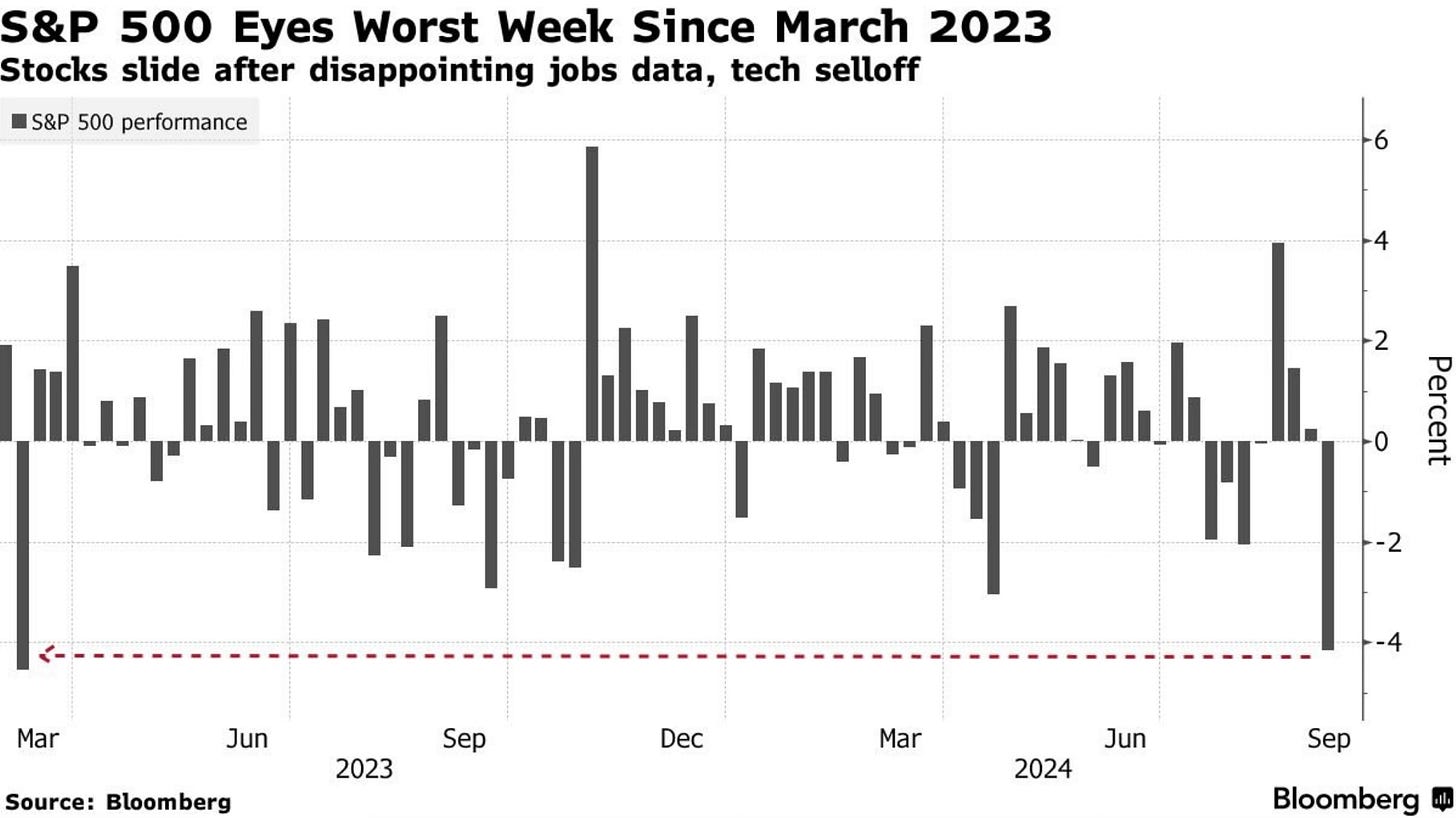

This week ended with the S&P 500 down 4 days in a row. That made for the worst week of the year. It was the worst week for the S&P 500 since March 2023.

It was the worst week for the Nasdaq since June 2022. The tech sector and semiconductors both had their worst week since March 2020.

Remember this bad of a start to a month just happened, last month. To start the first 4 trading day of August, the S&P 500 was down 5%. To start the first 4 trading day this month, the S&P 500 is now down 4%.

Market Recap

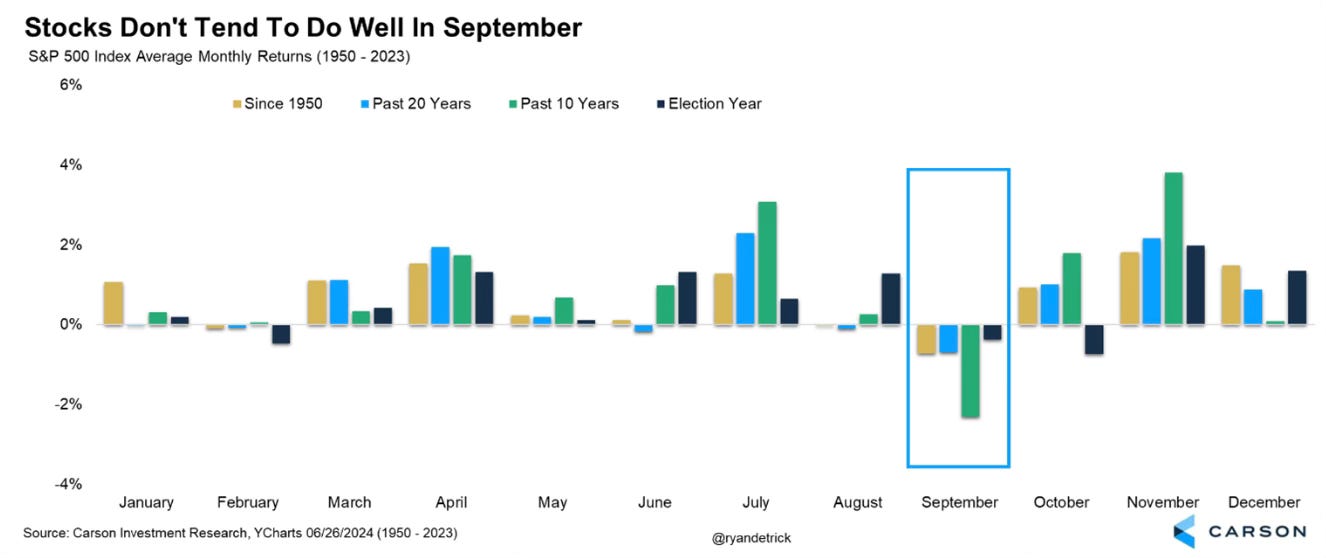

September is usually one of the worst months of the year going back to 1950, over the past 20 years, 10 year and in an election year.

But the underperformance usually occurs in the back half of the month, not the beginning.

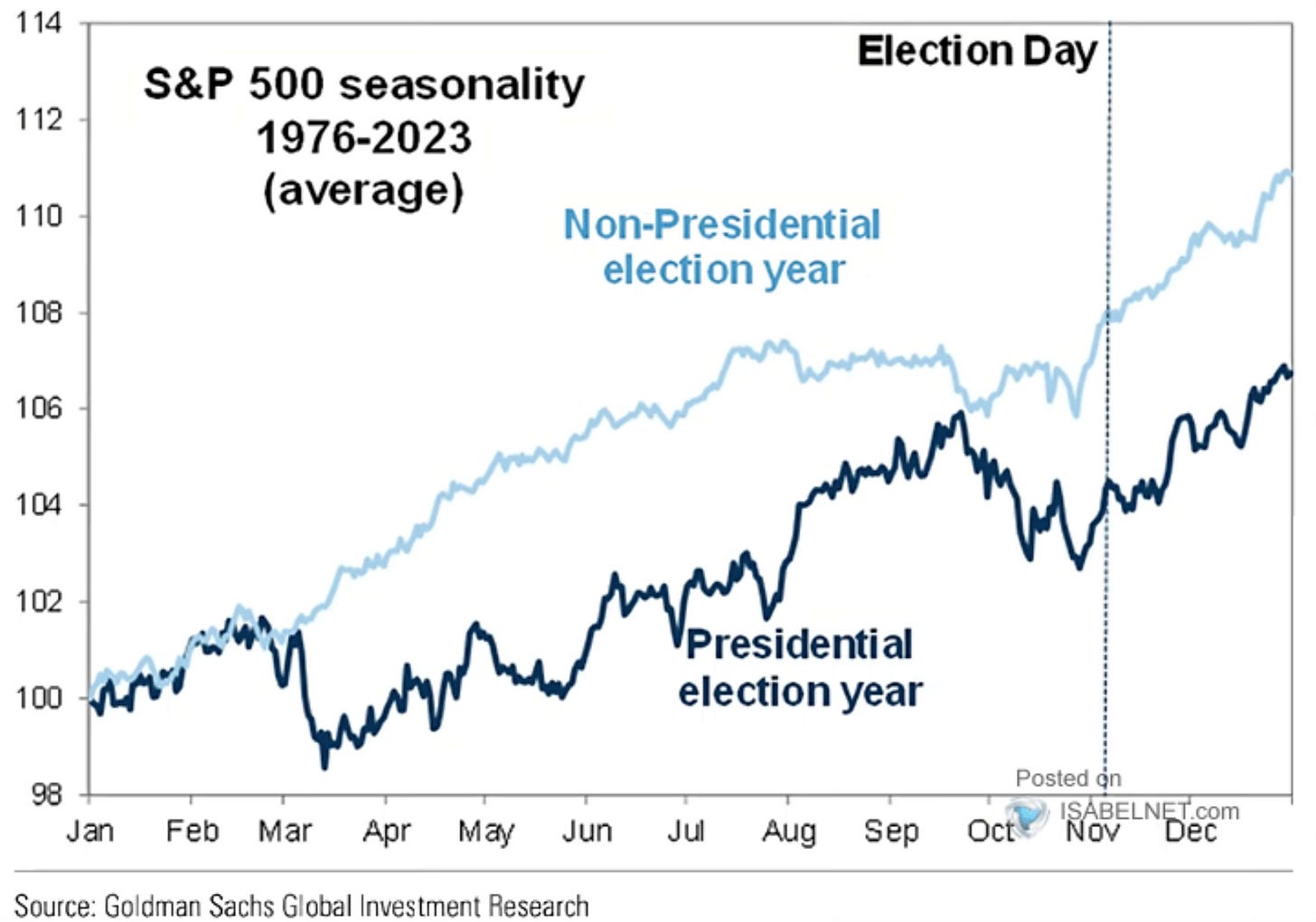

S&P 500 seasonality does show that this is historically the beginning of a pullback period and even more so in a presidential election year.

I’ve been saying that we can expect more volatility and another pullback as the election nears. It seems to be starting a little early. We will likely retest the August lows from a month ago. A 8-10% pullback over the next two months wouldn’t be a surprise.

I still see it as a buyable dip. This market is still very strong. We’re about to enter the rate cutting cycle along with falling inflation. I’m still firmly bullish this current market. We haven’t seen the top for 2024 yet in my view.

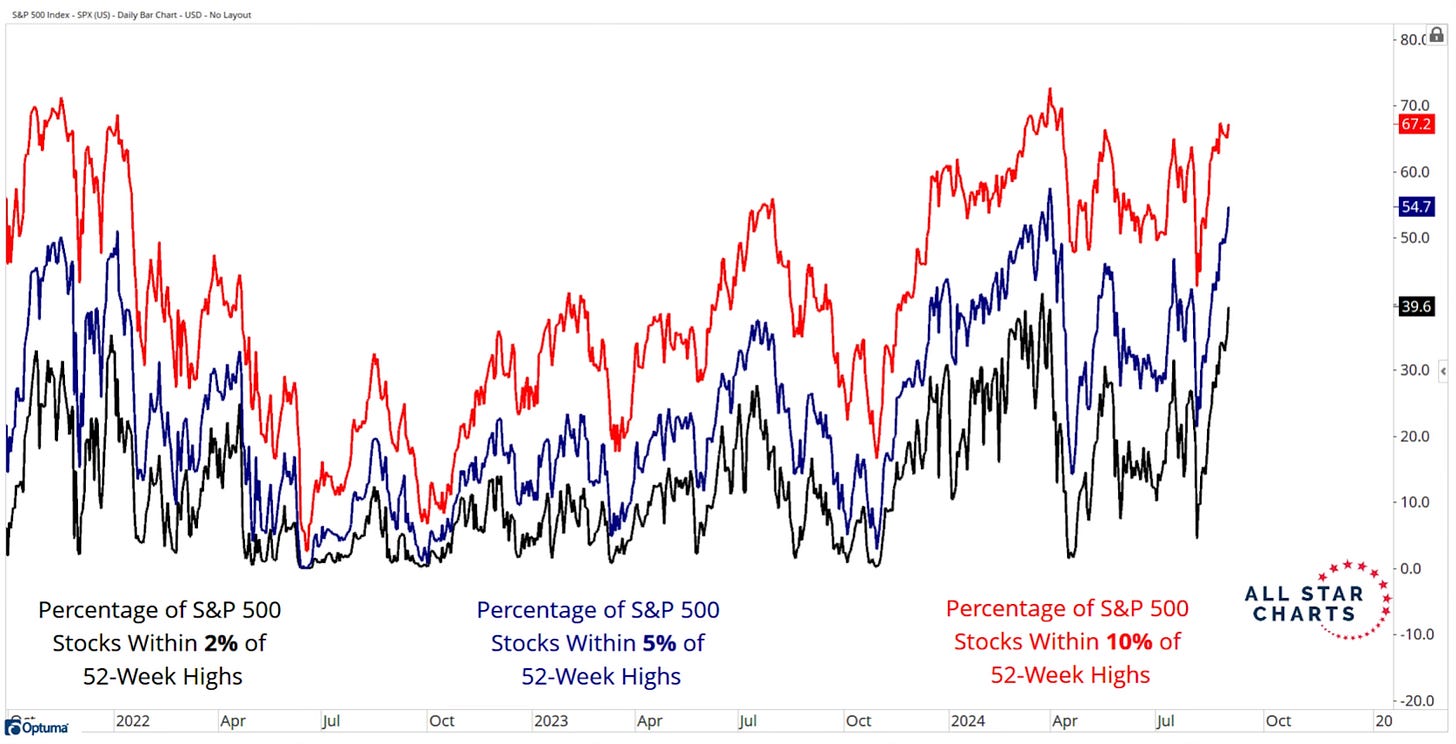

There is still strength as 67.2% of S&P 500 stocks are within 10% of their all-time highs. 54.7% of S&P 500 stocks are within 5% of their all-time highs.